Latin America Natural Food Colors Market Outlook to 2030

Region:Central and South America

Author(s):Paribhasha Tiwari

Product Code:KROD3596

December 2024

90

About the Report

Latin America Natural Food Colors Market Overview

- The Latin America Natural Food Colors market is experiencing robust growth driven by increasing consumer preference for clean-label products and the rise of plant-based food alternatives. The market is valued at USD 250 million, with the natural ingredients trend pushing companies to shift towards sustainable and organic alternatives. With consumer health concerns at the forefront, the demand for natural food coloring is growing, especially in processed foods, dairy, and beverages. This shift is supported by various government regulations restricting synthetic color additives, further fueling the natural food color market in the region.

- Key countries such as Brazil, Mexico, and Argentina dominate the Latin American natural food colors market. Brazil stands out due to its strong agricultural sector, which provides a steady supply of raw materials like annatto, turmeric, and other plant-based sources used in the production of natural colors. Mexico follows closely, leveraging its large processed food industry and increasing exports to neighboring North American markets, further establishing its dominance in the region.

- The Brazilian government, through ANVISA, has implemented stricter regulations on the use of synthetic additives in food products. These regulations, revised in 2023, have promoted the adoption of natural food colors in processed and packaged foods. The initiative focuses on reducing the consumption of artificial colors, which are linked to health concerns, and encouraging the use of safer, plant-based alternatives. In response to these regulations, companies in Brazil are reformulating their food and beverage products to include natural colorants derived from local sources such as annatto and turmeric.

Latin America Natural Food Colors Market Segmentation

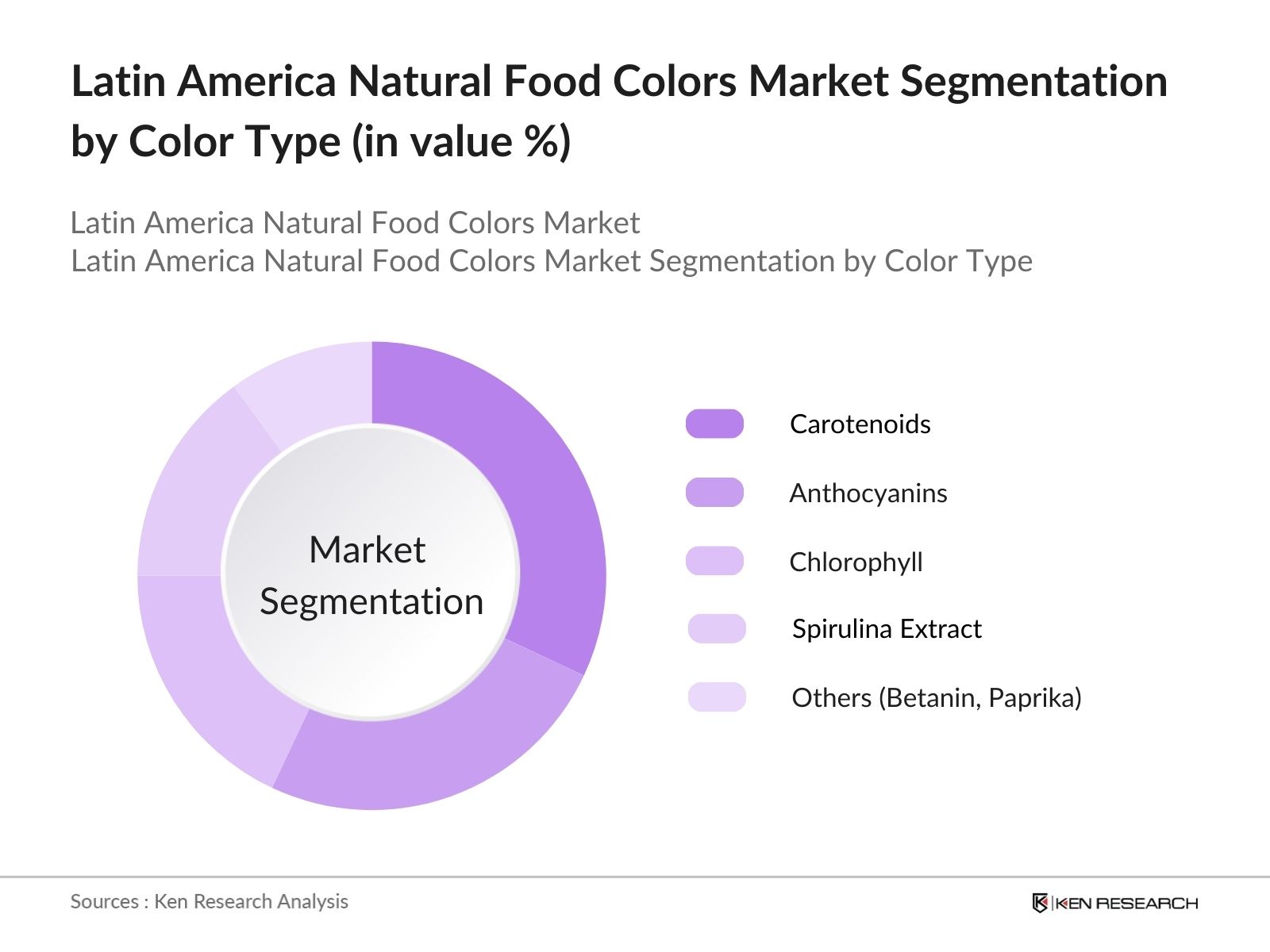

By Color Type: The Latin America Natural Food Colors market is segmented by color type into anthocyanins, carotenoids, chlorophyll, spirulina extract, and others (betanin, paprika extract). Among these, carotenoids, derived from sources such as tomatoes, carrots, and peppers, dominate the market share due to their widespread use in beverages and dairy products. Carotenoids are favored for their vibrant color and antioxidant properties, making them popular in health-conscious food segments.

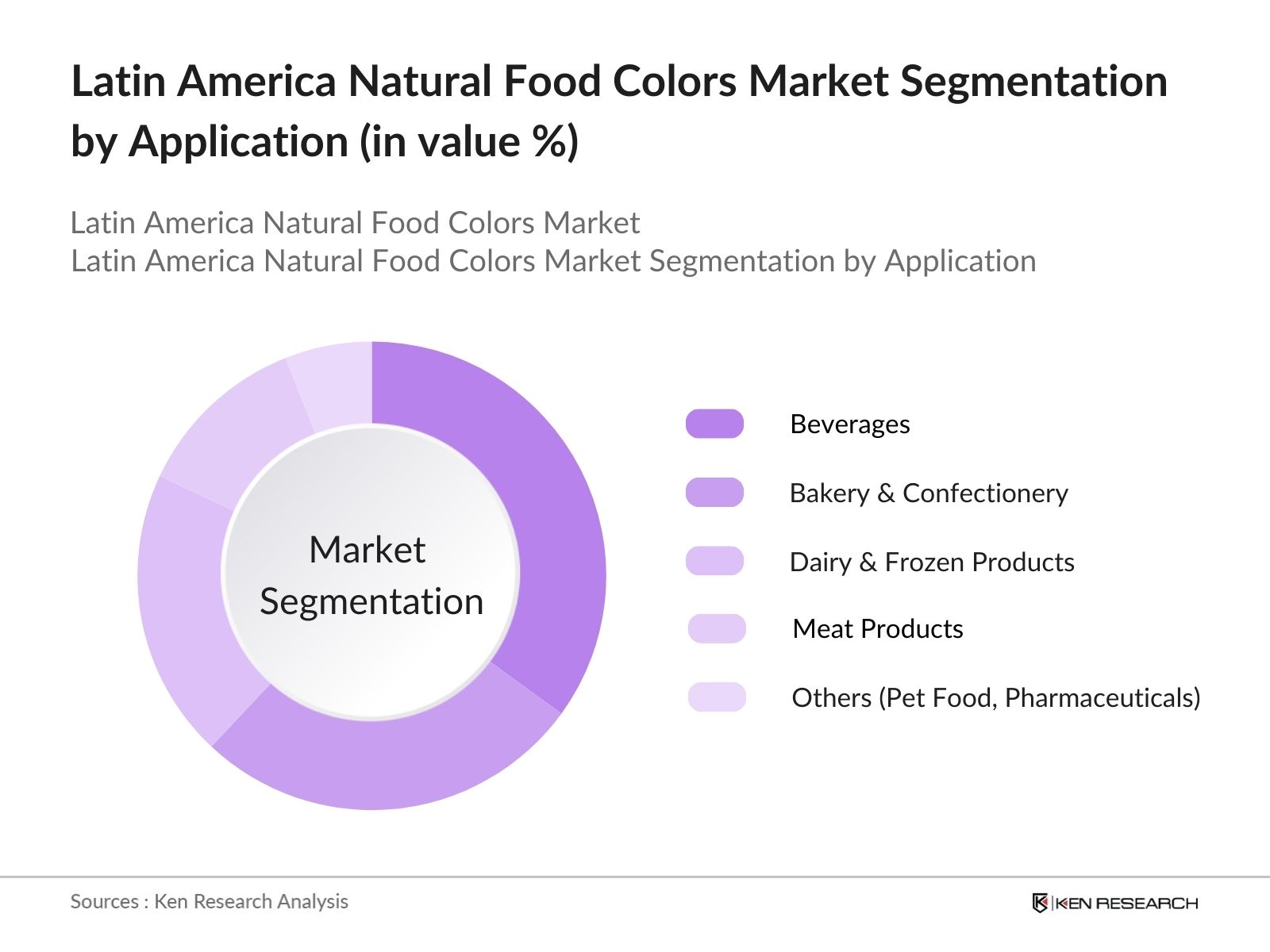

By Application: The market is segmented by application into beverages, bakery & confectionery, dairy & frozen products, meat products, and others (pet food, pharmaceuticals). The beverages segment holds a dominant position in the market due to the rising consumption of fruit-based drinks, smoothies, and flavored waters. The demand for visually appealing, natural, and healthy beverage options has fueled the uptake of natural food colors in this segment.

Latin America Natural Food Colors Market Competitive Landscape

The Latin America Natural Food Colors market is characterized by the presence of both global and local players. These companies are constantly investing in R&D to innovate and develop new, stable, and vibrant natural food color formulations to cater to the evolving demands of the food and beverage industry. The competitive landscape is marked by consolidation, with larger companies acquiring smaller, innovative firms to expand their product portfolios and market reach.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

No. of Employees |

R&D Expenditure |

Sustainability Initiatives |

Global Reach |

Revenue (USD Mn) |

|

GNT Group |

1978 |

The Netherlands |

- | - | - | - | - | - |

|

Sensient Technologies |

1882 |

USA |

- | - | - | - | - | - |

|

Chr. Hansen Holding |

1873 |

Denmark |

- | - | - | - | - | - |

|

Naturex (Givaudan) |

1992 |

France |

- | - | - | - | - | - |

|

Kalsec Inc. |

1958 |

USA |

- | - | - | - | - | - |

Latin America Natural Food Colors Market Analysis

Growth Drivers

- Increased Consumer Preference for Natural Ingredients: Consumers in Latin America are increasingly seeking natural alternatives in food products due to growing health consciousness. In 2024, demand for food products without synthetic additives has surged, with consumers opting for foods colored using ingredients like turmeric, beetroot, and spirulina. According to a government survey conducted in Brazil, 70 million consumers actively avoid synthetic ingredients, pushing manufacturers to adopt natural food colors in processed goods. This shift in consumer preferences is driving significant growth in the natural food colors market as companies reformulate their offerings to meet this demand.

- Rise of Clean Label Products in Processed Foods: The "clean label" movement has gained momentum in Latin America, as consumers seek transparency in the ingredients used in food products. This demand is especially high in Brazil and Mexico, where processed food companies have increasingly begun labeling their products with clear ingredient lists that avoid artificial colors. Data from the Brazilian Ministry of Health indicates a 15% increase in the sales of clean label products in 2024, fueling the demand for natural food colors as companies aim to meet regulatory and consumer expectations for healthier, simpler products.

- Regulatory Push for Natural Additives in Food Products: Governments across Latin America have begun enforcing stricter regulations on the use of synthetic additives in food products. Mexicos Secretariat of Health, in particular, implemented policies in 2023 that limit the use of certain artificial colors in food and beverage products. As a result, food producers in Mexico are increasingly turning to natural food colors to comply with regulations, creating a growing market for natural alternatives. This trend is supported by government-backed initiatives that encourage the use of safe, natural ingredients.

Market Challenges

- High Cost of Sourcing Natural Raw Materials One of the main challenges for manufacturers in Latin America is the high cost of sourcing raw materials for natural food colors. Ingredients like spirulina and turmeric often need to be imported or grown under specific conditions, which adds to production costs. In 2024, data from Mexicos Ministry of Agriculture show that the cost of cultivating natural color sources like beets and carrots has increased by 10%, placing pressure on small and mid-sized food companies that rely on these materials for their product lines.

- Limited Availability of Raw Materials in Latin America The limited availability of key raw materials for natural food color production is another significant barrier for the market. Although Latin America is a large producer of various natural products, the supply chains for specific natural colorants, such as saffron or spirulina, are underdeveloped in many countries. For instance, only 5% of Latin American farms produce crops dedicated to natural color extraction. The lack of local sources forces manufacturers to depend on imports, driving up costs and limiting the scalability of natural food color production.

Latin America Natural Food Colors Market Future Outlook

Over the coming years, the Latin America Natural Food Colors market is expected to grow significantly due to continued consumer demand for organic and sustainable products. As health consciousness rises and regulatory bodies increasingly push for the restriction of synthetic additives, natural food color manufacturers will continue to innovate in response to market demands. The expanding middle class in Latin America and the ongoing efforts of regional governments to promote sustainable agriculture will also play a vital role in driving future market growth.

Market Opportunities

- Growing Veganism and Plant-Based Foods The rising trend of veganism and plant-based diets in Latin America has created new opportunities for natural food color producers. Vegan food companies in markets like Brazil and Chile are increasingly using plant-based natural colors in their products to appeal to health-conscious consumers. In 2024, the number of vegan food producers doubled, contributing to the increased demand for natural colors derived from fruits and vegetables like carrots and blueberries, which are seen as clean and ethical choices for plant-based consumers.

- Expansion into Non-Food Sectors (Cosmetics, Pharmaceuticals) There is growing interest in using natural colors not just in food but also in non-food sectors such as cosmetics and pharmaceuticals. In countries like Mexico and Colombia, natural colors are being used to replace synthetic dyes in beauty and skincare products, as consumers demand more eco-friendly and health-conscious options. Data from Mexicos Ministry of Health showed that the use of natural ingredients in cosmetic products increased by 25% in 2024, and this shift opens up significant opportunities for natural food color manufacturers to diversify their product offerings.

Scope of the Report

|

By Color Type |

Anthocyanins Carotenoids Chlorophyll Spirulina Extract Others (Betanin, Paprika Extract) |

|

By Source |

Plant-Based Animal-Based Microbial |

|

By Application |

Beverages Bakery & Confectionery Dairy & Frozen Products Meat Products Others (Pet Food, Pharmaceuticals) |

|

By Form |

Powder Liquid Gel |

|

By Distribution Channel |

Direct Sales Distributors/Wholesalers Online Retail |

Products

Key Target Audience

Food and Beverage Manufacturers

Organic and Natural Food Retailers

Government and Regulatory Bodies (ANVISA, COFEPRIS)

Investors and Venture Capitalist Firms

Food Processing Companies

Natural Ingredient Suppliers

Sustainable Agriculture Cooperatives

Exporters and Importers of Food Additives

Companies

Players Mentioned in the Report:

GNT Group

Sensient Technologies

Chr. Hansen Holding

Naturex (Givaudan)

Kalsec Inc.

San-Ei Gen F.F.I., Inc.

Roha Dyechem

DDW (D.D. Williamson)

Symrise AG

ADM (Archer Daniels Midland Company)

Table of Contents

1. Latin America Natural Food Colors Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Latin America Natural Food Colors Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Latin America Natural Food Colors Market Analysis

3.1. Growth Drivers (Natural Ingredient Demand, Clean Label Trend, Regulatory Influence)

3.1.1. Increased Consumer Preference for Natural Ingredients

3.1.2. Rise of Clean Label Products in Processed Foods

3.1.3. Regulatory Push for Natural Additives in Food Products

3.1.4. Demand from Organic Food Processing Industry

3.2. Market Challenges (Supply Chain Constraints, Price Volatility)

3.2.1. High Cost of Sourcing Natural Raw Materials

3.2.2. Limited Availability of Raw Materials in Latin America

3.2.3. Production Costs in Comparison to Synthetic Colors

3.2.4. Shelf-life and Stability of Natural Colors

3.3. Opportunities (Sustainability, Product Innovation)

3.3.1. Growing Veganism and Plant-Based Foods

3.3.2. Expansion into Non-Food Sectors (Cosmetics, Pharmaceuticals)

3.3.3. Research in Sustainable Sourcing of Raw Materials

3.3.4. Collaboration Between Regional and Global Players for Innovation

3.4. Trends (Technological Advancements, End-Use Industry Adoption)

3.4.1. Advancements in Extraction Technologies

3.4.2. Growing Adoption in Beverages and Bakery Products

3.4.3. Increased Use in Dairy and Frozen Desserts

3.4.4. Shift Toward Hybrid Natural-Synthetic Color Solutions

3.5. Government Regulations (Labeling Standards, Safety Regulations)

3.5.1. Regulation of Additives by Latin American Food Safety Authorities

3.5.2. Harmonization of Food Color Additive Standards in Latin America

3.5.3. Guidelines on Labeling and Packaging of Products Using Natural Colors

3.5.4. Tax Incentives for Organic and Natural Food Products

3.6. SWOT Analysis

3.7. Stake Ecosystem (Farmers, Suppliers, Processors, End-Use Industries)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Latin America Natural Food Colors Market Segmentation

4.1. By Color Type (In Value %)

4.1.1. Anthocyanins

4.1.2. Carotenoids

4.1.3. Chlorophyll

4.1.4. Spirulina Extract

4.1.5. Others (Betanin, Paprika Extract)

4.2. By Source (In Value %)

4.2.1. Plant-Based

4.2.2. Animal-Based

4.2.3. Microbial

4.3. By Application (In Value %)

4.3.1. Beverages

4.3.2. Bakery & Confectionery

4.3.3. Dairy & Frozen Products

4.3.4. Meat Products

4.3.5. Others (Pet Food, Pharmaceuticals)

4.4. By Form (In Value %)

4.4.1. Powder

4.4.2. Liquid

4.4.3. Gel

4.5. By Distribution Channel (In Value %)

4.5.1. Direct Sales

4.5.2. Distributors/Wholesalers

4.5.3. Online Retail

5. Latin America Natural Food Colors Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. GNT Group

5.1.2. Sensient Technologies

5.1.3. Chr. Hansen Holding

5.1.4. DDW (D.D. Williamson)

5.1.5. Naturex (Part of Givaudan)

5.1.6. Kalsec Inc.

5.1.7. San-Ei Gen F.F.I., Inc.

5.1.8. Roha Dyechem

5.1.9. Frutarom Industries Ltd.

5.1.10. ADM (Archer Daniels Midland Company)

5.1.11. Symrise AG

5.1.12. IFC Solutions

5.1.13. FMC Corporation

5.1.14. Lycored

5.1.15. BioconColors

5.2. Cross Comparison Parameters

(No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Global Reach, Sustainability Initiatives, Research & Development Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Latin America Natural Food Colors Market Regulatory Framework

6.1. Food Safety and Additives Standards

6.2. Certification and Compliance Requirements

6.3. Eco-Labeling and Sustainability Regulations

6.4. Customs and Trade Policies

7. Latin America Natural Food Colors Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Latin America Natural Food Colors Future Market Segmentation

8.1. By Color Type (In Value %)

8.2. By Source (In Value %)

8.3. By Application (In Value %)

8.4. By Form (In Value %)

8.5. By Distribution Channel (In Value %)

9. Latin America Natural Food Colors Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves the creation of a market ecosystem map to identify the major stakeholders within the Latin America Natural Food Colors Market. Extensive desk research and secondary data analysis are conducted, including government databases and proprietary databases, to gather industry-level data.

Step 2: Market Analysis and Construction

In this stage, historical market data is compiled and analyzed, assessing factors such as market penetration, demand for specific food colors, and overall market revenue. This includes an evaluation of various segments and key product categories to ensure accuracy in revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

A set of market hypotheses are validated through direct consultations with industry experts, using computer-assisted telephone interviews (CATIs) and in-depth interviews with stakeholders across the supply chain. These insights help refine and corroborate the market data.

Step 4: Research Synthesis and Final Output

The final step entails engagement with key players in the food and beverage sector to gain insights into product development, sales performance, and market dynamics. This data is synthesized to form a comprehensive, validated analysis of the Latin America Natural Food Colors Market.

Frequently Asked Questions

1. How big is the Latin America Natural Food Colors Market?

The Latin America Natural Food Colors market is valued at USD 250 million, driven by the increasing demand for clean-label and natural products across various food and beverage sectors.

2. What are the challenges in the Latin America Natural Food Colors Market?

Challenges in the Latin America Natural Food Colors market include high production costs due to the sourcing of raw materials, limited shelf-life of natural colorants, and stringent regulations on food additives, which can increase operational complexity for manufacturers.

3. Who are the major players in the Latin America Natural Food Colors Market?

Key players in the Latin America Natural Food Colors market include GNT Group, Sensient Technologies, Chr. Hansen Holding, Naturex (Givaudan), and Kalsec Inc., each dominating through their strong portfolios of natural and plant-based colorants.

4. What are the growth drivers of the Latin America Natural Food Colors Market?

The Latin America Natural Food Colors market is propelled by the growing consumer demand for organic and clean-label products, as well as regulatory pressure to reduce the use of synthetic food colorants in processed foods.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.