MEA Helicopters Market Outlook to 2030

Region:Global

Author(s):Meenakshi Bisht

Product Code:KROD7029

December 2024

89

About the Report

MEA Helicopters Market Overview

- The MEA Helicopters Market, based on a comprehensive five-year analysis, is valued at USD 2.1 billion, showing sustained growth. Key drivers include increasing demand from military sectors across the region and rising adoption in oil and gas operations. A growing focus on emergency medical services (EMS) is also contributing significantly to market expansion. Key investments from major defense players and rising operational applications in the private sector are facilitating a robust market demand.

- The market sees dominant activity in the Gulf Cooperation Council (GCC) countries and South Africa due to substantial investments in defense, EMS, and oil and gas infrastructure. GCC nations, notably the UAE and Saudi Arabia, lead in defense expenditure, prioritizing helicopter procurement for national security. In addition, South Africas established EMS network enhances demand for helicopters, with multiple sectors driving regional dominance.

- MEA countries have stringent aviation standards, with the UAE and Saudi Arabia imposing rigorous checks for safety compliance and certification. UAEs aviation authority invested $200 million in upgrading its airspace monitoring and regulatory framework to enhance safety across its aerial fleet. These standards impact helicopter operations, requiring operators to meet specific airworthiness and safety benchmarks. Such regulatory oversight reinforces safety but imposes additional operational costs for helicopter operators in the region, shaping the MEA helicopter markets regulatory environment.

MEA Helicopters Market Segmentation

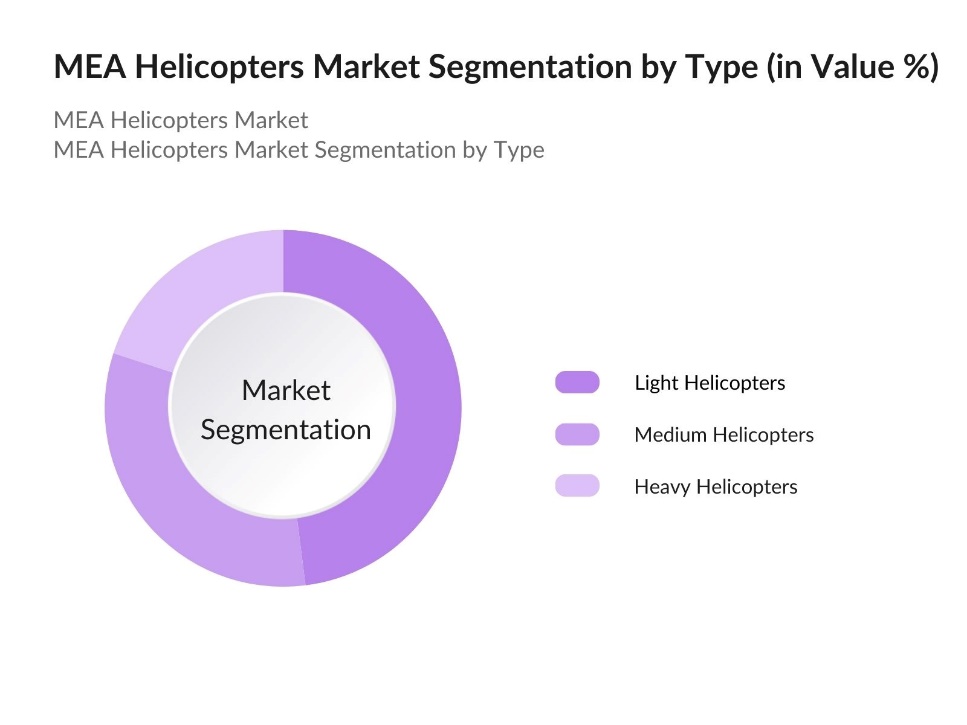

By Type: The market is segmented by type into Light, Medium, and Heavy Helicopters. Among these, Light Helicopters hold a dominant market share. This dominance is attributed to their versatility and cost-effectiveness, making them ideal for short-distance operations in EMS, corporate transport, and other utility services. Light helicopters are increasingly preferred due to lower operating costs, higher maneuverability, and widespread use in critical services, including border surveillance and aerial inspection in densely populated areas.

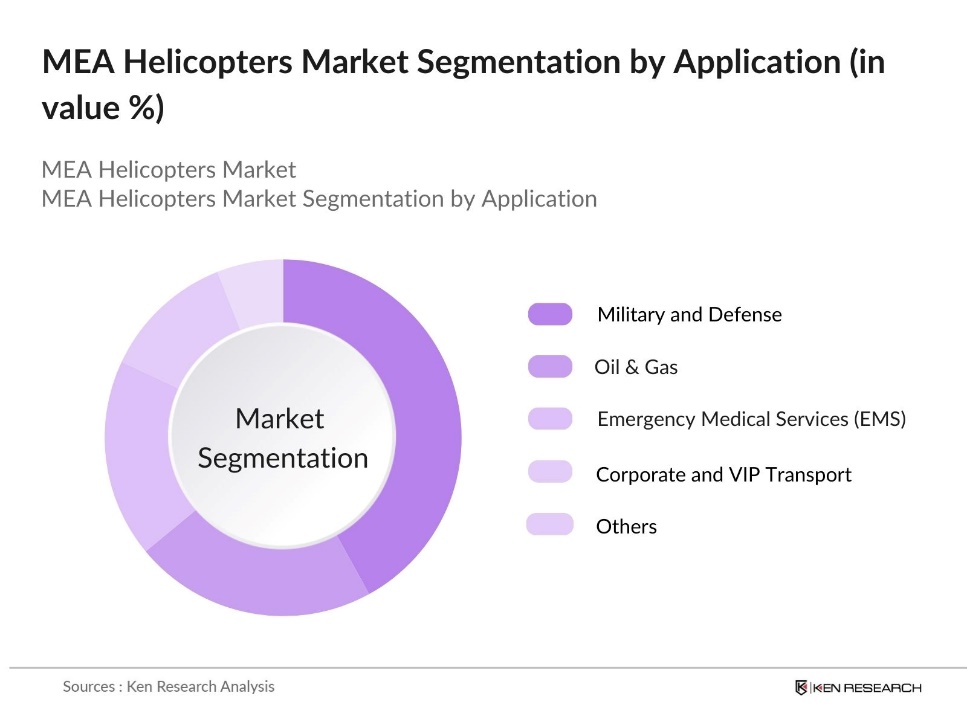

By Application: The market is divided by application, with categories including Military and Defense, Oil & Gas, Emergency Medical Services (EMS), Corporate and VIP Transport, and Other sectors. Military and Defense is the leading application due to its demand for robust and technologically advanced helicopters for surveillance, tactical support, and transportation. Increased government defense budgets, especially in GCC countries, support this segment's dominance as helicopters offer strategic advantages in complex terrains, enhancing operational effectiveness.

MEA Helicopters Market Competitive Landscape

The MEA Helicopters Market is concentrated with several major players, including global giants and regional leaders. Companies like Airbus Helicopters, Boeing, and Lockheed Martin play pivotal roles, with each bringing unique technological capabilities. This consolidation highlights the significant influence of these key firms, as they dominate through strategic collaborations, technological advancements, and strong brand presence.

MEA Helicopters Industry Analysis

Growth Drivers

- Military and Defense Spending: Military and defense budgets in the MEA region have seen a notable increase, driven by national security priorities, particularly in Saudi Arabia, the UAE, and Israel. In 2023, Saudi Arabia allocated approximately $75.8 billion to its defense budget, marking a notable increase from previous years. This heightened defense expenditure is pushing up demand for military-grade helicopters across the MEA region, creating a robust market outlook for the industry.

- Expansion in Oil & Gas Operations: The largest individual producers within the GCC are Saudi Arabia and the United Arab Emirates (UAE), with Saudi Arabia alone producing approximately 11.13 million barrels per day. Countries like Saudi Arabia and UAE are increasingly investing in offshore exploration, necessitating helicopters for transport and logistics. This is bolstered by infrastructure spending in remote oil fields that require aerial transport solutions, reflecting a critical growth driver in this sector.

- Emergency Medical Services (EMS) Demand: Increasing demand for efficient emergency response has led to substantial investments in EMS helicopters across the MEA region. In areas with limited ground access, helicopters play a vital role in rapid medical transport, enhancing healthcare reach and emergency response capabilities. This growing reliance on aerial medical services highlights the importance of helicopters in supporting regional healthcare needs and emergency infrastructure development.

Market Challenges

- High Acquisition and Maintenance Costs: The high costs associated with acquiring and maintaining helicopters present significant barriers in the MEA market, especially as countries prioritize diversified economic spending. These expenses limit fleet expansion, particularly in nations with budget constraints or economies reliant on fluctuating resources. The financial demands of helicopter ownership impact modernization efforts, slowing market growth and affecting the ability of smaller economies to expand their aerial fleets.

- Regulatory Restrictions: Strict aviation regulations in the MEA region add considerable operational costs for helicopter operators. Compliance with licensing, airworthiness standards, and import restrictions on helicopter components can hinder fleet updates and the adoption of advanced models. These regulatory requirements create challenges across both civilian and commercial sectors, affecting fleet growth and modernization in the regional helicopter market.

MEA Helicopters Market Future Outlook

The MEA Helicopters Market is set to experience consistent growth over the next five years, driven by heightened demand from military and defense sectors, advancements in medical transport, and the expansion of oil and gas exploration activities. The adoption of next-generation helicopter technologies, coupled with supportive regulatory frameworks, is expected to foster industry growth and increase the demand for diverse helicopter models in the MEA region.

Market Opportunities

- Fleet Modernization: Fleet modernization is a key opportunity in the MEA helicopter market, as aging fleets are being upgraded to improve safety, reliability, and performance. Modern, fuel-efficient models are increasingly prioritized to meet the operational needs of sectors like defense and oil and gas. This trend not only enhances operational efficiency but also supports market expansion for suppliers offering advanced helicopter technologies.

- New Technological Integrations (Electric and Hybrid Helicopters): MEA countries are actively exploring electric and hybrid helicopter technologies to enhance sustainability in aviation. Electric helicopters, though in early adoption, promise reduced operational costs, making them appealing for sectors such as tourism and urban transport. The integration of hybrid models is paving the way for long-term market growth with an environmentally conscious focus, aligning with global sustainability trends.

Scope of the Report

|

Helicopter Type |

Light Helicopters Medium Helicopters Heavy Helicopters |

|

Application |

Military and Defense Oil & Gas Emergency Medical Services (EMS) Corporate and VIP Transport Others |

|

Point of Sale |

Original Equipment Manufacturer (OEM) Aftermarket |

|

Engine Type |

Turboshaft Turboprop Electric and Hybrid |

|

Region |

North East West Gulf Cooperation Council (GCC) South |

Products

Key Target Audience

Emergency Medical Service Providers

Oil & Gas Corporations (Saudi Aramco, ADNOC)

Corporate Aviation Companies

Helicopter Maintenance and Repair Operators (MRO)

Government and Regulatory Bodies (Nigerian Civil Aviation Authority)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Airbus Helicopters

Boeing

Lockheed Martin

Leonardo S.p.A.

Bell Textron Inc.

Russian Helicopters

Robinson Helicopter Company

MD Helicopters, Inc.

Hindustan Aeronautics Limited

Enstrom Helicopter Corporation

Table of Contents

1. MEA Helicopters Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Market Segmentation Overview

2. MEA Helicopters Market Size (USD Mn)

2.1 Historical Market Analysis

2.2 Demand Drivers and Constraints

2.3 Key Developments and Industry Milestones

3. MEA Helicopters Market Dynamics

3.1 Growth Drivers

3.1.1 Military and Defense Spending

3.1.2 Expansion in Oil & Gas Operations

3.1.3 Emergency Medical Services (EMS) Demand

3.2 Market Challenges

3.2.1 High Acquisition and Maintenance Costs

3.2.2 Regulatory Restrictions

3.2.3 Limited Infrastructure

3.3 Opportunities

3.3.1 Fleet Modernization

3.3.2 New Technological Integrations (Electric and Hybrid Helicopters)

3.3.3 Demand in Urban Air Mobility

3.4 Trends

3.4.1 Unmanned Aerial Systems (UAS) in Civil Use

3.4.2 Autonomous Flight Technologies

3.4.3 Customization for Specialized Operations

3.5 Regulatory Overview

3.5.1 Regional Aviation Standards

3.5.2 Import-Export Regulations

3.5.3 Environmental Compliance

3.6 Competitive Ecosystem

3.7 Porters Five Forces Analysis

3.8 Stakeholder Ecosystem

3.9 SWOT Analysis

4. MEA Helicopters Market Segmentation

4.1 By Helicopter Type

4.1.1 Light Helicopters

4.1.2 Medium Helicopters

4.1.3 Heavy Helicopters

4.2 By Application

4.2.1 Military and Defense

4.2.2 Oil & Gas

4.2.3 Emergency Medical Services (EMS)

4.2.4 Corporate and VIP Transport

4.2.5 Others

4.3 By Point of Sale

4.3.1 Original Equipment Manufacturer (OEM)

4.3.2 Aftermarket

4.4 By Engine Type

4.4.1 Turboshaft

4.4.2 Turboprop

4.4.3 Electric and Hybrid

4.5 By Region

4.5.1 North Africa

4.5.2 East Africa

4.5.3 West Africa

4.5.4 Gulf Cooperation Council (GCC)

4.5.5 South Africa

5. MEA Helicopters Market Competitive Analysis

5.1 Detailed Company Profiles

5.1.1 Airbus Helicopters

5.1.2 Boeing

5.1.3 Lockheed Martin

5.1.4 Leonardo S.p.A.

5.1.5 Bell Textron Inc.

5.1.6 Russian Helicopters

5.1.7 Robinson Helicopter Company

5.1.8 MD Helicopters, Inc.

5.1.9 Hindustan Aeronautics Limited

5.1.10 Enstrom Helicopter Corporation

5.1.11 Sikorsky Aircraft Corporation

5.1.12 Kawasaki Heavy Industries

5.1.13 Korea Aerospace Industries

5.1.14 Safran Helicopter Engines

5.1.15 Advanced Helicopter Services

5.2 Cross Comparison Parameters (Employee Count, Headquarters, Establishment Year, Revenue, Product Portfolio, Key Customers, Technology Innovations, Production Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Landscape

5.7 Government Grants and Support

5.8 Partnerships and Collaborations

6. MEA Helicopters Market Regulatory Framework

6.1 Aviation Safety Standards

6.2 Import-Export Regulations for Defense

6.3 Certification and Licensing

6.4 Environmental and Emission Standards

6.5 Emergency Protocol Compliance

7. MEA Helicopters Market Future Market Segmentation

7.1 By Helicopter Type

7.2 By Application

7.3 By Engine Type

7.4 By Point of Sale

7.5 By Region

8. MEA Helicopters Market Analyst Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Market Entry Strategy

8.3 Expansion and Growth Opportunities

8.4 Technology Adoption Roadmap

8.5 Customer Cohort Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involved identifying the major industry players, stakeholders, and market influencers within the MEA Helicopters Market. This process utilized proprietary databases and secondary research to obtain market-specific data on production, operational applications, and strategic requirements.

Step 2: Market Analysis and Construction

In this phase, comprehensive data was compiled to assess the penetration of helicopters in various sectors, focusing on military, EMS, and oil and gas sectors. Historical market penetration rates were analyzed alongside operational factors to establish current market trends.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding the market demand and competitive positioning were validated through consultations with industry experts. This included direct interviews with helicopter manufacturers and aviation operators to acquire insights into operational needs and strategic market positioning.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the gathered information to form a validated market overview, focusing on key segments, applications, and future growth factors. This ensured accuracy and reliability in the final analysis, providing a comprehensive view of the MEA Helicopters Market.

Frequently Asked Questions

01. How big is the MEA Helicopters Market?

The MEA Helicopters Market is valued at USD 2.1 billion, driven by increasing defense investments and the expansion of emergency services.

02. What are the challenges in the MEA Helicopters Market?

Challenges in MEA Helicopters Market include high acquisition costs, stringent regulatory frameworks, and limited infrastructure for helicopter maintenance and operation in remote regions.

03. Who are the major players in the MEA Helicopters Market?

Key players in MEA Helicopters Market include Airbus Helicopters, Boeing, Lockheed Martin, Leonardo S.p.A., and Bell Textron Inc., dominating due to strong regional partnerships and advanced technology offerings.

04. What drives the demand for helicopters in the MEA region?

The MEA Helicopters Market demand is primarily driven by military applications, expanding oil and gas operations, and an increasing need for emergency medical services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.