MEA (Middle East & Africa) Advanced Metering Infrastructure (AMI) Market Outlook to 2030

Region:Middle East

Author(s):Shreya Garg

Product Code:KROD1871

November 2024

84

About the Report

MEA Advanced Metering Infrastructure (AMI) Market Overview

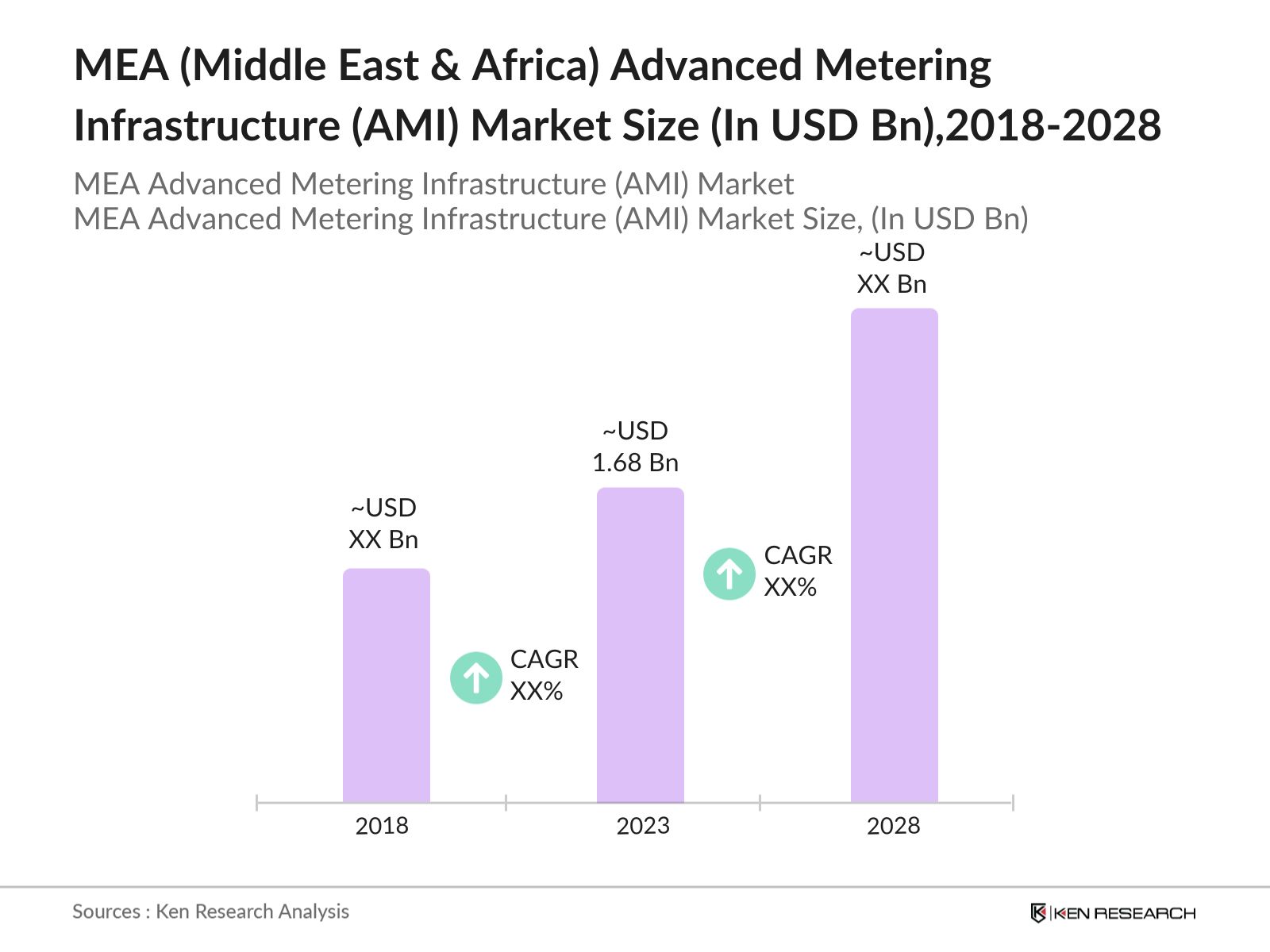

The MEA Advanced Metering Infrastructure (AMI) market was valued at USD 1.68 billion . This growth has been driven by increasing government mandates for energy conservation, growing urbanization, and the adoption of smart technologies across utilities. Utility companies across the region are investing heavily in AMI systems to enhance their energy distribution efficiency, reduce technical and commercial losses, and cater to the growing demand for energy-efficient solutions.

The key players operating in the MEA advance metering infrastructure market include Siemens AG, Schneider Electric, Itron, Landis+Gyr, and Honeywell International Inc. These companies are not only focused on providing smart metering solutions but are also involved in developing integrated software and IoT-based platforms to enhance energy management efficiency.

In 2023, Schneider Electric announced a USD 100 million project to upgrade smart metering systems in Egypt. This move is part of the governments broader initiative to modernize its energy infrastructure. Schneider's implementation aims to install 500,000 smart meters by the end of 2024, enhancing energy efficiency by reducing losses and enabling real-time monitoring for both consumers and utility providers.

Saudi Arabia and the UAE, dominate the market in 2023. Saudi Arabia's massive investment in smart metering infrastructure through the Smart Metering Program, alongside the UAE's ambitious energy efficiency targets, has led to the rapid adoption of AMI systems. These nations also benefit from high levels of urbanization and technological advancements.

MEA (Middle East & Africa) Advanced Metering Infrastructure (AMI) Market Segmentation

By Product Type: The market is segmented by product type into hardware, software, and services. In 2023, hardware dominated the market share, primarily due to the demand for smart meters and communication devices across utilities. The dominance of hardware is attributed to the ongoing large-scale installations of smart meters and associated equipment in key markets like Saudi Arabia.

By End-User Industry: The market is further segmented into residential, commercial, and industrial sectors. In 2023, the residential sector held a substantial market share due to the large-scale deployment of smart meters for individual households, especially in countries like Saudi Arabia and the UAE. Government-driven residential AMI rollouts have driven this segments dominance.

By Region: The Market is segmented by region into North, South, East, and West. In 2023, North Africa dominated the market which is driven by strong government initiatives and large-scale energy projects in Egypt. Egypts efforts to modernize its grid infrastructure with AMI solutions have led to the rapid adoption of these technologies in the region.

MEA (Middle East & Africa) Advanced Metering Infrastructure (AMI) Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Siemens AG |

1847 |

Germany |

|

Schneider Electric |

1836 |

France |

|

Itron |

1977 |

USA |

|

Landis+Gyr |

1896 |

Switzerland |

|

Honeywell International |

1906 |

USA |

Landis+Gyr: In 2023, Landis+Gyr announced the deployment of 2 million smart meters across Egypt as part of the governments energy modernization plan. The USD 200 million project is expected to be completed by 2026 and will reduce energy losses and improve billing accuracy in urban areas like Cairo.

Honeywell: In 2017, DEWA appointed Honeywell to help deliver a first-of-its-kind smart energy project in Dubai. The project aimed to develop smart infrastructure for electricity transmission and distribution networks, to enhance the speed of service delivery and response. In August 2024, DEWA prepared for an outstanding participation in GITEX Global 2024 to showcase its innovative digital initiatives, services, and programmes.

MEA (Middle East & Africa) Advanced Metering Infrastructure (AMI) Industry Analysis

Growth Drivers

- Growing Investments in Smart Grid Infrastructure: Egyptian government is planning to invest over USD 100 million in smart metering technologies in 2024. This is part of the country's broader modernization plan to reduce energy losses and improve billing accuracy. South Africa's largest utility, Eskom, invested USD 300 million in 2024 to integrate advanced metering systems in its electricity network, aiming to reduce technical losses by 2 million megawatt-hours annually.

- Increased Energy Consumption in Urban Areas: As of 2024, energy consumption in Cairo alone is expected to reach 30,000 gigawatt-hours, necessitating the adoption of AMI to optimize grid performance. This demand for enhanced energy management solutions is driving utilities to invest in AMI systems, ensuring the efficient distribution of energy in high-demand urban centers.

- Rising Demand for Renewable Energy Integration: MEA governments are increasingly integrating renewable energy sources like solar and wind into their energy grids. In 2024, Egypt commissioned a 1,000 MW solar project that requires advanced metering systems for real-time energy monitoring and management. Smart meters are essential for the integration of renewable energy into existing grids.

Challenges

- Lack of Skilled Workforce: As of 2024, the MEA region faces a shortage of skilled professionals capable of maintaining and operating AMI systems. Countries like Egypt report that very small part of their utility workforce is trained in handling smart grid technologies, leading to operational inefficiencies and delays in project implementation. This lack of expertise is a major barrier to the widespread adoption of AMI in the region.

- Cybersecurity Risks: The integration of smart meters into national grids has raised concerns about cybersecurity. In 2024, MEA countries reported over 1,000 cyberattacks targeting energy infrastructure, with several attacks leading to temporary shutdowns. The lack of robust cybersecurity frameworks for AMI systems exposes the energy sector to potential data breaches and operational disruptions.

Government Initiatives

- Saudi Arabias Smart Metering Program: In 2019, Saudi Electricity Company (SEC) awarded a USD 2.5 billion smart metering project to install 10 million smart meters across Saudi Arabia over 3 years. This program is part of the government's broader goal to reduce energy consumption by 15% and modernize its energy infrastructure. One-third of the 10 million smart meters are being manufactured locally in Saudi Arabia.

- UAEs Energy Strategy 2050: The UAE is investing heavily in smart grid technologies as part of its Energy Strategy 2050. In 2024, the government committed USD 500 million to the deployment of advanced metering systems, which are essential for managing the growing share of renewable energy in the countrys energy mix. By 2024, the UAE had installed over 1 million smart meters in major cities like Dubai and Abu Dhabi.

MEA (Middle East & Africa) Advanced Metering Infrastructure (AMI) Market Future Outlook

The MEA AMI market is expected to expand by 2028, this growth will be driven by government-led modernization projects in key economies like Saudi Arabia, Egypt, and the UAE, where investments in energy infrastructure and smart grid technologies are expected to surge. The deployment of smart meters across various sectors such as residential, commercial, and industrial is expected to further fuel market growth.

Future Trends

- Expansion of Renewable Energy Projects: The MEA region is expected to witness a surge in renewable energy projects, particularly in solar and wind energy. By 2028, Egypts solar energy capacity is projected to exceed, necessitating the widespread adoption of AMI systems to manage the integration of renewable energy into the national grid. Smart meters will play a crucial role in balancing energy loads and ensuring grid stability.

- Increase in Government-Led Initiatives: Governments across the MEA region is expected to launch new initiatives to promote energy efficiency and modernize energy infrastructure. By 2028, Saudi Arabia, the UAE, and Egypt are projected to invest heavily collectively in smart grid technologies, with a significant portion allocated to AMI systems. These initiatives will accelerate the adoption of smart meters and enhance energy management across the region.

Scope of the Report

|

By Product Type |

Hardware Software Services |

|

By End User |

Residential Commercial Industrial sectors |

|

By Region |

Israel United Arab Emirates Jordan Morocco South Africa Rest of MEA |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors and VC Firms

Banks and Financial Institutions

Power Generation Companies

Renewable Energy Companies

Smart Meter Manufacturers

Energy Management Solution Providers

IT and Software Providers for Smart Grids

Telecommunications Providers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Siemens AG

Schneider Electric

Itron

Landis+Gyr

Honeywell International

Elster Group

Kamstrup

Sensus

General Electric

ABB

Eaton Corporation

Silver Spring Networks

Huawei Technologies

Oracle Corporation

Aclara

Table of Contents

1. MEA Advanced Metering Infrastructure Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. MEA Advanced Metering Infrastructure Market Size (in USD), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Advanced Metering Infrastructure Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives for Energy Efficiency

3.1.2. Investments in Smart Grid Infrastructure

3.1.3. Rising Energy Consumption in Urban Areas

3.1.4. Integration of Renewable Energy

3.2. Restraints

3.2.1. High Initial Investment Costs

3.2.2. Lack of Skilled Workforce

3.2.3. Cybersecurity Risks

3.2.4. Limited Infrastructure in Rural Areas

3.3. Opportunities

3.3.1. IoT Integration

3.3.2. Expansion of Renewable Energy Projects

3.3.3. Smart City Developments

3.3.4. Public-Private Partnerships

3.4. Trends

3.4.1. Growth of Smart Cities

3.4.2. Increased Government-Led Initiatives

3.4.3. Demand for Real-Time Energy Monitoring

3.4.4. Focus on Energy Conservation

4. MEA Advanced Metering Infrastructure Market Segmentation, 2023

4.1. By Product Type (in Value)

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. By End-User Industry (in Value)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Region (in Value)

4.3.1. North Africa

4.3.2. South Africa

4.3.3. East Africa

4.3.4. West Africa

5. MEA Advanced Metering Infrastructure Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. Schneider Electric

5.1.3. Itron

5.1.4. Landis+Gyr

5.1.5. Honeywell International Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. MEA Advanced Metering Infrastructure Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. MEA Advanced Metering Infrastructure Market Regulatory Framework

7.1. Government Policies and Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. MEA Advanced Metering Infrastructure Future Market Size (in USD), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. MEA Advanced Metering Infrastructure Future Market Segmentation, 2028

9.1. By Product Type (in Value)

9.2. By End-User Industry (in Value)

9.3. By Region (in Value)

10. MEA Advanced Metering Infrastructure Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for MEA Advanced Metering Infrastructure industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different Advanced Metering Infrastructure companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple advanced metering companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such Advanced Metering Infrastructure companies.

Frequently Asked Questions

01 How big is the MEA Advanced Metering Infrastructure Market?

The MEA Advanced Metering Infrastructure market was valued at USD 1.68 billion in 2023, driven by government mandates for energy efficiency, increasing investments in smart grid infrastructure, and rising demand for improved energy management across key regions.

02 What are the challenges in the MEA Advanced Metering Infrastructure Market?

Challenges in the MEA Advanced Metering Infrastructure market include high initial investment costs for AMI systems, lack of skilled professionals for smart grid operations, cybersecurity risks, and limited infrastructure in rural areas which hampers the adoption of smart metering technologies.

03 Who are the major players in the MEA Advanced Metering Infrastructure Market?

Key players in the MEA Advanced Metering Infrastructure market include Siemens AG, Schneider Electric, Itron, Landis+Gyr, and Honeywell International. These companies dominate the market through their large-scale smart metering solutions and strong presence in government-led modernization projects.

04 What are the growth drivers of the MEA Advanced Metering Infrastructure Market?

The MEA Advanced Metering Infrastructure market is driven by government initiatives to modernize energy infrastructure, increased energy consumption in urban areas, integration of renewable energy sources, and growing investments from utility companies to reduce energy losses and enhance billing accuracy.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.