KSA Specialty Chemicals Industry Outlook to 2030

Region:Middle East

Author(s):Yogita Sahu

Product Code:KROD3874

October 2024

81

About the Report

KSA Specialty Chemicals Market Overview

- The KSA Specialty Chemicals Market is valued at USD 16.5 billion, driven by the robust demand from key industrial sectors such as oil & gas, construction, and water treatment. The Kingdoms push towards industrialization, as outlined in Vision 2030, plays a pivotal role in the expansion of this market. The growing infrastructure projects and large-scale production in various industries are further accelerating the demand for specialty chemicals.

- Major cities such as Riyadh, Jeddah, and Dammam dominate the specialty chemicals market due to their strategic industrial locations. These cities are home to key manufacturing hubs and industrial zones, benefiting from well-established infrastructure and proximity to major energy resources like oil. Their dominance is further supported by government policies that promote industrial diversification and regional development.

- Under the Vision 2030 initiative, the Saudi government has allocated $45 billion to the development and diversification of its chemical industry, aiming to reduce its reliance on basic petrochemicals and enhance specialty chemical production. This program is expected to boost the Kingdoms specialty chemicals market by fostering innovation in higher-value chemical segments such as agrochemicals, electronics chemicals, and polymer additives.

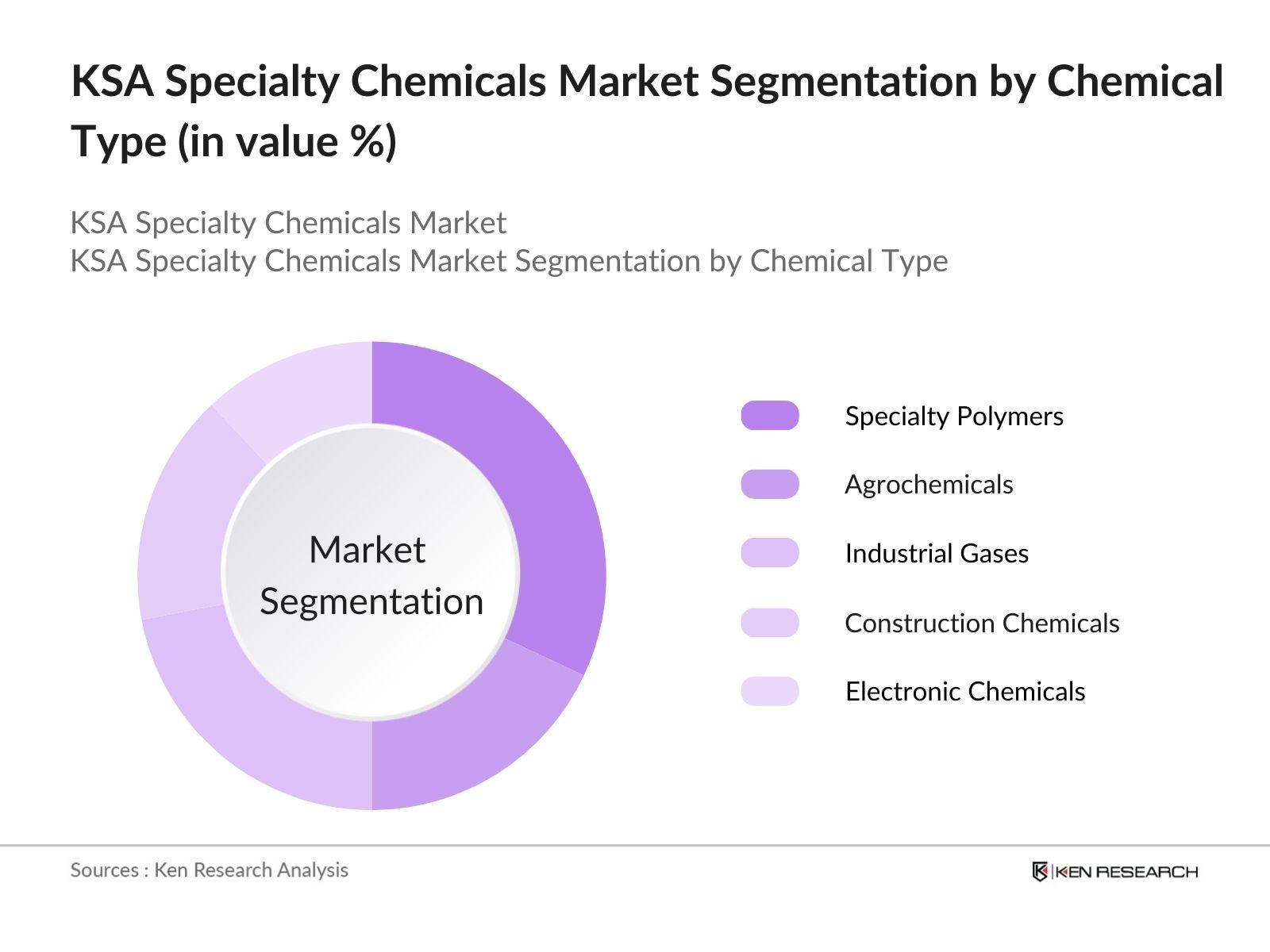

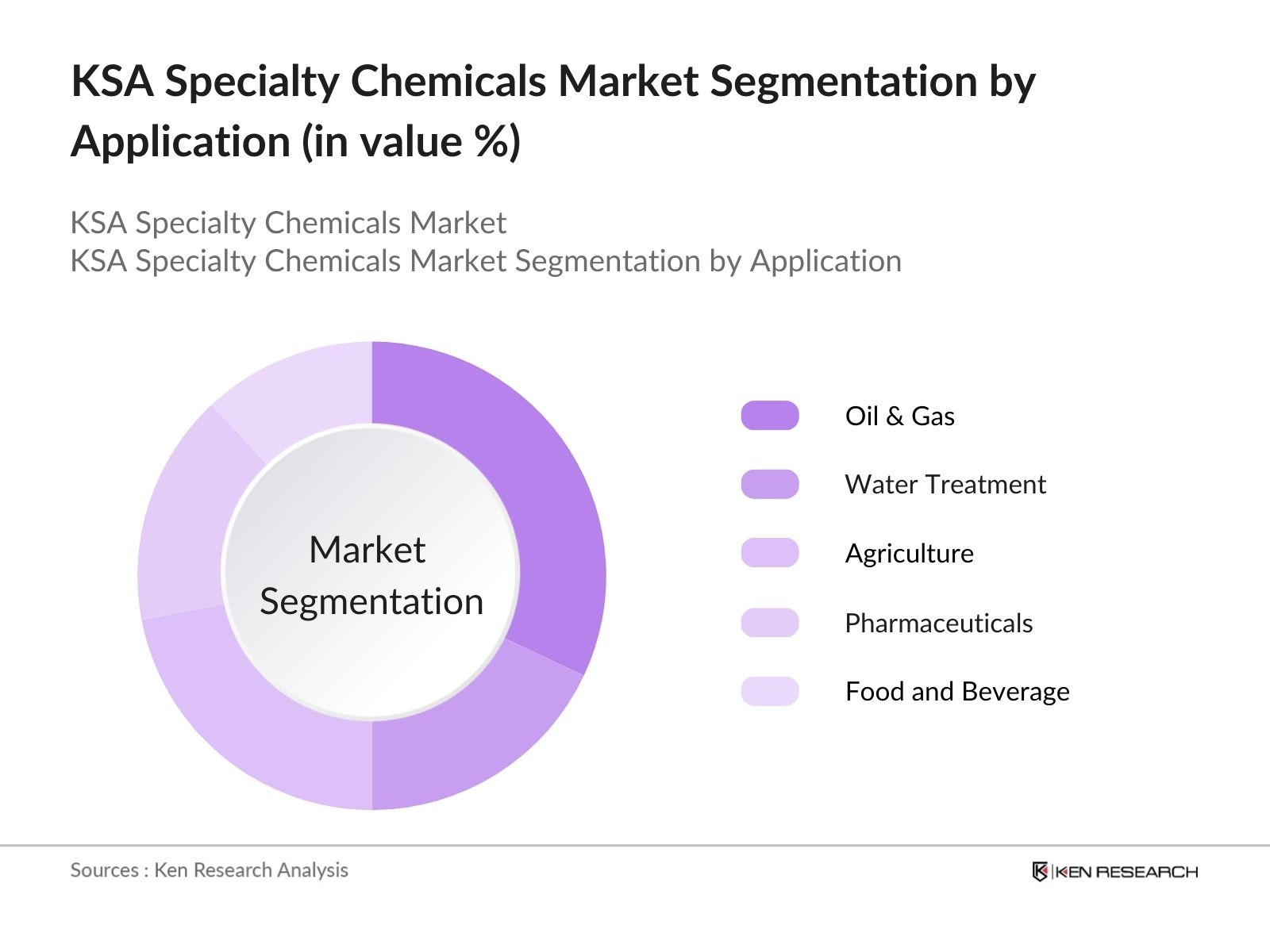

KSA Specialty Chemicals Market Segmentation

By Chemical Type: The market is segmented by chemical type into Specialty Polymers, Agrochemicals, Industrial Gases, Construction Chemicals, and Electronic Chemicals. Specialty Polymers hold the dominant market share due to their wide application in diverse industries such as automotive, electronics, and consumer goods. The growth of infrastructure projects in Saudi Arabia has also fueled demand for construction chemicals, including adhesives and sealants.

By End-User Industry: The market is also segmented by End-User Industry into Energy, Manufacturing, Consumer Goods, Electronics, and Healthcare. The Energy sector, particularly the oil and gas industry, dominates the specialty chemicals market due to its reliance on high-performance chemicals for extraction, refining, and environmental protection processes. The manufacturing sector also plays a role, driven by the rising demand for industrial chemicals that enhance production efficiency and product quality.

KSA Specialty Chemicals Market Competitive Landscape

The market is dominated by a mix of local and global players, with leading companies investing in capacity expansion and technological advancements. The market features a few large players, benefiting from their well-established supply chains and strategic partnerships with major industrial sectors.

|

Company |

Established |

Headquarters |

Revenue (USD) |

Employee Strength |

Production Capacity |

Global Reach |

R&D Investments |

Key Products |

|

Saudi Basic Industries Corporation |

1976 |

Riyadh |

||||||

|

Sadara Chemical Company |

2011 |

Jubail |

||||||

|

Sahara International Petrochemical |

1999 |

Riyadh |

||||||

|

Petro Rabigh |

2005 |

Rabigh |

||||||

|

Tasnee |

1985 |

Riyadh |

KSA Specialty Chemicals Market Analysis

Market Growth Drivers

- Expanding Petrochemical Sector: The market is witnessing growth driven by the Kingdoms thriving petrochemical sector. As of 2024, Saudi Arabia produces over 110 million tons of petrochemical products annually, of which specialty chemicals such as catalysts, coatings, and additives constitute a major part. The countrys focus on diversifying its chemical portfolio beyond basic petrochemicals, as highlighted in the Vision 2030 initiative, is fostering increased production of specialty chemicals for domestic consumption and export.

- Development of Renewable Energy Projects: Saudi Arabias renewable energy goals under Vision 2030, including the development of 58.7 GW of renewable energy capacity by 2030, are driving demand for specialty chemicals used in solar panels, wind turbines, and energy storage systems. Specialty materials like polymeric binders, resins, and coatings are essential for manufacturing durable and high-performance renewable energy components. By 2024, the renewable energy sector is projected to demand over 2 million metric tons of specialty chemicals annually, in line with the nations shift toward sustainable energy solutions.

- Growth in Infrastructure Projects: Saudi Arabia has allocated over $500 billion towards mega infrastructure projects like NEOM, Red Sea Project, and the Qiddiya entertainment city by 2030. These projects are driving the demand for construction chemicals, coatings, adhesives, and sealants in the specialty chemicals market. By 2024, ongoing construction across these mega projects is expected to require over 1.5 million tons of specialty construction chemicals, creating a surge in the demand for high-performance materials critical for sustainable building solutions.

Market Challenges

- Limited Skilled Workforce: A shortage of skilled professionals in Saudi Arabia's specialty chemicals sector is hindering growth. The chemicals industry requires highly specialized expertise in areas like chemical engineering, R&D, and process optimization, which is currently lacking due to inadequate local training and education programs. In 2024, the workforce gap is projected to include around 5,000 to 7,000 specialists, which is leading companies to invest more in training or hire from abroad, raising operational costs.

- High Energy Consumption in Chemical Production: The energy-intensive nature of specialty chemical production in Saudi Arabia presents challenges, as electricity consumption in the chemicals industry is forecasted to exceed 120 TWh (terawatt hours) by 2025. This high energy demand increases operational costs and makes the industry vulnerable to fluctuations in electricity prices. The transition to more energy-efficient production processes is slow and capital-intensive, which could restrict the competitiveness of local producers.

KSA Specialty Chemicals Market Future Outlook

Over the next five years, the KSA Specialty Chemicals industry is expected to witness substantial growth driven by continuous expansion in the industrial sector, increased investments in research and development, and the ongoing implementation of Vision 2030s goals. The demand for high-performance chemicals used in key industries such as construction, oil & gas, and water treatment is projected to increase, while environmental regulations will drive the adoption of more eco-friendly and sustainable chemical solutions.

Future Market Opportunities

- Shift Toward Local Production of Specialty Agrochemicals: The KSA governments focus on agricultural self-sufficiency will drive the local production of specialty agrochemicals, such as biofertilizers and crop protection chemicals. In the next five years, local agrochemical manufacturers are projected to increase their output by over 30% to meet the demand from the domestic agricultural sector, which is expanding rapidly due to government investment in sustainable farming technologies.

- Growing Role of Specialty Chemicals in Electric Vehicle (EV) Production: As Saudi Arabia pushes forward with its plans to become a hub for electric vehicle production, specialty chemicals will play a crucial role in EV battery manufacturing and lightweight materials for vehicle parts. By 2029, Saudi Arabia is expected to produce over 200,000 electric vehicles annually, with specialty chemicals required for battery efficiency, insulation, and advanced composites.

Scope of the Report

|

Chemical Type |

Specialty Polymers |

|

Agrochemicals |

|

|

Industrial Gases |

|

|

Construction Chemicals |

|

|

Electronic Chemicals |

|

|

Application |

Water Treatment |

|

Food and Beverage |

|

|

Oil & Gas |

|

|

Agriculture |

|

|

Pharmaceuticals |

|

|

End-User Industry |

Energy |

|

Manufacturing |

|

|

Consumer Goods |

|

|

Electronics |

|

|

Healthcare |

|

|

Region |

North |

|

East |

|

|

West |

|

|

South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Energy Companies (e.g., Saudi Aramco)

Petrochemical Manufacturers

Industrial Equipment Providers

Water Treatment Solution Providers

Construction Material Suppliers

Government and Regulatory Bodies (e.g., Ministry of Industry and Mineral Resources)

Investment and Venture Capitalist Firms

End-User Industries (Manufacturing, Consumer Goods)

Companies

Players Mentioned in the Report:

Saudi Basic Industries Corporation (SABIC)

Sipchem

Sadara Chemical Company

Petro Rabigh

Tasnee

Advanced Petrochemical Company

Sahara International Petrochemical Company

Saudi Aramco

Zamil Group

Nama Chemicals

Alujain Corporation

Chemanol

KEMYA (Al-Jubail Petrochemical Company)

Sahara & Maaden Petrochemical Company

Farabi Petrochemicals Company

Table of Contents

1. KSA Specialty Chemicals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Barrels, Tonnes, USD Billion)

1.4. Market Segmentation Overview

2. KSA Specialty Chemicals Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Local Production, Export Statistics, Regulatory Changes)

3. KSA Specialty Chemicals Market Analysis

3.1. Growth Drivers

3.1.1. Oil and Gas Sector Expansion

3.1.2. Increased Infrastructure Projects (Giga-Projects like NEOM)

3.1.3. Government Policies Favoring Industrialization

3.1.4. Rising Focus on Water Treatment and Environmental Regulations

3.2. Market Challenges

3.2.1. Fluctuating Oil Prices

3.2.2. High Production Costs

3.2.3. Supply Chain Disruptions (Raw Material Shortage)

3.2.4. Stringent Environmental Regulations

3.3. Opportunities

3.3.1. Rising Demand for Petrochemicals

3.3.2. Increasing Use of Specialty Chemicals in Renewable Energy Sector

3.3.3. Technological Advancements in Chemical Processing

3.3.4. Expansion into Emerging Sub-Sectors (Adhesives, Lubricants, Coatings)

3.4. Trends

3.4.1. Adoption of Eco-Friendly and Green Chemicals

3.4.2. Rise of Custom Specialty Chemicals for Specific Industries

3.4.3. Integration of Digital Solutions in Chemical Manufacturing

3.4.4. Increasing Export Opportunities in African and Asian Markets

3.5. Government Regulations

3.5.1. Saudi Vision 2030 Influence on Industrialization

3.5.2. Incentives for Localization and Export Promotion

3.5.3. Environmental Compliance and Sustainability Standards

3.5.4. Tariff and Non-Tariff Barriers on Imports

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Government Bodies, Private Firms, Industrial Associations)

3.8. Porters Five Forces

3.9. Competition Ecosystem (Distribution Channels, Supplier Networks)

4. KSA Specialty Chemicals Market Segmentation

4.1. By Chemical Type (In Value)

4.1.1. Specialty Polymers

4.1.2. Agrochemicals

4.1.3. Industrial Gases

4.1.4. Construction Chemicals

4.1.5. Electronic Chemicals

4.2. By Application (In Value)

4.2.1. Water Treatment

4.2.2. Food and Beverage

4.2.3. Oil & Gas

4.2.4. Agriculture

4.2.5. Pharmaceuticals

4.3. By End-User Industry (In Value)

4.3.1. Energy

4.3.2. Manufacturing

4.3.3. Consumer Goods

4.3.4. Electronics

4.3.5. Healthcare

4.4. By Region (In Value)

4.4.1. North

4.4.2. East

4.4.3. West

4.4.4. South

5. KSA Specialty Chemicals Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Saudi Basic Industries Corporation (SABIC)

5.1.2. Sadara Chemical Company

5.1.3. Sahara International Petrochemical Company (Sipchem)

5.1.4. Petro Rabigh

5.1.5. Tasnee

5.1.6. Advanced Petrochemical Company

5.1.7. Saudi Industrial Investment Group

5.1.8. Saudi Aramco

5.1.9. Zamil Group

5.1.10. Nama Chemicals

5.1.11. Alujain Corporation

5.1.12. Chemanol

5.1.13. KEMYA (Al-Jubail Petrochemical Company)

5.1.14. Sahara & Maaden Petrochemical Company

5.1.15. Farabi Petrochemicals Company

5.2 Cross Comparison Parameters

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Specialty Chemicals Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Specialty Chemicals Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Specialty Chemicals Future Market Segmentation

8.1. By Chemical Type (In Value)

8.2. By Application (In Value)

8.3. By End-User Industry (In Value)

8.4. By Region (In Value)

9. KSA Specialty Chemicals Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the ecosystem of the KSA Specialty Chemicals Market, including all major stakeholders such as manufacturers, end-users, and regulatory bodies. Data was collected through a mix of secondary research from proprietary databases and publicly available sources. Key variables influencing market dynamics, such as supply chain structures and government policies, were identified.

Step 2: Market Analysis and Construction

In this phase, historical data on the KSA Specialty Chemicals Market was analyzed. This analysis included evaluating the number of production facilities, import-export ratios, and chemical production capacities. Market penetration rates and industry performance were studied to establish reliable revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding demand trends, production volumes, and potential future developments were validated through expert consultations. Interviews with key players in the chemicals sector provided crucial insights into current market conditions and operational challenges. These consultations further helped refine the market projections.

Step 4: Research Synthesis and Final Output

In the final step, the collected data was synthesized to deliver a comprehensive analysis of the KSA Specialty Chemicals Market. Both top-down and bottom-up approaches were used to validate the research findings, ensuring an accurate representation of market conditions and future projections.

Frequently Asked Questions

01. How big is the KSA Specialty Chemicals Market?

The KSA Specialty Chemicals Market is valued at USD 16.5 billion, driven primarily by the oil & gas, construction, and water treatment sectors, in alignment with Vision 2030s push towards industrial diversification.

02. What are the major challenges in the KSA Specialty Chemicals Market?

Challenges in the KSA Specialty Chemicals Market include fluctuating oil prices, high production costs, and stringent environmental regulations that require chemical manufacturers to adopt sustainable practices.

03. Who are the key players in the KSA Specialty Chemicals Market?

Major players in the KSA Specialty Chemicals Market include Saudi Basic Industries Corporation (SABIC), Sipchem, Sadara Chemical Company, Petro Rabigh, and Tasnee, all of which have established themselves through their production capacities and government partnerships.

04. What drives the growth of the KSA Specialty Chemicals Market?

Growth in the KSA Specialty Chemicals Market is driven by the expansion of key sectors such as oil & gas, construction, and energy. The demand for high-performance and specialized chemicals in these industries, along with government incentives, supports market expansion.

05. What are the future trends in the KSA Specialty Chemicals Market?

Future trends in the KSA Specialty Chemicals Market include a shift towards more sustainable and eco-friendly chemicals, increased investments in R&D, and the growth of specialty chemicals used in renewable energy applications and advanced manufacturing technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.