MEA IT Asset Disposition Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD8297

December 2024

85

About the Report

MEA IT Asset Disposition Market Overview

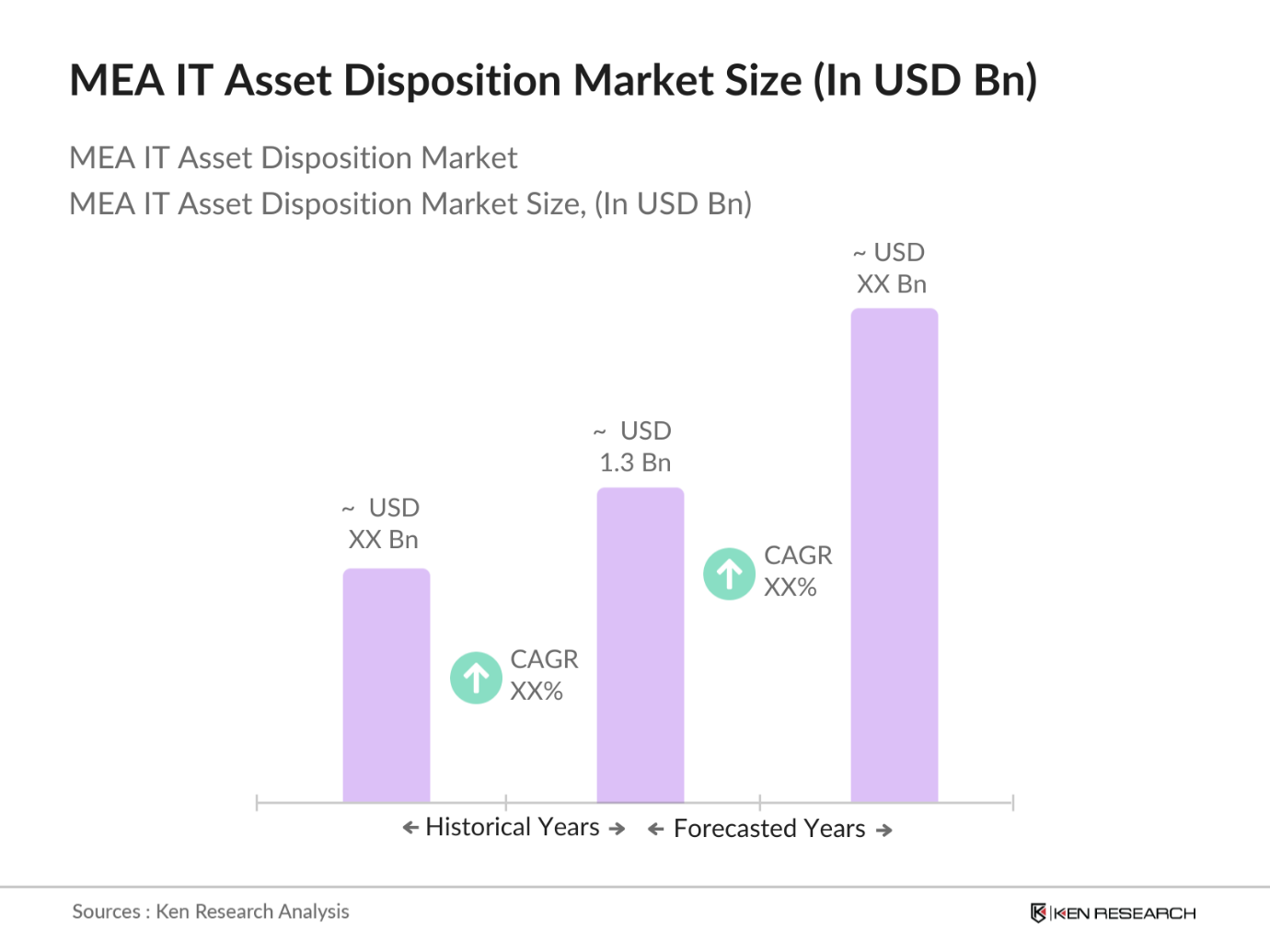

- The MEA IT Asset Disposition (ITAD) market is valued at USD 1.3 billion, reflecting the sectors steady growth due to increasing regulatory focus on data security, environmental sustainability, and responsible e-waste management. Companies are facing mounting pressure to comply with data protection regulations, which is driving up demand for secure and environmentally compliant IT asset disposal services.

- The Middle East is emerging as a leading region within the MEA ITAD market due to rapid digital transformation, government initiatives on e-waste management, and corporate focus on sustainability. Countries like the UAE and Saudi Arabia stand out for their strong regulatory framework and growing adoption of ITAD solutions across various sectors, including government, healthcare, and financial services.

- Increasingly stringent environmental regulations across the MEA are a significant driver for ITAD. Countries like Saudi Arabia and the UAE have implemented policies mandating responsible e-waste disposal and recycling to prevent environmental damage. These regulations enforce businesses to dispose of IT assets properly, leading to greater demand for certified ITAD solutions. These rules also ensure that companies adhere to sustainability goals, making ITAD essential for compliance with national e-waste guidelines and international environmental standards, promoting safe and eco-friendly disposal of electronic waste.

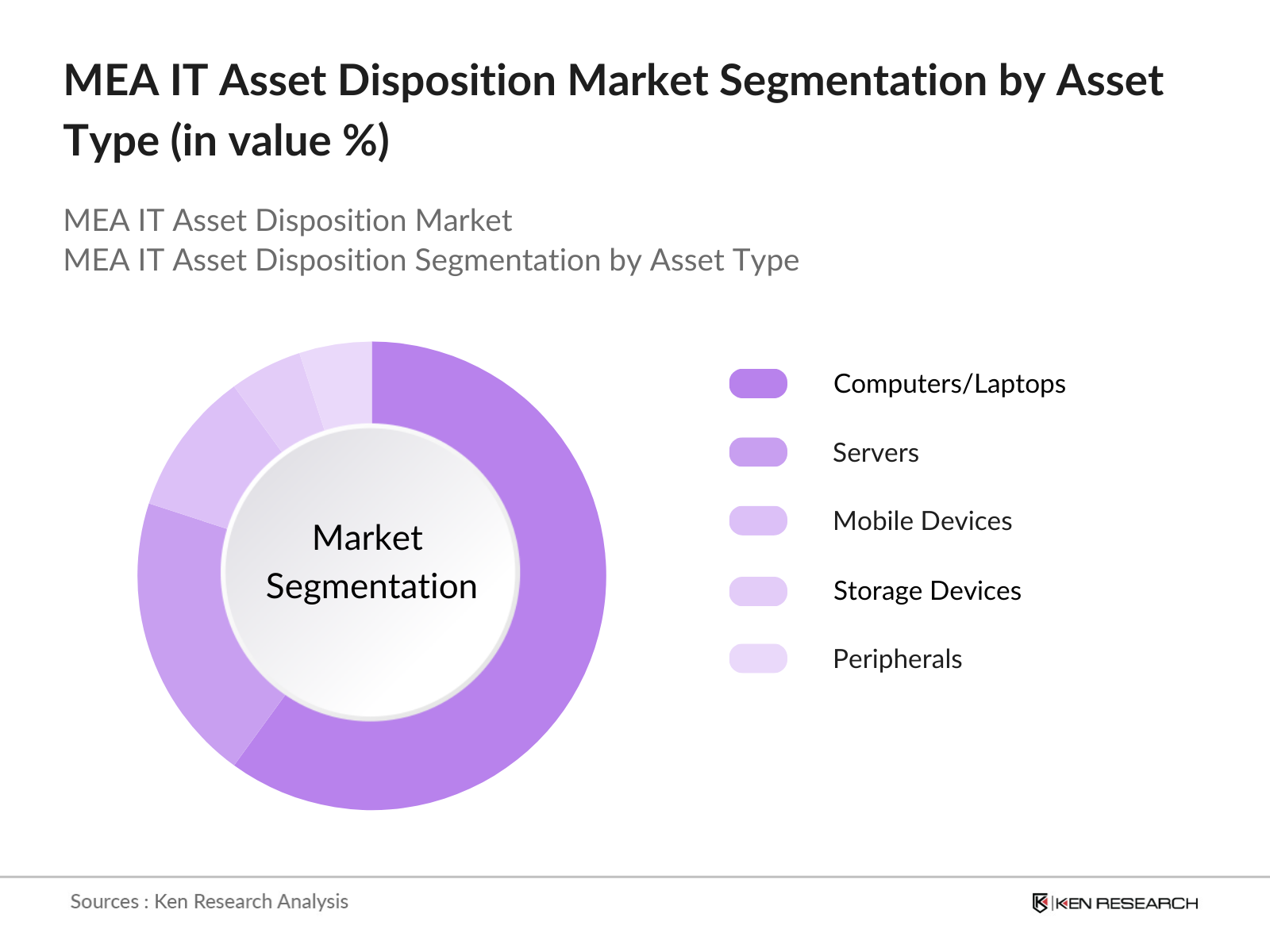

MEA IT Asset Disposition Market Segmentation

By Asset Type: The MEA IT Asset Disposition market is segmented by asset type into computers/laptops, servers, mobile devices, storage devices, and peripherals. Among these, computers/laptops dominate the market, driven by high usage and turnover rates in corporate and government sectors. These devices require specialized disposal to ensure data protection and compliance with environmental standards, contributing significantly to the markets overall growth.

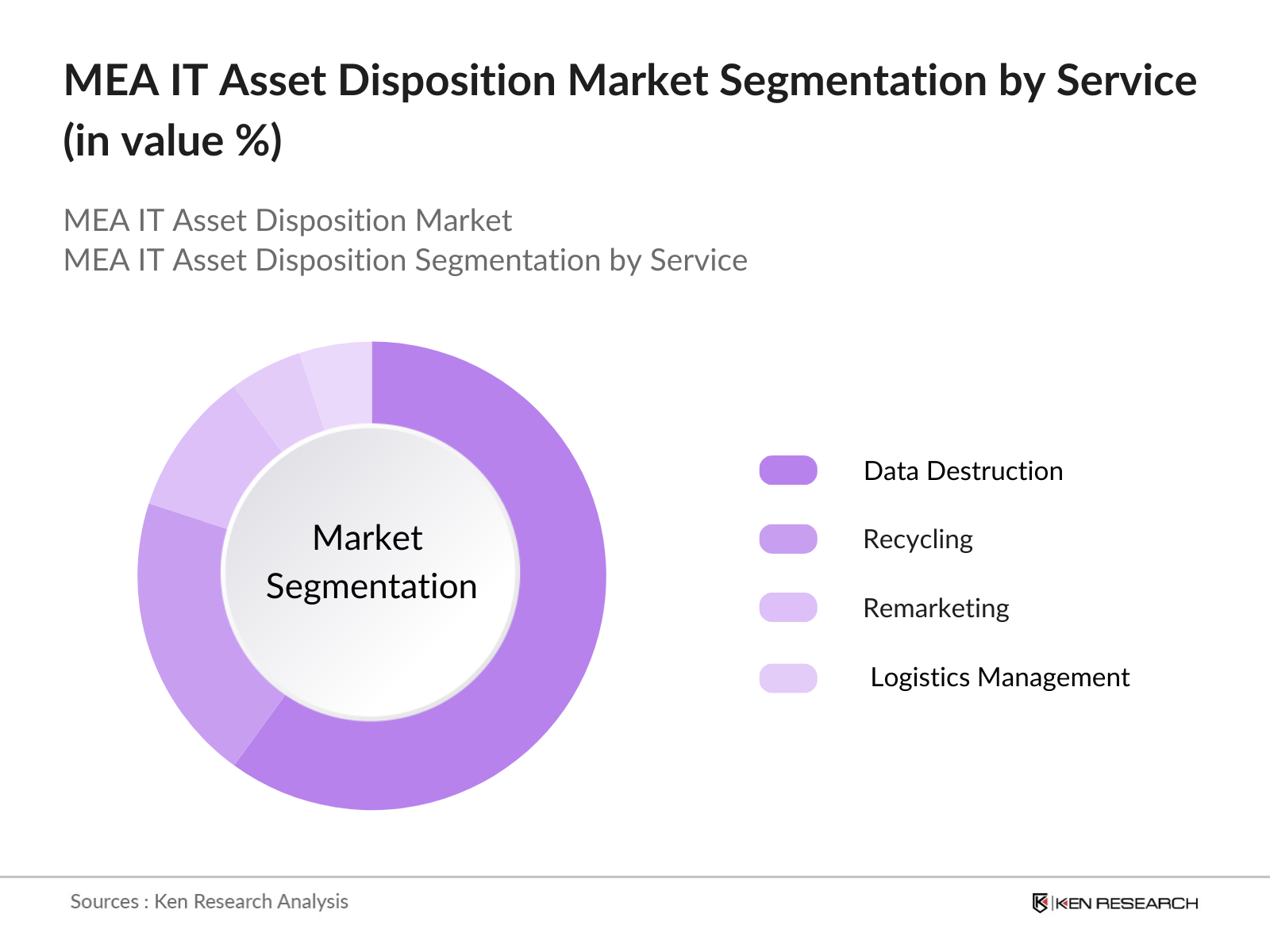

By Service: The market is categorized by services including data destruction, recycling, remarketing & value recovery, logistics management & reverse logistics, and de-manufacturing. Data destruction is the leading service segment as companies prioritize data privacy and regulatory compliance. This trend is particularly strong in industries handling sensitive information, such as BFSI and healthcare.

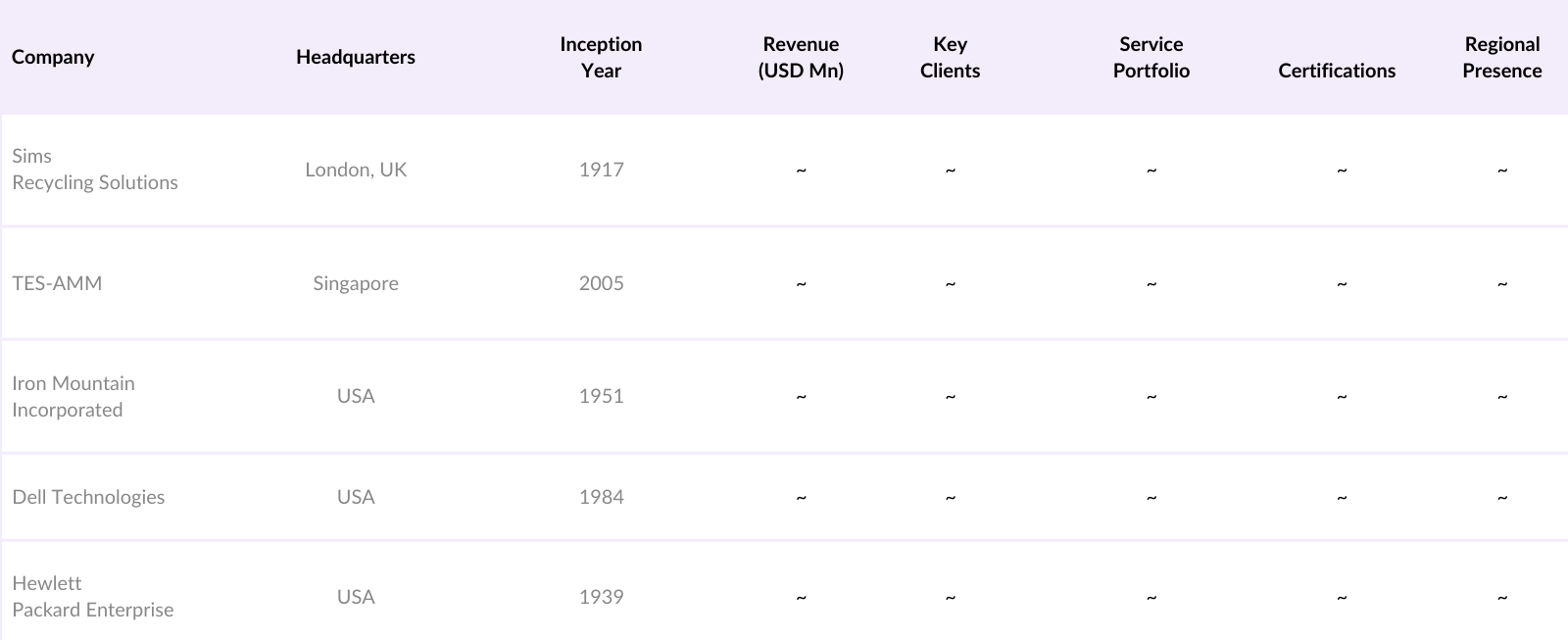

MEA IT Asset Disposition Competitive Landscape

The MEA ITAD market is dominated by a few key players, including Sims Recycling Solutions and TES-AMM, which are well-established in regions like the Middle East. These companies leverage their extensive recycling infrastructure and specialized ITAD services to maintain competitive market positions. Partnerships and strategic alliances are commonly pursued to expand service reach.

MEA IT Asset Disposition Market Analysis

Growth Drivers

- Increasing E-Waste Generation: The MEA region generates around 2 million tons of e-waste each year due to rapid technology adoption and shorter device lifespans. The surge in electronic waste has pushed governments and businesses to adopt sustainable IT asset disposition (ITAD) services. E-waste, which contains both valuable and toxic materials, requires proper handling, creating opportunities for certified ITAD providers. In countries like the UAE, regulations are intensifying to manage this waste, prompting enterprises to rely on professional ITAD services for responsible disposal, data sanitization, and recycling of their old electronic assets.

- Rising Data Security Concerns: With growing data privacy regulations in MEA countries, organizations are increasingly concerned about data breaches when disposing of IT assets. Failure to securely erase data can result in fines and reputational damage, particularly in sectors like finance and healthcare. This concern has elevated the need for ITAD services specializing in secure data destruction. Laws such as the UAEs Data Protection Law require data protection during disposal, increasing reliance on professional ITAD providers for certified data sanitization methods, which ensures legal compliance and mitigates risks of data leaks.

- Technological Advancements: Emerging technologies like blockchain, AI, and IoT are enhancing ITAD processes by improving tracking, data security, and asset recovery. For instance, AI-driven automation in sorting and refurbishing IT assets enhances efficiency and reduces costs, allowing ITAD providers to deliver services more competitively. Blockchain offers secure tracking and certification, ensuring data compliance throughout the asset lifecycle. These technological advancements make ITAD services more efficient and attractive to organizations, increasing adoption rates in MEA countries aiming to keep up with technological progress while ensuring sustainable asset disposition.

Market Challenges

- Lack of Awareness and Skilled Workforce: Limited awareness and a shortage of skilled workers in ITAD processes challenge market growth in the MEA. Many companies remain unaware of the risks associated with improper IT asset disposal, leading to reliance on informal practices. Skilled workforce shortages, particularly in data destruction and recycling, hinder efficient ITAD operations. Without adequate training programs and industry knowledge, businesses often overlook certified ITAD services. Addressing this gap is crucial for market expansion, as awareness initiatives and workforce development can build confidence in ITAD solutions and improve compliance.

- High Initial Costs: Establishing and maintaining ITAD facilities with advanced technology and regulatory compliance is capital-intensive, deterring many small and medium enterprises (SMEs) from entering the market. The costs associated with certifications, secure data destruction, and environmental compliance add financial burdens that discourage adoption, particularly in price-sensitive markets. Larger enterprises may manage these expenses, but for SMEs, the financial strain limits their ability to offer competitive ITAD services. Overcoming this barrier is essential for broader market penetration and to make sustainable asset disposition more accessible.

MEA IT Asset Disposition Future Outlook

Over the next five years, the MEA IT Asset Disposition market is expected to witness substantial growth driven by the increasing adoption of IT services, expanding digital infrastructure, and heightened data protection requirements across industries. Growth in urban centers and increased regulatory efforts for sustainable practices will continue to shape the market dynamics.

Market Opportunities

- Expansion into Emerging Markets: Emerging markets in the MEA region, such as Nigeria and Egypt, present vast opportunities for ITAD providers due to the rising volume of electronic waste and increasing regulatory frameworks. Rapid industrialization and growing digital adoption in these countries lead to significant IT asset turnover, driving demand for responsible ITAD services. Establishing a presence in these high-potential markets enables providers to tap into an expanding customer base, supporting market growth and helping businesses comply with emerging environmental regulations for IT asset disposition.

- Adoption of Circular Economy Practices: The MEA region is increasingly aligning with circular economy principles, emphasizing reuse, refurbishment, and recycling to minimize waste. Companies are adopting ITAD services that extend the lifecycle of IT assets through refurbishment and resale, reducing environmental impact and aligning with sustainability goals. This approach provides a cost-effective solution for businesses seeking to reduce their carbon footprint. ITAD providers focusing on these practices are likely to gain traction as businesses prioritize environmentally responsible disposal and look to create value from decommissioned assets.

Scope of the Report

|

By Asset Type |

Computers/Laptops |

|

By Service |

Data Destruction/Data Sanitization |

|

By Organization Size |

Small and Medium Enterprises |

|

By Industry Vertical |

Banking, Financial Services, and Insurance (BFSI) |

|

By Country |

United Arab Emirates |

Products

Key Target Audience

IT and Telecom Providers

Financial Institutions (including banks and investment firms)

Government and Regulatory Bodies (Ministry of Environment, Data Protection Authorities)

Healthcare Providers

Educational Institutions with extensive IT equipment needs

Manufacturing Companies with complex IT requirements

Retailers and E-commerce Companies with warehousing operations

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Sims Recycling Solutions

TES-AMM

Iron Mountain Incorporated

Dell Technologies

Hewlett Packard Enterprise

IBM Corporation

Arrow Electronics

Apto Solutions

Ingram Micro ITAD

Sipi Asset Recovery

Dataserv Group

EOL IT Services

Blancco Technology Group

LifeSpan International

Prolimax

Table of Contents

1 MEA ITAD Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2 MEA ITAD Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3 MEA ITAD Market Analysis

3.1 Growth Drivers

3.1.1 Increasing E-Waste Generation

3.1.2 Stringent Environmental Regulations

3.1.3 Rising Data Security Concerns

3.1.4 Technological Advancements

3.2 Market Challenges

3.2.1 Lack of Awareness and Skilled Workforce

3.2.2 High Initial Costs

3.2.3 Inadequate Infrastructure

3.3 Opportunities

3.3.1 Expansion into Emerging Markets

3.3.2 Adoption of Circular Economy Practices

3.3.3 Strategic Partnerships and Collaborations

3.4 Trends

3.4.1 Integration of AI and Automation

3.4.2 Growth of Cloud Computing

3.4.3 Emphasis on Sustainable Practices

3.5 Government Regulations

3.5.1 E-Waste Management Policies

3.5.2 Data Protection Laws

3.5.3 Environmental Compliance Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Landscape

4 MEA ITAD Market Segmentation

4.1 By Asset Type (In Value %)

4.1.1 Computers/Laptops

4.1.2 Mobile Devices

4.1.3 Peripherals

4.1.4 Storage Devices

4.1.5 Servers

4.2 By Service (In Value %)

4.2.1 Data Destruction/Data Sanitization

4.2.2 Remarketing and Value Recovery

4.2.3 De-Manufacturing and Recycling

4.2.4 Logistics Management and Reverse Logistics

4.2.5 Others

4.3 By Organization Size (In Value %)

4.3.1 Small and Medium Enterprises

4.3.2 Large Enterprises

4.4 By Industry Vertical (In Value %)

4.4.1 Banking, Financial Services, and Insurance (BFSI)

4.4.2 IT & Telecom

4.4.3 Healthcare

4.4.4 Government and Public Sector

4.4.5 Manufacturing

4.4.6 Others

4.5 By Country (In Value %)

4.5.1 United Arab Emirates

4.5.2 Saudi Arabia

4.5.3 South Africa

4.5.4 Egypt

4.5.5 Nigeria

4.5.6 Rest of MEA

5 MEA ITAD Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Sims Recycling Solutions

5.1.2 TES-AMM

5.1.3 Iron Mountain Incorporated

5.1.4 Dell Technologies

5.1.5 Hewlett Packard Enterprise

5.1.6 IBM Corporation

5.1.7 Arrow Electronics

5.1.8 Apto Solutions

5.1.9 TBS Industries

5.1.10 ITRenew

5.1.11 CloudBlue Technologies

5.1.12 LifeSpan International

5.1.13 Ingram Micro ITAD

5.1.14 Sipi Asset Recovery

5.1.15 R2 Corporation

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Service Portfolio, Regional Presence, Certifications, Key Clients)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6 MEA ITAD Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7 MEA ITAD Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8 MEA ITAD Future Market Segmentation

8.1 By Asset Type (In Value %)

8.2 By Service (In Value %)

8.3 By Organization Size (In Value %)

8.4 By Industry Vertical (In Value %)

8.5 By Country (In Value %)

9 MEA ITAD Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We start by mapping the major stakeholders and market drivers within the MEA IT Asset Disposition market, identifying key variables like regulatory compliance and technological trends.

Step 2: Market Analysis and Construction

This step includes examining historical data on service adoption, IT infrastructure maturity, and data management practices across the MEA region, supplemented by industry statistics and growth trajectories.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with industry experts and ITAD providers, we validate initial findings and refine market insights.

Step 4: Research Synthesis and Final Output

The final report synthesis is based on verified data from primary and secondary research, offering a reliable forecast and market analysis for business professionals.

Frequently Asked Questions

01 How big is the MEA IT Asset Disposition Market?

The MEA IT Asset Disposition market is valued at USD 1.3 billion, reflecting the strong demand for secure asset disposal solutions driven by regulatory requirements and corporate sustainability goals.

02 What are the primary growth drivers in the MEA ITAD Market?

Key drivers include increasing regulatory mandates, data security concerns, and the need for environmentally responsible disposal of IT assets.

03 Who are the major players in the MEA ITAD Market?

Major players include Sims Recycling Solutions, TES-AMM, and Iron Mountain, known for their secure and compliant asset disposal services.

04 What challenges does the MEA ITAD Market face?

Challenges include high disposal costs, limited awareness of ITAD services, and a lack of regional infrastructure for efficient asset disposition.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.