MEA Cut Flowers Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi Bisht

Product Code:KROD1334

October 2024

100

About the Report

MEA Cut Flowers Market Overview

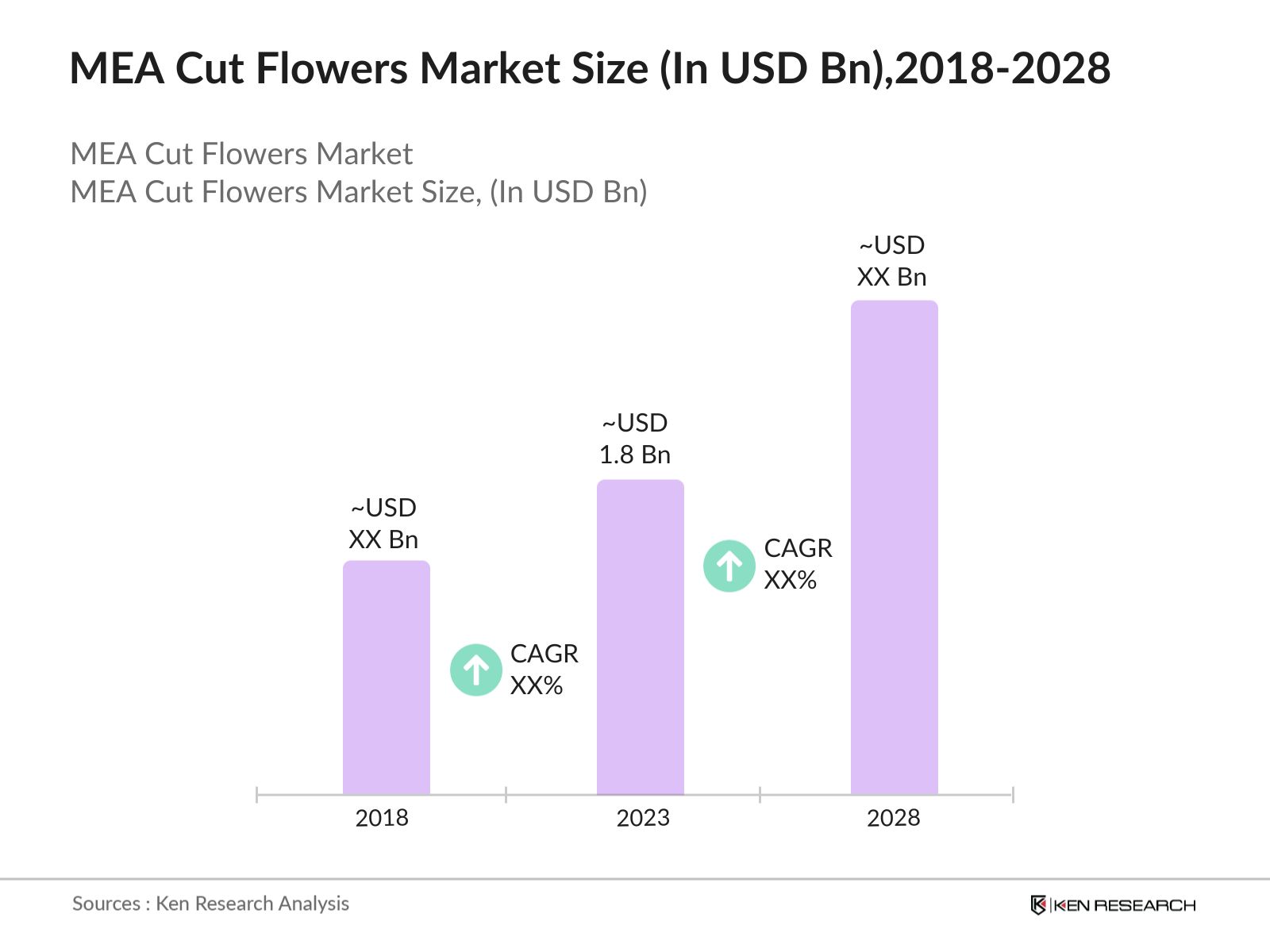

- The MEA Cut Flowers Market was valued at USD 1.8 billion in 2023, reflecting a robust expansion driven by increasing demand for decorative flowers and floral gifts in various sectors such as weddings, corporate events, and holidays. The market's growth is fueled by rising disposable incomes, urbanization, and changing consumer preferences towards premium floral arrangements.

- Key players in the MEA cut flowers market include prominent international and regional firms specializing in floral production and distribution. Leading players include Snoeck, FleuraMetz, Royal FloraHolland, Bougainvillea, and Netafim. These companies are at the forefront of the market, contributing significantly to its growth through extensive production networks, diverse floral offerings, and innovative solutions that enhance flower cultivation and distribution.

- In 2023, Royal FloraHolland participated in the annual International Floriculture Trade Expo (IFTEX) held in Nairobi, Kenya. The expo brought together over 150 registered exhibitors, including several new growers. It provided an opportunity for international flower buyers to source a wide assortment of Kenyan grown flowers

- In 2023, Dubai dominated the market due to its role as a major distribution hub further solidifies its market leadership. The country's high per capita income and thriving tourism sector drive significant floral consumption, making the UAE a key player in the regional market.

MEA Cut Flowers Market Segmentation

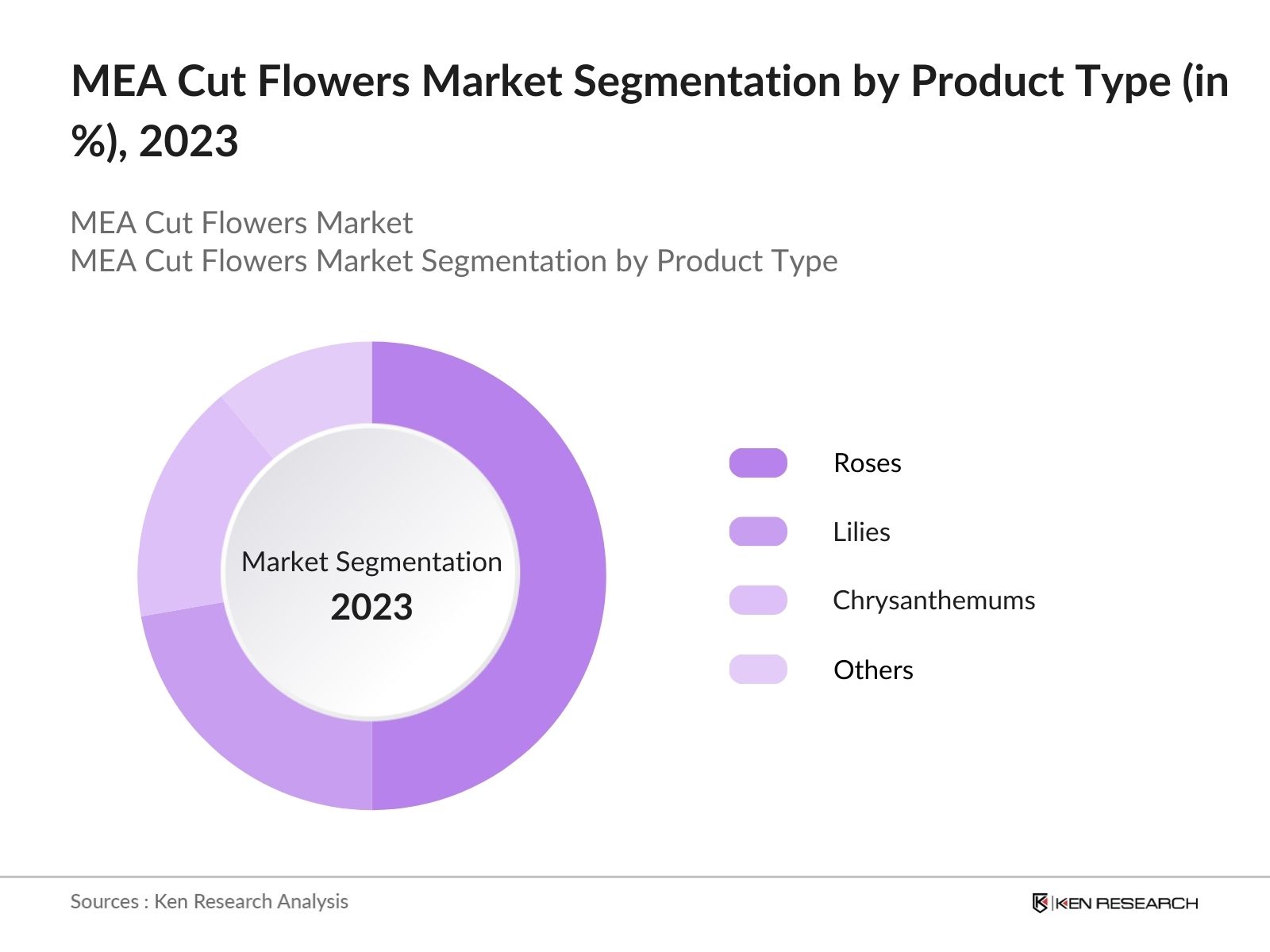

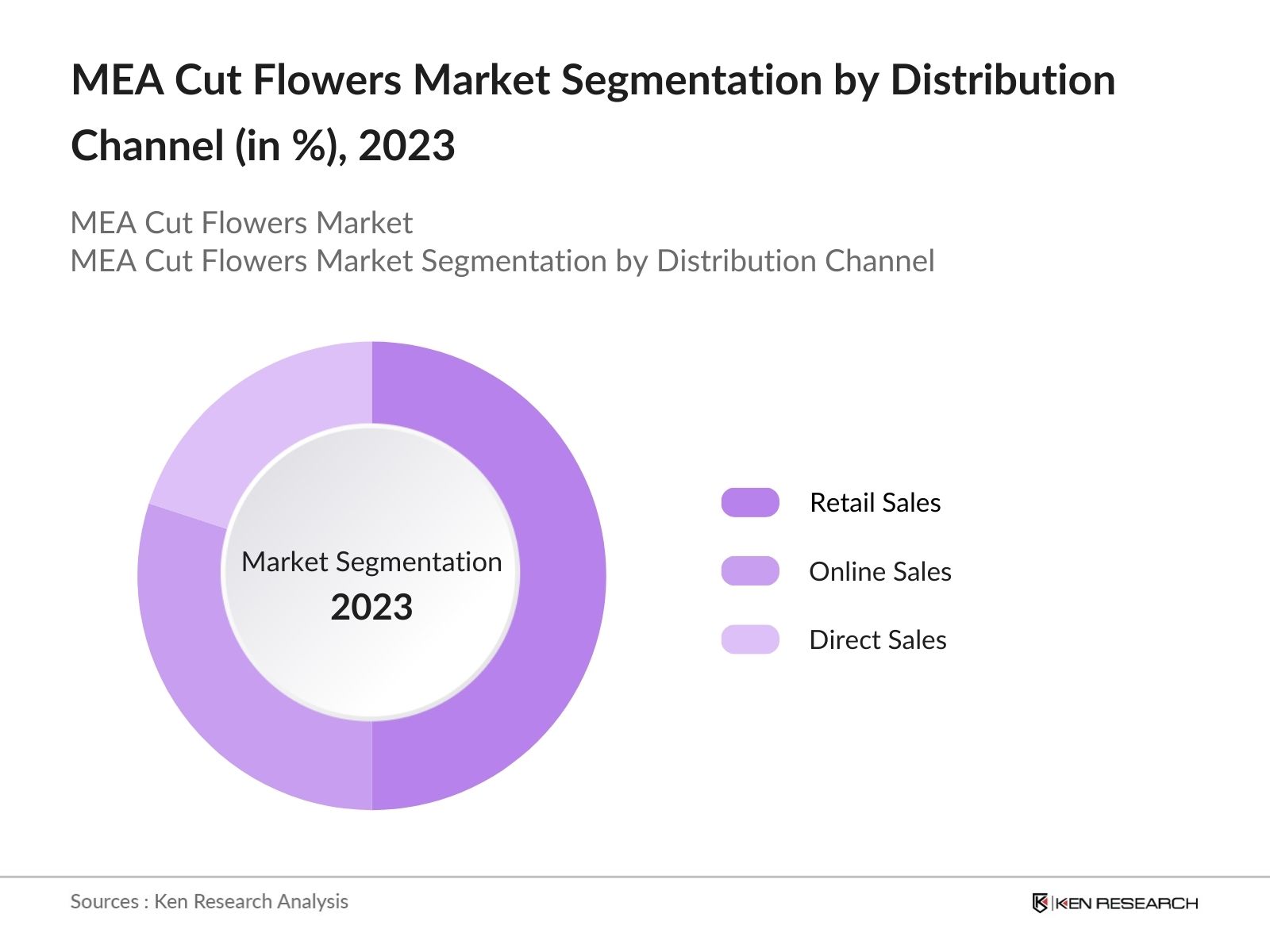

The MEA Cut Flowers Market is segmented into different factors like by product, by distribution channel and by region.

By Product Type: The market is segmented by product type into roses, lilies, chrysanthemums, and others. In 2023, roses held the largest market share, due to their popularity in floral arrangements for events and special occasions. Their extensive use in both personal and corporate settings contribute to their leading market position.

By Region: The market is segmented into the following regions Israel, United Arab Emirates, Jordan, Morocco, South Africa, and the Rest of MEA. In 2023, UAE emerged as the largest market, followed by South Africa and Israel. UAE leads the market due to its advanced infrastructure, high demand for luxury and premium floral products, and strategic location as a regional distribution hub. The city's growing population and tourism sector further boost its market dominance.

By Distribution Channel: The market is also segmented by distribution channel into direct sales, online sales, and retail sales. In 2023, retail sales dominated the market, due to their established presence and the ease with which consumers can purchase flowers. The wide availability of flower shops and supermarkets contributes to the high market share of retail sales.

MEA Cut Flowers Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Snoeck |

1985 |

Netherlands |

|

FleuraMetz |

1965 |

Netherlands |

|

Royal FloraHolland |

1911 |

Netherlands |

|

Bougainvillea |

1992 |

UAE |

|

Netafim |

1965 |

Israel |

- Syngenta Flowers: At the IPM Essen 2024, Syngenta Flowers will collaborate with Syngenta Professional Solutions under the theme "Every Flower Counts." They will showcase their latest product innovations, including the Delta Pro series, Helleborus Christmas Carol varieties, and new Cyclamen offerings. Syngenta Professional Solutions will introduce new adjuvants like Assist M 36 and Elasto G5, designed to improve plant treatment efficacy and sustainability in ornamental production.

- Royal FloraHolland: In 2023, Royal FloraHolland's significant exports to Germany, reflect a similar trend where key markets dominate import activities. For instance, Germany's share of 1.7 billion euros, nearly equaling the combined value of the UK and France, highlights the concentrated demand in specific regions, a pattern also seen in the MEA region.

MEA Cut Flowers Market Analysis

MEA Cut Flowers Market Growth Drivers

- Increased Consumer Spending on Floral Products: Rising consumer expenditure on cut flowers is significantly boosting market growth in the MEA region. As disposable incomes increase and spending on luxury items rises, there is a growing demand for high-quality floral arrangements. Consumers are investing more in flowers for personal enjoyment, gifting, and special occasions, leading to higher market revenues. The trend is particularly evident in high-income countries within the region, where premium floral products are becoming more popular.

- Expansion of Floral Distribution Channels: The expansion of online and traditional retail channels is boosting market reach and accessibility for cut flowers. E-commerce platforms and improved logistics enable convenient purchases and timely delivery. With majority of the population active on social media, businesses are using platforms like Facebook and WhatsApp to market and sell flowers, further supported by the rise of digital technologies and specialized floral delivery services, driving overall market growth.

- Development of Advanced Cultivation Technologies: The adoption of advanced cultivation technologies is enhancing flower production efficiency in the MEA region. In 2024, the implementation of smart irrigation systems and climate-controlled greenhouses is expected to boost flower yields by 15% across major flower-producing countries like Kenya and Morocco. These technologies are improving the quality and quantity of flower production.

MEA Cut Flowers Market Challenges

- Fluctuations in Supply Due to Weather Conditions: The MEA cut flowers market faces challenges from unpredictable weather patterns that can disrupt flower production. Extreme temperatures, droughts, and heavy rainfall can adversely affect flower yields and quality, leading to supply shortages and market instability. These weather-related issues can impact flower availability and result in increased costs for growers and suppliers, affecting the overall market dynamics.

- High Cost of Flower Production: Rising production costs pose a significant challenge for the cut flowers market. Expenses related to labor, raw materials, and energy are increasing, impacting the profitability of flower production. High costs can lead to higher prices for consumers and reduced margins for producers, making it difficult for smaller growers to compete and sustain their operations.

MEA Cut Flowers Market Government Initiatives

- Moroccos Support Farmers: In June 2023, Morocco launched a USD 990 million plan to enhance agricultural productivity. The initiative includes investments in irrigation infrastructure, advanced farming technologies, and financial aid for farmers. This plan aims to improve flower production efficiency and quality, supporting the growth of the cut flowers market in Morocco.

- Emirates Sustainable Agriculture Label: The UAE government has introduced the Emirates Sustainable Agriculture Label as part of its broader strategy to enhance food security and promote sustainable practices in agriculture. Launched in early 2024, this initiative aims to create a comprehensive national framework that encourages the adoption of sustainable agricultural practices. The label is designed to support local farmers in implementing environmentally friendly techniques, improving resource efficiency, and reducing environmental impact.

MEA Cut Flowers Market Future Outlook

The MEA Cut Flowers Market is growing continuously by 2028, driven by continued growth in consumer spending on floral products and expansion of flower cultivation areas. Innovations in floral varieties and sustainable farming practices are expected to shape the future landscape, enhancing market dynamics and offering new growth opportunities.

Market Trends

- Increased Adoption of Sustainable Cultivation Practices: Over the next five years, the MEA cut flowers market will likely see a significant shift towards sustainable cultivation practices. By 2028, there will be increase in flower production will involve eco-friendly technologies such as organic farming and water-saving irrigation systems. This trend will be driven by growing consumer demand for environmentally responsible products and supportive government policies.

- Emergence of New Floral Varieties: The introduction of new floral varieties and hybrids is anticipated to shape the market over the next five years. By 2028, the market will see a rise in the availability of unique and exotic flower varieties, catering to evolving consumer preferences and event trends. This development will be supported by advancements in floral breeding and production techniques.

Scope of the Report

|

By Product Type |

Roses Lilies Chrysanthemums Others |

|

By Application |

Home Commercial |

|

By Distribution Channel |

Direct Sales Online Sales Retail Sales |

|

By Region |

Israel United Arab Emirates Jordan Morocco South Africa Rest of MEA |

Products

Key Target Audience Organizations and Entities who can benefit by subscribing this report:

Hospitality Industry

Horticultural Companies

Event Management Companies

Floral Exporters and Importers

Floriculture Companies

Landscape Architecture Firms

Government Agencies (e.g., Ministry of Agriculture)

Investors and VC Firms

Banks and Financial Institutions

Companies

Players Mention in the Report:

Snoeck

FleuraMetz

Royal FloraHolland

Bougainvillea

Netafim

Dmmen Orange

Deliflor

Zabo Plant

Syngenta Flowers

Aalsmeer Flower Auction

Kwekerij Dekker

Amflora

The Flower Farm

Greenfield Flowers

Floranext

Table of Contents

1. MEA Cut Flowers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. MEA Cut Flowers Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Cut Flowers Market Analysis

3.1. Growth Drivers

3.1.1. Increased Consumer Spending on Floral Products

3.1.2. Expansion of Floral Distribution Channels

3.1.3. Development of Advanced Cultivation Technologies

3.1.4. Emergence of Premium Floral Products

3.2. Challenges

3.2.1. Fluctuations in Supply Due to Weather Conditions

3.2.2. High Cost of Flower Production

3.2.3. Logistical Issues in Distribution

3.2.4. Regulatory Constraints on Importing Flowers

3.3. Government Initiatives

3.3.1. Moroccos Support for Farmers

3.3.2. Emirates Sustainable Agriculture Label

3.3.3. Agricultural Productivity Enhancement Programs

3.3.4. Investment in Irrigation and Farming Technologies

3.4. Trends

3.4.1. Increased Adoption of Sustainable Cultivation Practices

3.4.2. Emergence of New Floral Varieties

3.4.3. Growth of Online Floral Retail Platforms

3.4.4. Rising Demand for Exotic Floral Arrangements

3.5. Competitive Landscape

3.5.1. Market Share Analysis

3.5.2. Strategic Initiatives

3.5.3. Mergers and Acquisitions

3.5.4. Investment Analysis

4. MEA Cut Flowers Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Roses

4.1.2. Lilies

4.1.3. Chrysanthemums

4.1.4. Others

4.2. By Region (in Value %)

4.2.1. Israel

4.2.2. United Arab Emirates

4.2.3. Jordan

4.2.4. Morocco

4.2.5. South Africa

4.2.6. Rest of MEA

4.3. By Distribution Channel (in Value %)

4.3.1. Direct Sales

4.3.2. Online Sales

4.3.3. Retail Sales

4.4. By Application (in Value %)

4.4.1. Corporate Events

4.4.2. Weddings

4.4.3. Holidays

4.4.4. Personal Use

4.5. By Floral Arrangement Type (in Value %)

4.5.1. Bouquets

4.5.2. Centerpieces

4.5.3. Wreaths

4.5.4. Custom Arrangements

5. MEA Cut Flowers Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Snoeck

5.1.2. FleuraMetz

5.1.3. Royal FloraHolland

5.1.4. Bougainvillea

5.1.5. Netafim

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. MEA Cut Flowers Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. MEA Cut Flowers Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. MEA Cut Flowers Market Future Outlook (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. MEA Cut Flowers Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Region (in Value %)

9.3. By Distribution Channel (in Value %)

9.4. By Application (in Value %)

9.5. By Floral Arrangement Type (in Value %)

10. MEA Cut Flowers Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step 2: Market Building

Collating statistics on MEA Cut Flowers Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for MEA Cut Flowers Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output

Our team will approach multiple horticulture companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach fromsuch industry specific companies.

Frequently Asked Questions

01 How big is the MEA Cut Flowers Market?

The MEA Cut Flowers Market was valued at USD 1.8 billion in 2023, driven by increased consumer spending on floral products and the expansion of floral distribution channels.

02 What are the challenges in the MEA Cut Flowers Market?

Challenges in MEA Cut Flowers Market include fluctuations in supply due to unpredictable weather conditions, high production costs, logistical issues in distribution, and regulatory constraints on importing flowers.

03 Who are the major players in the MEA Cut Flowers Market?

Key players in the MEA Cut Flowers Market include Snoeck, FleuraMetz, Royal FloraHolland, Bougainvillea, and Netafim. These companies are prominent due to their extensive production networks, broad product ranges, and innovative solutions in the floral industry.

04 What are the growth drivers of the MEA Cut Flowers Market?

The MEA Cut Flowers Market is driven by increased consumer spending on floral products, expansion of distribution channels, development of advanced cultivation technologies, and the growing events and hospitality industry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.