Latin America Head-Up display Market Outlook to 2030

Region:Central and South America

Author(s):Paribhasha Tiwari

Product Code:KROD4869

December 2024

92

About the Report

Latin America Head-Up Display (HUD) Market Overview

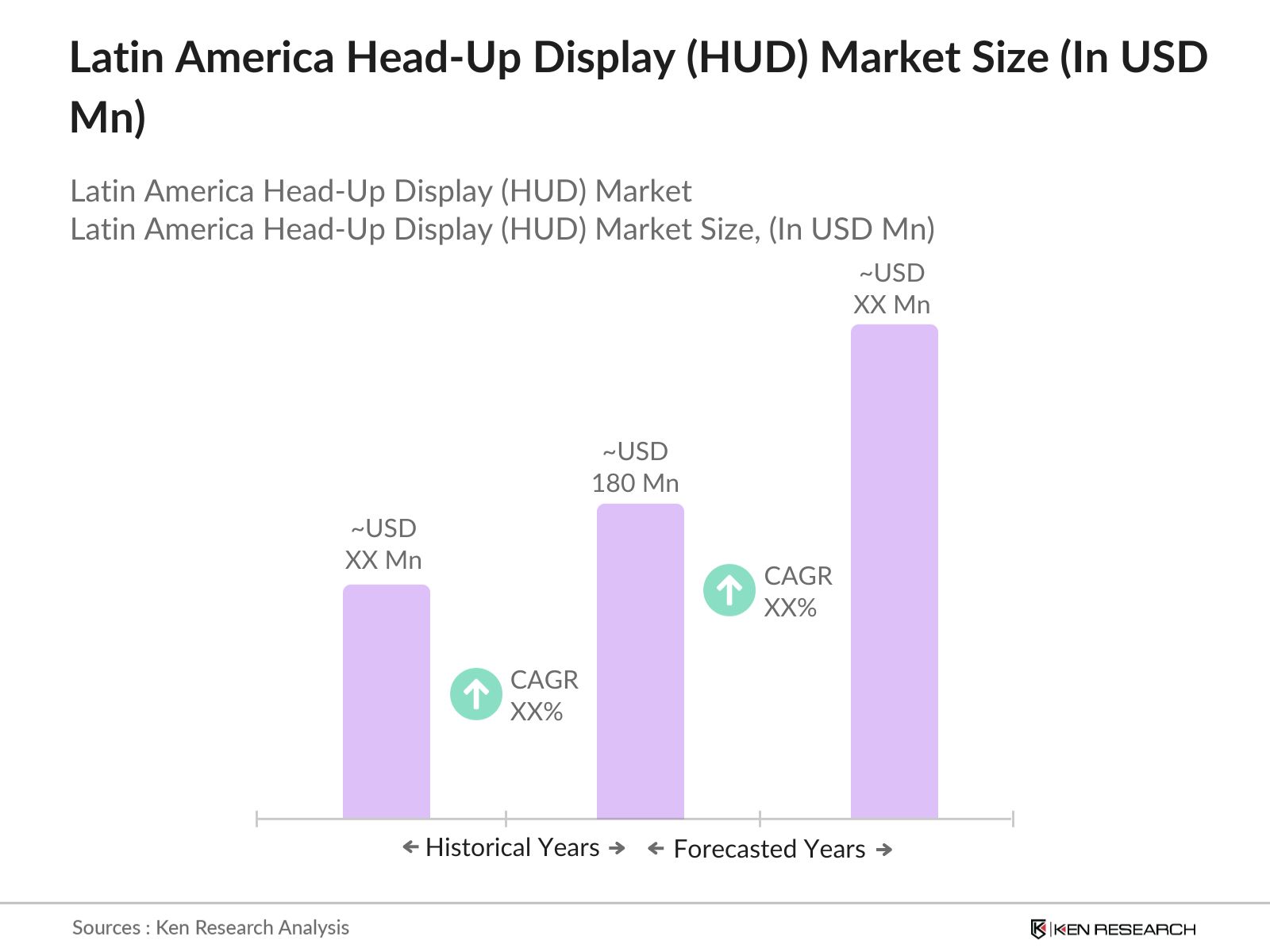

- The Latin America Head-Up Display (HUD) market is valued at USD 180 million, driven by the increasing demand for advanced safety features in the automotive and aviation sectors. This market has grown significantly due to the rise in consumer awareness regarding safety, enhanced user experiences, and technological advancements. HUD systems, once predominantly used in aviation, are now gaining traction in the automotive industry, particularly in premium and electric vehicle (EV) segments, creating a ripple effect of demand across the region.

- In terms of geographical dominance, Brazil and Mexico are the leading markets in Latin America. Brazil, being the largest automotive producer in the region, shows substantial adoption of HUD systems, especially in luxury vehicles. Mexico, due to its role as a major automotive manufacturing hub, contributes significantly to the market's growth. These countries benefit from established automotive industries and an increasing demand for connected vehicles, further cementing their market leadership.

- In 2023, the Brazilian government launched a $1.5 billion initiative to enhance automotive safety by promoting the adoption of advanced driver assistance systems (ADAS), including HUD systems. The initiative aims to reduce traffic-related fatalities and injuries, which stood at 31,000 deaths annually according to Brazil's Ministry of Transportation. By subsidizing safety technologies in vehicles, the government is encouraging automakers to integrate HUD systems into new car models, especially in the growing electric vehicle sector.

Latin America Head-Up Display (HUD) Market Segmentation

By Product Type: The Latin America HUD market is segmented by product type into Windshield HUDs, Combiner HUDs, and Augmented Reality (AR) HUDs. Among these, Windshield HUDs hold a dominant market share due to their wide adoption in both luxury and mid-range vehicles. Windshield HUDs provide a seamless user experience by displaying key driving information directly onto the windshield, reducing driver distraction. Their integration into mid-range vehicles, coupled with the increasing demand for electric vehicles (EVs) across the region, has significantly driven their adoption. Additionally, the high cost-efficiency and ease of manufacturing for Windshield HUDs make them a preferred choice for automakers in Latin America.

By Application: The market is also segmented by application into Automotive, Aviation, and Industrial sectors. The Automotive segment holds the largest share of the HUD market in Latin America. The growing adoption of HUD systems in luxury and high-end vehicles, combined with rising safety regulations, is propelling the market growth. Additionally, as more Latin American consumers opt for electric vehicles (EVs), automakers are focusing on integrating HUD systems to enhance the driving experience. The Aviation sector, although smaller in market share, is witnessing growth in both military and commercial aviation as HUD systems become critical for flight safety and navigation.

Latin America Head-Up Display (HUD) Market Competitive Landscape

The Latin America HUD market is dominated by key international players who are continuously investing in R&D to bring about innovations in augmented reality and advanced HUD technologies. The competitive landscape is concentrated, with major companies holding significant influence due to their extensive distribution networks and partnerships with automakers.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

Revenue (USD) |

R&D Expenditure |

Market Share |

Innovation Index |

Strategic Partnerships |

Mergers & Acquisitions |

|

Continental AG |

1871 |

Hanover, Germany |

- | - | - | - | - | - | - |

|

Bosch Automotive |

1886 |

Gerlingen, Germany |

- | - | - | - | - | - | - |

|

Denso Corporation |

1949 |

Kariya, Japan |

- | - | - | - | - | - | - |

|

Panasonic Corporation |

1918 |

Osaka, Japan |

- | - | - | - | - | - | - |

|

Visteon Corporation |

2000 |

Michigan, USA |

- | - | - | - | - | - | - |

Latin America Head-Up Display Market Analysis

Growth Drivers

- Increasing Automotive Production: In 2024, Latin America's automotive sector remains a crucial driver of the Head-Up Display (HUD) market. Brazil, as the region's largest automotive manufacturer, produced around 2.2 million vehicles in 2022, with Mexico following close behind. This high automotive output is driving the demand for advanced safety and convenience features like HUD systems. These systems are particularly being integrated into mid-range and premium vehicles, enhancing both driver experience and safety. The strong automotive production levels across key countries, such as Argentina and Mexico, are expected to sustain demand for HUDs across the Latin American market.

- Rising Investments in Aerospace and Defense: Brazil's defense spending reached $30 billion in 2023, a significant portion of which is dedicated to upgrading avionics systems for military aviation. This includes integrating HUD systems to enhance flight navigation and safety. Latin Americas civil aviation sector, too, saw a resurgence post-pandemic, with over 300 million passengers in 2022. Aerospace manufacturers in Brazil and Mexico are increasingly incorporating HUD technology to improve safety and operational efficiency, particularly in civil and military aviation. This rising demand in aerospace and defense is expected to bolster the HUD market in the region.

- Government Policies Encouraging Technological Innovation: Latin American governments are prioritizing technological advancements within the automotive and aviation sectors to promote safety. Brazil and Mexico have introduced policies to incentivize the adoption of advanced driving and flying assistance technologies, including HUD systems. In 2023, the Brazilian government allocated $1.5 billion to support innovation in automotive safety systems, with a focus on real-time driver assistance technologies like HUDs. Such government initiatives, aimed at reducing road accidents and enhancing transportation infrastructure, are set to drive the demand for HUD systems in the coming years.

Market Challenges

- High Initial Costs of HUD Systems: Although the adoption of HUD systems is growing, their high cost remains a significant barrier in Latin America. With an average vehicle price in Brazil of around $25,000 in 2023, the addition of HUD systems could increase this price by up to $2,000. This makes HUD systems less accessible to mid-income consumers. Additionally, since most HUD components are imported, currency fluctuations and supply chain disruptions can further raise costs, making it difficult for automotive manufacturers to integrate these systems across lower-priced models in emerging Latin American markets.

- Underdeveloped Infrastructure in Some Countries: The lack of sufficient infrastructure, particularly in rural areas of countries like Bolivia, Paraguay, and Peru, limits the use of HUD systems, which rely heavily on good road conditions and reliable traffic data for optimal performance. According to the World Bank, only 20% of roads in Bolivia are paved, creating challenges for the effective implementation of advanced automotive technologies. These infrastructure deficits not only hinder HUD adoption but also reduce the effectiveness of the systems in areas with limited road and traffic infrastructure.

Latin America Head-Up Display (HUD) Market Future Outlook

Over the next five years, the Latin America Head-Up Display market is expected to experience significant growth, driven by increased adoption of electric and autonomous vehicles, along with the rising importance of safety and convenience features. The expansion of the automotive and aviation sectors in countries like Brazil, Mexico, and Argentina will further contribute to this growth. Additionally, the introduction of augmented reality HUDs and advancements in display technologies will enhance the capabilities of HUD systems, making them more appealing to both automakers and consumers.

Market Opportunities

- Expansion into Electric and Autonomous Vehicles: Latin Americas electric vehicle (EV) market is growing rapidly, with over 20,000 electric vehicles sold in 2022, mainly concentrated in Brazil and Chile. As EV adoption rises, so does the opportunity for HUD systems to be integrated into these vehicles, offering features like real-time battery status updates, navigation, and traffic information. Additionally, Brazils recent $1.3 billion investment in autonomous vehicle development provides an ideal platform for advanced HUD technologies. The shift toward sustainable transportation solutions offers a significant growth avenue for HUD manufacturers as electric and autonomous vehicles increasingly require sophisticated display technologies.

- Integration with Advanced Driver Assistance Systems (ADAS): Advanced Driver Assistance Systems (ADAS) are becoming more common in Latin American vehicles, and HUD systems are a critical component of this trend. In 2023, Latin America saw over 1.5 million ADAS-equipped vehicles, primarily in Brazil and Mexico, where automakers are increasingly integrating HUD systems with features like lane departure warnings and adaptive cruise control. As ADAS adoption continues to grow, the demand for HUD systems will rise in tandem, particularly as consumers and manufacturers look for ways to enhance vehicle safety and functionality.

Scope of the Report

|

By Product Type |

Windshield HUD Combiner HUD Augmented Reality HUD |

|

By Component |

Projector Display Panel Software Video Generator |

|

By Application |

Automotive (Passenger Vehicles, Commercial Vehicles) Aviation Industrial Apps |

|

By Technology |

Conventional HUD Augmented Reality HUD |

|

By Country |

Brazil Mexico Argentina Chile Rest of Latin America |

Products

Key Target Audience

Automotive OEMs

Aviation Manufacturers

HUD Component Suppliers

Electric Vehicle Manufacturers

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Brazil's National Traffic Department)

AR and VR Technology Providers

HUD Software Developers

Companies

Players Mentioned in the Report:

Continental AG

Bosch Automotive

Denso Corporation

Panasonic Corporation

Visteon Corporation

WayRay SA

Garmin Ltd

Thales Group

Rockwell Collins

HUDWAY LLC

Table of Contents

1. Latin America Head-Up Display Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Latin America Head-Up Display Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Latin America Head-Up Display Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption in Automotive Industry (Passenger, Commercial Vehicles)

3.1.2. Rising Demand in Aerospace and Defense (Military Aviation, Civil Aviation)

3.1.3. Technological Advancements (Augmented Reality, Holographic Displays)

3.1.4. Growing Consumer Awareness for Enhanced Driving Experience

3.2. Market Challenges

3.2.1. High Initial Cost of HUD Systems

3.2.2. Lack of Infrastructure in Emerging Economies (Latin America-specific)

3.2.3. Technical Limitations in Complex Environments (Weather Conditions, Road Infrastructure)

3.3. Opportunities

3.3.1. Expansion into Electric and Autonomous Vehicles

3.3.2. Integration with Advanced Driver Assistance Systems (ADAS)

3.3.3. Growth in Demand for Premium and Luxury Cars in Latin America

3.4. Trends

3.4.1. Adoption of Augmented Reality HUDs

3.4.2. Collaboration with Software Providers for Enhanced User Interfaces

3.4.3. Increase in Aftermarket HUD Solutions

3.5. Government Regulation

3.5.1. Safety Standards for HUD in Automotive Applications (Local, Regional Regulations)

3.5.2. Aviation Regulations for HUD Use in Commercial Planes

3.5.3. Environmental Standards for HUD Manufacturing (Green Initiatives)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of Substitutes

3.8.4. Threat of New Entrants

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Latin America Head-Up Display Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Windshield HUD

4.1.2. Combiner HUD

4.1.3. Augmented Reality HUD

4.2. By Component (In Value %)

4.2.1. Projector

4.2.2. Display Panel

4.2.3. Software

4.2.4. Video Generator

4.3. By Application (In Value %)

4.3.1. Automotive (Passenger Vehicles, Commercial Vehicles)

4.3.2. Aviation (Military Aviation, Civil Aviation)

4.3.3. Others (Wearable Displays, Industrial Applications)

4.4. By Technology (In Value %)

4.4.1. Conventional HUD

4.4.2. Augmented Reality HUD

4.5. By Country (In Value %)

4.5.1. Brazil

4.5.2. Mexico

4.5.3. Argentina

4.5.4. Chile

4.5.5. Rest of Latin America

5. Latin America Head-Up Display Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Continental AG

5.1.2. Denso Corporation

5.1.3. Nippon Seiki Co. Ltd

5.1.4. Panasonic Corporation

5.1.5. Visteon Corporation

5.1.6. Bosch Automotive

5.1.7. Harman International

5.1.8. WayRay SA

5.1.9. Pioneer Corporation

5.1.10. YAZAKI Corporation

5.1.11. BAE Systems

5.1.12. Thales Group

5.1.13. Rockwell Collins

5.1.14. HUDWAY LLC

5.1.15. Garmin Ltd

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, R&D Investment, Regional Presence, Innovation Index, Market Share, Key Strategic Initiatives, Product Launches)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Product Development)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Latin America Head-Up Display Market Regulatory Framework

6.1. Automotive and Aviation Safety Regulations

6.2. Compliance and Certification Requirements

6.3. Environmental Standards for Display Manufacturing

7. Latin America Head-Up Display Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Latin America Head-Up Display Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Component (In Value %)

8.5. By Country (In Value %)

9. Latin America Head-Up Display Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Serviceable Available Market (SAM) Analysis

9.3. Serviceable Obtainable Market (SOM) Analysis

9.4. White Space Opportunity Analysis

9.5. Customer Segmentation and Strategy

Research Methodology

Step 1: Identification of Key Variables

The first step involves developing a comprehensive ecosystem of the Latin America HUD market. Through desk research and industry databases, we map key stakeholders, including manufacturers, distributors, and end-users. Critical variables such as technological advancements and market demand drivers are identified at this stage.

Step 2: Market Analysis and Construction

In this phase, we analyze historical market data for HUD penetration in the automotive and aviation sectors. Market shares, demand drivers, and geographic penetration of HUD technologies are studied in-depth. This phase includes a thorough assessment of market saturation levels in leading regions like Brazil and Mexico.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses regarding market growth and challenges are validated through interviews with industry experts and executives from major players like Continental AG and Bosch Automotive. These consultations allow us to cross-check market estimations and provide insights into upcoming trends.

Step 4: Research Synthesis and Final Output

Finally, a detailed synthesis of the research findings is conducted. This includes the consolidation of primary data, industry feedback, and market forecasts. The research output provides a well-rounded, validated analysis of the Latin America HUD market.

Frequently Asked Questions

01. How big is the Latin America Head-Up Display Market?

The Latin America Head-Up Display market is valued at USD 180 million, driven by the demand for advanced safety systems in automotive and aviation applications.

02. What are the challenges in the Latin America Head-Up Display Market?

Key challenges in the Latin America Head-Up Display market include the high initial costs of HUD systems, the technical complexity of integrating HUDs into vehicles, and the lack of infrastructure in emerging Latin American markets.

03. Who are the major players in the Latin America Head-Up Display Market?

Major players in the Latin America Head-Up Display market include Continental AG, Bosch Automotive, Denso Corporation, Panasonic Corporation, and Visteon Corporation, all of which have established strong footholds in the market.

04. What are the growth drivers of the Latin America Head-Up Display Market?

The Latin America Head-Up Display market is propelled by the growing adoption of HUD systems in luxury and electric vehicles, increasing safety regulations, and advancements in augmented reality technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.