MEA Adult Diapers Market Outlook to 2030

Region:Middle East

Author(s):Shambhavi

Product Code:KROD4003

December 2024

121

About the Report

MEA Adult Diapers Market Overview

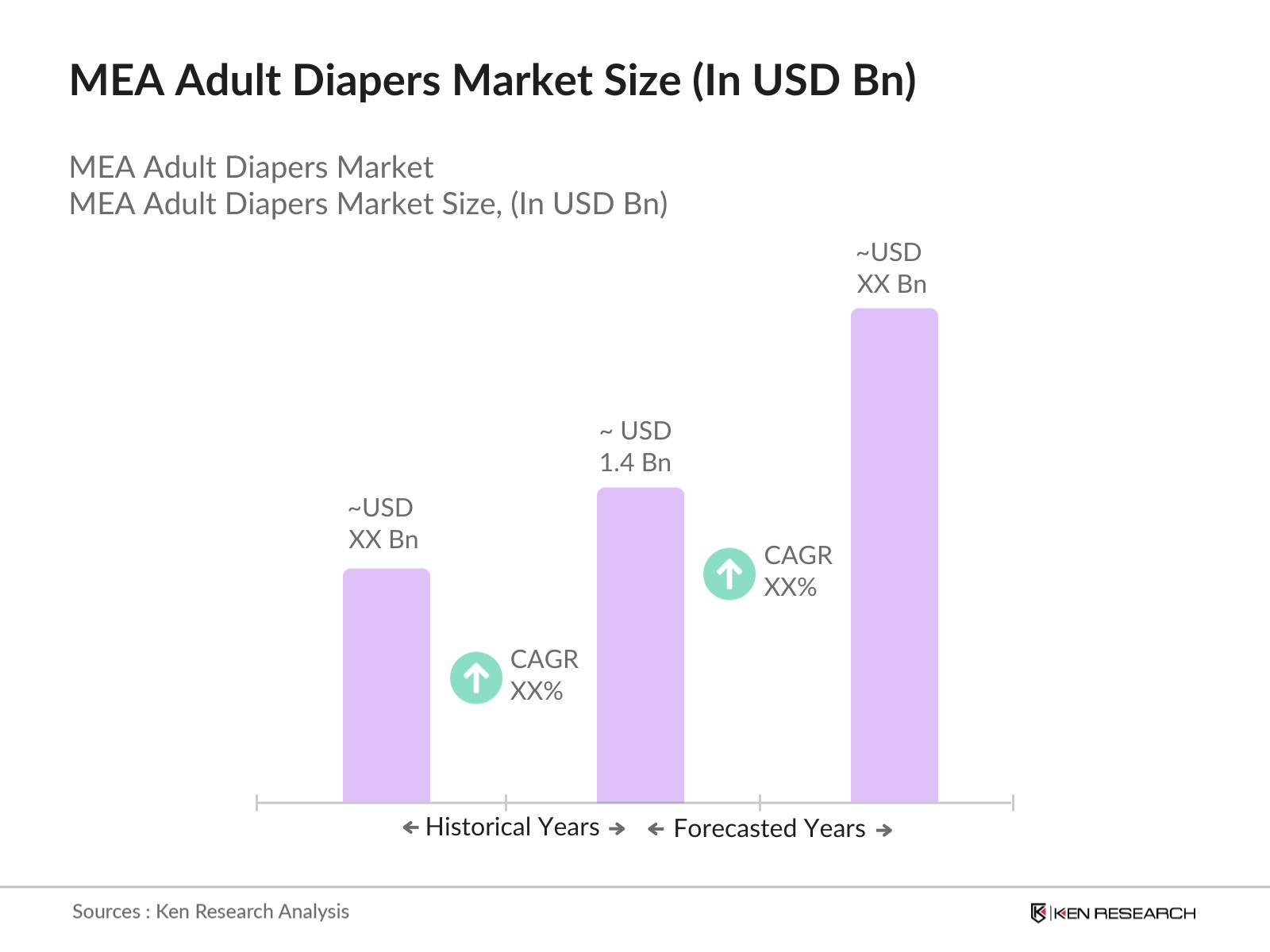

- The MEA adult diapers market is valued at USD 1.4 billion, driven by a rapidly aging population, increased awareness of incontinence management, and a surge in healthcare investments across the region. The market is experiencing steady growth due to growing consumer awareness about hygiene, particularly among the elderly and disabled populations. Government support for elderly care and healthcare infrastructure in key regions like the GCC countries has also significantly propelled the demand for adult diapers.

- Countries like Saudi Arabia, the UAE, and South Africa dominate the MEA adult diapers market due to their advanced healthcare systems, increasing disposable incomes, and higher levels of consumer awareness. The cultural shift towards accepting adult incontinence products and the rising number of healthcare facilities in these regions have further solidified their dominance. In addition, rapid urbanization and improvements in distribution networks contribute to the market's growth in these countries.

- Government regulations on hygiene products, including adult diapers, play a significant role in the MEA market. By 2023, countries like Saudi Arabia and Egypt imposed stringent import tariffs on hygiene products, impacting the pricing and availability of adult diapers. Tariff rates vary but typically range from 5% to 15% across the region, influencing both local production and imports. These regulations are part of broader efforts to protect local industries while controlling the quality and safety of imported goods.

MEA Adult Diapers Market Segmentation

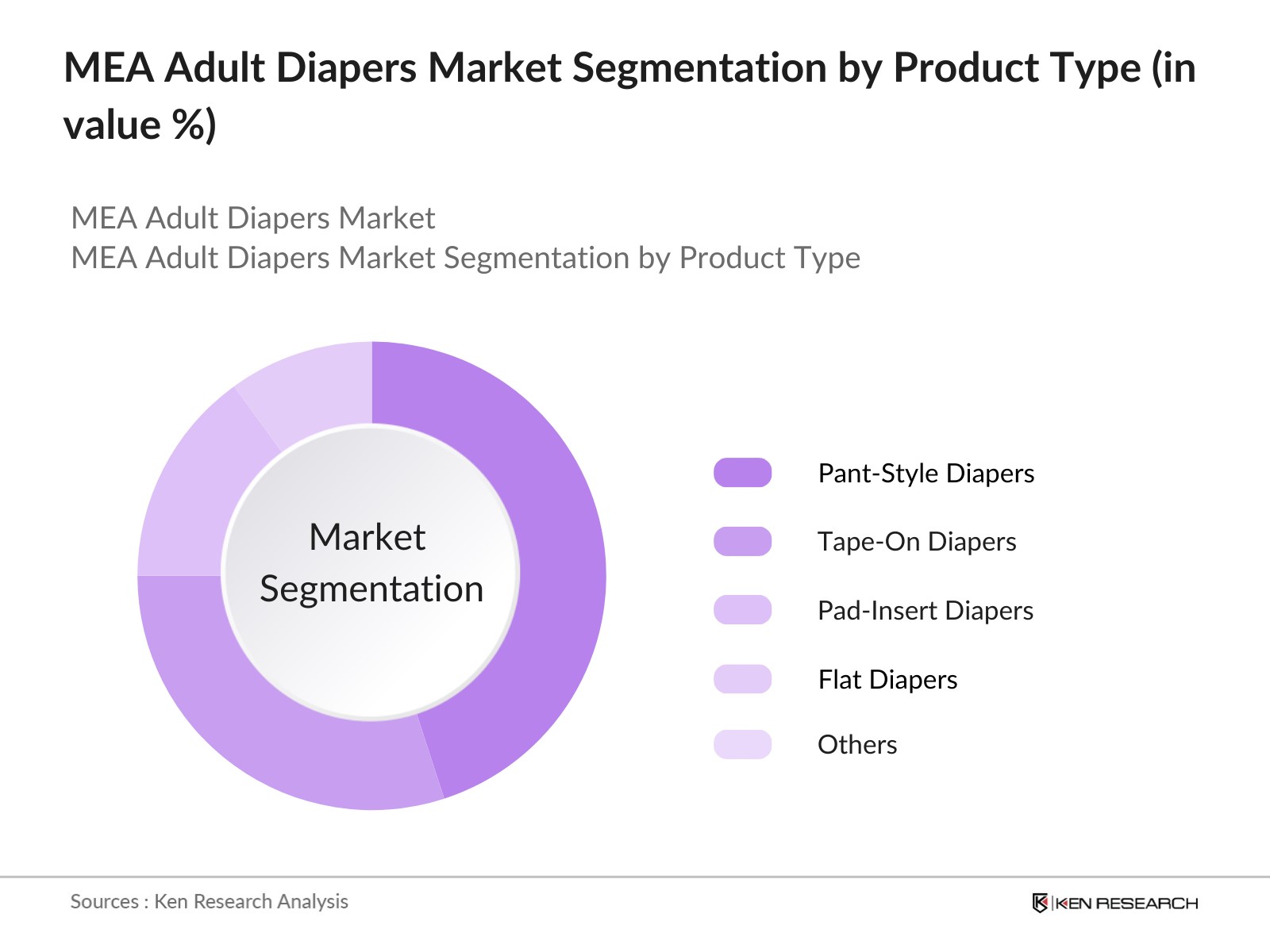

By Product Type: The MEA adult diapers market is segmented by product type into pant-style diapers, tape-on diapers, pad-insert diapers, flat diapers, and others. Recently, pant-style diapers have dominated the market due to their ease of use and comfort, which appeal to both caregivers and users. The popularity of pant-style diapers is also driven by their ability to offer a higher degree of mobility and independence, which is essential for active older adults in urban areas. Moreover, the increasing adoption of premium and high-absorbency pant-style diapers has bolstered this segment's growth.

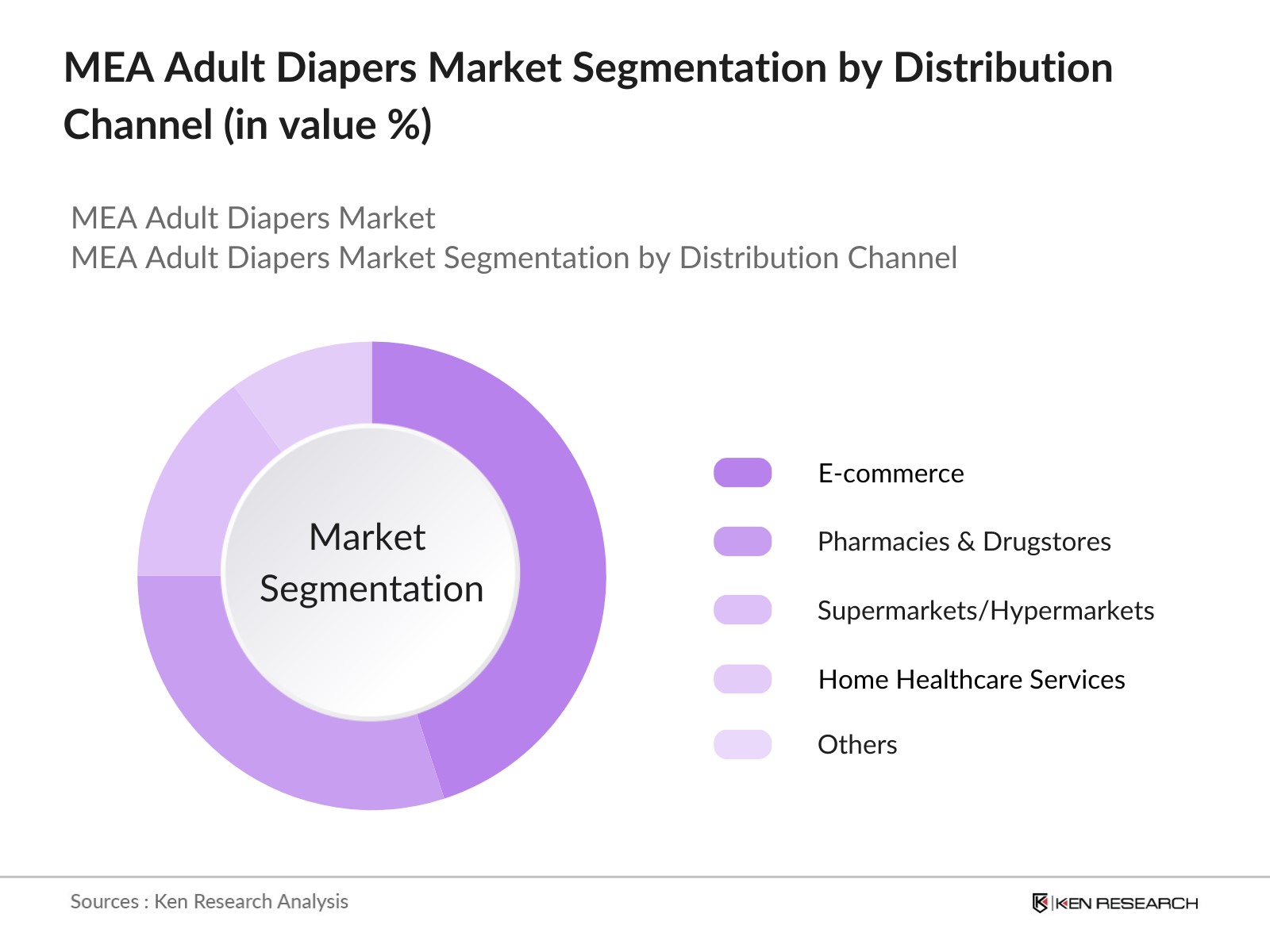

By Distribution Channel: The market is also segmented by distribution channels, including pharmacies and drugstores, e-commerce, supermarkets/hypermarkets, home healthcare services, and others. E-commerce is currently the most dominant channel, especially in countries like the UAE and Saudi Arabia, where internet penetration and consumer confidence in online shopping are significantly higher. The convenience of home delivery and access to a wide variety of products at competitive prices has made e-commerce the preferred platform for purchasing adult diapers.

MEA Adult Diapers Market Competitive Landscape

The MEA adult diapers market is dominated by global and regional companies, with a few major players holding significant market shares. These companies invest heavily in research and development to introduce innovative products, including biodegradable and smart adult diapers. Some companies focus on expanding their regional presence through partnerships with local distributors, which has become a key strategy for tapping into underserved markets across Africa and the Middle East. The MEA adult diapers market is shaped by a mix of global giants like Kimberly-Clark and local players that cater to specific regional needs.

|

Company Name |

Establishment Year |

Headquarters |

Market Strategy |

R&D Investments |

Environmental Initiatives |

Product Portfolio |

Digital Transformation |

Regional Penetration |

Patents |

|

Kimberly-Clark Corporation |

1872 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Essity AB |

1929 |

Sweden |

- |

- |

- |

- |

- |

- |

- |

|

Procter & Gamble Co. |

1837 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Ontex Group |

1979 |

Belgium |

- |

- |

- |

- |

- |

- |

- |

|

Unicharm Corporation |

1961 |

Japan |

- |

- |

- |

- |

- |

- |

- |

MEA Adult Diapers Market Analysis

Growth Drivers

- Aging Population in the MEA Region: The aging population in the Middle East and Africa (MEA) region has been a significant driver of the adult diaper market. As of 2024, countries like Saudi Arabia and the UAE are experiencing increasing numbers of elderly citizens, with over 3 million people aged 65 and above. This trend is forecasted to rise, as life expectancy continues to improve due to enhanced healthcare systems. In Egypt alone, the aging population reached approximately 9 million by 2022. The growing elderly population increases the demand for adult diapers, as more people face incontinence-related issues.

- Increasing Healthcare Awareness: In recent years, healthcare awareness in the MEA region has grown significantly due to the efforts of governments and NGOs. By 2023, more than 50% of healthcare campaigns in the region focused on incontinence management, leading to increased awareness of adult diapers. Countries like South Africa, where healthcare awareness programs reach around 75% of the population, have seen a corresponding rise in the demand for incontinence products. Improved access to healthcare services has led to a growing recognition of incontinence management as part of senior care.

- Growing Awareness on Hygiene and Incontinence Management: In the MEA region, hygiene awareness has become more pronounced, particularly after the COVID-19 pandemic. By 2024, the WHO reported that over 80% of healthcare facilities in the region emphasize hygiene in their patient care programs, with incontinence management being a key focus area. The expansion of urban healthcare systems, such as those in Nigeria and Kenya, has led to better education about personal hygiene and adult diapers, addressing stigmas and misconceptions. The increasing promotion of such products in both urban and rural areas has contributed to market growth.

Market Challenges

- Cultural Stigmas Around Adult Diaper Usage: In many MEA countries, cultural sensitivities around aging and personal care contribute to the reluctance to use adult diapers. As of 2023, WHO estimates show that nearly 40% of the population in rural parts of countries like Sudan and Ethiopia associate adult diaper use with social stigma. Despite efforts to normalize incontinence care, the challenge remains in breaking cultural taboos. This affects market penetration, especially in rural and conservative areas, where adult diaper usage is still perceived as unnecessary or shameful.

- High Product Costs for Premium Adult Diapers: The cost of premium adult diapers in the MEA region poses a significant challenge for widespread adoption. By 2023, data from the African Development Bank indicated that over 70% of consumers in sub-Saharan Africa could not afford premium hygiene products. This is particularly true in countries like Kenya, where the average household income is significantly lower than in developed economies, limiting the market reach for higher-end adult diapers. Price sensitivity in these markets reduces accessibility to premium products, impacting market growth potential.

MEA Adult Diapers Market Future Outlook

Over the next five years, the MEA adult diapers market is expected to experience robust growth driven by increasing awareness of incontinence management, a rapidly aging population, and continued investments in healthcare infrastructure. With urbanization on the rise, demand for high-absorbency and comfortable adult diapers is projected to increase, particularly in urban centers. Furthermore, the integration of smart diapers with health monitoring capabilities is likely to appeal to caregivers and healthcare providers, further boosting market demand.

The region's focus on sustainability and biodegradable products will also play a pivotal role, as consumers and governments alike push for eco-friendly solutions. This, coupled with technological advancements in manufacturing, will continue to shape the future of the MEA adult diapers market.

Market Opportunities

Product Customization to Meet Regional Preferences: Customization presents a significant opportunity for growth in the MEA adult diaper market. By 2024, many global adult diaper brands are tailoring products to cater to regional preferences, such as modest designs and specific sizing to suit local demographics. For instance, in Egypt and Saudi Arabia, over 40% of surveyed consumers in urban areas prefer products that align with cultural and religious considerations, such as modest packaging and enhanced privacy features. This demand for tailored products creates a lucrative opportunity for manufacturers.

Expansion Opportunities in Emerging Economies: Emerging economies within the MEA region, such as Ethiopia and Tanzania, offer significant potential for market expansion. By 2023, Ethiopias GDP grew to USD 156 billion, indicating a growing middle class and improved healthcare infrastructure. This economic progress opens doors for the adult diaper market to penetrate previously underserved regions. In Tanzania, adult diaper penetration is still below 10%, suggesting untapped growth opportunities as disposable income levels rise and healthcare systems expand in rural areas.

Scope of the Report

|

By Product Type |

Pant Style Tape-On Pad-Insert Flat, Others |

|

By Absorbency Level |

Light Moderate Heavy |

|

By Distribution Channel |

Pharmacies E-Commerce Supermarkets Home Healthcare Services Others |

|

By End-User |

Elderly Adults with Disabilities Bedridden Others |

|

By Region |

GCC South Africa Egypt North Africa Sub-Saharan Africa |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority, UAE Ministry of Health)

Retail Chains and Pharmacies

Online Retailers and E-Commerce Platforms

Healthcare Providers and Hospitals

Manufacturers and Suppliers of Hygiene Products

Senior Care Facilities

Distributors and Wholesalers

Companies

Major Players Mentioned in the Report

Kimberly-Clark Corporation

Essity AB

Procter & Gamble Co.

Ontex Group

Unicharm Corporation

First Quality Enterprises, Inc.

Daio Paper Corporation

Domtar Corporation

Hengan International Group

Medline Industries, Inc.

Drylock Technologies

Nippon Paper Industries Co. Ltd.

TZMO SA

Abena Group

Paul Hartmann AG

Table of Contents

1. MEA Adult Diapers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. MEA Adult Diapers Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Adult Diapers Market Analysis

3.1. Growth Drivers (Aging Population, Increasing Healthcare Awareness, Changing Demographics, Rising Disposable Income)

3.1.1. Aging Population in the MEA Region

3.1.2. Increasing Healthcare Awareness

3.1.3. Growing Awareness on Hygiene and Incontinence Management

3.1.4. Rising Disposable Income in Emerging Markets

3.2. Market Challenges (Cultural Sensitivity, High Product Costs, Low Awareness in Rural Areas)

3.2.1. Cultural Stigmas Around Adult Diaper Usage

3.2.2. High Product Costs for Premium Adult Diapers

3.2.3. Lack of Awareness in Rural and Underserved Areas

3.3. Opportunities (Product Customization, Market Penetration in Emerging Economies, Technological Innovations)

3.3.1. Product Customization to Meet Regional Preferences

3.3.2. Expansion Opportunities in Emerging Economies

3.3.3. Integration of Biodegradable and Environmentally Friendly Products

3.4. Trends (Sustainability, Online Retail Channels, Premiumization, Product Innovations)

3.4.1. Adoption of Sustainable and Biodegradable Diaper Solutions

3.4.2. Growth in Online Retail and E-Commerce

3.4.3. Increasing Demand for Premium Adult Diapers with Advanced Features

3.4.4. Smart Diapers with IoT for Monitoring Incontinence

3.5. Government Regulation (Import Restrictions, Product Certifications, Healthcare Policies)

3.5.1. Import Tariffs and Regulations on Hygiene Products

3.5.2. Product Certification Standards for Quality Control

3.5.3. Government Healthcare Subsidies for Senior Care

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem

3.7.1. Suppliers and Distributors

3.7.2. Retailers and E-Commerce Channels

3.7.3. Healthcare Providers

3.7.4. Government and Non-Governmental Organizations

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

3.9.1. Competitive Landscape

3.9.2. Market Positioning of Key Players

3.9.3. Key Strategic Initiatives

4. MEA Adult Diapers Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Pant Style Adult Diapers

4.1.2. Tape-On Adult Diapers

4.1.3. Pad-Insert Adult Diapers

4.1.4. Flat Adult Diapers

4.1.5. Others

4.2. By Absorbency Level (In Value %)

4.2.1. Light Absorbency Diapers

4.2.2. Moderate Absorbency Diapers

4.2.3. Heavy Absorbency Diapers

4.3. By Distribution Channel (In Value %)

4.3.1. Pharmacies & Drugstores

4.3.2. E-Commerce

4.3.3. Supermarkets/Hypermarkets

4.3.4. Home Healthcare Services

4.3.5. Others

4.4. By End-User (In Value %)

4.4.1. Elderly

4.4.2. Adults with Disabilities

4.4.3. Bedridden Patients

4.4.4. Others

4.5. By Region (In Value %)

4.5.1. GCC

4.5.2. South Africa

4.5.3. Egypt

4.5.4. North Africa

4.5.5. Sub-Saharan Africa

5. MEA Adult Diapers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Kimberly-Clark Corporation

5.1.2. Essity AB

5.1.3. Procter & Gamble Co.

5.1.4. Ontex Group

5.1.5. Unicharm Corporation

5.1.6. First Quality Enterprises, Inc.

5.1.7. Daio Paper Corporation

5.1.8. Domtar Corporation

5.1.9. Hengan International Group

5.1.10. Medline Industries, Inc.

5.1.11. Drylock Technologies

5.1.12. Nippon Paper Industries Co. Ltd.

5.1.13. TZMO SA

5.1.14. Abena Group

5.1.15. Paul Hartmann AG

5.2. Cross Comparison Parameters (R&D Investments, Market Presence, Number of Patents, Product Innovation, Manufacturing Capacities, Environmental Initiatives, Digital Transformation, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. MEA Adult Diapers Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Import Regulations and Duties

6.3. Product Quality Certifications

6.4. Waste Disposal and Environmental Standards

7. MEA Adult Diapers Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. MEA Adult Diapers Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Absorbency Level (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. MEA Adult Diapers Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. Product Portfolio Diversification

9.4. Untapped Market Opportunities

Research Methodology

Step 1: Identification of Key Variables

The initial stage of the research involved identifying the major stakeholders within the MEA adult diapers market. Extensive desk research was carried out using industry-specific reports and proprietary databases. The key variables, including consumer demographics, disposable income, and product availability, were defined during this phase.

Step 2: Market Analysis and Construction

A comprehensive analysis of historical data and current market dynamics was conducted to construct a reliable market model. This included analyzing market penetration, distribution channel performance, and key revenue drivers.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy of the data, market hypotheses were validated through consultations with industry experts and distributors. These consultations helped refine the market projections and confirmed the key growth drivers.

Step 4: Research Synthesis and Final Output

The final step involved compiling data from multiple sources, including direct interviews with manufacturers and healthcare providers, to validate the projections. This helped produce a well-rounded and reliable market report for stakeholders.

Frequently Asked Questions

01. How big is the MEA adult diapers market?

The MEA adult diapers market is valued at USD 1.4 billion, driven by increasing awareness of hygiene and a growing aging population.

02. What are the challenges in the MEA adult diapers market?

The major challenges include cultural sensitivities surrounding adult incontinence, high product costs, and low awareness in rural areas.

03. Who are the major players in the MEA adult diapers market?

Key players include Kimberly-Clark Corporation, Essity AB, Procter & Gamble Co., Ontex Group, and Unicharm Corporation.

04. What are the growth drivers of the MEA adult diapers market?

The market is driven by a rising aging population, growing healthcare investments, and increasing consumer awareness about incontinence management.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.