Malaysia Warehousing Market Outlook to 2028

Driven by ecommerce industrial growth, trade agreements & regulatory measures

Region:Asia

Author(s):Sunaiyna and Rajat

Product Code:KR1457

October 2024

91

About the Report

Malaysia Warehousing Market Overview:

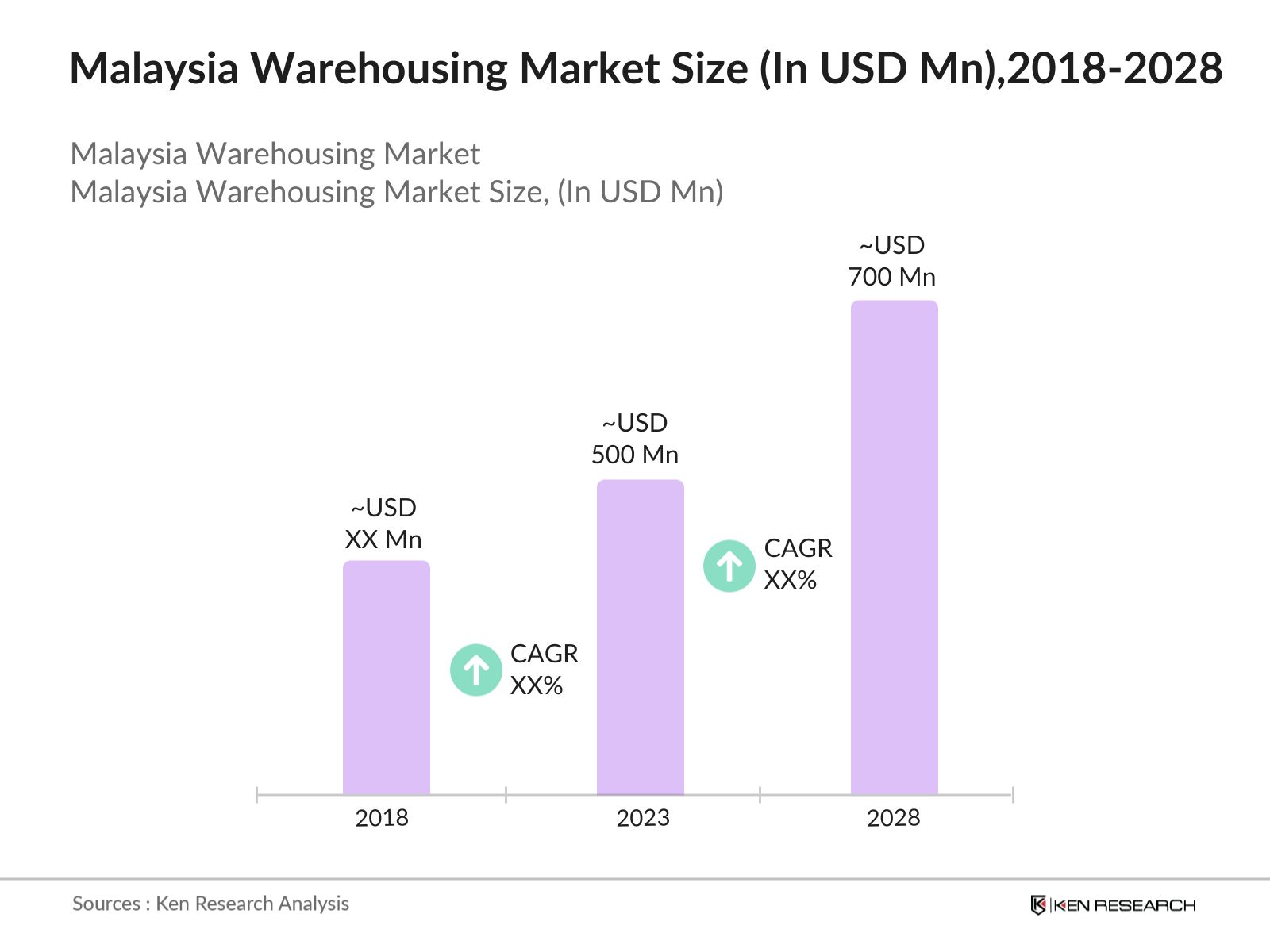

- Malaysia Warehousing Market reached a size of USD 500 million in 2023. This market is driven primarily by the country's strategic location within Southeast Asia, which has made it a crucial logistics hub for the region. The growing demand for e-commerce, coupled with increased international trade, has significantly boosted the need for warehousing facilities.

- Key players in the market include Tiong Nam Logistics Holdings Berhad, YCH Group, Kerry Logistics Network Limited, Kuehne + Nagel, and DHL Supply Chain. These companies have established strong footholds due to their extensive networks and high standards of service.

- In 2023, Tiong nam completed a new 1.1 million square feet of RM200 million mega-warehouse facility for lease to Mercedes-Benz in Senai, Johor. This will enhance logistics efficiency for Mercedes-Benz, catering to the growing demand in the automotive sector and is expected to play a crucial role in supporting Mercedes-Benz's supply chain operations across Southeast Asia.

- Selangor is a pivotal hub in Malaysia's warehousing market, primarily due to its strategic location, advanced infrastructure, and proximity to key transportation nodes. As the most developed and populous state in Malaysia, Selangor plays a crucial role in the country's logistics and supply chain sectors.

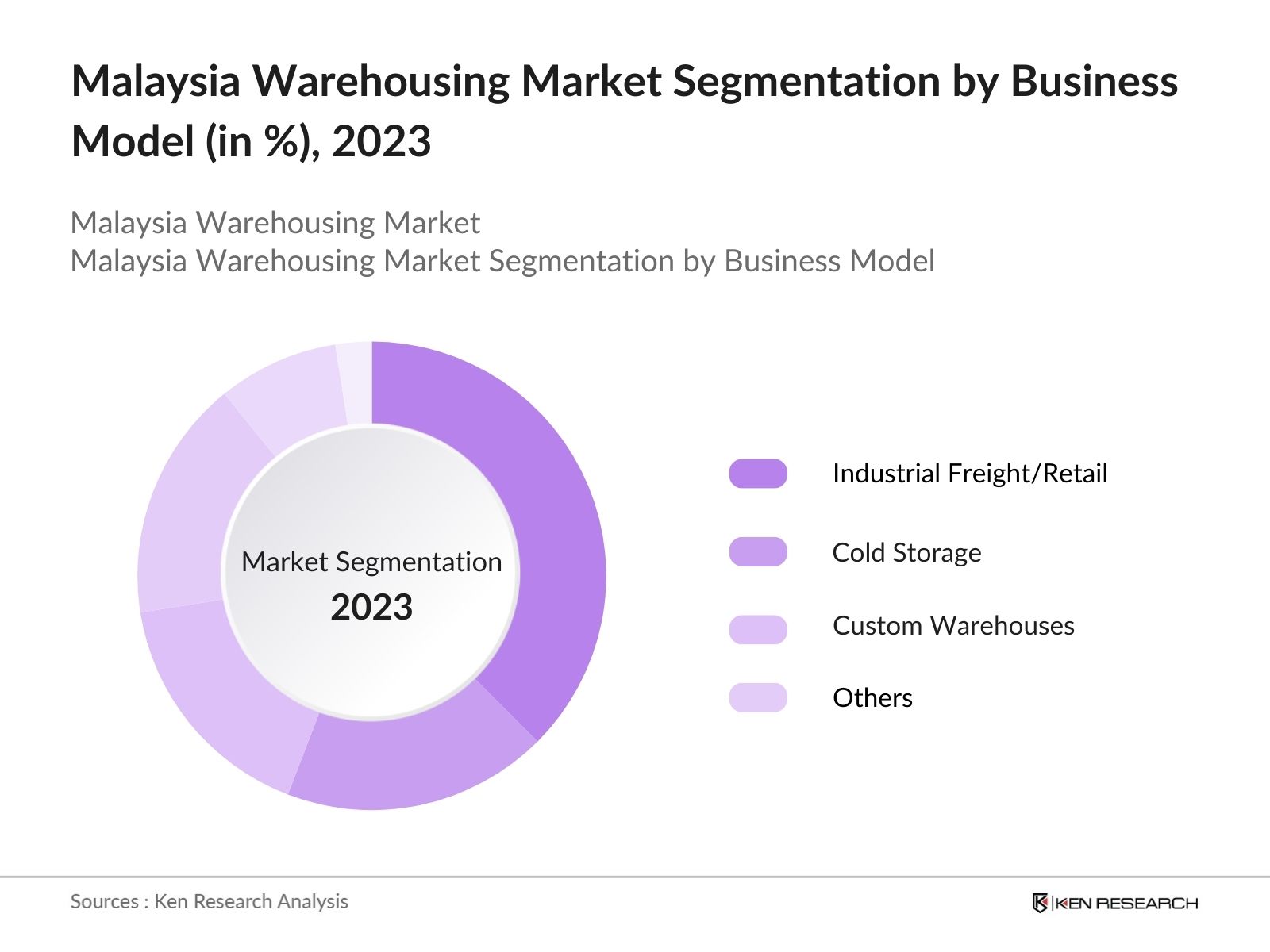

Malaysia Warehousing Market Segmentation:

By Business Model: Malaysia warehousing market is segmented into industrial freight/retail, cold storage, custom warehouses, container freight & others. In 2023, Industrial Freight/Retail dominated this segment, driven by the country's robust manufacturing sector and growing e-commerce activities. This segment benefited from increased demand for storage and distribution solutions to support the efficient movement of goods across domestic and international markets.

By End-User: Malaysia warehousing market is segmented into food & beverage, retail, industrial & construction, automotive & engineering, pharmaceuticals & others. In 2023, Food & Beverage dominated this segment driven by the growing demand for cold storage and distribution facilities. This dominance was further supported by increased consumer spending and the expansion of the food delivery and retail sectors across the country.

By Region: Malaysia warehousing market is segmented into Selangor, Johor, Penang, Sarawak, Sabah & others. In 2023, Selangor was the dominant region due to its strategic location and well-developed infrastructure. The region's proximity to major ports and urban centers also made it a preferred choice for logistics and distribution activities.

Malaysia Warehousing Industry Analysis:

Malaysia Warehousing Market Growth Drivers:

- Expansion of E-Commerce Sector: This growth has resulted in a surge in demand for warehousing facilities, particularly in urban centers like Kuala Lumpur and Johor Bahru. In 2022, 29.5 million people were active internet users in Malaysia, facilitating access to ecommerce. The demand for last-mile delivery services and the need for efficient storage solutions have led to the expansion of warehousing infrastructure across the country.

- Strategic Locations & Trade Agreements: Malaysias strategic location in Southeast Asia, coupled with its participation in multiple free trade agreements (FTAs) like the Regional Comprehensive Economic Partnership (RCEP) signed in 2020, has significantly boosted its warehousing market. The RCEP, which includes major economies such as China and Japan, facilitates smoother trade operations, increasing the need for warehousing facilities to handle the influx of goods.

- Government Initiatives and Infrastructure Development: The Malaysian governments ongoing infrastructure projects, such as the East Coast Rail Link (ECRL) has created new opportunities for the warehousing market. It is a major railway project in Malaysia, spanning 665 kilometers and designed to enhance connectivity between the east and west coasts of Peninsular Malaysia.

Malaysia Warehousing Market Challenges

- High Land and Construction Costs: In 2024, the average price of industrial land in key areas like Kuala Lumpur and Selangor is between MYR 60 to MYR 200 per square foot, making it increasingly difficult for companies to expand their warehousing capacities. Additionally, construction costs have risen due to inflationary pressures and supply chain disruptions.

- Regulatory and Compliance Issues: The Malaysian Investment Development Authority (MIDA) introduced stricter guidelines for the construction and operation of warehousing facilities, particularly those handling hazardous materials. These regulations require extensive documentation, safety measures, and compliance with environmental standards, leading to higher operational costs and delays in project approvals.

Malaysia Warehousing Market Government Initiatives:

- National Logistics and Trade Facilitation Masterplan (NLTFM): The National Logistics and Trade Facilitation Masterplan (NLTFM) is a strategic initiative launched by the Malaysian government in March 2015 to enhance the productivity and competitiveness of the country's logistics industry. The plan also includes initiatives to streamline customs procedures and reduce logistics costs, which are expected to benefit the warehousing market by increasing efficiency and attracting foreign investment.

- East Coast Rail Link (ECRL) Project: Construction began in August 2017 after the Malaysian government signed an agreement with the China Communications Construction Company (CCCC) for a project valued at USD 13.1 billion. The project has already attracted investment from logistics companies looking to capitalize on the improved connectivity and the strategic location of warehousing hubs near the ECRL stations.

Malaysia Warehousing Market Competitive Landscape:

|

Player |

Headquarter |

Establishment Year |

|

Tiong Nam |

Johor Bahru |

1975 |

|

Maple Tree |

Singapore; office in Kuala Lumpur |

2000 |

|

TASCO Bhd |

Shah Alam |

1974 |

|

PKT Group |

Shah Alam |

1974 |

|

LYL Group |

Petaling Jaya |

1990 |

- RS Group: In 2023, RS Group has opened a new 50,000 sq. ft warehouse in Shah Alam, Malaysia, to support growth and expand services. Located 25 minutes from Klang Sea Port and 50 minutes from KLIA, it ensures order fulfilment within 1-2 days for local businesses. In collaboration with Geodis MY, the Industry 4.0-ready facility features wireless coverage, SAP, and vendor-managed inventory systems for efficient operations

- Maple Tree Logistics: In 2022, Mapletree Logistics Trust (MLT) completed the acquisition of two prime land parcels in Subang Jaya, Selangor, Malaysia, for a total price of S$21 million. This acquisition is part of MLT's strategic plan to develop the first mega modern logistics warehouse in Subang Jaya, which is recognized as a significant logistics hub due to its excellent connectivity to Kuala Lumpur city center and Port Klang.

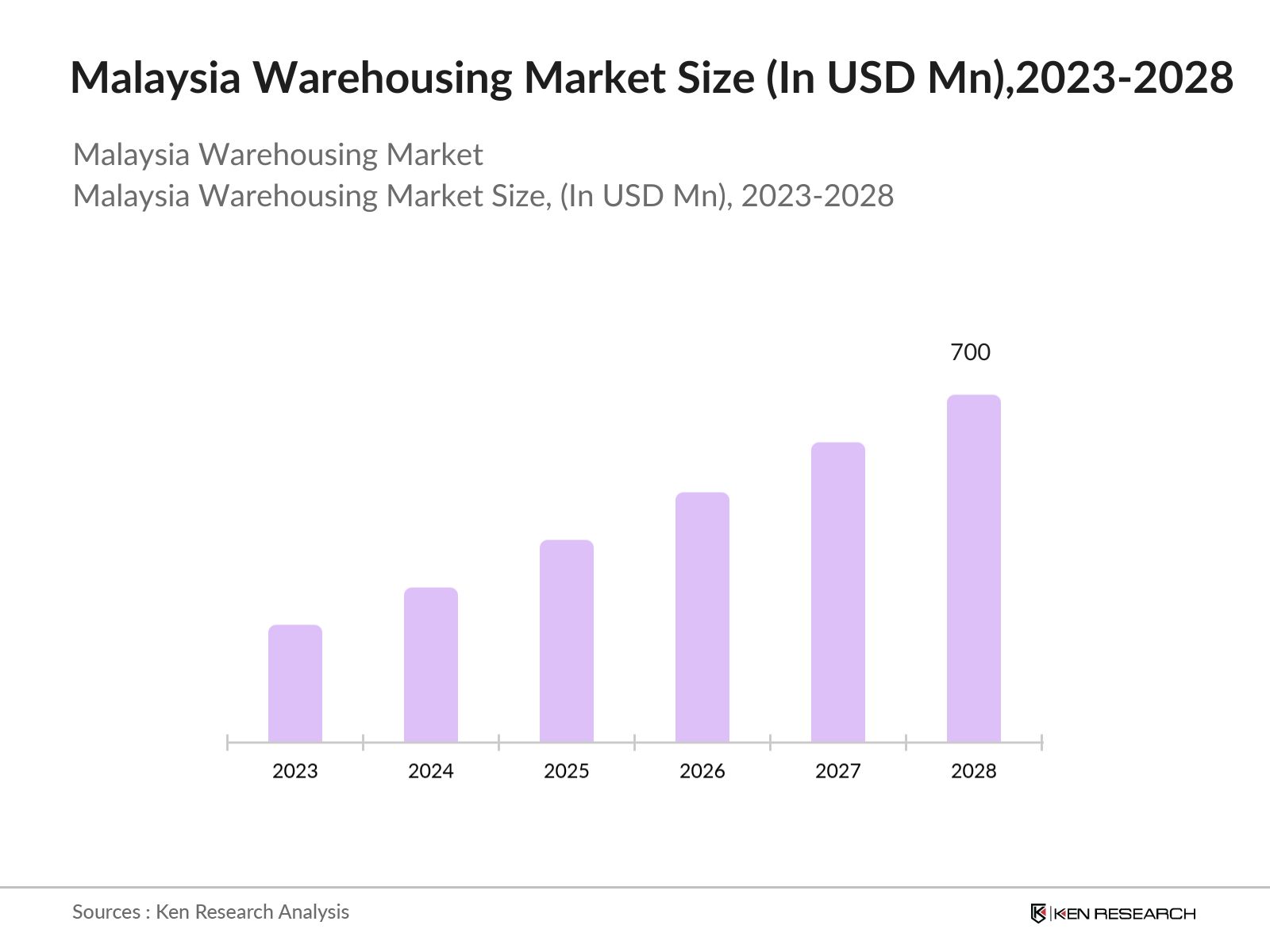

Malaysia Warehousing Future Market Outlook:

Malaysia Warehousing Market is expected to reach USD 700 Mn by 2028. The ongoing expansion of the e-commerce sector is expected to continue fueling demand for warehousing facilities, particularly in urban areas where the need for quick delivery services is highest.

Future Market Trends:

- Adoption of Automation and AI: Over the next five years, the adoption of automation and artificial intelligence (AI) in warehousing operations will become increasingly prevalent in Malaysia. Companies will invest in automated storage and retrieval systems (ASRS), robotics, and AI-driven inventory management to improve efficiency and reduce operational costs.

- Sustainability and Green Warehousing: The future of the Malaysia warehousing market will be marked by a strong focus on sustainability. Warehousing companies will increasingly adopt green building practices, such as the use of energy-efficient lighting, solar panels, and rainwater harvesting systems. There will also be a growing emphasis on reducing carbon footprints through the use of electric vehicles for transportation within warehouses and eco-friendly packaging materials.

Scope of the Report

|

By Business Model |

Industrial Freight/Retail Cold Storage Custom Warehouses Container Freights Others |

|

Bonded Non-Bonded |

|

|

By End-User |

Food & Beverage Retail Industrial & Construction Automotive & Engineering Pharmaceuticals Others |

|

By Region |

Selangor Johor Penang Sarawak Sabah Others |

|

By Warehouse Type |

Grade A Grade B Grade C |

Products

Key Target Audience:

Logistics Companies

E-Commerce Companies

Pharmaceutical Companies

Food and Beverage Manufacturers

Automotive Manufacturers

Freight Forwarding Companies

Investment & Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Transport Malaysia, Malaysia Investment Development Authority)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Table of Contents

1. Malaysia Warehousing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. Malaysia Warehousing Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Malaysia Warehousing Market Analysis

3.1. Growth Drivers

3.1.1. E-commerce Boom

3.1.2. Increased Foreign Direct Investment (FDI)

3.1.3. Government Infrastructure Projects

3.1.4. Strategic Location in Southeast Asia

3.2. Restraints

3.2.1. High Operational Costs

3.2.2. Regulatory Challenges

3.2.3. Limited Skilled Workforce

3.3. Opportunities

3.3.1. Technological Integration

3.3.2. Expansion of Cold Storage Facilities

3.3.3. Increasing Demand for Green Warehousing

3.4. Trends

3.4.1. Growing Importance of Automation among Third-Party Logistics (3PL)

3.4.2. Demand for Bigger Warehouses

3.4.3. Growing Demand for E-commerce and Omnichannel Retailing

3.4.4 Growing Demand for Value-Added Services

3.4.5 Cloud-Native Implementations

3.4.6 Adoption of Automation Technologies

3.5. Government Regulation

3.5.1. National Logistics and Trade Facilitation Masterplan (NLTFM)

3.5.2. East Coast Rail Link (ECRL) Project

3.5.3. Public-Private Partnerships in Infrastructure

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Malaysia Warehousing Market Segmentation, 2023

4.1 By Business Model

4.1.1 Industrial Freight/Retail

4.1.2 Cold Storage

4.1.3 Custom Warehouses

4.1.4 Container Freight

4.1.5 Others

4.2 By Warehouse Type (in Value %)

4.2.1 Grade A

4.2.2 Grade B

4.2.3 Grade C

4.4 By Storage Type (in Value %)

4.4.1 Bonded

4.4.2 non-bonded

4.5 By End-User Industry (in Value %)

4.5.1. Food & Beverage

4.5.2. Retail

4.5.3. Industrial & Construction

4.5.4. Automotive & Engineering

4.5.5 Pharmaceuticals

4.5.6 Others

4.6 By Region (in Value %)

4.6.1. Selangor

4.6.2. Johor

4.6.3. Penang

4.6.4. Sarawak

4.6.5 Sabah

4.6.6 Others

5. Malaysia Warehousing Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.5.1 Tiong Nam

5.5.2 Maple Tree

5.5.3 TASCO Bhd

5.5.4 PKT Group

5.5.5 LYL Group

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Malaysia Warehousing Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Malaysia Warehousing Market Regulatory Framework

7.1. Equity Policy

7.2. Capital Requirements

7.3. Special Industrial Building Allowance for Warehouses

8. Malaysia Warehousing Market Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Malaysia Warehousing Market Future Segmentation, 2028

9.1 By Business Model (in Value %)

9.2 By Warehouse Type (in Value %)

9.3 By Business Model (in Value %)

9.4 By Storage Type (in Value %)

9.5 By End-User Industry (in Value %)

9.6 By Region (in Value %)

10. Malaysia Warehousing Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

11. Disclaimer

12. Contact Us

Research Methodology

Step 1: Market Hypothesis Development and Initial Segmentation

The research team used an AI-based extraction database to analyze and segment the number of warehouses in the country by size and type. This segmentation enabled a detailed calculation of the overall market supply.

Step 2: In-Depth Market Understanding through Stakeholder Interviews

To better understand Malaysia's warehousing market supply, the research team conducted interviews with industry stakeholders, including Heads of Operations, Centre Managers, and Branch Supervisors. They also utilized proprietary internal research from major warehousing companies in Malaysia, providing insights not publicly available.

Step 3: Market Size Validation through Secondary Data Sources

The market supply size was validated through a thorough sanity check using multiple secondary sources, including industry reports, government databases, and academic studies. This cross-referencing ensured the accuracy of findings and provided a comprehensive view of the market supply landscape in Indonesia.

Step 4: Revenue Calculation Using Weighted Occupancy Rates and Rental Prices

The total supply was multiplied by the weighted average of occupancy rates and rental prices to estimate warehousing revenue. Weights were assigned based on market share, occupancy rate, and rental price for each warehouse type. For example, cold storage facilities, though less than 10% of the market, have rental prices three times higher than general warehouses, impacting the overall average.

Frequently Asked Questions

01 How big is Malaysia Warehousing Market?

Malaysia Warehousing Market reached a size of USD 500 million in 2023. This market is driven primarily by the country's strategic location within Southeast Asia, which has made it a crucial logistics hub for the region.

02 What are the Key Factors Driving Malaysia Warehousing Market?

Malaysia Warehousing Market is driven by strategic investments, government initiatives & an expanding ecommerce industry. This growth has resulted in a surge in demand for warehousing facilities, particularly in urban centers like Kuala Lumpur and Johor Bahru.

03 Who are the Major Players in Malaysia Warehousing Market?

Key players in the market include Tiong Nam Logistics Holdings Berhad, YCH Group, Kerry Logistics Network Limited, Kuehne + Nagel, and DHL Supply Chain. These companies have established strong footholds due to their extensive networks and high standards of service.

04 What is the Future of Malaysia Warehousing Market?

Malaysia Warehousing Market is expected to reach USD 700 Mn by 2028. The ongoing expansion of the e-commerce sector is expected to continue fueling demand for warehousing facilities, particularly in urban areas where the need for quick delivery services is highest.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.