KSA Truck Market Outlook to 2029

Region:Middle East

Author(s):Rebecca Mary Reji

Product Code:KRO035

June 2025

90

About the Report

KSA Truck Market Overview

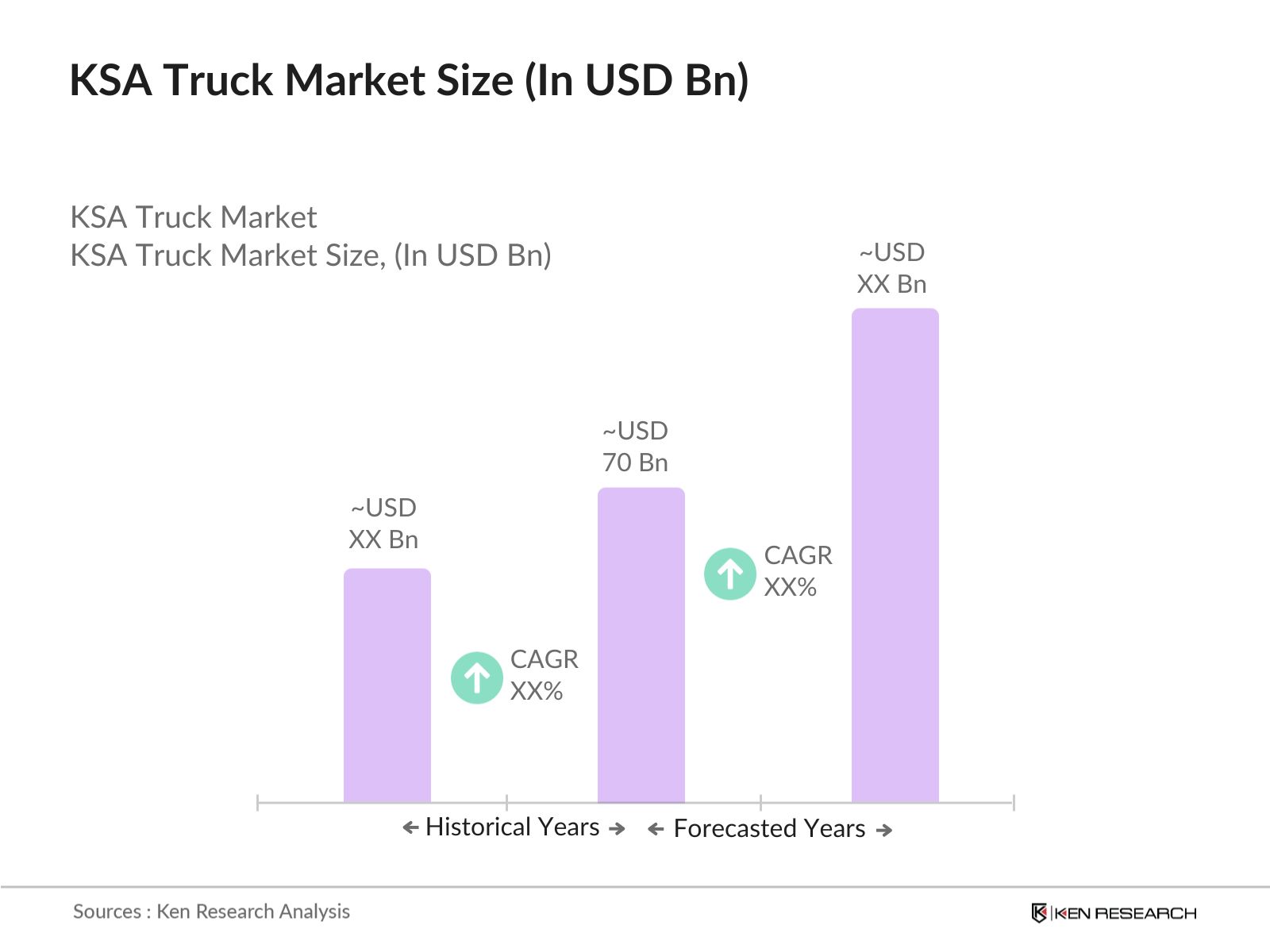

- The KSA Truck Market is valued at USD 70 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for logistics and transportation services, fueled by the rapid expansion of infrastructure projects and urbanization in the region. The rise in e-commerce and the need for efficient supply chain solutions have further contributed to the market's expansion.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the KSA Truck Market due to their strategic locations and robust economic activities. Riyadh, being the capital, serves as a central hub for trade and commerce, while Jeddah's port facilitates international shipping. Dammam, with its proximity to oil fields, supports the transportation of goods related to the energy sector, making these cities pivotal in the market landscape.

- In 2025, Saudi Arabia implemented new regulations requiring all new heavy-duty diesel trucks to meet Euro 5 emission standards. This initiative aims to reduce air pollution and enhance environmental sustainability in the transportation sector. The regulation encourages manufacturers to adopt cleaner technologies and improve fuel efficiency, aligning with the Kingdom’s broader sustainability goals.

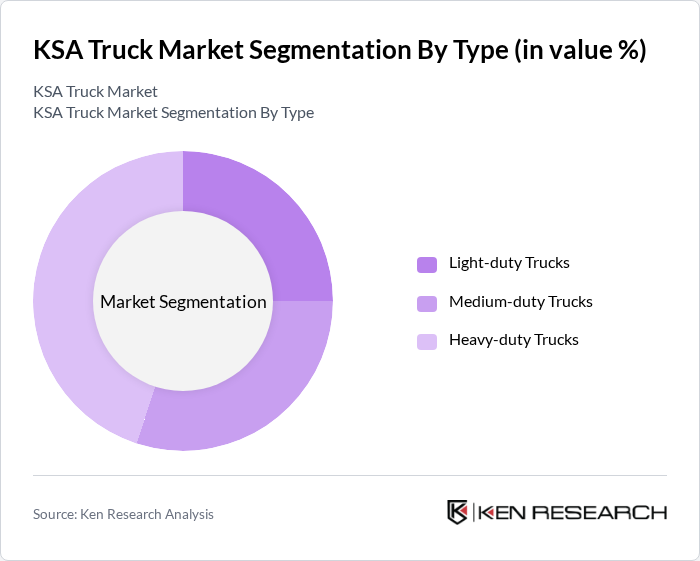

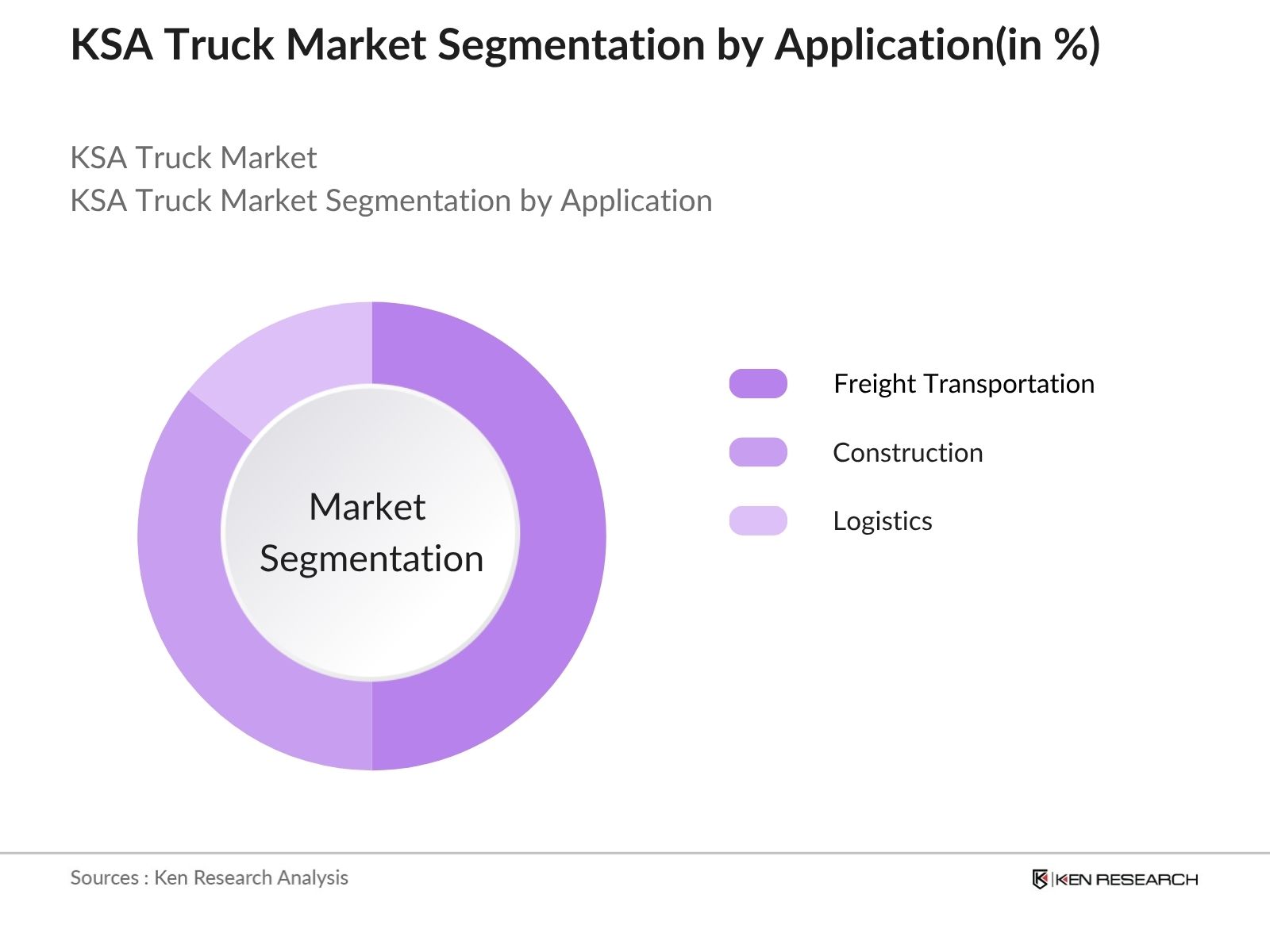

KSA Truck Market Segmentation

By Type: The KSA Truck Market is segmented into light-duty trucks, medium-duty trucks, and heavy-duty trucks. Among these, heavy-duty trucks dominate the market due to their essential role in transporting large volumes of goods across long distances. The increasing demand for freight transportation, particularly in the construction and oil sectors, has led to a significant rise in the adoption of heavy-duty trucks. Additionally, advancements in technology and fuel efficiency have made these trucks more appealing to logistics companies, further solidifying their market position.

By Application: The market is further segmented based on applications, including freight transportation, construction, and logistics. The freight transportation segment holds the largest share, driven by growing trade volumes and the need for long-haul capabilities. Companies are investing in efficient freight solutions to ensure timely delivery across regions. The construction sector follows, supported by large-scale infrastructure developments requiring heavy-duty vehicles for material movement. Logistics is also a key contributor, with rising demand from warehousing and distribution centers fueling the need for specialized transport solutions

KSA Truck Market Competitive Landscape

The KSA Truck Market is characterized by a competitive landscape with several key players, including MAN Truck & Bus, Mercedes-Benz, Isuzu Motors, Hino Motors, and Volvo Trucks. These companies are known for their innovative technologies and extensive product portfolios, catering to various segments of the market. The competition is intense, with firms focusing on enhancing fuel efficiency, reducing emissions, and improving overall vehicle performance to meet the evolving demands of consumers.

KSA Truck Market Industry Analysis

Growth Drivers

- Increasing Demand for Logistics and Transportation Services: The logistics sector in Saudi Arabia is projected to grow at a CAGR of 6.5%. This growth is fueled by rising demand for efficient transportation solutions, especially in urban areas, and is supported by government investments in modern highways and logistics hubs. Transportation services remain the largest revenue segment, driving increased sales and utilization of trucks across the Kingdom

- Government Investments in Infrastructure Development: Saudi Arabia’s Vision 2030 is propelling multi-billion-dollar investments in transformative projects such as New Murabba, Jeddah Central, and Sports Boulevard. Nearly $1 trillion has been committed to construction and real estate projects, including the modernization of roads, ports, and logistics hubs. These initiatives are enhancing freight transport efficiency and creating robust demand for trucks—particularly heavy-duty models—required for construction and logistics, offering new opportunities for truck manufacturers.

- Rising E-commerce Activities Boosting Freight Transport Needs: E-commerce in Saudi Arabia is experiencing rapid expansion and is projected to grow at a CAGR of 12.8% through 2033. This surge in online shopping is driving logistics companies to expand their fleets, particularly in the light and medium-duty truck segments. The light commercial vehicle sales are expected to reach 131,900 units, largely due to the logistics sector’s growth. As businesses adapt to the booming e-commerce landscape, demand for reliable and efficient transportation solutions will continue to propel the truck market forward, supporting robust growth across various truck types

Market Challenges

- Fluctuating Fuel Prices Impacting Operational Costs: The volatility of fuel prices poses a significant challenge for truck operators in Saudi Arabia. Fluctuations in fuel costs directly impact the overall operational expenses of logistics companies. This unpredictability can lead to budget constraints, forcing operators to reconsider fleet expansion plans and potentially stalling market growth as they seek to manage expenses effectively.

- Stringent Environmental Regulations Affecting Vehicle Compliance: The Saudi government is implementing stricter environmental regulations aimed at reducing emissions from heavy-duty vehicles. Compliance with these standards requires significant investments in technology and retrofitting for many truck operators. This challenge may deter some companies from upgrading their fleets, leading to potential delays in market growth as businesses navigate the costs associated with meeting new environmental standards.

KSA Truck Market Future Outlook

The KSA truck market is poised for substantial growth, driven by ongoing infrastructure investments and the expansion of the logistics sector. As e-commerce continues to flourish, the demand for efficient freight transport solutions will increase, particularly for light and medium-duty trucks. Additionally, advancements in electric and hybrid truck technologies will likely reshape the market landscape, offering sustainable alternatives that align with environmental regulations. Overall, the market is expected to adapt to these trends, fostering innovation and competitiveness among key players.

Market Opportunities

- Growth in the Electric Truck Segment: By 2024, electric trucks will account for less than 2% of total truck sales in major markets like India, with a 1% EV penetration rate in the commercial vehicle segment as of March 2025. The segment is growing rapidly due to government incentives and rising demand for eco-friendly transport, but electric trucks remain a small share of overall truck sales

- Expansion of the Logistics Sector Driven by Vision 2030 Initiatives: The Vision 2030 initiative is set to transform the logistics landscape in Saudi Arabia, creating opportunities for truck manufacturers. With an expected increase in logistics activities, particularly in urban areas, companies can capitalize on the demand for advanced logistics solutions. This expansion will likely lead to increased truck sales, particularly in the medium and heavy-duty categories, as businesses seek to enhance their operational capabilities.

Scope of the Report

| By Vehicle Type |

Light-Duty Trucks Medium-Duty Trucks Heavy-Duty Trucks |

| By Application |

Freight Transportation Construction Logistics |

| By Fuel Type |

Diesel Gasoline Electric Hybrid |

| By Region |

Riyadh Jeddah Dammam Makkah |

| By End-User |

Private Fleet Operators Public Fleet Operators Logistics Companies |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Transport, Saudi Standards, Metrology and Quality Organization)

Truck Manufacturers and Producers

Logistics and Freight Companies

Fleet Management Service Providers

Automotive Parts Suppliers

Industry Associations (e.g., Saudi Arabian Trucking Association)

Financial Institutions and Banks

Companies

Players Mentioned in the Report:

MAN Truck & Bus

Mercedes-Benz

Isuzu Motors

Hino Motors

Volvo Trucks

Scania

Freightliner

Kenworth

Mack Trucks

Peterbilt

Table of Contents

1. KSA Truck Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Truck Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Truck Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand for logistics and transportation services

3.1.2. Government investments in infrastructure development

3.1.3. Rising e-commerce activities boosting freight transport needs

3.2. Market Challenges

3.2.1. Fluctuating fuel prices impacting operational costs

3.2.2. Stringent environmental regulations affecting vehicle compliance

3.2.3. Competition from alternative transportation modes

3.3. Opportunities

3.3.1. Growth in the electric truck segment due to sustainability trends

3.3.2. Expansion of the logistics sector driven by Vision 2030 initiatives

3.3.3. Technological advancements in truck manufacturing and telematics

3.4. Trends

3.4.1. Shift towards automation and smart logistics solutions

3.4.2. Increasing focus on fuel efficiency and emissions reduction

3.4.3. Rising popularity of fleet management systems among operators

3.5. Government Regulation

3.5.1. Implementation of emission standards for heavy-duty vehicles

3.5.2. Licensing and registration requirements for truck operators

3.5.3. Safety regulations governing truck design and operation

3.5.4. Incentives for adopting electric and hybrid trucks

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. KSA Truck Market Segmentation

4.1. By Vehicle Type

4.1.1. Light-Duty Trucks

4.1.2. Medium-Duty Trucks

4.1.3. Heavy-Duty Trucks

4.2. By Application

4.2.1. Freight Transportation

4.2.2. Construction

4.2.3. Logistics

4.3. By Fuel Type

4.3.1. Diesel

4.3.2. Gasoline

4.3.3. Electric

4.3.4. Hybrid

4.4. By Region

4.4.1. Riyadh

4.4.2. Jeddah

4.4.3. Dammam

4.4.4. Makkah

4.5. By End-User

4.5.1. Private Fleet Operators

4.5.2. Public Fleet Operators

4.5.3. Logistics Companies

5. KSA Truck Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. MAN Truck & Bus

5.1.2. Mercedes-Benz

5.1.3. Isuzu Motors

5.1.4. Hino Motors

5.1.5. Volvo Trucks

5.1.6. Scania

5.1.7. Freightliner

5.1.8. Kenworth

5.1.9. Mack Trucks

5.1.10. Peterbilt

5.2. Cross-Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Product Portfolio Diversity

5.2.4. Geographic Presence

5.2.5. Customer Satisfaction Ratings

5.2.6. Innovation Index

5.2.7. Supply Chain Efficiency

5.2.8. Brand Reputation

6. KSA Truck Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Truck Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Truck Market Future Market Segmentation

8.1. By Vehicle Type

8.1.1. Light-Duty Trucks

8.1.2. Medium-Duty Trucks

8.1.3. Heavy-Duty Trucks

8.2. By Application

8.2.1. Freight Transportation

8.2.2. Construction

8.2.3. Logistics

8.3. By Fuel Type

8.3.1. Diesel

8.3.2. Gasoline

8.3.3. Electric

8.3.4. Hybrid

8.4. By Region

8.4.1. Riyadh

8.4.2. Jeddah

8.4.3. Dammam

8.4.4. Makkah

8.5. By End-User

8.5.1. Private Fleet Operators

8.5.2. Public Fleet Operators

8.5.3. Logistics Companies

9. KSA Truck Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key stakeholders and variables that impact the KSA Truck Market. This includes identifying manufacturers, suppliers, and regulatory bodies through extensive desk research. The goal is to establish a clear understanding of the factors that drive market dynamics and consumer behavior.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical and current data related to the KSA Truck Market. This includes evaluating market size, growth trends, and competitive landscape. The analysis will also focus on identifying key segments and their respective contributions to overall market performance.

Step 3: Hypothesis Validation and Expert Consultation

We will formulate market hypotheses and validate them through structured interviews with industry experts and stakeholders. This qualitative approach will provide insights into market trends, challenges, and opportunities, ensuring that our hypotheses are grounded in real-world experiences and data.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all collected data and insights to produce a comprehensive report on the KSA Truck Market. This will include detailed analyses of market segments, consumer preferences, and competitive strategies. The output will be designed to inform stakeholders and guide strategic decision-making in the industry.

Frequently Asked Questions

01. How big is the KSA Truck Market?

The KSA Truck Market is valued at USD 70 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the KSA Truck Market?

Key challenges in the KSA Truck Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the KSA Truck Market?

Major players in the KSA Truck Market include MAN Truck & Bus, Mercedes-Benz, Isuzu Motors, Hino Motors, Volvo Trucks, among others.

04. What are the growth drivers for the KSA Truck Market?

The primary growth drivers for the KSA Truck Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.