MEA Mobile Virtual Network Operator Market Outlook to 2030

Region:Middle East

Author(s):Yogita Sahu

Product Code:KROD8352

December 2024

89

About the Report

MEA Mobile Virtual Network Operator Market Overview

- The Middle East and Africa (MEA) Mobile Virtual Network Operator (MVNO) market was valued at USD 1.4 billion. This market expansion is largely driven by the rising demand for affordable mobile services, increased smartphone penetration, and the rollout of 4G and 5G networks in the region. Regulatory changes encouraging MVNO operations have also played a crucial role in facilitating market entry, leading to competitive pricing strategies, better service quality, and a broader range of mobile offerings across consumer segments.

- Countries like Saudi Arabia, South Africa, and Egypt dominate the MVNO landscape in the region. Saudi Arabia leads due to its advanced digital infrastructure, government support, and higher consumer demand for mobile services. South Africa and Egypt are other major markets, bolstered by increasing investments in digital services, improved network coverage, and a growing middle class seeking affordable mobile plans.

- In 2024, Saudi Arabia's Communications and Information Technology Commission (CITC) announced plans to issue additional MVNO licenses as part of its Vision 2030 strategy. The initiative aims to boost competition in the telecom market by adding at least five more MVNOs by 2025, with a focus on increasing mobile penetration in remote areas.

MEA Mobile Virtual Network Operator Market Segmentation

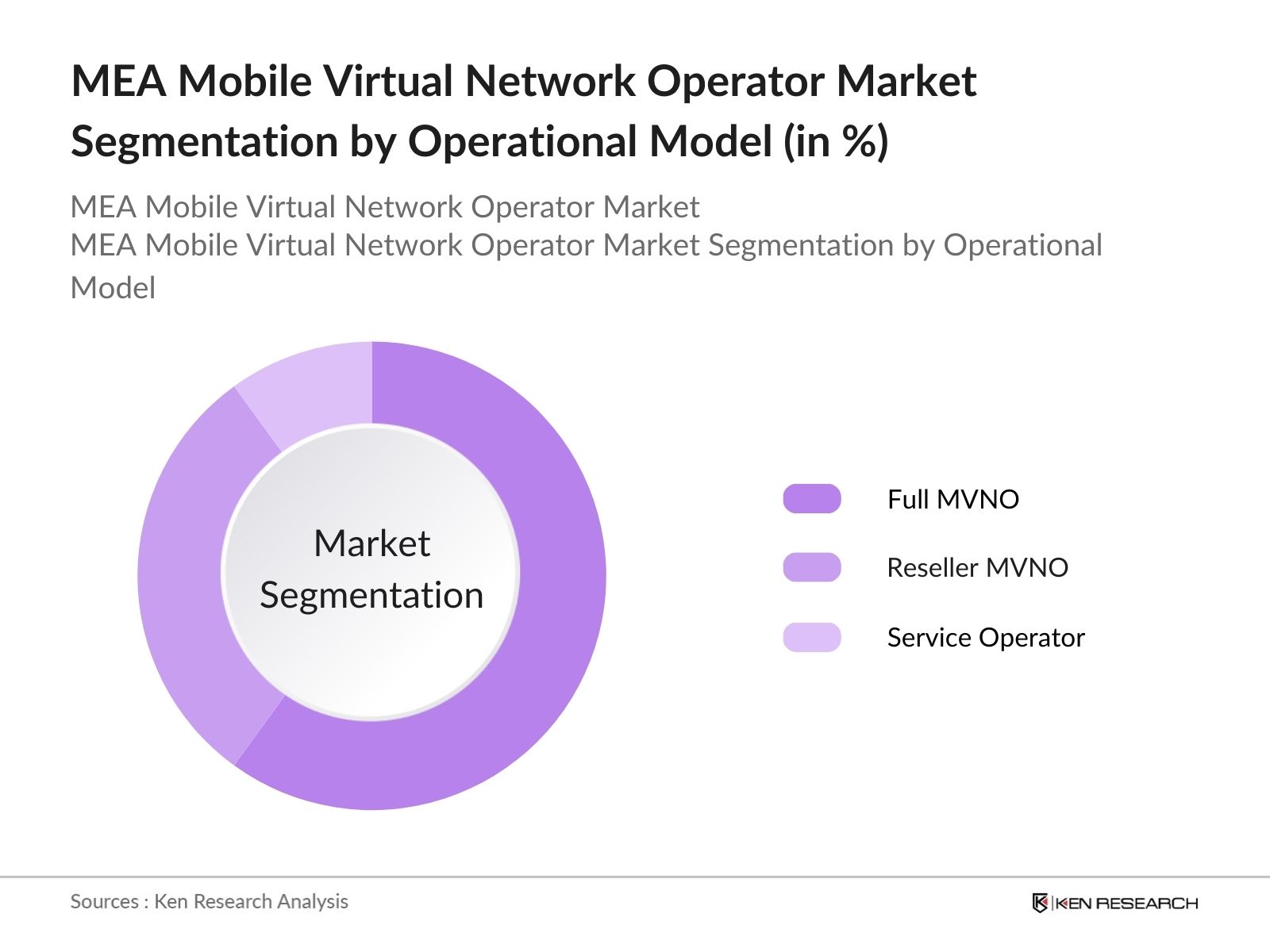

By Operational Model: The market is segmented by operational models into Reseller, Service Operator, and Full MVNOs. The Full MVNO segment dominated the market in 2023, accounting for nearly 60% of the market share. Full MVNOs manage their infrastructure and customer services, enabling them to offer competitive pricing, greater flexibility, and international roaming services. The strong growth of Full MVNOs can be attributed to regulatory support for new entrants, helping them compete with established mobile network operators (MNOs).

By Subscriber Type: Subscriber segmentation in the market includes Consumer and Enterprise segments. The Consumer segment leads the market, making up a substantial portion of the revenue, primarily driven by high smartphone adoption and the rising demand for mobile data services. The Enterprise segment is gaining traction, particularly in the Machine-to-Machine (M2M) and Internet of Things (IoT) markets, as businesses increasingly seek customized mobile solutions.

MEA Mobile Virtual Network Operator Market Competitive Landscape

The market is competitive, with several established players and newer entrants. The competitive landscape is shaped by strategic partnerships between MVNOs and MNOs, as well as mergers and acquisitions to enhance service offerings and expand market share.

|

Company |

Establishment Year |

Headquarters |

Key Partnerships |

Subscriber Base (Million) |

Market Focus |

Technological Focus |

Revenue (USD Mn) |

Presence in GCC |

Global Reach |

|

Virgin Mobile KSA |

2007 |

Riyadh, KSA |

|||||||

|

Lebara Mobile KSA |

2004 |

London, UK |

|||||||

|

FRiENDi Mobile |

2009 |

Dubai, UAE |

|||||||

|

Swyp (Etisalat UAE) |

2017 |

Abu Dhabi, UAE |

|||||||

|

Majan Telecommunication |

2007 |

Muscat, Oman |

MEA Mobile Virtual Network Operator Market Analysis

Market Growth Drivers

- Increased Demand for Low-Cost Communication Services: The market has witnessed rising demand for low-cost communication services, particularly among the migrant population and cost-conscious users. According to a 2024 report from the International Telecommunication Union (ITU), over 100 million mobile phone users in the MEA region prefer prepaid services, driving the growth of MVNOs, which offer flexible, budget-friendly plans.

- Regulatory Support for MVNO Expansion: Governments across the MEA region have been actively promoting competition in the telecom sector by encouraging MVNO licenses. In 2024, Saudi Arabia issued licenses for multiple new MVNOs, allowing more players to enter the market. As per the Telecommunications Regulatory Authority (TRA) of the UAE, more than 10 new MVNO licenses have been issued in the past three years, enabling companies to expand their operations.

- Rising Mobile Penetration in Rural Areas: The MEA region has witnessed an increase in mobile penetration in rural and underserved areas, further driving the demand for affordable telecom solutions. According to the World Banks 2024 report, mobile penetration in rural Africa has grown by over 50 million new subscribers in the last five years.

Market Challenges

- High Dependency on Host Networks: MVNOs in the MEA region face a challenge due to their reliance on host Mobile Network Operators (MNOs) for infrastructure and spectrum access. In 2024, approximately 90% of MVNOs in the region depend on leasing spectrum and infrastructure from MNOs, limiting their ability to offer differentiated services.

- Limited Market Differentiation: A key challenge for MVNOs in the MEA region is limited differentiation in their service offerings. According to the GSMAs 2024 market analysis, over 50 MVNOs in the region offer similar prepaid voice and data plans, making it difficult for smaller players to carve out a unique market position.

MEA Mobile Virtual Network Operator Market Future Outlook

Over the next five years, the MEA MVNO industry is expected to experience substantial growth, driven by factors such as the widespread adoption of 5G technology, increased penetration of affordable smartphones, and growing demand for IoT and M2M services.

Future Market Opportunities

- Expansion of 5G MVNO Services: Over the next five years, the market will see an expansion in 5G services as mobile operators continue to invest heavily in upgrading their network infrastructure. By 2029, it is estimated that over 50 million MVNO users in the MEA region will have access to 5G services, particularly in urban centers of Saudi Arabia, the UAE, and South Africa.

- Growth of Digital-Only MVNOs in North Africa: The digital-only MVNO model is expected to gain considerable traction in North Africa, with a projected 10 million new digital subscribers by 2029. Countries like Egypt and Tunisia, which already have high mobile penetration rates, will witness the entry of more digital-focused MVNOs, catering to the increasing demand for mobile-first financial services and e-commerce platforms.

Scope of the Report

|

Operational Model |

Reseller Full MVNO Service Operator |

|

Subscriber Type |

Consumer Enterprise |

|

Service Type |

Prepaid Postpaid |

|

Business Model |

Discount Specialist Data Roaming |

|

Region |

GCC North Africa Rest of Middle East Sub-Saharan Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecom Operators and Service Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Telecommunications Regulatory Authority, GCC Telecom Bodies)

Mobile Device Manufacturers

Enterprise Customers (IoT/M2M service users)

Technology Solution Providers

Infrastructure Providers

Retail and E-Commerce Companies

Companies

Players Mentioned in the Report:

Virgin Mobile KSA

Lebara Mobile KSA

FRiENDi Mobile

Swyp (Etisalat UAE)

Majan Telecommunication LLC (Renna Mobile)

Vodacom

Digicel

Virgin Mobile South Africa

Tunisie Telecom

Telecom Egypt

Table of Contents

1. MEA Mobile Virtual Network Operator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Structure

1.4. Market Segmentation Overview

2. MEA Mobile Virtual Network Operator Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Market Growth Rate

2.3. Key Milestones and Developments

3. MEA Mobile Virtual Network Operator Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of 5G Networks

3.1.2. Increasing Mobile Penetration

3.1.3. Favorable Government Regulations

3.1.4. Rising Demand for IoT and M2M Services

3.2. Market Challenges

3.2.1. Intense Competition and Price Wars

3.2.2. Regulatory and Infrastructure Challenges

3.2.3. Customer Retention and Churn Rates

3.3. Opportunities

3.3.1. Expansion into Underserved Markets

3.3.2. Strategic Partnerships with Telecom Operators

3.3.3. Adoption of Data-Driven Business Models

3.4. Trends

3.4.1. Rise of Multi-Service MVNOs

3.4.2. Adoption of Digital-Only MVNO Models

3.4.3. Increase in Enterprise-Focused MVNO Solutions

4. MEA Mobile Virtual Network Operator Market Segmentation

4.1. By Operational Model (In Value %)

4.1.1. Reseller MVNOs

4.1.2. Full MVNOs

4.1.3. Service Operator MVNOs

4.2. By Subscriber Type (In Value %)

4.2.1. Consumer

4.2.2. Enterprise

4.3. By Service Type (In Value %)

4.3.1. Prepaid

4.3.2. Postpaid

4.4. By Business Model (In Value %)

4.4.1. Discount MVNOs

4.4.2. Specialist Data MVNOs

4.4.3. Roaming MVNOs

4.5. By Region (In Value %)

4.5.1. GCC Countries

4.5.2. North Africa

4.5.3. Rest of Middle East

4.5.4. Sub-Saharan Africa

5. MEA Mobile Virtual Network Operator Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Virgin Mobile KSA

5.1.2. Lebara Mobile KSA

5.1.3. FRiENDi Mobile

5.1.4. Swyp (Etisalat UAE)

5.1.5. Majan Telecommunication LLC (Renna Mobile)

5.1.6. Vodacom

5.1.7. Digicel

5.1.8. Virgin Mobile South Africa

5.1.9. Tunisie Telecom

5.1.10. Telecom Egypt

5.1.11. Orange MEA

5.1.12. MTN South Africa

5.1.13. Zain KSA

5.1.14. Ooredoo

5.1.15. Mobily

5.2. Cross Comparison Parameters (Revenue, Subscribers, Market Share, Key Partnerships, Technology Usage)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

6. MEA Mobile Virtual Network Operator Regulatory Framework

6.1. Telecom Regulatory Environment

6.2. MVNO Licensing Process

6.3. Data Privacy and Security Regulations

6.4. Compliance and Certification Requirements

7. MEA Mobile Virtual Network Operator Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Growth Drivers

8. MEA Mobile Virtual Network Operator Future Market Segmentation

8.1. By Operational Model (In Value %)

8.2. By Subscriber Type (In Value %)

8.3. By Service Type (In Value %)

8.4. By Business Model (In Value %)

8.5. By Region (In Value %)

9. MEA Mobile Virtual Network Operator Market Analysts Recommendations

9.1. White Space Opportunity Analysis

9.2. Competitive Positioning

9.3. Market Entry Strategies

9.4. Technology Adoption Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We start by mapping the key stakeholders within the MEA MVNO market, utilizing both secondary databases and proprietary sources to gather market data. The focus is on identifying variables that shape the market, such as technological innovations and regulatory changes.

Step 2: Market Analysis and Construction

In this phase, we collect historical data on MVNO operations, including the number of subscribers and revenue generated. We also analyze network penetration rates and operational models to provide a comprehensive understanding of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with telecom experts and key industry stakeholders, using computer-assisted telephone interviews (CATI). This provides practical insights into operational and financial aspects of MVNOs in the region.

Step 4: Research Synthesis and Final Output

We finalize the market report by integrating feedback from MVNO operators and cross-referencing the data obtained through a bottom-up approach to ensure accurate revenue projections and market forecasts.

Frequently Asked Questions

1. How big is the MEA MVNO market?

The MEA MVNO market is valued at USD 1.4 billion, driven by rising smartphone penetration and demand for affordable services across the region.

2. What are the challenges in the MEA MVNO market?

Challenges in the MEA MVNO market include regulatory complexities, network infrastructure limitations in rural areas, and competition from established mobile network operators.

3. Who are the major players in the MEA MVNO market?

Key players in the MEA MVNO market include Virgin Mobile KSA, Lebara Mobile, FRiENDi Mobile, Swyp (Etisalat UAE), and Majan Telecommunication LLC.

4. What is driving growth in the MEA MVNO market?

Growth in the MEA MVNO market is fueled by the adoption of 5G technology, increasing demand for affordable mobile services, and strategic partnerships between MVNOs and MNOs.

5. What are the future trends in the MEA MVNO market?

Future trends in the MEA MVNO market include the expansion of IoT and M2M services, the rollout of 5G networks, and regulatory reforms supporting MVNO operations across the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.