KSA Soup Market Outlook to 2030

Region:Middle East

Author(s):Shambhavi Awasthi

Product Code:KROD9230

December 2024

86

About the Report

KSA Soup Market Overview

- The KSA soup market is valued at USD 770 million, grounded on historical analysis and current consumer trends. The market is primarily driven by the growing demand for ready-to-eat meals and convenience food products, driven by the increasing urban population and busy lifestyles in the Kingdom. The rising awareness regarding healthy eating habits and demand for diverse flavors further propel the growth of the soup market, as consumers seek options that are both nutritious and easy to prepare.

- In the KSA, major urban centers like Riyadh and Jeddah lead in soup consumption. This dominance is due to the high population density and the lifestyle of these metropolitan areas, where demand for quick, nutritious meals aligns well with the busy schedules of urban residents. These cities also have a higher concentration of working professionals and expatriates who prefer convenience food products, contributing to the prominence of soup products in these regions.

- The Saudi Food and Drug Authority (SFDA) is responsible for establishing and enforcing food safety standards. These standards encompass hygiene requirements, permissible additives, and microbiological criteria to ensure that food products, including soups, are safe for consumption. For instance, the SFDA has outlined specific hygienic requirements for food establishments to maintain high safety standards.

KSA Soup Market Segmentation

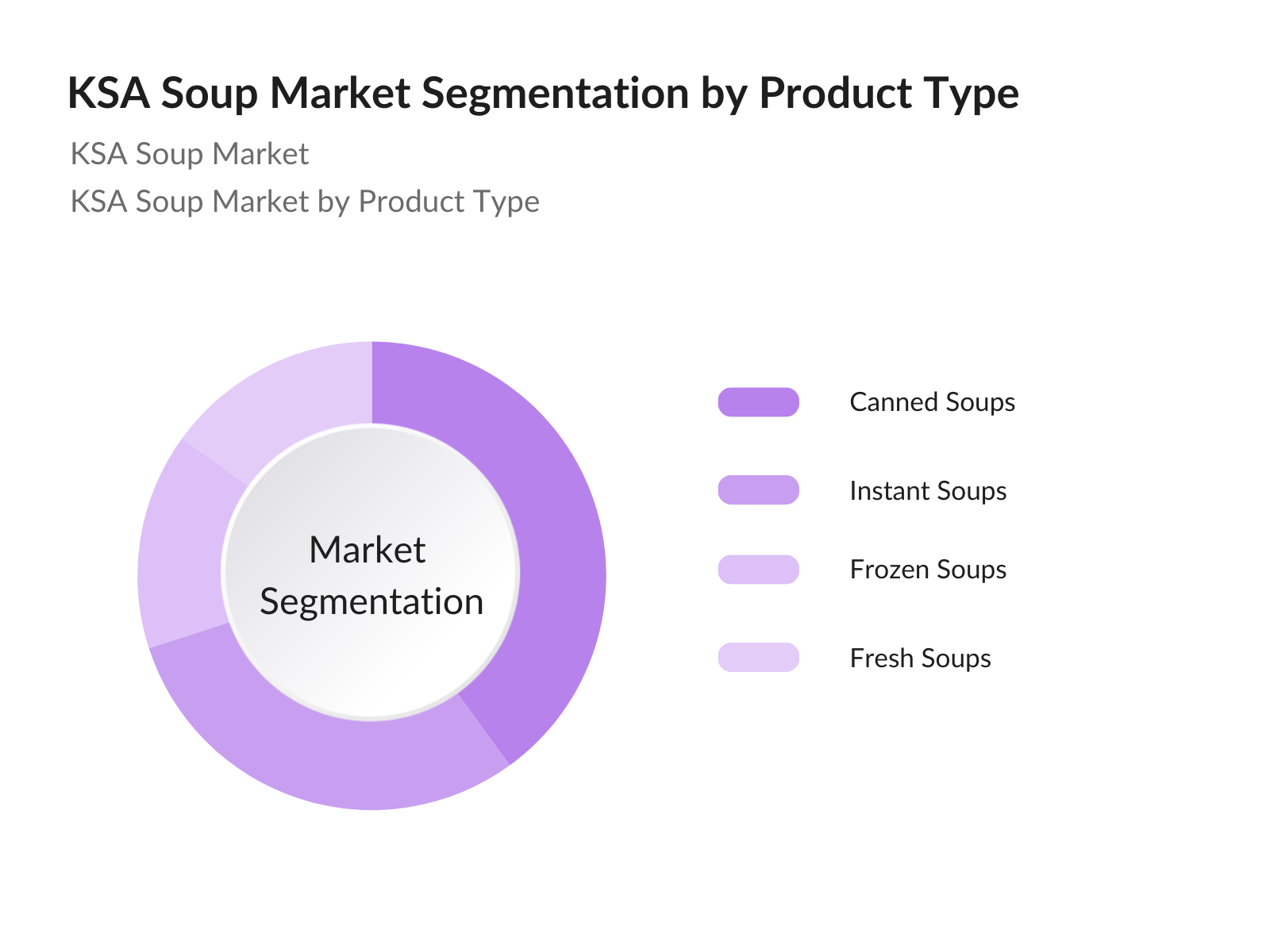

- By Product Type: The KSA soup market is segmented by product type into canned soup, Instant Soups, Frozen Soups and Fresh Soups. Canned soup holds a dominant market share in the product type segmentation. Its convenience, long shelf life, and variety in flavors make it highly popular among consumers, especially those with a preference for ready-to-eat meals. The product's ability to retain flavor and nutrients during storage has established a strong consumer base, supported by prominent brands that continue to innovate within this segment.

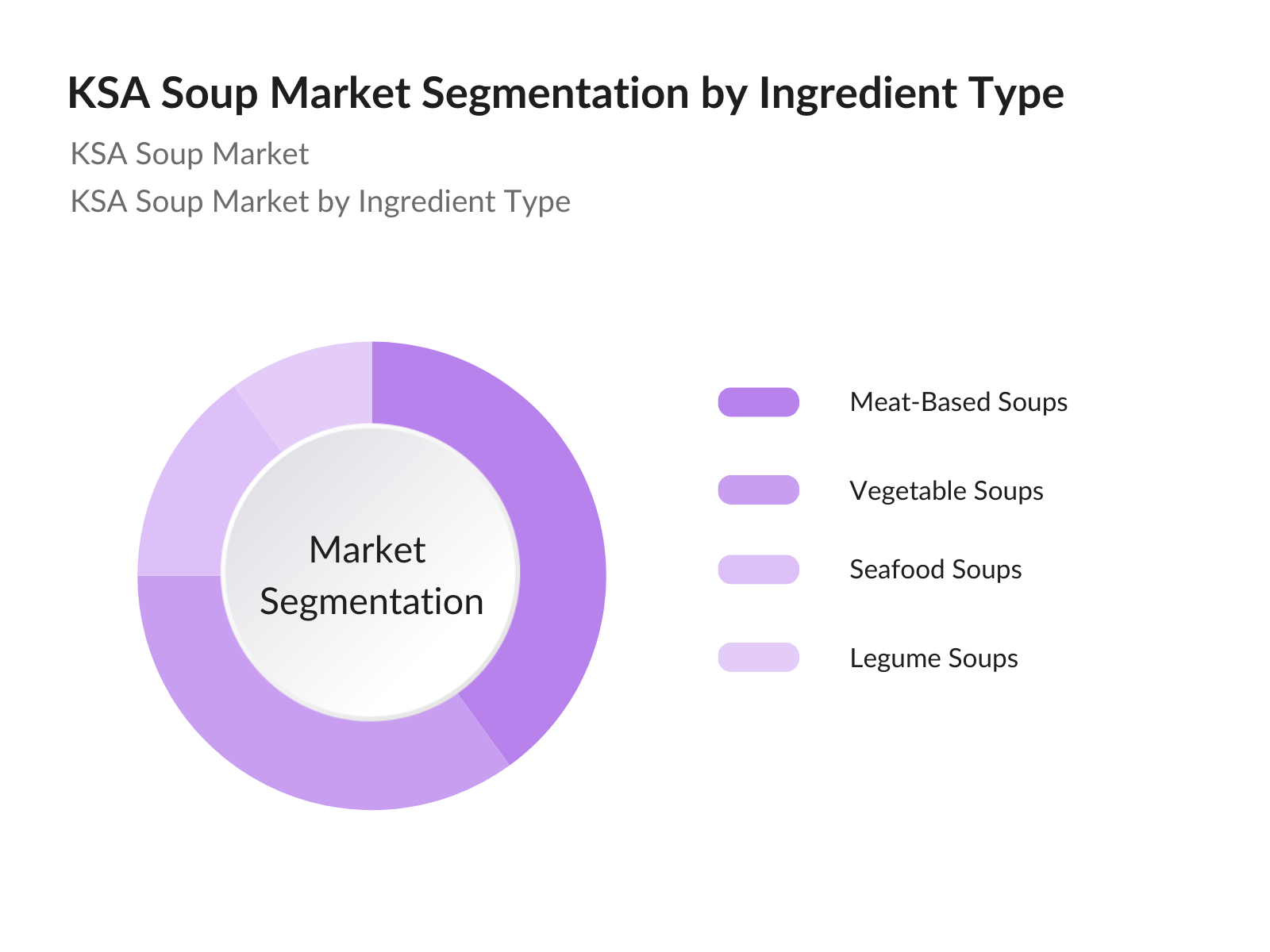

- By Ingredient Type: The market is further segmented by ingredient type into Meat-Based Soups, Vegetable Soups, seafood soup and Legume Soups. Vegetable soup dominates this category, largely due to the growing preference for plant-based diets and health-conscious choices among KSA consumers. With a rising demand for vegetarian options, vegetable soups provide a nutritious, low-calorie alternative that caters to various dietary preferences, including vegetarian and vegan lifestyles.

KSA Soup Market Competitive Landscape

The KSA soup market is dominated by several key players, ranging from established multinational brands to local companies. This concentration demonstrates the influence of large firms with expansive distribution networks and strong brand recognition. The KSA soup market is primarily led by international brands with significant influence, supported by strong marketing and distribution strategies. Prominent brands like Knorr, Campbells, and Maggi have cemented their presence by offering a wide range of flavors that cater to local tastes, while some local brands capitalize on traditional flavors to appeal to the KSA population.

KSA Soup Market Analysis

Growth Drivers

- Rising Health Consciousness: The KSA population is increasingly prioritizing health, with a significant shift towards healthier eating habits. According to the Saudi Ministry of Health, approximately 70% of the population is aware of the health benefits of consuming nutritious food, including soups. This awareness drives the demand for soups that are low in sodium, sugar, and fats. The growth of health-focused campaigns has led to a rise in soup consumption, with health-oriented products gaining popularity.

- Increased Availability of Varieties: The soup market in KSA is experiencing an expansion in product variety, including traditional and international flavors. The introduction of innovative recipes and unique ingredients caters to the diverse palates of consumers. Market players report that a 30% increase in the variety of soups offered has led to higher sales, with consumers willing to try new flavors and health-focused options. This increased variety supports growth as it appeals to a broader audience.

- Increased Availability of Varieties: The soup market in KSA is experiencing an expansion in product variety, including traditional and international flavors. The introduction of innovative recipes and unique ingredients caters to the diverse palates of consumers. Market players report that a 30% increase in the variety of soups offered has led to higher sales, with consumers willing to try new flavors and health-focused options. This increased variety supports growth as it appeals to a broader audience.

KSA Soup Market Analysis: Challenges

- Competition from Alternative Products: The KSA soup market faces intense competition from a wide array of alternative meal solutions, including instant noodles, frozen meals, and ready-to-eat products. Consumers are increasingly drawn to these alternatives due to their lower prices and perceived convenience. Market analysis indicates that instant noodle consumption in the region has risen by approximately 25% in the past two years, posing a significant challenge to soup manufacturers. This trend necessitates innovation in soup offerings to differentiate them from competing products.

- Supply Chain Disruptions: The global supply chain has been significantly affected by geopolitical tensions, pandemics, and trade disruptions, impacting the availability and pricing of raw materials essential for soup production. For instance, the cost of tomatoes, a primary ingredient in many soups, saw fluctuations of 30% in recent years due to supply shortages. Such disruptions can lead to increased operational costs for manufacturers, ultimately affecting profit margins and market stability.

KSA Soup Market Future Outlook

The KSA soup market is poised for notable growth over the next five years, driven by the increasing urban population, changing dietary preferences towards healthier options, and greater demand for convenience foods. As consumers in the Kingdom continue to adopt busy lifestyles, the market is expected to benefit from a steady introduction of new flavors, health-oriented product offerings, and innovative packaging.

KSA Soup Market Analysis: Opportunities

- Expansion into New Regions: As urbanization spreads across KSA, there are substantial opportunities for soup manufacturers to expand their reach into underserved rural markets. Current demographic trends suggest that around 30% of the population resides in rural areas, with increasing demand for convenient meal options. Expanding distribution networks to these regions can tap into a new customer base, driving growth in the soup market. Investing in local partnerships for distribution can enhance market penetration and brand visibility.

- Product Innovations and Customizations: There is a growing consumer demand for innovative and customized soup products, including organic, low-sodium, and plant-based options. The increasing interest in health and wellness is driving manufacturers to develop new recipes that cater to specific dietary needs, such as gluten-free or vegan soups. Market research indicates that over 40% of consumers are willing to pay a premium for healthier options, providing an opportunity for brands to differentiate themselves through product innovation and targeted marketing strategies

Scope of the Report

|

Segment |

Sub-Segment |

|

By Product Type |

Canned Soups |

|

Instant Soups |

|

|

Frozen Soups |

|

|

Fresh Soups |

|

|

By Ingredient Type |

Vegetable Soups |

|

Meat-Based Soups |

|

|

Seafood Soups |

|

|

Legume Soups |

|

|

By Distribution Channel |

Supermarkets and Hypermarkets |

|

Convenience Stores |

|

|

Online Retail |

|

|

Specialty Stores |

|

|

By Packaging Type |

Tetra Packs |

|

Glass Jars |

|

|

Plastic Bottles |

|

|

By Region |

Riyadh |

|

Jeddah |

|

|

Dammam |

|

|

Other Regions |

Products

Key Target Audience

Food and Beverage Distributors

Retail Chains and Supermarkets

Packaged Food Manufacturers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority - SFDA)

Health and Wellness Organizations

HoReCa (Hotel, Restaurant, and Catering) Sector

Export and Import Firms

Companies

Players mentioned in the Market

Knorr

Campbells

Maggi

Halwani Bros

Noor Asia

Heinz

Nestl

Al Rabie

Premier Foods

Marhaba

Barakat Quality Plus

Freshly Foods

Emirates Food Industries

Arabian Delights

Siblou

Table of Contents

1. KSA Soup Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Soup Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Soup Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Urbanization Trends

3.1.3. Increased Availability of Varieties

3.1.4. Demand for Convenience Food

3.1.5. Rise in E-commerce and Online Sales

3.2. Market Challenges

3.2.1. Competition from Alternative Products

3.2.2. Supply Chain Disruptions

3.2.3. Fluctuations in Raw Material Prices

3.3. Opportunities

3.3.1. Expansion into New Regions

3.3.2. Product Innovations and Customizations

3.3.3. Growing Export Markets

3.4. Trends

3.4.1. Growth of Organic Soups

3.4.2. Introduction of Functional Soups

3.4.3. Sustainability Initiatives

3.5. Government Regulation

3.5.1. Food Safety Standards

3.5.2. Labeling Regulations

3.5.3. Import Tariffs and Trade Agreements

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Soup Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Canned Soups

4.1.2. Instant Soups

4.1.3. Frozen Soups

4.1.4. Fresh Soups

4.2. By Ingredient Type (In Value %)

4.2.1. Vegetable Soups

4.2.2. Meat-Based Soups

4.2.3. Seafood Soups

4.2.4. Legume Soups

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Specialty Stores

4.4. By Packaging Type (In Value %)

4.4.1. Tetra Packs

4.4.2. Glass Jars

4.4.3. Plastic Bottles

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Other Regions

5. KSA Soup Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Campbell Soup Company

5.1.2. Unilever

5.1.3. Nestl

5.1.4. General Mills

5.1.5. Kraft Heinz Company

5.1.6. ConAgra Foods

5.1.7. Premier Foods

5.1.8. Amy's Kitchen

5.1.9. S&B Foods

5.1.10. Baxters Food Group

5.1.11. Hain Celestial Group

5.1.12. McCormick & Company

5.1.13. Del Monte Foods

5.1.14. Kettle Cuisine

5.1.15. Marco's Pizza

5.2. Cross Comparison Parameters (Market Share, Product Range, Geographic Presence, R&D Investment, Price Point, Brand Recognition, Distribution Network, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Soup Market Regulatory Framework

6.1. Food Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Soup Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Soup Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredient Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. KSA Soup Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins by mapping the soup market ecosystem in the KSA, identifying stakeholders across distribution channels, suppliers, and consumers. This step incorporates extensive secondary research to outline the variables that influence the market, including consumer preferences, purchasing behaviors, and distribution networks.

Step 2: Market Analysis and Construction

The next phase involves examining historical data and trends within the soup market, with a focus on segment performance and consumer adoption rates. The analysis assesses regional and product-wise market penetration, aiming to build an accurate and detailed market model.

Step 3: Hypothesis Validation and Expert Consultation

The initial hypotheses are verified through in-depth discussions with industry experts, conducted via computer-assisted interviews. This step provides first-hand insights into sales patterns, consumer preferences, and competitive strategies, helping validate the market projections and other findings.

Step 4: Research Synthesis and Final Output

The final research phase consolidates the gathered insights, providing a comprehensive analysis validated through interactions with market players and quantitative modeling. This synthesis ensures a thorough and reliable perspective on the KSA soup market.

Frequently Asked Questions

01. How big is the KSA Soup Market?

The KSA soup market is valued at USD 770 million, with its growth fueled by the increasing demand for convenience foods and the expanding urban population in the Kingdom.

02. What are the challenges in the KSA Soup Market?

Challenges include intense competition among brands, fluctuating raw material prices, and consumer preferences shifting towards fresh food over packaged alternatives. Regulatory concerns regarding food additives and preservatives also pose challenges.

03. Who are the major players in the KSA Soup Market?

Key players in the market include Knorr, Campbells, Maggi, Halwani Bros, and Noor Asia. Their established brand loyalty, extensive distribution networks, and diverse product portfolios contribute to their market dominance.

04. What are the growth drivers of the KSA Soup Market?

Key growth drivers include the rising demand for ready-to-eat meals, increasing urbanization, and a shift towards healthier, convenient food options. Innovative packaging and product variety also play a significant role.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.