MEA Polyolefin Market Outlook to 2030

Region:Global

Author(s):Shreya

Product Code:KROD3048

November 2024

90

About the Report

MEA Polyolefin Market Overview

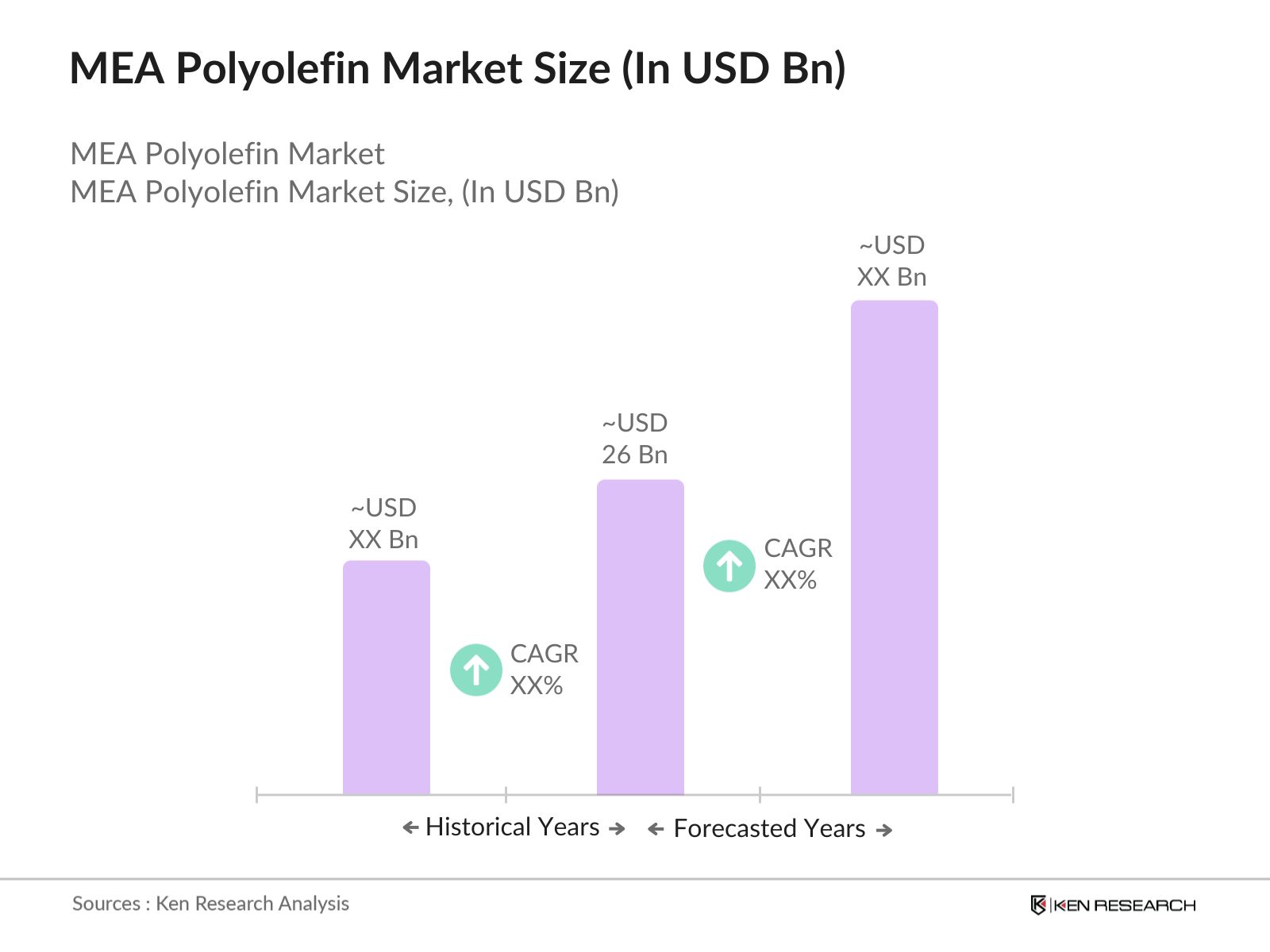

- The MEA Polyolefin Market is valued at USD 26 billion, based on a comprehensive analysis of the last five years. This market is driven by increasing demand across various sectors such as packaging, automotive, and construction. The rise in consumer goods packaging and the increasing use of lightweight materials in automotive production are key drivers for polyolefins in this region. Government initiatives focused on expanding infrastructure, especially in the GCC countries, further bolster the demand for polyolefins across the Middle East and Africa.

- The market dominance is centered around a few key countries, particularly Saudi Arabia and the United Arab Emirates. These nations dominate due to their substantial investments in petrochemical infrastructure, with companies like SABIC and Borouge leading production. Saudi Arabias access to abundant natural gas and feedstock contributes significantly to its dominance, while the UAE benefits from its advanced logistics and export facilities, allowing it to be a key player in the export of polyolefins.

- MEA governments are enforcing stricter environmental regulations, particularly concerning plastic waste management and emission norms. In 2024, Saudi Arabia and the UAE introduced regulations requiring companies to reduce plastic waste by 30% and meet stringent emissions targets by 2025. These regulations are directly impacting the polyolefin industry, as manufacturers must adopt more sustainable production practices to remain compliant. This regulatory environment presents both challenges and opportunities for polyolefin producers, as they invest in new technologies to meet these requirements.

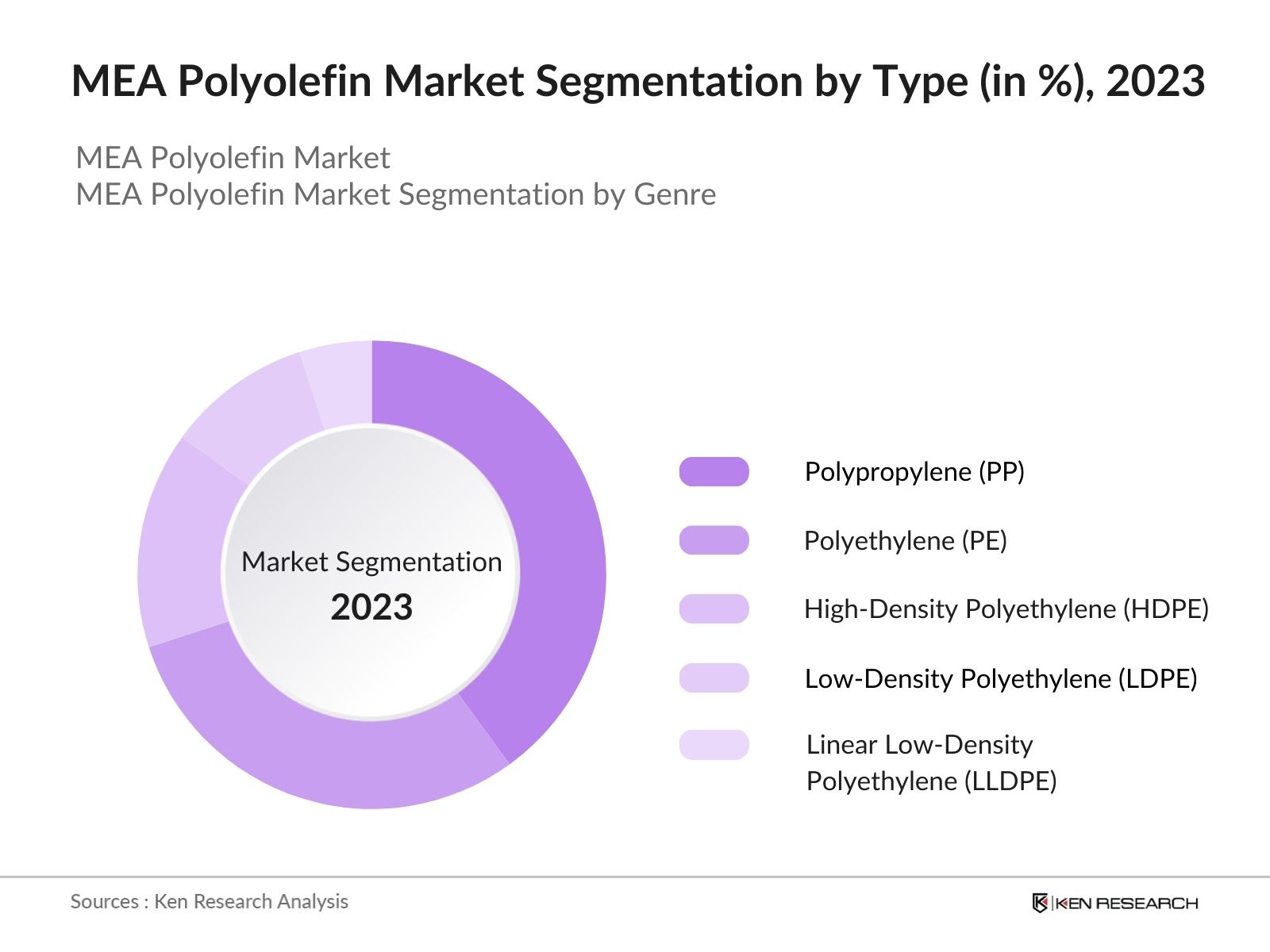

MEA Polyolefin Market Segmentation

- By Type: The market is segmented by type into Polyethylene (PE), Polypropylene (PP), Linear Low-Density Polyethylene (LLDPE), High-Density Polyethylene (HDPE), and Low-Density Polyethylene (LDPE).

In the segmentation by type, Polypropylene has recently secured a dominant market share, largely due to its versatility and wide range of applications in packaging, automotive, and healthcare sectors. PPs resilience to high temperatures and mechanical stress makes it ideal for automotive components and medical devices, driving its demand significantly within the market.

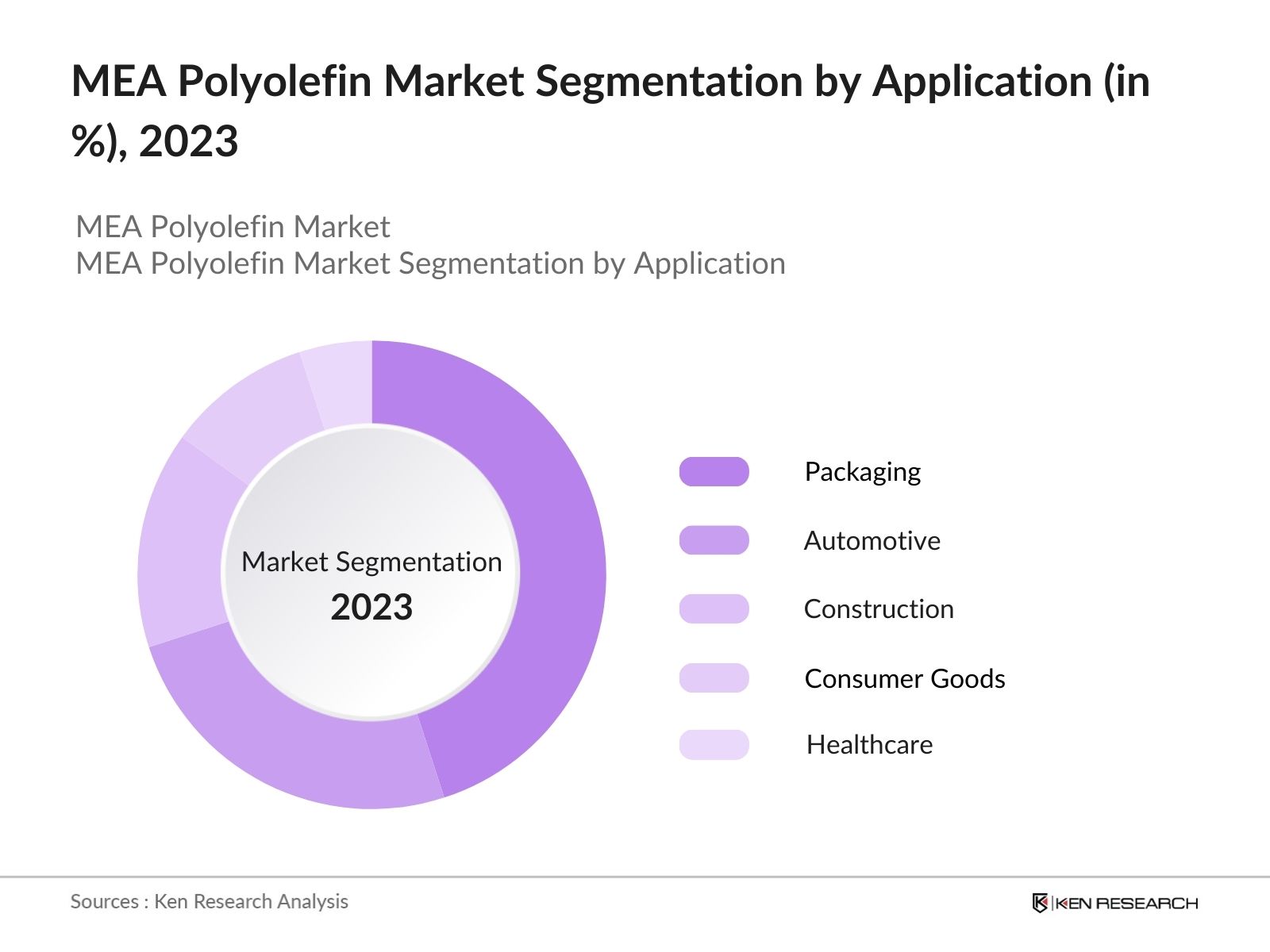

- By Application: The market is also segmented by application into Packaging, Automotive, Construction, Consumer Goods, and Healthcare. The Packaging sub-segment dominates the market primarily due to the extensive use of polyolefins in flexible packaging, rigid containers, and films for food and consumer products. The packaging industrys increasing demand for sustainable and recyclable materials further solidifies the dominance of polyolefins in this sector.

MEA Polyolefin Market Competitive Landscape

The MEA Polyolefin market is dominated by a few major players, including global and regional companies such as SABIC, Borouge, and LyondellBasell. These companies are well-established within the region, and their extensive production capabilities, along with a focus on sustainability and innovation, allow them to maintain significant market shares. The competitive landscape is shaped by major petrochemical companies that have vertical integration and access to key raw materials, thus ensuring cost-effective production.

|

Company |

Year of Establishment |

Headquarters |

Revenue (USD Bn) |

Production Capacity (Tons) |

Geographic Reach |

R&D Investment (USD Mn) |

Sustainability Initiatives |

Strategic Partnerships |

Product Innovation |

|---|---|---|---|---|---|---|---|---|---|

|

SABIC |

1976 |

Riyadh, Saudi Arabia |

|||||||

|

Borouge |

1998 |

Abu Dhabi, UAE |

|||||||

|

LyondellBasell |

1985 |

Houston, USA |

|||||||

|

ExxonMobil Corporation |

1870 |

Irving, USA |

|||||||

|

Dow Inc. |

1897 |

Midland, USA |

MEA Polyolefin Industry Analysis

Growth Drivers

- Increasing Demand for Packaging: The polyolefin market in the MEA region is driven by the growing demand for sustainable packaging solutions. As of 2024, global demand for eco-friendly packaging materials is at 62 million tons, with the MEA region contributing around 7 million tons to this figure. Consumer goods packaging is a key driver, supported by a significant increase in e-commerce, which saw 2.1 billion packages shipped in the region in 2023. Governments in the UAE and Saudi Arabia are introducing stricter regulations on single-use plastics, further pushing demand for sustainable packaging.

- Construction Sector Expansion: The construction sector in the MEA region is rapidly expanding due to large-scale infrastructure projects. As of 2024, over 800 billion USD in construction projects are underway, particularly in Saudi Arabia and the UAE. Polyolefins are essential for pipes, insulation, and geomembranes, which are being extensively used in these projects. The demand for polyolefin pipes has increased by 15 million tons annually in the Middle East due to rising urbanization, housing projects, and government infrastructure programs like Saudi Vision 2030, driving growth in the sector.

Source: IMF - Automotive Industry Growth: With the MEA automotive market showing steady growth, the demand for lightweight materials such as polyolefins is increasing. In 2023, automotive production in the region reached 3.7 million units. Polyolefins contribute to the reduction of vehicle weight, enhancing fuel efficiency by up to 15%, which aligns with the region's push towards more fuel-efficient vehicles, driven by policies like the UAE Energy Strategy 2050. This shift is expected to result in an additional demand for around 4 million tons of polyolefins per year by 2025.

Market Challenges

- Volatility in Crude Oil Prices: Polyolefin production relies heavily on crude oil, and the MEA market faces challenges due to fluctuating oil prices. In 2023, crude oil prices ranged between 75 to 95 USD per barrel, making raw material costs for polyolefin production highly volatile. This price instability impacts profit margins and supply chain reliability for polyolefin manufacturers, particularly in countries like Saudi Arabia and the UAE, where oil contributes to a significant portion of the economy. This ongoing volatility poses a critical challenge for the growth of the polyolefin market in the region.

- Environmental Regulations: MEA countries are increasingly focusing on environmental regulations, particularly related to plastic waste management. In 2024, the UAE and Saudi Arabia enacted stringent laws requiring manufacturers to meet recycling targets and reduce plastic waste. The UAE's Circular Economy Policy aims to recycle 75% of its waste by 2030, which directly affects polyolefin producers by increasing compliance costs and pushing for more sustainable production methods. This growing regulatory pressure poses a challenge to polyolefin manufacturers who need to align with these regulations to avoid penalties.

MEA Polyolefin Market Future Outlook

Over the next five years, the MEA Polyolefin market is expected to experience substantial growth, driven by rising demand for sustainable packaging solutions, technological advancements in production, and an increase in automotive manufacturing across the region. In addition, the construction sector in key markets like Saudi Arabia and the UAE will continue to drive demand for polyolefins in pipes and insulation applications. The focus on recycling and sustainability will also push companies to innovate in the production of eco-friendly and circular polyolefins, creating significant growth opportunities.

Scope of the Report

|

Segment |

Sub-segments |

|---|---|

|

Type |

Polyethylene (PE) Polypropylene (PP) LLDPE HDPE LDPE |

|

Application |

Packaging Automotive Construction Consumer Goods Healthcare |

|

End-User Industry |

Industrial Residential Commercial |

|

Processing Technology |

Injection Molding Blow Molding Extrusion Film Processing |

|

Region |

GCC Countries North Africa Sub-Saharan Africa Levant |

Products

Key Target Audience

Packaging Manufacturers

Automotive Component Suppliers

Construction Material Providers

Healthcare Product Manufacturers

Polyolefin Raw Material Suppliers

Government and Regulatory Bodies (Ministry of Industry and Mineral Resources, Environmental Protection Agency)

Investments and Venture Capitalist Firms

Petrochemical Producers

Companies

Major Players

Saudi Basic Industries Corporation (SABIC)

Borouge

LyondellBasell Industries

ExxonMobil Corporation

Dow Inc.

Reliance Industries Limited

TotalEnergies

INEOS Group Holdings S.A.

Braskem

Sasol Limited

Chevron Phillips Chemical Company

Formosa Plastics Corporation

Mitsubishi Chemical Holdings

China Petroleum & Chemical Corporation (Sinopec)

LG Chem

Table of Contents

1. MEA Polyolefin Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Polyethylene, Polypropylene, Linear Low-Density Polyethylene)

1.4. Market Segmentation Overview (By Type, By Application, By End-User)

2. MEA Polyolefin Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (Volume, Value)

2.3. Key Market Developments and Milestones (Raw Material Supply, Production Capacity)

3. MEA Polyolefin Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Packaging (Sustainability, Consumer Goods)

3.1.2. Construction Sector Expansion (Pipes, Insulation)

3.1.3. Automotive Industry Growth (Lightweighting, Fuel Efficiency)

3.1.4. Government Infrastructure Projects

3.2. Market Challenges

3.2.1. Volatility in Crude Oil Prices

3.2.2. Environmental Regulations (Plastic Waste Management)

3.2.3. Competition from Biodegradable Alternatives

3.2.4. Limited Recycling Infrastructure

3.3. Opportunities

3.3.1. Technological Advancements in Production Processes

3.3.2. Rising Adoption of Sustainable Packaging Solutions

3.3.3. Expansion of Manufacturing Capacity in Emerging Markets

3.3.4. Development of New Applications in Agriculture and Healthcare

3.4. Trends

3.4.1. Increasing Use of Recycled Polyolefins

3.4.2. Integration of Digital Technology in Production (Automation, AI)

3.4.3. Growth of Polyolefin Composites

3.4.4. Innovation in High-Performance Polyolefin Grades

3.5. Government Regulation

3.5.1. Regional Environmental Laws (Plastic Waste, Emission Norms)

3.5.2. Incentives for Sustainable Packaging Solutions

3.5.3. Import/Export Tariffs and Trade Policies

3.5.4. Energy Efficiency Standards for Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. MEA Polyolefin Market Segmentation

4.1. By Type (In Value %)

4.1.1. Polyethylene (PE)

4.1.2. Polypropylene (PP)

4.1.3. Linear Low-Density Polyethylene (LLDPE)

4.1.4. High-Density Polyethylene (HDPE)

4.1.5. Low-Density Polyethylene (LDPE)

4.2. By Application (In Value %)

4.2.1. Packaging

4.2.2. Automotive

4.2.3. Construction

4.2.4. Consumer Goods

4.2.5. Healthcare

4.3. By End-User Industry (In Value %)

4.3.1. Industrial

4.3.2. Residential

4.3.3. Commercial

4.4. By Processing Technology (In Value %)

4.4.1. Injection Molding

4.4.2. Blow Molding

4.4.3. Extrusion

4.4.4. Film Processing

4.5. By Region (In Value %)

4.5.1. GCC Countries

4.5.2. North Africa

4.5.3. Sub-Saharan Africa

4.5.4. Levant Region

5. MEA Polyolefin Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Saudi Basic Industries Corporation (SABIC)

5.1.2. Borouge

5.1.3. LyondellBasell Industries

5.1.4. Reliance Industries Limited

5.1.5. TotalEnergies

5.1.6. ExxonMobil Corporation

5.1.7. INEOS Group Holdings S.A.

5.1.8. Dow Inc.

5.1.9. Braskem

5.1.10. Sasol Limited

5.1.11. Chevron Phillips Chemical Company

5.1.12. Mitsubishi Chemical Holdings

5.1.13. Formosa Plastics Corporation

5.1.14. China Petroleum & Chemical Corporation (Sinopec)

5.1.15. LG Chem

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Geographic Presence, Sustainability Initiatives, Number of Patents, Product Innovation, Strategic Partnerships, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. MEA Polyolefin Market Regulatory Framework

6.1. Environmental Standards for Plastic Waste

6.2. Compliance Requirements for Packaging Materials

6.3. Certification Processes for Polyolefin Products

7. MEA Polyolefin Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Innovation, Investment, Policy Changes)

8. MEA Polyolefin Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Processing Technology (In Value %)

8.5. By Region (In Value %)

9. MEA Polyolefin Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclamer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research began by constructing an ecosystem map of the MEA Polyolefin market, covering all major stakeholders. Extensive desk research was undertaken to gather industry-level data using secondary sources and proprietary databases. The aim was to define key variables influencing the market, such as demand drivers and supply constraints.

Step 2: Market Analysis and Construction

Historical data for the MEA Polyolefin market was compiled, focusing on market penetration and industry growth across key sectors like automotive, construction, and packaging. Market revenue was analyzed to ensure reliability in data points.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were formulated and validated through telephone interviews with industry experts, including executives from leading polyolefin manufacturers. These insights helped refine the market data and provided operational perspectives on industry dynamics.

Step 4: Research Synthesis and Final Output

The final phase involved interactions with key polyolefin manufacturers and suppliers to verify product performance and consumer trends. This bottom-up approach helped ensure comprehensive and accurate analysis of the MEA Polyolefin market, validated by direct market participants.

Frequently Asked Questions

1. How big is the MEA Polyolefin Market?

The MEA Polyolefin market is valued at USD 26 billion, driven by demand in packaging, automotive, and construction sectors.

2. What are the challenges in the MEA Polyolefin Market?

Key challenges in the MEA Polyolefin market include fluctuating raw material prices, environmental regulations concerning plastic waste, and limited recycling infrastructure.

3. Who are the major players in the MEA Polyolefin Market?

Major players in the MEA Polyolefin market include Saudi Basic Industries Corporation (SABIC), Borouge, LyondellBasell, Dow Inc., and ExxonMobil, dominating through extensive production capabilities and strategic investments.

4. What are the growth drivers of the MEA Polyolefin Market?

The MEA Polyolefin market is driven by increased demand for lightweight materials in automotive production, growth in packaging for consumer goods, and government investment in infrastructure.

5. What trends are shaping the MEA Polyolefin Market?

Key trends in the MEA Polyolefin market include the rising use of recycled polyolefins, advancements in digital production technologies, and innovations in high-performance polyolefin grades for various industrial applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.