Mexico Cold Chain Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD11162

December 2024

94

About the Report

Mexico Cold Chain Market Overview

- The Mexico Cold Chain Logistics market is valued at USD 3 billion, supported by increasing exports of perishable goods and the growing demand for temperature-sensitive pharmaceuticals. This market is primarily driven by advancements in refrigeration technology and infrastructure investments to support Mexicos thriving food and pharmaceutical sectors. The stable economic conditions and Mexico's strategic geographic position for trade further enhance growth, enabling the efficient movement of goods across North and Latin America.

- Key regions driving the cold chain market in Mexico include Mexico City, Guadalajara, and Monterrey, known for their industrial infrastructure and extensive storage facilities. These cities dominate due to their proximity to production hubs and established logistics networks, which facilitate smooth supply chains. Their logistical connectivity to international ports also enables efficient cross-border trade, bolstering Mexicos position in the regional cold chain market.

- In line with global environmental commitments, Mexico has adopted regulations to phase out the use of ozone-depleting substances in refrigeration systems. The country is a signatory to the Montreal Protocol and its Kigali Amendment, which mandate the gradual reduction of hydrofluorocarbons (HFCs) used in refrigeration and air conditioning. This regulatory framework compels cold chain logistics providers to transition to environmentally friendly refrigerants and adopt energy-efficient technologies, thereby reducing the environmental impact of their operations.

Mexico Cold Chain Market Segmentation

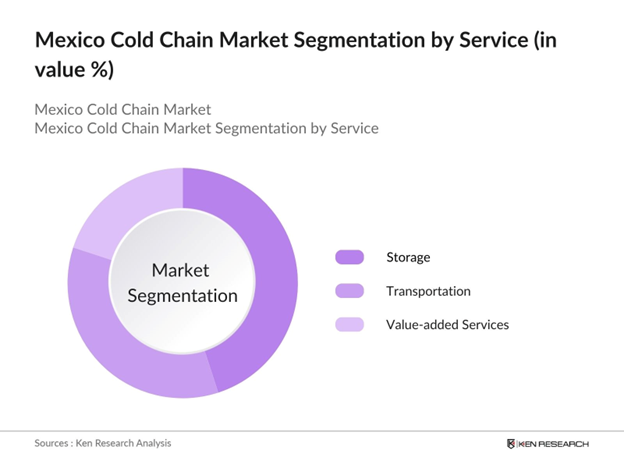

By Service: The Mexico Cold Chain Logistics market is segmented by service type into storage, transportation, and value-added services. Currently, storage services hold a dominant share within this segment, as Mexicos agricultural and pharmaceutical sectors require reliable and extensive cold storage facilities to preserve perishable items. Companies have focused on expanding cold storage capacities, especially near agricultural hubs, to support the transport and export of fresh produce.

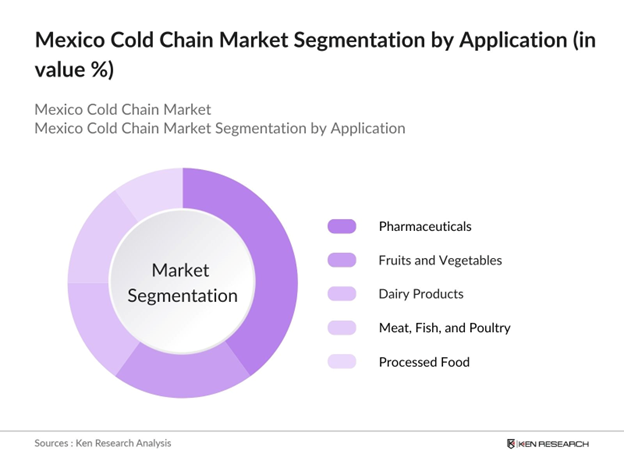

By Application: Mexico Cold Chain Logistics is segmented by application into fruits and vegetables, dairy products, meat, fish, and poultry, pharmaceuticals, and processed food. Among these, pharmaceuticals dominate due to strict temperature control requirements for sensitive drugs and vaccines. As a major supplier to Latin America, Mexico has expanded its cold chain infrastructure to accommodate pharmaceutical exports, especially with the recent demand for vaccine distribution.

Mexico Cold Chain Market Competitive Landscape

The Mexico Cold Chain Logistics market is led by a combination of domestic and international players, each leveraging technology and strategic partnerships to establish a stronghold. These companies' advanced capabilities, along with their extensive regional networks, contribute to market consolidation.

Mexico Cold Chain Market Analysis

Growth Drivers

- Expansion of Agri-food Exports: In 2023, Mexico's agri-food exports reached a record high of USD 51.87 billion, marking a 3.9% increase from the previous year. This growth was driven by significant exports of beverages like beer and tequila, as well as live beef cattle, which saw a 63.1% rise in export value, totaling USD 1.11 billion. Agri-food exports accounted for 8.7% of Mexico's total exports in 2023, which exceeded USD 593 billion. This consistent growth over 14 consecutive years underscores the increasing demand for efficient cold chain logistics to maintain product quality during transportation.

- Rising Demand for Processed Foods: Mexico's processed food sector has been expanding, with a notable increase in the consumption of processed chicken meat, such as cold cuts and frozen breaded products. In 2023, the country's chicken meat consumption was expected to rise by 3% to 4.9 million tonnes. This surge in demand for processed foods necessitates robust cold chain logistics to ensure product safety and quality from production to consumption.

- Technological Advancements in Refrigeration: The integration of advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), and blockchain is revolutionizing cold chain logistics. IoT devices enhance real-time tracking and monitoring of goods, AI optimizes routes and inventory management, and blockchain ensures secure and transparent transactions. These technologies improve efficiency, reduce costs, and offer greater visibility, driving market growth.

Challenges

- High Operational Costs: The development of cold chain infrastructure places a substantial burden on the environment since refrigeration is a source of greenhouse gases and is energy-intensive. Refrigerated transportation accounts for about 7% of total world hydrofluorocarbons (HFCs) consumption. Diesel-powered reefer trucks, trailers, and containers consume around 21% more power than non-refrigerated diesel-powered trucks. This has noteworthy implications on climate change, as the development of cold chain infrastructure becomes almost ubiquitous in developing nations.

- Infrastructure Limitations: Mexico's cold chain logistics infrastructure faces challenges due to the country's diverse temperature zones, ranging from tropical to temperate climates. These variations create unique challenges in preserving perishable goods, necessitating adaptable cold chain logistics infrastructure to ensure product quality during shipping and storage.

Mexico Cold Chain Market Future Outlook

Over the next five years, the Mexico Cold Chain Logistics market is expected to experience substantial growth fueled by continued investment in cold storage facilities and transportation infrastructure. The increasing export demand for Mexican agricultural products and pharmaceuticals, coupled with stricter regulatory standards, will likely accelerate the adoption of advanced cold chain solutions.

Market Opportunities

- Investment in Sustainable Practices: Within Mexico's cold chain logistics, there is a rising emphasis on sustainability. Efforts to minimize carbon emissions, enhance energy efficiency, and use environmentally friendly refrigerants are in line with global sustainability goals. Mexico aims to achieve a clean energy target of35% by 2024, which encourages companies in the cold chain sector to invest in renewable energy sources, thereby reducing their carbon footprint.

- Integration of IoT and Real-time Monitoring: The adoption of innovative IoT-based automated software for cold chain management provides live data to operators, thus allowing unmatched visibility into every process and transaction within cold chain logistics. The cold chain industry faces significant waste, with$218 billion worth of food wasted annuallydue to spoilage during transit, highlighting the critical need for effective monitoring. Operators can connect to intermodal shipping containers, cargo, vessels, and trailers with enterprise IT systems via sensors, GPS, mobile networks, and cloud-based platforms.

Scope of the Report

|

Segment |

Sub-segments |

|

Service |

Storage |

|

Temperature Type |

Chilled |

|

Application |

Fruits and Vegetables |

|

Technology |

Dry Ice |

|

Region |

Northern |

Products

Key Target Audience

Cold Chain Logistics Companies

Food and Beverage Manufacturers

Pharmaceutical Manufacturers

Temperature-controlled Transportation Providers

Agricultural Exporters

Retail and E-commerce Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Secretara de Agricultura y Desarrollo Rural)

Companies

Players Mentioned in the Report

Frialsa Frigorficos

Friopuerto Veracruz

Serbom Group

Americold Logistics

Emergent Cold LatAm

Mex Storage

AIT Worldwide Logistics

Brasfrigo

Conestoga Cold Storage

Friozem Armazens Frigorificos Ltda

Table of Contents

1. Mexico Cold Chain Logistics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Mexico Cold Chain Logistics Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Mexico Cold Chain Logistics Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of Agri-food Exports

3.1.2 Rising Demand for Processed Foods

3.1.3 Technological Advancements in Refrigeration

3.1.4 Government Initiatives and Trade Agreements

3.2 Market Challenges

3.2.1 High Operational Costs

3.2.2 Infrastructure Limitations

3.2.3 Regulatory Compliance

3.3 Opportunities

3.3.1 Investment in Sustainable Practices

3.3.2 Integration of IoT and Real-time Monitoring

3.3.3 Expansion into Emerging Markets

3.4 Trends

3.4.1 Adoption of Automation and Robotics

3.4.2 Growth of E-commerce and Online Grocery

3.4.3 Increased Focus on Pharmaceutical Cold Chain

3.5 Government Regulation

3.5.1 National Logistics Development Plan

3.5.2 Food Safety Standards

3.5.3 Environmental Regulations on Refrigerants

3.5.4 Trade Policies Impacting Cold Chain

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Landscape

4. Mexico Cold Chain Logistics Market Segmentation

4.1 By Service (In Value %)

4.1.1 Storage

4.1.2 Transportation

4.1.3 Value-added Services

4.2 By Temperature Type (In Value %)

4.2.1 Chilled

4.2.2 Frozen

4.2.3 Ambient

4.3 By Application (In Value %)

4.3.1 Fruits and Vegetables

4.3.2 Dairy Products

4.3.3 Meat, Fish, and Poultry

4.3.4 Pharmaceuticals

4.3.5 Processed Food

4.4 By Technology (In Value %)

4.4.1 Dry Ice

4.4.2 Gel Packs

4.4.3 Eutectic Plates

4.4.4 Liquid Nitrogen

4.4.5 Quilts

4.5 By Region (In Value %)

4.5.1 Northern Mexico

4.5.2 Central Mexico

4.5.3 Western Mexico

4.5.4 Eastern Mexico

4.5.5 Southern Mexico

5. Scope of the Report

6. Mexico Cold Chain Logistics Market Competitive Analysis

6.1 Detailed Profiles of Major Companies

6.1.1 Frialsa Frigorficos

6.1.2 Friopuerto Veracruz

6.1.3 Serbom Group

6.1.4 Friozem Armazens Frigorificos Ltda

6.1.5 Brasfrigo

6.1.6 Conestoga Cold Storage

6.1.7 Americold Logistics

6.1.8 AIT Worldwide Logistics

6.1.9 Mex Storage

6.1.10 Emergent Cold LatAm

6.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Service Portfolio, Technological Capabilities, Market Share, Regional Presence)

6.3 Market Share Analysis

6.4 Strategic Initiatives

6.5 Mergers and Acquisitions

6.6 Investment Analysis

6.7 Venture Capital Funding

6.8 Government Grants

6.9 Private Equity Investments

7. Mexico Cold Chain Logistics Market Regulatory Framework

7.1 Environmental Standards

7.2 Compliance Requirements

7.3 Certification Processes

8. Mexico Cold Chain Logistics Future Market Size (In USD Million)

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

9. Mexico Cold Chain Logistics Future Market Segmentation

9.1 By Service (In Value %)

9.2 By Temperature Type (In Value %)

9.3 By Application (In Value %)

9.4 By Technology (In Value %)

9.5 By Region (In Value %)

10. Mexico Cold Chain Logistics Market Analysts Recommendations

10.1 Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

10.2 Customer Cohort Analysis

10.3 Marketing Initiatives

10.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the Mexican Cold Chain Logistics ecosystem by identifying stakeholders and essential variables influencing the market. We conducted desk research and consulted various databases to gather critical industry information.

Step 2: Market Analysis and Construction

In this step, historical data was collected and analyzed to determine market growth, with a focus on key applications such as pharmaceuticals and agriculture. This phase also included assessing logistics infrastructure and services offered.

Step 3: Hypothesis Validation and Expert Consultation

Using telephone interviews with industry experts, we validated the initial hypotheses and acquired insights from operational perspectives, which reinforced the accuracy of the gathered data.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing information from cold chain service providers to confirm segment performance and demand. This step ensured a robust and validated analysis.

Frequently Asked Questions

01. How big is the Mexico Cold Chain Market?

The Mexico Cold Chain market is valued at USD 3 billion, driven by increasing demand from the agricultural and pharmaceutical sectors and ongoing investments in cold storage infrastructure.

02. What are the primary drivers of the Mexico Cold Chain Market?

Mexico Cold Chain market is propelled by the rising need for temperature-sensitive logistics solutions, particularly for exporting agricultural goods and distributing pharmaceuticals, as well as advancements in refrigeration technology.

03. Who are the major players in the Mexico Cold Chain Logistics Market?

Key players in Mexico Cold Chain Market include Frialsa Frigorficos, Friopuerto Veracruz, and Americold Logistics, all of which have established themselves through strategic investments and regional presence.

04. What are the major challenges in the Mexico Cold Chain Logistics Market?

Challenges in Mexico Cold Chain Market include high operational costs, infrastructure limitations, and compliance with strict regulatory standards, particularly for food safety and pharmaceutical transportation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.