MEA Simulation Software Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD10637

December 2024

90

About the Report

MEA Simulation Software Market Overview

- In 2023, the MEA simulation software market was valued at USD 2 billion. This growth is driven by the increasing adoption of simulation software in industries such as automotive, aerospace, and healthcare. Companies in these sectors are using simulation tools to reduce costs, improve efficiency, and accelerate the product development cycle.

- Major players in the MEA simulation software market include Ansys Inc., Dassault Systmes, Siemens PLM Software, Altair Engineering, and Autodesk. These companies dominate the market due to their comprehensive suite of simulation software solutions, established brand reputation, and partnerships with local industries. Siemens PLM and Ansys Inc. are particularly dominant, providing solutions that cater to multiple industries ranging from automotive to oil and gas.

- In 2023, Siemens Digital Industries Software announced a major partnership with Saudi Aramco to implement advanced simulation tools for oil and gas exploration. This collaboration aims to use Siemens' simulation software to enhance drilling operations, improve safety, and reduce environmental impact. This development highlights the growing need for simulation software in the energy sector as companies focus on optimizing their processes using digital twins.

- Dubai and Riyadh dominate the MEA simulation software market due to their rapidly growing manufacturing and energy sectors. Both cities are home to numerous international firms and government-backed technology hubs that foster innovation. Additionally, Dubais focus on becoming a global leader in smart city technologies and Riyadhs ambitious Vision 2030 initiatives have spurred demand for advanced software solutions.

MEA Simulation Software Market Segmentation

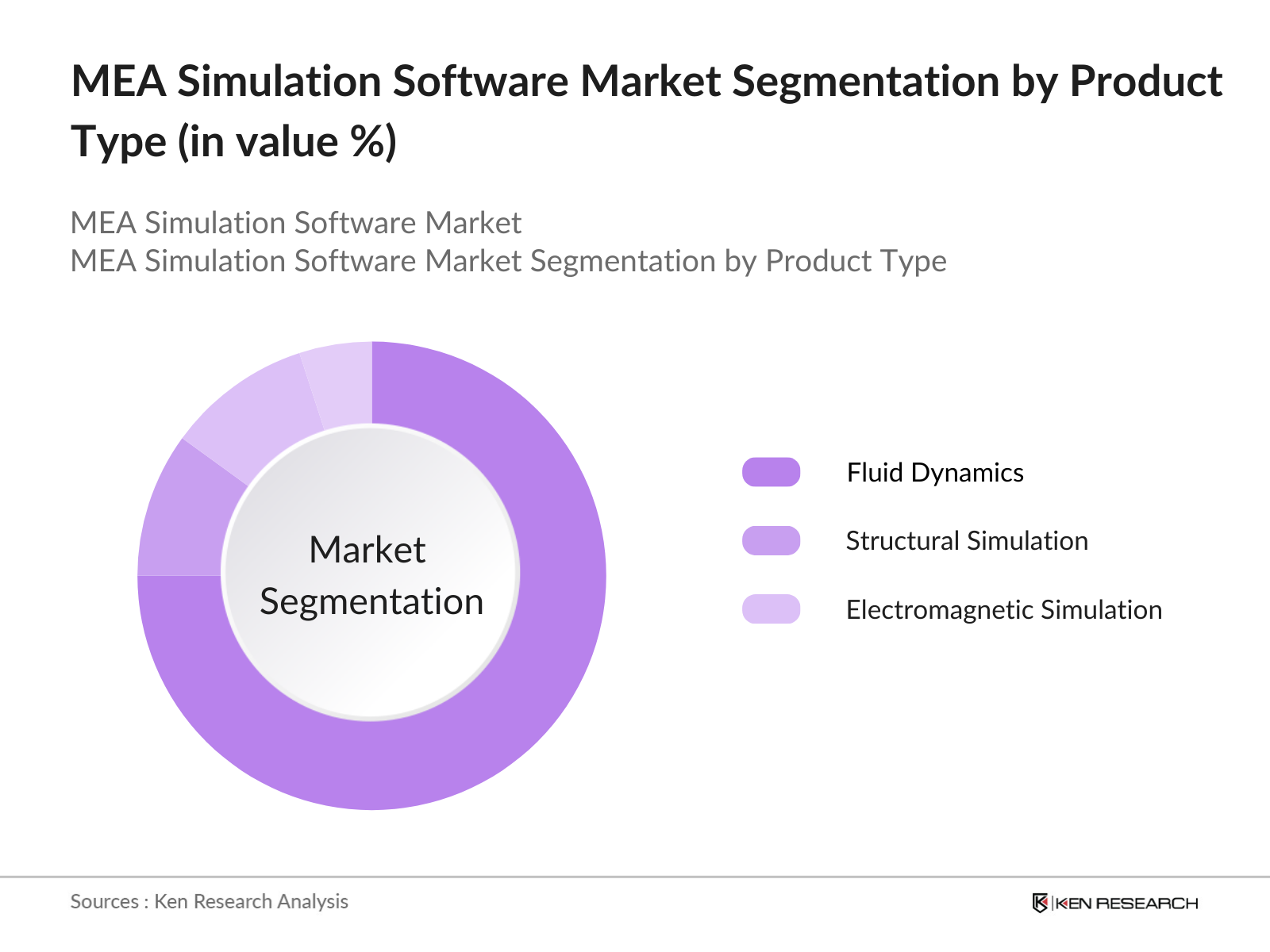

By Product Type: The MEA simulation software market is segmented into fluid dynamics, structural simulation, and electromagnetic simulation. In 2023, fluid dynamics software dominated the market share due to its extensive application in the oil and gas and automotive sectors. The ability to simulate complex fluid flow systems, optimize designs, and improve energy efficiency has made it the most preferred choice among industries.

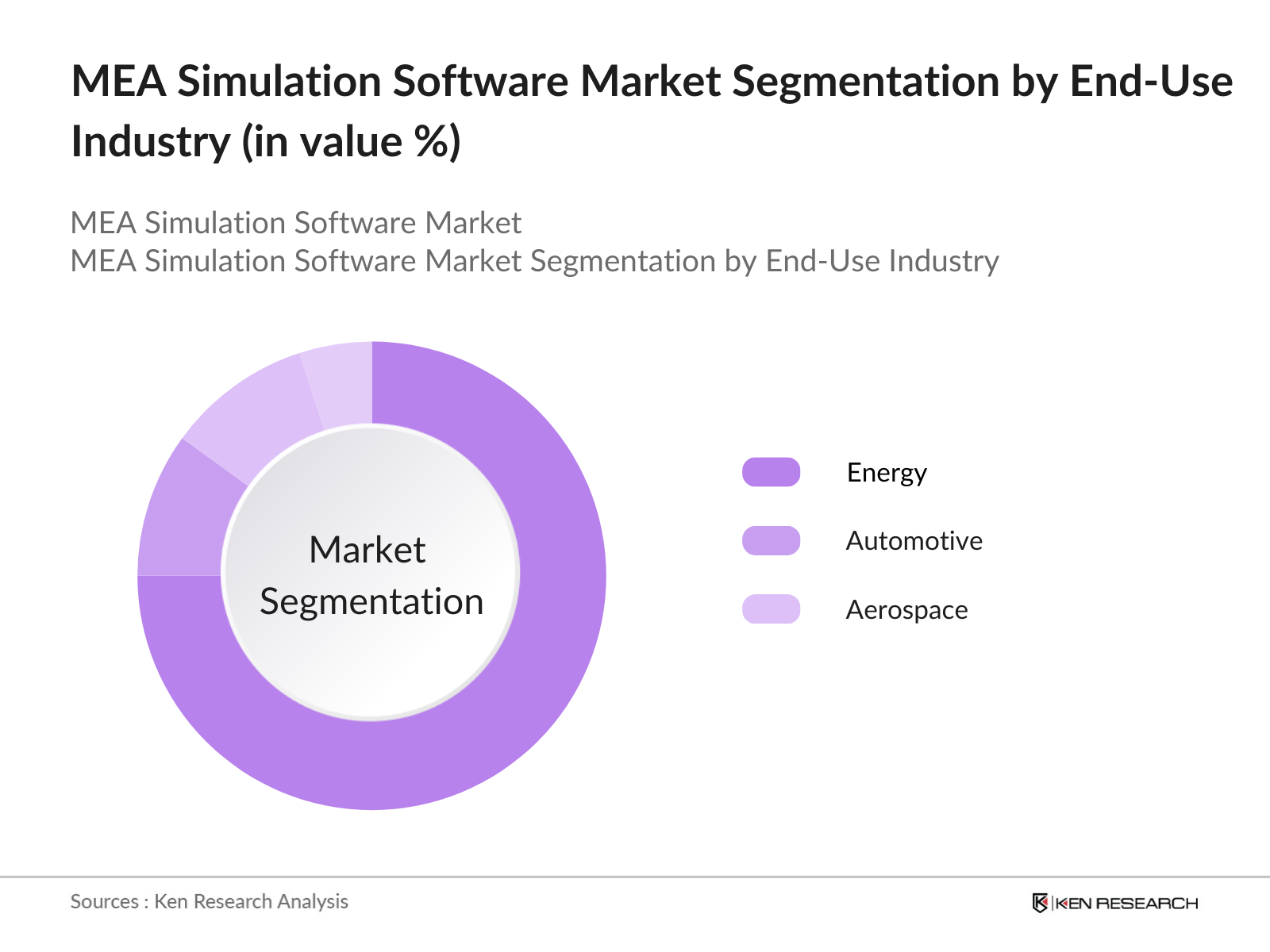

By End-Use Industry: The simulation software market in the MEA region is segmented by end-use industries into automotive, aerospace, and energy. The energy sector held the dominant share in 2023, accounting for the largest market share due to the ongoing demand for digital solutions to improve exploration and production efficiency. The regions heavy reliance on oil and gas exports has encouraged companies to adopt simulation software for optimizing drilling, refining, and supply chain operations. Moreover, the increasing focus on sustainable energy sources has driven investments in energy sector-specific simulation technologies.

By Region: The MEA simulation software market is segmented into North Africa, Sub-Saharan Africa, and GCC. The GCC region holds the dominant market share in 2023, driven by the substantial investments in oil and gas, construction, and smart city projects. Governments across the Gulf Cooperation Council (GCC) countries have made significant investments in technological innovation and digital infrastructure, making this region a leading adopter of advanced simulation software. The region's emphasis on economic diversification away from oil and gas has further enhanced its role in driving market growth.

MEA Simulation Software Market Competitive Landscape

|

Company |

Established Year |

Headquarters |

|

Ansys Inc. |

1970 |

Canonsburg, USA |

|

Dassault Systmes |

1981 |

Vlizy-Villacoublay, France |

|

Siemens PLM Software |

1983 |

Plano, USA |

|

Altair Engineering |

1985 |

Troy, USA |

|

Autodesk |

1982 |

San Rafael, USA |

- Ansys Inc.: In 2024, Ansys announced a strategic partnership with the Emirates Nuclear Energy Corporation (ENEC) to provide advanced simulation tools for nuclear energy research and development. The collaboration aims to improve safety measures and optimize nuclear plant performance. ENEC's Barakah Nuclear Energy Plant is projected to generate 40 terawatt-hours (TWh) of clean electricity annually, fulfilling 25% of the UAE's electricity needs and preventing approximately 37.7 megatonnes of CO2 emissions.

- Dassault Systmes: In 2023, Dassault Systmes partnered with Saudi Arabia's Ministry of Industry and Mineral Resources to implement its 3DEXPERIENCE platform across the country's manufacturing sector. This collaboration focuses on boosting digital transformation in line with Saudi Vision 2030. The platform is expected to support smart manufacturing initiatives by providing comprehensive simulation capabilities .

MEA Simulation Software Market Analysis

Growth Drivers

- Increased Demand for Automation in Manufacturing and Energy Sectors: The growing demand for automation in key sectors like manufacturing and energy has significantly driven the adoption of simulation software across the MEA region. Simulation tools are being integrated into automated processes to optimize manufacturing lines and minimize downtime, particularly in the energy sector, where oil refineries and drilling operations utilize digital twins to improve output. This demand is expected to grow further as automation technologies continue to advance in these sectors.

- Government Investments in Infrastructure Development: The increasing government spending on infrastructure development projects, particularly in Saudi Arabia and the UAE, has directly contributed to the market's expansion. As of 2023, the Saudi government allocated USD 100 billion for the expansion of its infrastructure sector under Vision 2030, with simulation software playing a key role in planning and managing these projects. Simulation tools are utilized to model traffic flow, resource allocation, and optimize urban planning initiatives.

- Emergence of Industry 4.0 and Smart Manufacturing: The adoption of Industry 4.0 practices across the Middle East has spurred the need for advanced simulation software to streamline manufacturing processes. In 2024, the UAEs Ministry of Industry and Advanced Technology (MoIAT) announced plans to invest USD 20 billion in smart manufacturing initiatives over the next two years, making simulation tools integral to this transformation. Manufacturers are leveraging these tools to simulate production environments, test prototypes, and enhance supply chain management.

Market Challenges

- High Initial Costs of Simulation Software Implementation: Despite the benefits of simulation software, its high initial costs remain a significant barrier for small and medium-sized enterprises (SMEs) across the MEA region. A report by the Dubai Chamber of Commerce in 2023 highlighted that SMEs in the region found the upfront costs of adopting such technologies prohibitive, especially for smaller firms with limited budgets. The high cost of software licensing, infrastructure, and the required technical expertise limits wider adoption, particularly in developing countries within the region.

- Limited Availability of Skilled Workforce: One of the main challenges facing the growth of the simulation software market is the scarcity of a skilled workforce proficient in utilizing these tools. The 2023 report from the Arab Monetary Fund revealed that only some of engineering and technology graduates in the GCC region possess the necessary skills to operate advanced simulation platforms. This skills gap hampers companies from fully leveraging the benefits of simulation software, especially in industries like automotive, aerospace, and energy, which require high levels of technical expertise.

Government Initiatives

- Saudi Vision 2030 National Industrial Development and Logistics Program (2021): Under Saudi Vision 2030, the National Industrial Development and Logistics Program (NIDLP) was launched in 2021 to promote industrial growth and digital transformation across multiple sectors, including manufacturing, energy, and logistics. The government has allocated USD 20 billion to advance technological innovations, including simulation software, to optimize industrial processes and enhance productivity.

- UAEs Fourth Industrial Revolution (4IR) Strategy (2022) The UAE government introduced the Fourth Industrial Revolution (4IR) Strategy in 2022 to boost technological advancements across industries, emphasizing the use of artificial intelligence, robotics, and simulation software in smart manufacturing and infrastructure projects. The UAE Ministry of Industry and Advanced Technology (MoIAT) has committed USD 30 billion in investments to accelerate the country's transition towards digitalization.

MEA Simulation Software Future Outlook

The MEA simulation software market is poised for substantial growth over the next five years, driven by the increasing focus on digital transformation across key industries like manufacturing, energy, and infrastructure. By 2028, the market is expected to witness significant advancements in simulation technology, particularly with the integration of artificial intelligence and machine learning. Governments across the region are prioritizing smart manufacturing, automation, and sustainable energy, which will play a pivotal role in accelerating the adoption of simulation software.

Future Trends

- Rise of Digital Twins in Energy and Infrastructur: Over the next five years, the use of digital twins in energy and infrastructure projects will expand significantly across the MEA region. These virtual replicas of physical assets will enable companies to optimize resource management, enhance operational efficiency, and reduce costs. As governments invest heavily in infrastructure development and renewable energy projects, digital twin technology will play a critical role in simulating and managing complex systems.

- Increased Adoption of AI-Driven Simulation Tools: The integration of artificial intelligence (AI) into simulation software will revolutionize industries like manufacturing and aerospace in the MEA region. AI-powered simulations will allow companies to predict outcomes more accurately, optimize production processes, and reduce time-to-market for new products. Over the next five years, AI will become a core component of simulation platforms, offering real-time analysis and decision-making capabilities for industries looking to innovate.

Scope of the Report

|

By Product Type |

Fluid Dynamics Structural Simulation Electromagnetic Simulation |

|

By End-Use |

Energy Automotive Aerospace Manufacturing |

|

By Technology |

Continuous Simulation |

|

By Deployment Type |

On-Premises Simulation Software |

|

By Region |

GCC Region North Africa Sub-Saharan Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Aerospace and Defense Companies

Oil and Gas Corporations

Energy Companies

Construction and Infrastructure Companies

Technology and Innovation Hubs

Industrial Equipment Manufacturers

Healthcare and Medical Device Companies

Telecommunications Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry and Mineral Resources, UAE Ministry of Energy)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

VinFast

Tesla

Hyundai

BYD

Mitsubishi

Nissan

Kia

Honda

Toyota

Mercedes-Benz

BMW

Audi

General Motors

Volvo

Geely

Table of Contents

1. MEA Simulation Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate and Historical Performance

1.4. Key Market Milestones and Developments (Technology integration, Digital Twin Adoption, etc.)

1.5. Market Segmentation Overview

1.6. Market Size and Financial Metrics (Revenue, Software Penetration, Operational Metrics)

2. MEA Simulation Software Market Size (in USD)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (Revenue growth, unit growth, end-user industry adoption)

2.3. Key Developments Impacting Market Size (Regulatory changes, technological advancements, mergers)

3. MEA Simulation Software Market Growth Drivers

3.1. Rise of Industry 4.0 in Manufacturing (Investment statistics, Government-backed initiatives)

3.2. Expansion of Renewable Energy Projects (Government energy targets, strategic investments in clean energy)

3.3. Adoption of Digital Twin Technology in Critical Sectors (Adoption rates, specific sector usage in oil & gas, construction)

4. MEA Simulation Software Market Challenges

4.1. High Initial Capital Investment for Enterprises (Cost analysis, SME market penetration data)

4.2. Scarcity of Skilled Workforce (Educational gaps, upskilling initiatives)

4.3. Cybersecurity and Data Privacy Concerns (Sector-specific concerns in energy, aerospace)

5. MEA Simulation Software Government Initiatives

5.1. Saudi Vision 2030: National Industrial Development and Logistics Program (Infrastructure investment, Industry growth)

5.2. UAE Fourth Industrial Revolution Strategy (MoIAT-backed tech investments in smart manufacturing, digital innovation)

5.3. Egypts Digital Transformation Strategy (Sectoral targets, projected digital adoption in industrial applications)

6. MEA Simulation Software Market Segmentation

6.1. By Product Type (in value %)

6.1.1. Fluid Dynamics Simulation

6.1.2. Structural Simulation

6.1.3. Electromagnetic Simulation

6.2. By End-Use Industry (in value %)

6.2.1. Energy Sector

6.2.2. Automotive Sector

6.2.3. Aerospace Sector

6.2.4. Healthcare Sector

6.2.5. Manufacturing Sector

6.3. By Technology (in value %)

6.3.1. Continuous Simulation

6.3.2. Intermittent Simulation

6.3.3. AI-Powered Simulation Tools

6.4. By Deployment Type (in value %)

6.4.1. On-Premises Simulation Software

6.4.2. Cloud-Based Simulation Software

6.5. By Region (in value %)

6.5.1. GCC Region

6.5.2. North Africa

6.5.3. Sub-Saharan Africa

7. MEA Simulation Software Competitive Landscape

7.1. Market Share Analysis (2023)

7.2. Competitive Benchmarking (Key performance indicators, revenue growth, industry partnerships)

7.3. Strategic Initiatives (Collaborations, joint ventures, and partnerships in digitalization)

7.4. Mergers and Acquisitions (Notable deals, synergies, and sector-specific takeovers)

7.5. Investment Analysis (Government funding, venture capital involvement, private equity interest)

8. MEA Simulation Software Major Players

8.1. Ansys Inc.

8.2. Dassault Systmes

8.3. Siemens PLM Software

8.4. Altair Engineering

8.5. Autodesk

8.6. COMSOL Inc.

8.7. Bentley Systems

8.8. MSC Software

8.9. ESI Group

8.10. MathWorks

8.11. PTC Inc.

8.12. Rockwell Automation

8.13. Honeywell International Inc.

8.14. Hexagon AB

8.15. Aspen Technology

9. MEA Simulation Software Market Analysis

9.1. SWOT Analysis

9.1.1. Strengths (Industry adoption rates, regulatory support)

9.1.2. Weaknesses (Cost constraints, skill shortages)

9.1.3. Opportunities (Emerging industries, cross-border collaborations)

9.1.4. Threats (Cybersecurity issues, geopolitical risks)

9.2. Stakeholder Analysis (Influence and engagement of manufacturers, software developers, energy players)

10. MEA Simulation Software Regulatory Framework

10.1. Key Regional Regulations (GCC, North Africa, Sub-Saharan Africa)

10.2. Compliance Standards (Cybersecurity mandates, industry-specific regulatory requirements)

10.3. Certification Processes (Software certification, professional competency requirements)

11. MEA Simulation Software Market Investment Opportunities

11.1. Venture Capital and Private Equity Investments (Key investors, investment trends)

11.2. Government Grants and Incentives (R&D support, tax credits, regulatory incentives)

11.3. Public-Private Partnerships (Key projects, sector involvement, government backing)

12. MEA Simulation Software Market Future Trends

12.1. Expansion of Digital Twins in Energy and Infrastructure

12.2. Integration of AI-Driven Simulation Tools

12.3. Growth in Simulation in Healthcare and Medical Devices

12.4. Rise of Cloud-Based Simulation Software

12.5. Evolution of Sustainable and Green Energy Simulation Tools

13. MEA Simulation Software Analyst Recommendations

13.1. TAM/SAM/SOM Analysis (Total addressable market, serviceable available market, serviceable obtainable market)

13.2. Customer Cohort Analysis (Key customer profiles, demand analysis, use-case specifics)

13.3. White Space Opportunity Analysis (New market entry strategies, product diversification)

13.4. Marketing and Sales Strategies (B2B marketing initiatives, partnership models)

Disclaimer

Contact US

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step 2: Market Building

Collating statistics on the MEA simulation software Market over the years, analyzing the penetration of MEA simulation software technologies, and computing the revenue generated for the market. This step also involves reviewing technology adoption rates and application effectiveness to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple MEA simulation software companies to understand the nature of technology segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these MEA simulation software companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01. How big is the MEA Simulation Software Market?

The MEA simulation software market was valued at USD 2 billion in 2023, driven by increased adoption across manufacturing, energy, and aerospace sectors in the region.

02. What are the challenges in the MEA Simulation Software Market?

Challenges include high initial investment costs, scarcity of skilled workforce capable of using advanced simulation tools, and data security concerns, particularly in critical sectors like energy and defense.

03. Who are the major players in the MEA Simulation Software Market?

Key players in the market include Ansys Inc., Dassault Systmes, Siemens PLM Software, Altair Engineering, and Autodesk, each of which holds a significant market share due to their comprehensive product portfolios and industry partnerships.

04. What are the growth drivers of the MEA Simulation Software Market?

The market is propelled by factors such as the rise of Industry 4.0 practices in manufacturing, increasing government investments in digital infrastructure, and the adoption of digital twins in energy and infrastructure projects

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.