Latin America Acetic Acid Market Outlook to 2030

Region:Central and South America

Author(s):Paribhasha Tiwari

Product Code:KROD5992

December 2024

85

About the Report

Latin America Acetic Acid Market Overview

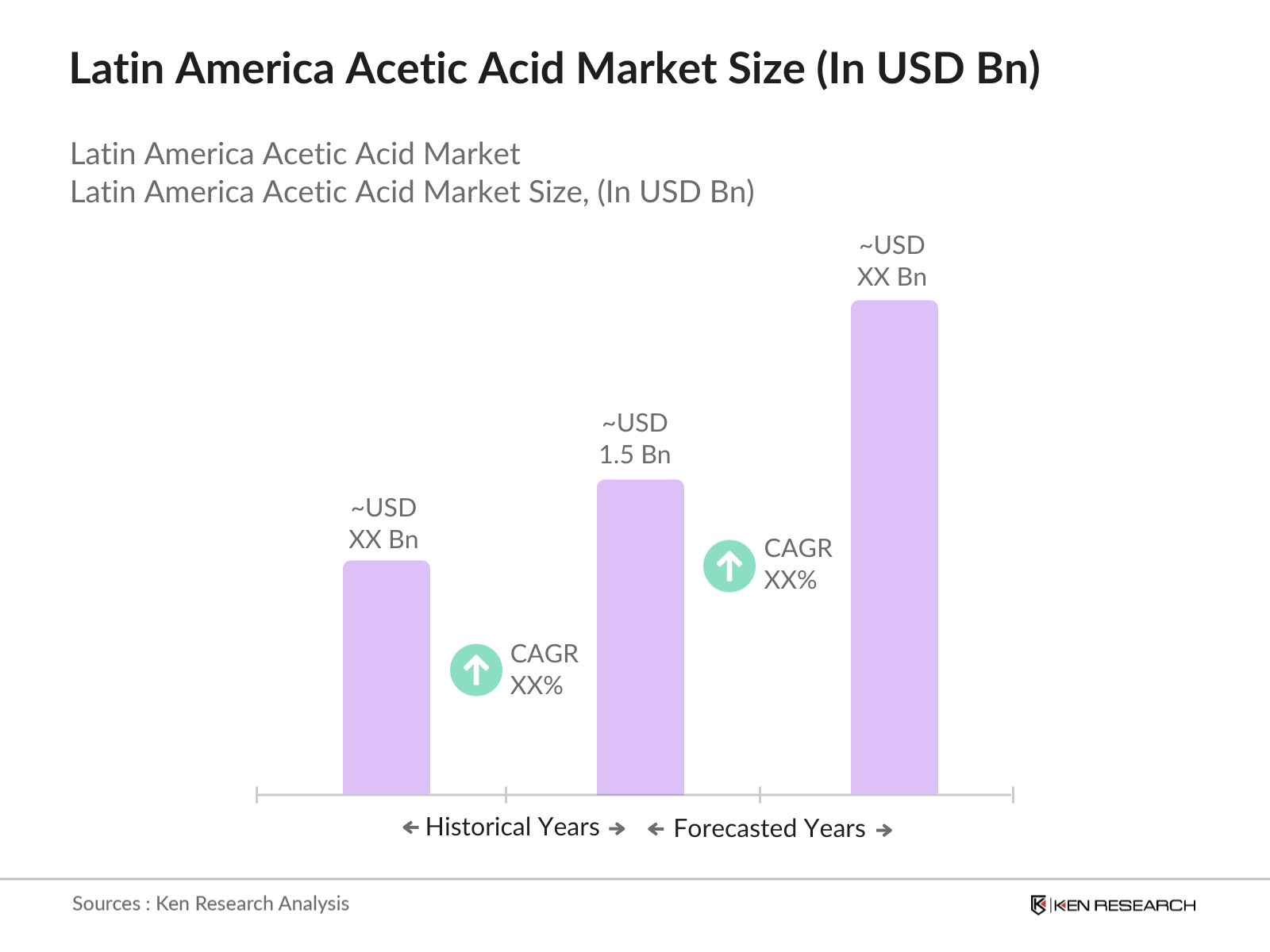

- The Latin America Acetic Acid Market is valued at USD 1.5 billion, driven by expanding applications in vinyl acetate monomer (VAM), purified terephthalic acid (PTA), and acetate esters production. The growing textile industry and increasing demand for food preservatives also propel the market. Methanol carbonylation remains the primary production method due to cost efficiency and high yield. The market's growth is further bolstered by technological advancements and rising industrialization in key economies.

- Brazil and Mexico dominate the Latin America Acetic Acid Market due to their robust industrial base and strong chemical manufacturing infrastructure. Brazil's focus on renewable chemical production and Mexicos integration into the North American supply chain bolster their market presence. Both countries benefit from significant demand in packaging, food, and beverage sectors, alongside governmental support for industrial expansion.

- In 2023, a notable development in the Latin America acetic acid market is the announcement ofcapacity expansionsby leading chemical manufacturers. These companies are investing in new production facilities and upgrading existing ones to improve efficiency and sustainability, addressing the increasing demand for acetic acid across various sectors. This strategic move reflects a response to the robust growth anticipated in the market, which is projected to reach approximatelyUSD 1.70 billion by 2030.

Latin America Acetic Acid Market Segmentation

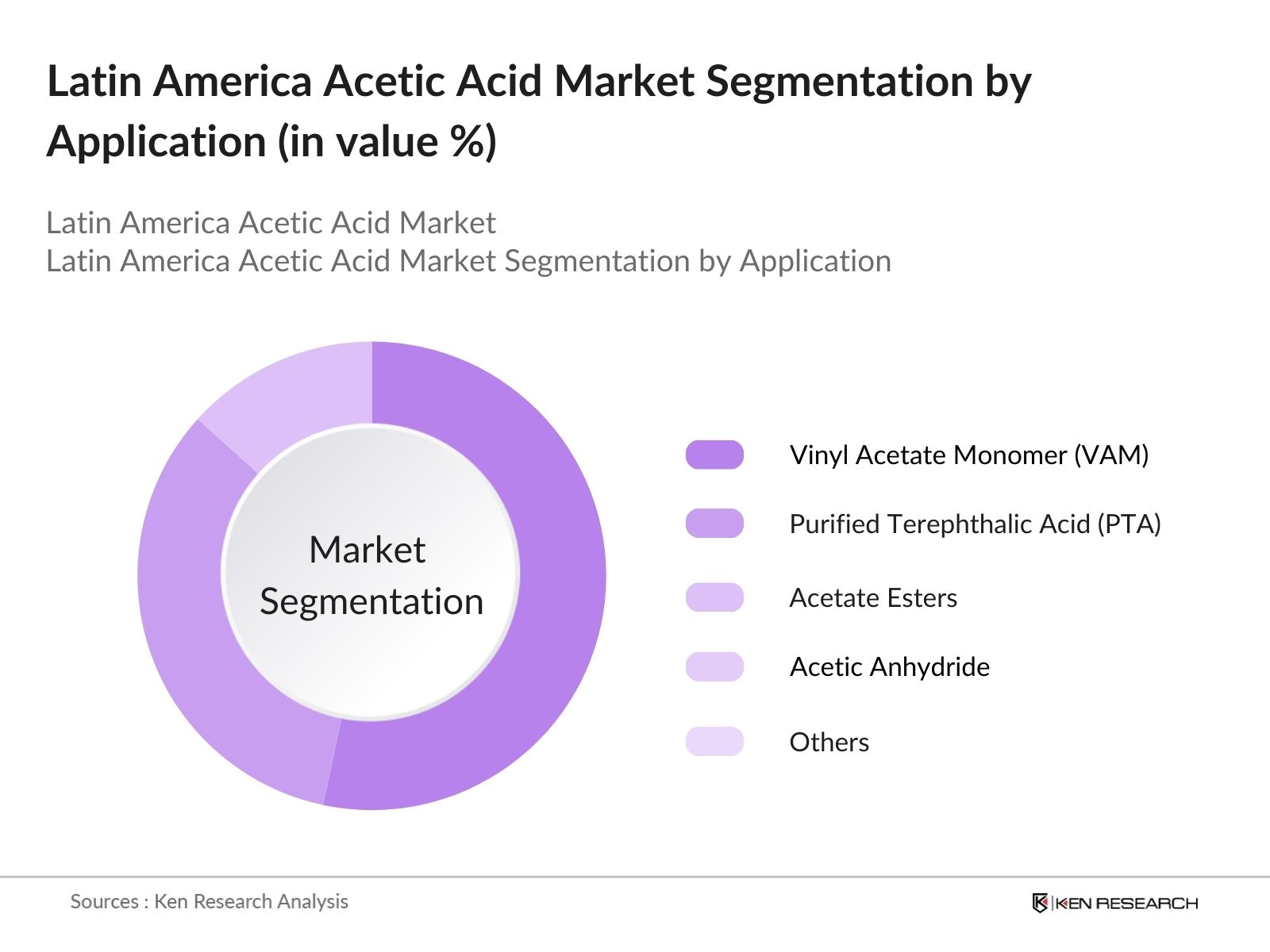

By Application: The Latin America Acetic Acid Market is segmented into vinyl acetate monomer (VAM), purified terephthalic acid (PTA), acetate esters, and acetic anhydride. VAM dominates with a 40% market share in 2023, attributed to its widespread use in adhesives, coatings, and paints. Its demand is sustained by the region's growing construction and automotive sectors. Furthermore, PTA remains significant for polyester fiber production, fueled by demand in textiles and packaging.

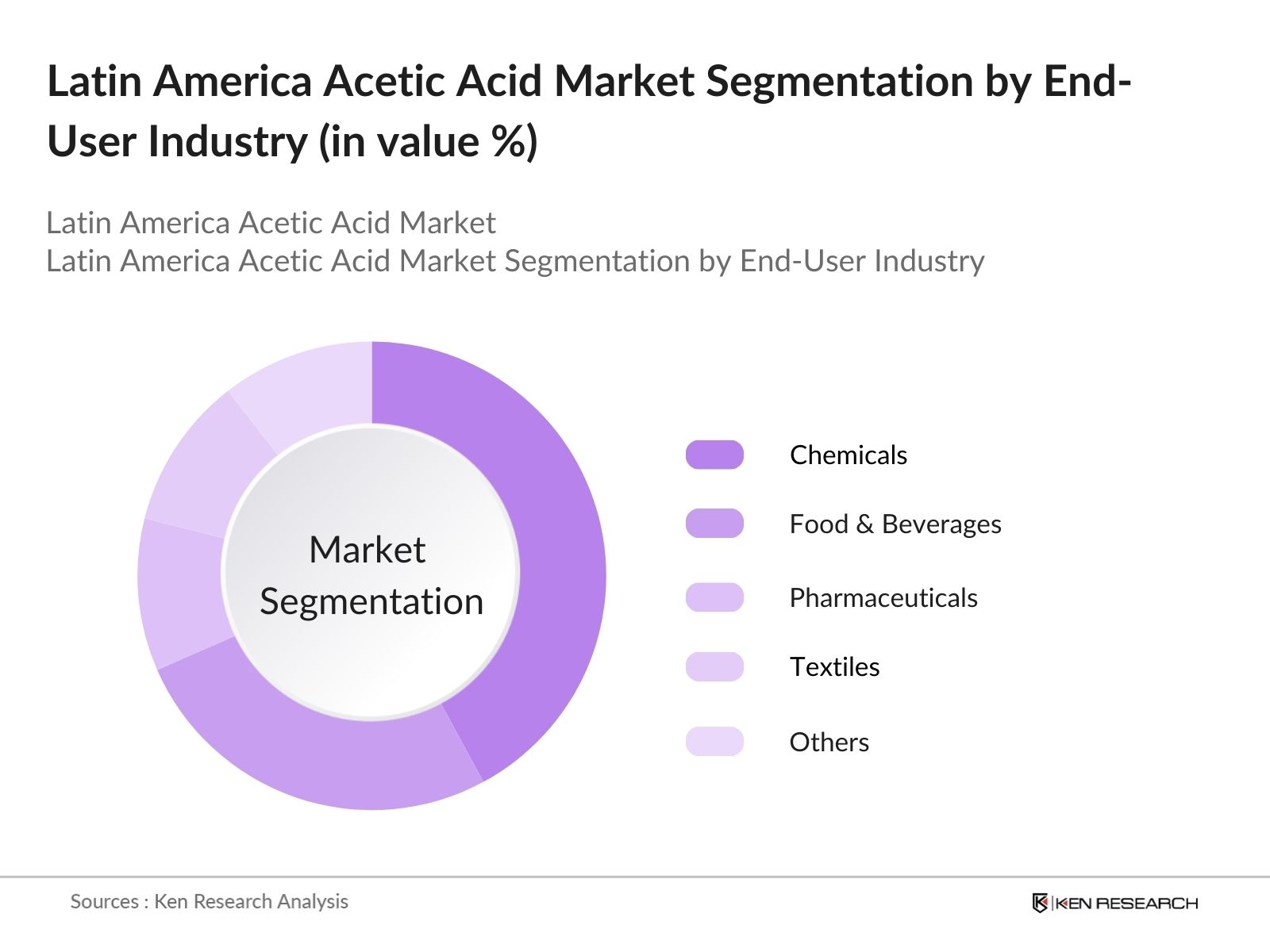

By End-Use Industry: The chemicals segment leads the Latin America Acetic Acid Market with a 50% share in 2023, driven by its use in manufacturing VAM and PTA. Food and beverages hold the second-largest share due to acetic acid's role as an acidulant and preservative. Pharmaceuticals also show strong growth, leveraging acetic acid for the production of intermediates and medications.

Latin America Acetic Acid Market Competitive Landscape

The Latin America Acetic Acid Market is dominated by both global and regional players. The competitive landscape is shaped by a mix of established manufacturers and emerging innovators leveraging sustainable production technologies. Major companies are focusing on expanding their production capacities and forming strategic alliances to strengthen their market positions.

Latin America Acetic Acid Market Analysis

Growth Drivers

- Expansion of Chemical Manufacturing (Demand for Vinyl Acetate Monomer): In 2024, the global production of vinyl acetate monomer (VAM) reached approximately 8 million metric tons, driven by its extensive use in adhesives, paints, and coatings. This surge in VAM production has significantly increased the demand for acetic acid, a primary feedstock in VAM synthesis. The chemical industry's robust growth, particularly in Asia-Pacific regions, has further amplified this demand.

- Growth in Textile Industry (Use of Acetic Acid in Dyes and Finishing): The global textile industry produced over 120 million metric tons of fibers in 2024, with a substantial portion requiring acetic acid for dyeing and finishing processes. Acetic acid's role in maintaining pH levels during dyeing ensures color consistency and fabric quality, making it indispensable in textile manufacturing.

- Rising Demand in Food Preservation (Acidulant Applications): In 2024, the global processed food market was valued at approximately $4 trillion, with a significant segment utilizing acetic acid as a preservative and acidulant. Its antimicrobial properties make it effective in extending the shelf life of various food products, catering to the increasing consumer demand for longer-lasting and safe consumables.

Market Challenges

- Fluctuating Raw Material Costs (Methanol): In 2024, methanol prices experienced volatility, ranging from $300 to $400 per metric ton, directly impacting acetic acid production costs. Since methanol constitutes a significant portion of production expenses, such fluctuations pose challenges for manufacturers in maintaining stable pricing.

- Stringent Environmental Policies: Governments worldwide have implemented stricter regulations on chemical emissions. For instance, the European Union's REACH regulation mandates rigorous compliance, leading to increased operational costs for acetic acid producers to meet environmental standards.

Latin America Acetic Acid Market Future Outlook

The Latin America Acetic Acid Market is poised for significant growth driven by advancements in bio-based acetic acid production, increasing demand for PTA in packaging, and expansion of the food and beverage sector. Strengthened governmental policies promoting sustainable practices and renewable chemical production are expected to shape the market dynamics in the coming years.

Market Opportunities

- Development of Bio-based Acetic Acid Solutions: Investments in bio-based acetic acid production have increased. In 2024, funding for research and development in this sector reached $500 million, aiming to produce sustainable and eco-friendly alternatives to traditional acetic acid.

- Growth in Emerging Markets (Brazil and Mexico): Brazil and Mexico have shown significant industrial growth. In 2024, Brazil's chemical industry was valued at $150 billion, while Mexico's reached $80 billion, indicating a rising demand for acetic acid in various applications.

Scope of the Report

|

By Application |

Vinyl Acetate Monomer (VAM) Purified Terephthalic Acid (PTA) Acetate Esters Acetic Anhydride Solvents |

|

By End-Use Industry |

Chemicals Food and Beverages Pharmaceuticals Textiles Paints and Coatings |

|

By Production Method |

Methanol Carbonylation Acetaldehyde Oxidation Fermentation Ethylene Oxidation |

|

By Distribution Channel |

Direct Sales Distributors Online Platforms |

|

By Country |

Brazil Mexico Argentina Chile Rest of Latin America |

Products

Key Target Audience

Acetic Acid Manufacturers

Food and Beverage Companies

Textile Manufacturers

Pharmaceutical Producers

Government and Regulatory Bodies (ANVISA, Ministry of Industry and Trade)

Adhesives and Paints Manufacturers

Investors and Venture Capitalist Firms

Packaging Industry Stakeholders

Companies

Players mentioned in the report:

Celanese Corporation

BP Chemicals Ltd

LyondellBasell Industries

Eastman Chemical Company

Jiangsu Sopo Group

SABIC

Mitsubishi Chemical Corporation

Wacker Chemie AG

Helm AG

Daicel Corporation

Table of Contents

1. Latin America Acetic Acid Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Latin America Acetic Acid Market Size (USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Latin America Acetic Acid Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of Chemical Manufacturing (Demand for Vinyl Acetate Monomer)

3.1.2 Growth in Textile Industry (Use of Acetic Acid in Dyes and Finishing)

3.1.3 Rising Demand in Food Preservation (Acidulant Applications)

3.1.4 Technological Innovations in Acetic Acid Production

3.2 Market Challenges

3.2.1 Fluctuating Raw Material Costs (Methanol)

3.2.2 Stringent Environmental Policies

3.2.3 Competition from Bio-based Alternatives

3.3 Opportunities

3.3.1 Development of Bio-based Acetic Acid Solutions

3.3.2 Growth in Emerging Markets (Brazil and Mexico)

3.3.3 Strategic Partnerships for R&D

3.4 Trends

3.4.1 Increasing Adoption in Pharmaceutical Intermediates

3.4.2 Sustainable Production Technologies (Carbon Reduction Initiatives)

3.4.3 Applications in High-performance Packaging

3.5 Government Regulations

3.5.1 Environmental Standards on VOC Emissions

3.5.2 Trade Policies (Import and Export Duties)

3.5.3 Incentives for Green Chemistry Practices

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Latin America Acetic Acid Market Segmentation

4.1 By Application (Value %)

4.1.1 Vinyl Acetate Monomer (VAM)

4.1.2 Purified Terephthalic Acid (PTA)

4.1.3 Acetate Esters

4.1.4 Acetic Anhydride

4.1.5 Solvents

4.2 By End-Use Industry (Value %)

4.2.1 Chemicals

4.2.2 Food and Beverages

4.2.3 Pharmaceuticals

4.2.4 Textiles

4.2.5 Paints and Coatings

4.3 By Production Method (Value %)

4.3.1 Methanol Carbonylation

4.3.2 Acetaldehyde Oxidation

4.3.3 Fermentation

4.3.4 Ethylene Oxidation

4.4 By Distribution Channel (Value %)

4.4.1 Direct Sales

4.4.2 Distributors

4.4.3 Online Platforms

4.5 By Country (Value %)

4.5.1 Brazil

4.5.2 Mexico

4.5.3 Argentina

4.5.4 Chile

4.5.5 Rest of Latin America

5. Latin America Acetic Acid Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Celanese Corporation

5.1.2 BP Chemicals Ltd

5.1.3 LyondellBasell Industries

5.1.4 Eastman Chemical Company

5.1.5 Jiangsu Sopo (Group) Co. Ltd

5.1.6 SABIC

5.1.7 Mitsubishi Chemical Corporation

5.1.8 Wacker Chemie AG

5.1.9 Jubilant Life Sciences Ltd

5.1.10 Helm AG

5.1.11 Daicel Corporation

5.1.12 Chang Chun Group

5.1.13 Svensk Etanolkemi AB (SEKAB)

5.1.14 INEOS Group Holdings

5.1.15 Global Chemical Resources

5.2 Cross-Comparison Parameters

5.2.1 Number of Employees

5.2.2 Revenue

5.2.3 Headquarters

5.2.4 Market Share

5.2.5 Product Portfolio

5.2.6 R&D Investment

5.2.7 Regional Reach

5.2.8 Production Capacity

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Investments

5.6.2 Government Subsidies

5.6.3 Private Equity

6. Latin America Acetic Acid Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Latin America Acetic Acid Future Market Size (USD Billion)

7.1 Projected Market Size

7.2 Key Drivers of Future Growth

8. Latin America Acetic Acid Future Market Segmentation

8.1 By Application (Value %)

8.2 By End-Use Industry (Value %)

8.3 By Production Method (Value %)

8.4 By Distribution Channel (Value %)

8.5 By Country (Value %)

9. Latin America Acetic Acid Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Strategies

9.4 White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping the ecosystem of the Latin America Acetic Acid Market by identifying key players, demand drivers, and growth constraints. Data was sourced from proprietary databases and secondary research from industry reports.

Step 2: Market Analysis and Construction

This step focused on compiling historical data for revenue trends and penetration across various applications. Market sizing was achieved through detailed segmentation analysis validated against industry benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts via interviews provided insights into operational challenges and emerging opportunities. These inputs were used to validate data trends and ensure accuracy.

Step 4: Research Synthesis and Final Output

The final phase involved integrating primary and secondary research findings to deliver an exhaustive market analysis. Inputs from direct interactions with manufacturers strengthened the market's bottom-up approach for reliable insights.

Frequently Asked Questions

01. How big is the Latin America Acetic Acid Market?

The Latin America Acetic Acid Market is valued at USD 1.5 billion, driven by increasing demand in VAM and PTA applications and a growing food and beverage industry.

02. What are the challenges in the Latin America Acetic Acid Market?

Challenges in the Latin America Acetic Acid Market include fluctuating methanol prices, strict environmental regulations, and competition from bio-based chemical alternatives.

03. Who are the major players in the Latin America Acetic Acid Market?

Major players in the Latin America Acetic Acid Market include Celanese Corporation, Eastman Chemical Company, SABIC, Wacker Chemie AG, and Jiangsu Sopo Group.

04. What are the growth drivers of the Latin America Acetic Acid Market?

Key growth drivers of Latin America Acetic Acid Market are the expansion of industrial sectors, rising demand in adhesives and coatings, and technological advancements in production processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.