KSA Tire Market Outlook to 2030

Region:Middle East

Author(s):Mukul

Product Code:KROD3491

October 2024

99

About the Report

KSA Tire Market Overview

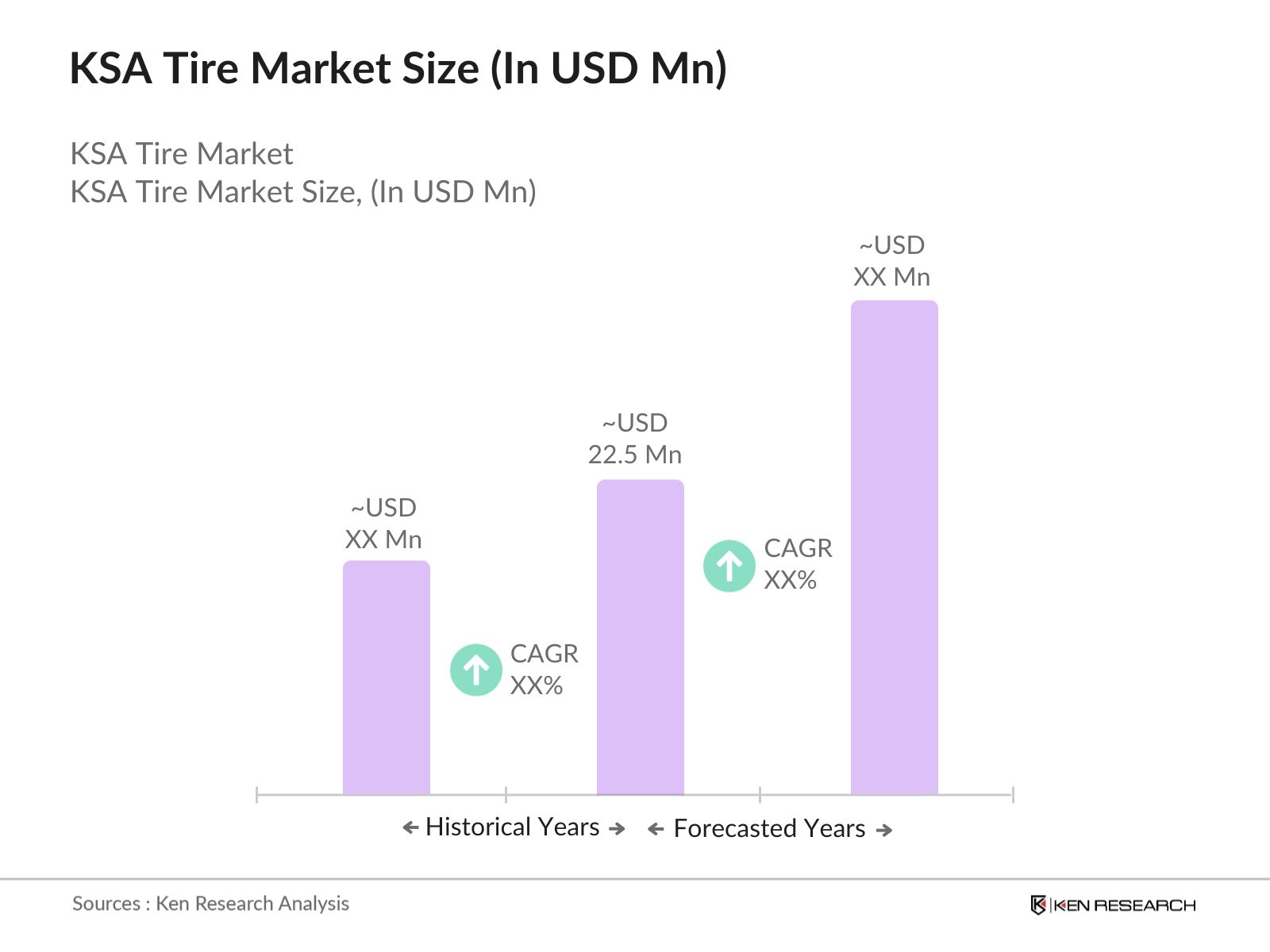

- The KSA tire market is valued at USD 22.5 million in 2023, driven by the robust demand for vehicles and a rapidly growing automotive aftermarket. The significant rise in vehicle ownership in urban areas, coupled with increasing infrastructure development, has bolstered tire demand across both the OEM and replacement segments. Additionally, government initiatives, such as Vision 2030, continue to enhance transportation infrastructure, leading to increased sales in the tire market, particularly for passenger and commercial vehicles.

- Major cities like Riyadh, Jeddah, and Dammam dominate the KSA tire market due to their larger populations, higher vehicle density, and economic significance. Riyadh, being the capital and a hub of economic activity, sees strong demand for both OEM and replacement tires. Jeddahs port facilities make it a key distribution point for tire imports, while Dammam's industrial base creates demand for heavy-duty and commercial vehicle tires. These cities serve as the primary consumption centers, driven by increased urbanization and economic growth.

- Saudi Arabias SASO introduced new standards for tire labeling in 2022, requiring manufacturers to display detailed information about safety ratings and fuel efficiency. The implementation of these labels has improved consumer awareness, with over 75% of all new tires sold in 2023 complying with these standards. The initiative aims to increase road safety and reduce the environmental impact of tires. These regulations are part of the countrys broader goal to reduce fuel consumption by 15% by 2030.

KSA Tire Market Segmentation

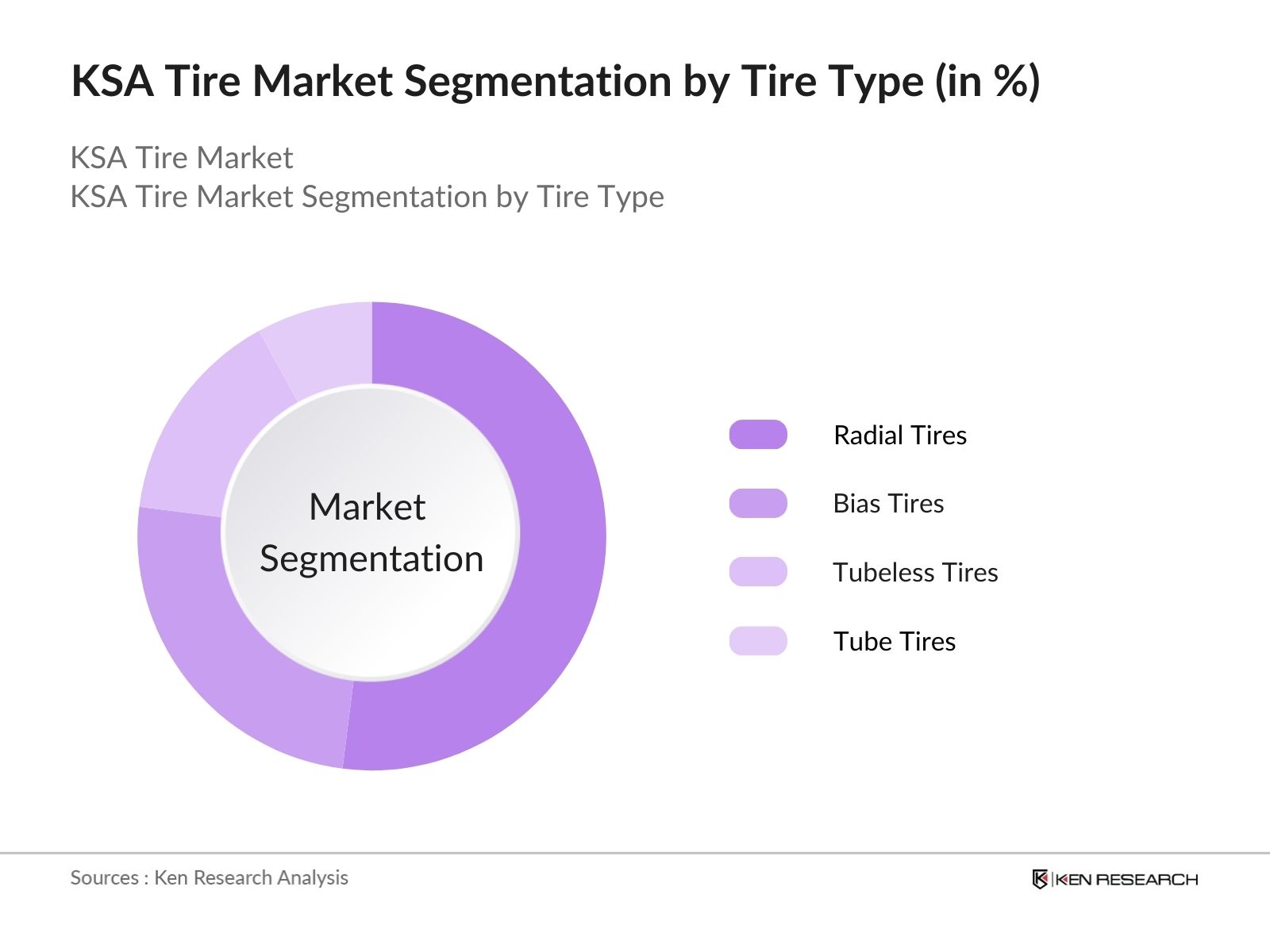

- By Tire Type: The KSA tire market is segmented by tire type into radial tires, bias tires, tubeless tires, and tube tires. Recently, radial tires dominated the market due to their superior durability, better fuel efficiency, and increasing adoption by OEMs for both passenger and commercial vehicles. Radial tires, known for their flexibility and comfort, are increasingly preferred by KSA consumers, particularly in urban regions where smooth road conditions favor the use of these tires. OEMs also favor radial tires due to their longer lifespan, which reduces overall vehicle maintenance costs, making them the dominant sub-segment.

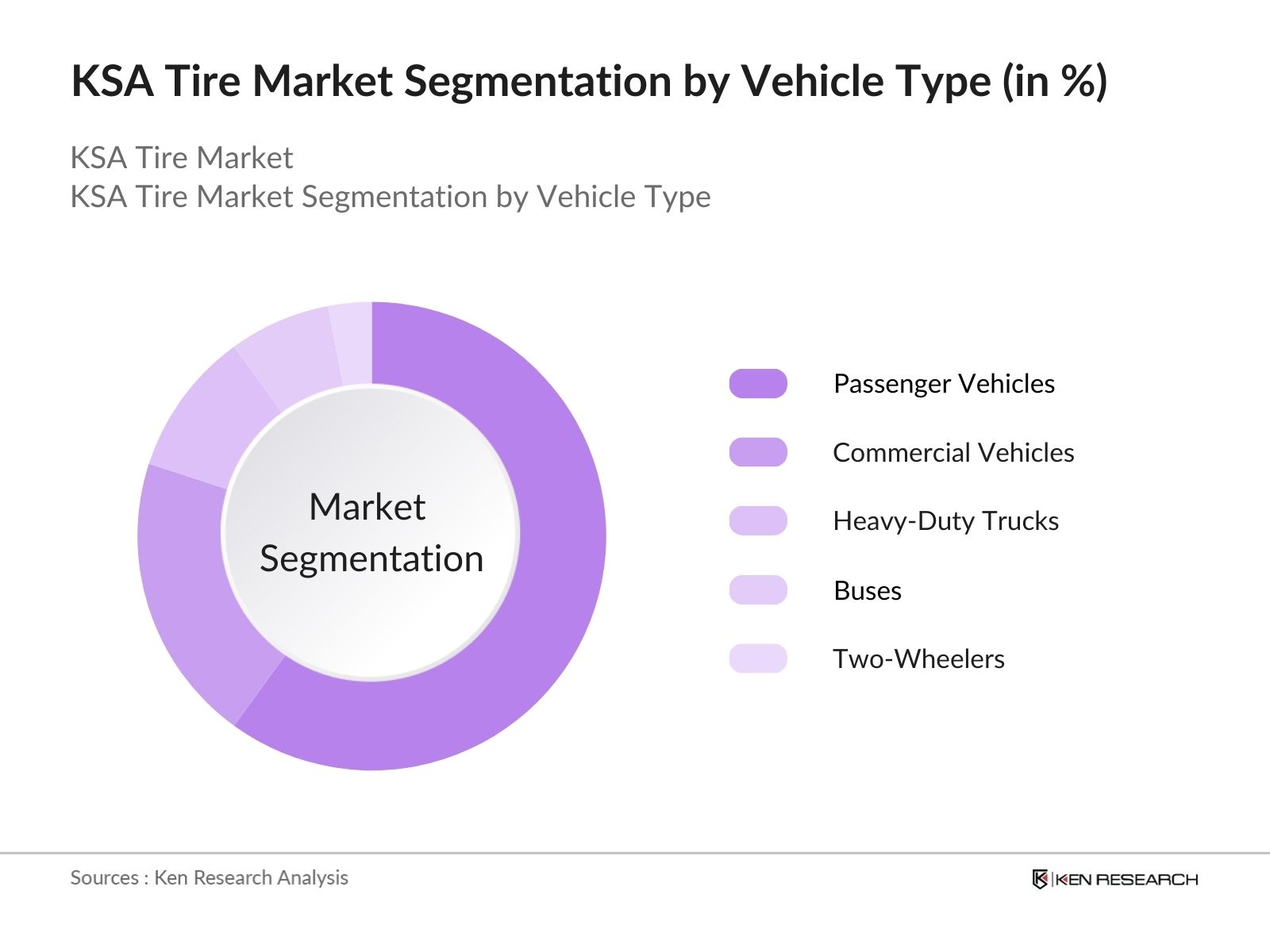

- By Vehicle Type: The KSA tire market is also segmented by vehicle type into passenger vehicles, commercial vehicles, heavy-duty trucks, buses, and two-wheelers. Among these, passenger vehicles dominated the market. The growth of the middle class, increasing disposable income, and the expanding automotive sector have all contributed to the rising demand for tires in the passenger vehicle segment. With the government's efforts to promote homegrown car manufacturing under Vision 2030, this segment is expected to retain its dominance in the market.

KSA Tire Market Competitive Landscape

The KSA tire market is dominated by a mix of global and regional players, with a few major players controlling a significant portion of the market share. Companies like Bridgestone and Michelin have established strong brand loyalty and wide distribution networks, while regional brands cater to specific local demands, particularly in the replacement tire market. The presence of international brands ensures a competitive pricing landscape, while local players focus on niche markets and offer lower-cost alternatives to the global giants.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

No. of Employees |

Geographic Presence |

Product Range |

Innovation Focus |

Sustainability Initiatives |

|

Bridgestone Corporation |

1931 |

Tokyo, Japan |

||||||

|

Michelin Group |

1889 |

Clermont-Ferrand |

||||||

|

Goodyear Tire & Rubber |

1898 |

Ohio, USA |

||||||

|

Pirelli & C. S.p.A |

1872 |

Milan, Italy |

||||||

|

Hankook Tire |

1941 |

Seoul, South Korea |

KSA Tire Industry Analysis

KSA Tire Market Growth Drivers

- Increasing Vehicle Sales (Passenger, Commercial): In 2023, Saudi Arabia experienced significant growth in vehicle sales, with over 585,000 new passenger vehicles sold, driven by a growing population and expanding middle class. Commercial vehicle sales also increased, supporting construction and logistics sectors linked to Vision 2030. Vehicle ownership rates in KSA have now exceeded 300 vehicles per 1,000 people, indicating a robust demand for tires. The Ministry of Investment has highlighted these trends, emphasizing the role of urbanization and economic growth in increasing vehicle sales, ultimately boosting demand for both OEM and aftermarket tires.

- Expanding Automotive Aftermarket (OEM vs. Replacement Market): The automotive aftermarket in Saudi Arabia is expanding as consumers increasingly favor tire replacements after warranties expire, often beyond the 2-year mark. OEM sales reached approximately 400,000 units in 2023, while the replacement tire market surged to over 9 million units, attributed to harsher driving conditions in the desert and long vehicle lifecycles. The General Authority for Statistics in KSA estimates this growth in tire replacement is propelled by a high average vehicle age of 5 years, with frequent tire wear in urban centers.

- Economic Growth and Urbanization (Impact on Tire Demand): With Saudi Arabias GDP surpassing $1 trillion in 2023, the countrys economic growth is fueling tire demand, particularly in urban areas. By 2024, urbanization levels in Saudi Arabia are projected to rise to 85%, spurring demand for passenger vehicles and commercial fleets. This urban growth is further amplified by large-scale construction projects like NEOM, which rely heavily on commercial trucks, increasing tire consumption. The Ministry of Finances reports link this urban expansion directly to rising vehicle ownership and, consequently, higher tire demand.

KSA Tire Market Restraints

- Fluctuating Raw Material Prices (Natural Rubber, Synthetic Rubber): The tire industry in KSA faces challenges due to fluctuating raw material prices. For instance, the global price of natural rubber hovered around $1.4 per kg in 2023, while synthetic rubber reached $1.6 per kg, driven by volatile crude oil prices. Since Saudi Arabia imports a substantial portion of its raw materials for tire production, these fluctuations directly impact tire manufacturing costs and pricing. Data from the International Rubber Study Group suggests continued instability in raw material costs, posing a challenge to tire manufacturers.

- Stringent Environmental Regulations (Sustainability, Recycling): Environmental regulations are becoming stricter in KSA, with new laws introduced in 2022 mandating tire recycling and reducing carbon emissions in production processes. The National Center for Waste Management has set a target of recycling 50% of the countrys scrap tires by 2030, which presents immediate challenges to manufacturers who need to invest in eco-friendly tire production methods. Additionally, the Saudi Standards, Metrology and Quality Organization (SASO) enforces standards for tire labeling related to fuel efficiency, putting pressure on manufacturers to innovate

KSA Tire Market Future Outlook

Over the next five years, the KSA tire market is expected to witness steady growth, driven by the continued expansion of the automotive sector, particularly in the commercial vehicle segment, and the increasing penetration of electric vehicles. With growing government support for infrastructure projects and sustainability initiatives, the demand for advanced tire technologies, such as eco-friendly and high-performance tires, will increase. The rise of digital retail channels for tire sales, especially in the replacement market, will also be a key factor shaping the markets future.

Market Opportunities

- Growth in E-commerce and Digital Retail for Tires: The e-commerce sector in Saudi Arabia saw a 34% increase in online transactions for auto parts and tires in 2023, reflecting a shift in consumer buying behavior. Platforms like Noon and Amazon have expanded their auto parts categories, which saw sales of over 100,000 tires in the past year. This trend is supported by the countrys high internet penetration rate of 98%, as reported by the Communications and Information Technology Commission (CITC). Digital retail is expected to continue transforming the tire market, making it more accessible to consumers.

- Adoption of Electric Vehicles (Impact on Tire Design and Demand): Saudi Arabia is promoting electric vehicles (EVs) under its Vision 2030 initiative, which is boosting demand for specialized EV tires. In 2023, around 6,000 electric vehicles were registered in the Kingdom, increasing the need for low-rolling-resistance tires optimized for electric cars. The Ministry of Energy expects EV adoption to grow, necessitating innovations in tire designs that accommodate the heavier weight and higher torque of these vehicles, creating opportunities for tire manufacturers to cater to this niche market.

Scope of the Report

|

By Tire Type |

Radial Tires |

|

By Vehicle Type |

Passenger Vehicles |

|

By Distribution Channel |

OEMs |

|

By Seasonality |

Summer Tires |

|

By Region |

Riyadh |

Products

Key Target Audience

Automotive Manufacturers (OEMs)

Tire Distributors and Retailers

Vehicle Fleet Owners and Operators

Logistics and Transportation Companies

Investments and Venture Capital Firms

Government and Regulatory Bodies (Ministry of Industry and Mineral Resources, Saudi Standards, Metrology, and Quality Organization - SASO)

Automotive Aftermarket Service Providers

Online and Offline Retail Platforms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Bridgestone Corporation

Michelin Group

Goodyear Tire & Rubber Company

Pirelli & C. S.p.A

Hankook Tire & Technology

Yokohama Rubber Co., Ltd.

Toyo Tire Corporation

Sumitomo Rubber Industries

Apollo Tyres

Kumho Tire Co. Inc.

Table of Contents

1. KSA Tire Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Volume, Revenue)

1.4. Market Segmentation Overview

2. KSA Tire Market Size (In USD Million)

2.1. Historical Market Size (By Tire Type, Vehicle Type)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (New Product Launches, Strategic Partnerships)

3. KSA Tire Market Analysis

3.1.Growth Drivers

3.1.1. Increasing Vehicle Sales (Passenger, Commercial)

3.1.2. Expanding Automotive Aftermarket (OEM vs. Replacement Market)

3.1.3. Economic Growth and Urbanization (Impact on Tire Demand)

3.1.4. Government Initiatives (Infrastructure Development, Automotive Industry Boost)

3.2.Market Challenges

3.2.1. Fluctuating Raw Material Prices (Natural Rubber, Synthetic Rubber)

3.2.2. Stringent Environmental Regulations (Sustainability, Recycling)

3.2.3. Competitive Pricing Pressure (Local vs. International Brands)

3.3.Opportunities

3.3.1. Growth in E-commerce and Digital Retail for Tires

3.3.2. Adoption of Electric Vehicles (Impact on Tire Design and Demand)

3.3.3. Investments in Tire Retreading and Recycling (Circular Economy)

3.4.Trends

3.4.1. Increasing Demand for High-performance Tires (SUV, Luxury Vehicles)

3.4.2. Focus on Sustainable and Fuel-efficient Tires (Eco-friendly Solutions)

3.4.3. Rising Popularity of Winter and All-season Tires

3.5.Government Regulations

3.5.1. Standardization of Tire Labelling (Safety, Fuel Efficiency)

3.5.2. Import Tariffs and Trade Regulations (Impact on Tire Imports)

3.5.3. Environmental Impact Laws (Scrap Tire Disposal, Recycling Mandates)

3.6. SWOT Analysis

3.7. Stake Ecosystem (OEMs, Distributors, Dealers, Retailers)

3.8. Porters Five Forces

3.9. Competition Ecosystem (Local, International Brands)

4. KSA Tire Market Segmentation

4.1.By Tire Type (In Value & Volume %)

4.1.1. Radial Tires

4.1.2. Bias Tires

4.1.3. Tubeless Tires

4.1.4. Tube Tires

4.2.By Vehicle Type (In Value & Volume %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Heavy-Duty Trucks

4.2.4. Buses

4.2.5. Two-Wheelers

4.3.By Distribution Channel (In Value %)

4.3.1. OEMs

4.3.2. Aftermarket

4.3.3. Online Retailers

4.3.4. Offline Retailers

4.4.By Seasonality (In Value %)

4.4.1. Summer Tires

4.4.2. Winter Tires

4.4.3. All-season Tires

4.5.By Region (In Value & Volume %)

4.5.1. Riyadh

4.5.2. Eastern Province

4.5.3. Makkah

4.5.4. Jeddah

4.5.5. Others

5. KSA Tire Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bridgestone Corporation

5.1.2. Michelin Group

5.1.3. Goodyear Tire & Rubber Company

5.1.4. Continental AG

5.1.5. Pirelli & C. S.p.A

5.1.6. Hankook Tire & Technology

5.1.7. Yokohama Rubber Co., Ltd.

5.1.8. Toyo Tire Corporation

5.1.9. Sumitomo Rubber Industries

5.1.10. Apollo Tyres

5.1.11. Kumho Tire Co. Inc.

5.1.12. Nexen Tire Corporation

5.1.13. Maxxis International

5.1.14. Giti Tire

5.1.15. ZC Rubber

5.2. Cross Comparison Parameters (Revenue, Market Share, Production Capacity, Geographic Footprint, Innovation Focus, Brand Positioning, Partnerships, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Investments

5.8. Government Incentives and Grants

6. KSA Tire Market Regulatory Framework

6.1. Emission Standards for Tires

6.2. Import and Export Regulations (Tariffs, Certifications)

6.3. Safety and Quality Certifications (Saudi Standards, Metrology and Quality Organization - SASO)

7. KSA Tire Market Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Tire Market Future Segmentation

8.1. By Tire Type (In Value & Volume %)

8.2. By Vehicle Type (In Value & Volume %)

8.3. By Distribution Channel (In Value %)

8.4. By Seasonality (In Value %)

8.5. By Region (In Value & Volume %)

9. KSA Tire Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing and Sales Strategy Recommendations

9.3. White Space Opportunity Analysis

9.4. Strategic Partnerships and Joint Ventures

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involved identifying and mapping out the KSA tire market ecosystem by assessing the roles of manufacturers, distributors, and consumers. Desk research was conducted using both secondary sources and proprietary databases to compile critical data points on market dynamics, growth drivers, and key challenges.

Step 2: Market Analysis and Construction

This phase involved analyzing historical data from the tire industry in KSA, focusing on market penetration, consumer demand trends, and revenue generation. The data was scrutinized to assess the balance between OEM and replacement market needs.

Step 3: Hypothesis Validation and Expert Consultation

Industry-specific hypotheses were validated through interviews with executives from tire manufacturing companies and local distributors. These consultations provided critical financial insights that helped shape revenue forecasts and understand future market trends.

Step 4: Research Synthesis and Final Output

The final phase involved consolidating findings from manufacturers and market stakeholders, resulting in a comprehensive market report. This approach ensured a thorough understanding of KSAs tire market and its future growth trajectory.

Frequently Asked Questions

01. How big is the KSA Tire Market?

The KSA tire market is valued at USD 22.5 million in 2023, primarily driven by increasing vehicle sales and the expansion of the automotive aftermarket.

02. What are the challenges in the KSA Tire Market?

Key challenges include fluctuating raw material prices, environmental regulations around tire disposal and recycling, and competitive pricing pressures between local and international brands.

03. Who are the major players in the KSA Tire Market?

Major players in the KSA tire market include Bridgestone, Michelin, Goodyear, Pirelli, and Hankook. These companies dominate due to their strong brand presence and wide distribution networks.

04. What are the growth drivers of the KSA Tire Market?

The market is driven by rising vehicle ownership, infrastructure development projects under Vision 2030, and a robust automotive aftermarket. The growing popularity of online tire sales is also contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.