MEA Freighter Aircraft Market Outlook to 2030

Region:Global

Author(s):Shubham Kashyap

Product Code:KROD5572

December 2024

83

About the Report

MEA Freighter Aircraft Market Overview

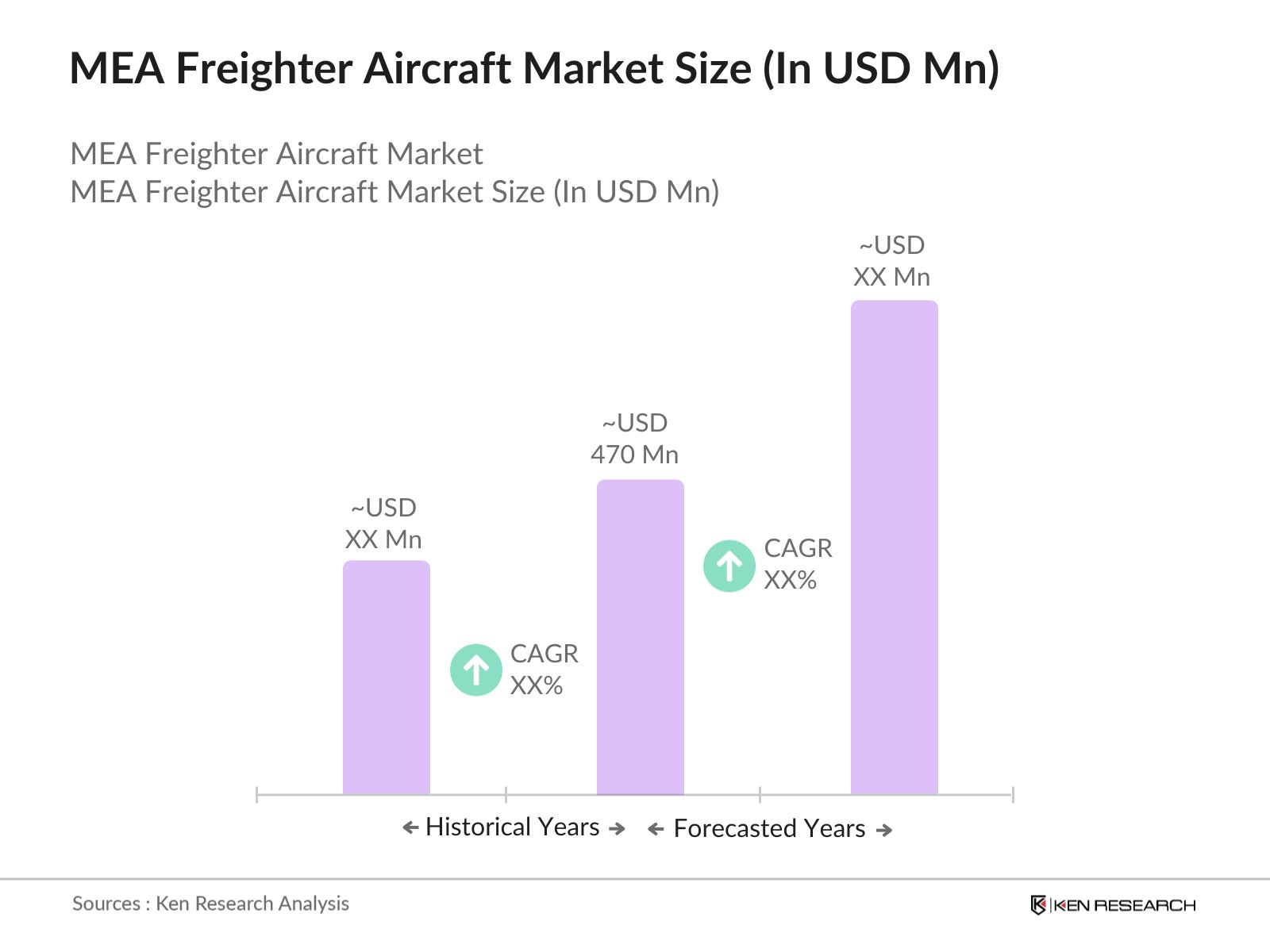

- The MEA Freighter Aircraft market is valued at USD 470 million, driven by the exponential growth in e-commerce and the increasing demand for efficient air freight services. The rise of online retail platforms and the necessity for rapid logistics solutions have significantly contributed to market expansion, fostering investments in modern freighter fleets and advanced cargo handling technologies. Additionally, the strategic investments by major airlines in expanding their cargo operations further propel the market growth, ensuring a robust infrastructure to support the burgeoning air freight demand.

- Dominance in the MEA Freighter Aircraft market is primarily observed in key regions such as the Middle East and North Africa. Countries like the United Arab Emirates, Saudi Arabia, and Egypt lead the market due to their strategic geographic locations, serving as major transit hubs connecting Asia, Europe, and Africa. The presence of well-established aviation infrastructure, favorable government policies, and significant investments by leading global airlines enhance their market leadership. Furthermore, the robust economic growth and expanding industrial sectors in these regions create a sustained demand for freighter aircraft, reinforcing their dominant positions in the market.

- Governments in the MEA region are implementing policies to reduce carbon emissions in aviation. The United Arab Emirates aims to achieve net-zero emissions by 2050, influencing airlines to adopt fuel-efficient aircraft and sustainable aviation fuels. These initiatives align with the ICAO's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), mandating carbon-neutral growth from 2021 onwards. Compliance with these norms is essential for carriers to operate within the region.

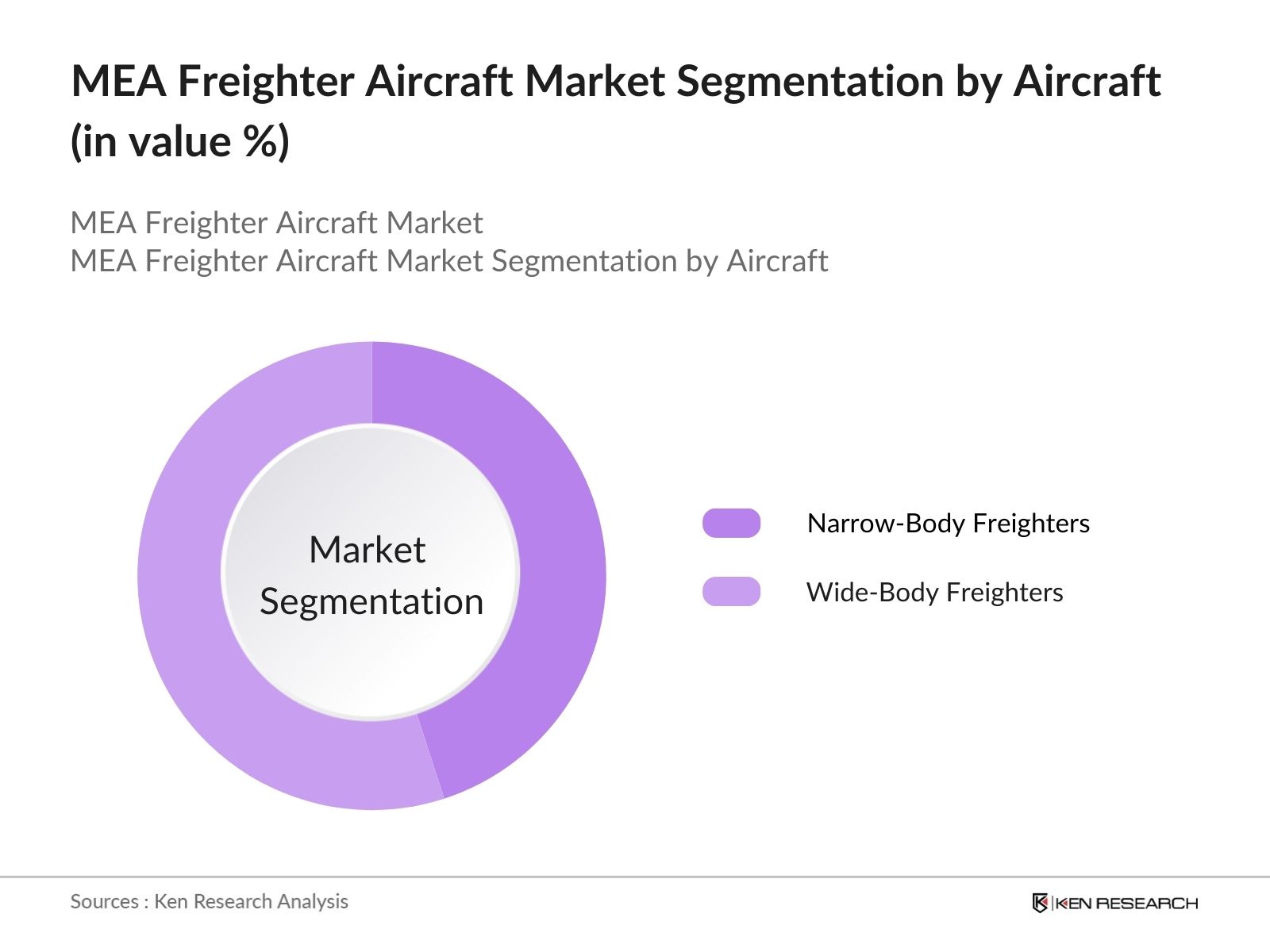

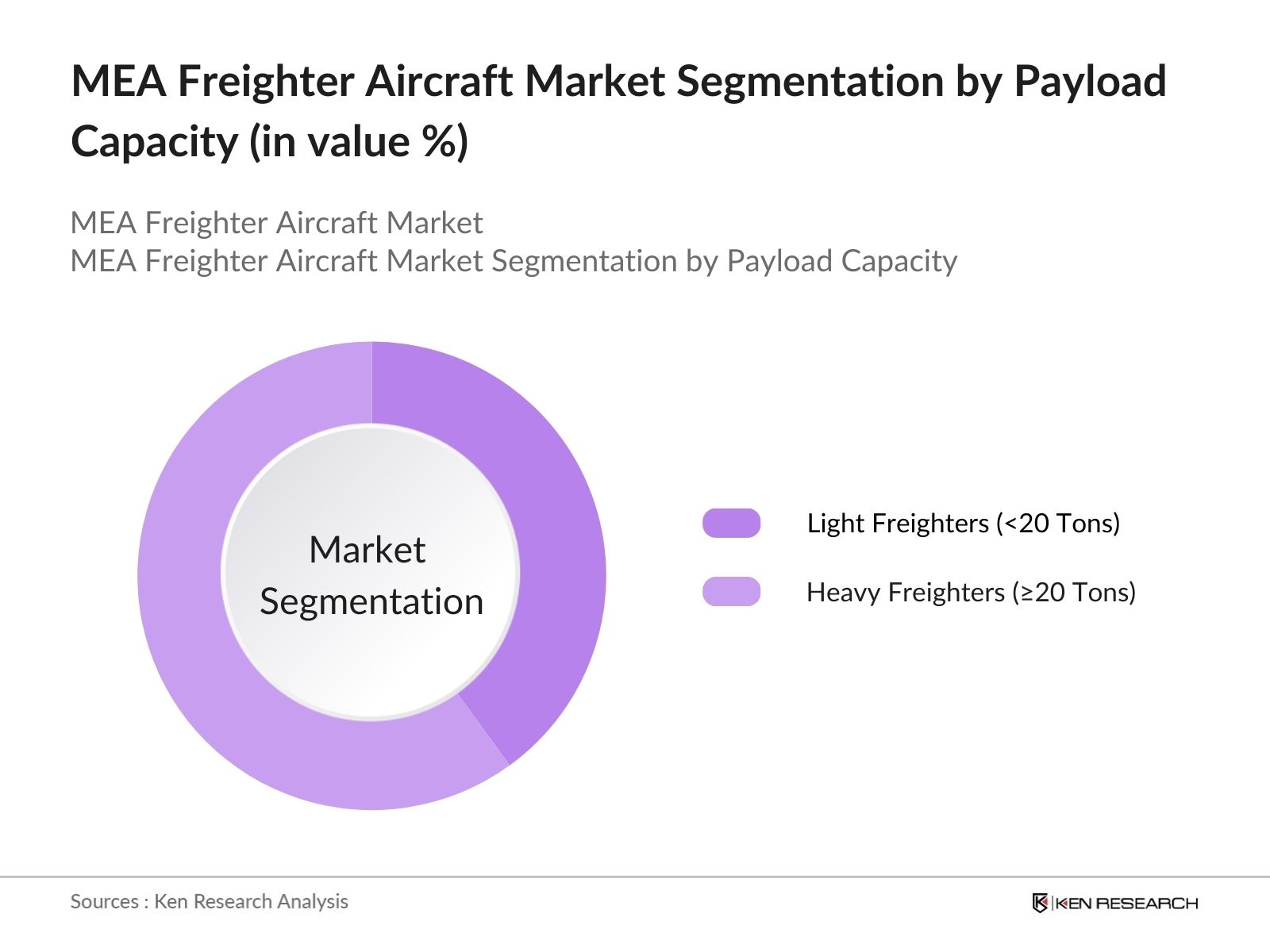

MEA Freighter Aircraft Market Segmentation

- By Aircraft Type: The MEA Freighter Aircraft market is segmented by aircraft type into narrow-body freighters and wide-body freighters. Wide-Body Freighters dominant market in 2023. This dominance is attributed to their superior payload capacity and extended range, making them ideal for long-haul international cargo transport. Wide-body freighters are preferred by major airlines for their ability to carry large volumes of goods, including heavy and bulky items, which is crucial for industries such as automotive, electronics, and pharmaceuticals. The increasing globalization of supply chains and the need for efficient intercontinental shipments further bolster the preference for wide-body aircraft, ensuring their leading position in the market.

- By Payload Capacity: The market is further segmented by payload capacity into light freighters (<20 Tons) and heavy freighters (20 Tons). Heavy Freighters account majority of the market share in 2023. Their ability to transport larger and bulkier shipments makes them indispensable for high-volume cargo sectors such as automotive, machinery, and consumer goods. Heavy freighters offer enhanced payload capabilities and longer range, which are critical for intercontinental shipments and large-scale cargo operations. The increasing demand for efficient bulk transport solutions and the expansion of global trade networks drive the preference for heavy freighters, ensuring their prominent position in the market.

MEA Freighter Aircraft Competitive Landscape

The MEA Freighter Aircraft market is dominated by a few major players, including Emirates SkyCargo, Qatar Airways Cargo, Etihad Cargo, Turkish Cargo, and Lufthansa Cargo. This consolidation underscores the significant influence of these leading companies, which leverage extensive global networks, advanced fleet capabilities, and strategic partnerships to maintain their market positions. These key players invest heavily in fleet modernization, adopt innovative technologies, and expand their service offerings to cater to the evolving demands of the air freight industry. Their strong brand presence and operational excellence further reinforce their dominance in the competitive landscape.

MEA Freighter Aircraft Market Analysis

Growth Drivers

- E-commerce Expansion: The Middle East and Africa (MEA) region has witnessed a significant surge in e-commerce activities, with online retail sales reaching USD 50 billion in 2023, up from USD 30 billion in 2020. This growth has been propelled by increased internet penetration, which stood at 40% in 2023, and a youthful, tech-savvy population. The United Arab Emirates (UAE) alone accounted for USD 12 billion in e-commerce sales in 2023, highlighting the region's rapid digital transformation. This escalation in online shopping has intensified the demand for efficient air freight services to ensure timely delivery of goods across vast geographies.

- Increasing Demand for Air Freight: The MEA region has experienced a notable rise in air freight volumes, with cargo tonnage reaching 3 million metric tons in 2023, up from 2.5 million metric tons in 2020. This increase is attributed to the region's strategic position as a global trade hub, facilitating the movement of goods between Asia, Europe, and Africa. Major airports like Dubai International handled majority of cargo in 2023, underscoring the critical role of air freight in regional logistics.

- Technological Advancements in Aircraft: The adoption of advanced freighter aircraft, such as the Boeing 777F and Airbus A330-200F, has enhanced cargo capacity and fuel efficiency in the MEA region. These aircraft offer payload capacities of around 100 metric tons and 70 metric tons, respectively, enabling airlines to transport larger volumes of goods per flight. The integration of digital tracking systems and automation in cargo handling has further streamlined operations, reducing turnaround times substantially.

Challenges

- High Operational Costs: Operating freighter aircraft in the Middle East and Africa (MEA) region entails substantial expenses. Fuel costs, maintenance of wide-body freighters, and crew salaries collectively form a significant portion of the operational expenditures. Airlines face the challenge of balancing these costs while ensuring efficient and profitable operations. The high costs associated with these factors make it difficult for operators to maintain competitiveness in a rapidly evolving market.

- Regulatory Compliance: Adhering to diverse aviation regulations across the MEA region presents complexities and costs for freighter operators. The International Civil Aviation Organization (ICAO) mandates stringent safety standards, requiring substantial investment in compliance measures such as training and equipment. Additionally, varying customs regulations and clearance procedures in different countries further complicate operations and can cause delays. These regulatory requirements often create barriers to market expansion and operational efficiency for freighter aircraft operators.

MEA Freighter Aircraft Market Future Outlook

Over the next five years, the MEA Freighter Aircraft market is expected to exhibit substantial growth, driven by continuous advancements in aviation technology, expanding e-commerce sectors, and increasing investments in air freight infrastructure. The adoption of sustainable aviation practices and the integration of digital solutions such as AI and IoT will further propel market expansion. Additionally, strategic alliances and the enhancement of cargo handling capabilities are anticipated to create new opportunities, fostering a dynamic and resilient market landscape.

Future Market Opportunities

- Integration of Sustainable Aviation Technologies: The MEA region is witnessing a growing adoption of sustainable aviation technologies to meet emission reduction targets. Airlines are investing in fuel-efficient aircraft and exploring alternative fuels to minimize their environmental footprint, presenting opportunities for technology providers and fuel suppliers. These efforts are further supported by regional governments' sustainability initiatives, emphasizing carbon-neutral growth and green aviation practices.

- Expansion of Cargo Hubs: The development of new and expanded cargo hubs in strategic locations across the MEA region offers significant growth opportunities. Enhanced cargo infrastructure will facilitate more efficient operations and attract additional freight traffic, boosting the demand for freighter aircraft. These hubs are becoming pivotal in improving regional connectivity and streamlining cross-border trade.

Scope of the Report

|

By Aircraft Type |

Single-Aisle Freighters |

|

By Payload Capacity |

Light Freighters (<20 Tons) |

|

By Propulsion Type |

Turbojet |

|

By End-User |

E-commerce |

|

By Region |

Middle East |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Civil Aviation Authorities of UAE, Saudi Arabia, and Egypt)

Airline Companies

Logistics and Supply Chain Managers

Freight Forwarding Companies

Aircraft Manufacturers

Corporate Fleet Managers

Companies

Players Mentioned in the Report

Emirates SkyCargo

Qatar Airways Cargo

Etihad Cargo

Turkish Cargo

Lufthansa Cargo

Cargolux Airlines International

Korean Air Cargo

FedEx Express

DHL Aviation

UPS Airlines

Singapore Airlines Cargo

China Airlines Cargo

Air France-KLM Cargo

British Airways World Cargo

ANA Cargo

Table of Contents

MEA Freighter Aircraft Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

MEA Freighter Aircraft Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

MEA Freighter Aircraft Market Analysis

3.1. Growth Drivers

3.1.1. E-commerce Expansion

3.1.2. Increasing Demand for Air Freight

3.1.3. Technological Advancements in Aircraft

3.1.4. Strategic Alliances and Partnerships

3.2. Market Challenges

3.2.1. High Operational Costs

3.2.2. Regulatory Compliance

3.2.3. Infrastructure Limitations

3.3. Opportunities

3.3.1. Emerging Markets in MEA

3.3.2. Adoption of Sustainable Practices

3.3.3. Fleet Modernization

3.4. Trends

3.4.1. Integration of AI and IoT

3.4.2. Shift Towards Fuel-Efficient Aircraft

3.4.3. Growth of On-Demand Freight Services

3.5. Government Regulation

3.5.1. Aviation Safety Standards

3.5.2. Emission Norms and Sustainability Policies

3.5.3. Trade Agreements Impacting Air Freight

3.5.4. Public-Private Partnerships in Aviation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

MEA Freighter Aircraft Market Segmentation

4.1. By Aircraft Type (In Value %)

4.1.1. Single-Aisle Freighters

4.1.2. Twin-Aisle Freighters

4.2. By Payload Capacity (In Value %)

4.2.1. Light Freighters (<20 Tons)

4.2.2. Medium Freighters (20-40 Tons)

4.2.3. Heavy Freighters (>40 Tons)

4.3. By Propulsion Type (In Value %)

4.3.1. Turbojet

4.3.2. Turbofan

4.3.3. Electric

4.4. By End-Use Industry (In Value %)

4.4.1. E-commerce

4.4.2. Pharmaceuticals

4.4.3. Perishables

4.4.4. Automotive

4.4.5. Electronics

4.5. By Region (In Value %)

4.5.1. Middle East

4.5.2. Africa

4.5.3. Asia-Pacific

4.5.4. Europe

4.5.5. North America

MEA Freighter Aircraft Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Emirates SkyCargo

5.1.2. Qatar Airways Cargo

5.1.3. Etihad Cargo

5.1.4. Turkish Cargo

5.1.5. Lufthansa Cargo

5.1.6. Cargolux Airlines International

5.1.7. Korean Air Cargo

5.1.8. FedEx Express

5.1.9. DHL Aviation

5.1.10. UPS Airlines

5.1.11. Singapore Airlines Cargo

5.1.12. China Airlines Cargo

5.1.13. Air France-KLM Cargo

5.1.14. British Airways World Cargo

5.1.15. ANA Cargo

5.2. Cross Comparison Parameters (Fleet Size, Market Share, Revenue, Geographic Presence, Operational Efficiency, Technological Adoption, Service Offerings, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

MEA Freighter Aircraft Market Regulatory Framework

6.1. Aviation Safety Standards

6.2. Environmental Regulations

6.3. Trade and Tariff Policies

6.4. Certification Processes

MEA Freighter Aircraft Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

MEA Freighter Aircraft Future Market Segmentation

8.1. By Aircraft Type (In Value %)

8.2. By Payload Capacity (In Value %)

8.3. By Propulsion Type (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

MEA Freighter Aircraft Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the MEA Freighter Aircraft Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the MEA Freighter Aircraft Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of operational efficiency statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple freighter aircraft manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the MEA Freighter Aircraft market.

Frequently Asked Questions

01. How big is the MEA Freighter Aircraft Market?

The MEA Freighter Aircraft market is valued at USD 470 million, driven by the rapid expansion of e-commerce and the increasing demand for efficient air freight services. This valuation is supported by substantial investments in modern freighter fleets and advanced cargo handling technologies.

02. What are the challenges in the MEA Freighter Aircraft Market?

Challenges in the MEA Freighter Aircraft market include high operational costs, stringent regulatory compliance, and infrastructure limitations. Additionally, fluctuations in fuel prices and the need for sustainable aviation practices pose significant hurdles to market growth.

03. Who are the major players in the MEA Freighter Aircraft Market?

Key players in the MEA Freighter Aircraft market include Emirates SkyCargo, Qatar Airways Cargo, Etihad Cargo, Turkish Cargo, and Lufthansa Cargo. These companies dominate due to their extensive global networks, advanced fleet capabilities, and strategic partnerships.

04. What are the growth drivers of the MEA Freighter Aircraft Market?

The MEA Freighter Aircraft market is propelled by factors such as the surge in e-commerce activities, increasing demand for rapid air freight services, advancements in aviation technology, and strategic investments in air freight infrastructure. Additionally, the rise of global supply chains significantly contributes to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.