MEA Wheat Protein Flour Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD7038

December 2024

90

About the Report

MEA Wheat Protein Flour Market Overview

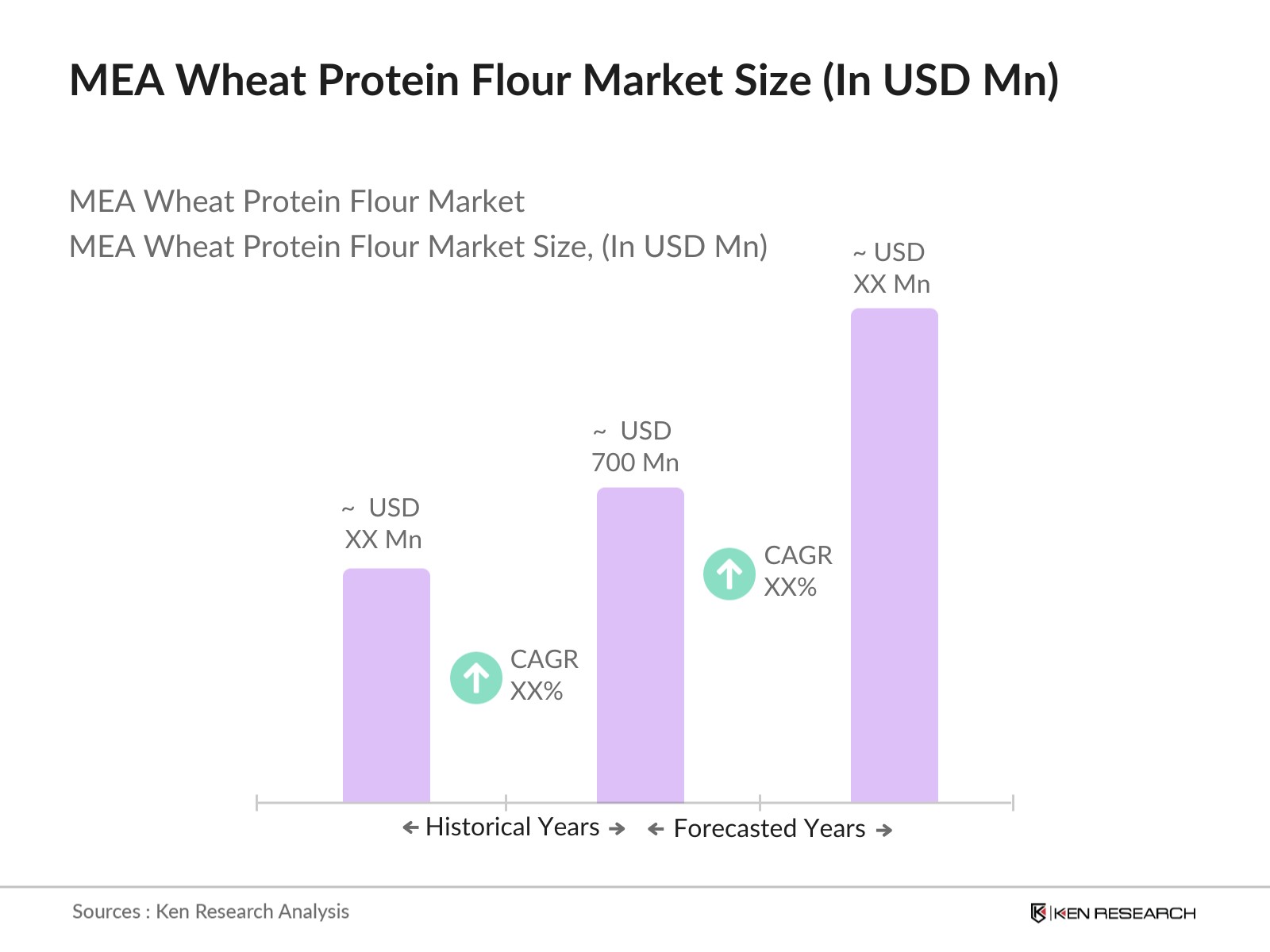

- The MEA Wheat Protein Flour market is valued at USD 700 million, driven by rising health consciousness and demand for high-protein diets. Increased urbanization and the growth of the food processing industry further support market expansion, as wheat protein flour finds application in various food sectors, including bakery, confectionery, and functional foods. Additionally, government initiatives to enhance food security and local wheat production foster steady growth in the industry.

- Key regions such as Riyadh, Jeddah, and Dammam lead the market due to their larger population, urbanization levels, and developed food and beverage industry infrastructure. These regions host major production facilities and are central distribution hubs for wheat-based protein products. The presence of a high concentration of health-conscious consumers also supports the growth and dominance of these regions in the market.

- The Saudi government has prioritized domestic wheat production to strengthen food security, leading to policies that encourage local farming. As per the Ministry of Environment, Water, and Agriculture, Saudi Arabia aims to produce over 500,000 metric tons of wheat annually by incentivizing local farmers. This increase in wheat production supports the wheat protein flour industry by ensuring a stable raw material supply, critical to meeting the growing domestic and regional demand for high-protein wheat-based products

MEA Wheat Protein Flour Market Segmentation

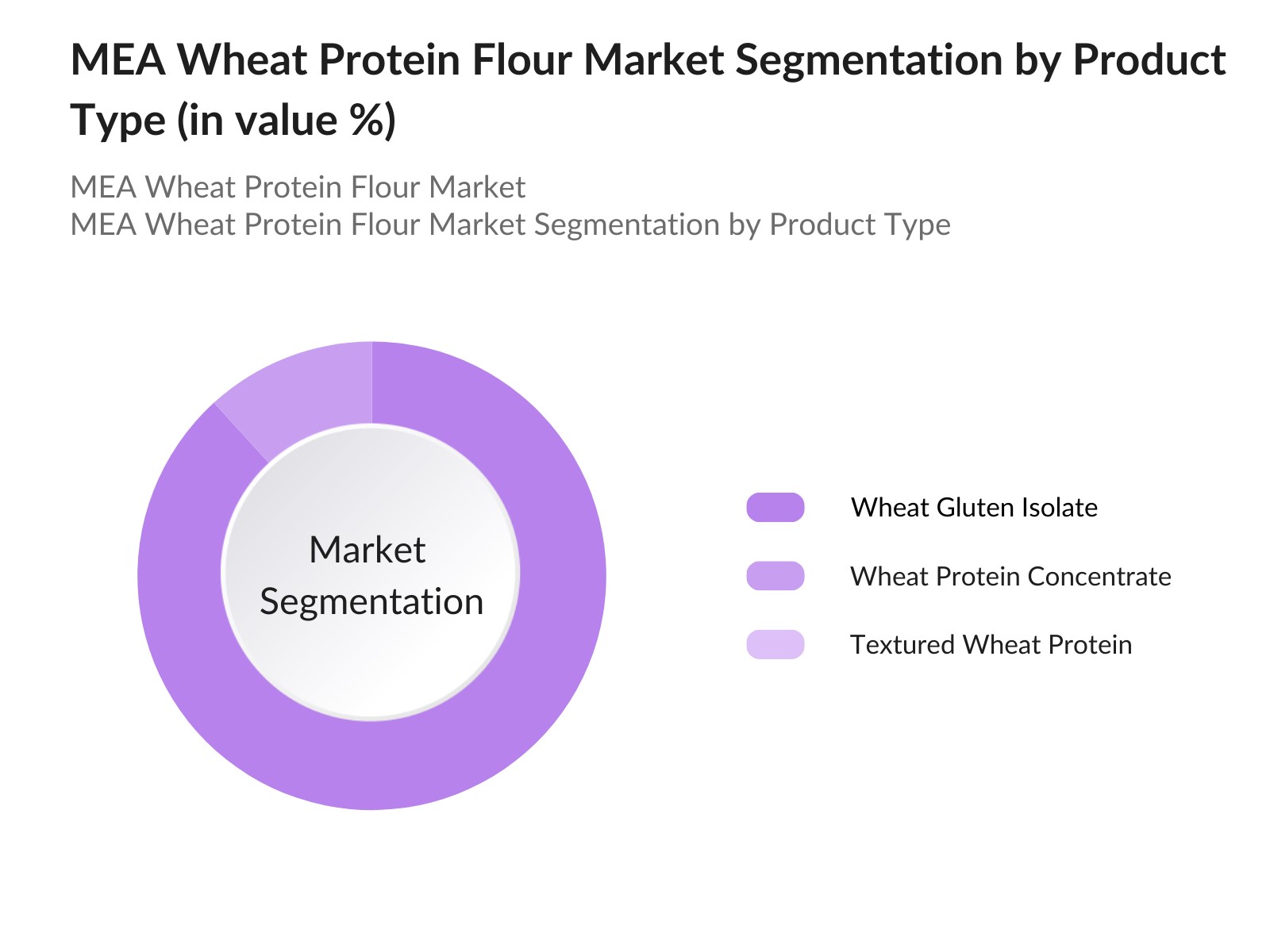

By Product Type: The MEA Wheat Protein Flour market is segmented by product type into wheat gluten isolate, wheat protein concentrate, and textured wheat protein. Recently, wheat gluten isolate has gained a dominant market share due to its high protein content and versatility in applications like bakery and processed foods. This product type meets consumer demands for protein-rich and gluten-structured products, catering to growing trends in health-conscious and fitness-focused diets.

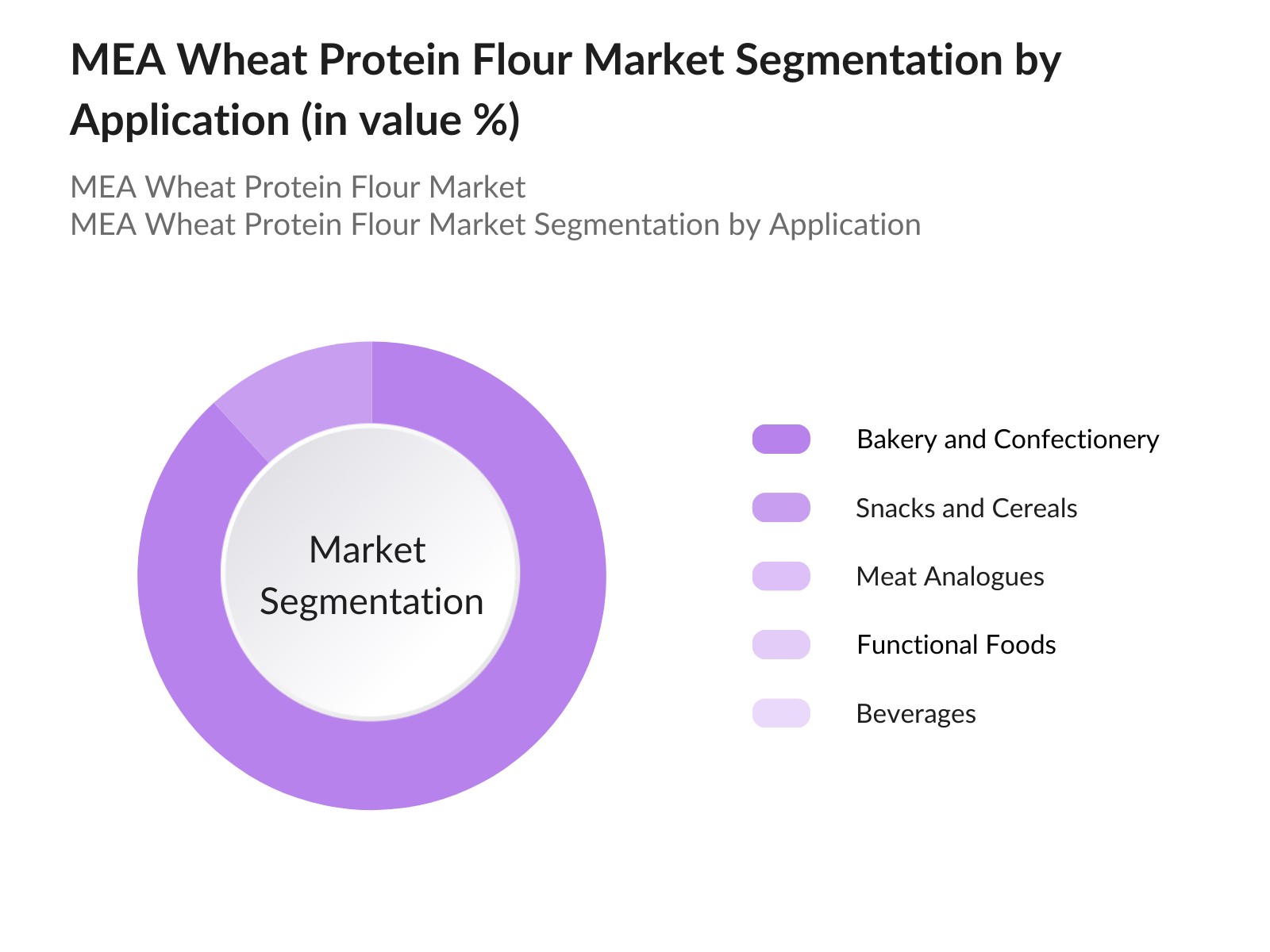

By Application: The market is further segmented by application into bakery and confectionery, snacks and cereals, meat analogues, functional foods, and beverages. The bakery and confectionery segment dominates due to the extensive use of wheat protein flour to improve the texture and nutritional profile of baked goods. The ongoing demand for high-protein bakery items, especially in urban areas, contributes to the prominence of this segment.

MEA Wheat Protein Flour Competitive Landscape

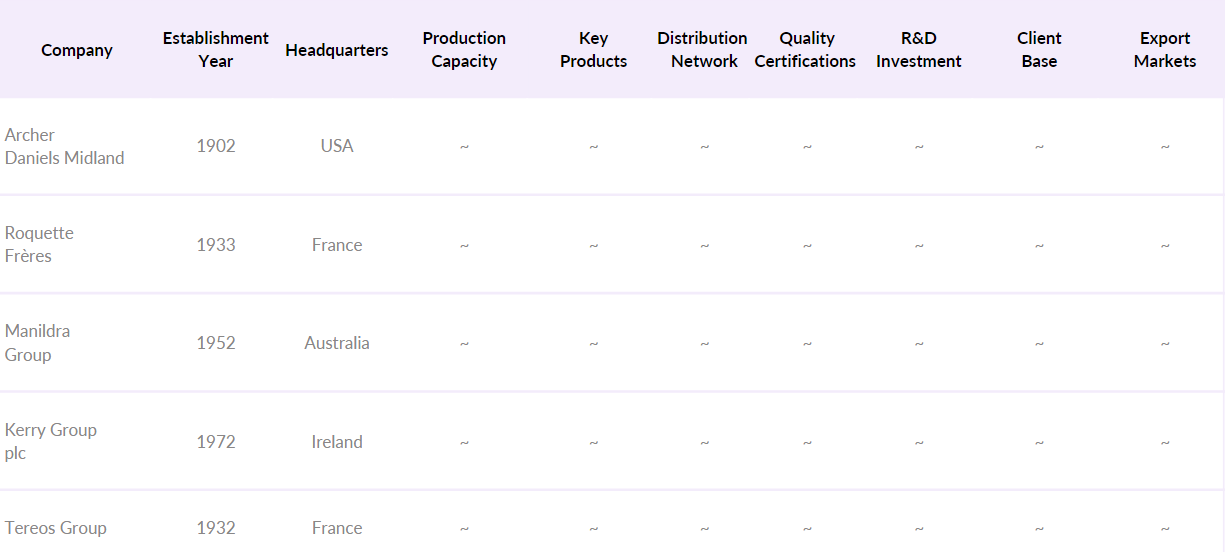

The MEA Wheat Protein Flour market is dominated by a few established players, including both local and international companies that contribute to market consolidation. Companies leverage advanced protein extraction technology and strong distribution networks to maintain a competitive edge.

MEA Wheat Protein Flour Market Analysis

Growth Drivers

- Consumer Demand for High-Protein Diets: Increasing health consciousness among MEA consumers has led to a shift toward high-protein diets, driving the demand for wheat protein flour. According to the Saudi General Authority for Statistics, over 62% of Saudi consumers have shown a preference for high-protein food products, with urban centers experiencing the highest demand due to their access to modern retail outlets and fitness centers. This trend aligns with Saudi Arabias National Transformation Program, which promotes healthier dietary habits as part of Vision 2030, further boosting the wheat protein flour market by expanding product availability to meet this demand.

- Increase in Processed Food Manufacturing: Saudi Arabias processed food industry has been expanding, valued at approximately USD 11 billion as reported by the Ministry of Environment, Water, and Agriculture. Wheat protein flour, known for its versatility, has seen increased usage across processed food manufacturing due to its functional benefits in enhancing texture and protein content. The increased investment in local food processing facilities has also accelerated the demand for wheat protein flour, supporting Saudi Arabia's goal to reduce food import dependence by fostering a self-sufficient food production sector.

- Expansion of Bakery and Confectionery Industry: The bakery and confectionery industry in Saudi Arabia has witnessed growth, with annual sales reaching approximately USD 2.5 billion, according to the Saudi Industrial Development Fund. Wheat protein flour, primarily used to improve dough elasticity and shelf stability, has become essential in the bakery segment. The growth in urban populations and changes in dietary preferences toward bakery products have fueled this demand, which is also supported by retail giants increasing their distribution channels across the region.

Market Challenges

- Price Fluctuations of Wheat: Wheat prices in Saudi Arabia have been subject to fluctuation due to varying global supply chains and international economic pressures. According to the Saudi Agricultural and Livestock Investment Company (SALIC), wheat import costs have seen changes influenced by global commodity markets and regional trade agreements. Such price volatility affects wheat protein flour manufacturers, who must adjust to these fluctuations to maintain profitability while meeting rising demand

- High Production Costs: The production costs for wheat protein flour in MEA remain relatively high due to energy costs, labor, and reliance on specialized equipment. Saudi Arabias electricity costs for industrial manufacturing are set at approximately 18.9 halalas per kWh, as per the Saudi Electricity Company. High operational expenses impact profit margins for wheat protein flour manufacturers, especially as they strive to keep pace with consumer demand and industry competition

MEA Wheat Protein Flour Market Future Outlook

The MEA Wheat Protein Flour market is expected to continue evolving, driven by health-oriented consumer trends and the expansion of the food and beverage sector. With innovations in plant-based food products and wheat protein applications, the market is set for steady growth. Increasing collaborations between local suppliers and international firms to meet demand for organic and high-quality protein ingredients will likely further boost the market.

Market Opportunities

- Technological Advancements in Protein Extraction: The adoption of advanced protein extraction technologies has created new opportunities in the wheat protein flour industry in MEA. According to the Saudi Standards, Metrology and Quality Organization, the incorporation of sustainable extraction methods has increased protein yields by up to 20%, allowing manufacturers to produce high-quality protein concentrates. This technological advancement strengthens Saudi Arabia's position in the protein market by making wheat protein flour production more efficient and aligned with global sustainability standards.

- Expansion in Plant-Based Food Segment: The plant-based food segment has seen substantial growth in Saudi Arabia, with the Saudi Investment Authority estimating an annual increase of plant-based food product launches by 15%. Wheat protein flour, known for its adaptability, is increasingly used in plant-based alternatives such as meat analogs, meeting the rising consumer demand for plant-based foods. This trend offers significant growth potential for wheat protein flour manufacturers as they supply ingredients to an expanding plant-based food industry

Scope of the Report

|

Product Type |

Wheat Gluten Isolate |

|

Application |

Bakery and Confectionery |

|

Form |

Dry |

|

Distribution Channel |

B2B |

|

Region |

Central MEA |

Products

Key Target Audience

Food and Beverage Manufacturing Companies

Health Food Chains and Stores

Bakery and Confectionery Manufacturers

Nutraceutical Companies

Large Retail Chains

Protein Supplement Producers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food & Drug Authority, Ministry of Environment, Water and Agriculture)

Companies

Players Mentioned in the Report

Archer Daniels Midland Company

Roquette Frres

Manildra Group

MGP Ingredients, Inc.

Kroner-Starke GmbH

Tereos Group

Agrana Beteiligungs-AG

Kerry Group plc

Meelunie BV

Glico Nutrition Co., Ltd.

Shandong Qufeng Food Technology Co., Ltd.

Permolex Ltd.

Jckering Group

Amilina

Cargill, Inc.

Table of Contents

1. MEA Wheat Protein Flour Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Supply Chain Analysis

2. MEA Wheat Protein Flour Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Market Penetration Analysis

3. MEA Wheat Protein Flour Market Analysis

3.1 Growth Drivers

3.1.1 Consumer Demand for High-Protein Diets

3.1.2 Increase in Processed Food Manufacturing

3.1.3 Expansion of Bakery and Confectionery Industry

3.1.4 Government Support for Domestic Wheat Production

3.2 Market Challenges

3.2.1 Price Fluctuations of Wheat

3.2.2 High Production Costs

3.2.3 Limited Awareness Among End-Users

3.3 Opportunities

3.3.1 Technological Advancements in Protein Extraction

3.3.2 Expansion in Plant-Based Food Segment

3.3.3 Growing Export Potential

3.4 Trends

3.4.1 Rising Popularity of Gluten-Free and High-Protein Foods

3.4.2 Focus on Organic Wheat Protein Flour

3.4.3 Increased Application in Nutraceuticals

3.5 Regulatory Environment

3.5.1 Food Safety Standards

3.5.2 Certification Requirements for Organic Wheat Protein Flour

3.5.3 Labeling and Ingredient Regulations

3.6 Competitive Ecosystem

3.7 Porters Five Forces Analysis

3.8 SWOT Analysis of Market Participants

4. MEA Wheat Protein Flour Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Wheat Gluten Isolate

4.1.2 Wheat Protein Concentrate

4.1.3 Textured Wheat Protein

4.2 By Application (In Value %)

4.2.1 Bakery and Confectionery

4.2.2 Snacks and Cereals

4.2.3 Meat Analogues

4.2.4 Functional Foods

4.2.5 Beverages

4.3 By Form (In Value %)

4.3.1 Dry

4.3.2 Liquid

4.4 By Distribution Channel (In Value %)

4.4.1 B2B

4.4.2 B2C

4.5 By Region (In Value %)

4.5.1 Central MEA

4.5.2 Western MEA

4.5.3 Eastern MEA

5. MEA Wheat Protein Flour Market Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Archer Daniels Midland Company

5.1.2 Roquette Frres

5.1.3 Cargill, Inc.

5.1.4 Manildra Group

5.1.5 MGP Ingredients, Inc.

5.1.6 Kroner-Starke GmbH

5.1.7 Tereos Group

5.1.8 Agrana Beteiligungs-AG

5.1.9 Kerry Group plc

5.1.10 Meelunie BV

5.1.11 Glico Nutrition Co., Ltd.

5.1.12 Shandong Qufeng Food Technology Co., Ltd.

5.1.13 Permolex Ltd.

5.1.14 Jckering Group

5.1.15 Amilina

5.2 Cross-Comparison Parameters (Employee Strength, Global Presence, Market Share, R&D Investment, Product Portfolio, Key Clients, Quality Certifications, Distribution Network)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Partnerships and Collaborations

5.6 Investment Trends

5.7 R&D Expenditures

5.8 Export Market Potential

6. MEA Wheat Protein Flour Market Regulatory Framework

6.1 Compliance with MEA Food Safety Regulations

6.2 Import and Export Regulations

6.3 Organic Certification Standards

7. MEA Wheat Protein Flour Future Market Size (In USD Billion)

7.1 Key Growth Indicators for Future Market Size

7.2 Technological Influences on Market Development

8. MEA Wheat Protein Flour Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Form (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. MEA Wheat Protein Flour Market Analysts Recommendations

9.1 Target Market Analysis (TAM/SAM/SOM)

9.2 Customer Profile Analysis

9.3 Strategic Marketing Recommendations

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research began with mapping out critical stakeholders within the MEA Wheat Protein Flour Market, including major producers, suppliers, and end-users. Comprehensive desk research using secondary data sources identified essential variables shaping market dynamics.

Step 2: Market Analysis and Data Collection

Data collection encompassed gathering historical data on the wheat protein flour market in MEA, including consumer demand, production capacities, and technological advancements. Rigorous analysis ensured that all data was accurate and applicable.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were verified through expert consultations. Interviews with industry stakeholders provided insights into production trends, demand, and regulatory influences, corroborating findings from secondary sources.

Step 4: Final Report Synthesis and Validation

Synthesized data from all sources were consolidated into the final report, integrating verified insights on market size, competitive dynamics, and key drivers. This approach ensured an accurate representation of the MEA Wheat Protein Flour market.

Frequently Asked Questions

01. How big is the MEA Wheat Protein Flour Market?

The MEA Wheat Protein Flour market is valued at USD 700 million, driven by consumer health trends and increased production capacities within the food industry.

02. What challenges does the MEA Wheat Protein Flour Market face?

Challenges include fluctuating wheat prices, production costs, and limited consumer awareness about wheat protein benefits in certain regions.

03. Who are the major players in the MEA Wheat Protein Flour Market?

Key players include Archer Daniels Midland, Roquette Frres, Manildra Group, and MGP Ingredients, each holding a significant market presence due to strong product portfolios and extensive distribution networks.

04. What drives the growth of the MEA Wheat Protein Flour Market?

Growth drivers include rising demand for high-protein diets, expanding applications in bakery and functional foods, and supportive government initiatives for local wheat production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.