Mexico Residential Real Estate Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD5686

November 2024

88

About the Report

Mexico Residential Real Estate Market Overview

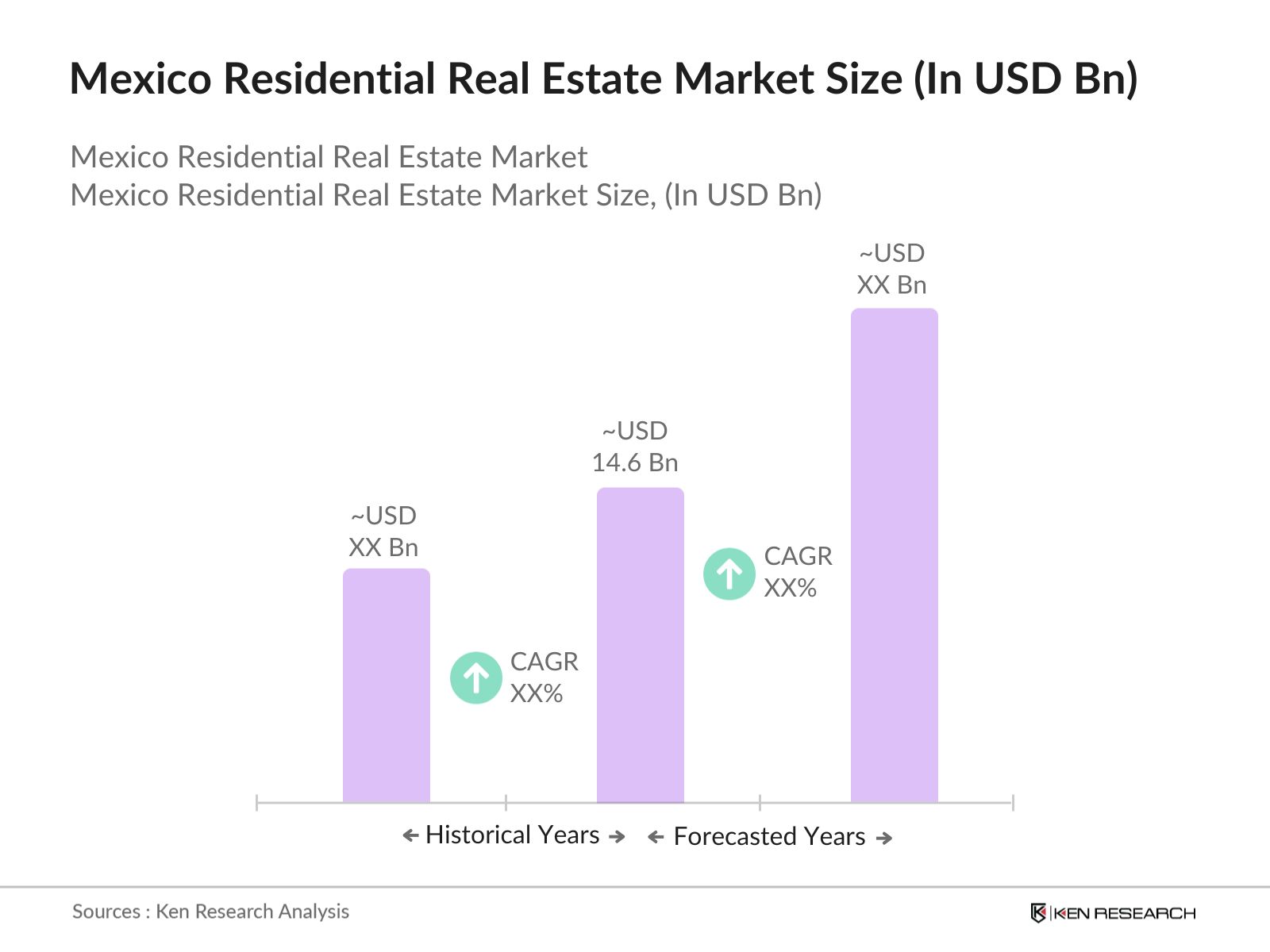

- The Mexico residential real estate market, valued at USD 14.6 billion, is driven by several factors, including urbanization, government housing initiatives, and increased access to financing options. These developments have contributed to steady demand, particularly in metropolitan areas where the need for new housing units continues to grow. The growing middle-class population, coupled with low mortgage rates and government-backed programs like INFONAVIT, has further stimulated growth. Backed by a five-year historical analysis, the market is projected to continue its stable trajectory in upcoming years.

- Mexico City, Guadalajara, and Monterrey are the dominant regions in Mexico's residential real estate market. These urban centers hold significance due to high population density, ongoing infrastructure projects, and their roles as economic hubs. The demand for both affordable and high-end properties is particularly strong in these areas due to rising migration from rural to urban locations, job opportunities, and increased foreign direct investment (FDI) into the real estate sector.

- In 2024, the Mexican government expanded INFONAVITs loan program, aiming to increase housing affordability for first-time buyers. The program is expected to provide over 2.5 million new loans over the next five years, focusing on low and middle-income households. This initiative has the potential to significantly boost the construction of residential properties, especially in urban areas where housing demand is highest.

Mexico Residential Real Estate Market Segmentation

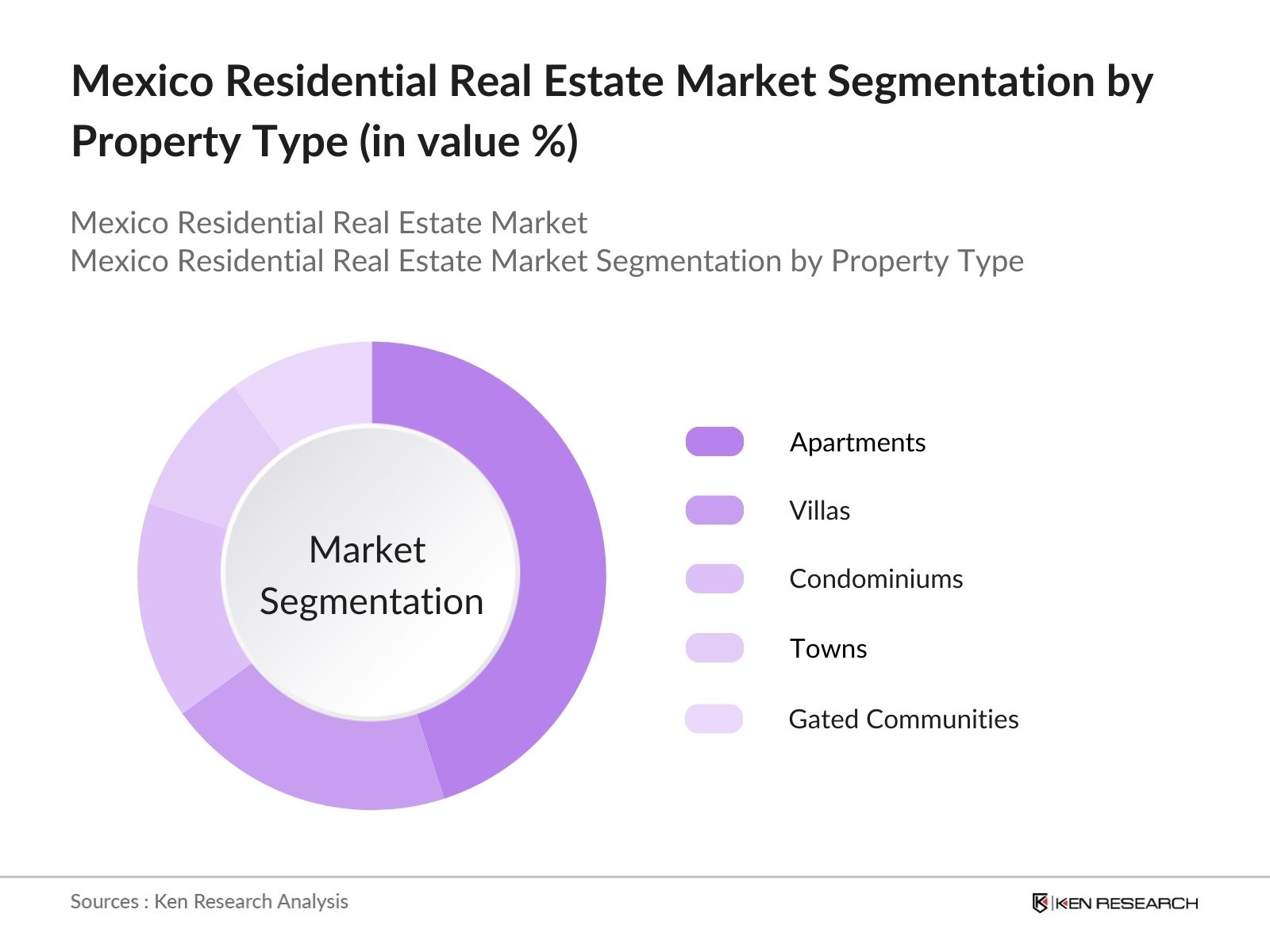

- By Property Type: The Mexico residential real estate market is segmented by property type into apartments, villas, condominiums, townhouses, and gated communities. Among these, apartments currently dominate the market share, driven by the increasing urban population seeking affordable housing solutions. Apartments in urban regions like Mexico City are particularly sought after due to their proximity to employment centers, educational institutions, and modern amenities. The rising trend of vertical living and the high cost of land in metropolitan areas have made apartments a more feasible option for both first-time homebuyers and investors.

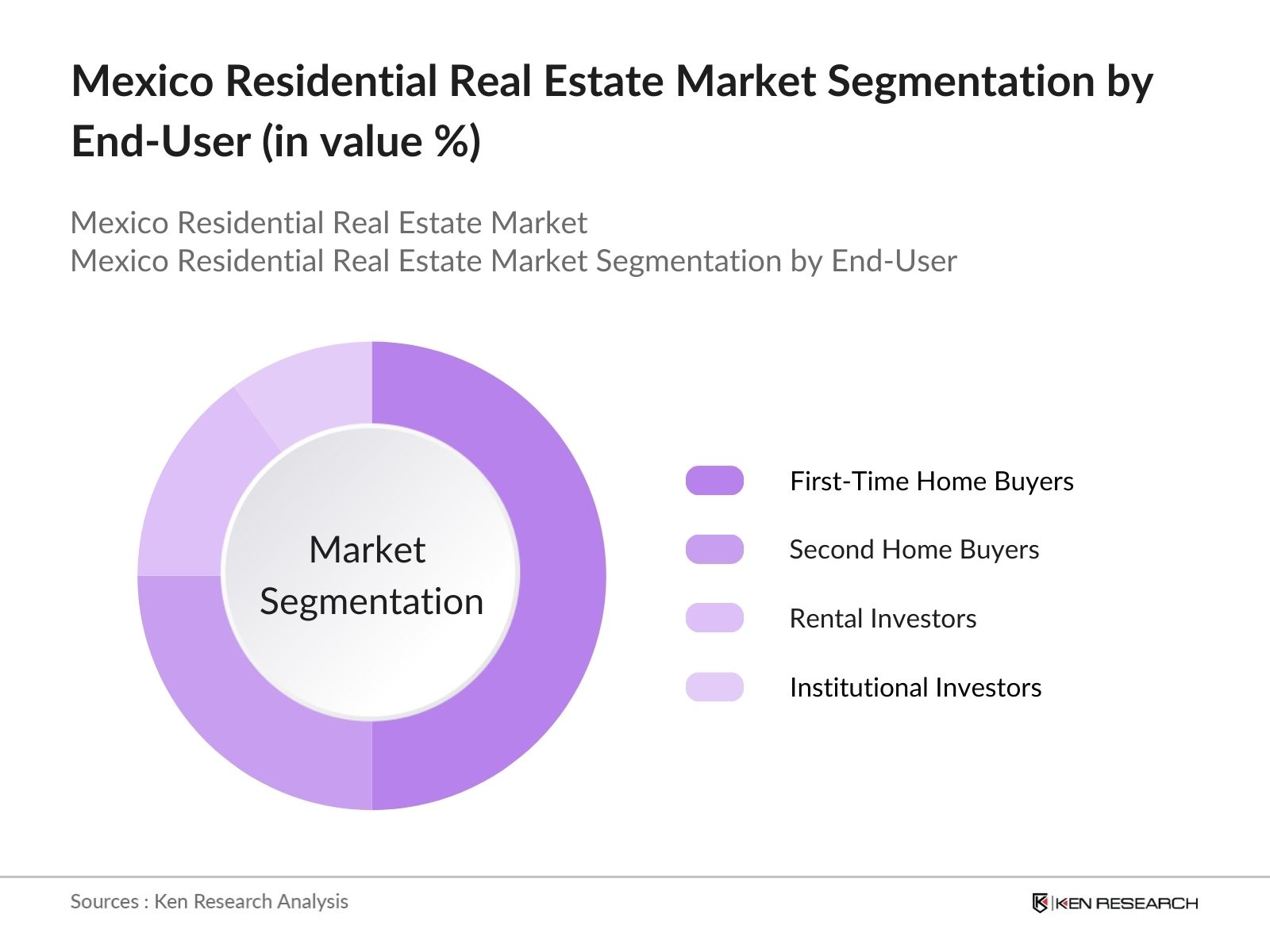

- By End-User: The market is further segmented by end-user into first-time home buyers, second home buyers, rental investors, and institutional investors. First-time home buyers hold the largest market share in this category, supported by government housing programs and low mortgage rates. The growing demand from young professionals and newly married couples looking for affordable housing solutions has also propelled the growth of this segment. Additionally, the availability of mortgage financing through public housing funds like INFONAVIT has increased accessibility to homeownership for this demographic.

Mexico Residential Real Estate Competitive Landscape

The competitive landscape of the Mexico residential real estate market is dominated by a mix of large national players and international developers. Key players have established a strong foothold in the market by capitalizing on housing demand in high-growth urban areas and leveraging government housing initiatives. The market is dominated by both local developers, such as Casas GEO and Homex, and international firms like PulteGroup. These companies have developed a wide array of housing options, ranging from affordable units to luxury properties, to cater to Mexicos diverse housing needs. Local firms tend to focus on affordable housing projects in suburban areas, while international players emphasize high-end developments in urban centers.

|

Company |

Establishment Year |

Headquarters |

Total Number of Projects |

Focus on Affordable Housing |

Presence in Urban Centers |

Partnership with Govt Programs |

Revenue (2023) |

Number of Employees |

Sustainability Initiatives |

|

Casas GEO |

1973 |

Mexico City |

- | - | - | - | - | - | - |

|

Vinte Viviendas Integrales |

2001 |

Mexico City |

- | - | - | - | - | - | - |

|

Urbi Desarrollos Urbanos |

1981 |

Tijuana |

- | - | - | - | - | - | - |

|

PulteGroup |

1950 |

Atlanta, USA |

- | - | - | - | - | - | - |

|

Grupo Lar |

1965 |

Mexico City |

- | - | - | - | - | - | - |

Mexico Residential Real Estate Market Analysis

Market Growth Drivers

- Urbanization and Influx of Population in Urban Areas: In Mexico, the shift from rural to urban living continues to be a significant driver of demand in the residential real estate market. By 2024, the country is expected to add over 2 million people to its urban areas, which increases the pressure for residential space in cities like Mexico City and Guadalajara. Urban centers are seeing a growing need for housing infrastructure to accommodate this influx of residents, creating a persistent demand for both low-cost and premium housing options. Mexicos urban population is expected to cross 100 million by 2024, highlighting the sustained need for residential development in urban centers.

- Increase in Government Housing Programs (e.g., INFONAVIT): INFONAVIT, Mexicos national housing fund for workers, continues to provide access to affordable housing, significantly contributing to the growth of the residential real estate sector. As of 2024, INFONAVIT has provided more than 10 million loans to Mexican citizens, driving the construction of residential properties. The Mexican government plans to increase its annual loan disbursement by 20% over the next few years, enabling more first-time homebuyers to access affordable housing options, further driving the growth of the residential real estate market.

- Foreign Direct Investment (FDI) in Real Estate Sector: Mexicos real estate sector continues to attract substantial Foreign Direct Investment (FDI), with over $4.3 billion invested in the countrys real estate market in 2024 alone. FDI in Mexicos residential real estate is bolstered by the countrys proximity to the U.S. and favorable trade agreements such as the USMCA. Investors from countries like the U.S., Spain, and Canada have been active in Mexicos real estate market, especially in high-demand areas like Mexico City, Cancun, and Tulum, contributing to the development of residential properties, including luxury and vacation homes.

Market Challenges

- Rising Land Prices in Prime Urban Areas: Land prices in major urban areas of Mexico, such as Mexico City and Monterrey, have seen a sharp increase due to high demand and limited availability. As of 2024, the cost of prime real estate in these cities has surged to over MXN 20,000 per square meter, making it difficult for developers to acquire land for new residential projects. This rise in land prices significantly affects the affordability of housing, especially in metropolitan areas where residential development is critical to meeting population demand.

- Delays Due to Bureaucracy in Real Estate Approval Process: Mexicos real estate market faces significant delays in property development due to bureaucratic hurdles. In 2024, the average time to secure necessary permits for a new residential construction project in Mexico exceeds six months, which can further extend project timelines and inflate costs. The complexity of navigating local regulations and approvals is a challenge for both local and foreign developers, leading to slower growth in the residential housing market.

Mexico Residential Real Estate Future Outlook

Over the next five years, the Mexico residential real estate market is expected to show stable growth, driven by sustained government support through housing subsidies, continued infrastructure development, and increasing urbanization. The availability of low-interest mortgages, particularly for first-time home buyers, will likely continue to drive demand. Additionally, the demand for luxury properties in tourist-centric regions is expected to rise due to growing interest in second homes and investment properties among both domestic and foreign buyers.

Market Opportunities

- Expansion of Affordable Housing Projects: The Mexican government is investing heavily in affordable housing projects to address the housing shortage among low- and middle-income households. By 2024, the government aims to construct over 500,000 affordable housing units through initiatives like INFONAVIT and public-private partnerships. This expansion in affordable housing creates opportunities for developers to access government incentives and subsidies, driving growth in the residential sector.

- Increased Demand for Second Homes and Rental Properties in Tourism Areas: Mexicos popular tourist destinations, such as Cancun and Tulum, have seen a significant increase in demand for second homes and vacation rentals. In 2024, more than 70,000 new residential properties are expected to be added to the Riviera Maya region alone, fueled by both local and foreign investors looking to capitalize on tourism-driven real estate opportunities. The influx of tourists and remote workers has led to a growing demand for short-term rental properties, particularly in high-tourism areas, creating lucrative opportunities for real estate investors and developers.

Scope of the Report

|

By Property Type |

Apartments Villas Condominiums Townhouses Gated Communities |

|

By End-User |

First-Time Home Buyers Second Home Buyers Rental Investors Institutional Investors |

|

By Location |

Urban Areas Tourist Locations Suburban Areas Rural Areas |

|

By Construction Type |

New Construction Pre-Owned/Resale Properties Rental Developments |

|

By Transaction Type |

Residential Sales Residential Rentals Mortgage-Based Purchases, Cash Purchases |

Products

Key Target Audience

Real Estate Developers

Government Housing Agencies (e.g., INFONAVIT, CONAVI)

Financial Institutions and Mortgage Lenders

Property Management Companies

Real Estate Investment Trusts (REITs)

Private Equity and Investment Firms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Secretara de Desarrollo Agrario, Territorial y Urbano - SEDATU)

Companies

Players Mentioned in the Report:

Casas GEO

Vinte Viviendas Integrales

Urbi Desarrollos Urbanos

Homex

PulteGroup

Grupo Sadasi

Gicsa

Ara

Quiero Casa

Grupo Lar

Table of Contents

1. Mexico Residential Real Estate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Mexico Residential Real Estate Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Mexico Residential Real Estate Market Analysis

3.1. Growth Drivers (Urbanization Rate, Population Growth, Mortgage Rate, Foreign Investments)

3.1.1. Urbanization and Influx of Population in Urban Areas

3.1.2. Increase in Government Housing Programs (e.g., INFONAVIT)

3.1.3. Foreign Direct Investment (FDI) in Real Estate Sector

3.1.4. Low Mortgage Interest Rates and Increased Lending Options

3.2. Market Challenges (Land Costs, Bureaucratic Delays, Construction Costs, Environmental Regulations)

3.2.1. Rising Land Prices in Prime Urban Areas

3.2.2. Delays Due to Bureaucracy in Real Estate Approval Process

3.2.3. Increasing Construction Costs due to Inflation and Material Price Hikes

3.2.4. Stringent Environmental and Zoning Regulations

3.3. Opportunities (Affordable Housing, Tourism-Driven Second Homes, Sustainable Development, Smart Cities)

3.3.1. Expansion of Affordable Housing Projects

3.3.2. Increased Demand for Second Homes and Rental Properties in Tourism Areas (e.g., Cancun, Tulum)

3.3.3. Government Incentives for Sustainable Construction and Green Building Practices

3.3.4. Growth in Smart City Developments and Digital Infrastructure

3.4. Trends (Sustainable Development, Technology Integration, Remote Working, Short-Term Rentals)

3.4.1. Adoption of Sustainable Construction Techniques and Eco-Friendly Materials

3.4.2. Growth in Technology-Enabled Smart Homes

3.4.3. Increase in Residential Properties Targeting Remote Workers

3.4.4. Rise of Short-Term Rental Platforms (e.g., Airbnb) Boosting Investment Property Demand

3.5. Government Regulation (Tax Policies, Real Estate Licensing, Environmental Impact Laws, Affordable Housing Programs)

3.5.1. Changes in Real Estate Taxation and Property Transfer Laws

3.5.2. Licensing and Regulations for Real Estate Professionals

3.5.3. Environmental Impact Assessment Requirements

3.5.4. Government-Led Affordable Housing Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Government Bodies, Real Estate Developers, Financial Institutions, Contractors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Mexico Residential Real Estate Market Segmentation

4.1. By Property Type (In Value %)

4.1.1. Apartments

4.1.2. Villas

4.1.3. Condominiums

4.1.4. Townhouses

4.1.5. Gated Communities

4.2. By End-User (In Value %)

4.2.1. First-Time Home Buyers

4.2.2. Second Home Buyers (Vacation/Investment Properties)

4.2.3. Rental Investors

4.2.4. Institutional Investors

4.3. By Location (In Value %)

4.3.1. Urban Areas (Mexico City, Guadalajara, Monterrey)

4.3.2. Tourist Locations (Cancun, Tulum, Puerto Vallarta)

4.3.3. Suburban and Semi-Urban Areas

4.3.4. Rural Areas

4.4. By Construction Type (In Value %)

4.4.1. New Construction

4.4.2. Pre-Owned/Resale Properties

4.4.3. Rental Developments

4.5. By Transaction Type (In Value %)

4.5.1. Residential Sales

4.5.2. Residential Rentals

4.5.3. Mortgage-Based Purchases

4.5.4. Cash Purchases

5. Mexico Residential Real Estate Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Casas GEO

5.1.2. Vinte Viviendas Integrales

5.1.3. Urbi Desarrollos Urbanos

5.1.4. Homex

5.1.5. Grupo Sadasi

5.1.6. Gicsa

5.1.7. Quiero Casa

5.1.8. Ara

5.1.9. Citibanamex

5.1.10. Banorte

5.1.11. Santander

5.1.12. BBVA

5.1.13. PulteGroup

5.1.14. Cemex

5.1.15. Grupo Lar

5.2. Cross Comparison Parameters

5.2.1 Total Number of Employees

5.2.2 Headquarter Location

5.2.3 Inception Year

5.2.4 Revenue

5.2.5 Number of Projects Completed

5.2.6 Types of Residential Properties Developed

5.2.7 Presence in Different Regions

5.2.8 Partnerships and Joint Ventures

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Mexico Residential Real Estate Market Regulatory Framework

6.1. Property Ownership Laws for Foreigners (Fideicomiso, Restricted Zones)

6.2. Legal Requirements for Real Estate Transactions

6.3. Environmental and Zoning Regulations

6.4. Mortgage Lending Regulations

7. Mexico Residential Real Estate Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Mexico Residential Real Estate Future Market Segmentation

8.1. By Property Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Location (In Value %)

8.4. By Construction Type (In Value %)

8.5. By Transaction Type (In Value %)

9. Mexico Residential Real Estate Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives

9.3. White Space Opportunity Analysis

9.4. Target Segment Analysis

Research Methodology

Step 1: Identification of Key Variables

The research began by mapping all major stakeholders in the Mexico residential real estate market, including developers, government housing agencies, and financial institutions. Extensive desk research from both secondary and proprietary databases was conducted to identify key variables like mortgage rates, land availability, and government housing initiatives.

Step 2: Market Analysis and Construction

Historical data on housing development, residential demand, and mortgage issuance was analyzed to construct the market landscape. The analysis involved data on residential property transactions, average selling prices, and the availability of affordable housing.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed regarding the impact of government housing programs on demand and were validated through expert interviews with developers, government officials, and real estate agents. These consultations helped to refine revenue estimates and validate trends observed from desk research.

Step 4: Research Synthesis and Final Output

The final output involved a synthesis of expert insights and quantitative data, presenting a comprehensive overview of the residential real estate market. Direct consultations with industry players enabled the validation of forecasted trends and market dynamics, ensuring the accuracy of the final report.

Frequently Asked Questions

01. How big is the Mexico Residential Real Estate Market?

The Mexico residential real estate market is valued at USD 14.6 billion, driven by factors such as urbanization, mortgage accessibility, and government-backed housing initiatives.

02. What are the challenges in the Mexico Residential Real Estate Market?

Challenges in the Mexico residential real estate market include rising land and construction costs, bureaucratic delays in approvals, and stringent environmental regulations, all of which hinder rapid development.

03. Who are the major players in the Mexico Residential Real Estate Market?

Key players in the Mexico residential real estate market include Casas GEO, Homex, Vinte Viviendas Integrales, PulteGroup, and Urbi Desarrollos Urbanos, who dominate through large-scale residential projects and partnerships with government programs.

04. What are the growth drivers in the Mexico Residential Real Estate Market?

The Mexico residential real estate market is propelled by affordable mortgage options, government housing subsidies, and increasing urban migration, which continually raises demand for new housing units.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.