Middle East and Africa (MEA) Surgical Robots Market Outlook to 2030

Region:Middle East

Author(s):Shreya

Product Code:KROD2868

November 2024

84

About the Report

Middle East and Africa (MEA) Surgical Robots Market Overview

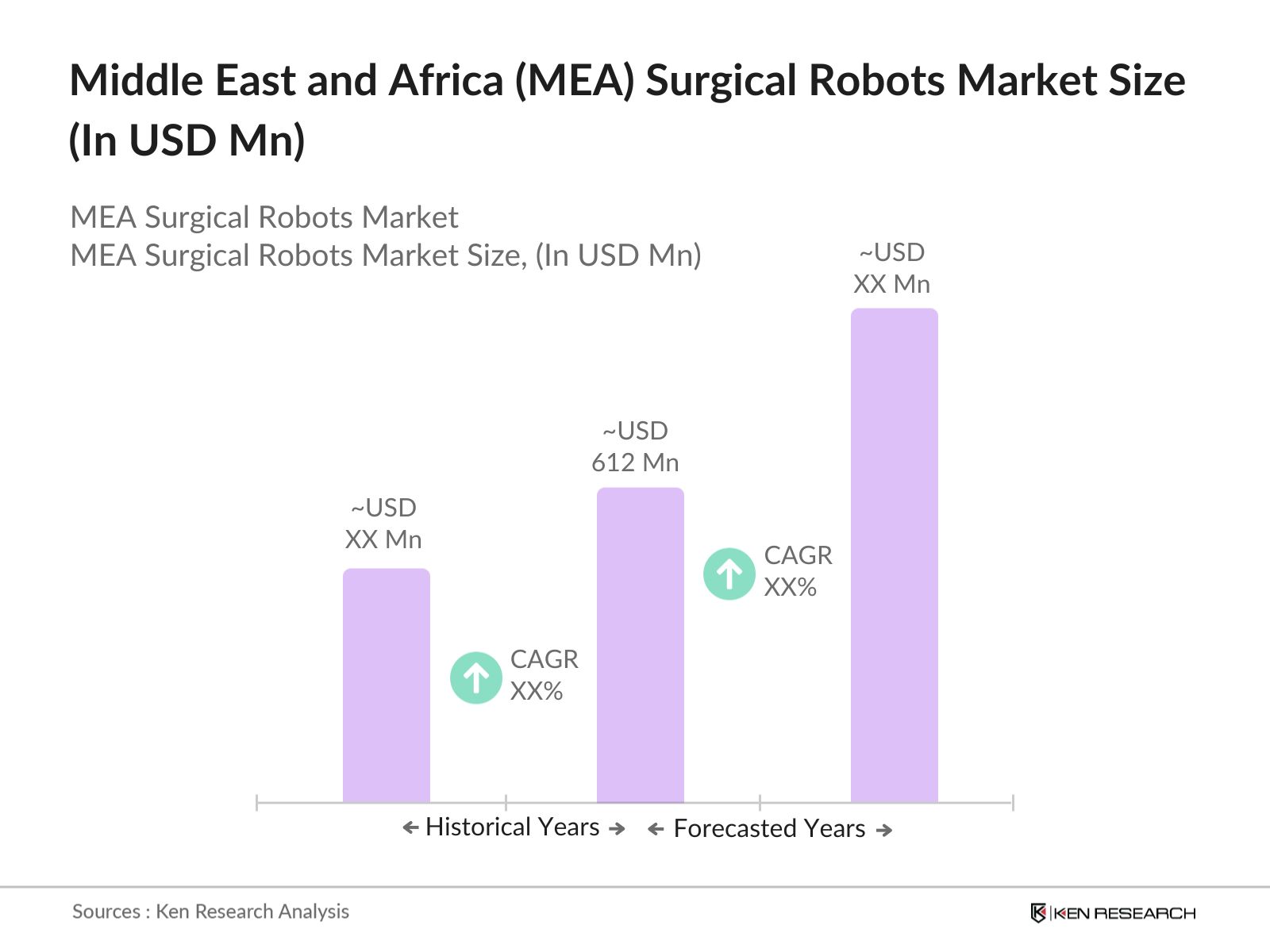

The Middle East and Africa (MEA) surgical robot market was valued at USD 612 million based on the historic data of past five years. This growth is fueled by the rising prevalence of chronic diseases, a shift towards minimally invasive surgeries, and increased healthcare spending. The integration of artificial intelligence (AI) and machine learning (ML) in robotic-assisted surgeries is also driving demand. The growing aging population and increased demand for precision surgeries have further bolstered market growth.

The key players in the Middle East and Africa surgical robots market include Intuitive Surgical, Medtronic, Zimmer Biomet, Smith & Nephew, and Stryker Corporation. These companies dominate the region through advanced product offerings, strategic partnerships, and a robust distribution network. Intuitive Surgical, in particular, maintains a significant share due to its highly popular da Vinci robotic system, which has been widely adopted in hospitals across the region.

In 2024, Intuitive Surgical announced the expansion of its distribution network in the UAE, collaborating with three major hospital chains. This expansion includes the introduction of new da Vinci systems, with over 300 surgeries already performed using these systems in the first half of the year.

Dubai, dominates the surgical robot market in the MEA region. Dubais advanced healthcare infrastructure, high rate of technological adoption, and government-backed initiatives make it a leader in robotic surgery adoption. In 2023, Dubai accounted for over one-third of the regions market share, primarily due to its rapid deployment of robotic surgery systems in both public and private hospitals.

Middle East and Africa (MEA) Surgical Robots Market Segmentation

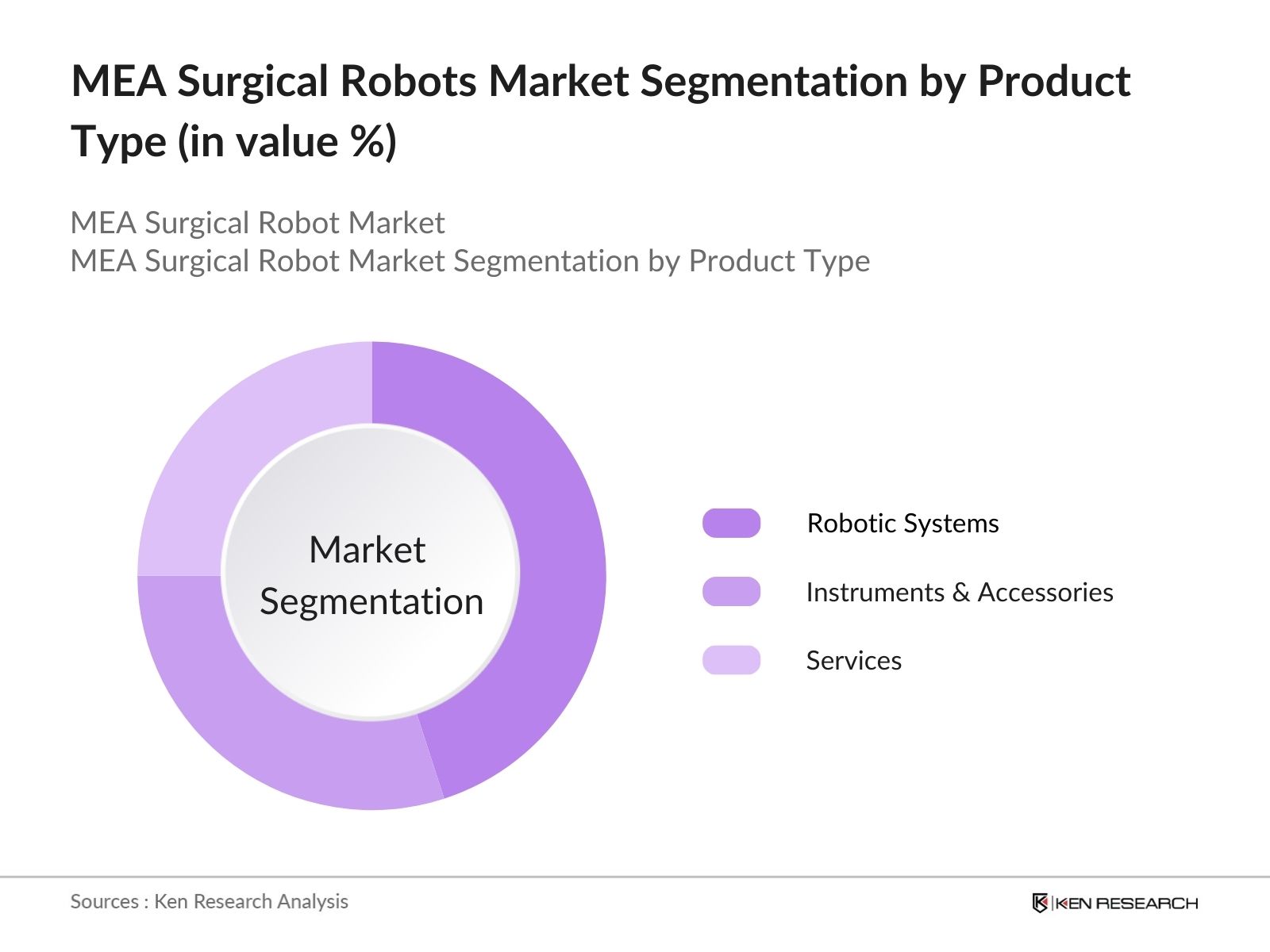

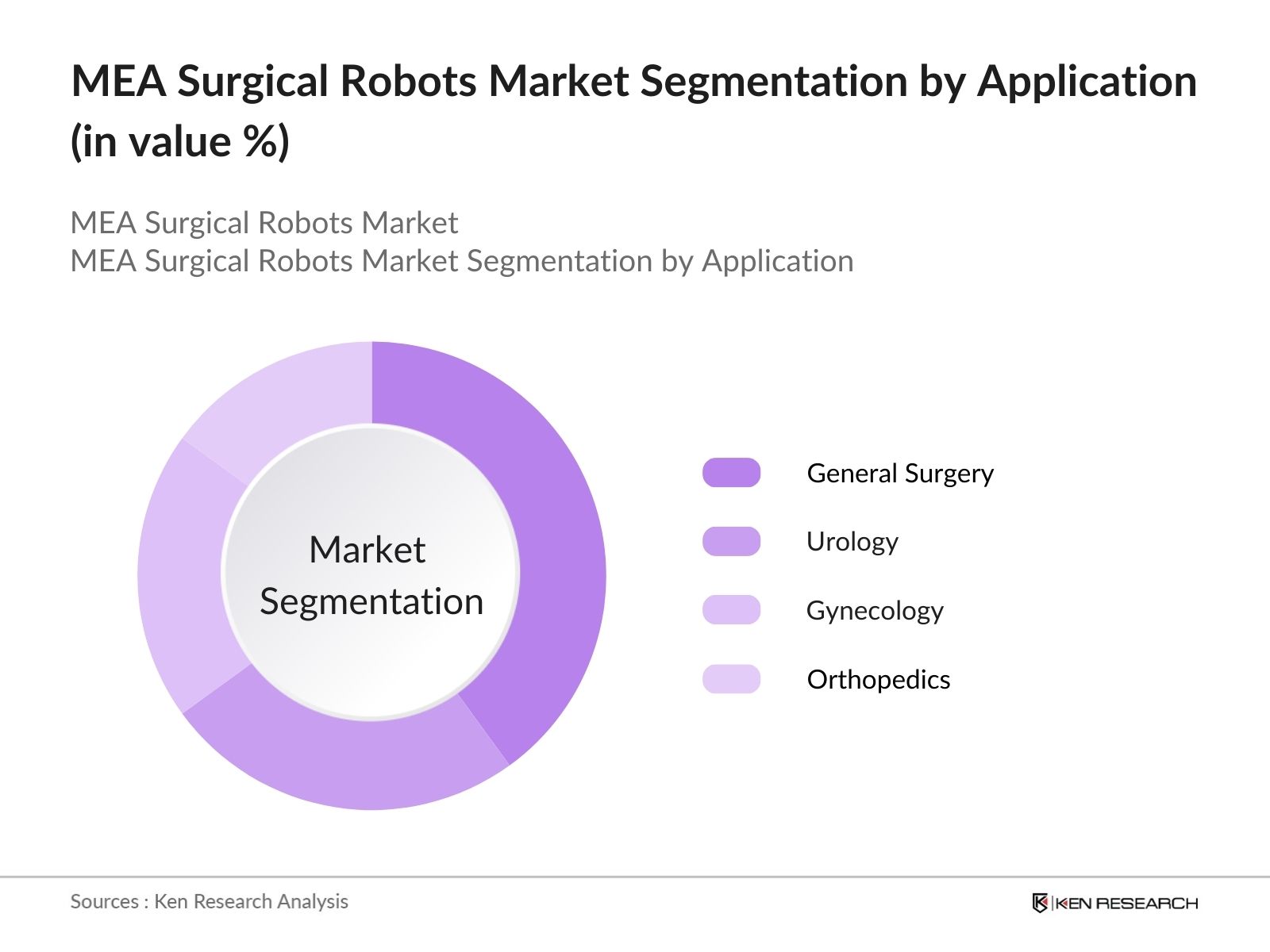

The MEA surgical robot market is segmented into various factors such as product type, application and region etc.

By Product Type: The market is segmented by product type into robotic systems, instruments & accessories, and services. In 2023, robotic systems held the largest market share. This dominance is attributed to the increasing number of hospitals and healthcare institutions adopting robotic systems for precision surgeries. There is also ease of integration of robotic systems with existing healthcare infrastructures and advancements in AI-powered technologies.

By Application: The market is segmented by application into general surgery, urology, gynecology, and orthopedics. General surgery held the largest market share. This is driven by the rising incidence of complex procedures, such as cancer-related surgeries, which require precision and accuracy. The demand for minimally invasive general surgery procedures is rapidly increasing, leading to the dominant position of this sub-segment.

By Region: The market is segmented by region into Israel, United Arab Emirates, South Africa, Morocco, Jordan and Rest of MEA. Israel holds the dominant market share in the Middle East and Africa surgical robot market due to its advanced healthcare infrastructure, high investment in medical technology, and the presence of several leading research institutions focused on robotics and AI. Israel's strong innovation ecosystem also supports rapid adoption of robotic surgery systems.

Middle East and Africa (MEA) Surgical Robots Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Intuitive Surgical |

1995 |

Sunnyvale, USA |

|

Medtronic |

1949 |

Dublin, Ireland |

|

Zimmer Biomet |

1927 |

Warsaw, USA |

|

Stryker Corporation |

1941 |

Kalamazoo, USA |

|

Smith & Nephew |

1856 |

London, UK |

- Launch of New Robotic Systems in Dubai Hospitals: American Hospital Dubai as the first facility in the region to install the fourth generation da Vinci robotic system and to perform robotic surgeries. They mention that over 100 surgeries have been successfully conducted since the introduction of this system. The precision of robotic surgery typically results in lower blood loss compared to traditional methods.

- Strategic Partnership Between Medtronic and Egypt's Ministry of Health: In 2023, Medtronic partnered with Egypts Ministry of Health to equip public hospitals with Hugo robotic-assisted surgery systems. By the end of 2024, this partnership aims to place 50 robotic systems in key hospitals across the country, improving access to advanced surgical technologies.

Middle East and Africa (MEA) Surgical Robots Industry Analysis

Growth Drivers

- Increasing Healthcare Expenditure in the MEA Region: Countries like Saudi Arabia and the UAE have allocated substantial budgets for healthcare improvement, focusing on advanced technologies like surgical robots. This investment is driving the adoption of surgical robots in major hospitals across the region. The increase in government expenditure directly influences the availability and implementation of robotic surgery systems in public hospitals, thus contributing to market growth.

- Rising Number of Surgical Procedures: In 2024, there were over 1.3 million surgical procedures performed in the MEA region, with a growing number being conducted using robotic-assisted technology. Hospitals in the UAE and Saudi Arabia reported a surge in demand for robotic surgeries in fields such as urology and gynecology. The increasing number of patients opting for precision surgeries is pushing the adoption of robotic systems, contributing to the market's growth.

- Aging Population and Growing Chronic Disease Prevalence: In 2024, the MEA region is witnessing an increasing elderly population, with over 30 million people aged above 65. This demographic shift is contributing to a rise in chronic diseases such as cancer and cardiovascular conditions, which often require complex surgical interventions. The growing demand for minimally invasive surgeries, which robotic systems excel at, is driving their adoption in major healthcare facilities, further boosting the market.

Challenges

- Limited Accessibility in Rural and Remote Areas: The MEA region faces challenges in delivering advanced healthcare technologies like surgical robots to rural and remote areas. A major part of the population in North Africa and parts of East Africa do not have access to advanced surgical technologies due to poor infrastructure and healthcare facilities. This gap in healthcare access limits the markets growth, as the majority of the demand for robotic systems comes from urban areas.

- Maintenance and Operating Costs: The maintenance and operating costs associated with surgical robots are substantial. In 2024, healthcare facilities reported annual maintenance costs for robotic systems ranging from USD 100,000 to USD 150,000 per unit. Additionally, the cost of consumables, such as robotic instruments, further adds to the financial burden, making it challenging for hospitals with limited budgets to operate these systems efficiently.

Government Initiatives

- UAE's Artificial Intelligence Strategy 2031: The UAE government has set a goal to become a global leader in AI by 2031. As part of this initiative, the UAE's Ministry of Health and Prevention has introduced a dedicated budget of USD 1.5 billion in 2024 to integrate AI and robotics into healthcare. This initiative includes funding for AI-driven surgical robots, which is expected to drive significant growth in the surgical robotics market in the coming years.

- Egypt's National Healthcare Improvement Plan: Egypt is prioritizing the modernization of its healthcare infrastructure through its National Healthcare Improvement Plan. In 2024, the government allocated USD 500 million to enhance hospital infrastructure, with a portion of the funds directed towards acquiring robotic surgery systems. This initiative aims to improve surgical outcomes and expand access to robotic-assisted surgeries in major hospitals.

Middle East and Africa (MEA) Surgical Robots Market Future Outlook

The MEA surgical robot market is projected to grow exponentially, driven by continued advancements in robotic surgery, increasing healthcare infrastructure, and the rising adoption of AI-powered robotics systems. Further government initiatives to improve healthcare access and quality in emerging economies within the region are expected to support market expansion.

Future Trends

- Expansion of Robotic Surgery Training Programs: The MEA region is expected to increase the robotic surgery training centers, providing advanced training for surgeons in minimally invasive procedures. These centers, funded by both government and private entities, will help bridge the gap in skilled robotic surgeons and enhance the region's capacity to perform robotic-assisted surgeries.

- Robotic Systems for Specialized Surgeries

In the coming years, the MEA region will see an increase in the use of robotic systems for specialized surgeries such as neurosurgery, orthopedic surgery, and pediatric surgery. Many specialized robotic systems are projected to be in operation across key hospitals in the region, driven by advancements in AI and machine learning that will enable robots to handle increasingly complex surgical procedures.

Scope of the Report

|

By Product Type |

Robotic Systems Instruments & Accessories Services |

|

By Application |

Surgery Urology Gynecology Orthopedics |

|

By Region |

Israel United Arab Emirates Jordan Morocco South Africa Rest of MEA |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Medical Device Manufacturers

AI and Robotics Companies

Healthcare IT Solutions Providers

Health Insurance Companies

Healthcare Technology Regulatory Authorities

Ministry of Health

Investors and VC Firms

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Intuitive Surgical

Medtronic

Zimmer Biomet

Stryker Corporation

Smith & Nephew

TransEnterix

Johnson & Johnson

Renishaw

Think Surgical

Brainlab

Verb Surgical

Mazor Robotics

Hansen Medical

Titan Medical

Accuray

Table of Contents

Middle East and Africa Surgical Robots Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Middle East and Africa Surgical Robots Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

Middle East and Africa Surgical Robots Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Healthcare Expenditure

3.1.2. Rising Demand for Minimally Invasive Surgeries

3.1.3. Government Funding for Robotics

3.1.4. Growing Prevalence of Chronic Diseases

3.2. Restraints

3.2.1. High Initial Costs

3.2.2. Shortage of Skilled Surgeons

3.2.3. Maintenance and Operating Expenses

3.3. Opportunities

3.3.1. Government Healthcare Initiatives

3.3.2. Integration of AI in Surgical Robots

3.3.3. Growing Focus on Specialized Surgeries

3.4. Trends

3.4.1. AI-Driven Surgical Robots

3.4.2. Increased Hospital Adoption

3.4.3. Expansion of Robotic Surgery Training Programs

3.5. Government Regulation

3.5.1. Health Sector Transformation Programs

3.5.2. AI and Robotics Strategies

3.5.3. Public-Private Partnerships in Healthcare

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

Middle East and Africa Surgical Robots Market Segmentation, 2023

4.1. By Product Type (in Value USD Mn)

4.1.1. Robotic Systems

4.1.2. Instruments & Accessories

4.1.3. Services

4.2. By Application (in Value USD Mn)

4.2.1. General Surgery

4.2.2. Urology

4.2.3. Gynecology

4.2.4. Orthopedics

4.3. By Region (in Value USD Mn)

4.3.1. Israel

4.3.2. United Arab Emirates

4.3.3. Jordan

4.3.4. Morocco

4.3.5. South Africa

4.3.6. Rest of MEA

5. Middle East and Africa Surgical Robots Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Intuitive Surgical

5.1.2. Medtronic

5.1.3. Zimmer Biomet

5.1.4. Stryker Corporation

5.1.5. Smith & Nephew

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

Middle East and Africa Surgical Robots Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Government Funding

6.4.2. Private Equity Investments

Middle East and Africa Surgical Robots Market Regulatory Framework

7.1. Medical Device Standards

7.2. Compliance and Certification

7.3. National Health Programs

Middle East and Africa Surgical Robots Market Future Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Growth

Middle East and Africa Surgical Robots Market Future Segmentation, 2028

9.1. By Product Type (in Value USD Mn)

9.2. By Application (in Value USD Mn)

9.3. By Region (in Value USD Mn)

Middle East and Africa Surgical Robots Market Analysts' Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Middle East and Africa surgical robot market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Middle East and Africa Surgical Robot Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different surgical robot companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple surgical robot manufacturers and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from surgical robot companies.

Frequently Asked Questions

How big is the Middle East and Africa Surgical Robots Market?

The Middle East and Africa surgical robot market was valued at USD 612 million in 2023, driven by rising healthcare expenditure, growing demand for minimally invasive surgeries, and government investments in healthcare technology.

What are the challenges in the Middle East and Africa Surgical Robots Market?

Challenges in the Middle East and Africa surgical robots market include the high initial investment required for robotic systems, the shortage of skilled robotic surgeons, and limited access to advanced healthcare technologies in rural areas. High maintenance costs and the need for continuous training also hinder market expansion.

Who are the major players in the Middle East and Africa Surgical Robots Market?

Key players in the Middle East and Africa surgical robots market include Intuitive Surgical, Medtronic, Zimmer Biomet, Stryker Corporation, and Smith & Nephew. These companies lead due to their advanced product offerings, strong market presence, and partnerships with healthcare institutions across the region.

What are the growth drivers of the Middle East and Africa Surgical Robots Market?

The Middle East and Africa surgical robot market is driven by increasing healthcare expenditure, rising prevalence of chronic diseases requiring complex surgeries, government funding for AI and robotics, and a growing elderly population that demands minimally invasive surgical procedures.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.