Region:Middle East

Author(s):Geetanshi

Product Code:KRAB0067

Pages:86

Published On:August 2025

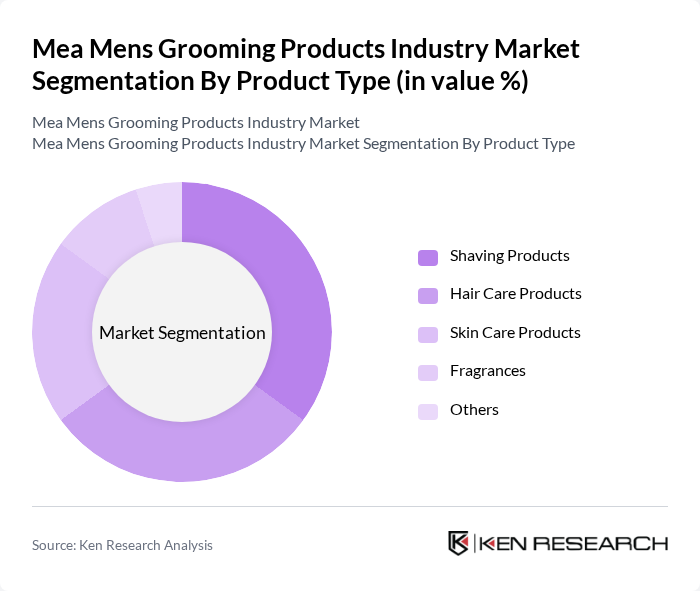

By Product Type:The market is segmented into various product types, including shaving products, hair care products, skin care products, fragrances, and others. Shaving products have historically dominated the market due to the essential nature of shaving in men's grooming routines. However, hair care products are rapidly gaining traction as consumers increasingly prioritize hair health and styling. The demand for skin care products is also on the rise, driven by a growing awareness of skincare among men.

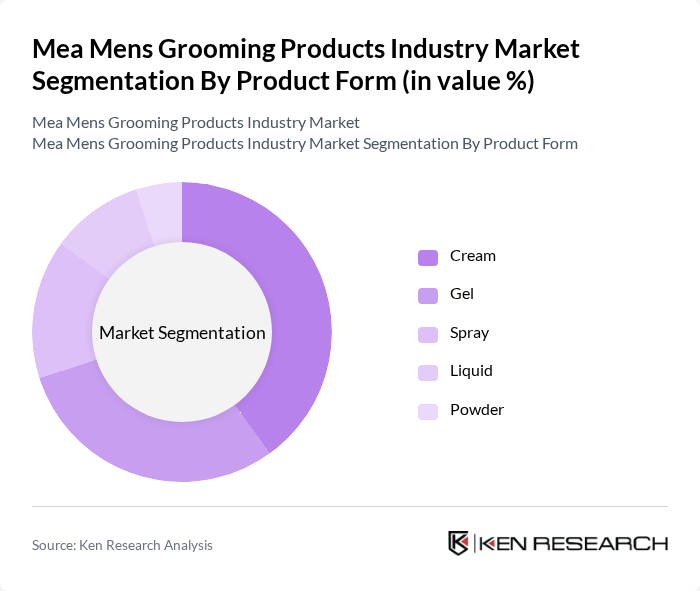

By Product Form:The product form segmentation includes cream, gel, spray, liquid, and powder. Creams and gels are the most popular forms due to their ease of application and effectiveness. Sprays are gaining popularity for their convenience, especially in hair care and fragrances. Liquid forms are commonly used in skin care products, while powders are less common but are finding niche markets in specific grooming applications.

The Mea Mens Grooming Products Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Unilever PLC, Beiersdorf AG, L'Oréal S.A., Colgate-Palmolive Company, Edgewell Personal Care Company, Coty Inc., Revlon Inc., Shiseido Company, Limited, Estée Lauder Companies Inc., Henkel AG & Co. KGaA, Johnson & Johnson, Cremo Company, American Crew (Revlon), Jack Black LLC, Nivea Men (Beiersdorf), Bulldog Skincare for Men, Lush Cosmetics, Marico Limited, Dabur International contribute to innovation, geographic expansion, and service delivery in this space.

The Mea mens grooming products industry is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to innovate with eco-friendly products, aligning with the growing demand for responsible consumption. Additionally, the integration of AI in personalized grooming solutions will enhance customer experiences, allowing for tailored recommendations. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Shaving Products Hair Care Products Skin Care Products Fragrances Others |

| By Product Form | Cream Gel Spray Liquid Powder |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Convenience Stores Online Retail Stores Other Distribution Channels |

| By Price Range | Budget Mid-Range Premium |

| By Geography | United Arab Emirates Saudi Arabia South Africa Nigeria Rest of Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Users | 100 | Consumers aged 18-45, Skincare Enthusiasts |

| Haircare Product Retailers | 60 | Store Managers, Beauty Advisors |

| Shaving Product Consumers | 50 | Men aged 25-55, Grooming Product Users |

| Online Grooming Product Shoppers | 80 | eCommerce Users, Digital Marketing Managers |

| Natural Grooming Product Advocates | 40 | Eco-conscious Consumers, Health & Wellness Influencers |

The Mea Mens Grooming Products Industry Market is valued at approximately USD 8.5 billion, reflecting a significant growth trend driven by increased consumer awareness and demand for premium grooming products.