KSA Virtual Reality Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD2100

October 2024

118

About the Report

KSA Virtual Reality Market Overview

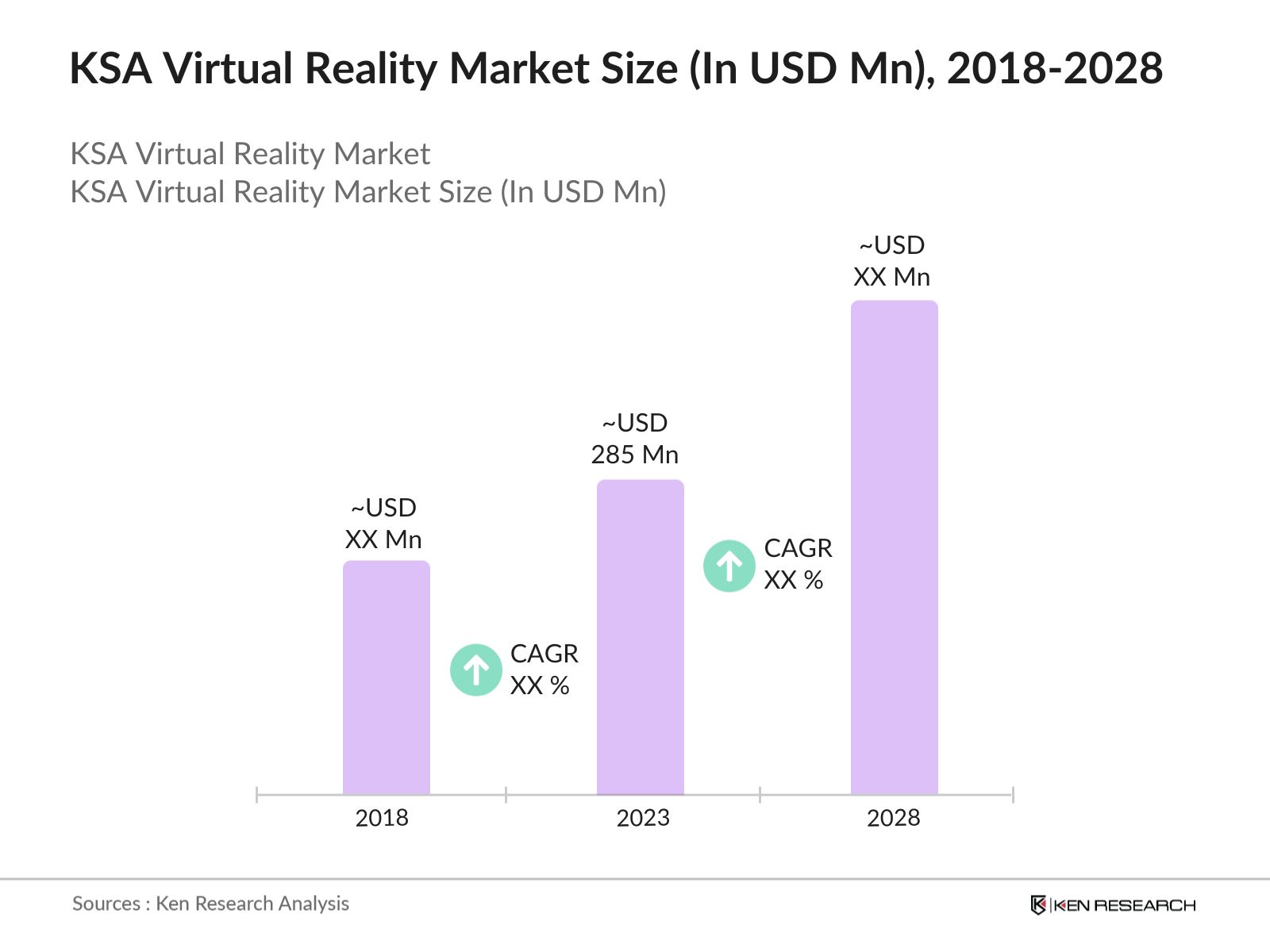

- The KSA Virtual Reality (VR) Market was valued at USD 285 million, driven by the country's rapid adoption of advanced technologies across various industries, including entertainment, healthcare, education, and retail. The market's growth aligns with Saudi Arabias Vision 2030, which promotes digital transformation and diversification from oil dependency by investing heavily in the tech sector.

- Major players in the KSA VR market include HTC Vive, Oculus (Meta Platforms), Microsoft, Sony Interactive Entertainment, and Magic Leap. These companies dominate through strategic partnerships with local firms, substantial investments in VR hardware, and innovation in immersive content development.

- The Central and Western regions, including Riyadh and Jeddah, lead the market due to the high population density, urbanization rates, and strong governmental backing for digital initiatives. The Eastern region is also experiencing rapid growth, supported by industrial applications of VR in training and simulation for sectors like oil and gas.

- In early 2024, HTC Vive partnered with the Saudi government to implement VR in education through the Ministry of Educations nationwide initiative to create virtual classrooms. The project aims to bring immersive learning experiences to over 1 million students by 2025.

KSA Virtual Reality Market Segmentation

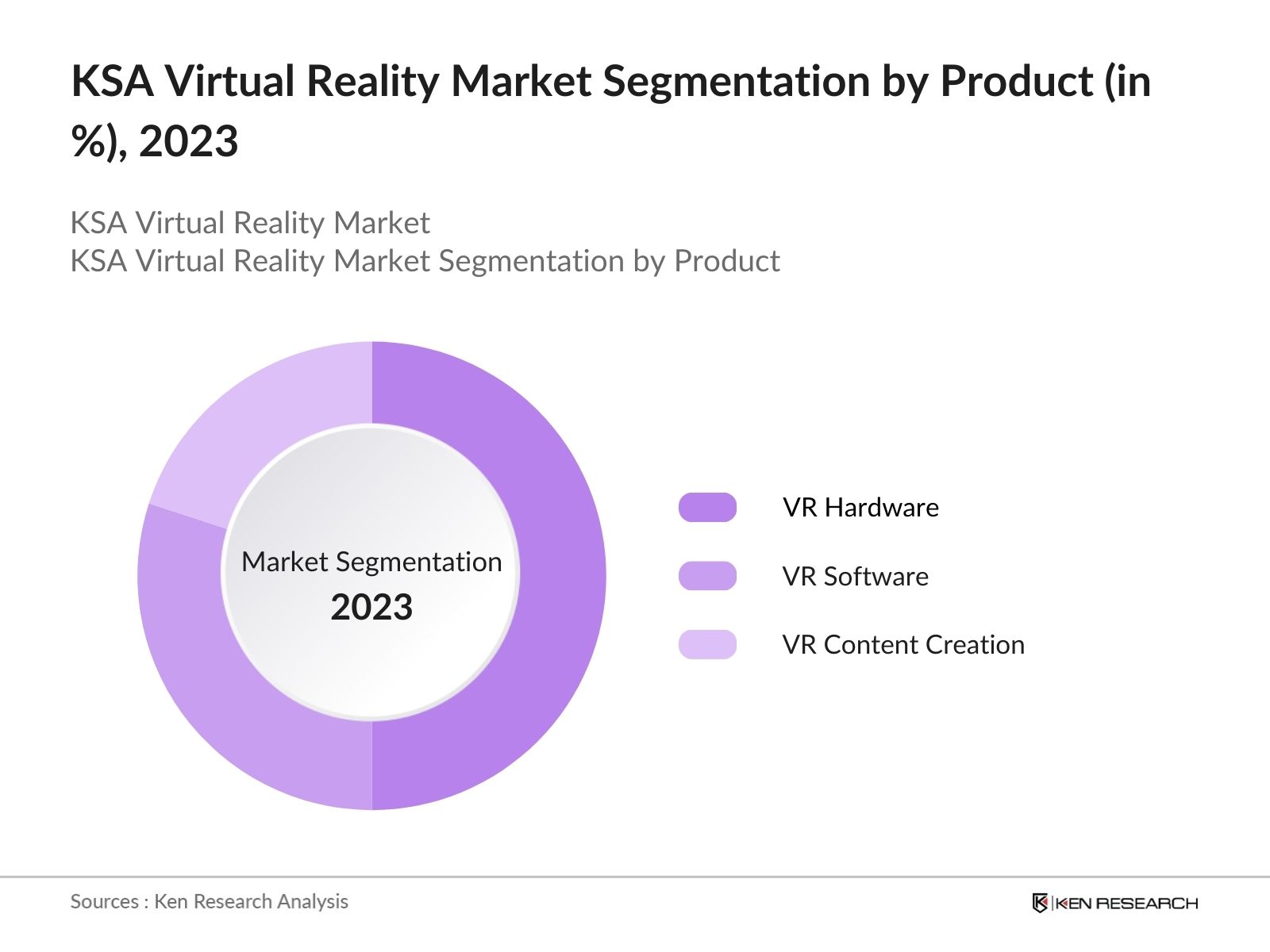

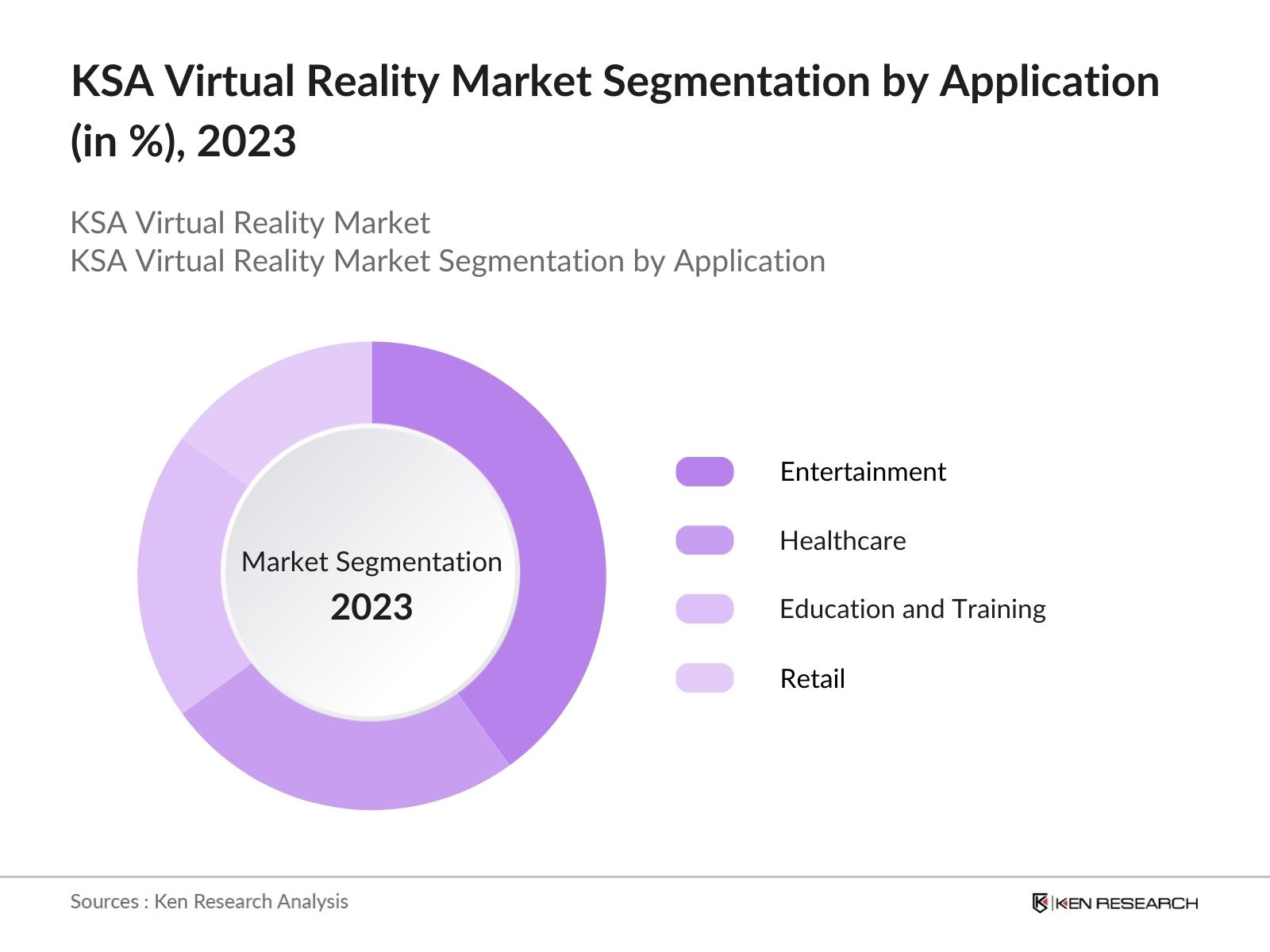

The KSA Virtual Reality Market is segmented by product, application, and region.

- By Product: The market is segmented into Hardware, Software, and Content Development. In 2023, VR Hardware held the dominant market share, driven by demand for immersive headsets and peripherals for both consumer and industrial applications. Key players like Oculus and HTC Vive offer a wide range of products catering to multiple sectors.

- By Application: The market is segmented by applications into Entertainment & Gaming, Healthcare, Education, Retail, and Industrial. The Entertainment & Gaming segment led the market in 2023, fueled by the growing popularity of immersive gaming experiences, followed closely by the Healthcare sector, where VR is being used for medical training and therapy.

- By Region: The market is segmented by region into Central, Eastern, Western, and Northern. The Central region, particularly Riyadh, dominates the market due to its strong digital infrastructure and favorable government initiatives, such as the Digital Saudi 2030 program, which aims to foster technology adoption across all sectors.

KSA Virtual Reality Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

HTC Vive |

2015 |

New Taipei City, Taiwan |

|

Oculus (Meta Platforms) |

2014 |

Menlo Park, USA |

|

Microsoft |

1975 |

Redmond, USA |

|

Sony Interactive Entertainment |

1993 |

San Mateo, USA |

|

Magic Leap |

2010 |

Plantation, USA |

- Oculus (Meta Platforms): In April 2024, Meta announced partnerships with companies like Asus, Microsoft, and Lenovo to open its Horizon OS to third-party hardware manufacturers. This initiative aims to enable these partners to develop their own virtual reality headsets using Meta's operating system, enhancing the ecosystem for developers and providing consumers with more choices.

- Microsoft: In May 2023, Microsoftlaunched the HoloLens 2 mixed reality headset in the market. This innovative device aims to empower Saudi organizations across various industries, including manufacturing, healthcare, and education, by providing immersive collaboration tools that enhance productivity and operational efficiency.

KSA Virtual Reality Market Analysis

Growth Drivers:

- Increased Government Investments in Digital Transformation: In 2023, the Saudi government made substantial investments in digital transformation as part of its Vision 2030 initiative. The ICT Sector Strategy aimed to generate over 25,000 employment opportunities and enhance the information technology market by 50%, contributing an additional USD 13.3 billion to the GDP. The increased investments include VR technology adoption in key sectors such as education, healthcare, and industrial training.

- Growing Demand for VR in Healthcare: In 2024, the healthcare sector in Saudi Arabia continues to embrace VR technology, driven by government-led initiatives to modernize medical services. The rising prevalence of chronic diseases necessitates innovative treatment approaches, with VR-based therapies gaining traction for pain management and rehabilitation. Hospitals in Riyadh and Jeddah have begun implementing VR solutions for remote surgery training, reducing the time and cost associated with conventional methods while improving medical education quality.

- Adoption of VR for Large-Scale Events and Entertainment: Saudi Arabia is witnessing a boom in large-scale events like Riyadh Season and Jeddah Season, both of which have incorporated VR-based entertainment experiences. In 2023, the government-backed General Entertainment Authority (GEA) reported over millions of visitors to VR-driven attractions during Riyadh Season, signaling the growing demand for immersive entertainment. The increase in VR experiences at public events is supported by the Kingdom's for the entertainment sector, aimed at diversifying the economy by 2030.

Challenges:

- High Costs of VR Hardware: Despite the increasing adoption of VR technologies across various sectors, the high cost of VR hardware remains a momentous barrier to broader use, especially for small and medium-sized enterprises (SMEs). The price of high-quality VR headsets is often too high for many businesses and educational institutions to justify, limiting their ability to invest in this technology.

- Limited Local Content Development: The limited availability of localized VR content in Saudi Arabia is another challenge preventing widespread adoption. Most of the VR content used in the country is developed internationally, which often fails to fully meet the cultural and linguistic preferences of the local population. Although the government has initiated programs to support local developers.

Government Initiatives

- Vision 2030 and Digital Saudi 2030: The Vision 2030 initiative emphasizes the digital transformation of the Kingdom, with a specific focus on integrating technologies like VR into education and industrial applications. The strategy emphasizes the expansion of electronic government platforms to streamline services and improve efficiency, enhancing citizen engagement.

- NEOM and VR as a Tool for Smart City Development: NEOM, Saudi Arabias futuristic smart city project, announced the inclusion of VR and AR technologies as part of its 2030 Digital Infrastructure Plan. In 2024, a substantial amount has been allocated specifically for integrating VR into urban planning, architectural design, and interactive public spaces. This initiative aims to create immersive experiences for residents and visitors, making NEOM a global hub for VR innovation and usage.

KSA Virtual Reality Market Future Outlook

The KSA Virtual Reality Market is expected to witness exponential growth, driven by increasing government support, the adoption of VR in multiple sectors, and technological advancements.

Future Market Trends:

- Growth in VR Training Programs for Industrial Applications: By 2028, VR training programs for industries such as oil and gas, defense, and aviation are expected to constitute a portion of the market. Companies like Saudi Aramco and Saudi Airlines are already investing in VR-based training modules to enhance workforce efficiency.

- Growing Adoption in Education and Healthcare: The KSA Virtual Reality industry is projected to experience substantial growth over the next five years, largely fueled by the increasing integration of VR technologies in education and healthcare. The use of VR in these sectors is expected to transform learning and training processes, particularly in fields such as medicine, engineering, and science.

Scope of the Report

|

By Product |

VR Hardware VR Software Content Development |

|

By Application |

Entertainment & Gaming Healthcare Education Retail Industrial |

|

By Region |

Central Eastern Western Northern |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report

VR Hardware Manufacturers

VR Software Developers

Content Creation Companies

Entertainment and Gaming Companies

Healthcare Providers and Hospitals

Retail Companies

Investments and Venture Capital Firms

Government and Regulatory Bodies (Saudi Ministry of Communications and Information Technology)

Banks and Financial Institutions

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

HTC Vive

Oculus (Meta Platforms)

Microsoft

Sony Interactive Entertainment

Magic Leap

Samsung Electronics

Google LLC

Unity Technologies

NVIDIA Corporation

Qualcomm Technologies

Huawei Technologies

STC Group

Neom Tech & Digital

KAUST

Saudi Aramco

Table of Contents

1. KSA Virtual Reality Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Valuation and Historical Performance

1.4 Key Market Trends and Developments

1.5 Market Segmentation Overview

2. KSA Virtual Reality Market Size (in USD Mn), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Virtual Reality Market Analysis

3.1 Growth Drivers

3.1.1 Increased Government Investments in Digital Transformation

3.1.2 Growing Demand for VR in Healthcare

3.1.3 Adoption of VR for Large-Scale Events and Entertainment

3.2 Challenges

3.2.1 High Costs of VR Hardware

3.2.2 Limited Local Content Development

3.3 Opportunities

3.3.1 VR Integration into Public and Private Education

3.3.2 Development of VR Training for Industrial Applications

3.4 Trends

3.4.1 Rise in VR-Based Retail Experiences

3.4.2 Growth in VR for Remote Work and Collaboration

3.4.3 Expansion of VR in Real Estate Market

3.5 Government Initiatives

3.5.1 Vision 2030 and Digital Saudi 2030

3.5.2 NEOM and VR as a Tool for Smart City Development

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. KSA Virtual Reality Market Segmentation, 2023

4.1 By Product Type (in Value %)

4.1.1 VR Hardware

4.1.2 VR Software

4.1.3 Content Development

4.2 By Application (in Value %)

4.2.1 Entertainment & Gaming

4.2.2 Healthcare

4.2.3 Education

4.2.4 Retail

4.2.5 Industrial

4.3 By Region (in Value %)

4.3.1 Central

4.3.2 Eastern

4.3.3 Western

4.3.4 Northern

5. KSA Virtual Reality Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 HTC Vive

5.1.2 Oculus (Meta Platforms)

5.1.3 Microsoft

5.1.4 Sony Interactive Entertainment

5.1.5 Magic Leap

5.2 Cross Comparison Parameters (Establishment Year, Headquarters, Major Projects, Revenue)

6. KSA Virtual Reality Market Competitive Landscape Analysis

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

6.4.1 Government Grants and Subsidies

6.4.2 Private Sector Investments

6.4.3 Foreign Direct Investments (FDI)

7. KSA Virtual Reality Market Regulatory Framework

7.1 Vision 2030 Guidelines for VR Technology

7.2 Certification Processes for VR Technologies

8. KSA Virtual Reality Market Future Outlook (in USD Mn), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

9. KSA Virtual Reality Future Market Segmentation, 2028

9.1 By Product Type (in Value %)

9.2 By Application (in Value %)

9.3 By Region (in Value %)

10. KSA Virtual Reality Market Analysts’ Recommendations

10.1 TAM/SAM/SOM Analysis

10.2 Customer Cohort Analysis

10.3 Marketing Initiatives

10.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building

Collating statistics on KSA virtual reality market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA virtual reality market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple essential VR companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from VR companies.

Frequently Asked Questions

01 How big is the KSA Virtual Reality Market?

The KSA Virtual Reality (VR) Market was valued at USD 285 million in 2023, driven by rapid technological adoption in industries such as entertainment, healthcare, and education, supported by Saudi Arabias Vision 2030 initiative for digital transformation.

02 What are the challenges in the KSA Virtual Reality Market?

Challenges in the KSA Virtual Reality market include high hardware costs, limited availability of localized content, and infrastructure constraints such as internet bandwidth and latency issues, particularly outside major urban centers like Riyadh and Jeddah.

03 Who are the major players in the KSA Virtual Reality Market?

Major players in the KSA Virtual Reality market include HTC Vive, Oculus (Meta Platforms), Microsoft, Sony Interactive Entertainment, and Magic Leap. These companies dominate the market through innovative VR hardware, strategic partnerships, and immersive content development.

04 What are the growth drivers of the KSA Virtual Reality Market?

Growth drivers in the KSA Virtual Reality market include increased government investment in digital transformation through Vision 2030, the rising demand for VR-based applications in healthcare, and the growing popularity of VR entertainment experiences at large-scale public events like Riyadh Season.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.