KSA Video Game Market Outlook to 2030

Region:Middle East

Author(s):Naman Rohilla

Product Code:KROD4431

October 2024

83

About the Report

KSA Video Game Market Overview

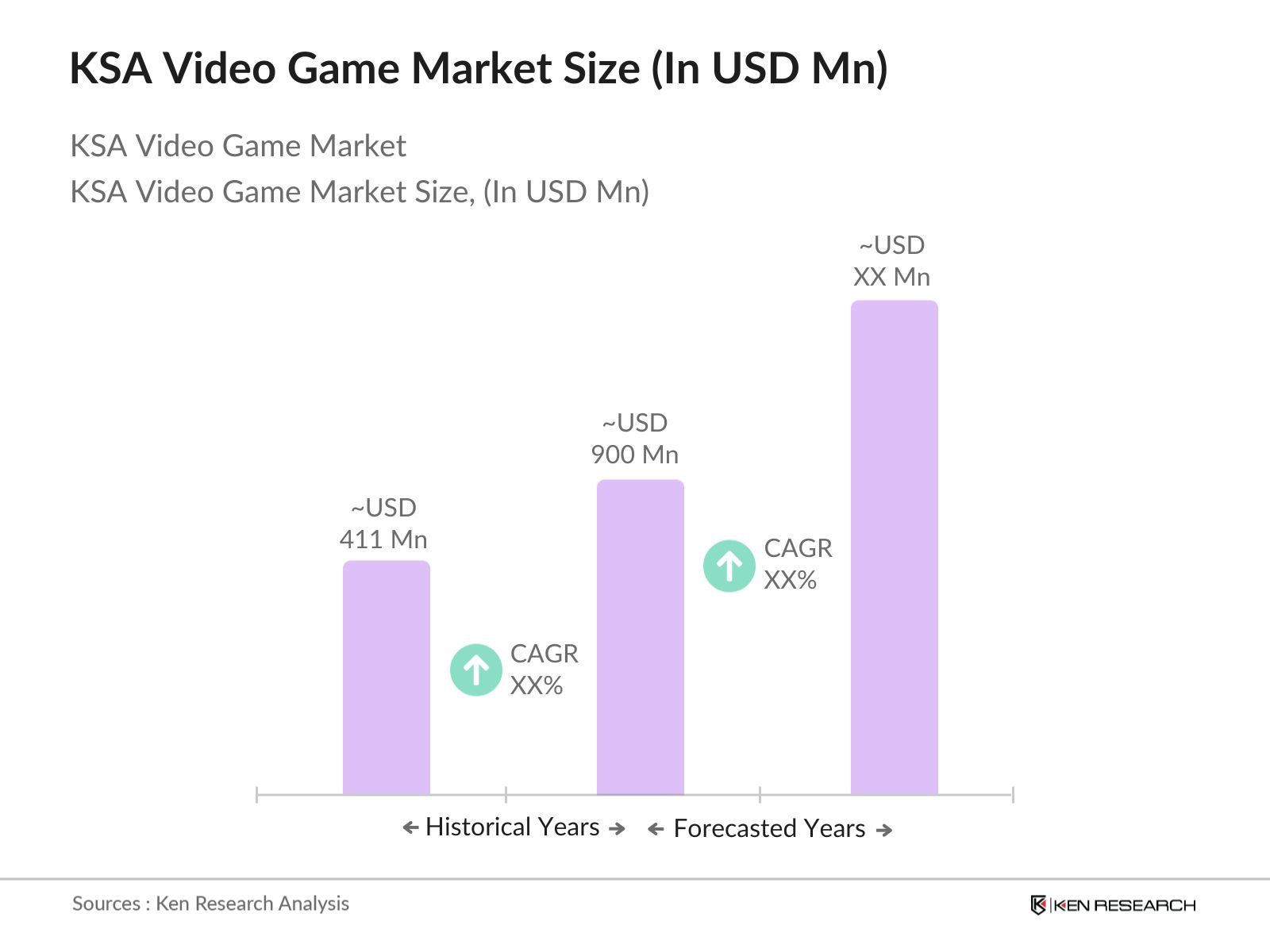

- The KSA Video Game Market is valued at USD 900 million, based on a five-year historical analysis. This valuation reflects the rapid growth of the industry, primarily driven by the country’s expanding youth population and government support under Vision 2030. With advancements in technology and increased smartphone penetration, the demand for mobile gaming has surged, complemented by the rising interest in esports and cloud gaming. Additionally, local initiatives to create a conducive environment for gaming developers further contribute to market expansion.

- Dominant regions in the KSA Video Game Market include Riyadh, Jeddah, and Dammam. These cities dominate the market due to their well-developed digital infrastructure, high income levels, and a growing number of gaming enthusiasts. Riyadh, in particular, hosts major gaming events and tournaments, attracting investments from both local and international gaming companies. The city's economic influence and government-backed initiatives also play a crucial role in the market's dominance.

- Vision 2030 is at the core of Saudi Arabia’s push to develop its entertainment sector, including video games. The government plans to increase household spending on cultural and entertainment activities from $300 annually to $1,000 by 2030. Substantial investments are being made into gaming infrastructure, including the development of e-sports venues and partnerships with global gaming companies. The strategy aligns with Saudi Arabia’s broader goals of diversifying the economy and creating job opportunities in the digital sector.

KSA Video Game Market Segmentation

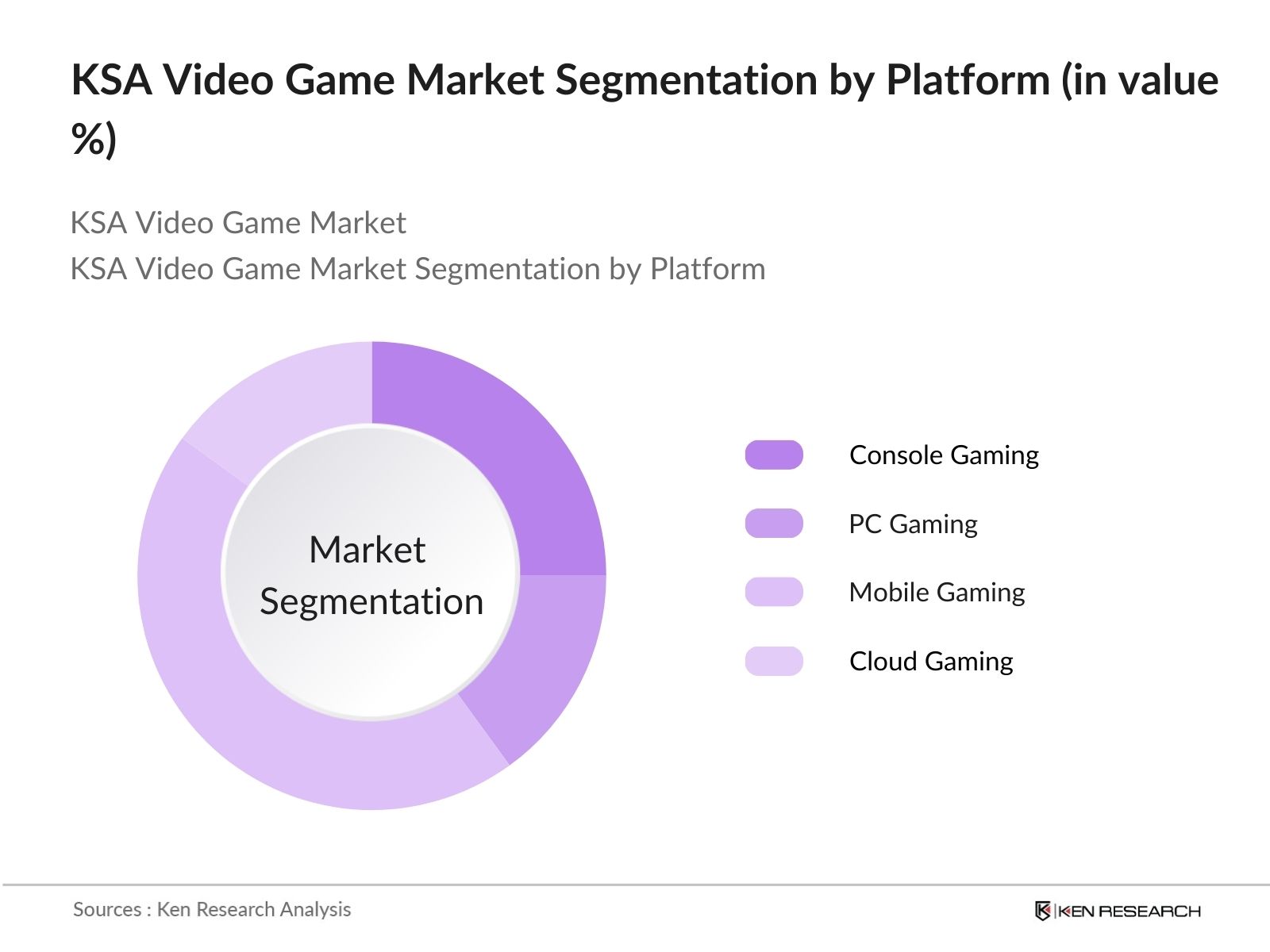

- By Platform: The KSA video game market is segmented by platform into console gaming, PC gaming, mobile gaming, and cloud gaming. Mobile gaming has recently dominated this segment due to its accessibility and the growing affordability of smartphones. With titles like PUBG Mobile and Fortnite gaining widespread popularity, mobile gaming appeals to a broad demographic, especially younger gamers. Additionally, the introduction of 5G technology is enhancing the mobile gaming experience with reduced latency and better graphics.

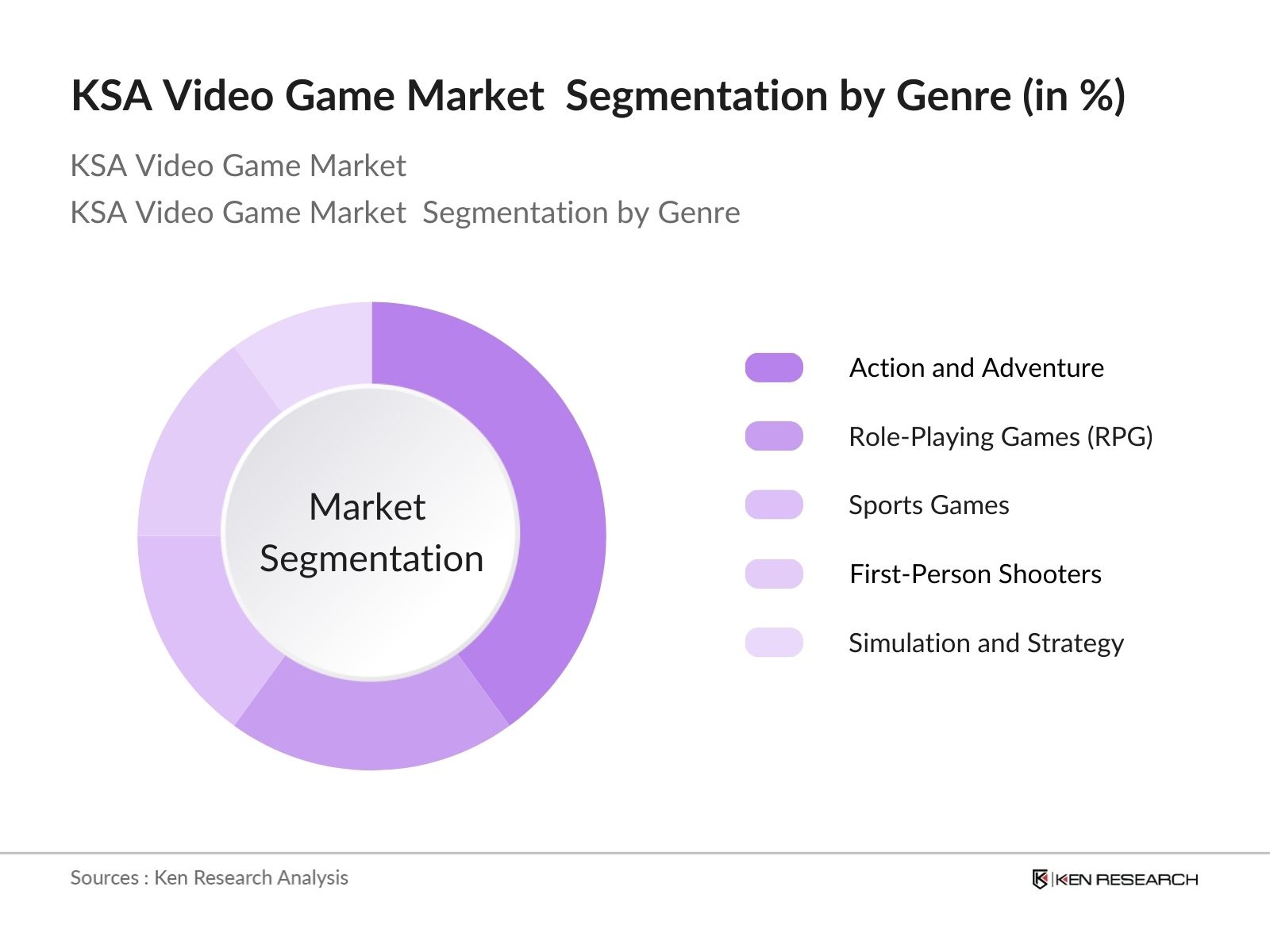

- By Genre: The KSA video game market is also segmented by genre into action and adventure, role-playing games (RPG), sports games, first-person shooters (FPS), and simulation and strategy. Among these, action and adventure games dominate the market share. The popularity of titles like Call of Duty and FIFA, alongside a strong competitive esports presence, has solidified the demand for fast-paced, action-oriented games. Saudi Arabia's active esports culture, backed by government funding, has also contributed to this genre’s dominance.

KSA Video Game Market Competitive Landscape

The KSA video game market is dominated by a few global and local key players. Companies like Sony Interactive Entertainment and Activision Blizzard, alongside growing local developers, contribute to market consolidation. The emergence of local companies, fueled by government support for local content creation and development, is shifting the competitive landscape.

| Company | Establishment Year | Headquarters | Market Share | Key Game Titles | Focus on Local Market | Partnerships | Key Platforms | Esports Involvement |

|---|---|---|---|---|---|---|---|---|

| Sony Interactive Entertainment | 1993 | San Mateo, CA, USA | - | - | - | - | - | - |

| Activision Blizzard | 2008 | Santa Monica, CA, USA | - | - | - | - | - | - |

| Tencent Games | 2003 | Shenzhen, China | - | - | - | - | - | - |

| Microsoft Corporation (Xbox) | 2001 | Redmond, WA, USA | - | - | - | - | - | - |

| Ubisoft Entertainment | 1986 | Montreuil, France | - | - | - | - | - | - |

KSA Video Game Market Analysis

KSA Video Game Market Growth Drivers

- Rising Youth Population and E-Sports Popularity: Saudi Arabia's youth population is a key driver in the growth of the video gaming market. With over 70% of the population under the age of 35, there is a growing demand for digital entertainment, including video games and e-sports. As of 2023, the Kingdom saw an 18% increase in the number of e-sports players, particularly driven by the youth demographic. E-sports events like Gamers8 have garnered attention, offering prize pools exceeding $45 million, attracting global participation, and further bolstering the industry.

- Advancements in Cloud Gaming Technology: Saudi Arabia is making strides in cloud gaming, thanks to partnerships with tech giants and improved internet infrastructure. The introduction of 5G technology has enabled faster internet speeds, with 5G penetration reaching 33% by mid-2023. This high-speed connectivity is crucial for cloud gaming services, which require robust and stable internet. The growing interest in cloud-based platforms has been supported by telecom operators, offering subscription-based services to gamers, thereby boosting the overall gaming experience in the Kingdom.

- Expansion of Internet and 5G Infrastructure: Saudi Arabia's ongoing expansion of its internet and 5G networks has fueled the growth of the gaming industry. By 2023, the Kingdom had expanded internet coverage to over 98% of the population, with average internet speeds of 200 Mbps. This infrastructure development supports online gaming, especially multiplayer and cloud gaming services. Moreover, Saudi telecom companies are investing an additional $10 billion into the expansion of 5G networks, aiming to further enhance the digital infrastructure needed for gaming.

KSA Video Game Market Challenges

- Regulatory Hurdles: Saudi Arabia has strict regulations governing the content available in video games, impacting the industry's growth. The General Commission for Audiovisual Media (GCAM) has introduced content censorship policies that restrict games with inappropriate content, limiting the variety of games available in the market. While these regulations aim to protect cultural values, they pose challenges for global game developers looking to enter the Saudi market. In 2023, around 40% of global games were either banned or required content modifications to be released in the Kingdom.

- High Game Development Costs: Developing video games in Saudi Arabia comes with high costs, primarily due to the lack of local game development infrastructure and reliance on imports for technology and expertise. In 2022, game development costs averaged $5 million per project, higher than other regional markets. This is largely attributed to the need to import gaming software, hardware, and hire international experts, as the local talent pool remains limited.

KSA Video Game Market Future Outlook

Over the next five years, the KSA video game market is expected to experience substantial growth driven by government support, increasing consumer demand for online entertainment, and the rise of esports tournaments. As the country continues its push to diversify its economy through Vision 2030, the gaming industry is set to benefit from enhanced infrastructure, technological advancements, and greater internet penetration. The expansion of 5G networks and cloud gaming services will also further elevate user experiences, opening new opportunities for mobile and cloud gaming segments.

KSA Video Game Market Opportunities

- Collaboration with Global Game Developers: Saudi Arabia presents opportunities for collaboration with global game developers. The government's investment in the gaming sector, including its recent acquisition of stakes in companies like SNK Corporation, highlights the potential for international partnerships. In 2023, the Kingdom signed agreements with global gaming companies to co-develop games aimed at both local and international markets. This trend is expected to attract further foreign investment and bolster the country's status as a gaming hub.

- Localization of Games to Cater to Regional Preferences: The localization of video games to cater to Saudi and Middle Eastern cultural preferences is a growing trend. In 2023, over 30 globally popular games were localized to include Arabic language options and culturally relevant content. This has increased the engagement of Saudi players, particularly among younger audiences. Localization efforts have also been supported by the government, which is encouraging game developers to tailor content that aligns with regional values and expectations.

Scope of the Report

| By Platform |

Console Gaming PC Gaming Mobile Gaming Cloud Gaming |

| By Genre |

Action, RPG Sports FPS Simulation and Strategy |

| By Age Group |

Teenagers Young Adults Adults |

| By Purchase Model |

Subscription-Based One-Time Purchase Free-to-Play |

| By Region |

Riyadh Jeddah Dammam Mecca Medina |

Products

Key Target Audience

Game Developers

Gaming Hardware Manufacturers

Banks and Financial Institutions

Esports Event Organizers

Investors and Venture Capital Firms

Government and Regulatory Bodies (Saudi General Entertainment Authority, Ministry of Communications and Information Technology)

Mobile Network Operators

Cloud Service Providers

Digital Advertising Firms

Companies

Sony Interactive Entertainment

Activision Blizzard

Tencent Games

Microsoft Corporation (Xbox)

Ubisoft Entertainment

Epic Games

Riot Games

Square Enix

Sega Sammy Holdings

Bandai Namco Entertainment

NetEase Games

Take-Two Interactive

Electronic Arts

Gameloft

Nintendo Co., Ltd.

Table of Contents

1. KSA Video Game Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Video Game Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Video Game Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives for Digital Entertainment

3.1.2. Rising Youth Population and E-Sports Popularity

3.1.3. Advancements in Cloud Gaming Technology

3.1.4. Expansion of Internet and 5G Infrastructure

3.2. Market Challenges

3.2.1. Regulatory Hurdles (Content Restrictions)

3.2.2. High Game Development Costs

3.2.3. Limited Skilled Workforce in Game Design

3.3. Opportunities

3.3.1. Collaboration with Global Game Developers

3.3.2. Localization of Games to Cater to Regional Preferences

3.3.3. Expanding Gaming Tourism in KSA

3.4. Trends

3.4.1. Shift towards Mobile Gaming

3.4.2. E-Sports Events and Tournaments

3.4.3. Gamification of Education and Learning Apps

3.5. Government Regulations

3.5.1. Vision 2030 and Entertainment Industry Development

3.5.2. Content Rating and Censorship Guidelines

3.5.3. Government Support for Local Game Development Studios

3.6. SWOT Analysis

3.7. Porter's Five Forces

3.8. Competition Ecosystem

4. KSA Video Game Market Segmentation

4.1. By Platform (In Value %)

4.1.1. Console Gaming

4.1.2. PC Gaming

4.1.3. Mobile Gaming

4.1.4. Cloud Gaming

4.2. By Genre (In Value %)

4.2.1. Action and Adventure

4.2.2. Role-Playing Games (RPG)

4.2.3. Sports Games

4.2.4. First-Person Shooters (FPS)

4.2.5. Simulation and Strategy

4.3. By Age Group (In Value %)

4.3.1. Teenagers

4.3.2. Young Adults

4.3.3. Adults

4.4. By Purchase Model (In Value %)

4.4.1. Subscription-Based

4.4.2. One-Time Purchase

4.4.3. Free-to-Play (In-App Purchases)

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Mecca

4.5.5. Medina

5. KSA Video Game Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Activision Blizzard

5.1.2. Sony Interactive Entertainment

5.1.3. Electronic Arts

5.1.4. Tencent Games

5.1.5. Microsoft Corporation (Xbox)

5.1.6. Ubisoft Entertainment

5.1.7. Take-Two Interactive

5.1.8. Nintendo Co., Ltd.

5.1.9. NetEase Games

5.1.10. Epic Games

5.1.11. Riot Games

5.1.12. Gameloft

5.1.13. Square Enix

5.1.14. Sega Sammy Holdings

5.1.15. Bandai Namco Entertainment

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Regional Presence, Key Franchises, Market Penetration in KSA, Key Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. KSA Video Game Market Regulatory Framework

6.1. Content Regulation Policies

6.2. Licensing Requirements for Local and International Game Developers

6.3. Taxation Policies on In-Game Purchases

6.4. Data Privacy and User Security

7. KSA Video Game Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Increased Adoption of AR/VR, 5G, Growth in E-Sports)

8. KSA Video Game Future Market Segmentation

8.1. By Platform (In Value %)

8.2. By Genre (In Value %)

8.3. By Age Group (In Value %)

8.4. By Purchase Model (In Value %)

8.5. By Region (In Value %)

9. KSA Video Game Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved constructing a comprehensive ecosystem map of all stakeholders within the KSA video game market. Extensive desk research was conducted, utilizing secondary databases to identify key variables such as revenue generation, technology adoption, and demographic trends influencing the market.

Step 2: Market Analysis and Construction

In this phase, historical data for the KSA video game market was analyzed to assess market penetration and revenue trends. Data from service providers, revenue projections, and competitive dynamics were gathered to ensure the reliability of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were developed and validated through consultations with industry experts. Key interviews were conducted with developers and esports event organizers to gather direct insights on operational trends and consumer behavior within the gaming sector.

Step 4: Research Synthesis and Final Output

In the final phase, detailed engagement with game publishers and developers was conducted. This provided insights into sales performance, consumer preferences, and game segment analysis. The gathered data was synthesized to generate a comprehensive market report on the KSA video game market.

Frequently Asked Questions

01. How big is the KSA Video Game Market?

The KSA video game market is valued at USD 900 million, driven by increasing smartphone usage, government support, and the rapid growth of esports in the country.

02. What are the challenges in the KSA Video Game Market?

Key challenges in the KSA video game market include regulatory hurdles around content censorship, the high cost of game development, and a lack of skilled workforce in areas such as game design and development.

03. Who are the major players in the KSA Video Game Market?

KSA video game market major players include Sony Interactive Entertainment, Activision Blizzard, Tencent Games, Microsoft Corporation (Xbox), and Ubisoft Entertainment, all of which hold notable market influence due to their popular titles and platform offerings.

04. What are the growth drivers of the KSA Video Game Market?

The KSA video game market growth is driven by expanding youth demographics, increasing internet penetration, government initiatives to promote entertainment, and technological advancements like 5G and cloud gaming.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.