KSA Tobacco Products Market Outlook to 2030

Region:Middle East

Author(s):Mukul

Product Code:KROD9145

October 2024

84

About the Report

KSA Tobacco Products Market Overview

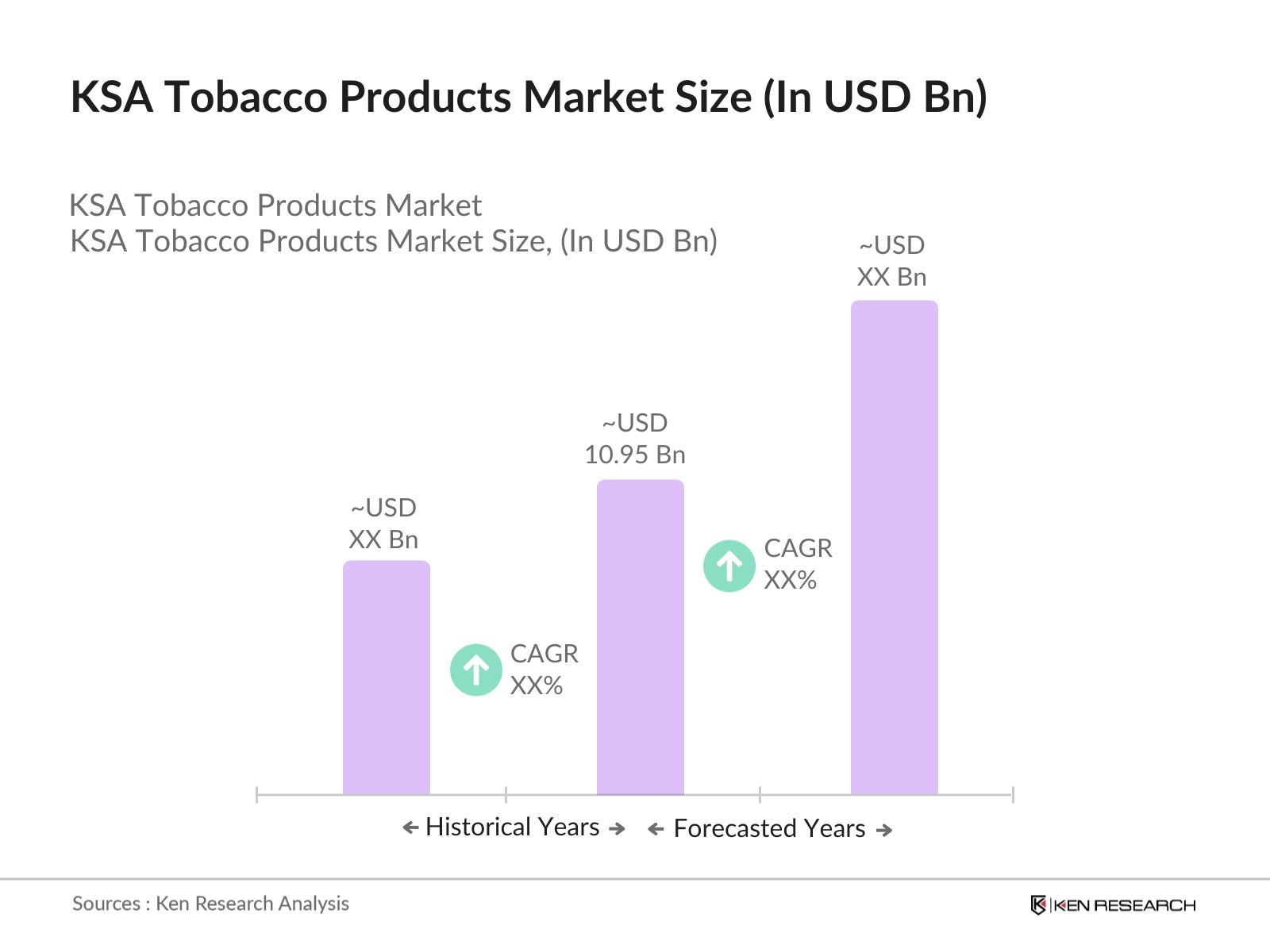

- The KSA Tobacco Products market is valued at USD 10.95 billion, driven by steady consumer demand for cigarettes, smokeless tobacco, and vaping products. Despite global anti-smoking trends, the market in Saudi Arabia remains resilient due to traditional smoking habits, particularly in rural areas, coupled with growing acceptance of smokeless alternatives. Additionally, the market is fueled by a youthful population with a rising disposable income, which has led to increased tobacco consumption.

- Major cities such as Riyadh, Jeddah, and Dammam dominate the tobacco market due to their dense populations, higher urbanization rates, and retail concentration. In these regions, modern retail channels and duty-free zones in airports make access to tobacco products easier. Riyadh leads the pack with its higher purchasing power, and the presence of multinational tobacco companies contributes to its dominance.

- Saudi Arabia enforced plain packaging for all tobacco products in 2020, becoming the first country in the Middle East to implement this regulation. By 2023, compliance rates reached 95%, with tobacco manufacturers required to remove branding and marketing elements from packaging. The policy aims to reduce the appeal of tobacco products, particularly among youth. While plain packaging has been linked to reduced smoking initiation rates, it also poses a challenge for brands looking to differentiate themselves in a competitive market.

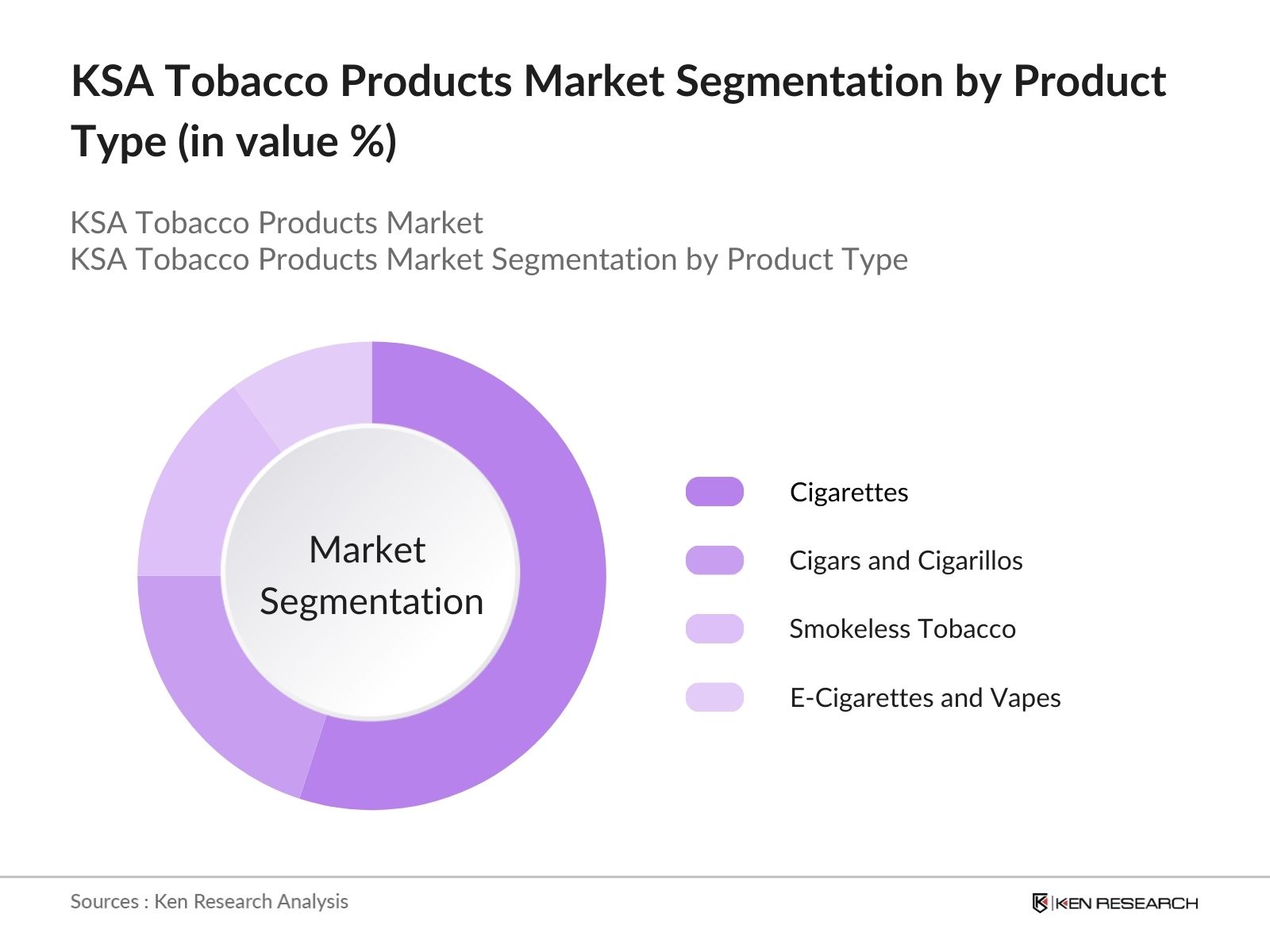

KSA Tobacco Products Market Segmentation

By Product Type: The KSA Tobacco Products market is segmented by product type into Cigarettes, Cigars and Cigarillos, Smokeless Tobacco, and E-Cigarettes and Vapes. Recently, Cigarettes have maintained a dominant market share in the Kingdom due to their entrenched cultural acceptance and the availability of a wide variety of brands at affordable prices. International brands like Marlboro and local brands such as Al Fakher dominate the market with well-established brand loyalty, contributing to their market strength.

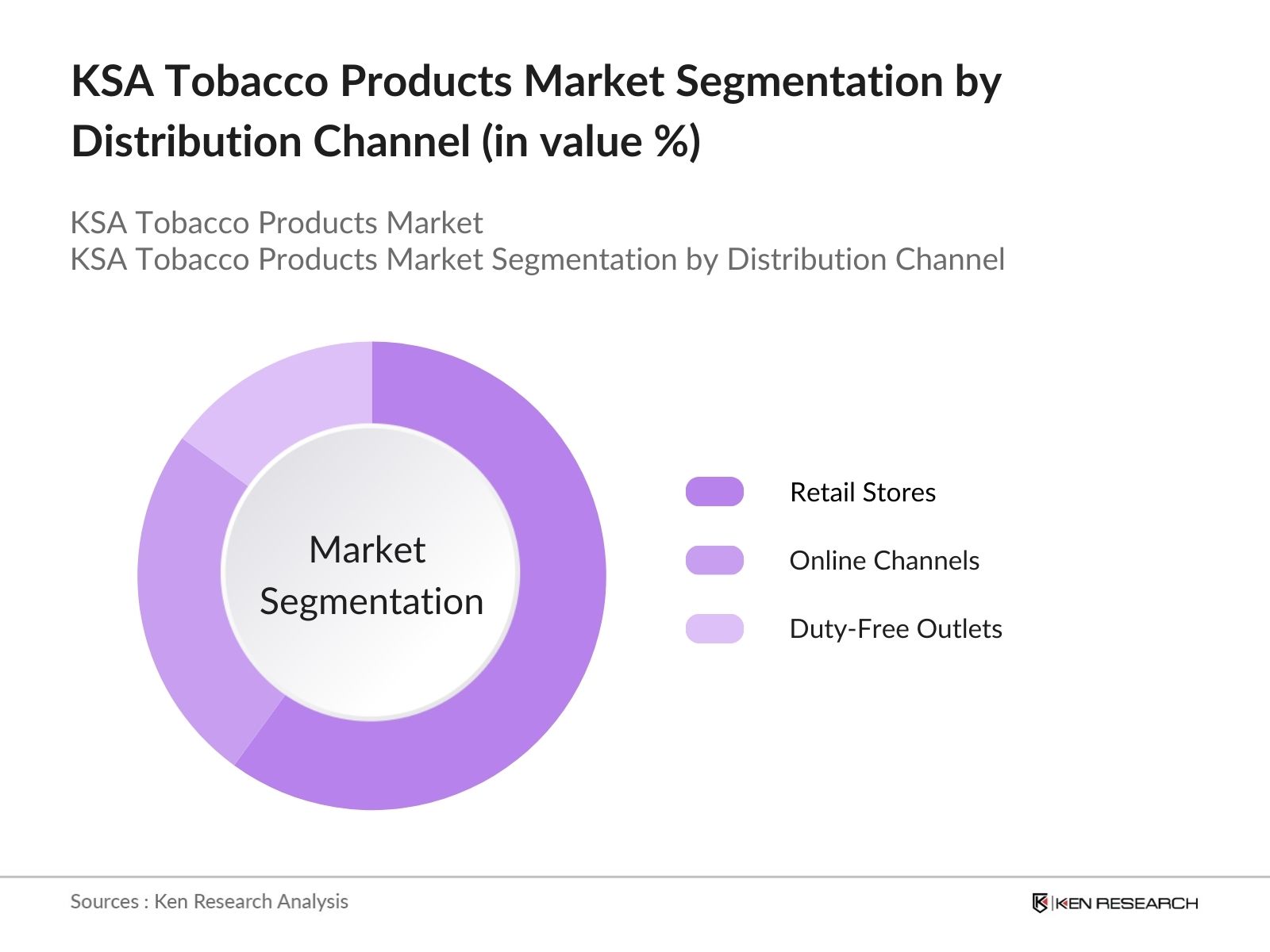

By Distribution Channel: The KSA Tobacco Products market is segmented by distribution channel into Retail Stores, Online Channels, and Duty-Free Outlets. Retail Stores have the largest market share due to their widespread accessibility, including in rural areas, making them the preferred point of sale. Most consumers still prefer purchasing tobacco products from physical outlets, where they can directly access their preferred brands and quantities.

KSA Tobacco Products Market Competitive Landscape

The KSA Tobacco Products market is highly competitive and includes several global and local players. Dominated by multinational giants such as British American Tobacco and Philip Morris International, the market also sees significant contributions from regional players. The presence of stringent regulations has led to these companies forming strong distribution networks and making strategic investments to maintain their market share.

|

Company Name |

Established |

Headquarters |

No. of Employees |

Revenue (USD mn) |

Product Portfolio |

R&D Investment |

Distribution Reach |

Market Entry Year |

Key Collaborations |

|

British American Tobacco |

1902 |

London, UK |

|||||||

|

Philip Morris International |

1847 |

New York, USA |

|||||||

|

Japan Tobacco International |

1898 |

Tokyo, Japan |

|||||||

|

Imperial Brands |

1901 |

Bristol, UK |

|||||||

|

Altria Group |

1822 |

Virginia, USA |

KSA Tobacco Products Industry Analysis

Growth Drivers

- Rising Disposable Income (Market Demand Indicator): As of 2023, Saudi Arabia's gross national income per capita stands at approximately $23,000, reflecting a consistent rise in disposable income levels. This increase in spending power directly correlates with higher demand for consumer goods, including tobacco products. With 40% of the population residing in urban areas, disposable income plays a significant role in tobacco consumption trends, especially among the younger demographics. As economic reforms under Saudi Vision 2030 continue to boost job creation and personal incomes, the demand for premium and alternative tobacco products is anticipated to grow.

- Growing Urbanization (Market Urbanization Metric): Saudi Arabias urbanization rate currently stands at 84%, a sharp increase from the 1970s when only 49% of the population lived in urban areas. Urbanization trends are contributing to changing lifestyles, with city dwellers often adopting smoking habits faster due to social and economic pressures. This demographic shift is particularly relevant in major cities such as Riyadh and Jeddah, where a higher percentage of youth are more inclined towards smoking. The increasing urban population has driven higher tobacco product sales, especially as modern retail outlets make these products easily accessible.

- Increasing Smoking Rates (Demographic Data): As of 2022, Saudi Arabia has an estimated 7.2 million smokers, with males constituting approximately 25% of the adult population. Among the younger population (ages 18-24), the number of daily smokers is steadily increasing, driven by social factors and peer influence. The demographic shift towards younger smokers is causing a growing demand for alternative tobacco products such as vapes and e-cigarettes, which are perceived as healthier options. The government's stance on smoking rates, despite public health initiatives, has yet to curb this trend, ensuring continued market demand for tobacco products.

Market Restraints

- Stringent Health Regulations (Regulatory Pressure): In 2022, Saudi Arabia further tightened its health regulations by expanding smoke-free zones in public areas and increasing excise duties on tobacco products. The Saudi Food and Drug Authority (SFDA) mandates health warnings on packaging, which have been updated to cover 65% of the surface. Despite these measures, tobacco-related illnesses continue to pose a significant public health burden, with 71% of hospital admissions related to smoking in 2023. These regulations, while necessary, present significant challenges for tobacco companies looking to expand in the market.

- Health Awareness Campaigns (Public Awareness Initiatives): The Saudi government has actively campaigned against smoking, especially through initiatives like "We Can Stop Smoking," launched in 2022. These campaigns have reached millions of residents via digital platforms and public health outreach programs. Smoking cessation programs now receive $30 million annually from the Ministry of Health, reflecting the governments commitment to reducing smoking rates. Despite the strong push for public health awareness, the challenge for the tobacco market lies in countering the societal shift toward healthier lifestyle choices, which can curb demand over time.

KSA Tobacco Products Market Future Outlook

Over the next five years, the KSA Tobacco Products market is expected to exhibit moderate growth, driven by an expanding youth population and the increasing adoption of alternative tobacco products such as e-cigarettes and vapes. The Saudi governments efforts to regulate and control tobacco use through taxes and restrictions are likely to have a positive impact on the market's premium segments, particularly among consumers seeking less harmful alternatives.

Market Opportunities

- Introduction of Harm Reduction Products (Product Innovation): With a growing health-conscious population, there is an increasing demand for harm-reduction products like nicotine pouches, vapes, and heated tobacco products. In 2023, over 500,000 consumers in Saudi Arabia have already switched to these alternatives, preferring them for perceived health benefits. The global shift towards reduced-risk products has reached the Saudi market, where public perception is gradually shifting. This shift presents an opportunity for manufacturers to introduce more harm-reduction alternatives, aligning with consumer preferences and future government regulations.

- Premiumization of Cigarettes (Product Diversification): Saudi consumers are increasingly opting for premium tobacco products, with premium cigarette sales accounting for 35% of the total market in 2023. As disposable incomes rise and consumer tastes become more refined, there is a growing appetite for high-quality tobacco products that offer a superior smoking experience. The shift towards premiumization reflects an opportunity for tobacco companies to introduce more differentiated, high-end products. This trend also presents a pathway for maintaining market share despite the challenges posed by regulatory pressures and health campaigns.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Cigarettes, Cigars and Cigarillos, Smokeless Tobacco, E-Cigarettes and Vapes |

|

Distribution Channel |

Retail Stores, Online Channels, Duty-Free Outlets |

|

Consumer Age Group |

18-24 Years, 25-44 Years, 45+ Years |

|

Nicotine Strength |

High Nicotine, Medium Nicotine, Low Nicotine, Nicotine-Free |

|

Region |

Riyadh, Jeddah, Dammam, Mecca |

Products

Key Target Audience

Tobacco Manufacturers

Retail Chains and Supermarkets

E-Cigarette and Vape Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Health)

Tobacco Importers and Exporters

Retail Distributors

Duty-Free Retailers

Companies

Players Mentioned in the Report:

British American Tobacco

Philip Morris International

Japan Tobacco International

Imperial Brands

Altria Group

ITC Limited

KT&G Corporation

Godfrey Phillips

China National Tobacco Corporation

Swedish Match

Reynolds American Inc.

Eastern Company

Scandinavian Tobacco Group

Nakhla Tobacco Company

Djarum

Table of Contents

1. KSA Tobacco Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Tobacco Products Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Tobacco Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Cigarettes

4.1.2. Cigars and Cigarillos

4.1.3. Smokeless Tobacco

4.1.4. E-Cigarettes and Vapes

4.2. By Distribution Channel (In Value %)

4.2.1. Retail Stores

4.2.2. Online Channels

4.2.3. Duty-Free Outlets

4.3. By Consumer Age Group (In Value %)

4.3.1. 18-24 Years

4.3.2. 25-44 Years

4.3.3. 45+ Years

4.4. By Nicotine Strength (In Value %)

4.4.1. High Nicotine

4.4.2. Medium Nicotine

4.4.3. Low Nicotine

4.4.4. Nicotine-Free

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Mecca

5. KSA Tobacco Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. British American Tobacco

5.1.2. Philip Morris International

5.1.3. Japan Tobacco International

5.1.4. Altria Group

5.1.5. Imperial Brands

5.1.6. ITC Limited

5.1.7. KT&G Corporation

5.1.8. Godfrey Phillips

5.1.9. China National Tobacco Corporation

5.1.10. Swedish Match

5.1.11. Reynolds American Inc.

5.1.12. Eastern Company

5.1.13. Scandinavian Tobacco Group

5.1.14. Nakhla Tobacco Company

5.1.15. Djarum

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Tobacco Products Market Regulatory Framework

6.1. Compliance Requirements (Market Compliance Metrics)

6.2. Certification Processes (Certification Guidelines)

7. KSA Tobacco Products Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Tobacco Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Age Group (In Value %)

8.4. By Nicotine Strength (In Value %)

8.5. By Region (In Value %)

9. KSA Tobacco Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of all major stakeholders within the KSA Tobacco Products Market. This step utilizes a combination of desk research and industry reports to gather critical data. The aim is to define the key variables impacting market demand and competition.

Step 2: Market Analysis and Construction

This phase involves gathering historical market data, analyzing key market segments, and calculating penetration rates. It also includes analyzing consumption trends across the different product categories and distribution channels to provide reliable revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

We will validate market assumptions by conducting interviews with industry experts and stakeholders, obtaining insights into supply chain performance, consumer behavior, and competitive dynamics.

Step 4: Research Synthesis and Final Output

The final step includes synthesizing findings from the interviews, historical data, and market analysis to produce a comprehensive report. The findings are verified through triangulation, ensuring the data's accuracy and reliability.

Frequently Asked Questions

01. How big is the KSA Tobacco Products Market?

The KSA Tobacco Products market is valued at USD 10.95 billion, driven by the strong demand for cigarettes and emerging alternatives such as vapes and smokeless tobacco products.

02. What are the challenges in the KSA Tobacco Products Market?

The market faces challenges such as stringent regulations, rising excise duties, and growing awareness of the health risks associated with tobacco consumption, all of which pose barriers to growth.

03. Who are the major players in the KSA Tobacco Products Market?

Key players include British American Tobacco, Philip Morris International, Japan Tobacco International, and Altria Group. These companies dominate due to their global presence, diverse product portfolios, and significant investment in R&D.

04. What are the growth drivers of the KSA Tobacco Products Market?

Key drivers include a youthful population with high disposable income, rising demand for premium tobacco products, and the increasing popularity of alternative tobacco forms such as e-cigarettes and smokeless products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.