KSA Solar Photovoltaic Market Outlook 2030

Region:Middle East

Author(s):Shivani Mehra

Product Code:KROD7608

November 2024

81

About the Report

KSA Solar Photovoltaic Market Overview

- The Saudi Arabia Solar Photovoltaic (PV) market is valued at USD 3926.26 million, driven primarily by the countrys commitment to diversifying its energy mix under. This growth is supported by the government's aggressive push for renewable energy, the reduction in PV module costs, and the increasing number of solar installations in both residential and utility segments. The energy transition is heavily dependent on the addition of solar capacity to meet rising electricity demand in the country.

- Key regions like Riyadh and Makkah dominate the PV market in Saudi Arabia. Riyadh is a focal point due to its urbanization, high energy demands, and large-scale government projects, while Makkah benefits from favorable solar radiation levels and a surge in utility-scale projects. Additionally, the countrys geographic location and consistent sunlight availability make these regions optimal for PV deployment.

- The National Renewable Energy Program (NREP) is a key initiative under Saudi Arabia's energy diversification strategy. Launched by the Ministry of Energy, it aims to develop 58.7 GW of renewable energy, with a major focus on solar power. As of 2023, the NREP had awarded contracts for over 7 GW of solar projects, encouraging private sector involvement and international partnerships to accelerate solar adoption across the Kingdom.

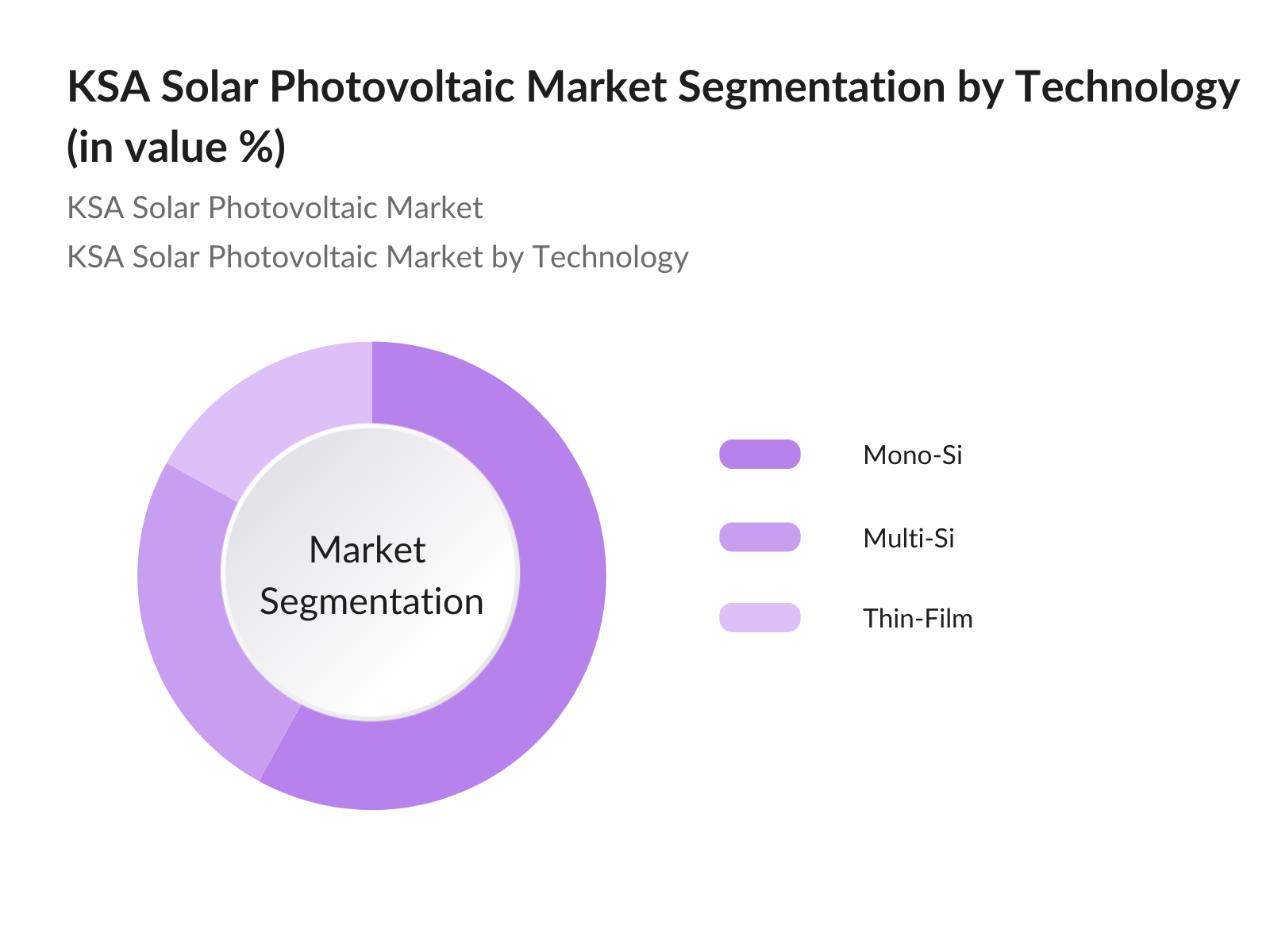

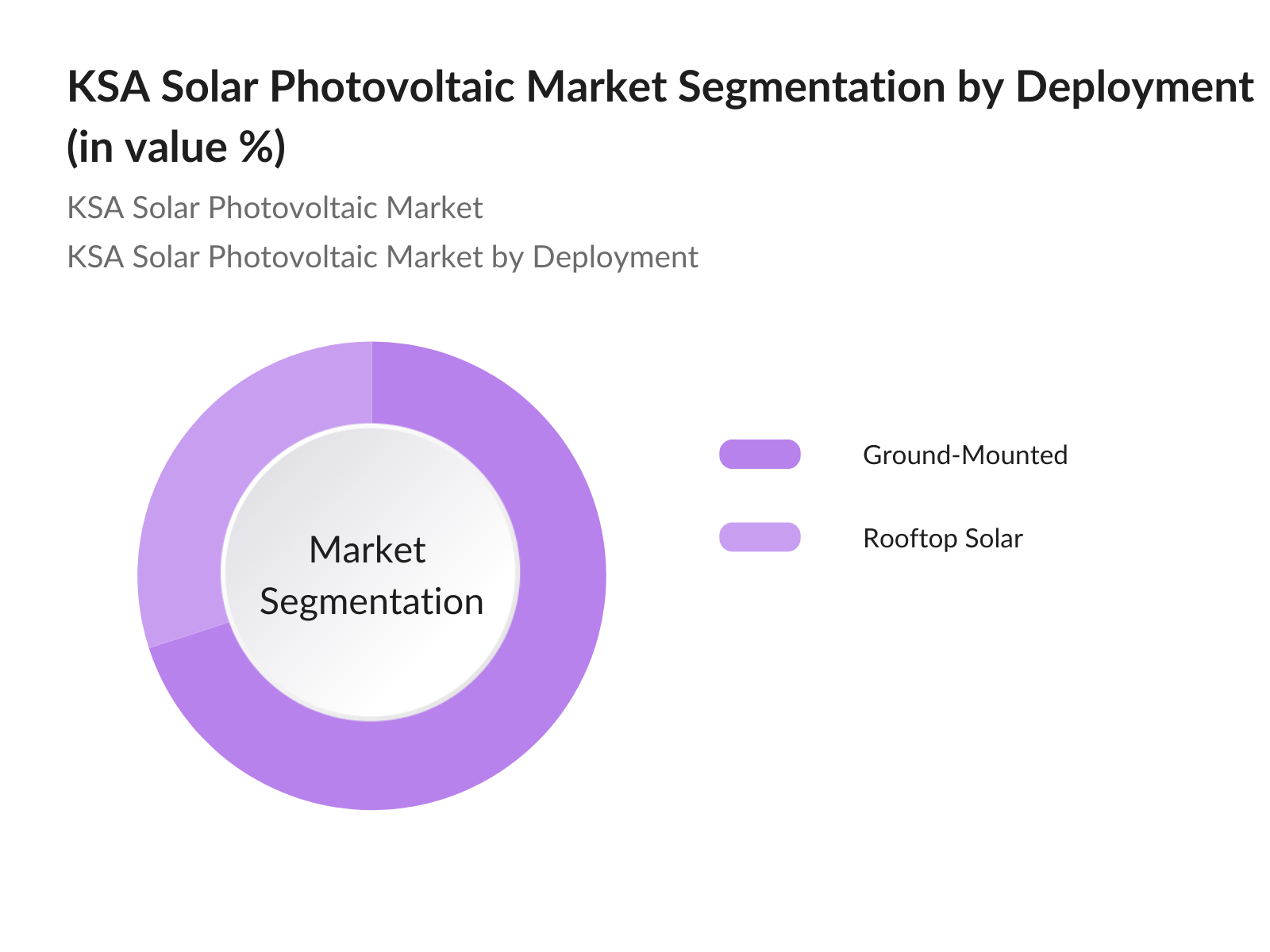

KSA Solar Photovoltaic Market Segmentation

- By Technology: Saudi Arabias solar photovoltaic market is segmented by technology into thin-film, multi-Si, and mono-Si technologies. Mono-Si technology is currently dominating the market share in Saudi Arabia due to its higher efficiency rates and longer lifespan compared to other technologies. Mono-Si modules have gained widespread use in large-scale utility projects and are increasingly being adopted for rooftop installations due to their performance in high temperatures.

- By Deployment: Deployment of solar photovoltaic systems is categorized into ground-mounted and rooftop solar installations. Ground-mounted solar installations currently dominate the market, driven by large-scale projects funded by both the private sector and government initiatives. These installations are primarily used in the utility sector, where space availability and higher efficiency make them the preferred choice.

KSA Solar Photovoltaic Market Competitive Landscape

The Saudi Arabia Solar PV market is dominated by a mix of local and international players. Companies such as LONGi Green Energy and Jinko Solar lead the market with innovative technologies and large-scale project deployments. This competitive landscape is also shaped by joint ventures and partnerships with local firms to comply with government regulations on local content requirements.

|

Company |

Establishment Year |

Headquarters |

Technology Portfolio |

Revenue (USD) |

Market Reach |

Installed Capacity |

Product Innovation |

Partnerships |

|

LONGi Green Energy Technology |

2000 |

China |

Mono-Si, Thin-Film |

- |

- |

- |

- |

- |

|

Jinko Solar Co., Ltd |

2006 |

China |

Mono-Si |

- |

- |

- |

- |

- |

|

CHINT Group |

1984 |

China |

Multi-Si, Mono-Si |

- |

- |

- |

- |

- |

|

GTek Solar |

2002 |

Saudi Arabia |

Thin-Film, Mono-Si |

- |

- |

- |

- |

- |

|

Bin Omairah Holding |

1975 |

Saudi Arabia |

Ground-mounted solutions |

- |

- |

- |

- |

- |

KSA Solar Photovoltaic Industry Analysis

Market Growth Drivers

- Government Renewable Energy Initiatives (Saudi Vision): The Saudi Vision includes ambitious targets to generate 58.7 GW from renewable energy, with 40 GW expected to come from solar energy. This initiative is aligned with the Kingdom's long-term goal to reduce reliance on fossil fuels and diversify its energy mix. In 2022, Saudi Arabias National Renewable Energy Program (NREP) awarded contracts for 2.2 GW of new solar capacity. This has created a significant push for solar energy, with the government setting policies to facilitate private sector investment in solar projects.

- Technological Advancements (Bifacial PV, N-Type Cells): Technological innovations, such as bifacial PV panels and N-type cells, are significantly boosting solar energy efficiency. Bifacial modules increase energy yield by capturing sunlight on both sides of the panel, making them ideal for maximizing energy production. Additionally, the adoption of N-type cells, known for higher efficiency and longer lifespans, is becoming prevalent in Saudi Arabias large-scale solar projects. These innovations are enhancing the overall performance of solar energy systems, ensuring more energy output for the same installation size, thus driving further growth in the Saudi solar market.

- Growing Demand in Residential and Utility Segments: The residential and utility sectors in Saudi Arabia have seen a surge in demand for solar energy installations. The utility sector, in particular, is witnessing major project developments like the 2.6 GW Al-Dibdibah Solar Project. In the residential sector, the push for decentralized energy generation through rooftop solar systems is gaining momentum, with the government providing incentives to encourage home installations. In 2023, over 150,000 households had adopted rooftop solar systems, reflecting a rising interest in residential solar energy solutions.

Market Challenges:

- High Initial Capital Requirements: Despite declining costs for solar modules, the high upfront capital expenditure required for solar PV installations remains a challenge. Large-scale solar projects in Saudi Arabia require significant investment, with initial costs for utility-scale projects exceeding USD 500 million for capacities over 500 MW. This capital-intensive nature of solar projects, coupled with the need for specialized equipment and installation expertise, poses a barrier for small and medium enterprises seeking to enter the solar energy market.

- Limited Grid Infrastructure for Solar Integration: Saudi Arabias electricity grid infrastructure, while expanding, still faces challenges in integrating large-scale solar projects. According to the Electricity & Co-Generation Regulatory Authority (ECRA), the national grid needs substantial upgrades to handle the intermittent nature of solar power. Grid bottlenecks and transmission constraints have been noted in remote areas where solar energy potential is high but grid connectivity is limited. In 2023, transmission losses were reported, impacting the efficient delivery of solar power to end-users.

KSA Solar Photovoltaic Market Future Outlook

Over the next few years, the Saudi Arabia solar photovoltaic market is expected to witness rapid growth. The countrys commitment to renewable energy and the significant investments in utility-scale solar projects, supported by declining solar PV costs, will be key growth drivers. Additionally, continuous advancements in solar technologies, such as the development of bifacial panels and N-Type cells, are likely to increase energy efficiency and lower costs.

Market Opportunities:

- Large-Scale Projects Using Thin Film Technology: Thin film technology is emerging as a popular option for large-scale solar projects in Saudi Arabia due to its flexibility and lower manufacturing costs. Projects like the Al-Kharsaah solar farm are utilizing thin film modules, which are known for performing better in high-temperature environments like those in Saudi Arabia. In 2023, over 1 GW of new solar installations used thin film technology, underscoring its growing adoption in large-scale projects where high efficiency and cost reduction are prioritized.

- Integration of Solar Energy in Smart Cities: Solar energy is becoming an integral part of Saudi Arabias smart city initiatives, particularly in projects like NEOM, which aims to be powered entirely by renewable energy, including solar. The integration of solar technologies in smart infrastructure, such as solar-powered street lighting and buildings equipped with rooftop solar systems, is expected to play a key role in reducing carbon emissions. In 2023, over 1,000 MW of solar capacity was integrated into smart city projects across the Kingdom.

Scope of the Report

|

By Technology |

Thin-Film Multi-Si Mono-Si |

|

By Deployment |

Ground-Mounted Rooftop |

|

By Connectivity |

On-Grid Off-Grid |

|

By End-User |

Residential Commercial Utility |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Renewable Energy Companies

Government and Regulatory Bodies (e.g., Saudi Energy Ministry)

Investors and Venture Capital Firms

Utility Providers

Solar Equipment Manufacturers

Construction Companies and Contractors

Energy Consulting Firms

Financial Institutions for Renewable Energy Projects

Companies

Players mentioned in the Market

LONGi Green Energy Technology Co., Ltd.

Jinko Solar Co., Ltd.

CHINT Group

GTek Solar

Bin Omairah Holding

Power Lines Contracting Co.

Clean Technologies Co.

SunPower Corporation

Hanwha Q Cells

Canadian Solar Inc.

Sharp Corporation

Solar Frontier K.K.

Yingli Green Energy Holding Co. Ltd.

JA Solar Technology Co. Ltd.

Trina Solar Ltd.

Table of Contents

1. Saudi Arabia Solar Photovoltaic (PV) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview (Drivers, Restraints, Opportunities)

2. Saudi Arabia Solar Photovoltaic Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments (Milestones, Major Projects, Government Initiatives)

3. Saudi Arabia Solar Photovoltaic Market Analysis

3.1. Growth Drivers

3.1.1. Government Renewable Energy Initiatives (Saudi Vision 2030)

3.1.2. Declining PV System Costs (Cost Trends of Solar Modules)

3.1.3. Technological Advancements (Bifacial PV, N-Type Cells)

3.1.4. Growing Demand in Residential and Utility Segments

3.2. Market Challenges

3.2.1. High Initial Capital Requirements

3.2.2. Limited Grid Infrastructure for Solar Integration

3.2.3. Lack of Skilled Workforce

3.3. Market Opportunities

3.3.1. Expansion of Utility-Scale Projects

3.3.2. Private-Public Partnerships in Solar Energy

3.3.3. Increasing Rooftop Solar Deployment

3.4. Trends

3.4.1. Large-Scale Projects Using Thin Film Technology

3.4.2. Adoption of On-Grid Solar Systems in Residential and Commercial Segments

3.4.3. Integration of Solar Energy in Smart Cities

3.5. Regulatory Landscape

3.5.1. Net-Zero Emission Commitments

3.5.2. Saudi Electricity Regulations and Solar Incentives

3.5.3. Decarbonization Initiatives

4. Saudi Arabia Solar Photovoltaic Market Segmentation

4.1. By Technology

4.1.1. Thin-Film Technology (In Value %)

4.1.2. Multi-Si Technology (In Value %)

4.1.3. Mono-Si Technology (In Value %)

4.2. By Deployment

4.2.1. Ground-Mounted (In Value %)

4.2.2. Rooftop Solar (In Value %)

4.3. By Connectivity

4.3.1. On-Grid (In Value %)

4.3.2. Off-Grid (In Value %)

4.4. By End Use

4.4.1. Residential (In Value %)

4.4.2. Commercial (In Value %)

4.4.3. Utility (In Value %)

4.5. By Region

4.5.1. Riyadh

4.5.2. Makkah

4.5.3. Eastern Province

4.5.4. Qassim

4.5.5. Others

5. Saudi Arabia Solar Photovoltaic Market Competitive Analysis

5.1. Profiles of Major Companies

5.1.1. LONGi Green Energy Technology Co. Ltd.

5.1.2. Jinko Solar Co., Ltd

5.1.3. CHINT Group

5.1.4. GTek Solar

5.1.5. Bin Omairah Holding

5.1.6. Power Lines Contracting Co.

5.1.7. Clean Technologies Co.

5.1.8. SunPower Corporation

5.1.9. Hanwha Q Cells

5.1.10. Canadian Solar Inc.

5.1.11. Sharp Corporation

5.1.12. Solar Frontier K.K.

5.1.13. Yingli Green Energy Holding Co. Ltd.

5.1.14. JA Solar Technology Co. Ltd.

5.1.15. Trina Solar Ltd.

5.2. Cross Comparison Parameters (Revenue, Solar Capacity, Technology Portfolio, Headquarters, M&A)

5.3. Market Share Analysis

5.4. Strategic Initiatives (M&A, JVs, Partnerships)

5.5. Government Grants and Support

5.6. Private Equity Investments in Solar

6. Saudi Arabia Solar Photovoltaic Market Regulatory Framework

6.1. Solar Energy Certifications and Standards

6.2. Compliance with Local Energy Laws

6.3. Policies for Solar Power Purchase Agreements (PPAs)

7. Saudi Arabia Solar Photovoltaic Future Market Size (In USD Mn)

7.1. Projected Solar PV Market Size

7.2. Key Factors Driving Future Growth

8. Saudi Arabia Solar Photovoltaic Market Analysts Recommendations

8.1. Market Entry Strategy

8.2. Technology Roadmap for New Entrants

8.3. Investment Opportunities in Utility-Scale Solar Projects

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The research began by identifying critical variables such as solar PV demand, government policies, and project data through secondary research. This stage involved utilizing industry reports, government data, and proprietary databases.

Step 2: Market Analysis and Construction

Historical data were collected to assess the growth of solar PV deployment, focusing on market trends and penetration rates. Special attention was given to Saudi Arabia's utility and residential sectors.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with experts from major companies and stakeholders in the solar PV industry helped refine market projections. These insights were validated through interviews with manufacturers and industry leaders.

Step 4: Research Synthesis and Final Output

Finally, the synthesized data were cross-verified with primary market research inputs from local players, ensuring that the report offers a comprehensive view of the KSA Solar PV market landscape.

Frequently Asked Questions

01. How big is the Saudi Arabia Solar Photovoltaic (PV) Market?

The Saudi Arabia solar photovoltaic (PV) market is valued at USD 3926.26 million, driven by government initiatives and growing demand for renewable energy.

02. What are the major challenges in the Saudi Arabia Solar PV Market?

Challenges include the high initial costs of solar projects, limited grid infrastructure, and the need for specialized expertise in the installation and maintenance of PV systems.

03. Who are the major players in the Saudi Arabia Solar PV Market?

Key players include LONGi Green Energy, Jinko Solar, CHINT Group, GTek Solar, and Bin Omairah Holding, all of which have a strong foothold in the market through their advanced technologies and project execution capabilities.

04. What is driving the growth of the Saudi Arabia Solar PV Market?

The growth is driven by Saudi Vision, decreasing costs of PV systems, and the countrys commitment to achieving net-zero emissions, which encourages large-scale solar installations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.