KSA Tablet Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi

Product Code:KROD3642

October 2024

90

About the Report

KSA Tablet Market Overview

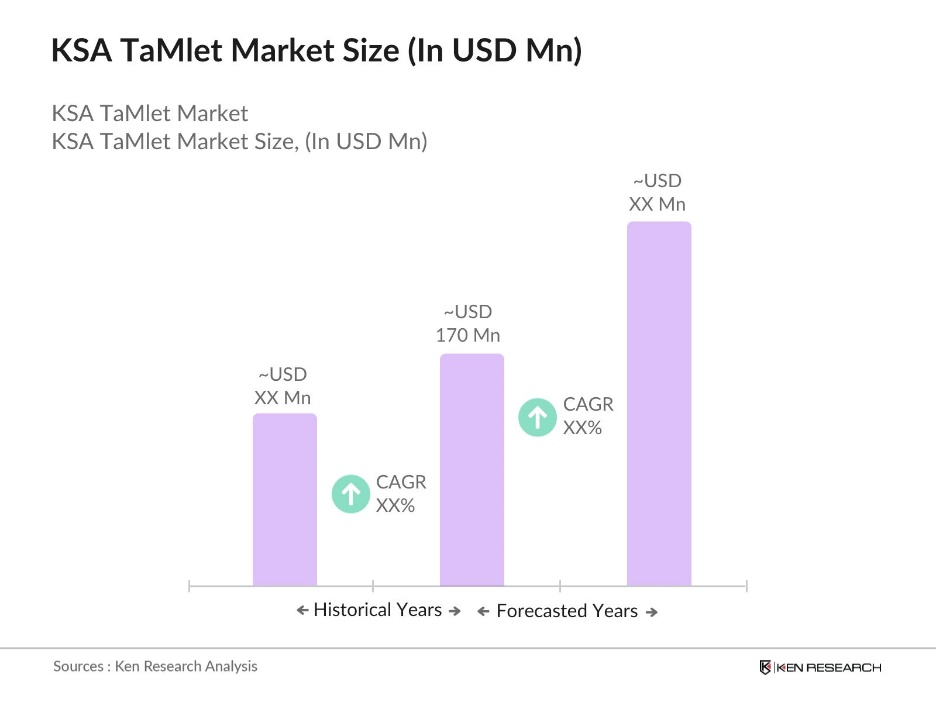

- The KSA Tablet Market is valued at USD 170 million, driven by increasing adoption of digital devices for education, entertainment, and business applications. With the government's focus on Vision 2030, there has been a rapid increase in e-learning initiatives, which significantly boosts the demand for tablets. Additionally, the growing digital literacy in the region and the rise in internet penetration have contributed to the market's expansion, making tablets essential devices in households, schools, and workplaces.

- Riyadh and Jeddah are the dominant cities in the KSA Tablet market, primarily due to their higher internet connectivity, affluent population, and better digital infrastructure. Riyadh's role as the economic hub and Jeddah's position as a commercial center allow them to lead in technology adoption, including tablet usage for personal and corporate purposes. The cities' well-established tech ecosystems and higher consumer spending power further solidify their dominance in the market.

- In 2023, the Saudi government continued to enforce a 15% Value Added Tax (VAT) on electronic devices, including tablets. This tax has contributed to the overall increase in tablet prices, affecting affordability for consumers. However, the government has introduced subsidy programs to offset the cost for students and low-income households. Despite VAT, the demand for tablets in educational and professional sectors remains strong, as these devices are now seen as essential.

KSA Tablet Market Segmentation

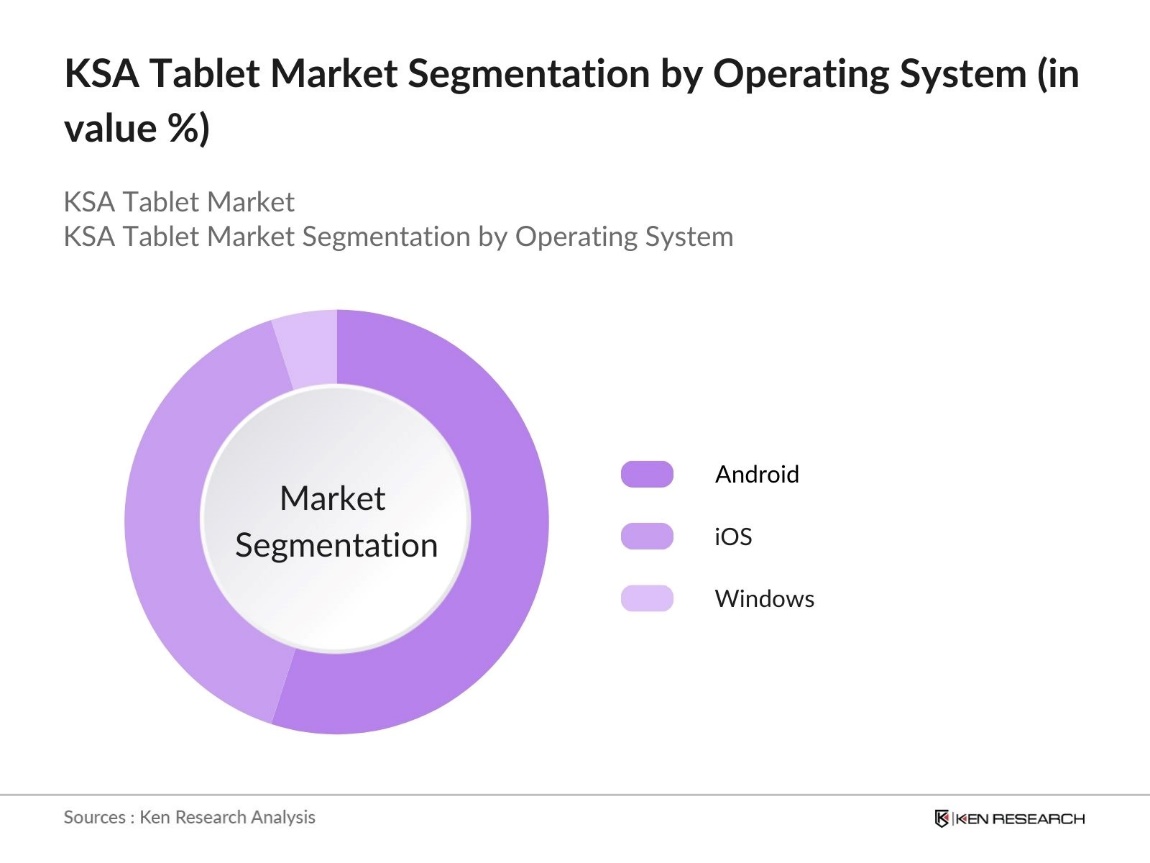

- By Operating System: The KSA Tablet market is segmented by operating system into iOS, Android, and Windows. Android-based tablets dominate this segment due to their affordability and wide availability across multiple price ranges, catering to a diverse consumer base. Moreover, Android tablets are supported by various brands, which offer consumers a broader selection, while integration with Google services and customizable features appeal to tech-savvy users.

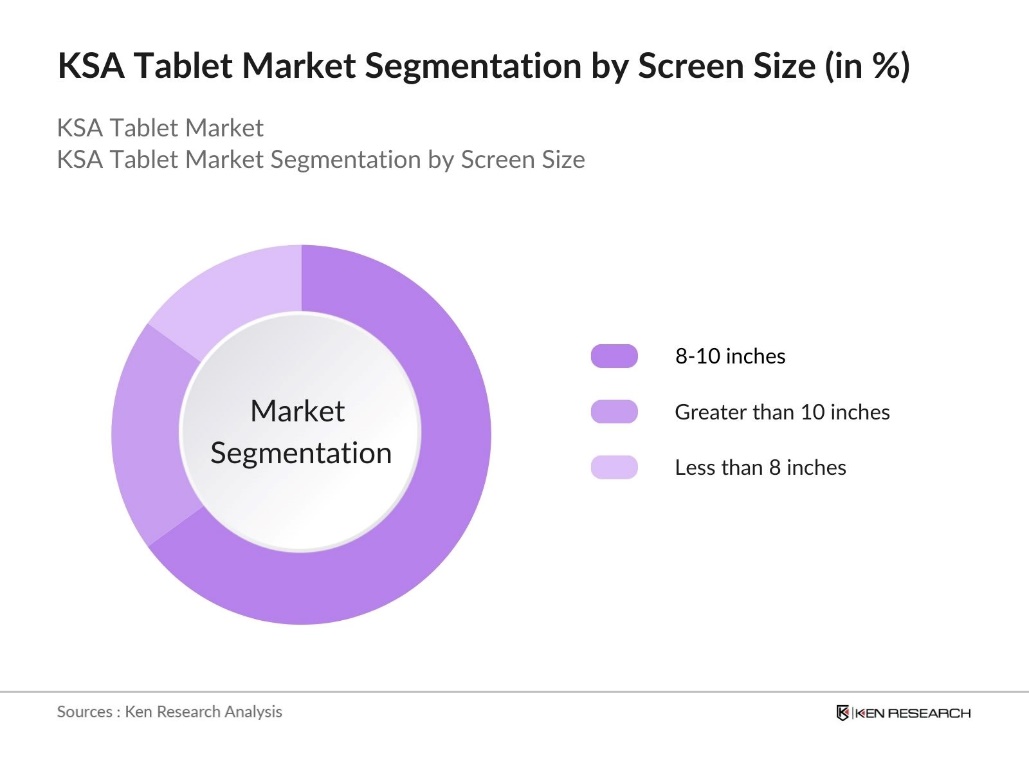

- By Screen Size: In terms of screen size, the KSA Tablet market is segmented into tablets with screen sizes of less than 8 inches, 8-10 inches, and greater than 10 inches. Tablets with screen sizes of 8-10 inches are the dominant sub-segment as they strike a balance between portability and functionality, making them ideal for educational use, entertainment, and business tasks. Their moderate size ensures that they are easy to carry while offering enough screen space for a quality viewing experience, particularly in remote learning environments.

KSA Tablet Market Competitive Landscape

The market is dominated by a few key players who offer a range of tablets catering to different consumer needs. These companies leverage their global brand recognition, extensive distribution networks, and ongoing product innovation to maintain their leadership positions in the market. Companies like Apple and Samsung dominate due to their advanced technology offerings and brand loyalty, while Huawei and Lenovo have strengthened their presence with affordable yet high-performance tablets.

|

Company Name |

Establishment Year |

Headquarters |

Key Products |

Market Reach |

Revenue |

Brand Loyalty |

Innovation Focus |

Customer Segments |

|

Apple Inc. |

1976 |

Cupertino, USA |

||||||

|

Samsung Electronics |

1938 |

Suwon, South Korea |

||||||

|

Huawei Technologies |

1987 |

Shenzhen, China |

||||||

|

Lenovo Group |

1984 |

Beijing, China |

||||||

|

Microsoft Corporation |

1975 |

Redmond, USA |

KSA Tablet Industry Analysis

Growth Drivers

- Increasing Digital Literacy: The Kingdom of Saudi Arabia has been making significant strides in digital literacy, supported by initiatives such as the National Transformation Program 2020 and Vision 2030. These initiatives have increased access to digital devices, including tablets. By 2024, the number of internet users in the country is projected to reach approximately 37.10 million, which constitutes about 99% of the population. This widespread connectivity is driving the adoption of tablets as an essential tool for education, work, and entertainment.

- Growing 5G Penetration: Saudi Telecom Company (STC) announced plans to expand its 5G network in over 75 cities across Saudi Arabia. This high-speed connectivity has enabled better tablet performance, especially for tasks requiring large data consumption like video conferencing and streaming. The Communications and Information Technology Commission (CITC) projects that by the end of 2024, 5G coverage will reach will increased in the KSA, making tablets an increasingly attractive option for users looking for fast, reliable internet access on mobile devices.

- Remote Work and Education Surge: Saudi Arabia has experienced a significant rise in the adoption of remote work and online education, largely due to global trends and the lasting impacts of the COVID-19 pandemic. The Ministry of Education has incorporated digital tools into the educational system, making tablets an essential device for students and educators. This shift has driven increased demand for tablets in both academic and professional settings.

Market Challenges

- High Competition from Smartphones: Smartphones are increasingly dominating the mobile device market in Saudi Arabia due to their advanced functionality and larger screen sizes. As smartphones become more versatile, the distinction between them and tablets is becoming less clear, causing many consumers to question the necessity of owning a separate tablet device. This overlap in features, especially in high-end smartphones, has impacted tablet sales, with many users opting for smartphones that can serve multiple purposes rather than purchasing a dedicated tablet.

- Price Sensitivity: Tablets, particularly high-end models, are often viewed as expensive when compared to other devices like laptops and smartphones. This price sensitivity affects consumer decisions, especially when considering additional costs such as VAT, which further increases the overall cost of purchasing a tablet. The affordability factor plays a significant role in limiting the adoption of premium tablets, as many consumers prefer more cost-effective alternatives that offer similar functionalities. This has made it difficult for manufacturers to push high-end tablet models in a price-conscious market.

KSA Tablet Market Future Outlook

Over the next five years, the KSA Tablet market is expected to experience significant growth, driven by continuous government support, especially in education and digitalization initiatives. The expansion of 5G networks, increasing e-learning platforms, and the growing trend of remote work are anticipated to fuel further demand for tablets. The rising popularity of hybrid models, such as 2-in-1 tablets, will also contribute to market growth, offering consumers enhanced portability and functionality.

Market Opportunities

- Adoption of AI-driven Applications: The integration of Artificial Intelligence (AI) in tablets offers significant growth potential in the KSA market. AI-driven applications are becoming increasingly prominent, especially in sectors like education and healthcare. Tablets equipped with AI-powered tools, such as smart learning platforms and telemedicine applications, are gaining popularity. This creates an opportunity for manufacturers to target these growing markets by offering AI-enhanced tablets that can support advanced functionalities, such as personalized learning experiences in education or AI-driven patient care in healthcare.

- Expansion into Education and Healthcare Sectors: Tablets are playing a crucial role in the education and healthcare sectors in Saudi Arabia. Many schools are incorporating tablets into their classrooms to support digital learning, and healthcare institutions are utilizing them for patient management and telehealth services. This growing demand in both sectors presents a significant opportunity for manufacturers to create specialized tablets that cater to the specific needs of education and healthcare professionals.

Scope of the Report

|

Operating System |

iOS |

|

Screen Size |

Less than 8 inches |

|

Connectivity |

Wi-Fi Only |

|

End-User |

Individual Users |

|

Region |

Riyadh |

Products

Key Target Audience

Tablet Manufacturers Companies

Consumer Electronics Companies

E-learning Platform Providers

IT Companies

Government and Regulatory Bodies (Ministry of Communications and Information Technology)

Banks and Financial Institutions

Investment and Venture Capitalist Firms

Companies

Major Players

Apple Inc.

Samsung Electronics

Huawei Technologies Co., Ltd.

Lenovo Group Limited

Microsoft Corporation

AsusTek Computer Inc.

Dell Technologies

Acer Inc.

Amazon.com, Inc.

Xiaomi Corporation

TCL Technology

Nokia Corporation

Sony Corporation

Google LLC

Realme

Table of Contents

1. KSA Tablet Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Operating System, Screen Size, Connectivity, Processor Type, Brand)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Tablet Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Tablet Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Digital Literacy

3.1.2. Remote Work and Education Surge

3.1.3. Government E-learning Initiatives

3.1.4. Growing 5G Penetration

3.2. Market Challenges

3.2.1. High Competition from Smartphones

3.2.2. Price Sensitivity

3.2.3. Limited Local Manufacturing

3.3. Opportunities

3.3.1. Adoption of AI-driven Applications

3.3.2. Expansion into Education and Healthcare Sectors

3.3.3. Partnerships with E-learning Platforms

3.4. Trends

3.4.1. Introduction of Foldable Tablets

3.4.2. Demand for High-performance Tablets

3.4.3. Growth in 2-in-1 Tablets Segment

3.5. Government Regulation

3.5.1. E-learning Policies

3.5.2. VAT Impact on Tablet Prices

3.5.3. Import Regulations and Custom Duties

3.5.4. Digital Infrastructure Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. KSA Tablet Market Segmentation

4.1. By Operating System (In Value %)

4.1.1. iOS

4.1.2. Android

4.1.3. Windows

4.2. By Screen Size (In Value %)

4.2.1. Less than 8 inches

4.2.2. 8-10 inches

4.2.3. Greater than 10 inches

4.3. By Connectivity (In Value %)

4.3.1. Wi-Fi Only

4.3.2. Wi-Fi + Cellular

4.4. By End-User (In Value %)

4.4.1. Individual Users

4.4.2. Education Sector

4.4.3. Corporate Users

4.4.4. Healthcare Sector

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Makkah

4.5.5. Eastern Province

5. KSA Tablet Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Apple Inc.

5.1.2. Samsung Electronics

5.1.3. Huawei Technologies Co., Ltd.

5.1.4. Lenovo Group Limited

5.1.5. Microsoft Corporation

5.1.6. AsusTek Computer Inc.

5.1.7. Dell Technologies

5.1.8. Acer Inc.

5.1.9. Amazon.com, Inc.

5.1.10. Xiaomi Corporation

5.1.11. TCL Technology

5.1.12. Nokia Corporation

5.1.13. Sony Corporation

5.1.14. Google LLC

5.1.15. Realme

5.2 Cross Comparison Parameters (Market Share, Revenue, R&D Expenditure, Key Product Offerings, Customer Segments, Marketing Strategies, Innovation Focus, Distribution Channels)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. KSA Tablet Market Regulatory Framework

6.1 Digital Certification Standards

6.2 Data Protection Laws

6.3 Compliance with E-commerce Regulations

7. KSA Tablet Market Future Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. KSA Tablet Market Future Segmentation

8.1 By Operating System (In Value %)

8.2 By Screen Size (In Value %)

8.3 By Connectivity (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. KSA Tablet Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Market Penetration Strategies

9.3 Customer Behavior Insights

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying critical variables influencing the KSA Tablet market, including growth drivers, technological advancements, and consumer preferences. This step involves comprehensive desk research, using a blend of proprietary databases and publicly available industry reports.

Step 2: Market Analysis and Construction

The second phase focuses on analyzing historical data, identifying key trends, and assessing the overall structure of the KSA Tablet market. This includes reviewing sales data, industry growth rates, and competitive dynamics, ensuring a detailed understanding of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market insights and hypotheses are validated through in-depth interviews with industry experts and tablet manufacturers. This step helps refine market estimates, uncover growth opportunities, and provide a more accurate forecast of the markets future trajectory.

Step 4: Research Synthesis and Final Output

The final stage of research involves synthesizing findings into a comprehensive market report, which includes insights into competitive landscape, market segmentation, and key growth drivers. This ensures a data-driven, actionable analysis tailored for business professionals.

Frequently Asked Questions

01. How big is the KSA Tablet Market?

The KSA Tablet Market is valued at USD 170 million, driven by the growing demand for digital devices in education, business, and entertainment sectors. The market is expected to continue expanding as consumer preferences shift towards portable and multifunctional devices.

02. What are the challenges in the KSA Tablet Market?

Key challenges in KSA Tablet Market include competition from smartphones, which offer similar functionalities at lower prices, and price sensitivity among consumers. Additionally, the high import costs and reliance on international suppliers can affect market profitability for local vendors.

03. Who are the major players in the KSA Tablet Market?

Major players in KSA Tablet Market include global tech giants such as Apple, Samsung, Huawei, Lenovo, and Microsoft. These companies dominate the market due to their innovative products, extensive distribution networks, and strong consumer loyalty.

04. What are the growth drivers of the KSA Tablet Market?

The KSA Tablet Market is driven by increasing internet penetration, government initiatives like Vision 2030 promoting digital education, and the growing need for portable digital devices for remote work and learning. Advancements in tablet technology, including 5G integration and AI features, further boost demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.