MEA Online Gambling Market Outlook to 2030

Region:Global

Author(s):Shreya

Product Code:KROD6961

December 2024

85

About the Report

MEA Online Gambling Market Overview

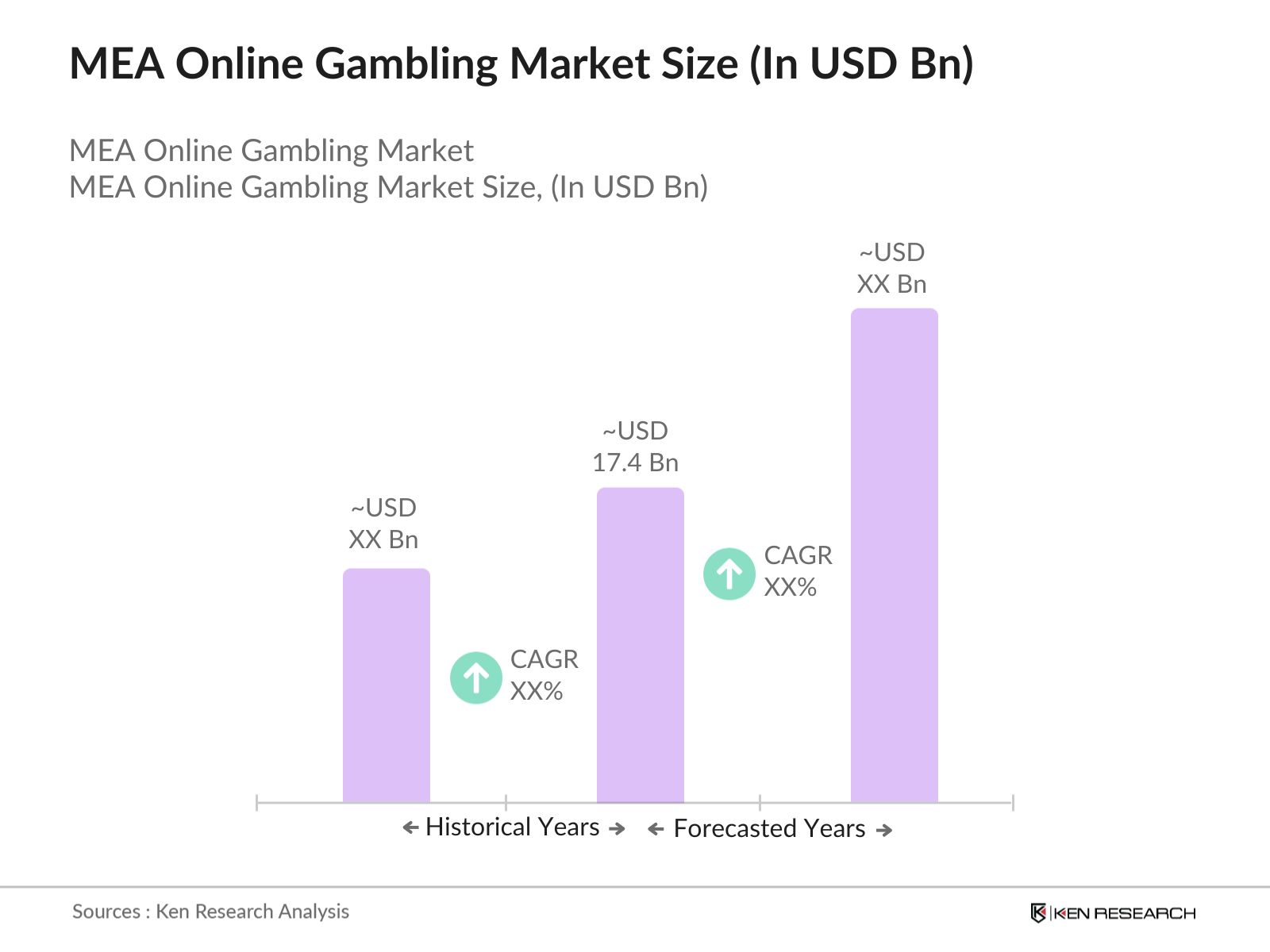

- The MEA Online Gambling Market is currently valued at USD 17.4 billion, driven by a combination of increasing internet penetration, growing mobile adoption, and shifts in consumer entertainment preferences across the region. The availability of online payment systems and relaxed regulatory frameworks in certain regions have contributed significantly to market expansion. Rising digital engagement and convenience have pushed more consumers towards online platforms, supporting consistent growth.

- The dominant regions within the MEA Online Gambling Market include the UAE, South Africa, and Nigeria. These regions exhibit substantial growth due to advanced infrastructure, high internet and smartphone penetration, and favorable economic conditions. The UAE and South Africa, in particular, benefit from a population with disposable income willing to engage in digital entertainment, while Nigerias youth demographic drives demand for accessible mobile gambling options.

- The regulatory landscape for online gambling in the MEA region varies significantly. In 2023, Kenya's Betting Control and Licensing Board issued 15 new licenses to online gambling operators, reflecting a structured approach to regulation. Conversely, countries like Saudi Arabia maintain strict prohibitions, with no licenses granted for gambling activities. This disparity necessitates that operators thoroughly understand and comply with local licensing requirements to operate legally within each jurisdiction.

MEA Online Gambling Market Segmentation

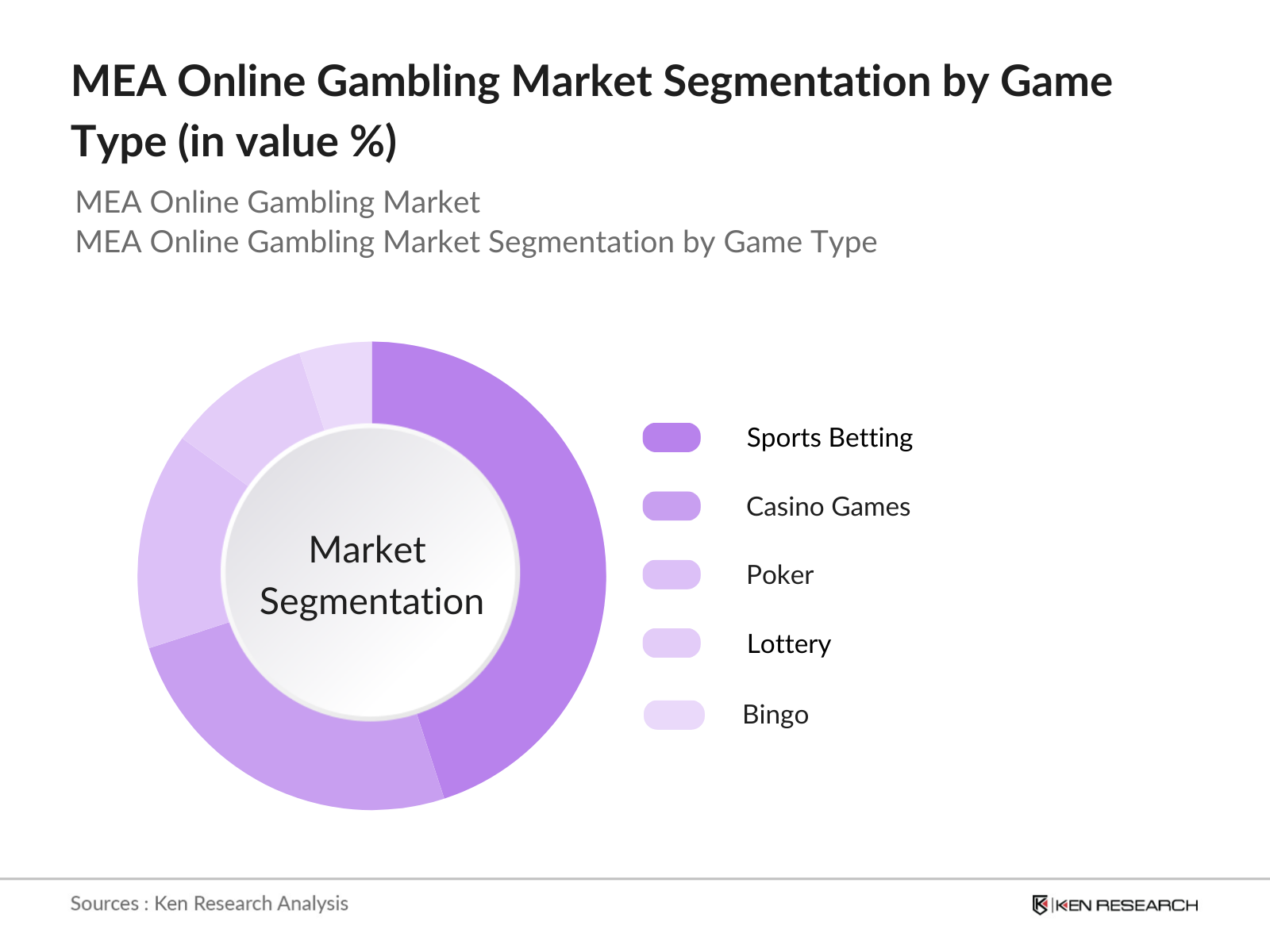

By Game Type: The Market is segmented by game type into sports betting, casino games, poker, lottery, and bingo. Recently, sports betting has a dominant market share in the MEA region under the segmentation by game type. This dominance is attributed to the immense popularity of global sports, particularly soccer, which attracts a large number of bettors. Additionally, mobile betting apps make it easy for consumers to engage in real-time betting, enhancing user experience and driving sports bettings popularity.

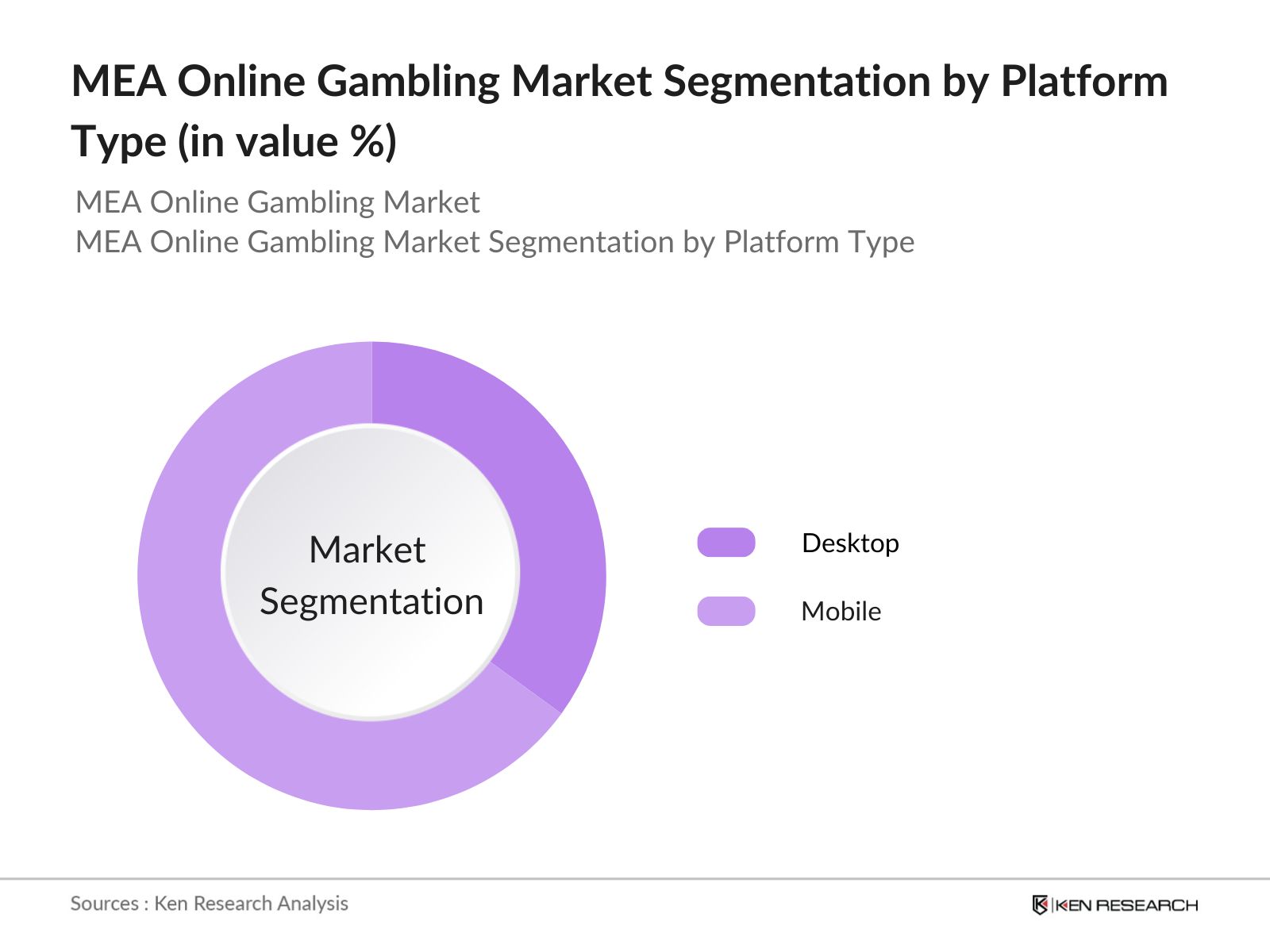

By Platform Type: The Market is segmented by platform type into desktop and mobile. The mobile segment has recently captured a significant market share, reflecting the increasing mobile device adoption across the region. The convenience of accessing games on-the-go and the tailored experience provided by mobile-friendly gambling apps have led to a higher preference for mobile gaming among consumers. This trend aligns with the global shift towards mobile engagement and is expected to continue its upward trajectory.

MEA Online Gambling Market Competitive Landscape

The MEA Online Gambling Market is characterized by the presence of both regional and international players. Leading players leverage technological advancements and region-specific marketing to capture substantial market shares. A few of the key players driving this market include Betway, 888 Holdings, and Ladbrokes Coral Group, whose established digital presence and brand loyalty make them formidable competitors.

MEA Online Gambling Market Analysis

Growth Drivers

- Increased Internet Penetration: As of 2024, the Middle East and Africa (MEA) region has witnessed a significant rise in internet users, reaching approximately 600 million individuals. This surge is largely attributed to substantial investments in digital infrastructure and the proliferation of affordable internet services. For instance, Nigeria reported over 150 million internet subscribers in 2023, reflecting the region's rapid digital transformation.

- Mobile Device Adoption: The MEA region has experienced a notable increase in mobile device usage, with over 700 million mobile connections recorded in 2023. This widespread adoption is driven by the availability of cost-effective smartphones and enhanced mobile network coverage. In South Africa, smartphone penetration reached 91% in 2023, facilitating greater access to online gambling platforms.

- Changing Consumer Preferences: Consumer behavior in the MEA region is shifting towards digital entertainment, with online gaming and gambling gaining popularity. A 2023 survey indicated that 35% of internet users in the region engaged in online gaming activities, highlighting a growing acceptance of digital gambling platforms. This trend is supported by the younger demographic's preference for mobile-based entertainment.

Market Challenges

- Regulatory Restrictions: Despite progress, certain MEA countries maintain stringent regulations on online gambling. For example, in 2023, Saudi Arabia upheld a complete ban on all forms of gambling, including online platforms, limiting market expansion in these regions. Additionally, Egypt's restrictive policies have resulted in the shutdown of multiple unauthorized online gambling sites in 2023.

- Concerns around Gambling Addiction: The rise of online gambling has led to increased concerns about addiction. In 2023, South Africa's National Responsible Gambling Programme reported a 15% rise in calls related to online gambling addiction. This underscores the need for effective measures to address problem gambling in the region.

MEA Online Gambling Market Future Outlook

Over the next five years, the MEA Online Gambling Market is expected to exhibit considerable growth driven by the expansion of internet infrastructure, advancements in mobile technology, and an increase in digital literacy among the youth population. Favorable regulatory shifts in specific regions are also anticipated to create new avenues for market players. As consumers increasingly shift towards digital forms of entertainment, the online gambling market is positioned to leverage technological innovations to offer more immersive and interactive experiences.

Future Market Opportunities

- Technological Innovations: The integration of Artificial Intelligence (AI) and Virtual Reality (VR) in online gambling offers immersive experiences. In 2023, several MEA-based platforms began implementing AI-driven personalized gaming recommendations, enhancing user engagement. Additionally, VR-enabled casinos are emerging, providing players with realistic gaming environments, thereby attracting a tech-savvy audience.

- E-Sports Betting Expansion: E-sports betting is gaining traction in the MEA region. In 2023, the Middle East saw over 5 million e-sports enthusiasts, with a significant portion engaging in betting activities. The establishment of regional e-sports tournaments has further fueled this trend, presenting opportunities for online gambling operators to tap into this growing market segment.

Scope of the Report

|

Type |

Sports Betting Casino Poker Bingo Lottery |

|

Platform |

Mobile Desktop Tablet |

|

Payment Method |

Credit/Debit Cards E-wallets Bank Transfers Cryptocurrency |

|

Age Group |

18-24 25-34 35-44 45 and above |

|

Country |

North Africa GCC Sub Saharan Africa |

Products

Key Target Audience

Government and Regulatory Bodies (e.g., UAE National Media Council, South African National Gambling Board)

Investments and Venture Capitalist Firms

Mobile Network Operators

Payment Processing Companies

Technology Solution Providers

Marketing and Advertising Agencies

Online Platform Developers

Cybersecurity Service Providers

Companies

Major Players

Betway

888 Holdings

Ladbrokes Coral Group

Bet365

Kindred Group

Betsson AB

The Stars Group

William Hill PLC

DraftKings

FanDuel

Mansion Group

Betfair

1xBet

Flutter Entertainment

GVC Holdings

Table of Contents

MEA Online Gambling Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics and Growth Rate

1.4. Market Segmentation Overview

MEA Online Gambling Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

MEA Online Gambling Market Analysis

3.1. Growth Drivers

3.1.1. Increased Internet Penetration

3.1.2. Mobile Device Adoption

3.1.3. Changing Consumer Preferences

3.1.4. Legalization and Regulatory Relaxation

3.2. Market Challenges

3.2.1. Regulatory Restrictions (Region-specific)

3.2.2. Concerns around Gambling Addiction

3.2.3. Payment Gateways and Banking Restrictions

3.2.4. Competition with Traditional Gambling

3.3. Opportunities

3.3.1. Technological Innovations (AI, VR)

3.3.2. E-Sports Betting Expansion

3.3.3. Strategic Partnerships and Sponsorships

3.3.4. Expansion into Untapped Regions

3.4. Trends

3.4.1. Rise of Cryptocurrency in Betting

3.4.2. Integration with Social Media Platforms

3.4.3. Personalized Betting Experiences

3.4.4. Live Betting and Streaming Services

3.5. Government Regulations

3.5.1. Gambling Licenses and Permits

3.5.2. Taxation Policies

3.5.3. Regional Regulatory Bodies

3.5.4. Player Protection Laws

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

MEA Online Gambling Market Segmentation

4.1. By Game Type (In Value %)

4.1.1. Sports Betting

4.1.2. Casino Games

4.1.3. Poker

4.1.4. Lottery

4.1.5. Bingo

4.2. By Platform Type (In Value %)

4.2.1. Desktop

4.2.2. Mobile

4.3. By Payment Method (In Value %)

4.3.1. Credit/Debit Card

4.3.2. E-Wallet

4.3.3. Bank Transfer

4.3.4. Cryptocurrency

4.4. By End-User Demographic (In Value %)

4.4.1. Age Group

4.4.2. Income Level

4.5. By Region (In Value %)

4.5.1. North Africa

4.5.2. GCC

4.5.3. Sub-Saharan Africa

MEA Online Gambling Market Competitive Analysis

5.1. Profiles of Major Companies

5.1.1. Betway

5.1.2. Bet365

5.1.3. 888 Holdings

5.1.4. Ladbrokes Coral Group

5.1.5. Betsson AB

5.1.6. Flutter Entertainment

5.1.7. The Stars Group

5.1.8. William Hill PLC

5.1.9. Kindred Group

5.1.10. GVC Holdings

5.1.11. 1xBet

5.1.12. DraftKings

5.1.13. FanDuel

5.1.14. Mansion Group

5.1.15. Betfair

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Regional Presence, Customer Base, Digital Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

MEA Online Gambling Market Regulatory Framework

6.1. National and Regional Regulations

6.2. Compliance Requirements

6.3. Certification Processes

6.4. Anti-Money Laundering (AML) Policies

MEA Online Gambling Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

MEA Online Gambling Market Future Segmentation

8.1. By Game Type (In Value %)

8.2. By Platform Type (In Value %)

8.3. By Payment Method (In Value %)

8.4. By End-User Demographic (In Value %)

8.5. By Region (In Value %)

MEA Online Gambling Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Cohort Analysis

9.3. Marketing Initiatives and Digital Engagement Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial step involved developing an ecosystem map identifying all significant stakeholders in the MEA Online Gambling Market. Comprehensive desk research utilizing secondary sources and proprietary databases was conducted to gather extensive market-level information, emphasizing critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data for the MEA Online Gambling Market was compiled and assessed, focusing on factors such as market penetration, consumer behavior trends, and technological adoption rates. Service quality statistics and user retention metrics were evaluated to ensure the accuracy of market estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated and validated through direct consultation with industry experts from various companies via computer-assisted interviews. These discussions provided essential insights into market performance, allowing for precise data validation.

Step 4: Research Synthesis and Final Output

Direct interactions with leading online gambling platforms contributed detailed information on user segments, popular game types, and other relevant data. This step aimed to substantiate the findings from the bottom-up analysis, ensuring a comprehensive and validated market evaluation.

Frequently Asked Questions

How big is the MEA Online Gambling Market?

The MEA Online Gambling Market is valued at USD 17.4 billion, driven by rising internet penetration, mobile adoption, and evolving consumer preferences towards digital gaming options.

What are the major challenges in the MEA Online Gambling Market?

Challenges in the MEA Online Gambling Market include regulatory constraints in certain regions, competition from traditional gambling methods, and issues with online payment processing. Cybersecurity is also a growing concern for operators.

Who are the key players in the MEA Online Gambling Market?

Major players in the MEA Online Gambling Market include Betway, 888 Holdings, Bet365, Ladbrokes Coral Group, and Kindred Group. These companies have established strong digital presences and brand loyalty, positioning them at the forefront of the market.

What are the main growth drivers for the MEA Online Gambling Market?

Growth drivers in the MEA Online Gambling Market include increased smartphone penetration, the convenience of digital payment solutions, and evolving consumer preferences for online entertainment, particularly in sports betting and casino gaming.

Which regions dominate the MEA Online Gambling Market?

The UAE, South Africa, and Nigeria are leading regions in the MEA Online Gambling Market due to their advanced internet infrastructure, high smartphone adoption rates, and supportive economic conditions for digital transactions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.