KSA Wearable Medical Devices Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD2035

November 2024

92

About the Report

KSA Wearable Medical Devices Market Overview

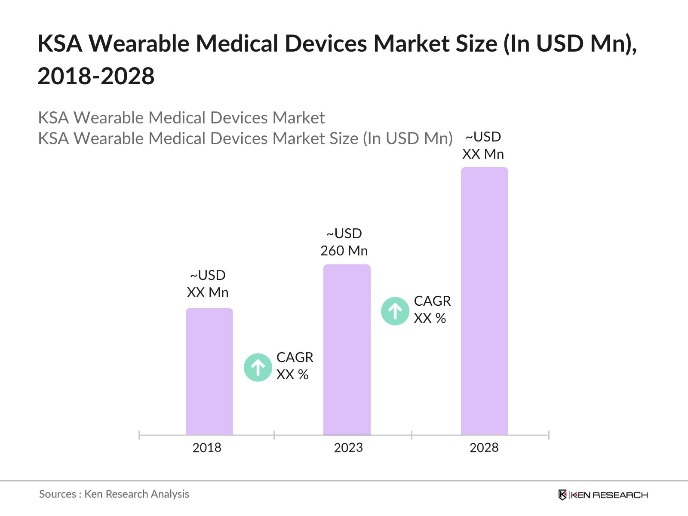

The KSA Wearable Medical Devices Market was valued at USD 260 million in 2023, driven by the rising prevalence of chronic diseases, increasing health consciousness among the population, and advancements in healthcare technology. Wearable medical devices, such as fitness trackers, smartwatches, and wearable ECG monitors, have gained substantial traction as they provide real-time health monitoring, which is crucial for managing and preventing health conditions.

Major players in the KSA Wearable Medical Devices Market include Fitbit, Apple, Garmin, Huawei, and Samsung. These companies lead the market with strong distribution networks, innovative product offerings, and strategic collaborations with healthcare providers and insurers to enhance the adoption of wearable technology in managing patient health.

Riyadh, Jeddah, and Dammam are key regions dominating the market due to their large urban populations, higher disposable incomes, and an increasing number of tech-savvy and health-conscious consumers. These cities also play a pivotal role in the distribution and consumption of wearable medical devices.

In 2023, Huawei launched its latest smartwatch, the Huawei WATCH GT 4, in the KSA market. The watch features a geometric aesthetic design and offers advanced health monitoring capabilities, including 24/7 heart rate monitoring, Blood oxygen (SpO2) tracking, and Stress and sleep tracking.

KSA Wearable Medical Devices Market Segmentation

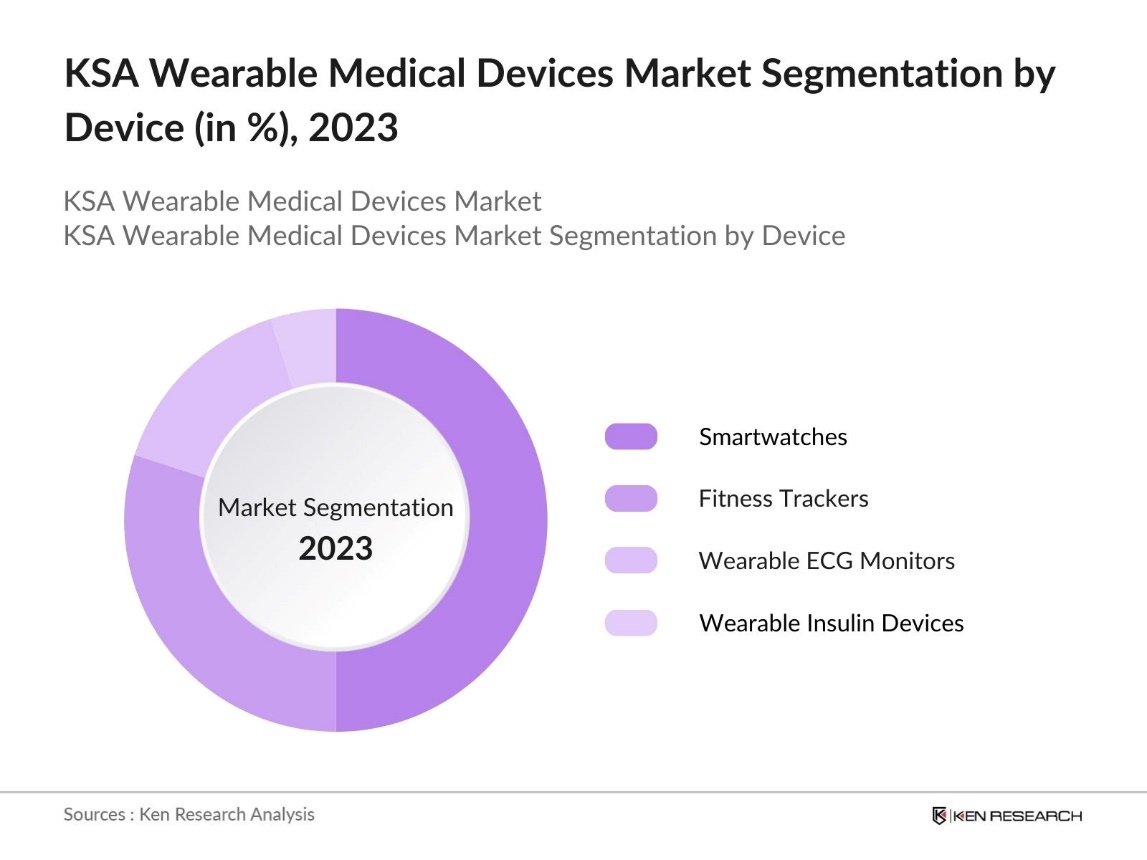

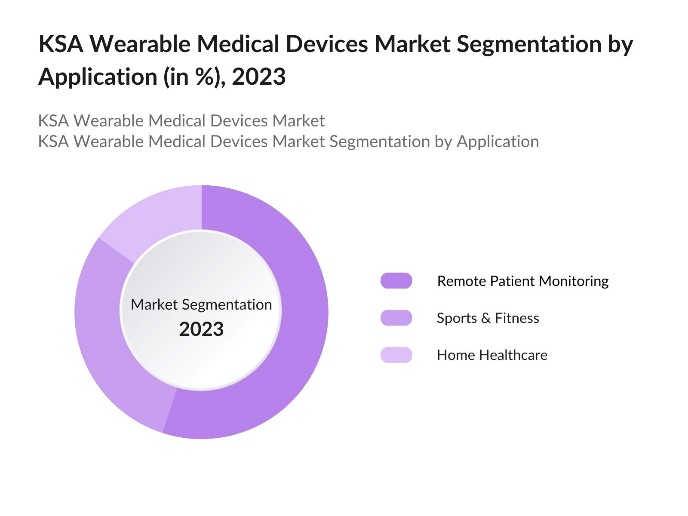

The KSA Wearable Medical Devices Market is segmented by device type, application, and end-user.

By Device Type: The market is segmented into Fitness Trackers, Smartwatches, Wearable ECG Monitors, and Wearable Insulin Devices. In 2023, Smartwatches held the dominant market share due to their multifunctionality, including health monitoring features like heart rate monitoring, ECG capabilities, and activity tracking. Companies like Apple and Samsung are key players in this segment, offering a variety of smartwatch models tailored to different consumer preferences and healthcare needs.

By Application: The market is segmented by application into Remote Patient Monitoring, Sports & Fitness, and Home Healthcare. Remote Patient Monitoring led the market in 2023, driven by the increasing demand for continuous health monitoring solutions and chronic disease management. The integration of wearable devices with telemedicine platforms is also gaining popularity, providing healthcare professionals with real-time patient data.

By Region: The market is segmented by region into North, South, East, and West. The North region, encompassing Riyadh and surrounding areas, dominated the market in 2023 due to its high urban population and advanced healthcare infrastructure. The region's focus on adopting digital health technologies and integrating wearable devices into healthcare practices drives market dominance.

KSA Wearable Medical Devices Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Fitbit |

2007 |

San Francisco, USA |

|

Apple |

1976 |

Cupertino, USA |

|

Garmin |

1989 |

Olathe, USA |

|

Huawei |

1987 |

Shenzhen, China |

|

Samsung |

1969 |

Seoul, South Korea |

- Fitbit: In 2022, Fitbit launched its new Fitbit Sense 2 and Versa 4, which come equipped with advanced health monitoring features such as ECG, SpO2, and skin temperature sensors. These devices are designed to provide users with more accurate and comprehensive health insights, which are especially beneficial for managing chronic conditions like diabetes and hypertension.

- Apple: In September 2023, Apple launched the Apple Watch Series 9, which includes new features designed to enhance tracking of physical and mental health. This model emphasizes privacy and security in health data management, showcasing Apple's commitment to providing comprehensive health insights through wearable technology.

KSA Wearable Medical Devices Market Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases: The rising incidence of chronic diseases such as diabetes, cardiovascular diseases, and obesity in KSA is a substantial growth driver for the wearable medical devices market. According to a systematic review and meta-analysis, the prevalence of type 2 diabetes mellitus (T2DM) among the general adult population in Saudi Arabia was reported to be 28% between 2016 and 2022, underscoring the need for continuous health monitoring solutions. Wearable devices, such as glucose monitors and ECG smartwatches, are gaining traction for their ability to provide real-time data to manage these conditions effectively.

- Rising Adoption of Digital Health Solutions: As part of Saudi Vision 2030, the Saudi government is heavily investing in digital health infrastructure, which includes the adoption of wearable medical devices. The Saudi government has proposed an investment of USD 1.5 billion in health IT and telemedicine as part of its Vision 2030 strategy, boosting the adoption of wearable devices that can be integrated with these platforms. This government push is supported by an increasing awareness of the benefits of digital health solutions among healthcare providers and patients.

- Growing Investments in Healthcare Innovation: In 2024, Saudi Arabia witnessed a surge in investments in the healthcare sector. The Saudi government announced a healthcare budget of USD 57 billion for health and social development in 2024. A noteworthy portion of this investment is directed towards innovations in medical technology, including wearable medical devices. With the government's support and increasing private sector participation, companies asre developing more sophisticated devices that offer better accuracy, comfort, and integration capabilities.

Challenges

- Data Privacy and Security Concerns: The wearable medical devices industry faces challenges related to data privacy and security, as these devices collect and transmit sensitive health data. Ensuring the security of this data is crucial to maintain consumer trust and comply with regulatory standards. Manufacturers and healthcare providers must implement robust encryption and security measures to protect patient information and prevent data breaches.

- High Cost and Limited Reimbursement Policies: The high cost of advanced wearable medical devices and limited reimbursement policies in KSA pose a challenge to market growth. Many consumers are price-sensitive, and without adequate insurance coverage, the adoption of these devices may be restricted. This economic barrier limits access to these technologies, especially among lower-income groups, hindering widespread market penetration.

Government Initiatives

- Saudi Vision 2030 and Healthcare Modernization: As part of Saudi Vision 2030, the Saudi government has emphasized the modernization of the healthcare sector, including the adoption of digital health technologies such as wearable medical devices. Vision 2030 proposes an investment of USD 1.5 billion specifically for health IT and telemedicine initiatives. This investment aims to enhance the digital health infrastructure and increase the efficiency of healthcare delivery.

- Introduction of National Data Protection Regulations: In 2024, the Saudi Data and Artificial Intelligence Authority (SDAIA) introduced new regulations focused on the protection of health data generated by wearable devices. The regulations require all wearable device manufacturers and healthcare providers to implement stringent data security measures, including encryption and user consent protocols.

KSA Wearable Medical Devices Market Future Outlook

The KSA Wearable Medical Devices Market is expected to witness substantial growth by 2028, driven by technological advancements, increasing health awareness, and supportive government policies.

Future Market Trends

- Expansion of AI and Machine Learning Capabilities in Wearable Devices

Over the next five years, the KSA wearable medical devices market will witness a substantial increase in the integration of AI and machine learning capabilities. These technologies will enhance the diagnostic accuracy and predictive analytics of wearable devices, allowing for more personalized healthcare solutions. - Growth in Demand for Wearables in Preventive Healthcare: As preventive healthcare becomes a more prominent focus in Saudi Arabia, the demand for wearable medical devices will grow significantly. By 2028, wearable devices will be commonly used not just for chronic disease management but also for early detection and prevention of potential health issues.

Scope of the Report

|

By Device |

Fitness Trackers Smartwatches Wearable ECG Monitors Wearable Insulin Devices |

|

By Application |

Fitness Trackers Smartwatches Wearable ECG Monitors Wearable Insulin Devices |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Medical Device Manufacturers

Healthcare Providers and Hospitals

Health Insurance Companies

Fitness Centers and Sports Organizations

Chronic Disease Management Centers

Digital Health Technology Companies

Pharmaceutical Companies

Government and Regulatory Bodies (SFDA, Ministry of Health)

Investors and Venture Capitalists

Banks and Financial institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Fitbit

Apple

Garmin

Huawei

Samsung

Philips Healthcare

Omron Healthcare

AliveCor

BioTelemetry (Philips)

iRhythm Technologies

VitalConnect

Medtronic

Dexcom

Abbott

Table of Contents

1. KSA Wearable Medical Devices Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Valuation and Historical Performance

1.4 Key Market Trends and Developments

1.5 Market Segmentation Overview

2. KSA Wearable Medical Devices Market Size (in USD Mn), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Wearable Medical Devices Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Prevalence of Chronic Diseases

3.1.2 Technological Advancements in Healthcare

3.1.3 Growing Health Awareness and Fitness Trends

3.2 Challenges

3.2.1 Data Privacy and Security Concerns

3.2.2 High Cost and Limited Reimbursement Policies

3.3 Opportunities

3.3.1 Integration with Telemedicine and Remote Monitoring

3.3.2 Growth in Smart Healthcare Solutions

3.4 Trends

3.4.1 Rising Adoption of AI in Wearables

3.4.2 Expansion of Wearable Device Applications

3.5 Government Initiatives

3.5.1 Saudi Vision 2030 and Healthcare Modernization

3.5.2 SFDA Regulations on Data Security

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. KSA Wearable Medical Devices Market Segmentation, 2023

4.1 By Device Type (in Value %)

4.1.1 Fitness Trackers

4.1.2 Smartwatches

4.1.3 Wearable ECG Monitors

4.1.4 Wearable Insulin Devices

4.2 By Application (in Value %)

4.2.1 Remote Patient Monitoring

4.2.2 Sports & Fitness

4.2.3 Home Healthcare

4.3 By Region (in Value %)

4.3.1 North

4.3.2 East

4.3.3 South

4.3.4 West

5. KSA Wearable Medical Devices Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 Fitbit

5.1.2 Apple

5.1.3 Garmin

5.1.4 Huawei

5.1.5 Samsung

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. KSA Wearable Medical Devices Market Competitive Landscape Analysis

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

6.4.1 Venture Capital Funding

6.4.2 Government Grants

6.4.3 Private Equity Investments

7. KSA Wearable Medical Devices Market Regulatory Framework

7.1 SFDA Guidelines

7.2 Compliance Requirements and Certification Processes

8. KSA Wearable Medical Devices Market Future Outlook (in USD Mn), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

8.3 Future Market Segmentation

8.3.1 By Device Type (in Value %)

8.3.2 By Application (in Value %)

8.3.3 By Region (in Value %)

9. KSA Wearable Medical Devices Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Market Building

Collating statistics on the KSA wearable medical devices market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated for the KSA wearable medical devices market. Reviewing service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple essential wearable medical device companies and understand the nature of product segments and sales, consumer preference, and other parameters, which will support us validate statistics derived through a bottom-to-top approach from wearable medical device companies.

Frequently Asked Questions

01 How big is the KSA Wearable Medical Devices Market?

The KSA wearable medical devices market was valued at USD 250 million in 2023, driven by rising demand for health monitoring solutions, technological advancements, and the growing prevalence of chronic diseases.

02 What are the challenges in the KSA Wearable Medical Devices Market?

Challenges in the KSA wearable medical devices market include data privacy and security concerns, high costs, and limited reimbursement policies. These factors can affect market adoption and growth potential.

03 Who are the major players in the KSA Wearable Medical Devices Market?

Key players in the KSA wearable medical devices market include Fitbit, Apple, Garmin, Huawei, and Samsung. These companies lead the market through strong distribution networks, innovative product offerings, and strategic collaborations with healthcare providers.

04 What are the growth drivers of the KSA Wearable Medical Devices Market?

The KSA wearable medical devices market is propelled by the increasing prevalence of chronic diseases, technological advancements in healthcare, and growing health awareness among consumers. These factors are driving the adoption of wearable devices for health monitoring and management.

KSA Wearable Medical Devices Market Size (USD Mn), 2018-2028

Device Type Market Share (2023)

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.