KSA Video Streaming Services Market Outlook to 2030

Region:Middle East

Author(s):Sanjna

Product Code:KROD8657

December 2024

96

About the Report

KSA Video Streaming Services Market Overview

- The KSA Video Streaming Services market is valued at USD 2 billion, based on a five-year historical analysis. The market is driven by the surge in internet penetration, which has reached over 90% of the population, and a growing demand for premium and localized content. Government initiatives under Saudi Arabia's Vision 2030, which emphasize digital transformation and the development of ICT infrastructure, have also fueled the rapid growth of this market.

- The dominant cities in the KSA Video Streaming Services market include Riyadh, Jeddah, and Dammam. These cities lead due to their larger populations, higher disposable incomes, and more developed digital infrastructures. Additionally, their younger, tech-savy populations are more inclined to consume digital content, driving the adoption of video streaming platforms. These urban centers have a robust demand for on-demand entertainment, which further solidifies their dominance in this sector.

- Saudi Arabia introduced stricter data privacy regulations in 2024, under the Personal Data Protection Law (PDPL). Streaming platforms must now adhere to stricter guidelines concerning the collection, storage, and use of customer data. Companies found to be in violation of these regulations can face fines of up to $1 million. The enforcement of these rules aims to protect consumers from data misuse, while also fostering trust between streaming platforms and their users. Compliance with these regulations is critical for platforms to maintain operations in the Kingdom.

KSA Video Streaming Services Market Segmentation

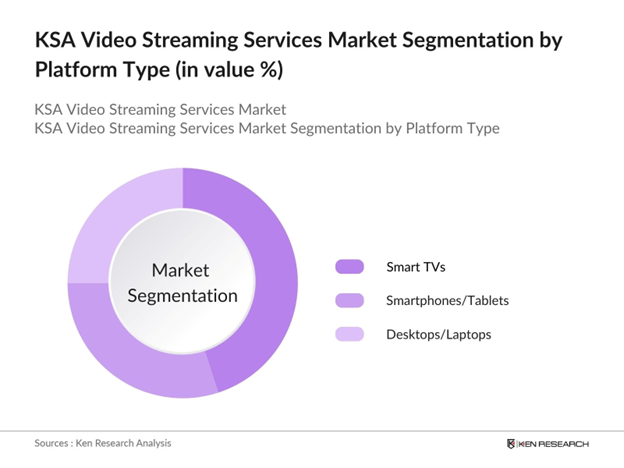

By Platform Type: In the KSA, video streaming services are segmented by platform type into Smart TVs, Smartphones/Tablets, and Desktops/Laptops. Smart TVs have emerged as a dominant platform in this market due to the increasing affordability and popularity of smart home technology. Users prefer Smart TVs for their large screen experiences, seamless integration with other devices, and the availability of high-definition content. This segment dominates because consumers are drawn to the convenience of on-demand viewing with built-in applications on Smart TVs, driving substantial market share.

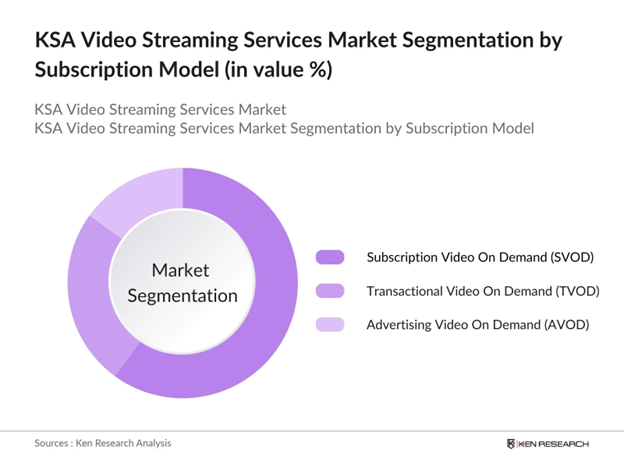

By Subscription Model: The market is segmented by subscription model into SVOD (Subscription Video on Demand), TVOD (Transactional Video on Demand), and AVOD (Advertising Video on Demand). SVOD currently holds the largest share of the market, driven by the success of platforms like Netflix and Shahid VIP. Consumers prefer SVOD for its vast content libraries, ad-free experiences, and the ability to binge-watch content at their own pace. The subscription-based model appeals to users looking for a higher quality viewing experience and exclusive content.

KSA Video Streaming Services Market Competitive Landscape

The KSA Video Streaming Services market is dominated by both international and local players, with global companies like Netflix and Amazon Prime Video competing alongside regional platforms such as Shahid VIP and OSN Streaming. These major players have established strong footholds through strategic partnerships with telecom companies, extensive content libraries, and exclusive streaming rights to popular series and films. This competitive landscape underscores the increasing consolidation and influence of these platforms in the market.

Company | Year Established | Headquarters | Platform Reach | Exclusive Content | Localized Content | Subscription Base | Pricing Models | Partnerships with Telecoms | Content Variety |

Netflix | 1997 | Los Gatos, USA | - | - | - | - | - | - | - |

Shahid VIP | 2008 | Riyadh, KSA | - | - | - | - | - | - | - |

Amazon Prime Video | 2006 | Seattle, USA | - | - | - | - | - | - | - |

OSN Streaming | 1992 | Dubai, UAE | - | - | - | - | - | - | - |

YouTube Premium | 2014 | San Bruno, USA | - | - | - | - | - | - | - |

KSA Video Streaming Services Market Analysis

Growth Drivers

- Digital Infrastructure Development: Saudi Arabias ongoing digital transformation is a key driver for the video streaming services market. In 2024, the Kingdoms fiber-optic infrastructure expanded to cover over 3.5 million homes, a significant boost to the internet ecosystem, ensuring seamless streaming experiences. The country's Vision 2030 initiative continues to focus on developing digital infrastructure, with $15 billion allocated for tech innovation and internet expansion.

- Expanding Content Libraries: With increasing demand for diverse and culturally relevant content, streaming platforms have significantly expanded their content libraries. By 2024, leading platforms have collectively invested over $2 billion in acquiring and producing original Arabic content, with a focus on family-friendly and culturally appropriate programming. This investment aligns with the growing number of Arabic-speaking viewers and a surge in demand for regional content.

- Increasing Smartphone Adoption: Smartphone penetration in Saudi Arabia has surged to over 49 million active devices by 2024, as reported by government sources. The proliferation of affordable smartphones, alongside widespread 5G network coverage, is driving the growth of video streaming services. With 90% of the population accessing content on mobile devices, the convenience and accessibility of streaming platforms have made mobile the primary medium for consuming video content in the country.

Challenges

- Stringent Content Regulations: Saudi Arabia enforces strict regulations on digital content, limiting the type of media that can be streamed within the Kingdom. The General Commission for Audiovisual Media (GCAM) has implemented a comprehensive censorship policy that led to the removal of over 200 pieces of content from streaming platforms in 2023-2024. These restrictions pose significant challenges for international platforms seeking to expand in the region, as they must navigate local content approval processes, which increases operational costs and delays in content releases.

- Competition with Pirated Content: Despite government efforts to combat digital piracy, it remains a major challenge in the Saudi streaming market. As of 2024, it is estimated that over 30% of online video content consumed in the Kingdom comes from illegal streaming services. This not only leads to significant revenue losses for legitimate platforms but also reduces the incentive for content creators to invest in the region.

KSA Video Streaming Services Market Future Outlook

KSA Video Streaming Services market is expected to witness significant growth, driven by continuous government support, technological advancements in streaming platforms, and increasing demand for high-quality localized content. The rising investment in 5G technology and the availability of high-speed internet will further support the expansion of video streaming services across Saudi Arabia. As consumer preferences shift towards on-demand viewing, platforms that offer exclusive content and seamless user experiences will remain competitive in this evolving market.

Market Opportunities

- Demand for Localized Arabic Content: There is growing demand for localized Arabic content as audiences seek more culturally relevant programming. Streaming platforms are responding by increasing their investment in Arabic-language shows and films. In 2024, nearly 40% of new content on platforms like Netflix, OSN, and Shahid is expected to be Arabic-language productions. This represents a significant opportunity for content creators and distributors to capitalize on the regions cultural preferences.

- Adoption of AI/ML for Content Personalization: The use of Artificial Intelligence (AI) and Machine Learning (ML) technologies to personalize viewing experiences presents an opportunity for platforms to increase user engagement. By 2024, approximately 70% of Saudi streaming subscribers have reported an improved user experience due to AI-powered content recommendations. With investments in AI technology expected to surpass $1 billion in 2024, platforms are leveraging these tools to analyze viewing patterns and suggest tailored content, enhancing retention rates and boosting overall user satisfaction.

Scope of the Report

Platform Type | Smart TVs Smartphones/Tablets Desktops/Laptops |

Subscription Model | SVOD TVOD AVOD |

Content Type | Movies TV Shows Sports Kids Content |

User Type | Individual Users Household Subscriptions Corporate/Institutional Users |

Region | Central Region Western Region Eastern Region Southern Region |

Major Players

- Netflix

- Shahid VIP

- Amazon Prime Video

- OSN Streaming

- YouTube Premium

- STARZPLAY

- Disney+

- Apple TV+

- Viu

- icflix

Products

Key Target Audience

OTT Platform Providers

Telecom Operators (STC, Mobily, Zain)

Content Production Companies

Smart Device Manufacturers

Media and Entertainment Companies

Digital Payment Solution Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (CITC, Saudi Ministry of Media)

Table of Contents

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Video Streaming Services Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the KSA Video Streaming Services Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple video streaming service providers to acquire detailed insights into platform segments, subscription models, user preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA Video Streaming Services market.

Frequently Asked Questions

01. How big is the KSA Video Streaming Services Market?

The KSA Video Streaming Services Market is valued at USD 2 billion, driven by high internet penetration and growing demand for premium content.02. What are the challenges in the KSA Video Streaming Services Market?

Challenges of KSA Video Streaming Services Market include stringent content regulations, competition with pirated content, and high data consumption costs, which can limit market growth.03. Who are the major players in the KSA Video Streaming Services Market?

Key players in KSA Video Streaming Services Market include Netflix, Shahid VIP, Amazon Prime Video, OSN Streaming, and YouTube Premium, all competing with unique content offerings and partnerships with telecom operators.04. What are the growth drivers of the KSA Video Streaming Services Market?

Growth of KSA Video Streaming Services Market is propelled by expanding digital infrastructure under Vision 2030, increasing demand for localized Arabic content, and the rise of affordable smart devices.Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.