KSA Third-Party Logistics (3PL) Market Outlook to 2030

Region:Middle East

Author(s):Yogita Sahu

Product Code:KROD4566

October 2024

89

About the Report

KSA Third-Party Logistics (3PL) Market Overview

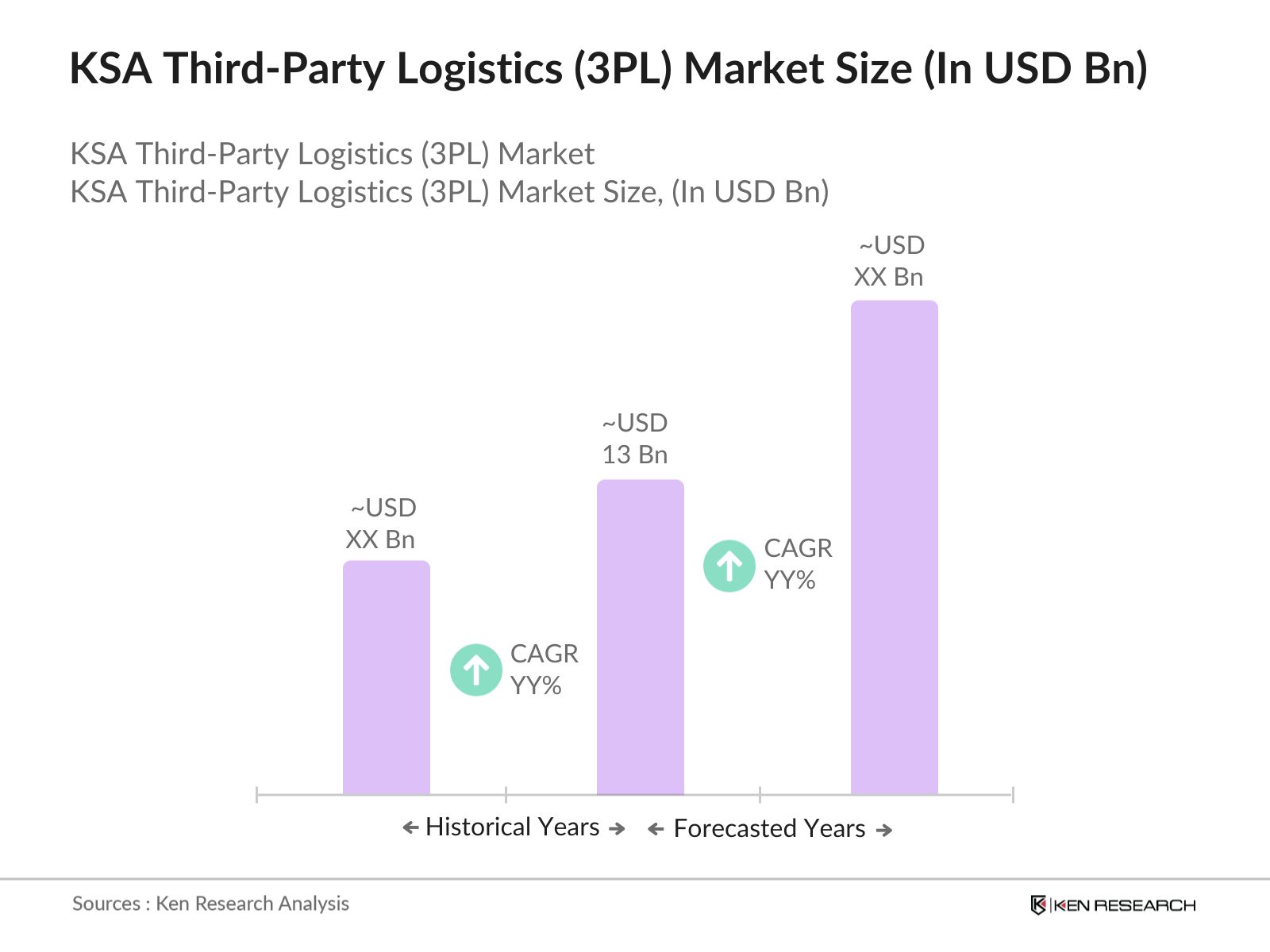

- The KSA Third-Party Logistics (3PL) market is valued at USD 13 billion, based on a five-year historical analysis. The growth of this market is driven by a surge in e-commerce, as the demand for efficient logistics solutions increases alongside the rise in online retail. Government initiatives under Vision 2030 also play a role by encouraging infrastructure investments, streamlining regulations, and promoting local businesses to support the countrys rapidly expanding logistics and supply chain sector.

- Saudi Arabia's major cities, including Riyadh, Jeddah, and Dammam, dominate the market due to their strategic locations as trade hubs. These cities are home to major economic activities, with Riyadh as the capital and commercial center, Jeddah as a significant port city, and Dammam being pivotal for industrial and oil-related activities.

- Saudi Arabia aims to position itself as a global logistics hub as part of its Vision 2030 plan. In 2024, the government allocated $3 billion to enhance logistics infrastructure, including new warehouses, distribution centers, and enhanced port facilities. This initiative is designed to make KSA a key player in the global logistics network, boosting the competitiveness of 3PL providers operating in the country.

KSA Third-Party Logistics (3PL) Market Segmentation

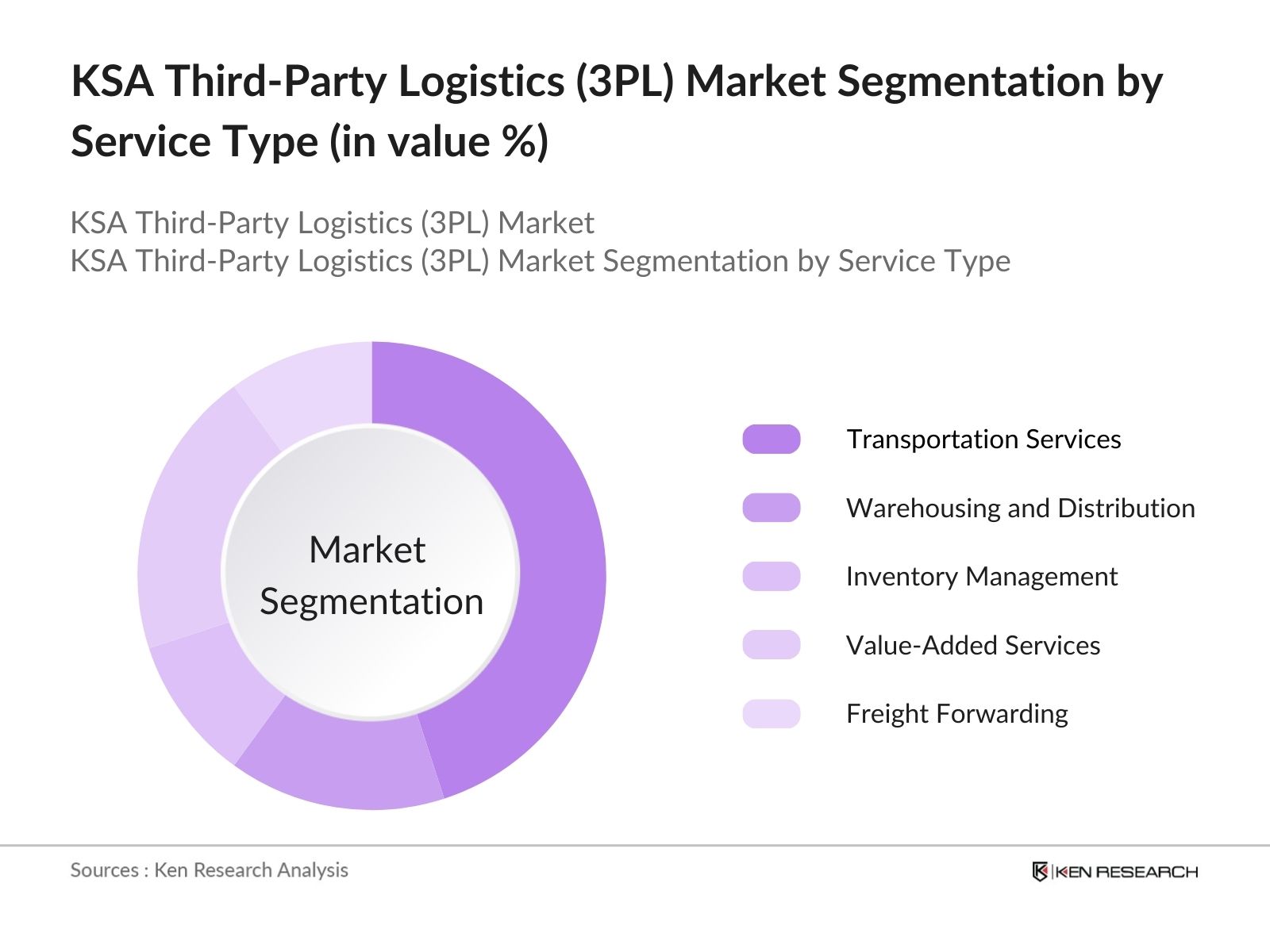

By Service Type: The market is segmented by service type into transportation services, warehousing and distribution, inventory management, value-added services, and freight forwarding. Transportation services hold a dominant market share due to the extensive demand for efficient movement of goods between urban centers and ports. The strategic location of Saudi Arabia as a key trade route between Europe, Asia, and Africa adds further to transportation, especially road and sea transport, which are critical for cross-border logistics.

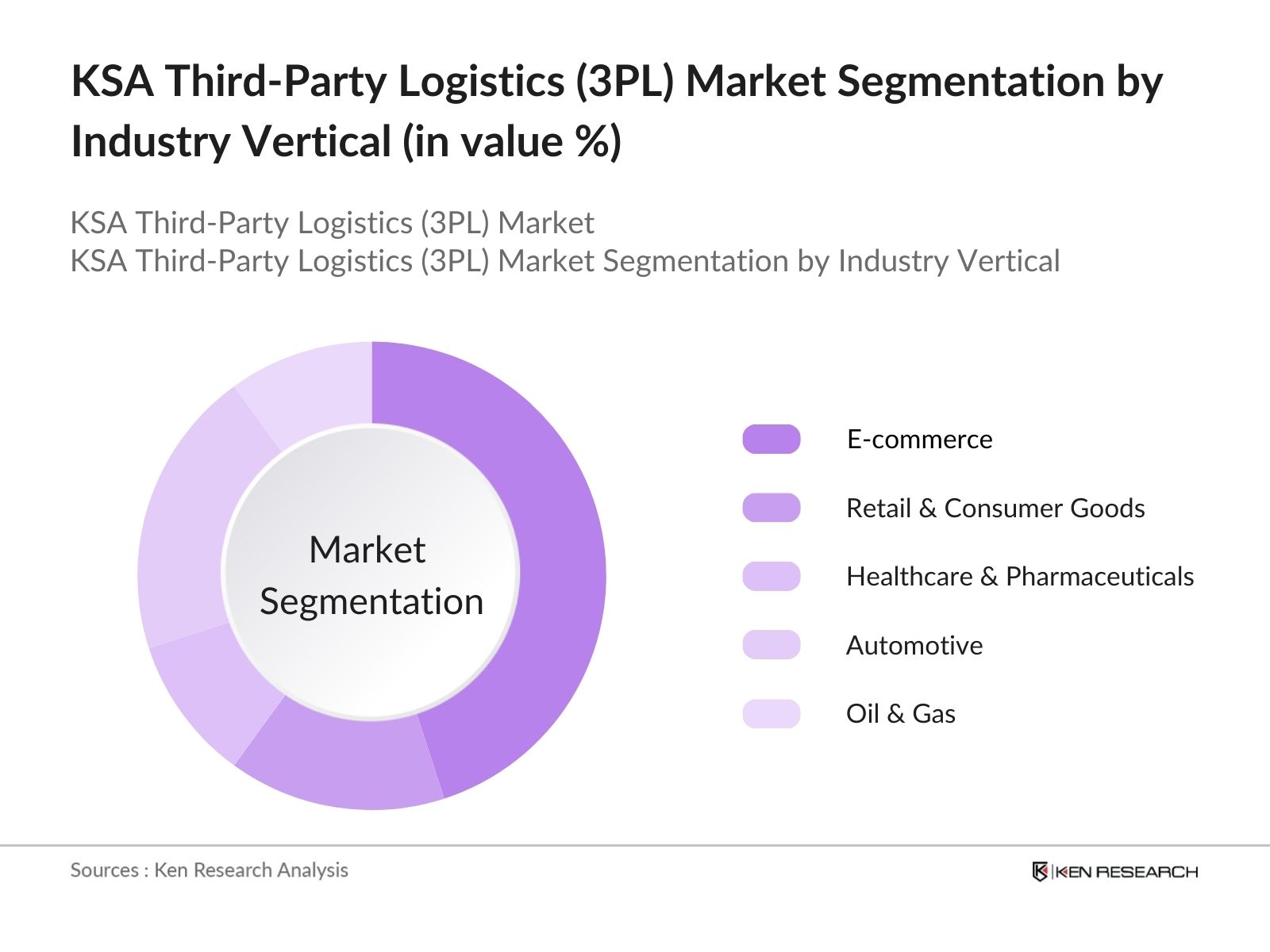

By Industry Vertical: The market is also segmented by industry vertical into e-commerce, retail & consumer goods, healthcare & pharmaceuticals, automotive, and oil & gas. The e-commerce sector has a dominant market share, fueled by the rapid digital transformation and increasing consumer demand for online shopping. This has led to a surge in last-mile delivery services and specialized logistics solutions for e-commerce retailers.

KSA Third-Party Logistics (3PL) Market Competitive Landscape

The market is dominated by a few key players who have established a strong presence in the region due to their scale of operations, comprehensive logistics solutions, and strategic partnerships with local businesses. Companies like Agility Logistics, DHL Supply Chain, and Aramex lead the market, leveraging their global networks to provide integrated logistics solutions that cater to multiple industries.

|

Company |

Establishment Year |

Headquarters |

Number of Employees |

Fleet Size |

Warehouse Space |

Contract Value |

Domestic Operations |

International Presence |

Key Industries |

|

Agility Logistics |

1979 |

Kuwait |

|||||||

|

DHL Supply Chain |

1969 |

Germany |

|||||||

|

Aramex |

1982 |

UAE |

|||||||

|

Al Majdouie Group |

1965 |

Saudi Arabia |

|||||||

|

Bahri Logistics |

1978 |

Saudi Arabia |

KSA Third-Party Logistics (3PL) Market Analysis

Market Growth Drivers

- Diversification of Saudi Economy: Saudi Arabia's Vision 2030 aims to reduce reliance on oil revenues, driving investments in non-oil sectors such as manufacturing, retail, and e-commerce. In 2023, the non-oil economy contributed $750 billion to the GDP. This economic shift is significantly increasing the demand for 3PL services to support diversified supply chains in industrial, agricultural, and retail sectors, including the transport and storage of goods.

- Expansion of E-Commerce: Saudi Arabia's e-commerce sector has been rapidly growing, with an estimated 28 million internet users making online purchases as of 2024. This growth is driving increased demand for 3PL services, particularly for last-mile delivery and warehousing solutions. Companies such as Souq.com (now Amazon) have expanded operations in KSA, requiring advanced logistics to handle the growing volume of orders. The expansion of digital platforms continues to fuel the logistics industry's growth in terms of both infrastructure and technology.

- Rising Cross-Border Trade: Saudi Arabias commitment to expanding trade relationships, particularly with neighboring Gulf Cooperation Council (GCC) countries and the wider Middle East, has stimulated the logistics sector. In 2024, bilateral trade with the UAE, KSAs largest trading partner, reached $28 billion. As a result, cross-border logistics networks are evolving, with 3PL providers increasing their capacity to handle international shipments, customs clearance, and storage to accommodate the rising volume of goods traded.

Market Challenges

- Customs and Regulatory Delays: Complex customs procedures continue to challenge the logistics industry, especially in terms of cross-border trade. Despite recent improvements, customs clearance processes for goods can take up to 72 hours, which affects delivery times. These bottlenecks create inefficiencies for 3PL providers, reducing their competitiveness compared to international counterparts. Further streamlining customs and regulatory processes is essential for reducing operational delays in the logistics chain.

- High Cost of Technology Integration: The adoption of advanced technologies such as AI, blockchain, and automated warehouses in logistics is essential for efficiency, but the high costs associated with these innovations are a barrier for many local 3PL providers. In 2024, it was estimated that the cost of fully automating a medium-sized warehouse in Saudi Arabia could exceed $8 million. Small and medium-sized enterprises (SMEs) are often unable to afford these costs, limiting their ability to compete with larger players.

KSA Third-Party Logistics (3PL) Market Future Outlook

Over the next five years, the KSA Third-Party Logistics industry is expected to show growth driven by the ongoing transformation of the logistics industry under Saudi Vision 2030. This includes increased investments in digitalization, infrastructure expansion, and the establishment of free economic zones, all of which will enhance the efficiency of supply chains.

Future Market Opportunities

- Increased Adoption of Green Logistics: Over the next five years, Saudi Arabia's market will witness a shift towards greener logistics solutions. With government mandates on emissions reduction and the growing use of electric and hybrid vehicles, the logistics sector is expected to reduce its carbon footprint by 50,000 tons annually by 2029. The adoption of renewable energy for warehouses and transport fleets will become more prevalent, aligning with national sustainability goals.

- Expansion of Digital Freight Platforms: Over the next five years, digital freight platforms will significantly reshape the market. By 2029, it is expected that over 40% of logistics transactions will occur via digital freight platforms, allowing companies to match cargo with available transportation resources in real-time. These platforms will improve cost efficiency and reduce the need for intermediaries in supply chain management.

Scope of the Report

|

By Service Type |

Transportation Services Warehousing and Distribution Inventory Management Value-Added Services Freight Forwarding |

|

By Industry Vertical |

E-commerce Retail and Consumer Goods Healthcare and Pharmaceuticals Automotive Oil & Gas |

|

By Mode of Transportation |

Road Transportation Air Transportation Sea Transportation Rail Transportation |

|

By Logistics Solution |

Dedicated Contract Logistics Non-Asset-Based 3PL Integrated 3PL Solutions Domestic Distribution Services |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

E-commerce and Retail Companies

Healthcare and Pharmaceutical Companies

Automotive Manufacturers

Oil and Gas Industry Players

Government and Regulatory Bodies (Saudi Ports Authority, Zakat, Tax, and Customs Authority)

Venture Capitalist and Investment Firms

Logistics and Transportation Companies

Banks and Financial Institutions

Companies

Players Mentioned in the Report:

Agility Logistics

DHL Supply Chain

Ceva Logistics

Aramex

Bahri Logistics

Al Majdouie Group

FedEx Express

Kuehne + Nagel

Naqel Express

GWC Logistics

Almajdouie De Rijke Logistics

Hala Supply Chain Services

Expeditors International

Panalpina World Transport

BDP International

Table of Contents

1. KSA 3PL Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA 3PL Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA 3PL Market Analysis

3.1. Growth Drivers

3.1.1. Rise of E-commerce

3.1.2. Government Vision 2030 Initiatives

3.1.3. Foreign Direct Investment (FDI) Influx

3.1.4. Infrastructure Expansion

3.2. Market Challenges

3.2.1. High Logistics Costs

3.2.2. Dependence on Oil Industry

3.2.3. Regulatory Framework and Bureaucracy

3.3. Opportunities

3.3.1. Digitalization in Logistics

3.3.2. Cross-Border Trade Enhancements

3.3.3. Expansion of Free Economic Zones

3.3.4. Customized 3PL Solutions for SMEs

3.4. Trends

3.4.1. Green Logistics and Sustainability Practices

3.4.2. Implementation of AI and IoT in Supply Chains

3.4.3. Shift towards Omni-Channel Fulfillment

3.4.4. Increased Demand for Cold Chain Logistics

3.5. Government Regulation

3.5.1. Vision 2030 Logistics Development Plan

3.5.2. Zakat, Tax, and Customs Authority Regulations

3.5.3. Logistics License Regulations

3.5.4. Saudi Ports Authority Initiatives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA 3PL Market Segmentation (Market-Specific Metrics: In Value % and Volume)

4.1. By Service Type (In Value %)

4.1.1. Transportation Services

4.1.2. Warehousing and Distribution

4.1.3. Inventory Management

4.1.4. Value-Added Services (Packaging, Labeling, etc.)

4.1.5. Freight Forwarding

4.2. By Industry Vertical (In Value %)

4.2.1. E-commerce

4.2.2. Retail and Consumer Goods

4.2.3. Healthcare and Pharmaceuticals

4.2.4. Automotive

4.2.5. Oil & Gas

4.3. By Mode of Transportation (In Value %)

4.3.1. Road Transportation

4.3.2. Air Transportation

4.3.3. Sea Transportation

4.3.4. Rail Transportation

4.4. By Logistics Solution (In Value %)

4.4.1. Dedicated Contract Logistics

4.4.2. Non-Asset-Based 3PL

4.4.3. Integrated 3PL Solutions

4.4.4. Domestic Distribution Services

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. KSA 3PL Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Agility Logistics

5.1.2. DHL Supply Chain

5.1.3. Ceva Logistics

5.1.4. Aramex

5.1.5. Bahri Logistics

5.1.6. Al Majdouie Group

5.1.7. FedEx Express

5.1.8. Kuehne + Nagel

5.1.9. Naqel Express

5.1.10. GWC Logistics

5.1.11. Almajdouie De Rijke Logistics

5.1.12. Hala Supply Chain Services

5.1.13. Expeditors International

5.1.14. Panalpina World Transport

5.1.15. BDP International

5.2. Cross Comparison Parameters (Market-Specific Metrics: Number of Employees, Fleet Size, Warehouse Space, Contract Value, Customer Base, Domestic vs International Operations, Service Specialization, Regional Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Collaborations

5.8. Private Equity and Venture Capital Funding

6. KSA 3PL Market Regulatory Framework

6.1. Saudi Customs Laws

6.2. Warehouse Compliance Regulations

6.3. Certification Requirements (ISO, HACCP, etc.)

6.4. Free Trade and Economic Zone Regulations

7. KSA 3PL Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA 3PL Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Industry Vertical (In Value %)

8.3. By Mode of Transportation (In Value %)

8.4. By Logistics Solution (In Value %)

8.5. By Region (In Value %)

9. KSA 3PL Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Competitive Strategy Recommendations

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins with the identification of critical market variables, focusing on the ecosystem within the KSA 3PL market. Desk research and secondary data sources such as industry reports, proprietary databases, and government publications were used to map out the stakeholders and define the key parameters influencing the market.

Step 2: Market Analysis and Construction

In this phase, we collected and analyzed historical data on the market size, growth rates, and key market drivers. The analysis focused on determining the impact of technological advancements, government policies, and the overall economic environment on the logistics sector.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews and consultations with industry experts, including executives from logistics firms, e-commerce companies, and government agencies. These interviews provided insights into market trends, competitive dynamics, and the impact of regulatory changes on the 3PL market.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the collected data and insights into a comprehensive report. Primary data from interviews was combined with secondary data to verify market estimates, segmentation, and future outlook, ensuring a well-rounded and accurate analysis.

Frequently Asked Questions

01 How big is the KSA 3PL Market?

The KSA 3PL market is valued at USD 13 billion, driven by the growing e-commerce sector, government initiatives under Vision 2030, and increased infrastructure investments.

02 What are the challenges in the KSA 3PL Market?

Challenges in the KSA 3PL market include high logistics costs, reliance on the oil industry, and complex regulatory frameworks that may hinder operational efficiency.

03 Who are the major players in the KSA 3PL Market?

Key players in the KSA 3PL market include Agility Logistics, DHL Supply Chain, Aramex, Bahri Logistics, and Al Majdouie Group, who dominate the market due to their established networks and specialized services.

04 What drives the growth of the KSA 3PL Market?

The growth of the KSA 3PL market is driven by increased demand for logistics services in the e-commerce, retail, and oil & gas sectors, along with government support for infrastructure development under Vision 2030.

05 What are the key trends in the KSA 3PL Market?

Key trends in the KSA 3PL market include the adoption of digital technologies such as AI and IoT, the rise of omni-channel fulfillment, and increasing demand for cold chain logistics due to the expansion of the pharmaceutical sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.