Latin America Coffee Market Outlook to 2030

Region:Central and South America

Author(s):Sanjna

Product Code:KROD11192

December 2024

98

About the Report

Latin America Coffee Market Overview

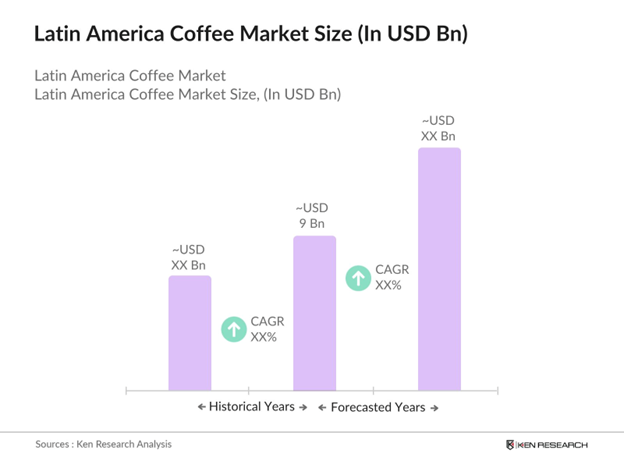

- The Latin America coffee market is valued at USD 9 billion, driven by a robust coffee culture and increasing domestic consumption. The region's rich tradition of coffee production and consumption, coupled with a growing middle class and urbanization, has significantly contributed to this substantial market size.

- Brazil stands as the dominant player in the Latin American coffee market, primarily due to its vast coffee plantations and favorable climatic conditions that support large-scale production. Additionally, countries like Colombia and Mexico have established strong coffee industries, benefiting from ideal growing environments and a deep-rooted coffee culture.

- Latin American governments are implementing National Air Quality Monitoring Programs to address environmental concerns affecting coffee production. For example, Colombia's Ministry of Environment and Sustainable Development has established air quality monitoring networks to assess pollution levels. In 2023, Bogot reported a 10% reduction in average PM2.5 concentrations compared to the previous year, demonstrating the effectiveness of air quality management strategies in urban areas. These programs aim to mitigate air pollution's impact on agriculture, including coffee cultivation, by enforcing regulations that promote cleaner air.

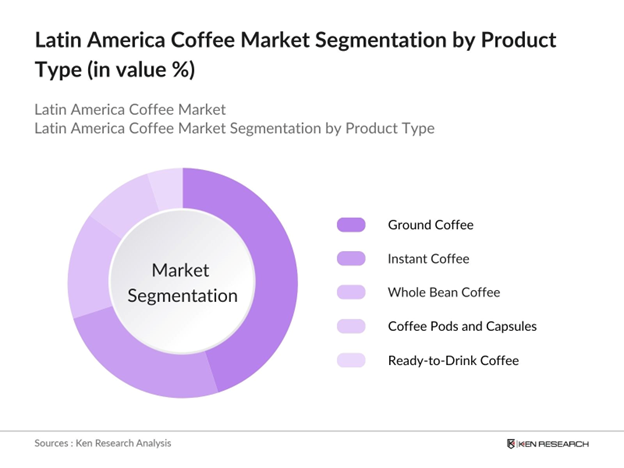

Latin America Coffee Market Segmentation

By Product Type: The Latin America coffee market is segmented by product type into whole bean coffee, ground coffee, instant coffee, coffee pods and capsules, and ready-to-drink coffee. Ground coffee holds a dominant market share in this segment, attributed to its widespread availability and consumer preference for traditional brewing methods. The convenience and rich flavor profile of ground coffee make it a staple in households across the region.

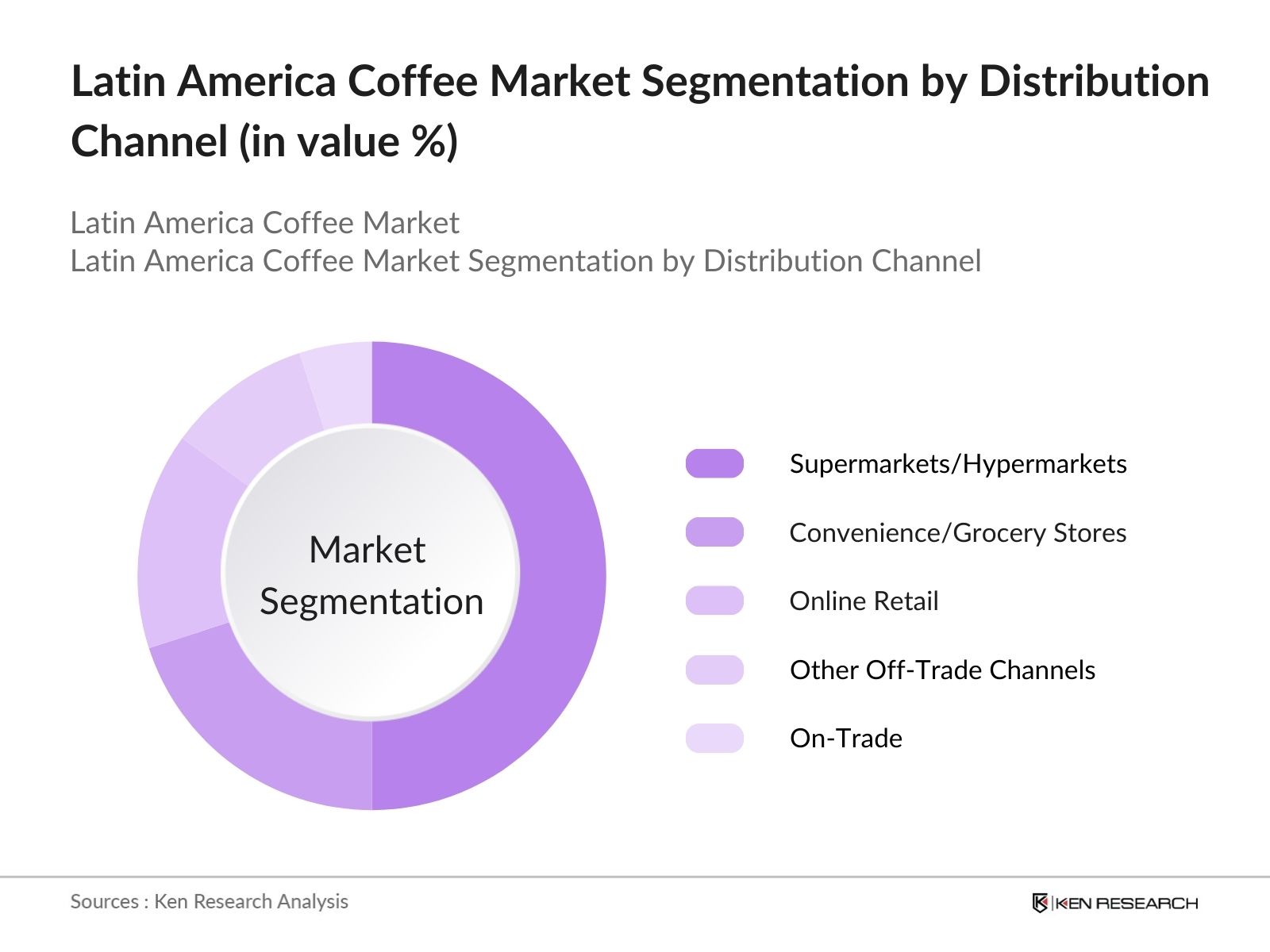

By Distribution Channel: The market is also segmented by distribution channel into on-trade and off-trade. Within the off-trade segment, supermarkets and hypermarkets lead the market share, offering consumers easy access to a wide variety of coffee products. Their extensive reach and diverse product offerings cater to the growing demand for coffee across different consumer demographics.

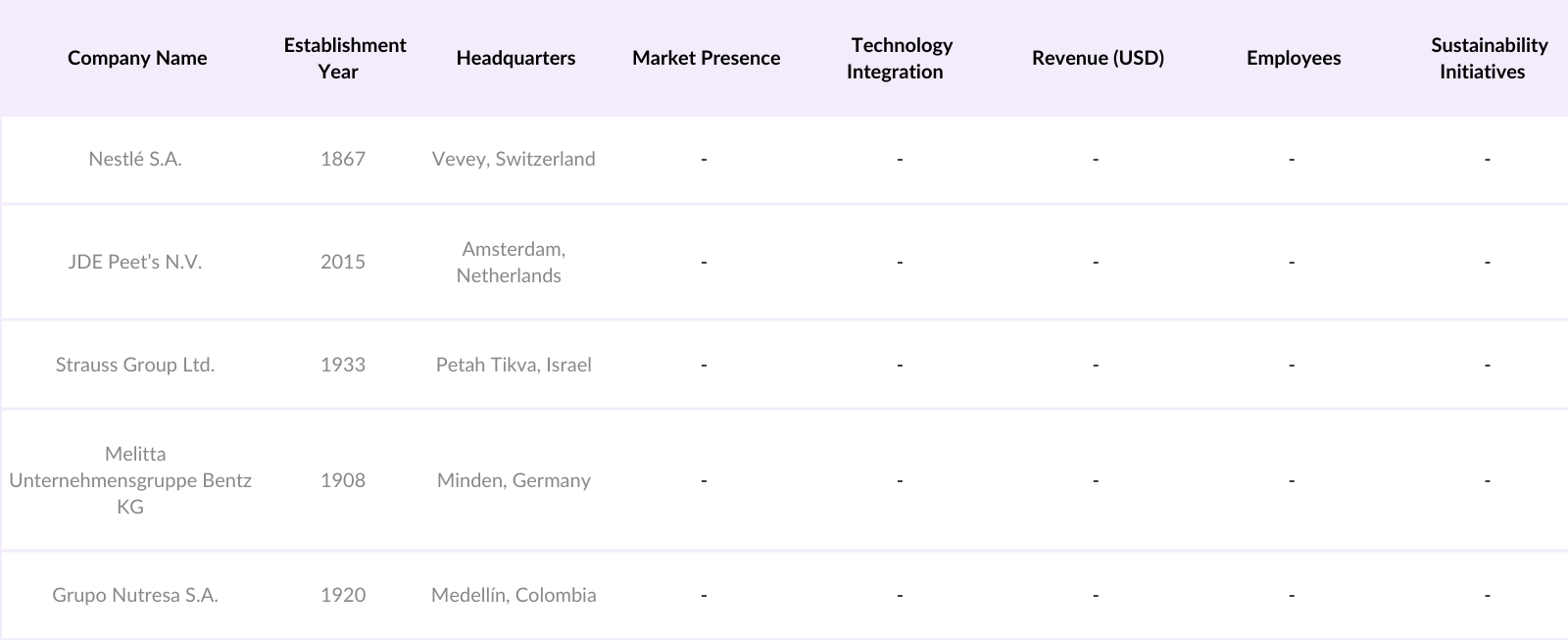

Latin America Coffee Market Competitive Landscape

The Latin America coffee market is characterized by the presence of several key players who have established strong footholds through extensive distribution networks and diverse product portfolios. This competitive environment underscores the significant influence of these companies in shaping market dynamics.

Latin America Coffee Market Analysis

Growth Drivers

- Increasing Demand for Certified Coffee Products: In Latin America, the demand for certified coffee products has surged, driven by consumer awareness of sustainable and ethical sourcing. In 2023, Brazil exported coffee worth USD 9.826 billion, reflecting a significant portion of certified coffee exports. This trend aligns with the global movement towards sustainability, as consumers increasingly prefer products that adhere to environmental and social standards. The rise in certified coffee production not only supports environmental conservation but also enhances the livelihoods of coffee farmers through fair trade practices.

- Consumer Acceptance of Single-Serve Coffee Brew Systems: The adoption of single-serve coffee brew systems has gained momentum in Latin America, offering convenience and variety to consumers. In 2023, Nestl introduced sustainable coffee pods in Brazil, catering to the growing demand for single-serve options. This shift is influenced by urbanization and busier lifestyles, leading consumers to seek quick and easy coffee solutions without compromising on quality. The popularity of single-serve systems has also spurred innovation in flavors and packaging, further driving market growth.

- Innovation in Flavors and Packaging: Latin American coffee producers are increasingly focusing on flavor diversification and innovative packaging to attract a broader consumer base. In 2023, Starbucks expanded its presence in Brazil by opening new stores in Fortaleza, Goinia, Alexnia, and Recife, offering a wide range of coffee products, including ready-to-drink beverages. Such initiatives cater to evolving consumer preferences and enhance the overall coffee experience, contributing to market expansion.

Challenges

- High Initial Costs: The coffee industry in Latin America faces significant challenges due to high initial costs associated with establishing and maintaining coffee plantations. These expenses include land acquisition, planting, and the implementation of sustainable farming practices. For sustainable coffee certifications, costs can range significantly. For instance, the total costs to meet certification standards can be approximately$111 per hectare for larger farmsand$156 per hectare for smaller farms. Additionally, the costs of obtaining certifications for sustainable coffee production add to the financial burden.

- Technical Challenges: Coffee production in Latin America is confronted with technical challenges, including the need for advanced agricultural practices and adaptation to climate change. The region has experienced significant biophysical changes in coffee-growing landscapes over the past two decades, driven by factors such as low coffee prices, changing climatic conditions, and severe plant pathogen outbreaks. These challenges necessitate the adoption of disease-resistant cultivars and the implementation of sustainable farming practices, which require technical expertise and resources that may not be readily available to all farmers.

Latin America Coffee Market Future Outlook

Over the next five years, the Latin America coffee market is expected to experience significant growth, driven by increasing domestic consumption, the expansion of specialty coffee shops, and a growing preference for premium coffee products. Technological advancements in coffee production and processing, along with sustainable farming practices, are anticipated to further propel market growth.

Market Opportunities

- Technological Advancements: The integration of technology in coffee production presents significant opportunities for the Latin American market. In Latin America, coffee leaf rust has caused estimated crop production losses of30%as of 2020, which represents18.4%of global coffee production losses due to this disease. The adoption of disease-resistant cultivars and sustainable farming practices has been instrumental in transforming coffee-growing landscapes across the region. These advancements enhance productivity, improve crop resilience, and contribute to environmental sustainability.

- International Collaborations: Engaging in international collaborations offers Latin American coffee producers access to new markets, resources, and expertise. The International Coffee Organization (ICO) reported that world coffee exports amounted to 10.76 million bags in September 2024, compared with 8.62 million in September 2023, indicating a growing global demand for coffee. By partnering with international organizations and participating in global trade initiatives, Latin American producers can expand their reach, enhance product quality, and adopt best practices, thereby strengthening their position in the global coffee market.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Whole Bean Coffee |

|

By Distribution Channel |

On-Trade |

|

By Packaging Type |

Flexible Packaging |

|

By Nature |

Conventional |

|

By Country |

Brazil |

Products

Key Target Audience

Coffee Producers and Manufacturers

Coffee Distributors and Wholesalers

Retailers and Supermarkets

Coffee Equipment Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Agriculture)

Coffee Exporters and Importers

Specialty Coffee Shops and Cafs

Companies

Players Mentioned in the Report

Nestl S.A.

JDE Peets N.V.

Strauss Group Ltd.

Melitta Unternehmensgruppe Bentz KG

Grupo Nutresa S.A.

Tostadores y Molinos de Cafe Combate S.A. de C.V.

Torrecafe Aguila Roja & Cia S.A.

INDUSTRIAS ALIMENTICIAS MARATA LTDA

Cafe Leon S.A.

Cabrales S.A.

Table of Contents

1. Latin America Coffee Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Latin America Coffee Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Latin America Coffee Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand for Certified Coffee Products

3.1.2 Consumer Acceptance of Single-Serve Coffee Brew Systems

3.1.3 Innovation in Flavors and Packaging

3.1.4 Rising Popularity Among Millennials and Gen Z

3.2 Market Challenges

3.2.1 High Initial Costs

3.2.2 Technical Challenges

3.2.3 Lack of Skilled Workforce

3.3 Opportunities

3.3.1 Technological Advancements

3.3.2 International Collaborations

3.3.3 Expansion into Rural Areas

3.4 Trends

3.4.1 Adoption of IoT

3.4.2 Integration with Smart City Projects

3.4.3 Increased Use of Mobile Monitoring Units

3.5 Government Regulation

3.5.1 National Air Quality Monitoring Program

3.5.2 Emission Reduction Targets

3.5.3 Clean Air Initiative

3.5.4 Public-Private Partnerships

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Latin America Coffee Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Whole Bean Coffee

4.1.2 Ground Coffee

4.1.3 Instant Coffee

4.1.4 Coffee Pods and Capsules

4.1.5 Ready-To-Drink Coffee

4.2 By Distribution Channel (In Value %)

4.2.1 On-Trade

4.2.2 Off-Trade

4.2.2.1 Supermarkets/Hypermarkets

4.2.2.2 Convenience/Grocery Stores

4.2.2.3 Online Retail

4.2.2.4 Other Off-Trade Channels

4.3 By Packaging Type (In Value %)

4.3.1 Flexible Packaging

4.3.2 Folding Cartons

4.3.3 Glass

4.3.4 Others

4.4 By Nature (In Value %)

4.4.1 Conventional

4.4.2 Organic

4.5 By Country (In Value %)

4.5.1 Brazil

4.5.2 Argentina

4.5.3 Chile

4.5.4 Colombia

4.5.5 Mexico

4.5.6 Rest of Latin America

5. Latin America Coffee Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nestl S.A.

5.1.2 JDE Peets N.V.

5.1.3 Strauss Group Ltd.

5.1.4 Melitta Unternehmensgruppe Bentz KG

5.1.5 Grupo Nutresa S.A.

5.1.6 Tostadores y Molinos de Cafe Combate S.A. de C.V.

5.1.7 Torrecafe Aguila Roja & Cia S.A.

5.1.8 INDUSTRIAS ALIMENTICIAS MARATA LTDA

5.1.9 Cafe Leon S.A.

5.1.10 Cabrales S.A.

5.2 Cross Comparison Parameters

Number of Employees

Headquarters

Inception Year

Revenue

Market Share

Product Portfolio

Regional Presence

Strategic Initiatives

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Latin America Coffee Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Latin America Coffee Market Future Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Latin America Coffee Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Packaging Type (In Value %)

8.4 By Nature (In Value %)

8.5 By Country (In Value %)

9. Latin America Coffee Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Latin America Coffee Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Latin America Coffee Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple coffee producers and distributors to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Latin America Coffee Market.

Frequently Asked Questions

01. How big is the Latin America Coffee Market?

The Latin America coffee market is valued at USD 9 billion, driven by a robust coffee culture and increasing domestic consumption.

02. What are the challenges in the Latin America Coffee Market?

Challenges in Latin America coffee market include fluctuating coffee prices due to market volatility, climate change affecting crop yields, and competition from alternative beverages. Additionally, the need for sustainable farming practices poses a challenge for producers.

03. Who are the major players in the Latin America Coffee Market?

Key players in Latin America coffee market include Nestl S.A., JDE Peets N.V., Strauss Group Ltd., Melitta Unternehmensgruppe Bentz KG, and Grupo Nutresa S.A. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04. What are the growth drivers of the Latin America Coffee Market?

Latin America coffee market is propelled by factors such as increasing domestic consumption, the expansion of specialty coffee shops, and a growing preference for premium coffee products. Technological advancements in coffee production and processing also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.