Kuwait Auto Accessories Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD9634

October 2024

94

About the Report

Kuwait Auto Accessories Market Overview

- The Kuwait Auto Accessories Market is currently valued at USD 170 million. This market is driven by the increase in car ownership in Kuwait, particularly the growing demand for luxury and customized vehicles. The rising disposable income of the population has also spurred the demand for premium auto accessories, including interior enhancements and performance upgrades. Notably, the popularity of off-roading activities, driven by Kuwait’s desert terrain, has further boosted the demand for specialized vehicle accessories such as tires, suspensions, and protection gear.

- Kuwait City dominates the market for auto accessories due to its status as the capital and economic hub, where a higher concentration of luxury vehicles exists. The city's affluent population is more inclined towards customization and maintenance of premium vehicles. Additionally, Ahmadi Governorate is also , driven by the presence of Kuwait’s major oil industries, which contributes to the demand for commercial vehicle accessories.

- Kuwait’s government enforces strict automotive regulations to ensure safety and environmental compliance. In 2023, new standards were introduced for vehicle emissions, which directly impact the type of accessories allowed in the market. All imported and locally produced accessories must meet specific safety and environmental guidelines, including reduced emissions from vehicle components. These regulations are aimed at promoting sustainability and enhancing road safety across the automotive sector.

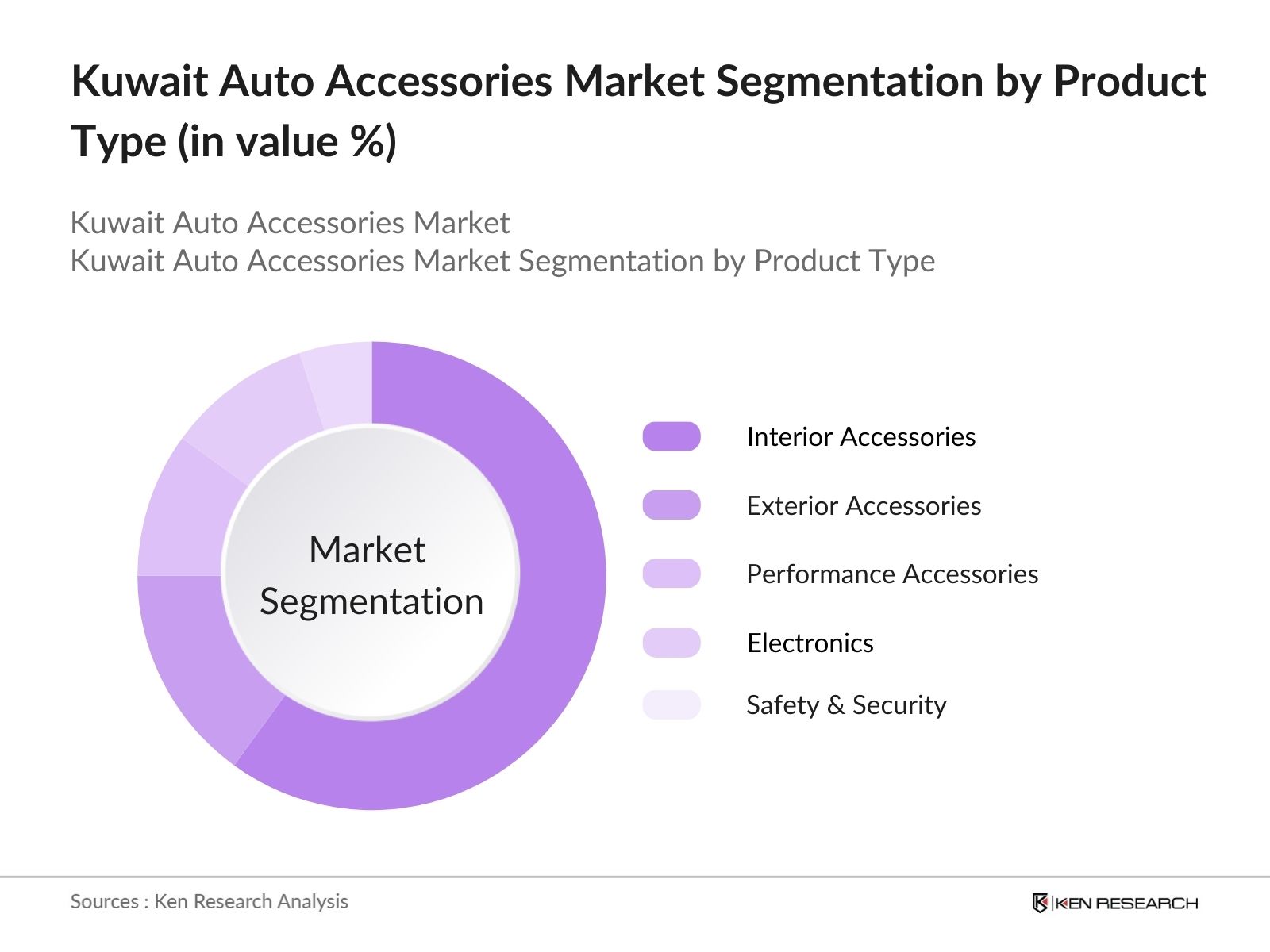

Kuwait Auto Accessories Market Segmentation

- By Product Type: The market is segmented by product type into interior accessories, exterior accessories, performance accessories, electronics, and safety & security products. Interior accessories, such as seat covers and floor mats, dominate the market due to their wide applicability across all types of vehicles. Many consumers are focused on enhancing the comfort and aesthetic appeal of their cars. The growing trend of personalization and vehicle customization, particularly among luxury vehicle owners, has also contributed to the popularity of interior accessories. Leather seat covers, premium floor mats, and advanced infotainment systems are especially in demand among high-end vehicle owners.

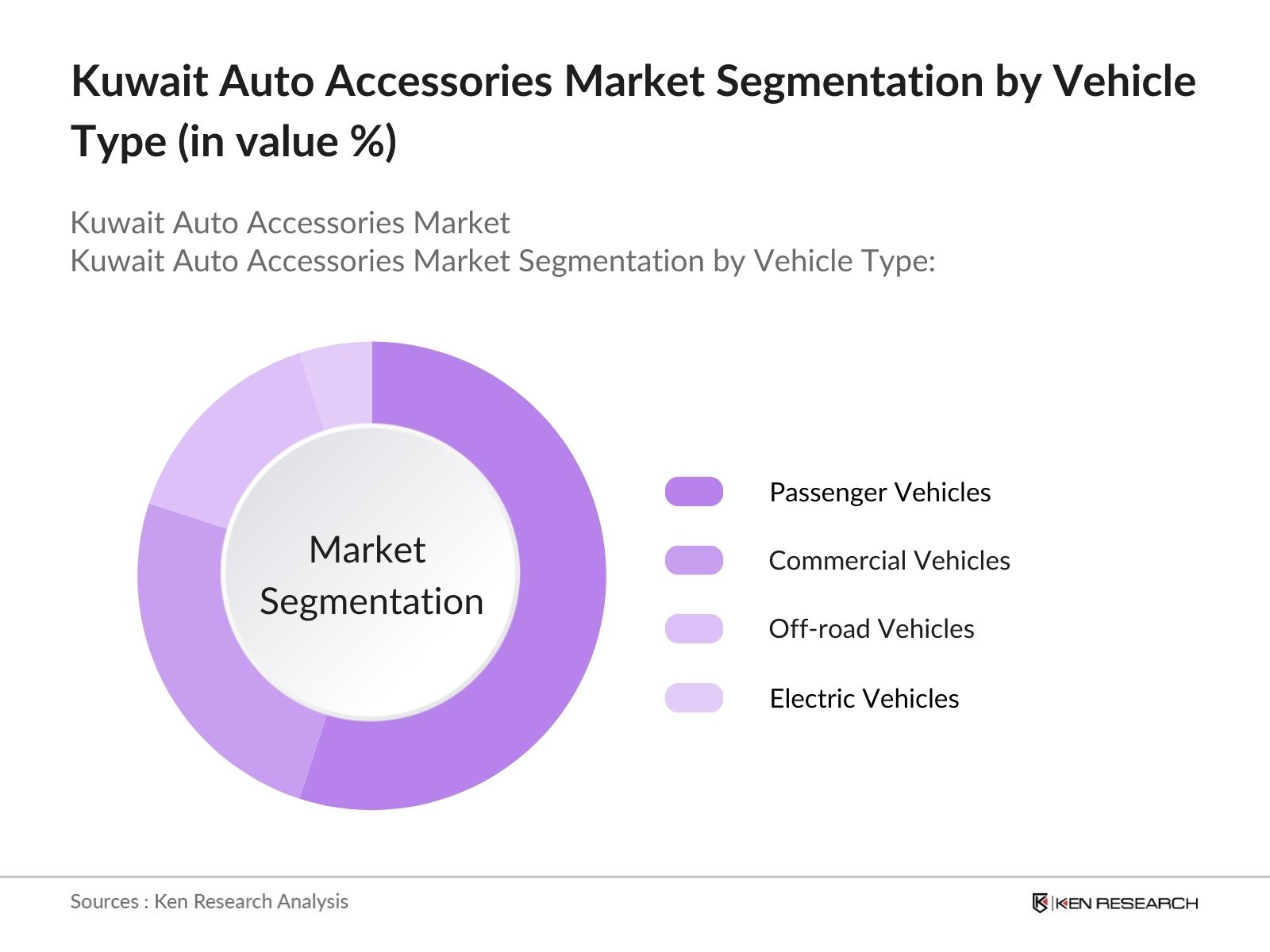

- By Vehicle Type: The market is further segmented by vehicle type into passenger vehicles, commercial vehicles, off-road vehicles, and electric vehicles (EVs). Passenger vehicles are the dominant sub-segment within this segmentation, accounting for the majority of accessory purchases. This is largely due to the prevalence of passenger cars in urban areas like Kuwait City, where individual car ownership is high. Consumers in this segment are keen on enhancing the aesthetics and comfort of their vehicles, particularly luxury car owners who seek premium accessories for personalization.

Kuwait Auto Accessories Market Competitive Landscape

The Kuwait Auto Accessories Market is dominated by a mix of international and local players. These companies have a strong foothold in various sub-segments of the market, offering a wide range of products and services. The Kuwait auto accessories market is highly competitive, with major international players like Bosch and Continental AG dominating the high-tech and performance-oriented segments. Local distributors also play a role in providing specialized products tailored to regional needs, particularly for off-road vehicles and commercial fleets.

| Company Name | Year of Establishment | Headquarters | Product Range | Global Presence | Technological Innovations | Sustainability Initiatives | Local Distribution | Brand Reputation |

|---|---|---|---|---|---|---|---|---|

| ACDelco | 1916 | USA | - | - | - | - | - | - |

| Bosch | 1886 | Germany | - | - | - | - | - | - |

| Valeo | 1923 | France | - | - | - | - | - | - |

| Continental AG | 1871 | Germany | - | - | - | - | - | - |

| Denso Corporation | 1949 | Japan | - | - | - | - | - | - |

Kuwait Auto Accessories Industry Analysis

Growth Drivers

- Increasing Urbanization (Urban Population Growth): Morocco's urban population has seen a steady rise due to internal migration and economic development. In 2024, over 25 million people, around 70% of the total population, live in urban areas, up from 23.5 million in 2022. This growth drives demand for new and used vehicles, as urban residents require personal transport for commuting. The government’s focus on expanding urban infrastructure and services further boosts vehicle sales. Data from the World Bank confirms Morocco's continuous urban growth, contributing to higher demand for vehicles, especially in growing metropolitan areas like Casablanca and Rabat.

- Rise in Middle-Class Incomes (GDP per Capita): Morocco's GDP per capita reached $4,165 in 2024, up from $3,805 in 2022, indicating rising disposable incomes, particularly among the middle class. As household incomes increase, so does the purchasing power for vehicles, including new and premium models. With more financial flexibility, middle-income families are increasingly considering vehicle ownership as a status symbol and for practical mobility. The upward trend in GDP per capita, as recorded by the IMF, reflects economic improvements that are directly supporting the growth of both the new and used vehicle markets in Morocco.

- Government Incentives for Electric Vehicles (EV) (Tax Benefits): To promote sustainable transportation, the Moroccan government introduced tax exemptions and reduced registration fees for electric vehicles in 2024. EV buyers can now benefit from zero customs duties, which typically amount to 40% for non-electric vehicles. These incentives have led to a notable increase in EV imports, with over 5,000 new EV registrations in 2024, compared to 3,000 in 2022. Such tax benefits are part of the government’s strategy to reduce reliance on fossil fuels and encourage eco-friendly transportation, fostering growth in the EV segment of the market.

Market Challenges

- High Import Tariffs on New Vehicles (Custom Duties): Morocco imposes import duties on new vehicles, which can reach up to 40%, making them unaffordable for many consumers. This high tariff structure limits the competitiveness of new vehicles in the market, pushing more consumers toward used vehicles. In 2024, customs duties on new vehicle imports remain a key barrier, with over 65% of the vehicles sold being used models. This policy affects market dynamics and hinders the growth of new vehicle sales in the country.

- Lack of Affordable Financing Options (Interest Rates): The vehicle financing market in Morocco remains underdeveloped, with high-interest rates making loans expensive for the average consumer. In 2024, average loan interest rates for car purchases stand at 7%, which deters many potential buyers, especially in the middle-income bracket. Limited access to affordable credit continues to challenge new vehicle sales, as many consumers opt for used vehicles, which are more affordable and often bought without financing. The lack of competitive financing options is a constraint on the broader market for new cars.

Kuwait Auto Accessories Market Future Outlook

The Kuwait Auto Accessories Market is set to witness steady growth in the coming years. The rise in demand for electric vehicle (EV) accessories is expected to provide new growth avenues, as Kuwait pushes for greener initiatives. With ongoing government support for electric vehicles and increasing consumer interest in vehicle customization, the market is poised for a shift towards eco-friendly and high-tech accessories.

Moreover, the increased focus on premium and luxury vehicle enhancements, driven by the affluent population in Kuwait, will continue to bolster demand for high-end auto accessories. The expansion of e-commerce platforms is expected to further facilitate the accessibility of these products to a wider audience.

Future Market Opportunities

- Expansion of EV Infrastructure (Charging Stations): Morocco's electric vehicle infrastructure has seen development, with over 250 new charging stations installed across the country in 2024, up from 100 in 2022. The government is prioritizing the expansion of EV charging networks in urban areas and along major highways. This infrastructure expansion is crucial for increasing the adoption of electric vehicles, making them a more viable option for consumers and supporting the country’s green mobility goals. The growth of charging stations is directly aligned with the rising demand for EVs, contributing to market opportunities for automakers and infrastructure providers.

- Partnership with International Automakers (Joint Ventures): In 2024, Morocco has strengthened partnerships with international automakers through joint ventures, particularly in the EV and hybrid vehicle segments. Companies like Stellantis and Renault have announced joint ventures with local firms to produce eco-friendly vehicles tailored to the Moroccan and broader African markets. These partnerships are aimed at capitalizing on Morocco’s strategic position as a manufacturing and export hub, while also addressing domestic demand for greener vehicles. The involvement of global automotive leaders presents growth opportunities for Morocco's automotive sector.

Scope of the Report

|

By Product Type |

Interior Accessories Exterior Accessories Performance Accessories Electronics Safety and Security |

|

By Vehicle Type |

Passenger Vehicles Commercial Vehicles Off-Road Vehicles Electric Vehicles |

|

By Sales Channel |

OEMs Aftermarket E-Commerce Retail Stores |

|

By End-User |

Individual Customers Fleet Owners Workshops |

|

By Region |

North East West South |

Products

Key Target Audience

- Vehicle Manufacturers

- Auto Accessories Manufacturers

- Automotive Dealerships

- Government and Regulatory Bodies (Kuwait Public Transport Company)

- Aftermarket Service Providers

- Fleet Management Companies

- Investor and Venture Capitalist Firms

- Banks and Financial Institutes

- E-commerce Platforms

Companies

Kuwait Auto Accessories Market Major Players

- ACDelco

- Bosch

- Continental AG

- Valeo

- Denso Corporation

- Magna International

- Delphi Technologies

- Goodyear Tire & Rubber Company

- Hella KGaA Hueck & Co.

- 3M Company

- NGK Spark Plug Co.

- Pioneer Corporation

- Kenwood Corporation

- JBL

- Autogem

Table of Contents

Kuwait Auto Accessories Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

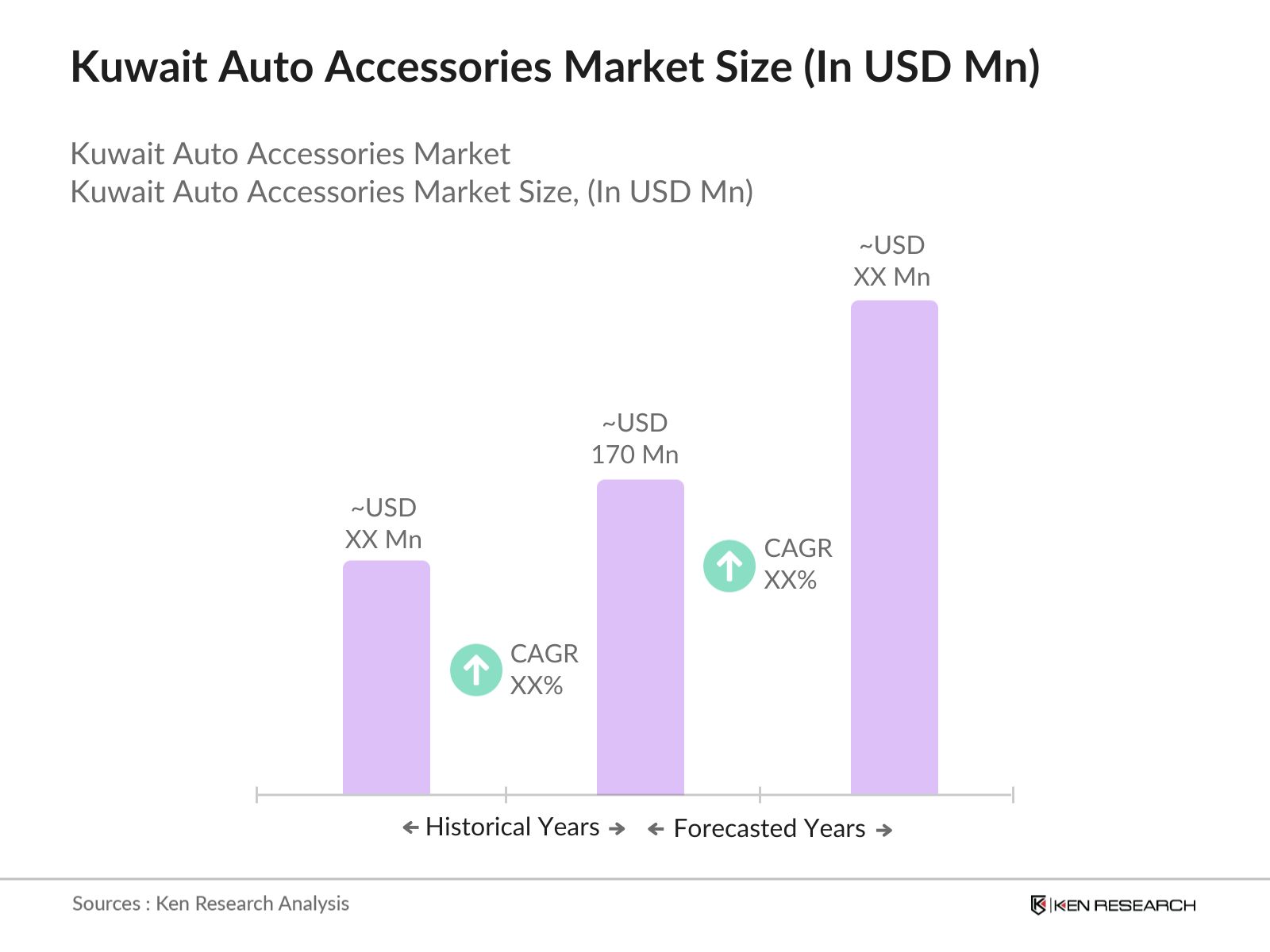

Kuwait Auto Accessories Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Kuwait Auto Accessories Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Disposable Income and Luxury Car Purchases (GDP per capita, disposable income)

3.1.2. Expanding Car Ownership (car ownership ratio)

3.1.3. Rise in Off-Roading Activities (number of off-road vehicles)

3.1.4. Rising Customization Trend (accessory customization demand)

3.2. Market Challenges

3.2.1. High Import Tariffs on Foreign Auto Parts (import duty, trade restrictions)

3.2.2. Competition from Grey Market (counterfeit products market size)

3.2.3. Lack of Aftermarket Support (service network availability)

3.3. Opportunities

3.3.1. Growth in E-commerce Platforms (online sales of auto accessories)

3.3.2. Government Initiatives for Local Manufacturing (government incentives for local production)

3.3.3. Demand for Environment-Friendly Accessories (regulations on emissions, EV accessories)

3.4. Trends

3.4.1. Technological Advancements (adoption of IoT, smart accessories)

3.4.2. Rise of Electric Vehicles (growth in EV accessory sales)

3.4.3. Increased Focus on Aesthetic and Performance Upgrades (demand for luxury and sports upgrades)

3.5. Government Regulation

3.5.1. Kuwait’s Automotive Regulations (compliance with safety and environmental standards)

3.5.2. Import Regulations for Auto Parts (customs and excise duties)

3.5.3. Government Initiatives for Local Auto Industry Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competitive Landscape

Kuwait Auto Accessories Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Interior Accessories (seat covers, floor mats, etc.)

4.1.2. Exterior Accessories (bumpers, spoilers, etc.)

4.1.3. Performance Accessories (turbochargers, exhaust systems, etc.)

4.1.4. Electronics (GPS systems, car infotainment, etc.)

4.1.5. Safety and Security (alarm systems, rear cameras, etc.)

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Off-Road Vehicles

4.2.4. Electric Vehicles

4.3. By Sales Channel (In Value %)

4.3.1. OEMs (Original Equipment Manufacturers)

4.3.2. Aftermarket

4.3.3. E-Commerce

4.3.4. Retail Stores

4.4. By End-User (In Value %)

4.4.1. Individual Customers

4.4.2. Fleet Owners

4.4.3. Workshops

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

Kuwait Auto Accessories Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ACDelco

5.1.2. Bosch

5.1.3. Continental AG

5.1.4. Denso Corporation

5.1.5. Magna International

5.1.6. Delphi Technologies

5.1.7. Valeo

5.1.8. Hella KGaA Hueck & Co.

5.1.9. 3M Company

5.1.10. Goodyear Tire & Rubber Company

5.1.11. Autogem

5.1.12. NGK Spark Plug Co.

5.1.13. Pioneer Corporation

5.1.14. Kenwood Corporation

5.1.15. JBL

5.2. Cross Comparison Parameters

- Product Range

- Global Presence

- Local Market Penetration

- Service Network Size

- Technological Innovation

- Market Share in GCC

- Sustainability Initiatives

- Partnerships and Collaborations

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Kuwait Auto Accessories Market Regulatory Framework

6.1. Standards for Auto Accessories (certification and compliance)

6.2. Import Tariff Regulations

6.3. Environmental and Emission Regulations

6.4. Certification and Quality Assurance Processes

Kuwait Auto Accessories Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Kuwait Auto Accessories Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Sales Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

Kuwait Auto Accessories Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Analysis

9.3. Marketing Strategy Recommendations

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This step begins by identifying the critical variables driving the Kuwait Auto Accessories Market. Desk research using proprietary databases, industry publications, and government reports forms the backbone of this phase, ensuring the inclusion of all stakeholders from OEMs to local distributors.

Step 2: Market Analysis and Construction

A thorough analysis of historical data is performed, including market penetration, growth of vehicle ownership, and revenue generation in the auto accessories market. This phase also examines the performance metrics of top companies operating in Kuwait.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are tested through consultation with experts via computer-assisted telephone interviews (CATIs). These interviews provide valuable insights on consumer behavior, sales trends, and operational challenges within the Kuwait Auto Accessories Market.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all data, validating it with industry players and analyzing consumer preferences for auto accessories. This ensures that the final report offers a comprehensive, accurate, and reliable overview of the market.

Frequently Asked Questions

01. How big is the Kuwait Auto Accessories Market?

The Kuwait Auto Accessories Market is valued at USD 170 million, driven by the rising demand for premium and customized vehicle enhancements, supported by increasing disposable income.

02. What are the challenges in the Kuwait Auto Accessories Market?

The Kuwait Auto Accessories Market faces challenges such as high import tariffs on foreign parts, which makes imported accessories more expensive, and the growing competition from counterfeit products in the grey market.

03. Who are the major players in the Kuwait Auto Accessories Market?

Key players in Kuwait Auto Accessories Market include ACDelco, Bosch, Valeo, Continental AG, and Denso Corporation, which dominate the market due to their strong brand reputation, extensive product range, and global presence.

04. What are the growth drivers of the Kuwait Auto Accessories Market?

The Kuwait Auto Accessories Market is driven by the increasing car ownership rate, rising disposable incomes, and the growing trend of vehicle customization, particularly in Kuwait City where luxury car ownership is higher.

05. How is the Kuwait Auto Accessories Market expected to evolve?

The Kuwait Auto Accessories Market is expected to shift towards eco-friendly and high-tech accessories, spurred by government incentives for electric vehicles and increased consumer interest in performance and aesthetic upgrades.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.