MEA Residential Lithium-ion Battery Energy Storage Systems Market Outlook to 2030

Region:Middle East

Author(s):Yogita Sahu

Product Code:KROD7528

November 2024

97

About the Report

MEA Residential Lithium-ion Battery Energy Storage Systems Market Overview

- The MEA Residential Lithium-ion Battery Energy Storage Systems market is valued at USD 118 million, based on a five-year historical analysis. This growth is primarily driven by increasing residential demand for renewable energy storage solutions, particularly for solar energy. With governments across the Middle East and Africa offering subsidies and incentives for adopting clean energy, consumers are increasingly investing in home-based storage systems.

- Countries such as the United Arab Emirates and South Africa dominate the market due to their proactive stance on renewable energy adoption and robust energy policies. The UAE has implemented ambitious clean energy programs such as the Dubai Clean Energy Strategy, encouraging the use of solar power and storage systems in households.

- Under Vision 2030, Saudi Arabia is focusing on increasing the share of renewable energy in its grid, and residential lithium-ion batteries play a crucial role. In 2024, as part of the NEOM smart city project, the government committed $3 billion to support the installation of energy storage systems in over 500,000 homes by 2028. This initiative will boost the market demand for energy storage in residential sectors.

MEA Residential Lithium-ion Battery Energy Storage Systems Market Segmentation

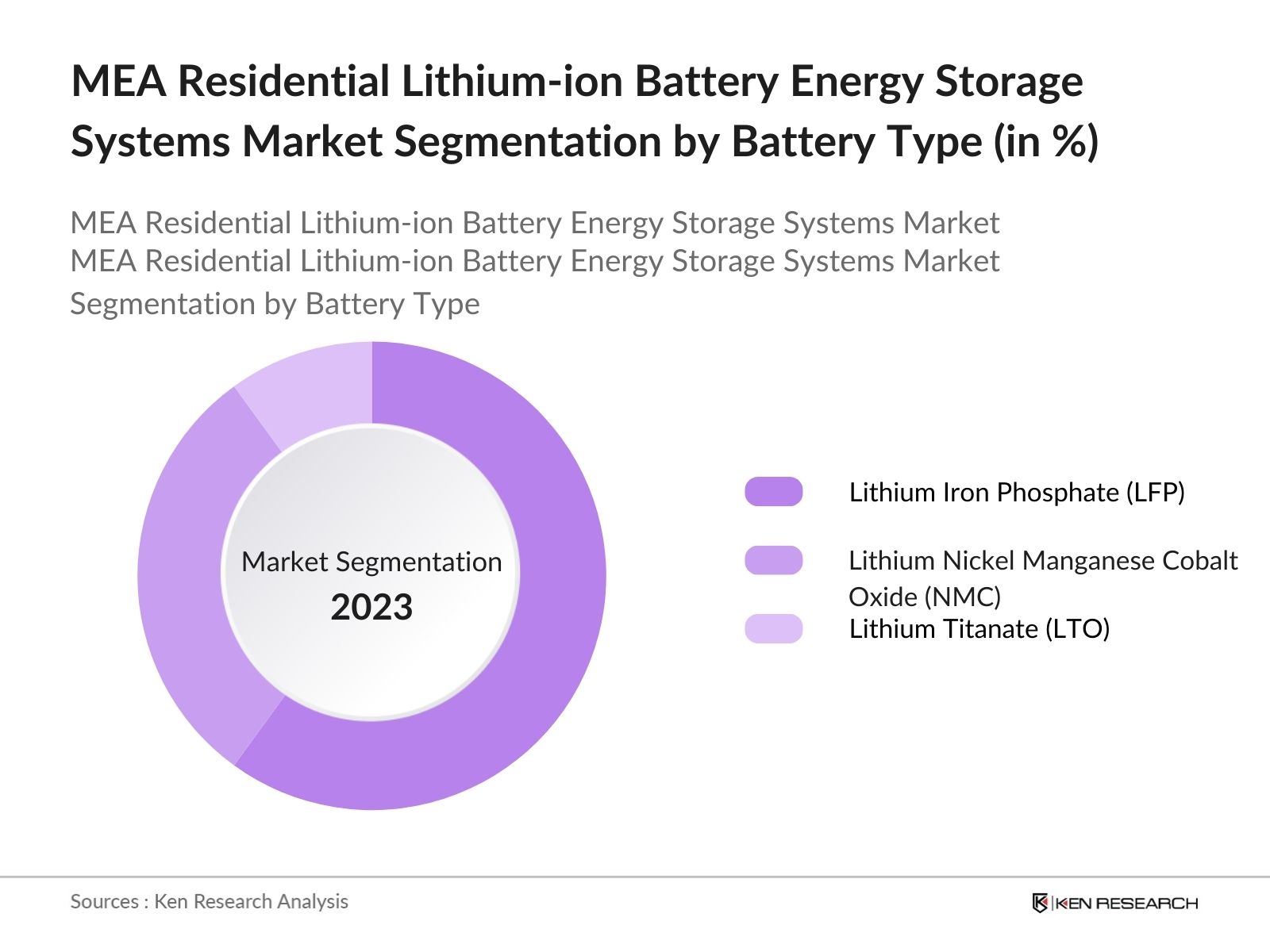

By Battery Type: The market is segmented by battery type into Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt Oxide (NMC), and Lithium Titanate (LTO). Recently, Lithium Iron Phosphate (LFP) batteries have gained a dominant market share within this segment. This can be attributed to their longer cycle life and superior thermal stability, making them ideal for residential applications in hot climates like those found in the Middle East.

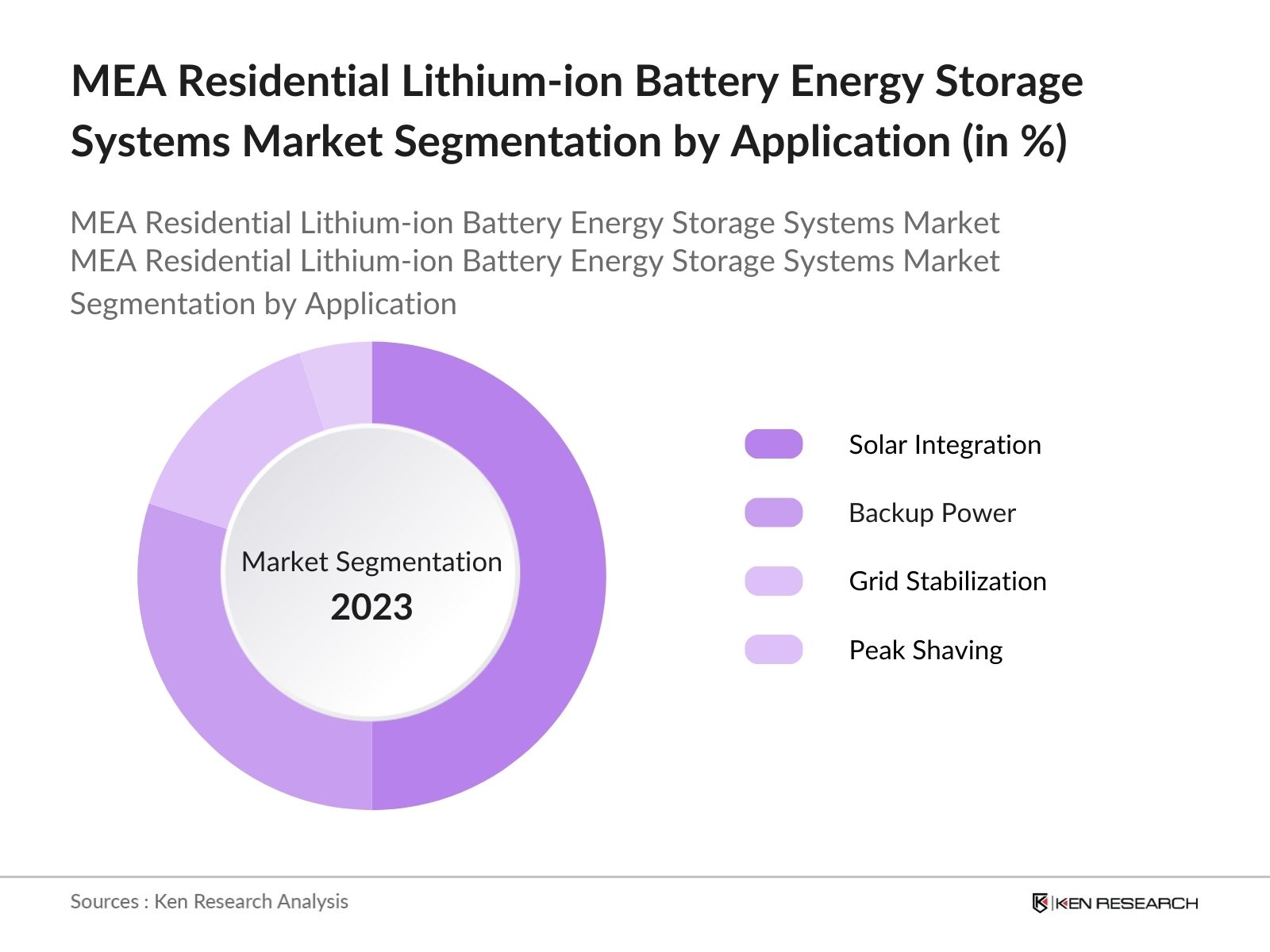

By Application: The market is also segmented by application into Solar Integration, Backup Power, Grid Stabilization, and Peak Shaving. Solar integration dominates the market as residential consumers increasingly pair lithium-ion batteries with rooftop solar panels. The demand for energy independence and the ability to store excess solar power for later use has made solar integration the most popular application for battery storage systems. Backup power applications are growing, especially in areas where grid reliability is low, such as parts of sub-Saharan Africa.

MEA Residential Lithium-ion Battery Energy Storage Systems Market Competitive Landscape

The market is dominated by a mix of global and regional players. These companies offer a range of products and services, from battery manufacturing to complete energy storage solutions for residential use.

|

Company Name |

Establishment Year |

Headquarters |

Market Presence |

Key Technologies |

Revenue (USD Bn) |

Installed Base (MW) |

Strategic Alliances |

Inception Year |

Geographic Reach |

|

Tesla, Inc. |

2003 |

Palo Alto, USA |

|||||||

|

LG Chem Ltd. |

1947 |

Seoul, South Korea |

|||||||

|

BYD Company Limited |

1995 |

Shenzhen, China |

|||||||

|

Sonnen GmbH |

2010 |

Wildpoldsried, Germany |

|||||||

|

Enphase Energy, Inc. |

2006 |

Fremont, USA |

MEA Residential Lithium-ion Battery Energy Storage Systems Market Analysis

Market Growth Drivers

- Growing Renewable Energy Projects in MEA: The increasing focus on integrating renewable energy sources, such as solar and wind, into the grid is driving the demand for residential lithium-ion battery energy storage systems. In 2024, governments in the UAE and Saudi Arabia are expected to fund over 100 renewable energy projects, adding a total capacity of around 7,000 MW. These projects necessitate energy storage solutions to manage the intermittent nature of renewables.

- Government Incentives and Subsidies: Several MEA governments are offering financial incentives to promote the adoption of energy storage solutions. In 2024, the UAE announced plans to invest $1.6 billion in subsidy programs for households installing solar panels and battery storage units, aiming to enhance residential energy efficiency. These subsidies reduce the upfront cost of lithium-ion battery systems, making them more accessible for residential use.

- Increased Energy Demand in Off-Grid Areas: The rising energy demand in off-grid and rural areas is fueling the need for reliable energy storage systems. In 2024, over 25 million people in off-grid regions of countries like Sudan and Ethiopia are estimated to lack access to stable electricity. The deployment of residential lithium-ion batteries, coupled with small-scale renewable setups, is anticipated to provide energy autonomy for these populations.

Market Challenges

- Limited Awareness and Technical Know-how: A challenge in the MEA market is the lack of awareness and technical understanding of lithium-ion battery storage systems among residential users. In 2024, surveys in countries like Kenya and Egypt found that nearly 60% of households are unaware of the potential benefits of energy storage. Furthermore, there is a shortage of trained technicians capable of installing and maintaining these systems.

- Supply Chain Disruptions: The reliance on imported lithium-ion batteries, mainly from Asia, makes the MEA region vulnerable to supply chain disruptions. In 2024, ongoing geopolitical tensions and economic sanctions on key battery-exporting countries have caused delays and price increases in battery imports. South Africa, which imports over 80% of its batteries, saw an increase in costs due to these disruptions.

MEA Residential Lithium-ion Battery Energy Storage Systems Market Future Outlook

Over the next five years, the MEA Residential Lithium-ion Battery Energy Storage Systems industry is expected to experience robust growth. This growth will be driven by a combination of factors, including continuous government support for renewable energy projects, advancements in lithium-ion battery technology, and increasing consumer demand for energy independence.

Future Market Opportunities

- Increased Localization of Battery Manufacturing: By 2028, several MEA countries, including Morocco and South Africa, are expected to establish domestic lithium-ion battery manufacturing facilities. This trend will reduce the regions dependence on imported batteries, lowering costs and accelerating the adoption of residential energy storage systems.

- Integration of Battery Storage with Smart Home Technologies: In the coming years, more households in the MEA region will integrate lithium-ion battery systems with smart home technologies, enhancing energy management capabilities. By 2028, it is estimated that over 3 million homes in the UAE and Saudi Arabia will incorporate AI-driven energy management systems, optimizing battery usage and reducing overall energy consumption.

Scope of the Report

|

Battery Type |

Lithium Iron Phosphate (LFP) Lithium Nickel Manganese Cobalt Oxide (NMC) Lithium Titanate (LTO) |

|

Application |

Solar Integration Backup Power Grid Stabilization Peak Shaving |

|

Storage Capacity |

Below 10 kWh 10-20 kWh Above 20 kWh |

|

System Type |

AC-Coupled Systems DC-Coupled Systems Hybrid Systems |

|

Region |

GCC North Africa Sub-Saharan Africa Rest of MEA |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (e.g., UAE Ministry of Energy, South African Department of Energy)

Banks and Financial Institution

Lithium-ion Battery Manufacturers

Renewable Energy Companies

Utility Providers

Private Equity Firms

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Tesla, Inc.

LG Chem Ltd.

BYD Company Limited

Sonnen GmbH

Enphase Energy, Inc.

Panasonic Corporation

Samsung SDI Co.

Eaton Corporation

SMA Solar Technology

VARTA AG

Table of Contents

1. MEA Residential Lithium-ion Battery Energy Storage Systems Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. MEA Residential Lithium-ion Battery Energy Storage Systems Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Residential Lithium-ion Battery Energy Storage Systems Market Analysis

3.1. Growth Drivers

3.1.1. Energy Security Initiatives

3.1.2. Solar and Renewable Integration

3.1.3. Government Incentives & Subsidies

3.1.4. Cost Reduction in Lithium-ion Technology

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Raw Material Sourcing Issues (e.g., Lithium, Cobalt)

3.2.3. Complex Regulatory Environment

3.2.4. Recycling and Disposal Concerns

3.3. Opportunities

3.3.1. Decentralized Energy Systems

3.3.2. Growth in Residential Solar PV Installations

3.3.3. Demand for Backup Power Systems

3.3.4. Technological Advancements in Battery Management Systems (BMS)

3.4. Trends

3.4.1. Integration with Smart Grids and IoT Systems

3.4.2. Shift towards Sustainable Energy Solutions

3.4.3. Increased Use of Second-life Batteries

3.4.4. Growth of Virtual Power Plants (VPPs)

3.5. Government Regulation

3.5.1. Net Metering Policies (By Country)

3.5.2. Subsidy Schemes and Tax Benefits

3.5.3. Battery Safety Standards (IEC, UL, etc.)

3.5.4. Energy Storage Legislation and Reforms

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. MEA Residential Lithium-ion Battery Energy Storage Systems Market Segmentation

4.1. By Battery Type (In Value %)

4.1.1. Lithium Iron Phosphate (LFP)

4.1.2. Lithium Nickel Manganese Cobalt Oxide (NMC)

4.1.3. Lithium Titanate (LTO)

4.2. By Application (In Value %)

4.2.1. Solar Integration

4.2.2. Backup Power

4.2.3. Grid Stabilization

4.2.4. Peak Shaving

4.3. By Storage Capacity (In Value %)

4.3.1. Below 10 kWh

4.3.2. 10-20 kWh

4.3.3. Above 20 kWh

4.4. By System Type (In Value %)

4.4.1. AC-Coupled Systems

4.4.2. DC-Coupled Systems

4.4.3. Hybrid Systems

4.5. By Region (In Value %)

4.5.1. GCC

4.5.2. North Africa

4.5.3. Sub-Saharan Africa

4.5.4. Rest of MEA

5. MEA Residential Lithium-ion Battery Energy Storage Systems Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tesla, Inc.

5.1.2. LG Chem Ltd.

5.1.3. Panasonic Corporation

5.1.4. BYD Company Limited

5.1.5. Samsung SDI Co.

5.1.6. Sonnen GmbH

5.1.7. Enphase Energy, Inc.

5.1.8. Eguana Technologies

5.1.9. SimpliPhi Power

5.1.10. Eaton Corporation

5.1.11. ABB Ltd.

5.1.12. SMA Solar Technology

5.1.13. VARTA AG

5.1.14. Generac Power Systems

5.1.15. Redflow Ltd.

5.2. Cross Comparison Parameters (Revenue, Market Presence, Product Portfolio, Key Technologies, Installed Base, Innovation Index, Strategic Alliances, Geographic Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

5.8. Private Equity and Venture Capital Funding

5.9. Partnerships and Collaborations

6. MEA Residential Lithium-ion Battery Energy Storage Systems Market Regulatory Framework

6.1. Battery Storage Standards

6.2. Safety Certifications and Compliance Requirements

6.3. Energy Policy Framework

6.4. Environmental Compliance

7. MEA Residential Lithium-ion Battery Energy Storage Systems Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. MEA Residential Lithium-ion Battery Energy Storage Systems Future Market Segmentation

8.1. By Battery Type (In Value %)

8.2. By Application (In Value %)

8.3. By Storage Capacity (In Value %)

8.4. By System Type (In Value %)

8.5. By Region (In Value %)

9. MEA Residential Lithium-ion Battery Energy Storage Systems Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the MEA Residential Lithium-ion Battery Energy Storage Systems market. This step is underpinned by extensive desk research using secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the MEA Residential Lithium-ion Battery Energy Storage Systems market is compiled and analyzed. This includes assessing market penetration, the ratio of storage systems to residential users, and revenue generation. An evaluation of performance and reliability statistics is also conducted to ensure the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through expert consultations with industry professionals. These consultations provide valuable insights into operational and financial metrics, helping to refine and validate the market data. Insights from these industry experts further support the formulation of accurate market forecasts.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple lithium-ion battery manufacturers and renewable energy companies to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction complements the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the MEA Residential Lithium-ion Battery Energy Storage Systems market.

Frequently Asked Questions

01. How big is the MEA Residential Lithium-ion Battery Energy Storage Systems Market?

The MEA Residential Lithium-ion Battery Energy Storage Systems market is valued at USD 118 million, driven by the increasing adoption of renewable energy solutions, particularly in residential sectors. This market has seen consistent growth over the past five years.

02. What are the challenges in the MEA Residential Lithium-ion Battery Energy Storage Systems Market?

Challenges in the MEA Residential Lithium-ion Battery Energy Storage Systems market include high initial investment costs, complex regulatory frameworks, and sourcing issues related to key raw materials such as lithium and cobalt. Additionally, the recycling and disposal of lithium-ion batteries pose significant environmental concerns.

03. Who are the major players in the MEA Residential Lithium-ion Battery Energy Storage Systems Market?

Key players in the MEA Residential Lithium-ion Battery Energy Storage Systems market include Tesla, Inc., LG Chem Ltd., BYD Company Limited, Sonnen GmbH, and Enphase Energy, Inc. These companies dominate due to their advanced technologies, strategic partnerships, and extensive product portfolios in the energy storage domain.

04. What are the growth drivers of the MEA Residential Lithium-ion Battery Energy Storage Systems Market?

The MEA Residential Lithium-ion Battery Energy Storage Systems market is driven by increasing demand for energy independence, government incentives for renewable energy adoption, and advancements in lithium-ion battery technology. Additionally, the declining costs of solar panels and battery systems have further boosted the market.

05. What is the future outlook for the MEA Residential Lithium-ion Battery Energy Storage Systems Market?

The MEA Residential Lithium-ion Battery Energy Storage Systems market is expected to witness strong growth over the next five years, driven by increasing demand for renewable energy storage, government support, and technological advancements in battery management systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.