MEA Generator Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD3442

December 2024

109

About the Report

MEA Generator Market Overview

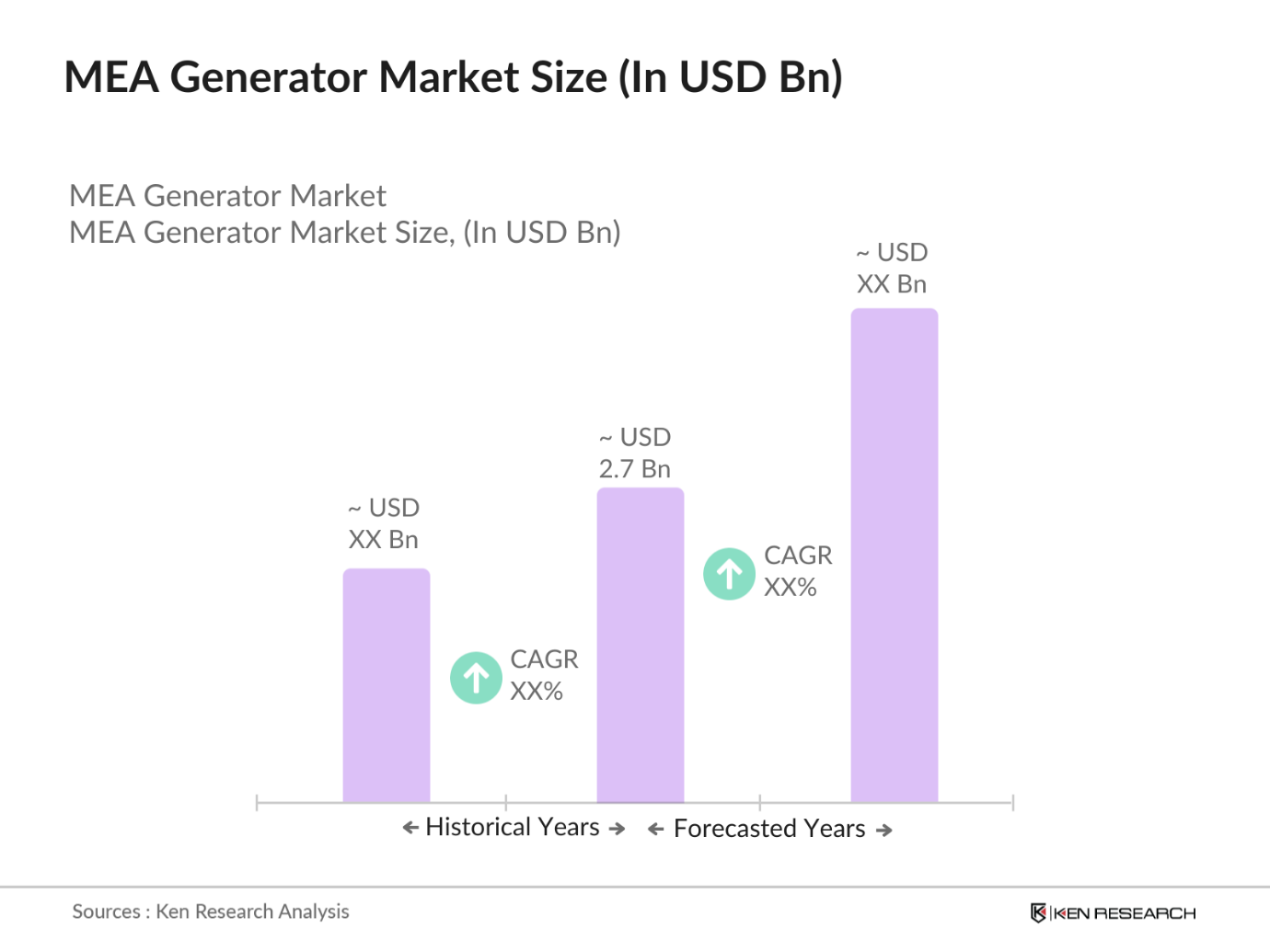

- The MEA (Middle East and Africa) Generator market is valued at USD 2.7 billion based on a five-year historical analysis. The markets growth is primarily driven by the region's growing demand for reliable power solutions, particularly in countries with unstable grids or a high demand for backup power. Industrial expansion, urbanization, and the need for consistent energy in sectors such as healthcare, telecommunications, and construction have further fueled the demand for generators in this region.

- The market is dominated by key countries such as Saudi Arabia, UAE, South Africa, and Egypt. Saudi Arabia and the UAE have significant infrastructure development and industrial growth, particularly in construction and oil and gas sectors, which drives their dominance in the generator market. In contrast, countries like South Africa dominate due to frequent power outages and reliance on backup generators to maintain energy security. The wide range of applications across different industries in these countries makes them pivotal players in the region.

- Several MEA countries have implemented carbon reduction initiatives, with South Africa leading the way by introducing a carbon tax in 2023. This tax has incentivized businesses to adopt cleaner energy solutions, including more efficient generators that produce fewer emissions. These government-led initiatives aim to align with global climate goals, driving the adoption of environmentally friendly power generation technologies.

MEA Generator Market Segmentation

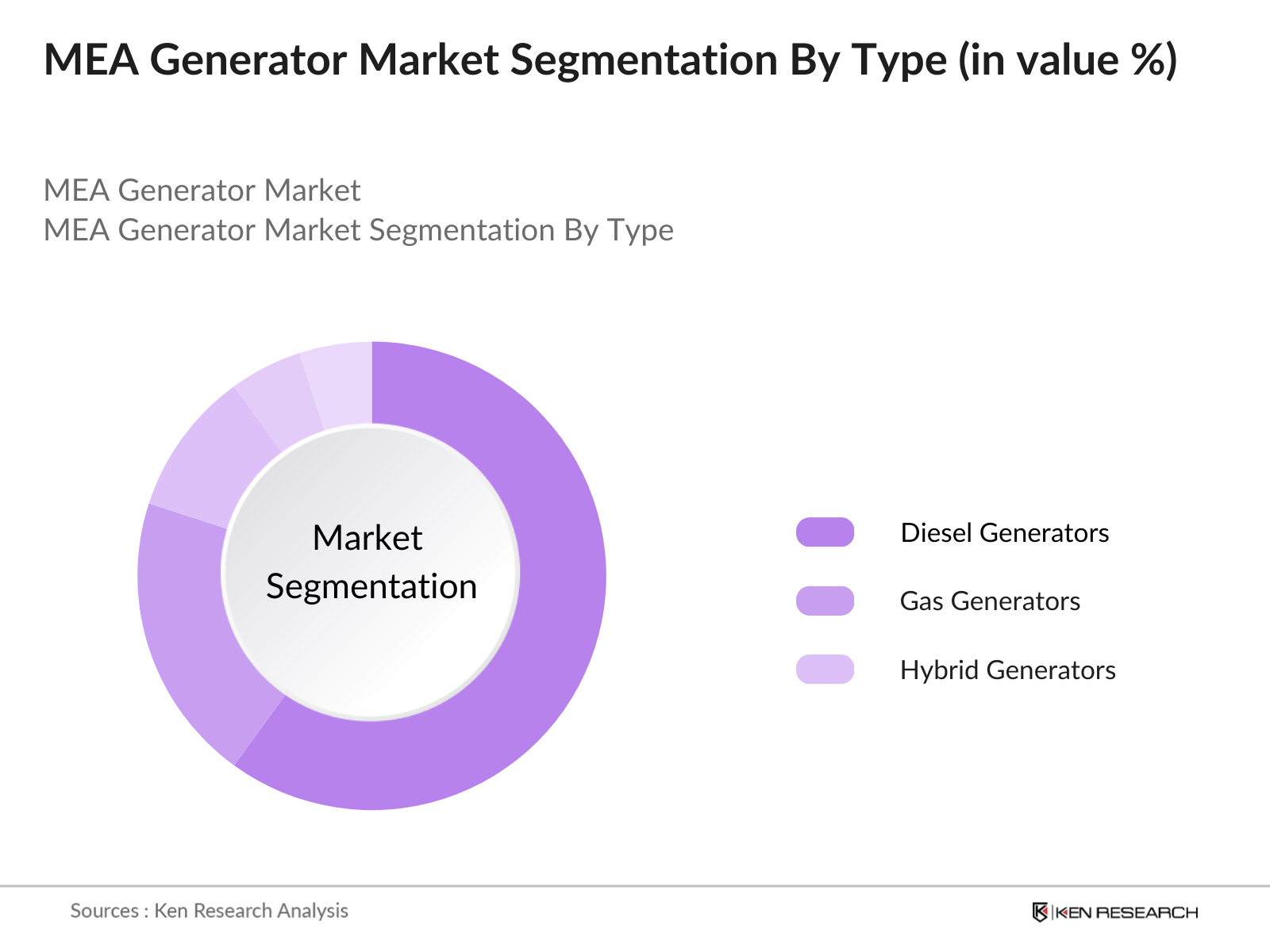

By Type: The MEA generator market is segmented by type into diesel generators, gas generators, and hybrid generators. Recently, diesel generators have maintained a dominant market share in the region. This is due to their affordability, availability of diesel fuel, and ability to provide high power outputs, which makes them a popular choice for industries such as construction, mining, and oil and gas. Diesel generators are known for their reliability, which is essential in areas where continuous and stable power supply is critical. Gas generators are gaining traction due to the increased focus on reducing emissions, but diesel remains the preferred choice.

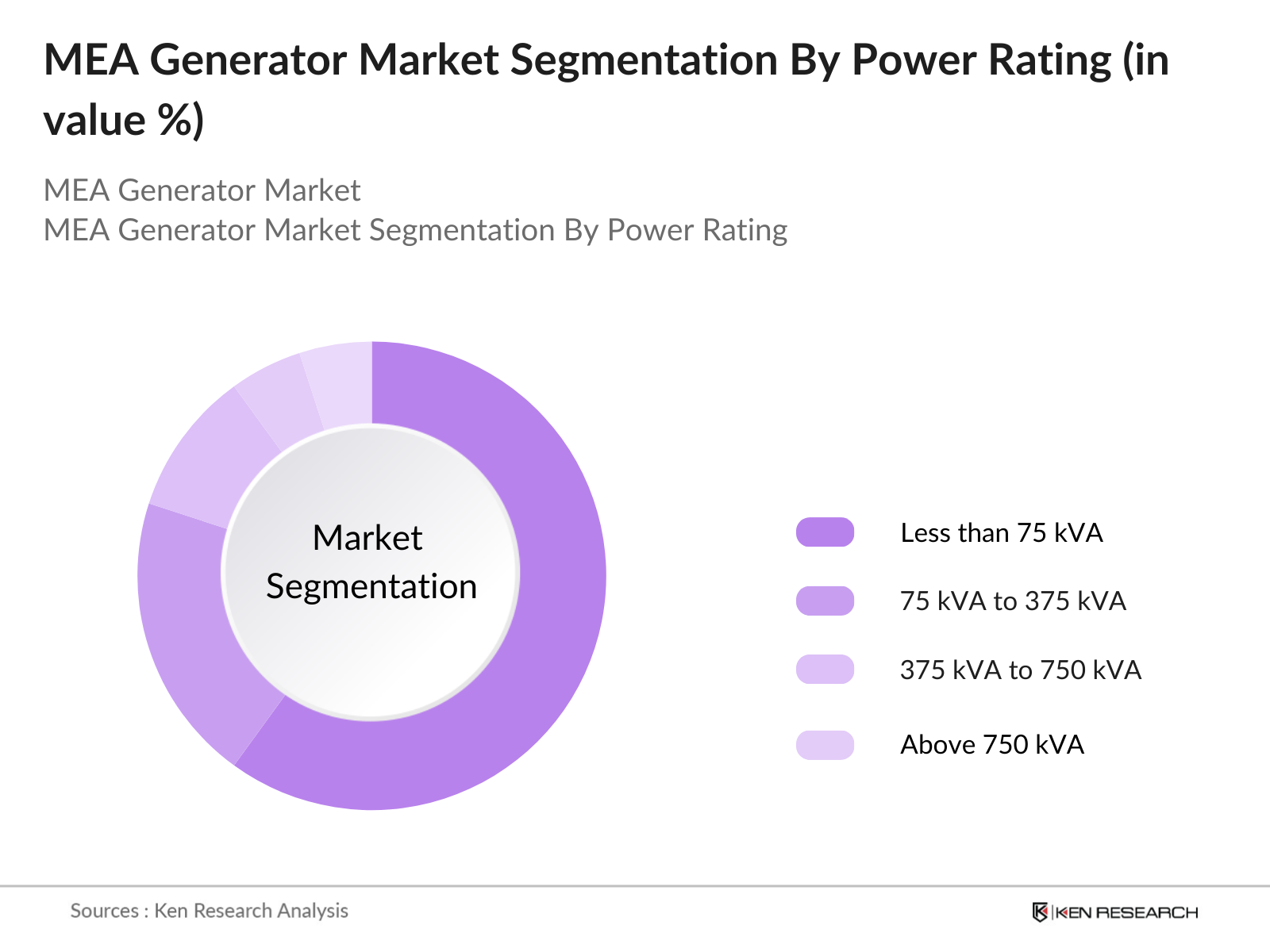

By Power Rating: The MEA generator market is also segmented by power rating into less than 75 kVA, 75 kVA to 375 kVA, 375 kVA to 750 kVA, and above 750 kVA. Generators with a power rating of 75 kVA to 375 kVA dominate the market due to their suitability for various applications, including commercial buildings, small-scale industries, and residential complexes. This segments dominance is largely due to the versatility and wide range of industries that rely on generators within this power bracket. These generators are also highly sought after in infrastructure development projects where reliable backup power is essential.

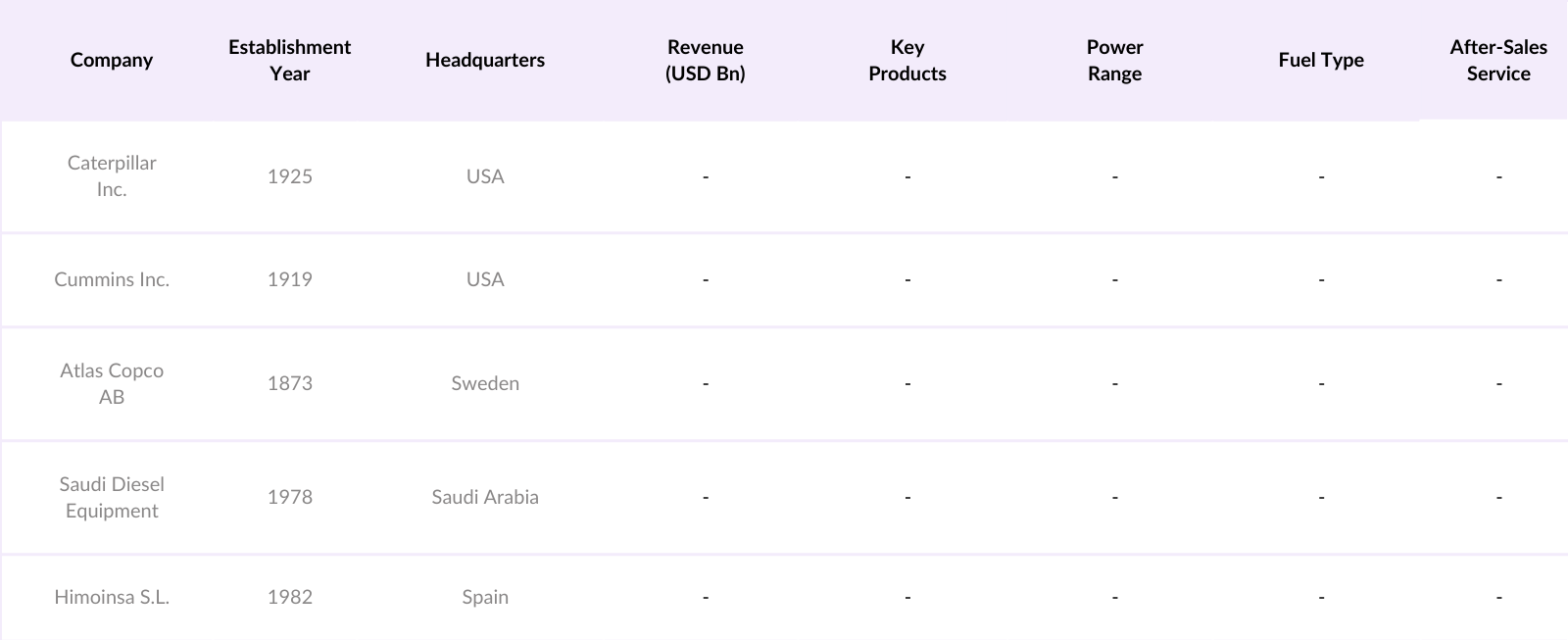

MEA Generator Market Competitive Landscape

The MEA generator market is dominated by several global and regional players, all contributing to the competitive landscape with a variety of products, services, and innovations. These companies often invest in R&D to provide generators that are energy-efficient and comply with environmental regulations. loThe market is led by multinational corporations like Caterpillar and Cummins, which benefit from strong brand recognition, extensive service networks, and robust after-sales support. Regional players, such as Saudi Diesel Equipment Co. and Himoinsa, are also key participants in the market, focusing on region-specific needs such as fuel availability and regulatory compliance.

MEA Generator Market Analysis

Growth Drivers

- Increased Demand in Data Centers & Healthcare: The data center market in the MEA region saw a rise in investments exceeding $3 billion by 2023. The expansion of the digital economy, e-commerce, and cloud services has fueled the need for uninterrupted power supply in data centers. In the healthcare sector, countries like Saudi Arabia and the UAE have seen investments rise to $100 billion in healthcare infrastructure, increasing the need for backup power solutions, particularly in rural and remote areas where grid reliability remains a challenge.

- Backup Power Solutions in Commercial & Residential Spaces: With an increasing frequency of power outages in countries such as Nigeria, where there were over 3,000 hours of power cuts in 2023 alone, demand for backup power solutions has spiked. In South Africa, which experiences daily rolling blackouts, generator sales surged as households and businesses sought reliable electricity sources. The commercial and residential sectors in MEA now account for a combined $1.5 billion in annual generator demand, driven by unreliable grid infrastructure.

- Rising Investments in Renewable Energy Integration: MEA's governments are pushing forward with renewable energy projects to reduce reliance on traditional power sources. The UAE alone has committed over $30 billion to renewable energy projects by 2024, with other countries like Egypt and Morocco following suit. As renewable energy sources, like solar and wind, expand, hybrid systems integrating generators for backup power are gaining traction to ensure constant electricity supply during periods of low renewable output.

Market Challenges

- High Capital Investment: The high upfront cost of acquiring and maintaining generators remains a significant challenge in the MEA region. In countries like Kenya and Ethiopia, where the GDP per capita remains below $2,000, generator costs pose a financial burden, especially for small businesses and residential consumers. Industrial-scale generators, particularly those with hybrid capabilities, can cost upwards of $100,000, making it difficult for many to adopt advanced solutions without government subsidies or financial assistance programs.

- Fluctuations in Fuel Prices: Fuel price volatility has been a consistent challenge across MEA, with diesel prices in Nigeria rising to 700 NGN per liter in 2023 due to supply chain disruptions. These fuel cost fluctuations directly impact the operational costs of generators, making it expensive for industries relying on continuous power generation. Additionally, in countries like South Africa, where fuel imports account for a significant portion of energy supply, rising global oil prices have led to increased operating costs for generator users.

MEA Generator Market Future Outlook

Over the next five years, the MEA Generator market is expected to experience significant growth driven by expanding industrial activities, the need for backup power in residential and commercial sectors, and an increasing focus on infrastructure development. Growing environmental concerns and stricter emission regulations will push market players to invest in cleaner technologies, leading to a rise in demand for gas and hybrid generators. Additionally, digital solutions like remote monitoring and predictive maintenance are set to become more widespread, further enhancing the operational efficiency of generator systems.

Market Opportunities

- Integration of Hybrid and Renewable Energy Generators: With the expansion of renewable energy projects in the MEA region, hybrid generators that can integrate with solar or wind energy systems are becoming more popular. The UAE, for instance, has already invested over $10 billion in hybrid energy systems, combining solar farms with backup generators to ensure reliable power. This trend offers significant opportunities for generator manufacturers focusing on hybrid solutions that can seamlessly integrate with renewable power sources, ensuring continuous power supply.

- Adoption of Smart Generators and IoT Technologies: Smart generators that incorporate Internet of Things (IoT) technologies are gaining traction across the MEA region. These generators allow real-time monitoring, predictive maintenance, and remote control, enhancing operational efficiency. In Egypt, over 2,000 smart generators were deployed in 2023 to support the growing industrial and commercial sectors. This adoption of smart technology is opening new market opportunities for generator manufacturers as industries demand more efficient, technology-driven solutions.

Scope of the Report

|

By Fuel Type |

Diesel Generators Gas Generators DualFuel Generators |

|

By Power Rating |

Less than 100 kVA 100 kVA – 350 kVA 350 kVA – 750 kVA Above 750 kVA |

|

By EndUser |

Residential Commercial Industrial Agricultural |

|

By Application |

Standby Power Prime Power Continuous Power |

|

By Region |

GCC Countries North Africa SubSaharan Africa South Africa |

Products

Key Target Audience

Investors and venture capitalist firms

Generator manufacturers

Energy and utilities companies

Oil and gas companies

Construction and infrastructure firms

Data centers and IT facilities

Healthcare institutions

Government and regulatory bodies (Environmental Protection Agencies, Energy Regulatory Commissions)

Companies

Major Players Mentioned in the Report

Caterpillar Inc.

Cummins Inc.

Atlas Copco AB

Generac Holdings Inc.

Kohler Co.

Mitsubishi Heavy Industries Ltd.

Aggreko Plc

Himoinsa S.L.

MTU Onsite Energy (Rolls-Royce Power Systems AG)

FG Wilson

Saudi Diesel Equipment Co.

Perkins Engines Company Ltd.

Doosan Portable Power

Inmesol S.L.

Honda Motor Co. Ltd.

Table of Contents

MEA Generator Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. MEA Generator Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. MEA Generator Market Analysis

3.1 Growth Drivers

3.1.1. Increasing Demand for Backup Power

3.1.2. Growth in Industrial and Commercial Sectors

3.1.3. Infrastructure Development Initiatives

3.1.4. Rising Power Outages in Remote Areas

3.2 Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Strict Environmental Regulations

3.2.3. Competition from Renewable Energy Sources

3.3 Opportunities

3.3.1. Hybrid Generator Solutions

3.3.2. Expansion in Rural and Remote Areas

3.3.3. Integration with IoT and Smart Grid Systems

3.4 Trends

3.4.1. Adoption of Natural Gas Generators

3.4.2. Development of Compact and Portable Generators

3.4.3. Focus on Green Energy Generators

3.5 Government Regulations

3.5.1. Emission Standards

3.5.2. Energy Efficiency Guidelines

3.5.3. Import/Export Policies

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porter’s Five Forces Analysis

3.9 Competitive Ecosystem

4. MEA Generator Market Segmentation

4.1 By Fuel Type (In Value %)

4.1.1. Diesel Generators

4.1.2. Gas Generators

4.1.3. Dual-Fuel Generators

4.2 By Power Rating (In Value %)

4.2.1. Less than 100 kVA

4.2.2. 100 kVA – 350 kVA

4.2.3. 350 kVA – 750 kVA

4.2.4. Above 750 kVA

4.3 By End-User (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Agriculture

4.4 By Application (In Value %)

4.4.1. Standby Power

4.4.2. Prime Power

4.4.3. Continuous Power

4.5 By Region (In Value %)

4.5.1. GCC Countries

4.5.2. North Africa

4.5.3. Sub-Saharan Africa

4.5.4. South Africa

5. MEA Generator Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

Cummins Inc.

Caterpillar Inc.

Generac Holdings Inc.

Atlas Copco AB

Kohler Co.

Mitsubishi Heavy Industries, Ltd.

FG Wilson

Himoinsa S.L.

Aggreko PLC

MTU Onsite Energy (Rolls-Royce Power Systems AG)

Perkins Engines Company Limited

Doosan Portable Power

Yamaha Motor Co., Ltd.

Mahindra Powerol

Greaves Cotton Limited

5.2 Cross Comparison Parameters

No. of Employees

Headquarters

Inception Year

Revenue

Market Share

Product Offerings

Distribution Channels

Key Strategies

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. MEA Generator Market Regulatory Framework

6.1 Emission Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. MEA Generator Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. MEA Generator Market Future Segmentation

8.1 By Fuel Type (In Value %)

8.2 By Power Rating (In Value %)

8.3 By End-User (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. MEA Generator Market Analysts’ Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping the stakeholders of the MEA Generator Market, which includes manufacturers, suppliers, and end-users. This is achieved through extensive desk research and data collection from credible databases, aiming to identify the critical drivers and inhibitors of the market.

Step 2: Market Analysis and Construction

The second step consists of gathering historical data to construct a comprehensive view of the market landscape. This includes examining market penetration levels, sales performance of key players, and overall revenue trends, ensuring the accuracy of market size estimations.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market assumptions are validated through direct engagement with industry professionals via interviews and surveys. This step ensures that market projections are grounded in real-world insights and experience from sector experts.

Step 4: Research Synthesis and Final Output

The last phase involves compiling the research findings into a coherent analysis, including in-depth profiling of product segments, future growth opportunities, and competitive dynamics. This output is cross-checked to align with both top-down and bottom-up market approaches, ensuring a holistic perspective.

Frequently Asked Questions

01. How big is the MEA Generator Market?

The MEA Generator Market is valued at USD 2.7 billion in 2023, driven by the need for reliable power in key sectors like oil and gas, healthcare, and telecommunications across the region.

02. What are the challenges in the MEA Generator Market?

Challenges in the MEA Generator market include high capital expenditure for advanced generators, fluctuating fuel prices, and stringent government regulations on emissions, which could limit market growth.

03. Who are the major players in the MEA Generator Market?

Key players in the MEA Generator Market include Caterpillar Inc., Cummins Inc., Atlas Copco AB, Saudi Diesel Equipment Co., and Himoinsa S.L. These companies dominate the market due to their strong product portfolios and expansive service networks.

04. What are the growth drivers of the MEA Generator Market?

The market is driven by industrialization, increasing demand for backup power, and infrastructure development across key sectors, particularly in the GCC region. The rise of renewable energy integration also opens new opportunities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.