KSA Virtual Reality (VR) Headset Market Outlook 2030

Region:Middle East

Author(s):Shivani Mehra

Product Code:KROD4038

November 2024

86

About the Report

KSA Virtual Reality (VR) Headset Market Overview

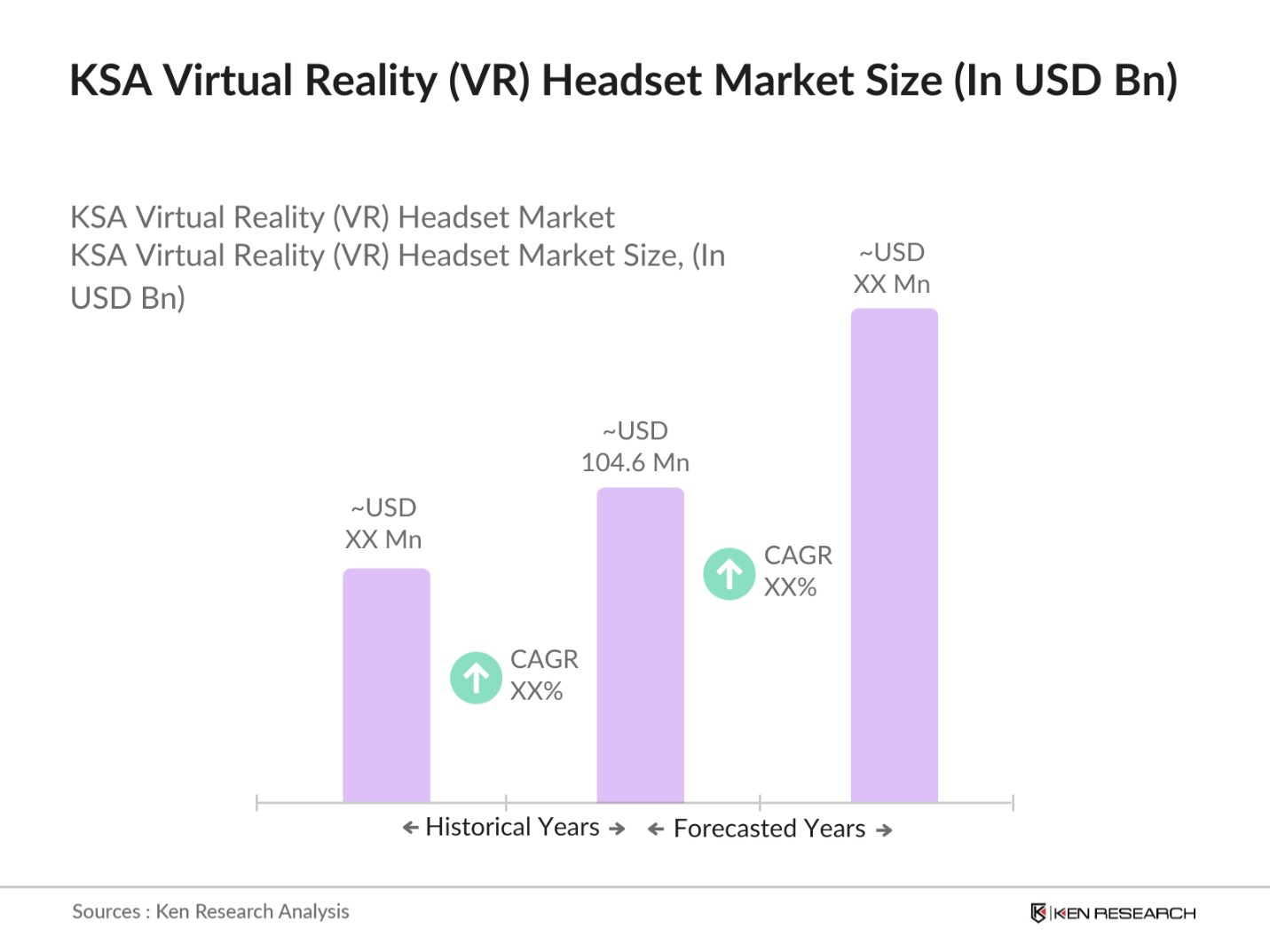

- The KSA VR headset market is valued at USD 104.6 million, based on a five-year historical analysis, driven by the rapid growth of the entertainment and gaming industry in the region. The market is primarily propelled by advancements in immersive technologies such as enhanced display quality and motion tracking, coupled with the rise of esports and virtual gaming platform.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the KSA VR headset market, owing to their well-established infrastructure and high disposable income levels. These cities are at the forefront of technological innovation. Additionally, these cities benefit from robust digital infrastructure and a growing population of tech-savvy consumers, further fueling the demand for VR headsets.

- The government has fostered public-private partnerships to promote VR in the educational sector, with SAR 2 billion invested in collaboration with international tech firms in 2023. These partnerships are focused on integrating VR-based learning tools into classrooms and higher education institutions across the Kingdom, providing students with immersive.

KSA Virtual Reality (VR) Headset Market Segmentation

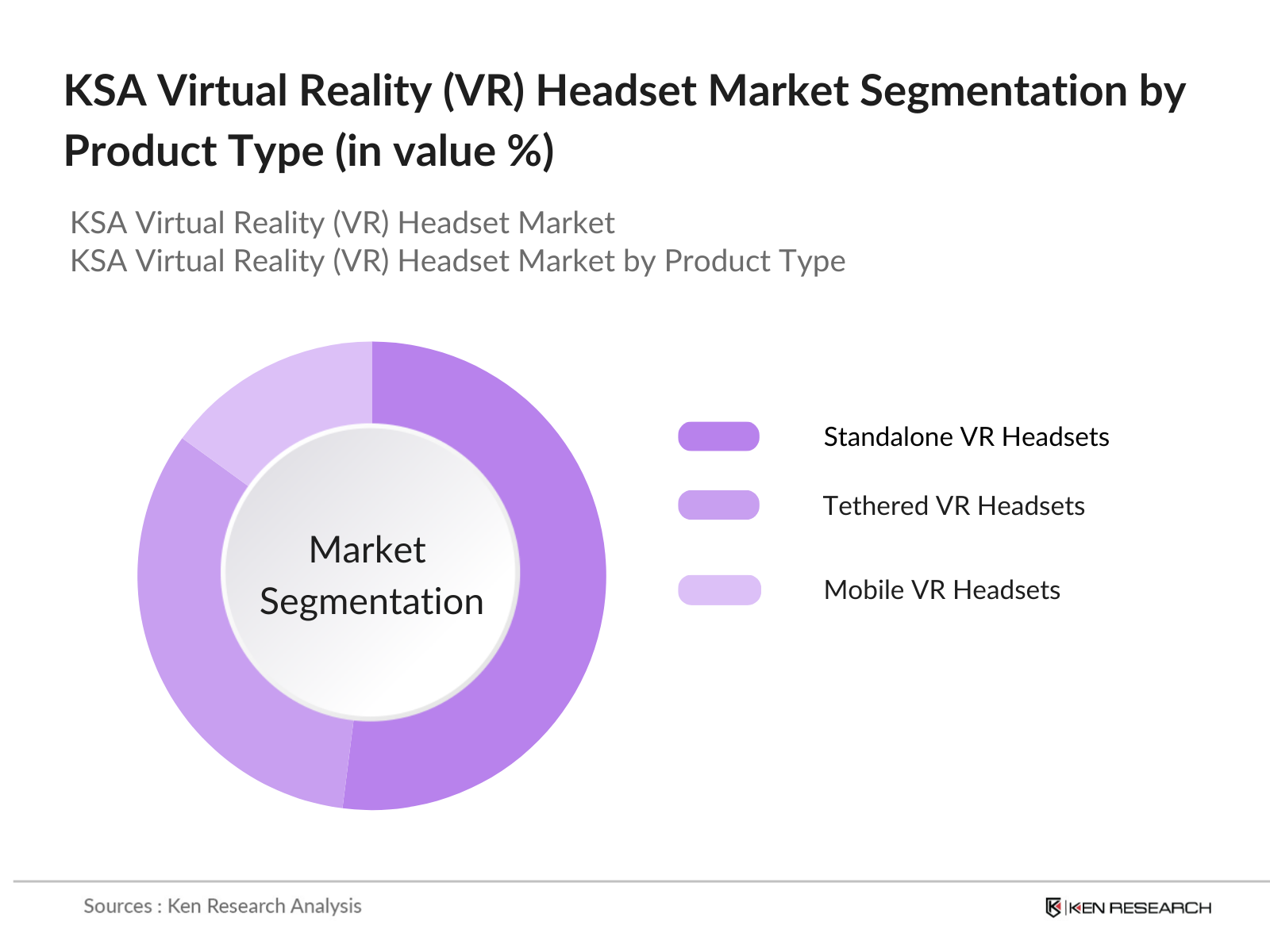

- By Product Type: The KSA VR headset market is segmented by product type into tethered VR headsets, standalone VR headsets, and mobile VR headsets. Recently, standalone VR headsets have dominated the market share due to their growing popularity among consumers seeking mobility and convenience. Standalone VR headsets eliminate the need for external hardware, making them an attractive option for gamers, professionals, and casual users alike. Their affordability, ease of use, and increasing content availability have cemented their position as the leading product type in the KSA market.

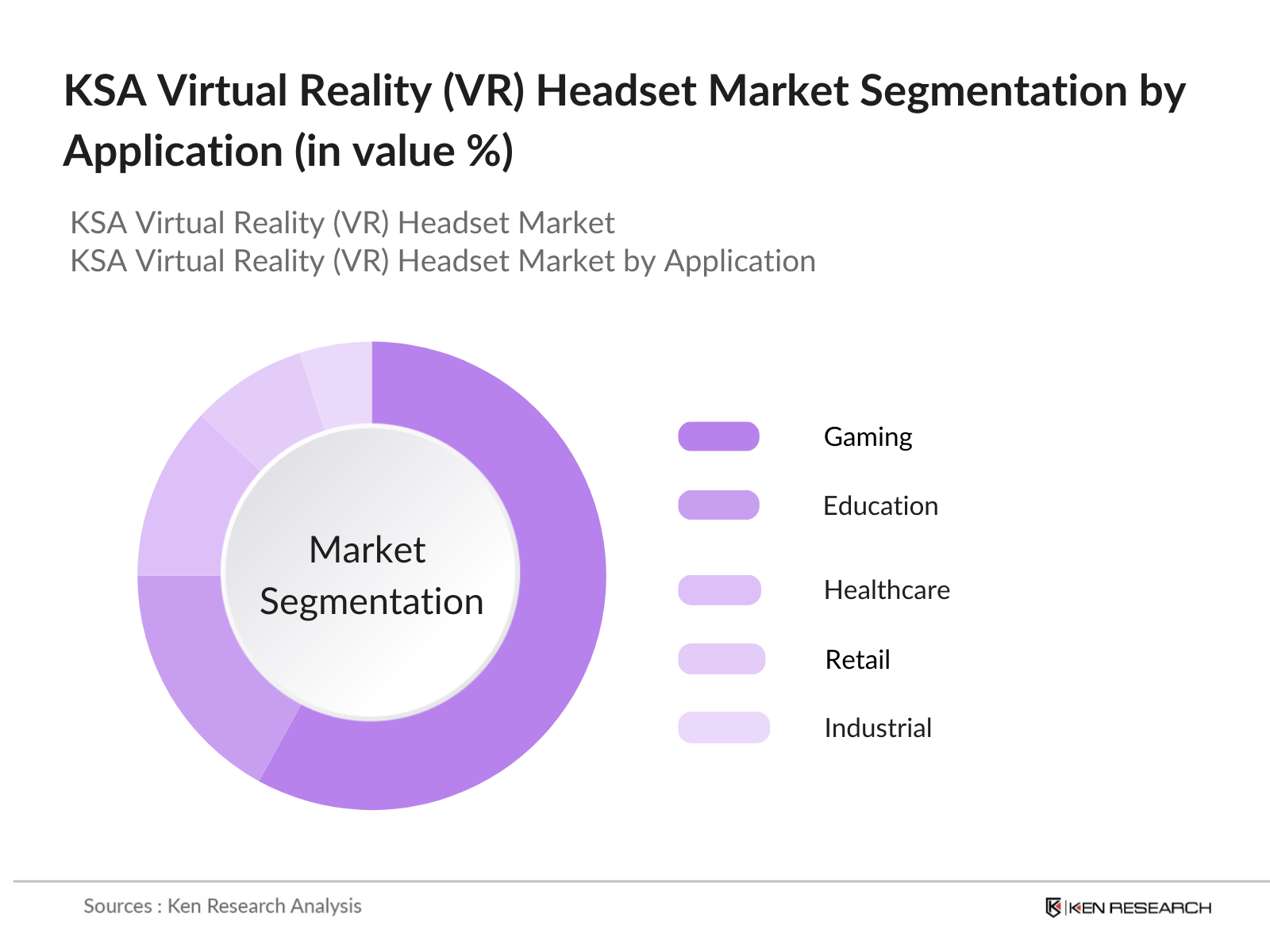

- By Application: The KSA VR headset market is segmented by application into gaming, education, healthcare, retail, and industrial sectors. Gaming continues to dominate the market under the application segmentation, largely due to the regions burgeoning esports culture and increasing consumer demand for immersive entertainment experiences. With local tournaments gaining international recognition and investments being funneled into gaming infrastructure, VR headsets are increasingly being used for enhanced interactive experiences in this sector.

KSA Virtual Reality (VR) Headset Market Competitive Landscape

The KSA VR headset market is dominated by several key international players, along with a few local manufacturers. Global giants like Sony and Meta (Oculus) have secured a strong presence due to their advanced product offerings and established market reputation. Additionally, companies like HTC and Samsung benefit from their comprehensive technology ecosystems, integrating VR into broader consumer electronics portfolios. The increasing involvement of domestic companies also highlights the region's push towards technological self-reliance as part of Vision 2030.

|

Company |

Establishment Year |

Headquarters |

Product Range |

R&D Investment |

Revenue (2023) |

Global vs Domestic Market Penetration |

VR Patent Portfolio |

VR Software Development |

|

Sony Corporation |

1946 |

Tokyo, Japan |

Tethered & Standalone |

- | - | - | - | - |

|

Meta (Oculus) |

2004 |

Menlo Park, USA |

Standalone |

- | - | - | - | - |

|

HTC Corporation |

1997 |

Taipei, Taiwan |

Tethered |

- | - | - | - | - |

|

Samsung Electronics |

1938 |

Seoul, South Korea |

Mobile VR |

- | - | - | - | - |

|

Pico Interactive |

2015 |

Beijing, China |

Standalone |

- | - | - | - | - |

KSA Virtual Reality (VR) Headset IndustryAnalysis

Market Growth Drivers

- Increasing Adoption in Gaming and Entertainmen: The gaming sector in Saudi Arabia has experienced significant growth due to the rising popularity of immersive VR experiences. According to the Saudi General Authority for Statistics, the Kingdom recorded an increase in consumer spending on gaming hardware, reaching approximately SAR 8 billion in 2023. The availability of high-speed internet, coupled with expanding digital infrastructure, has further driven demand for VR headsets in the entertainment sector.

- Advancements in VR Technology (Display Quality, Tracking Systems): Technological improvements in display resolution and tracking systems have spurred the adoption of VR headsets in Saudi Arabia. According to the Communications and Information Technology Commission (CITC), investments in digital innovation have increased, with over SAR 15 billion allocated to research and development in technology sectors, particularly for improved user interfaces in 2023. Enhanced display quality and superior motion tracking capabilities have created more engaging and realistic experiences, contributing to the rise of VR in sectors such as gaming, education, and virtual tourism.

- Expansion of 5G Networks: Saudi Arabias rapid deployment of 5G infrastructure has greatly enhanced the VR experience by providing lower latency and higher bandwidth. By 2023, the Kingdoms telecom companies had invested over SAR 30 billion in 5G technology, enabling faster streaming and better real-time VR capabilities. This expansion is critical in supporting VR applications across sectors like healthcare, education, and entertainment, where high-speed internet is essential for seamless performance.

Market Growth Challenges

- High Manufacturing Costs: The high cost of manufacturing VR headsets remains a significant barrier to market growth in Saudi Arabia. As per the Ministry of Industry and Mineral Resources, the average cost of producing advanced electronic components, such as those required for VR headsets, exceeds SAR 1.5 million per facility annually. The lack of local manufacturing capabilities increases dependence on imported components, which inflates prices and hinders mass adoption. The government has initiated programs to encourage local manufacturing, but high costs remain a challenge.

- Consumer Adoption Barriers (Affordability, Comfort): Affordability and comfort are significant challenges for widespread VR adoption in the Kingdom. Data from the Saudi Central Bank highlights that the average household expenditure on luxury tech products like VR headsets is less than SAR 2,000 annually, which is insufficient to purchase high-end devices. Additionally, issues such as motion sickness and device weight reduce consumer satisfaction, further inhibiting adoption.

KSA Virtual Reality (VR) Headset Market Future Outlook

Over the next few years, the KSA VR headset market is expected to show significant growth driven by the continued expansion of the gaming and entertainment industry, supported by advancements in VR technologies such as haptic feedback and spatial audio.

Market Opportunities

- Integration with Artificial Intelligence (AI): AI integration with VR technology is becoming a defining trend in Saudi Arabia. By 2024, over SAR 10 billion had been invested in AI research, which includes VR applications that enhance user experiences through adaptive learning, predictive algorithms, and improved interactive environments. This trend is particularly evident in sectors such as education, healthcare, and gaming, where AI-driven VR platforms offer personalized and responsive experiences.

- Development of Wireless and Standalone VR Headsets: In response to consumer demand for more comfortable and flexible VR solutions, manufacturers are focusing on wireless and standalone VR headsets. The Communications and Information Technology Commission (CITC) reported a SAR 2 billion investment in 2023 toward developing wireless VR solutions, eliminating the need for high-powered external hardware. This development aligns with consumer preferences for untethered, more portable VR experiences, which are expected to drive further adoption.

Scope of the Report

|

By Product Type |

Tethered VR Headsets Standalone VR Headsets Mobile VR Headsets |

|

By Technology Type |

Augmented Reality (AR) Virtual Reality (VR) |

|

By Connectivity |

Wired VR Headsets Wireless VR Headsets |

|

By User Base |

Enterprise Consumer |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

VR Headset Manufacturers

Gaming and Esports Companies

Healthcare Institutions

Educational Technology Providers

Retailers and E-commerce Platforms

Government and Regulatory Bodies (Communications and Information Technology Commission (CITC), Vision 2030 Authorities)

Investments and Venture Capitalist Firms

Telecommunication and 5G Network Providers

Companies

Players Mentioned in the report

Sony Corporation

Meta (Oculus)

HTC Corporation

Samsung Electronics

Google LLC

Microsoft Corporation

Pico Interactive

Valve Corporation

DPVR

Lenovo Group

Epson

Razer Inc.

VIVEPORT

Magic Leap

Pimax

Table of Contents

1. KSA VR Headset Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Technology Type, Product Type, Connectivity, User Base)

1.3. Key Growth Metrics

1.4. Key Applications (Gaming, Education, Healthcare, Retail, Industrial)

1.5. Market Growth Dynamics

2. KSA VR Headset Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Milestones and Developments

2.4. Emerging Product Launches

3. KSA VR Headset Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption in Gaming and Entertainment

3.1.2. Advancements in VR Technology (Display Quality, Tracking Systems)

3.1.3. Government Initiatives (Vision 2030)

3.1.4. Expansion of 5G Networks

3.2. Market Challenges

3.2.1. High Manufacturing Costs

3.2.2. Limited Content Availability

3.2.3. Consumer Adoption Barriers (Affordability, Comfort)

3.3. Opportunities

3.3.1. Immersive Experiences in Education and Training

3.3.2. Growth of Augmented Reality (AR) Integration

3.3.3. Rising Demand in Healthcare for Simulation-Based Training

3.4. Trends

3.4.1. Integration with Artificial Intelligence (AI)

3.4.2. Development of Wireless and Standalone VR Headsets

3.4.3. Expansion of VR for Remote Work Applications

3.5. Government Initiatives

3.5.1. Vision 2030 and Digital Infrastructure Investments

3.5.2. Support for Local Manufacturing of VR Technologies

3.5.3. Public-Private Partnerships to Promote VR in Education

3.6. Stake Ecosystem (Manufacturers, Distributors, Content Providers)

3.7. Porters Five Forces Analysis (Industry Rivalry, Threat of Substitutes, Buyer Power)

3.8. Competitive Landscape Overview (International vs Domestic Players)

4. KSA VR Headset Market Segmentation

4.1. By Product Type (In Value %) 4.1.1. Tethered VR Headsets

4.1.2. Standalone VR Headsets

4.1.3. Mobile VR Headsets

4.2. By Technology Type (In Value %)

4.2.1. Augmented Reality (AR)

4.2.2. Virtual Reality (VR)

4.3. By Connectivity (In Value %)

4.3.1. Wired VR Headsets

4.3.2. Wireless VR Headsets

4.4. By User Base (In Value %)

4.4.1. Enterprise

4.4.2. Consumer

4.5. By Application (In Value %)

4.5.1. Gaming

4.5.2. Education

4.5.3. Healthcare

4.5.4. Retail

4.5.5. Industrial

5. KSA VR Headset Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sony Corporation

5.1.2. Meta (Oculus)

5.1.3. HTC Corporation

5.1.4. Samsung Electronics

5.1.5. Google LLC

5.1.6. Microsoft Corporation

5.1.7. Pico Interactive

5.1.8. Valve Corporation

5.1.9. DPVR

5.1.10. Lenovo Group

5.1.11. Epson

5.1.12. Razer Inc.

5.1.13. VIVEPORT

5.1.14. Magic Leap

5.1.15. Pimax

5.2. Cross Comparison Parameters (Market-Specific):

5.2.1. Market Share by Region

5.2.2. Revenue by Product Type

5.2.3. R&D Investment in VR Technology

5.2.4. Patents in VR Technology

5.2.5. VR Adoption Rate by Industry

5.2.6. Product Launch Frequency

5.2.7. Global vs Domestic Market Penetration

5.2.8. Customer Satisfaction Ratings

5.3. Market Share Analysis (In %)

5.4. Strategic Initiatives and Investments

5.5. Mergers and Acquisitions

5.6. Venture Capital and Private Equity Funding

5.7. Investment in Startups (Local and International)

5.8. Government Grants and Support Programs

6. KSA VR Headset Market Regulatory Framework

6.1. Regulatory Standards for VR Technology

6.2. Certification Requirements

6.3. Compliance with Digital Infrastructure Initiatives

6.4. Guidelines for Data Privacy and User Safety

7. KSA VR Headset Future Market Size (In USD Bn)

7.1. Projected Market Size

7.2. Factors Influencing Future Growth (5G Rollout, Consumer Adoption)

7.3. Expansion of VR Use Cases

8. KSA VR Headset Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By User Base (In Value %)

8.4. By Technology Type (In Value %)

8.5. By Region (In Value %)

9. KSA VR Headset Market Analysts Recommendations

9.1. Market Entry Strategies

9.2. Marketing and Distribution Approaches

9.3. Consumer Behavior Insights

9.4. White Space Opportunities in Key Sectors (Healthcare, Industrial)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map of the KSA VR headset market. Extensive desk research is conducted using proprietary databases and credible secondary sources to identify the critical factors influencing the market, such as technological advancements, consumer preferences, and regulatory environment.

Step 2: Market Analysis and Construction

This phase focuses on compiling and analyzing historical data for the KSA VR headset market. Key metrics such as market penetration rates and revenue trends are examined to build an accurate model of the market. Additional attention is given to evaluating technological infrastructure supporting VR adoption, particularly in 5G connectivity.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth drivers and challenges are validated through consultations with industry experts, including VR headset manufacturers and content developers. These consultations provide operational insights that enhance the reliability of revenue estimates and market dynamics.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from primary and secondary sources into a cohesive report. This includes verifying key statistics and obtaining detailed insights from VR manufacturers regarding product trends, consumer feedback, and usage patterns, ensuring a comprehensive market outlook for the KSA VR headset industry.

Frequently Asked Questions

01. How big is the KSA VR headset market?

The KSA VR headset market is valued at USD 104.6 million, driven by the rapid growth of immersive technologies and the adoption of VR in various sectors, including gaming, healthcare, and education.

02. What are the challenges in the KSA VR headset market?

Key challenges include the high cost of VR hardware, limited content availability, and slow consumer adoption, particularly among non-gamers. These factors hinder the overall market penetration in certain segments.

03. Who are the major players in the KSA VR headset market?

Major players include Sony, Meta (Oculus), HTC, Samsung, and Google. These companies have established themselves through innovative product offerings and substantial investments in VR technology.

04. What are the growth drivers of the KSA VR headset market?

Growth is driven by advancements in VR technology, the rise of esports, and Saudi Arabias Vision 2030 initiative, which focuses on digital transformation and fostering a tech-driven economy.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.