MEA Packaged Vegan Food Market Outlook to 2030

Region:Global

Author(s):Abhinav Kumar

Product Code:KROD9576

January 2025

81

About the Report

MEA Packaged Vegan Food Market Overview

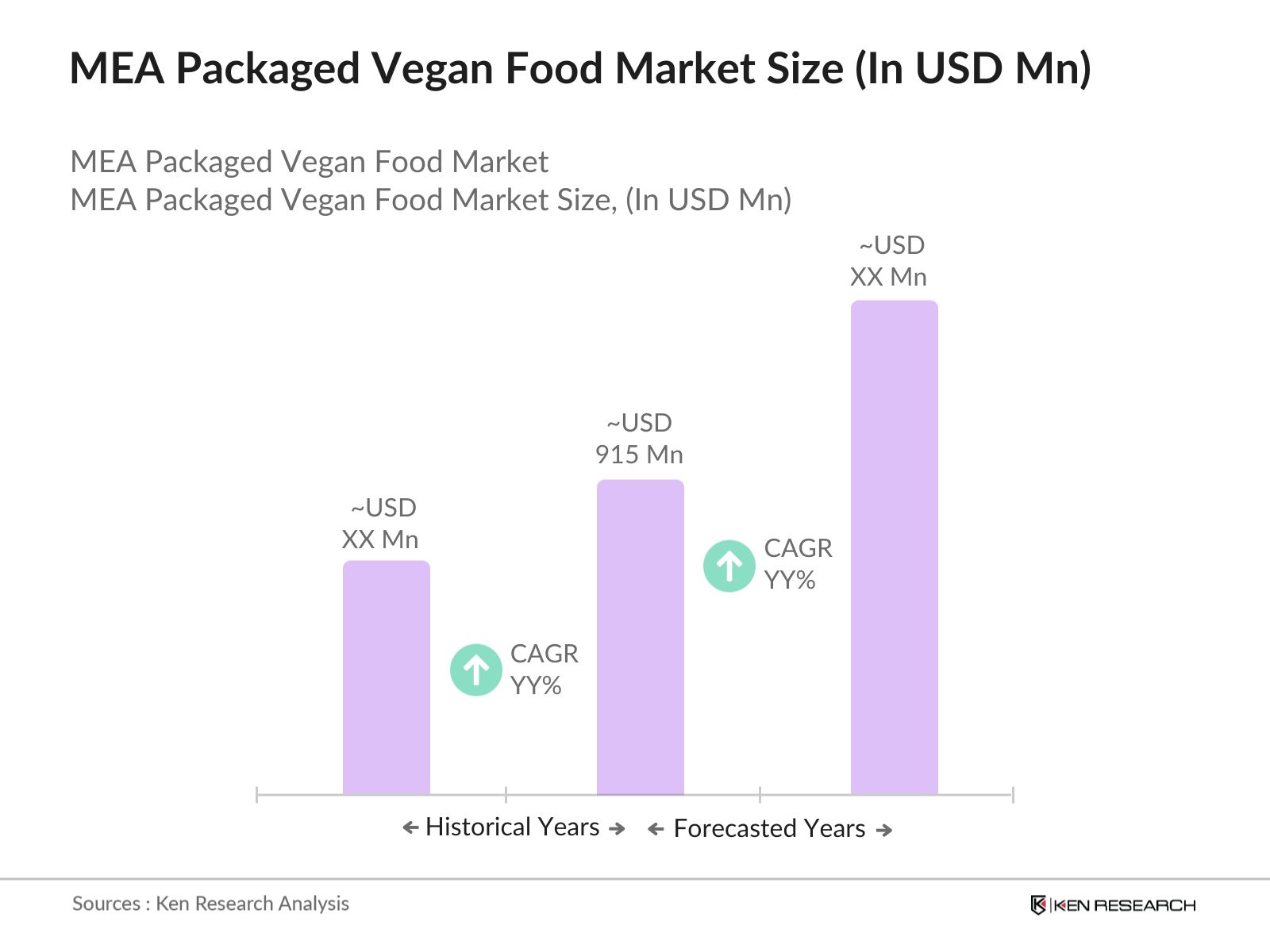

- The MEA Packaged Vegan Food market is valued at USD 915 million, based on a five-year historical analysis. The market is primarily driven by a shift in consumer preferences toward plant-based diets, motivated by health, environmental concerns, and ethical considerations. Additionally, advancements in food processing and an increase in the availability of vegan options across retail and e-commerce platforms have contributed to this growth.

- Countries such as the United Arab Emirates and South Africa dominate the market due to their growing urban populations, higher disposable incomes, and well-established retail infrastructure. The UAEs rapid adoption of sustainable lifestyles and South Africas increasing awareness of plant-based diets among health-conscious consumers position them as key players in the regions market landscape.

- As part of its Vision 2030 initiative, the Saudi government is promoting healthier lifestyles among its citizens. The Ministry of Health has launched campaigns encouraging the consumption of plant-based foods to combat rising obesity rates, which stood at 28.7% in 2023. These initiatives are expected to boost the vegan food market.

MEA Packaged Vegan Food Market Segmentation

By Product Type: The market is segmented by product type into dairy alternatives, meat substitutes, vegan bakery and confectionery, and ready-to-eat meals. Recently, dairy alternatives have a dominant market share under this segmentation. This is largely attributed to the increasing prevalence of lactose intolerance, alongside consumer demand for almond, soy, and oat-based milk products. The growing influence of international brands and their innovative product launches also bolster this segments dominance.

By Distribution Channel: The market is segmented by distribution channels into supermarkets/hypermarkets, online stores, and specialty vegan outlets. Supermarkets and hypermarkets dominate this segmentation due to their widespread availability, convenience, and ability to showcase a variety of packaged vegan products. Retailers like Carrefour and Spinneys have incorporated vegan sections to cater to this growing demand.

MEA Packaged Vegan Food Market Competitive Landscape

The market is characterized by a blend of regional and global players who focus on product innovation and strategic collaborations to capture market share. The market is dominated by companies like Beyond Meat and Alpro, which offer extensive product portfolios and leverage global branding strategies.

MEA Packaged Vegan Food Market Analysis

Market Growth Drivers

- Increasing Health Awareness: The Middle East and Africa (MEA) region has witnessed a significant rise in health consciousness among consumers. For instance, a survey by the International Food Information Council found that 63% of consumers in the UAE are actively seeking healthier food options, leading to a surge in demand for plant-based and vegan products.

- Environmental Concerns: Environmental sustainability has become a pressing issue in the MEA region. The United Nations Environment Programme reported that the region faces significant environmental challenges, including water scarcity and land degradation. As a result, consumers are increasingly turning to vegan diets, which have a lower environmental footprint compared to animal-based diets.

- Cultural Shifts and Influences: The MEA region is experiencing cultural shifts influenced by globalization and exposure to Western lifestyles. This has led to a growing acceptance of veganism, especially among younger populations. In Saudi Arabia, for example, the Saudi Gazette reported a 40% increase in vegan restaurant openings in major cities over the past two years, indicating a growing acceptance and demand for vegan options.

Market Challenges

- High Product Costs: Vegan products in the MEA region often come with a premium price tag. For instance, a market analysis by Euromonitor International found that plant-based meat alternatives in South Africa are priced 30% higher than their animal-based counterparts. This price disparity can deter price-sensitive consumers from adopting vegan products.

- Limited Consumer Awareness: Despite growing interest, there remains a lack of awareness about vegan diets and products in certain parts of the MEA region. A survey by Nielsen in 2023 revealed that 45% of consumers in Egypt are unfamiliar with vegan food options, indicating a need for increased education and marketing efforts.

MEA Packaged Vegan Food Market Future Outlook

Over the next five years, the MEA Packaged Vegan Food industry is anticipated to witness growth due to increasing awareness about plant-based diets, evolving consumer preferences, and government-led sustainability initiatives.

Market Opportunities:

- Increased Localization of Vegan Products: Over the next five years, the MEA Packaged Vegan Food market is expected to witness increased localization, with regional companies establishing production facilities. This shift aims to reduce reliance on imports, which accounted for 70% of the market in 2023, as reported by the African Development Bank.

- Technological Advancements in Plant-Based Foods: The adoption of advanced food processing technologies will enable the development of innovative plant-based products with improved taste and texture. For example, extrusion technology is expected to gain prominence, facilitating the production of meat substitutes that mimic the consistency and flavor of traditional meat.

Scope of the Report

|

Product Type |

Dairy Alternatives |

|

Distribution Channel |

Supermarkets/Hypermarkets |

|

Source |

Soy-Based |

|

Packaging Type |

Frozen |

|

Region |

United Arab Emirates |

Products

Key Target Audience:

Vegan and Plant-Based Food Manufacturers

Retail Chains and Supermarkets

Online Retailers and E-commerce Platforms

Food and Beverage Importers and Distributors

Health and Wellness Companies

Food Safety and Regulatory Bodies (Dubai Municipality, South Africas Food Control Directorate)

Investors and Venture Capitalist Firms

Packaging and Logistics Companies

Companies

Players Mentioned in the Report:

Beyond Meat

Alpro

Camelicious

Fry Family Food Co.

Green Valley Foods

Silk

Veggie Delight

Soya Foods Arabia

Plant Power

Happy Planet Foods

Table of Contents

01. MEA Packaged Vegan Food Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02. MEA Packaged Vegan Food Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

03. MEA Packaged Vegan Food Market Analysis

3.1 Growth Drivers

3.1.1 Rising Health Consciousness

3.1.2 Increasing Vegan Population

3.1.3 Expansion of Retail Channels

3.1.4 Technological Advancements in Food Processing

3.2 Market Challenges

3.2.1 High Product Costs

3.2.2 Limited Consumer Awareness

3.2.3 Supply Chain Constraints

3.3 Opportunities

3.3.1 Untapped Markets in Emerging Economies

3.3.2 Product Innovation and Diversification

3.3.3 Strategic Partnerships and Collaborations

3.4 Trends

3.4.1 Adoption of Plant-Based Diets

3.4.2 Growth of E-commerce Platforms

3.4.3 Sustainable and Eco-Friendly Packaging

3.5 Government Regulations

3.5.1 Food Safety Standards

3.5.2 Labeling and Certification Requirements

3.5.3 Import and Export Policies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

04. MEA Packaged Vegan Food Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Dairy Alternatives

4.1.2 Meat Alternatives & Packaged Vegan Meals

4.1.3 Vegan Bakery & Confectionery Products

4.1.4 Others

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Convenience Stores

4.2.3 Online Stores

4.2.4 Others

4.3 By Source (In Value %)

4.3.1 Soy-Based

4.3.2 Wheat-Based

4.3.3 Pea-Based

4.3.4 Others

4.4 By Packaging Type (In Value %)

4.4.1 Frozen

4.4.2 Refrigerated

4.4.3 Shelf-Stable

4.5 By Region (In Value %)

4.5.1 United Arab Emirates

4.5.2 Saudi Arabia

4.5.3 South Africa

4.5.4 Egypt

4.5.5 Rest of MEA

05. MEA Packaged Vegan Food Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amy's Kitchen, Inc.

5.1.2 Beyond Meat

5.1.3 Plamil Foods Ltd.

5.1.4 Tofutti Brands, Inc.

5.1.5 The WhiteWave Foods Company

5.1.6 Annie's Homegrown, Inc.

5.1.7 Barbara's Bakery

5.1.8 Dr. McDougall's Right Foods

5.1.9 Edward & Sons Trading Co.

5.1.10 Galaxy Nutritional Foods, Inc.

5.1.11 Pacific Foods of Oregon, LLC

5.1.12 The Bridge S.R.L.

5.1.13 Vegan Made Delight

5.1.14 Danone S.A.

5.1.15 Conagra Brands, Inc.

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Presence, R&D Investment, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

06. MEA Packaged Vegan Food Market Regulatory Framework

6.1 Food Safety Standards

6.2 Compliance Requirements

6.3 Certification Processes

07. MEA Packaged Vegan Food Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08. MEA Packaged Vegan Food Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Source (In Value %)

8.4 By Packaging Type (In Value %)

8.5 By Region (In Value %)

09. MEA Packaged Vegan Food Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping the entire ecosystem of the MEA Packaged Vegan Food market. By leveraging industry databases and secondary research, we identify the critical variables, such as consumer behavior, distribution strategies, and competitive benchmarks.

Step 2: Market Analysis and Construction

Historical data on sales, revenue, and product launches are analyzed. Additionally, the ratio of regional players to global brands is assessed to determine the market structure and entry barriers.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with key industry stakeholders, including manufacturers, distributors, and retailers. Insights are gathered to refine market estimates and identify emerging trends.

Step 4: Research Synthesis and Final Output

Data synthesis is performed by consolidating findings into actionable insights. Market forecasts are cross-verified through collaboration with food manufacturers and regional distributors, ensuring the credibility of the final output.

Frequently Asked Questions

01. How big is the MEA Packaged Vegan Food market?

The MEA Packaged Vegan Food market is valued at USD 915 million, driven by health-conscious consumers, technological advancements in food processing, and the growth of e-commerce platforms.

02. What are the challenges in the MEA Packaged Vegan Food market?

Key challenges in the MEA Packaged Vegan Food market include high costs of vegan food products, limited consumer awareness in rural areas, and supply chain inefficiencies in certain countries.

03. Who are the major players in the MEA Packaged Vegan Food market?

Major players in the MEA Packaged Vegan Food market include Beyond Meat, Alpro, Camelicious, Fry Family Food Co., and Green Valley Foods, leveraging strong product portfolios and market presence.

04. What are the growth drivers of the MEA Packaged Vegan Food market?

Growth drivers in the MEA Packaged Vegan Food market include increasing adoption of plant-based diets, rising health awareness, and innovations in packaging and distribution channels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.