KSA Tea Market Outlook to 2030

Region:Middle East

Author(s):Shreya Garg

Product Code:KROD9848

December 2024

94

About the Report

KSA Tea Market Overview

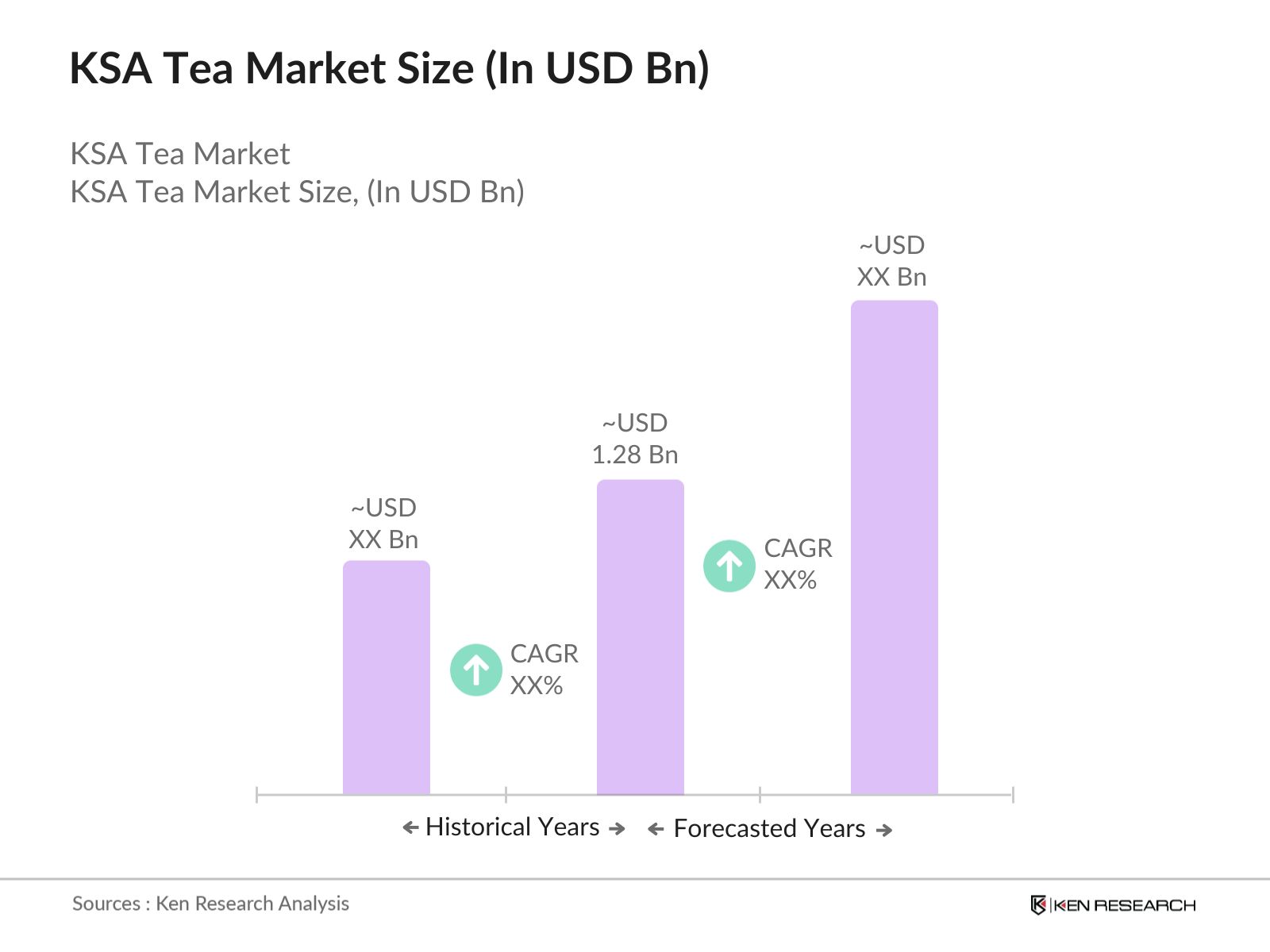

- The KSA Tea Market is valued at USD 1.28 billion, driven by strong cultural preferences for tea and a growing population of expatriates. Based on a five-year historical analysis, the markets growth is fueled by rising consumer demand for premium tea varieties, including green, black, and herbal teas. The increasing adoption of wellness teas, as well as growing interest in organic options, has further contributed to market expansion. This growing demand is also supported by the evolving preferences of health-conscious consumers.

- Riyadh and Jeddah dominate the KSA tea market, primarily due to their larger population bases and higher purchasing power. These cities are home to a diverse population, including expatriates from countries with a strong tea-drinking culture, such as India and the UK, which sustains the demand for various types of tea. Additionally, Riyadh's status as the capital and a major business hub makes it a critical market for high-end and luxury tea brands, further consolidating its dominance.

- The Saudi Food and Drug Authority (SFDA) regulates the import and export of tea to ensure quality and safety standards are met. In 2023, the SFDA implemented stricter guidelines on tea imports, requiring comprehensive testing for pesticide residues and contaminants. These regulations are aimed at protecting consumer health while ensuring that imported tea meets the highest safety standards. Non-compliance with SFDA guidelines can lead to product recalls or bans, highlighting the importance of regulatory compliance for tea importers.

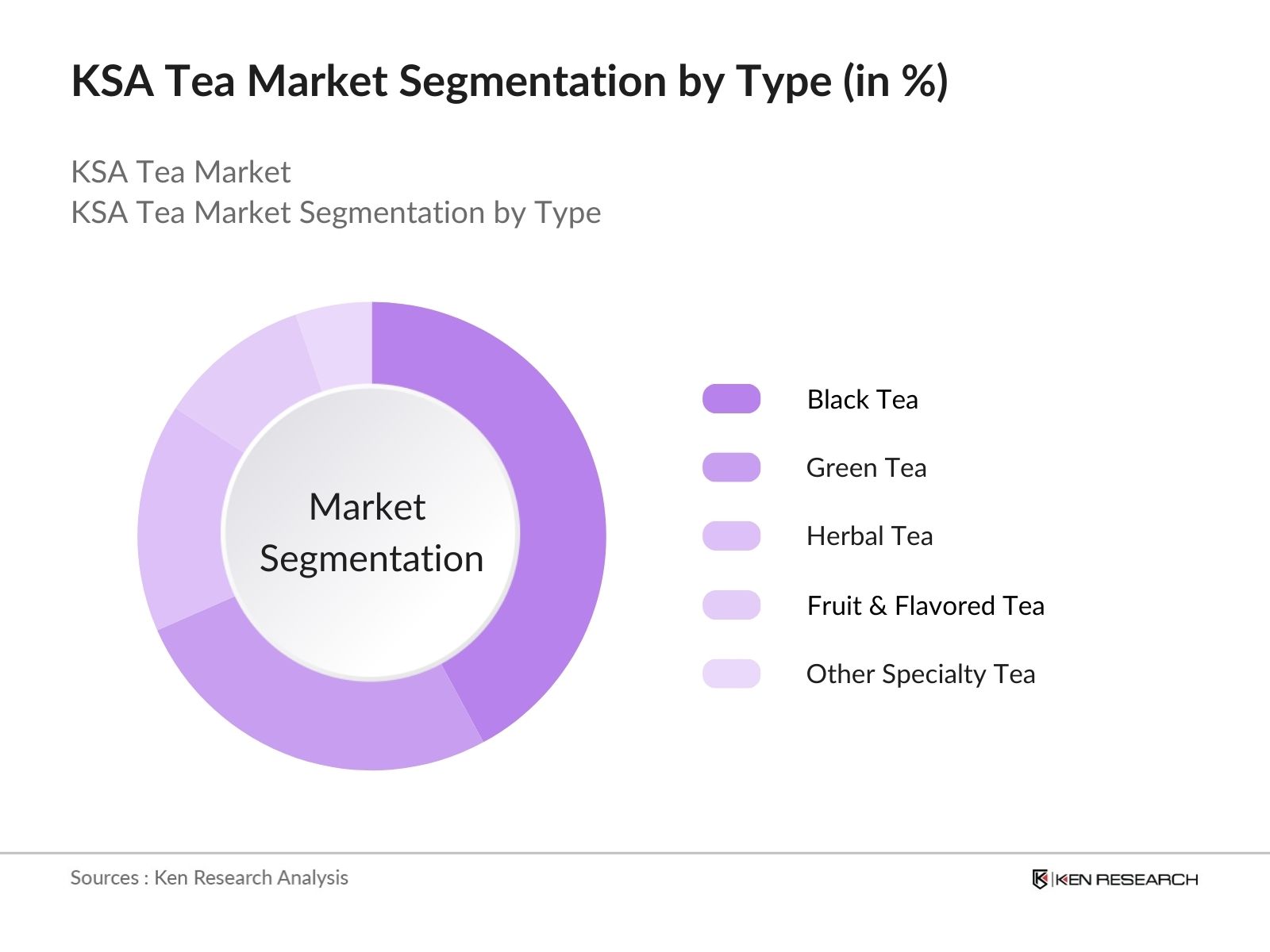

KSA Tea Market Segmentation

By Type: The Market is segmented by type into green tea, black tea, herbal tea, oolong tea, and others (including white tea and rooibos). Green tea holds a significant market share within this segmentation, driven by its association with numerous health benefits such as weight loss, improved brain function, and reduced risk of certain diseases. Consumers are increasingly aware of these benefits, leading to a growing preference for green tea. Furthermore, the rise of the health and wellness trend in KSA has supported the steady growth of this sub-segment.

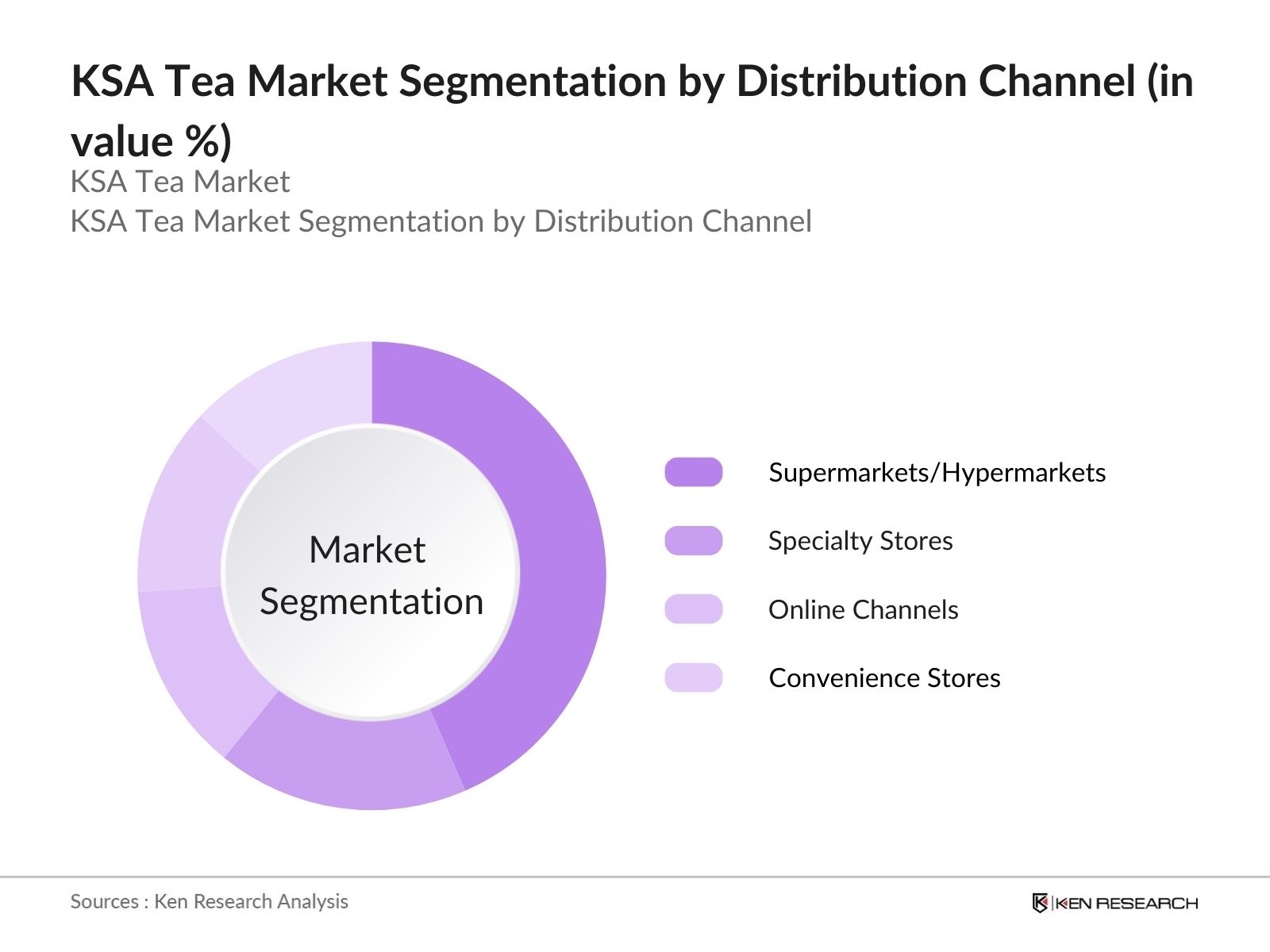

By Distribution Channel: The market is also segmented by distribution channels into supermarkets/hypermarkets, specialty stores, online channels, and convenience stores. Supermarkets and hypermarkets dominate the distribution channels due to their widespread presence across the Kingdom. These outlets offer consumers the convenience of purchasing tea along with other grocery items. Moreover, the availability of a wide variety of tea brands, including premium and international brands, contributes to the high market share of this segment. Supermarkets are also increasingly providing in-store promotions, further driving the dominance of this sub-segment.

KSA Tea Market Competitive Landscape

The KSA Tea Market is dominated by both international and local players, each vying to capture a larger share of this lucrative market. Global brands like Lipton and Twinings hold a significant presence due to their extensive distribution networks and strong brand recognition. Local players such as Rabea Tea also maintain a competitive edge by offering products that cater to local tastes and preferences, such as traditional black tea blends.

|

Company |

Year of Establishment |

Headquarters |

Product Range |

Distribution Channels |

Key Competitor |

Certifications |

Market Focus |

Partnerships |

Investment in KSA |

|

Lipton (Unilever) |

1890 |

London, UK |

|||||||

|

Twinings |

1706 |

Andover, UK |

|||||||

|

Rabea Tea |

1950 |

Jeddah, KSA |

|||||||

|

Alokozay Tea |

2003 |

Dubai, UAE |

|||||||

|

Ahmad Tea |

1986 |

London, UK |

KSA Tea Industry Analysis

Growth Drivers

- Rising Tea Consumption: Tea consumption in Saudi Arabia is a deeply embedded cultural practice, with the Kingdom registering significant per capita tea consumption. In 2022, Saudi Arabia imported over 25,000 metric tons of tea, showcasing the growing demand for tea products across various demographics. With the country's population expected to surpass 37 million by 2024, per capita consumption of tea remains robust, driven by increasing disposable incomes and social gatherings. Government records from the Saudi General Authority for Statistics confirm that the average tea intake per person is one of the highest among Gulf nations.

- Health and Wellness Trends: The increasing focus on health and wellness among Saudi consumers has led to a growing demand for organic and herbal teas. According to the Saudi Ministry of Health, in 2023, over 60% of consumers in urban areas expressed a preference for healthier alternatives, which include organic and herbal teas. This demand is being fueled by lifestyle changes aimed at reducing sugar and caffeine intake, with herbal teas like chamomile and mint seeing significant growth. This shift aligns with government health campaigns promoting healthier diets across the Kingdom.

- Cultural Significance of Tea: Tea has long been an integral part of Saudi hospitality, with its consumption intertwined with social and cultural practices. The Saudi General Authority for Statistics reported that tea is the second most consumed beverage after water in households across the Kingdom. Traditional teas, such as black tea, are frequently served during social gatherings and religious festivals, reinforcing tea's cultural importance. The ongoing preservation of these traditions is a major driver for consistent tea demand, with nearly 90% of households consuming tea regularly, according to 2023 surveys.

Market Challenges

- Price Volatility of Raw Materials: The tea market in Saudi Arabia is heavily dependent on imports, with nearly all of its tea being sourced from major exporters like India, Kenya, and Sri Lanka. According to the Saudi Customs Authority, the price of tea imports has been impacted by global economic instability and fluctuating commodity prices. The cost of imported tea leaves rose by 5% in 2023 due to supply chain disruptions and inflationary pressures, creating volatility in the local market. This volatility poses a challenge for suppliers to maintain price consistency.

- Increasing Competition from Coffee: While tea has traditionally been a staple beverage in Saudi Arabia, there is increasing competition from coffee, particularly among younger consumers. The Saudi Coffee Market Report from the Ministry of Commerce revealed that coffee consumption has grown by 8% in 2023, driven by the rise of specialty coffee shops and the growing coffee culture among millennials. The shift in beverage preferences is gradually eating into the tea market's share, as coffee becomes the drink of choice for social settings in urban areas like Riyadh and Jeddah.

KSA Tea Market Future Outlook

The KSA Tea Market is expected to grow significantly over the next five years, driven by increased demand for premium tea varieties and health-conscious products. Continuous innovations in tea flavors, packaging, and marketing, alongside the expansion of online retail channels, will further fuel this growth. Additionally, the rising number of expatriates in the country is expected to contribute to the increasing demand for diverse tea options, including herbal and organic teas.

Future Market Opportunities

- Rise in Premium Tea Varieties: There is a growing market for premium and luxury tea varieties in Saudi Arabia, especially among affluent consumers. According to the Saudi Ministry of Economy and Planning, demand for high-end tea products, such as white and matcha tea, increased by 15% in 2023. Consumers are increasingly willing to pay higher prices for quality, taste, and exclusivity, making the luxury tea segment a lucrative opportunity for both domestic and international tea brands. This trend is particularly strong in metropolitan areas like Riyadh and Jeddah, where premium tea lounges have gained popularity.

- Expansion of E-commerce Channels: The expansion of e-commerce channels in Saudi Arabia presents significant opportunities for tea sellers. The Saudi Communications and Information Technology Commission reported that e-commerce sales in the food and beverage sector grew by 30% in 2023, with tea being one of the top-selling products. With an increasing number of consumers opting for the convenience of online shopping, tea brands are capitalizing on this trend by offering a variety of tea products through online platforms, making it easier for consumers to access diverse and premium tea selections.

Scope of the Report

|

By Type |

Green Tea Black Tea Herbal Tea Oolong Tea Others |

|

By Format |

Loose Leaf Tea Bags Ready-to-Drink |

|

By Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Online Channels Convenience Stores |

|

By Flavor |

Plain Flavored |

|

By Region |

Riyadh Jeddah Dammam Makkah Medina |

Products

Key Target Audience

Tea Manufacturers

Tea Importers and Distributors

Supermarket and Hypermarket Chains

Specialty Tea Retailers

E-commerce Platforms

Health and Wellness Brands

Government and Regulatory Bodies (Saudi Food and Drug Authority)

Investors and Venture Capitalist Firms

Companies

Major Players

Lipton (Unilever)

Twinings

Ahmad Tea

Rabea Tea

Alokozay Tea

Dilmah Tea

Tetley (Tata Global Beverages)

Harney & Sons

Taylors of Harrogate

Bigelow Tea

Newby Teas

Betjeman & Barton

The Republic of Tea

Kusmi Tea

Alghazaleen Tea

Table of Contents

1. KSA Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Tea Market Size (In SAR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Tea Market Analysis

3.1. Growth Drivers

3.1.1. Rising Tea Consumption (per capita tea consumption)

3.1.2. Health and Wellness Trends (organic tea, herbal blends)

3.1.3. Cultural Significance of Tea (traditional tea culture)

3.1.4. Growing Population of Expats (demand for diverse tea varieties)

3.2. Market Challenges

3.2.1. Price Volatility of Raw Materials (imported tea leaves)

3.2.2. Increasing Competition from Coffee (shift in beverage preferences)

3.2.3. Supply Chain Disruptions (global tea production)

3.3. Opportunities

3.3.1. Rise in Premium Tea Varieties (luxury tea segment)

3.3.2. Expansion of E-commerce Channels (online tea sales)

3.3.3. Product Diversification (flavored and wellness teas)

3.4. Trends

3.4.1. Growing Demand for Ready-to-Drink Teas (convenience factor)

3.4.2. Increasing Popularity of Herbal and Organic Teas (health-conscious consumers)

3.4.3. Innovation in Packaging (sustainable and luxury packaging)

3.5. Government Regulation

3.5.1. Saudi Food and Drug Authority Regulations (import/export policies)

3.5.2. Tariff and Trade Laws (impact on tea imports)

3.5.3. Certification and Labelling Requirements (quality and safety standards)

3.6. SWOT Analysis

3.7. Stake Ecosystem (importers, distributors, retailers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Tea Market Segmentation

4.1. By Type (In Value %)

4.1.1. Green Tea

4.1.2. Black Tea

4.1.3. Herbal Tea

4.1.4. Oolong Tea

4.1.5. Others (White Tea, Rooibos)

4.2. By Format (In Value %)

4.2.1. Loose Leaf

4.2.2. Tea Bags

4.2.3. Ready-to-Drink

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Specialty Stores

4.3.3. Online Channels

4.3.4. Convenience Stores

4.4. By Flavor (In Value %)

4.4.1. Plain

4.4.2. Flavored (fruit, spices, herbs)

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Makkah

4.5.5. Medina

5. KSA Tea Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ahmad Tea

5.1.2. Twinings

5.1.3. Lipton (Unilever)

5.1.4. Rabea Tea

5.1.5. Alokozay Tea

5.1.6. Dilmah Tea

5.1.7. Tetley Tea (Tata Global Beverages)

5.1.8. Alghazaleen Tea

5.1.9. Harney & Sons

5.1.10. Taylors of Harrogate

5.1.11. Betjeman & Barton

5.1.12. Bigelow Tea

5.1.13. Newby Teas

5.1.14. The Republic of Tea

5.1.15. Kusmi Tea

5.2. Cross Comparison Parameters (Market Share, Revenue, Product Range, Presence in KSA, Retail Channels)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Brand Collaborations, Sponsorships)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

6. KSA Tea Market Regulatory Framework

6.1. Food Safety Regulations

6.2. Import Tariffs and Duties

6.3. Certification Processes (Halal Certification, Organic Labels)

7. KSA Tea Market Future Market Size (In SAR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Tea Market Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Format (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Flavor (In Value %)

8.5. By Region (In Value %)

9. KSA Tea Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis (Tea Drinking Habits, Preferences)

9.3. Marketing Strategies (Brand Positioning, Digital Campaigns)

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the KSA Tea Market, covering major stakeholders, including manufacturers, distributors, and retailers. This step relies on extensive desk research using secondary and proprietary databases to collect relevant industry-level data. Key variables like product type, distribution channel, and regional consumption patterns are identified.

Step 2: Market Analysis and Construction

In this phase, historical data on the KSA Tea Market is analyzed. This includes examining market penetration across different regions and product segments. Data from reputable sources is compiled to ensure the accuracy and reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts. These consultations provide valuable insights into market dynamics, including product preferences and consumer behavior. Interviews with key stakeholders help refine market estimates.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing research findings and engaging directly with tea manufacturers. Insights into product segments, consumer preferences, and distribution strategies are collected to verify the accuracy of the data. This ensures that the final report provides a comprehensive view of the KSA Tea Market.

Frequently Asked Questions

01. How big is the KSA Tea Market?

The KSA Tea Market is valued at USD 1.28 billion, driven by a combination of cultural factors, rising health consciousness, and increasing demand for premium tea varieties.

02. What are the challenges in the KSA Tea Market?

The market faces challenges such as price volatility in raw materials due to dependency on tea imports and increasing competition from coffee and other beverages.

03. Who are the major players in the KSA Tea Market?

Key players in the market include Lipton (Unilever), Twinings, Ahmad Tea, Rabea Tea, and Alokozay Tea, among others.

04. What are the growth drivers of the KSA Tea Market?

The market is driven by factors such as the rising health and wellness trend, increasing demand for organic and herbal teas, and a growing population of expatriates with strong tea-drinking traditions.

05. What trends are shaping the future of the KSA Tea Market?

Key trends include the increasing popularity of ready-to-drink teas, innovation in sustainable packaging, and the rise of e-commerce platforms for tea sales.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.