Latin America 3D Printing Market Outlook to 2030

Region:Central and South America

Author(s):Paribhasha Tiwari

Product Code:KROD1951

November 2024

92

About the Report

Latin America 3D Printing Market Overview

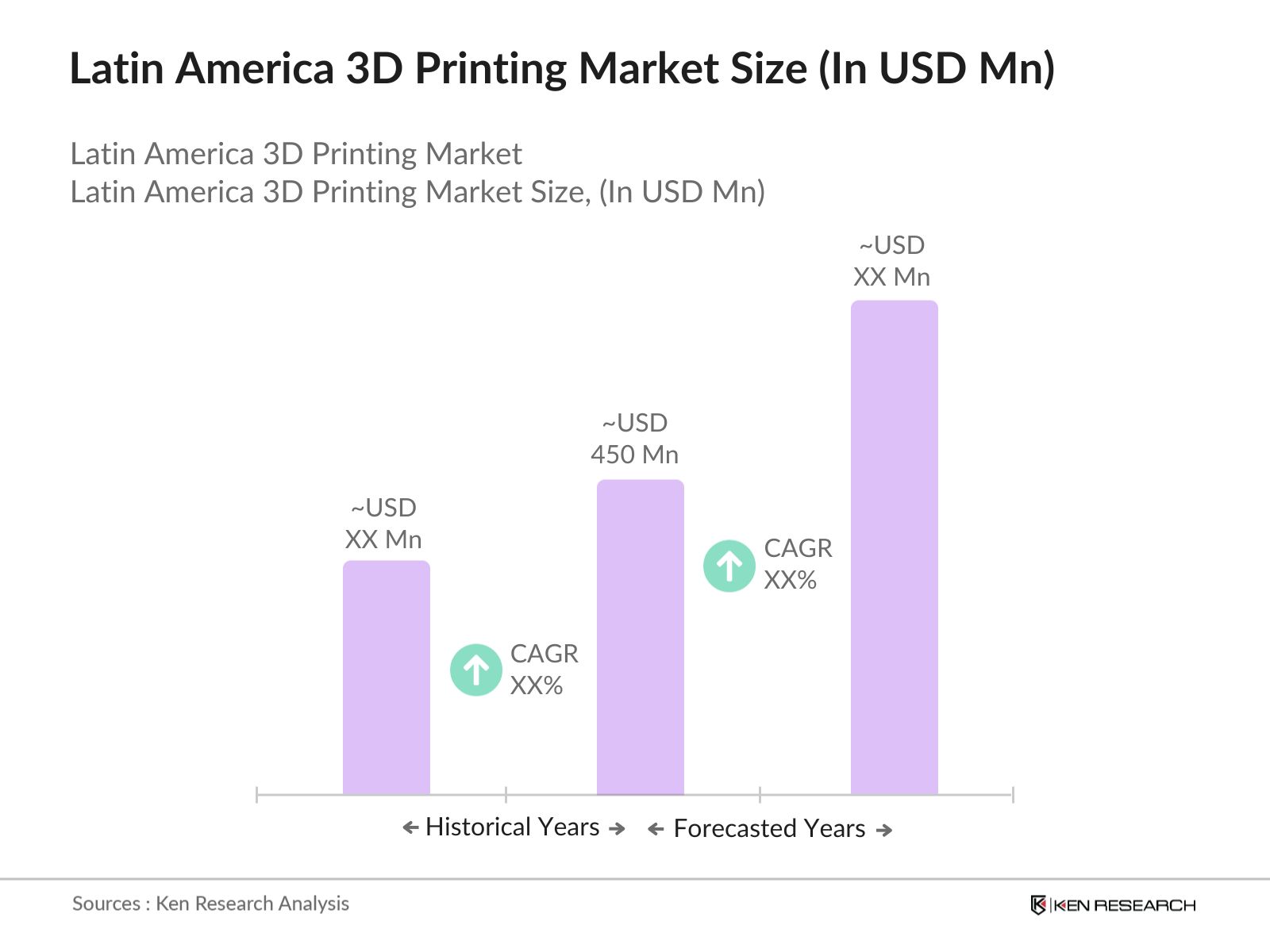

- The Latin America 3D Printing Market, valued at USD 450 Million in 2023, has seen robust growth over the past five years, driven by increasing industrial adoption of additive manufacturing techniques, especially in the automotive, aerospace, and healthcare sectors. The growth of the market has been further fueled by the demand for cost-effective and sustainable production methods, allowing manufacturers to produce small-batch and customized products at lower costs. This trend has been supported by advancements in 3D printing materials and technology, which have broadened the range of potential applications in various industries.

- Brazil and Mexico dominate the 3D printing market in Latin America. Brazil leads due to its large manufacturing base, particularly in the automotive and aerospace sectors, which have embraced 3D printing technology to enhance efficiency and reduce production lead times. Mexico is a close contender due to its proximity to the U.S. and its robust manufacturing sector, which includes a strong presence of global automotive and electronics companies that have integrated 3D printing into their supply chains.

- Governments across Latin America, including Brazil and Mexico, are offering significant tax incentives for companies that invest in 3D printing technologies. In 2024, Brazilian companies that purchase 3D printers are eligible for tax deductions of up to $50,000. These initiatives are helping to lower the financial barriers for SMEs looking to enter the additive manufacturing space, particularly in the automotive and aerospace sectors.

Latin America 3D Printing Market Segmentation

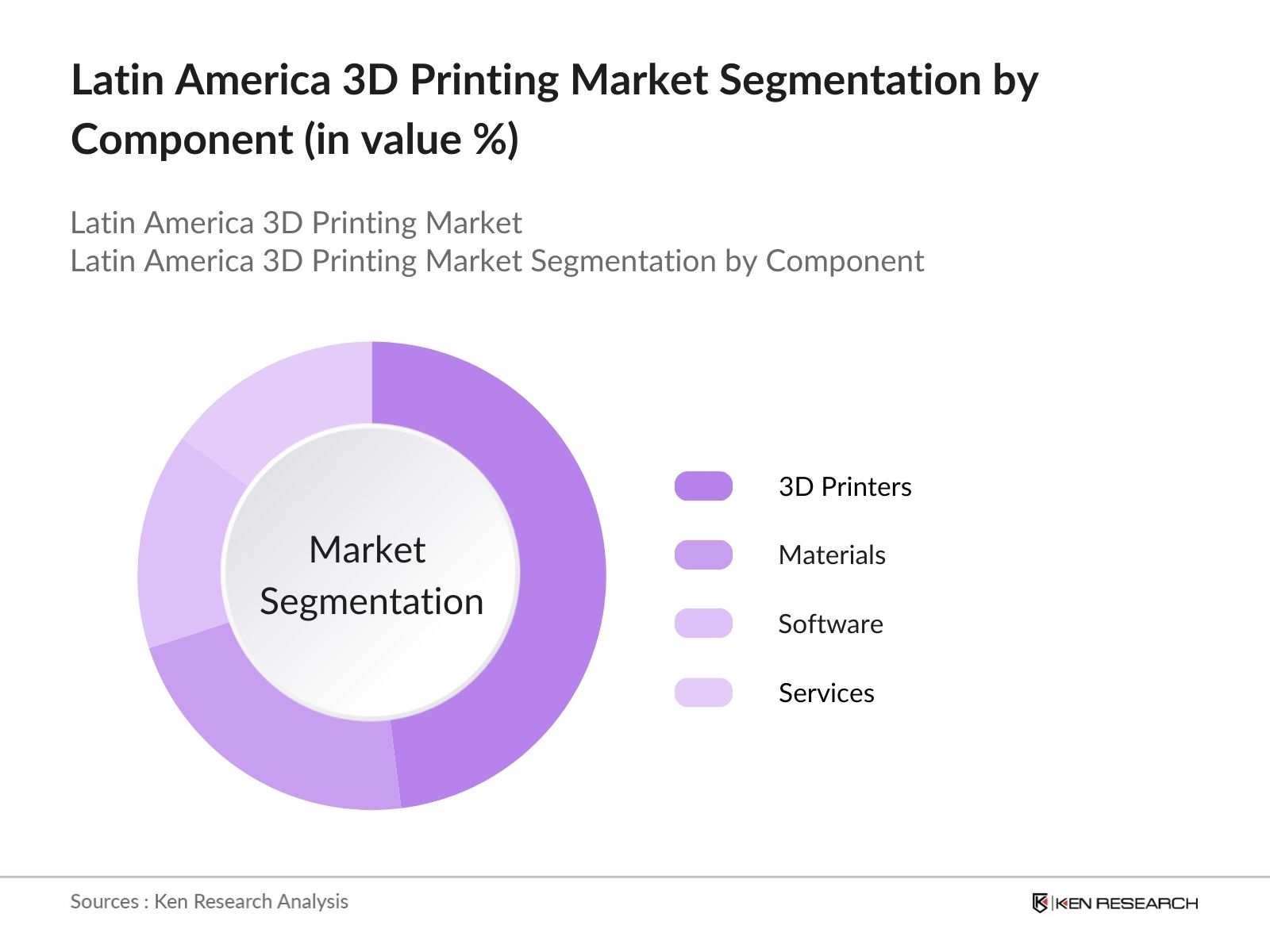

By Component: The Latin America 3D Printing market is segmented by component into 3D printers, materials, software, and services. Among these, 3D printers hold the dominant market share due to the increasing demand for advanced printers capable of multi-material and high-speed production. Large-scale industries such as automotive and aerospace have been significant adopters of high-end 3D printers, which are used for rapid prototyping and production of complex components. Additionally, the growing demand for more affordable desktop printers in the consumer goods and education sectors is further propelling the segments dominance.

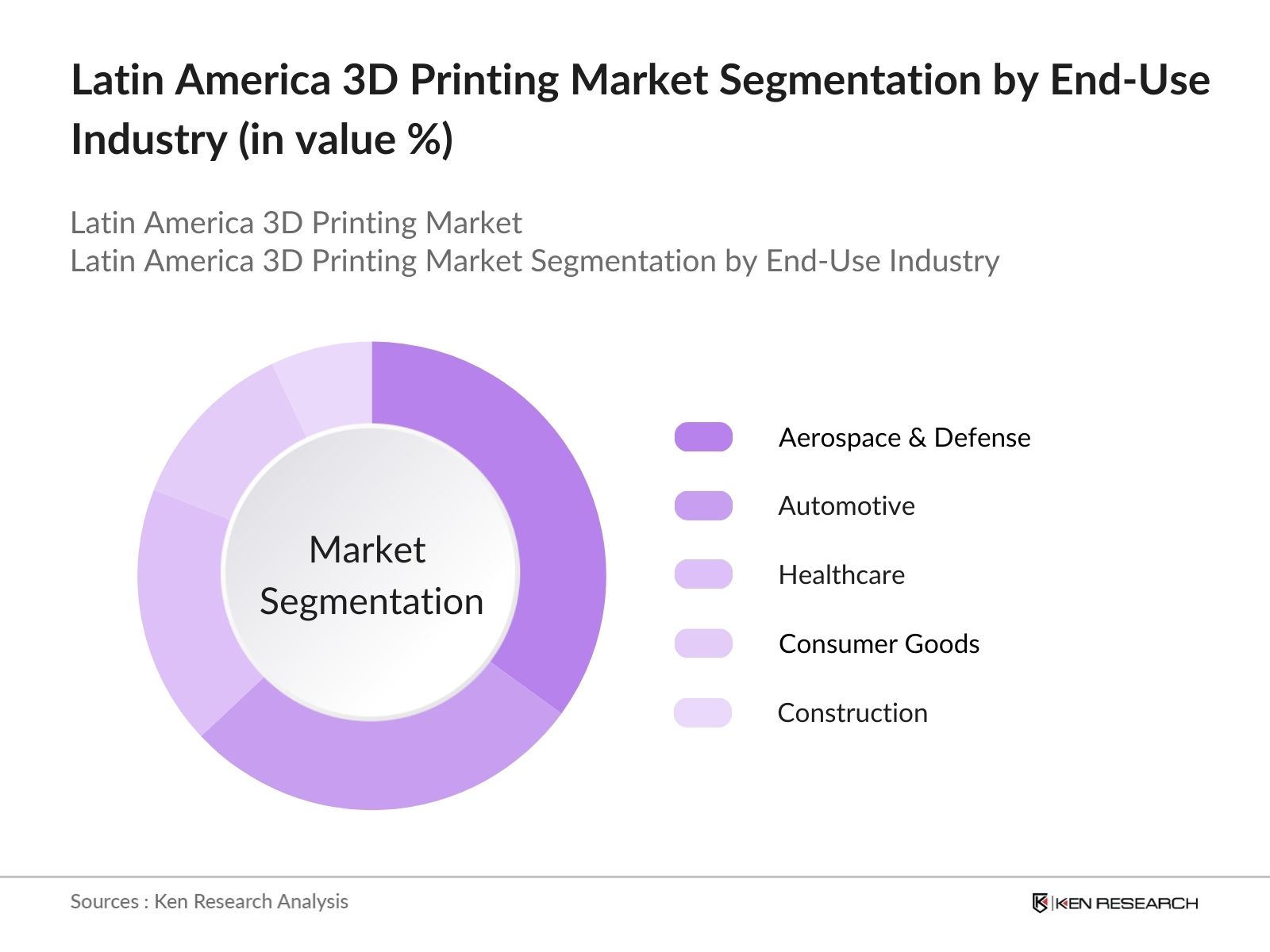

By End-Use Industry: The market is also segmented by end-use industry into automotive, aerospace & defense, healthcare, consumer goods, and construction. Aerospace & defense dominate the market, as these industries require complex, lightweight components that can be produced cost-effectively through 3D printing. The adoption of additive manufacturing has allowed companies in this sector to optimize their production processes, reduce material wastage, and create components with superior strength-to-weight ratios, making 3D printing an invaluable tool for future growth in the sector.

Latin America 3D Printing Market Competitive Landscape

The Latin America 3D Printing market is highly competitive, with major global and local players driving innovation and expansion in the region. Companies such as Stratasys Ltd., 3D Systems Corporation, HP Inc., and EOS GmbH have established strong market positions through their advanced technologies, extensive product portfolios, and partnerships with key industries such as automotive, aerospace, and healthcare. The competitive landscape is marked by a focus on research and development, collaborations with universities and research institutions, and the integration of 3D printing with Industry 4.0 technologies.

|

Company |

Establishment Year |

Headquarters |

No. of Patents |

Material Innovations |

R&D Expenditure |

Global Reach |

Additive Manufacturing Capability |

Strategic Partnerships |

Revenue (USD Billion) |

|---|---|---|---|---|---|---|---|---|---|

|

Stratasys Ltd. |

1989 |

USA |

- | - | - | - | - | - | - |

|

3D Systems Corporation |

1986 |

USA |

- | - | - | - | - | - | - |

|

HP Inc. |

1939 |

USA |

- | - | - | - | - | - | - |

|

EOS GmbH |

1989 |

Germany |

- | - | - | - | - | - | - |

|

GE Additive |

2016 |

USA |

- | - | - | - | - | - | - |

Latin America 3D Printing Market Analysis

Growth Drivers

- Rising Adoption of Additive Manufacturing (Sector-specific Adoption): Latin America is witnessing increasing adoption of 3D printing technologies across key industries like automotive, healthcare, and aerospace. In 2024, the automotive industry alone is estimated to utilize 3D printing for prototyping in more than 50% of manufacturing facilities in countries like Brazil and Mexico. This shift is being driven by the ability of 3D printing to reduce lead times for new product designs, allowing companies to create prototypes in a matter of hours instead of weeks. Furthermore, the aerospace sector in Latin America is exploring the use of 3D printing to manufacture lightweight components for aircraft, potentially saving millions in production costs over the next five years.

- Government Initiatives Supporting Innovation (Innovation Grants, Tax Incentives): Several Latin American governments have introduced initiatives to support the growth of additive manufacturing. In Brazil, the governments 2024 funding for innovation in manufacturing includes over $200 million in grants for companies that invest in 3D printing technologies. Additionally, Mexico has introduced tax incentives for companies adopting advanced manufacturing techniques, helping SMEs mitigate the high initial capital costs associated with 3D printing. This government support is expected to drive innovation across sectors such as consumer goods, healthcare, and construction.

- Increasing Demand for Rapid Prototyping (Automotive, Aerospace, Healthcare): The demand for rapid prototyping in Latin America is rising sharply, particularly in the automotive, aerospace, and healthcare sectors. In 2024, the healthcare industry in Mexico alone is projected to use 3D printing for the development of over 100,000 medical devices, including surgical guides and prosthetics. Rapid prototyping allows companies to cut down production timelines, test multiple iterations of a product, and reduce overall costs, which has proven essential in maintaining competitiveness in fast-paced industries.

Market Challenges

- High Capital Expenditure (Average Setup Cost for SMEs): The initial investment required for setting up 3D printing infrastructure remains a significant challenge for small and medium-sized enterprises (SMEs) in Latin America. In 2024, the average cost for establishing a basic 3D printing facility is around $150,000, including the cost of printers, materials, and software. This high capital expenditure deters many smaller companies from adopting 3D printing, limiting its widespread use in sectors such as consumer goods and manufacturing.

- Lack of Skilled Workforce (Shortage of Skilled Technicians): Latin America is currently facing a shortage of skilled professionals who are trained in 3D printing technologies. As of 2024, estimates suggest that there are fewer than 10,000 professionals across the region with the technical expertise required to operate and maintain 3D printing equipment. This gap is particularly evident in the aerospace and healthcare industries, where the demand for highly skilled technicians to work on complex projects like medical implants and aircraft components is growing faster than the workforce can meet.

Latin America 3D Printing Market Future Outlook

Over the next five years, the Latin America 3D Printing market is expected to witness substantial growth, driven by continuous technological advancements, increased investment in research and development, and the rising demand for sustainable and customized manufacturing solutions. Government initiatives supporting the adoption of additive manufacturing across various industries, coupled with increasing awareness about the benefits of 3D printing in reducing production costs and improving efficiency, are anticipated to fuel market expansion. Moreover, the emergence of bio-printing and metal 3D printing technologies is set to open new avenues for growth in sectors such as healthcare and aerospace.

Market Opportunities

- Expansion of Customization Capabilities: 3D printing is offering unprecedented opportunities for customization, particularly in sectors such as healthcare and consumer goods. In 2024, the Latin American healthcare sector is expected to produce more than 50,000 custom prosthetics and dental implants using 3D printing technologies. This ability to tailor products to individual specifications is also benefiting the consumer goods industry, where companies are using 3D printing to offer personalized products such as footwear and eyewear at competitive prices.

- Collaboration with Educational Institutions: Universities and technical schools in Latin America are increasingly incorporating 3D printing into their curriculums, creating a pipeline of skilled technicians and engineers. In 2024, over 200 institutions in Brazil and Argentina have introduced specialized programs focused on additive manufacturing technologies. This collaboration between academia and industry is expected to address the region's skills gap, while also fostering innovation in sectors like aerospace, automotive, and healthcare.

Scope of the Report

|

By Component |

3D Printers Materials (Plastics, Metals, Ceramics) Software Services |

|

By Technology |

Fused Deposition Modeling (FDM) Stereolithography (SLA) Selective Laser Sintering (SLS) Direct Metal Laser Sintering (DMLS) Others (PolyJet, Electron Beam Melting) |

|

By Application |

Prototyping Production Research and Development Personal Use |

|

By End-Use Industry |

Aerospace & Defense Healthcare (Dental, Medical Devices, Bio-Printing) Automotive Consumer Goods Construction |

|

By Country |

Brazil Mexico Argentina Chile Colombia |

Products

Key Target Audience

Automotive Manufacturers

Aerospace & Defense Contractors

Healthcare Providers (Hospitals, Clinics, Medical Device Manufacturers)

Consumer Goods Manufacturers

Investors and Venture Capitalist Firms

Construction Companies

Government and Regulatory Bodies (Brazilian Ministry of Industry, Mexican Ministry of Economy)

Research Institutions and Universities

Companies

Players Mentioned in the Report:

Stratasys Ltd.

3D Systems Corporation

HP Inc.

EOS GmbH

GE Additive

Desktop Metal Inc.

Markforged Inc.

Formlabs Inc.

Materialise NV

SLM Solutions Group AG

Table of Contents

1. Latin America 3D Printing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (In Units Sold, Revenue in USD)

1.4. Market Segmentation Overview

2. Latin America 3D Printing Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (In Units Sold and Value)

2.3. Key Market Developments and Milestones

3. Latin America 3D Printing Market Analysis

3.1. Growth Drivers

3.1.1. Rising Adoption of Additive Manufacturing (Sector-specific Adoption)

3.1.2. Government Initiatives Supporting Innovation (Innovation Grants, Tax Incentives)

3.1.3. Increasing Demand for Rapid Prototyping (Automotive, Aerospace, Healthcare)

3.1.4. Cost Efficiency in Small-Batch Production (Specific Savings in Manufacturing)

3.2. Market Challenges

3.2.1. High Capital Expenditure (Average Setup Cost for SMEs)

3.2.2. Lack of Skilled Workforce (Shortage of Skilled Technicians)

3.2.3. Regulatory Barriers in Specific Industries (Healthcare, Aerospace)

3.2.4. Limited Material Options in Specific Sectors (Automotive, Consumer Goods)

3.3. Opportunities

3.3.1. Expansion of Customization Capabilities (End-use Industry Specific Examples)

3.3.2. Collaboration with Educational Institutions (3D Printing Curriculum Integration)

3.3.3. Development of Bio-Printing Solutions (Medical Devices, Tissue Engineering)

3.3.4. Growing Adoption in Small-Scale Production (Automotive Aftermarket, Jewelry)

3.4. Trends

3.4.1. Adoption of Metal 3D Printing in Manufacturing (Sector-Specific Trends)

3.4.2. Advancements in Multi-Material Printing (New Composites, Alloys)

3.4.3. Integration of 3D Printing with IoT (Smart Manufacturing, Industrial Automation)

3.4.4. Expansion of On-Demand Manufacturing Services (Specific Use Cases)

3.5. Government Regulation

3.5.1. 3D Printing Standards and Certifications (Sector Specific - Medical, Automotive)

3.5.2. Import and Export Regulations on 3D Printed Products

3.5.3. Environmental Regulations Governing Material Use (Biodegradable Plastics, Recycling)

3.5.4. Intellectual Property and Licensing in 3D Printing

4. Latin America 3D Printing Market Segmentation

4.1. By Component (In Value %)

4.1.1. 3D Printers

4.1.2. Materials (Plastics, Metals, Ceramics)

4.1.3. Software

4.1.4. Services

4.2. By Technology (In Value %)

4.2.1. Fused Deposition Modeling (FDM)

4.2.2. Stereolithography (SLA)

4.2.3. Selective Laser Sintering (SLS)

4.2.4. Direct Metal Laser Sintering (DMLS)

4.2.5. Others (PolyJet, Electron Beam Melting)

4.3. By Application (In Value %)

4.3.1. Prototyping

4.3.2. Production

4.3.3. Research and Development

4.3.4. Personal Use

4.4. By End-Use Industry (In Value %)

4.4.1. Aerospace & Defense

4.4.2. Healthcare (Dental, Medical Devices, Bio-Printing)

4.4.3. Automotive

4.4.4. Consumer Goods

4.4.5. Construction

4.5. By Country (In Value %)

4.5.1. Brazil

4.5.2. Mexico

4.5.3. Argentina

4.5.4. Chile

4.5.5. Colombia

5. Latin America 3D Printing Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Stratasys Ltd.

5.1.2. 3D Systems Corporation

5.1.3. HP Inc.

5.1.4. EOS GmbH

5.1.5. SLM Solutions Group AG

5.1.6. Materialise NV

5.1.7. GE Additive

5.1.8. Ultimaker BV

5.1.9. EnvisionTEC GmbH

5.1.10. XYZprinting, Inc.

5.1.11. Carbon, Inc.

5.1.12. Formlabs Inc.

5.1.13. Markforged Inc.

5.1.14. Desktop Metal Inc.

5.1.15. Zortrax SA

5.2. Cross Comparison Parameters (No. of Patents, Additive Manufacturing Capability, Material Innovation, Strategic Partnerships, Software Integration, Global Reach, Industry Focus, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Latin America 3D Printing Market Regulatory Framework

6.1. Intellectual Property Regulations in 3D Printing

6.2. Compliance Requirements in Aerospace and Healthcare

6.3. Environmental Standards in Material Use

6.4. Certification and Approval Processes (ISO, ASTM Standards)

7. Latin America 3D Printing Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Latin America 3D Printing Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Country (In Value %)

9. Latin America 3D Printing Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved identifying the critical variables influencing the Latin America 3D Printing market, including the adoption rates in key industries, government initiatives, and technological advancements. A thorough review of secondary research from industry reports, proprietary databases, and government publications was conducted.

Step 2: Market Analysis and Construction

In this phase, historical data was compiled and analyzed to estimate the market size and growth rates. This included analyzing industry penetration, adoption in key sectors such as aerospace and healthcare, and production volume trends across major Latin American countries.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses were validated through direct consultations with industry experts from major companies operating in the 3D printing space, as well as representatives from government agencies and research institutions. These insights helped refine the market forecasts and provided deeper insight into the regional competitive dynamics.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the research findings and compiling the data into actionable insights. This included detailed segmentation, competitive analysis, and future growth projections, ensuring that the final report is comprehensive and accurate.

Frequently Asked Questions

1. How big is the Latin America 3D Printing Market?

The Latin America 3D Printing market was valued at USD 450 Million in 2023, driven by the growing adoption of additive manufacturing in the automotive, aerospace, and healthcare industries.

2. What are the key challenges in the Latin America 3D Printing Market?

Challenges in the Latin America 3D Printing market include high capital expenditure for setting up 3D printing facilities, limited access to skilled labor, and regulatory hurdles in certain industries such as healthcare and aerospace.

3. Who are the major players in the Latin America 3D Printing Market?

Key players in the Latin America 3D Printing market include Stratasys Ltd., 3D Systems Corporation, HP Inc., EOS GmbH, and GE Additive. These companies dominate the market due to their advanced technologies, strong industry partnerships, and wide product offerings.

4. What are the growth drivers of the Latin America 3D Printing Market?

Growth drivers of the Latin America 3D Printing market include increased demand for rapid prototyping, government initiatives supporting the adoption of advanced manufacturing technologies, and the growing need for customized and low-cost production solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.