MEA Anime Market Outlook to 2030

Region:Global

Author(s):Meenakshi Bisht

Product Code:KROD6001

December 2024

83

About the Report

MEA Anime Market Overview

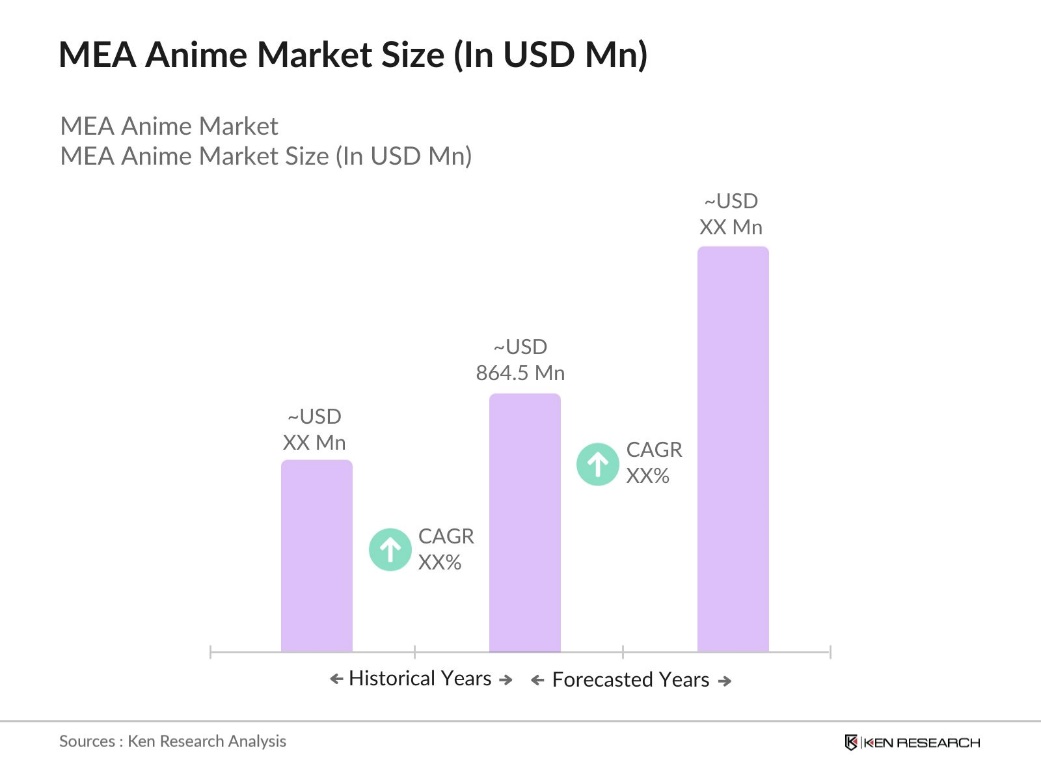

- The MEA Anime Market, valued at USD 864.5 million, is experiencing robust growth propelled by increased digital streaming and consumer engagement. Factors like the proliferation of online platforms and the rising appeal of Japanese culture have created strong demand, particularly among the youth demographic. The market is primarily driven by the expansion of anime streaming on platforms such as Netflix and Crunchyroll, which have made anime content more accessible across MEA.

- Dominant regions in the MEA Anime Market include the UAE, Saudi Arabia, and South Africa. These countries dominate due to the high internet penetration, increased disposable income, and a young population with a growing appetite for digital content. Moreover, anime conventions, pop culture events, and merchandise sales are concentrated in these regions, further supporting their leading roles in the market.

- MEA governments are increasingly offering grants to support the local animation and creative industries. For example, in 2024, the UAE's Ministry of Culture has launched the National Grant Programme for Culture and Creativity, which offers grants of up to Dh100,000 (approximately $27,230) for various creative projects, including animation and digital content development.

MEA Anime Market Segmentation

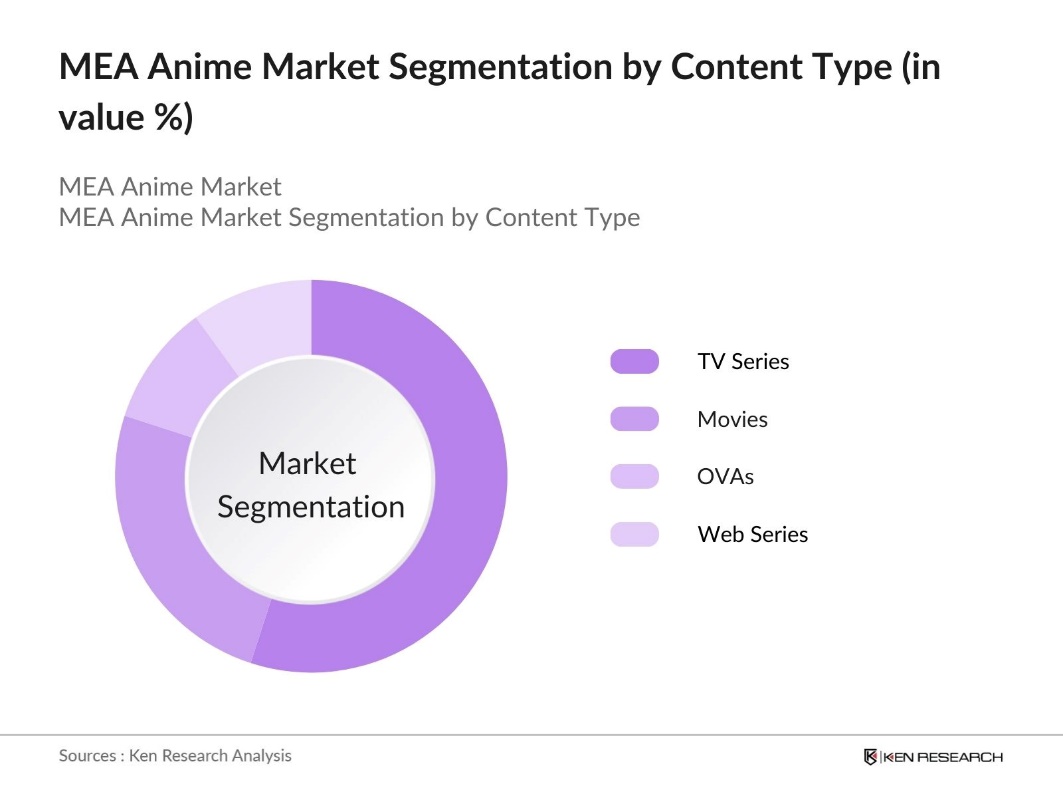

By Content Type: The market is segmented by content type into TV series, movies, OVAs (Original Video Animations), and web series. Among these, TV series dominate the market due to their consistent production and wide appeal. The availability of long-form episodic content allows viewers to engage over extended periods, creating dedicated fan bases. Additionally, platforms like Netflix focus heavily on TV anime series, contributing to the popularity of this segment.

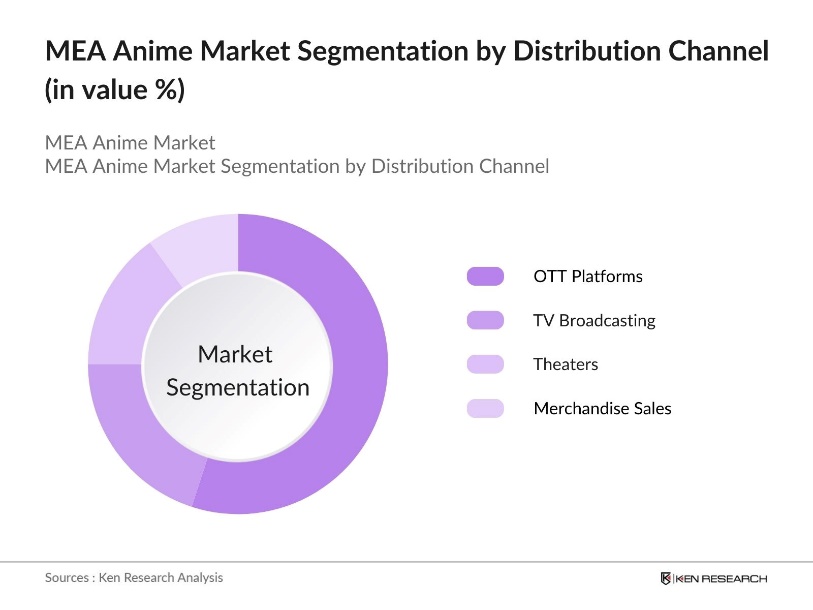

By Distribution Channel: The market is segmented by distribution channel into OTT platforms, TV broadcasting, theaters, and merchandise sales. OTT platforms hold a dominant share due to their extensive libraries and the convenience of on-demand streaming. With leading OTT services offering subtitled and dubbed anime content, viewership has expanded, particularly among the youth who prioritize flexibility and accessibility.

MEA Anime Market Competitive Landscape

The MEA Anime Market is dominated by a combination of international and regional players who are continually innovating through collaborations, content localization, and strategic distribution partnerships. The market features a few dominant players, such as Toei Animation, Netflix, Crunchyroll, Funimation, and VIZ Media. This market structure emphasizes the significant influence of international companies, although regional collaborations and locally-focused content also contribute to the competitive landscape.

MEA Anime Industry Analysis

Growth Drivers

- Regional Popularity Trends (Viewer Count): The MEA region has experienced a notable increase in anime viewership, actively consuming content across various digital platforms in 2024. This rise in viewers is influenced by greater exposure to Japanese culture and the expansion of Japanese studios targeting the Middle East audience. In Saudi Arabia, anime viewership on platforms like YouTube and streaming services has shown a 30% surge in viewership hours, reflecting a regional shift towards animation content over traditional media. This trend indicates a rising demand for anime-specific streaming services and localized content to cater to the diverse regional preferences.

- Digital Streaming Expansion (OTT Platform Subscriptions): As of 2024, Crunchyroll has surpassed 15 million paying subscribers globally, demonstrating a significant increase from previous years. This is due to the expansion of anime titles available in Arabic, French, and other regional languages. The growth aligns with the regions younger population, who are increasingly using mobile-first streaming platforms to access anime content. This shift to OTT platforms represents a vital avenue for monetizing anime, as it provides the viewer convenience and exclusive access to licensed content.

- Evolving Content Demand (Genre Preferences): The MEA region is witnessing growing interest in diverse anime genres, particularly fantasy, science fiction, and horror, which is driving content expansion across various countries. Viewers are increasingly drawn to narratives that resonate culturally, prompting both international and local creators to produce genre-specific anime that aligns with these preferences. This shift in genre demand is fostering a unique anime subculture in the region, motivating content creators to develop stories that cater to the tastes of the MEA audience and deepen engagement with anime as a distinct entertainment form.

Market Challenges

- Piracy and Licensing Issues: Piracy presents a significant challenge for the MEA anime market, as many viewers continue to access content through unlicensed sources. This widespread piracy impacts revenue for legitimate platforms and reduces the appeal for licensed distributors to invest in the region. Additionally, the lack of strict enforcement against copyright infringement complicates the efforts of anime producers to monetize their content, making it harder to sustain revenue streams essential for growth.

- Cultural Adaptation Challenges (Content Localization): The expansion of anime in the MEA region encounters cultural adaptation challenges, as certain themes in Japanese anime may not align with local values. This often requires content localization, such as dubbing or editing scenes to fit regional standards, which can add to production costs and delay delivery. These localization efforts are crucial for meeting cultural expectations but create additional hurdles that impact the broader growth of anime in the MEA market.

MEA Anime Market Future Outlook

Over the next five years, the MEA Anime Market is projected to experience substantial growth due to the increasing adoption of streaming services, the popularity of Japanese cultural content, and government support for the creative sector. Expanding internet access and a youthful demographic base further enhance the markets growth prospects. Local production and regional adaptations are expected to rise, catering to specific MEA cultural nuances while still capitalizing on global anime themes.

Market Opportunities

- Emerging Content Creation Platforms: Platforms like TikTok and YouTube Shorts are becoming popular channels for anime content in the MEA region, providing creators with an accessible way to reach large audiences. This shift towards short-form content enables creators to experiment with localized adaptations and engage directly with viewers in a format that resonates with modern content consumption habits. These platforms offer anime studios a cost-effective means to connect with the regional audience, increasing opportunities to create content tailored specifically to local tastes.

- Strategic Collaborations with Regional Production Studios: Collaborations between Japanese anime studios and MEA production companies are growing, fostering co-productions that cater to local preferences and cultural nuances. By partnering with regional studios, Japanese creators can leverage local expertise and resources, helping to create content that resonates more deeply with MEA audiences. These partnerships not only enhance cultural relevance but also expand distribution channels within the region, strengthening anime's presence in the MEA market.

Scope of the Report

|

Content Type |

TV Series |

|

Distribution Channel |

OTT Platforms |

|

Target Audience |

Children |

|

Genre |

Action |

|

Country |

UAE |

Products

Key Target Audience

Digital Streaming Platforms

Anime Content Creators and Producers Industry

Merchandising Companies

Cosplay and Anime Event Industry

Government and Regulatory Bodies (UAE Ministry of Culture, Saudi Arabia General Entertainment Authority)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Toei Animation

Netflix

Crunchyroll

Funimation

VIZ Media

Madhouse

Shueisha

Aniplex

Studio Ghibli

Nippon Animation

Table of Contents

1. MEA Anime Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. MEA Anime Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Anime Market Analysis

3.1. Growth Drivers

3.1.1. Regional Popularity Trends (Viewer Count)

3.1.2. Digital Streaming Expansion (OTT Platform Subscriptions)

3.1.3. Evolving Content Demand (Genre Preferences)

3.1.4. Rising Cosplay & Merchandise Sales

3.2. Market Challenges

3.2.1. Piracy and Licensing Issues

3.2.2. Cultural Adaptation Challenges (Content Localization)

3.2.3. Market Competition with International Studios

3.3. Opportunities

3.3.1. Emerging Content Creation Platforms

3.3.2. Strategic Collaborations with Regional Production Studios

3.3.3. Sponsorship and Product Placement Opportunities

3.4. Trends

3.4.1. Growth in Anime Conventions and Events

3.4.2. Influencer Marketing Impact (Social Media Influencer Collaborations)

3.4.3. Mobile-First Content Consumption

3.5. Government Initiatives and Support

3.5.1. Content Development Grants

3.5.2. Cultural Export Initiatives

3.6. Competitive Landscape

3.6.1. Major Production and Distribution Companies

3.6.2. Independent Studios and Emerging Players

3.6.3. Strategic Partnerships and Alliances

4. MEA Anime Market Segmentation

4.1. By Content Type (In Value %)

4.1.1. TV Series

4.1.2. Movies

4.1.3. OVAs (Original Video Animations)

4.1.4. Web Series

4.2. By Distribution Channel (In Value %)

4.2.1. OTT Platforms

4.2.2. TV Broadcasting

4.2.3. Theaters

4.2.4. Merchandise Sales

4.3. By Target Audience (In Value %)

4.3.1. Children

4.3.2. Teenagers

4.3.3. Adults

4.4. By Genre (In Value %)

4.4.1. Action

4.4.2. Romance

4.4.3. Fantasy

4.4.4. Comedy

4.5. By Country (In Value %)

4.5.1. UAE

4.5.2. Saudi Arabia

4.5.3. Egypt

4.5.4. South Africa

4.5.5. Rest of MEA

5. MEA Anime Market Competitive Analysis

5.1. Profiles of Key Companies

5.1.1. Toei Animation

5.1.2. Studio Ghibli

5.1.3. Crunchyroll

5.1.4. Funimation

5.1.5. Netflix

5.1.6. Sentai Filmworks

5.1.7. Aniplex

5.1.8. VIZ Media

5.1.9. Madhouse

5.1.10. Nippon Animation

5.1.11. Kodansha

5.1.12. Shueisha

5.1.13. Sunrise Inc.

5.1.14. A-1 Pictures

5.1.15. TMS Entertainment

5.2. Cross-Comparison Parameters (Market Share, Regional Presence, Content Library Size, Revenue, Production Capacity, Licensing Agreements, Streaming Deals, Merchandise Licensing)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Joint Ventures and Collaborations

5.8. Government Grants and Incentives

6. MEA Anime Market Regulatory Framework

6.1. Content Rating Regulations

6.2. Intellectual Property and Copyright Laws

6.3. Localization Requirements

6.4. Compliance with Cultural Sensitivities

7. MEA Anime Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Factors Influencing Future Growth

8. MEA Anime Future Market Segmentation

8.1. By Content Type

8.2. By Distribution Channel

8.3. By Target Audience

8.4. By Genre

8.5. By Country

9. MEA Anime Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Key Audience Targeting Strategies

9.3. Content Development Opportunities

9.4. White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We started by mapping out the key stakeholders within the MEA Anime Market. This phase involved extensive desk research using secondary and proprietary databases to capture a comprehensive view of market variables affecting demand, distribution, and revenue.

Step 2: Market Analysis and Construction

This phase focused on gathering and analyzing historical data regarding the MEA Anime Market. Key metrics such as content library size, streaming reach, and merchandising revenue were examined to ensure accuracy in revenue and market share estimations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding growth drivers and distribution challenges were validated through CATIs (Computer-Assisted Telephone Interviews) with experts from top anime production and distribution companies. These consultations provided insights into operational trends and financial metrics, which helped refine the reports data.

Step 4: Research Synthesis and Final Output

Finally, multiple anime production and streaming platforms were engaged for a direct perspective on the market. This collaborative approach ensured the report reflects current trends and offers a comprehensive, validated view of the MEA Anime Market.

Frequently Asked Questions

01. How big is the MEA Anime Market?

The MEA Anime Market is valued at USD 864.5 million, driven by the expansion of digital streaming platforms and rising youth engagement.

02. What are the challenges in the MEA Anime Market?

Challenges in MEA Anime Market include content localization barriers, high competition from global studios, and issues related to intellectual property enforcement.

03. Who are the major players in the MEA Anime Market?

Key players in MEA Anime Market include Toei Animation, Netflix, Crunchyroll, Funimation, and VIZ Media, known for their vast content libraries and extensive distribution networks.

04. What are the growth drivers for the MEA Anime Market?

Growth drivers in MEA Anime Market include the expanding digital streaming landscape, government support for cultural content, and increased demand for Japanese animated content among MEA audiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.