Middle East & Africa Batteries Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD10970

December 2024

90

About the Report

Middle East & Africa Batteries Market Overview

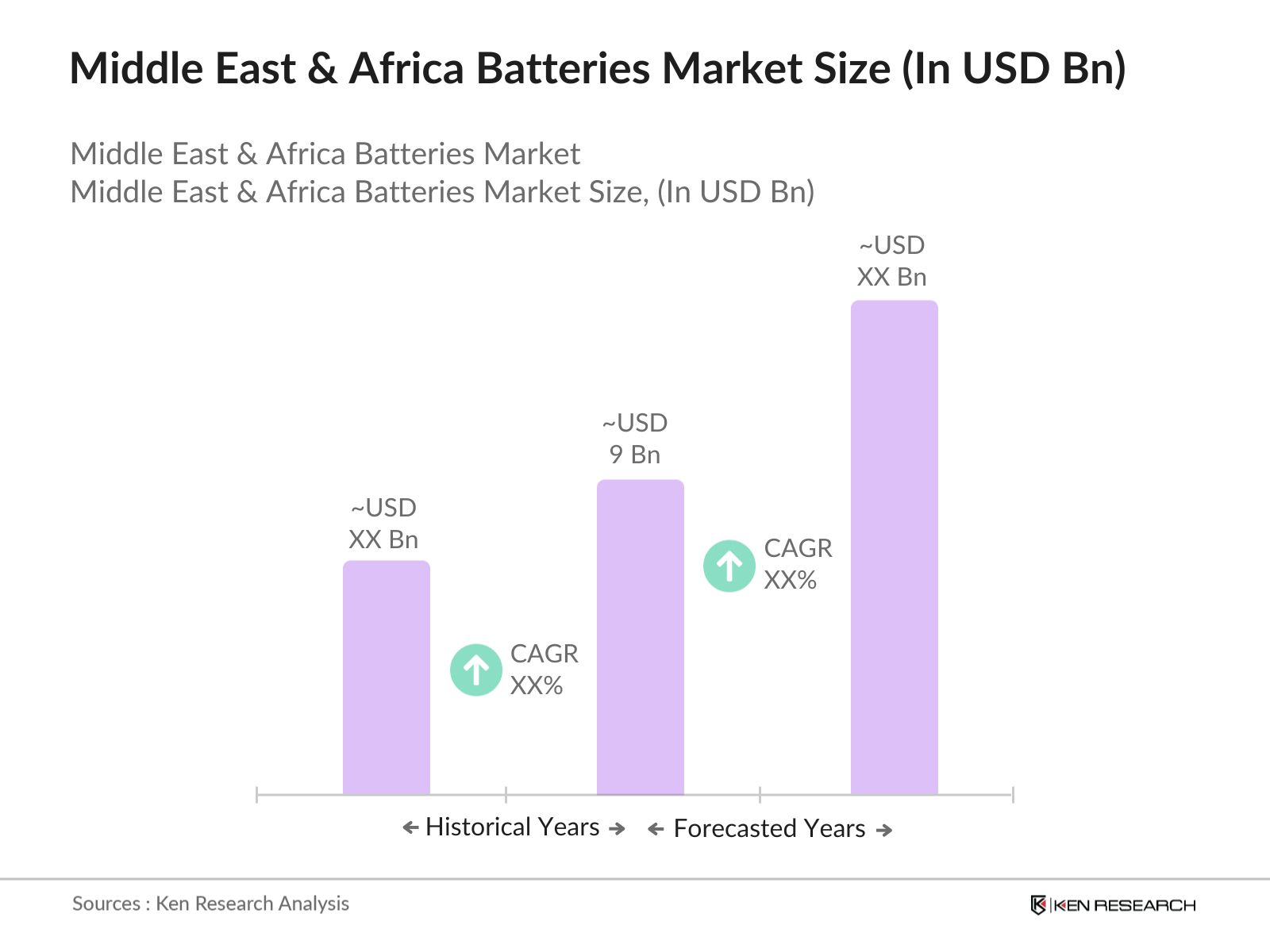

- The Middle East & Africa (MEA) batteries market is valued at USD 9 billion, driven by the increasing adoption of electric vehicles (EVs), expansion of renewable energy projects, and declining lithium-ion battery prices. Government initiatives promoting clean energy and technological advancements in battery storage solutions further contribute to market growth.

- Saudi Arabia and the United Arab Emirates (UAE) dominate the MEA batteries market due to substantial investments in renewable energy infrastructure and EV adoption. Saudi Arabia's Vision 2030 emphasizes renewable energy, while the UAE's initiatives like the Dubai Clean Energy Strategy 2050 aim for a significant share of clean energy, driving battery demand.

- Several MEA countries have set ambitious emission reduction targets as part of their commitments to the Paris Agreement, leading to increased adoption of battery-powered systems. For instance, the UAE has pledged to achieve net-zero emissions by 2050, which requires significant investments in renewable energy and electric mobility solutions. he UAE aims to increase its renewable energy capacity significantly, with plans to generate over70 GW of powerfrom renewable sources by 2050, supported by an investment of approximatelyUSD 700 billionin renewable energy projects

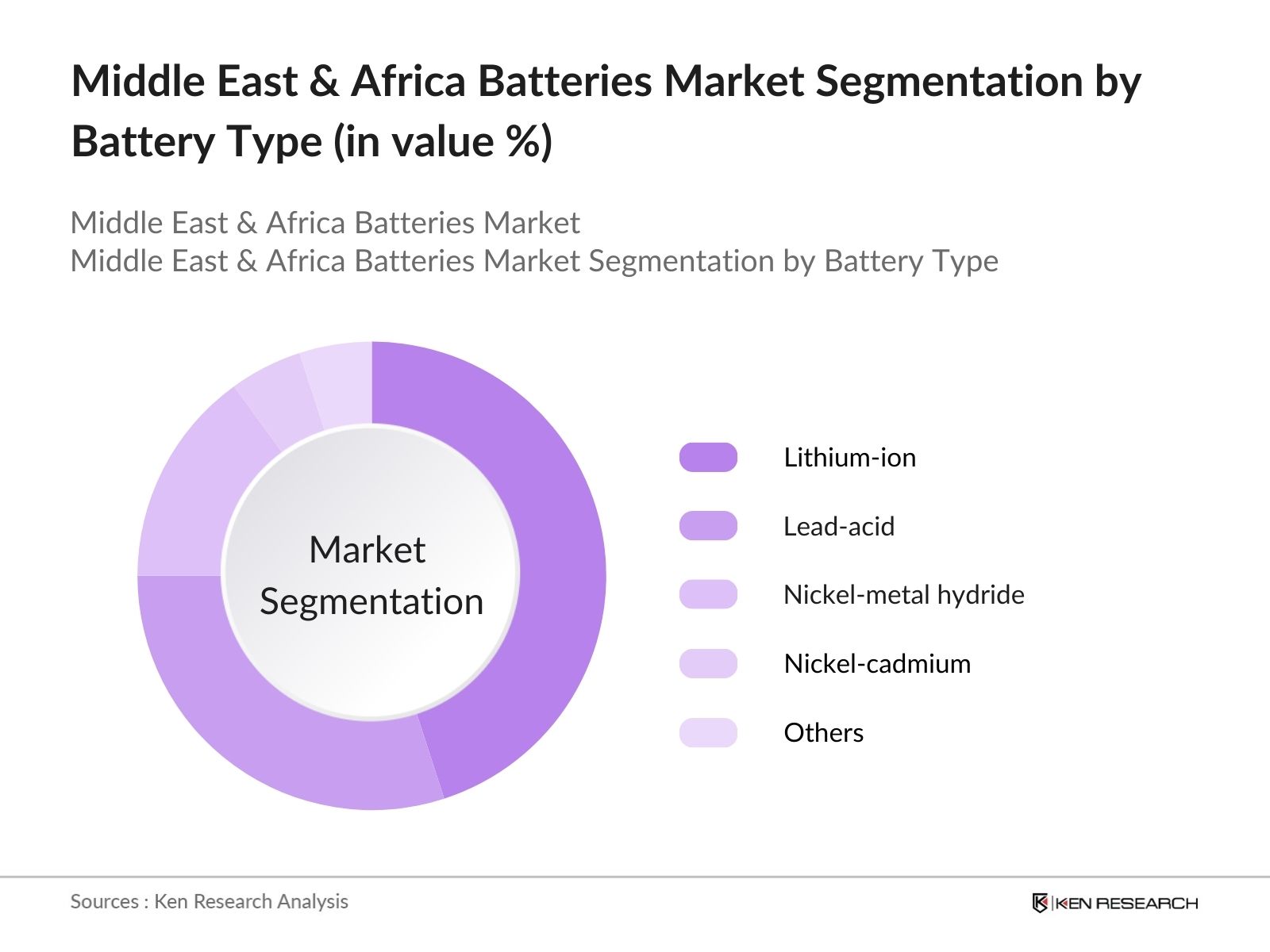

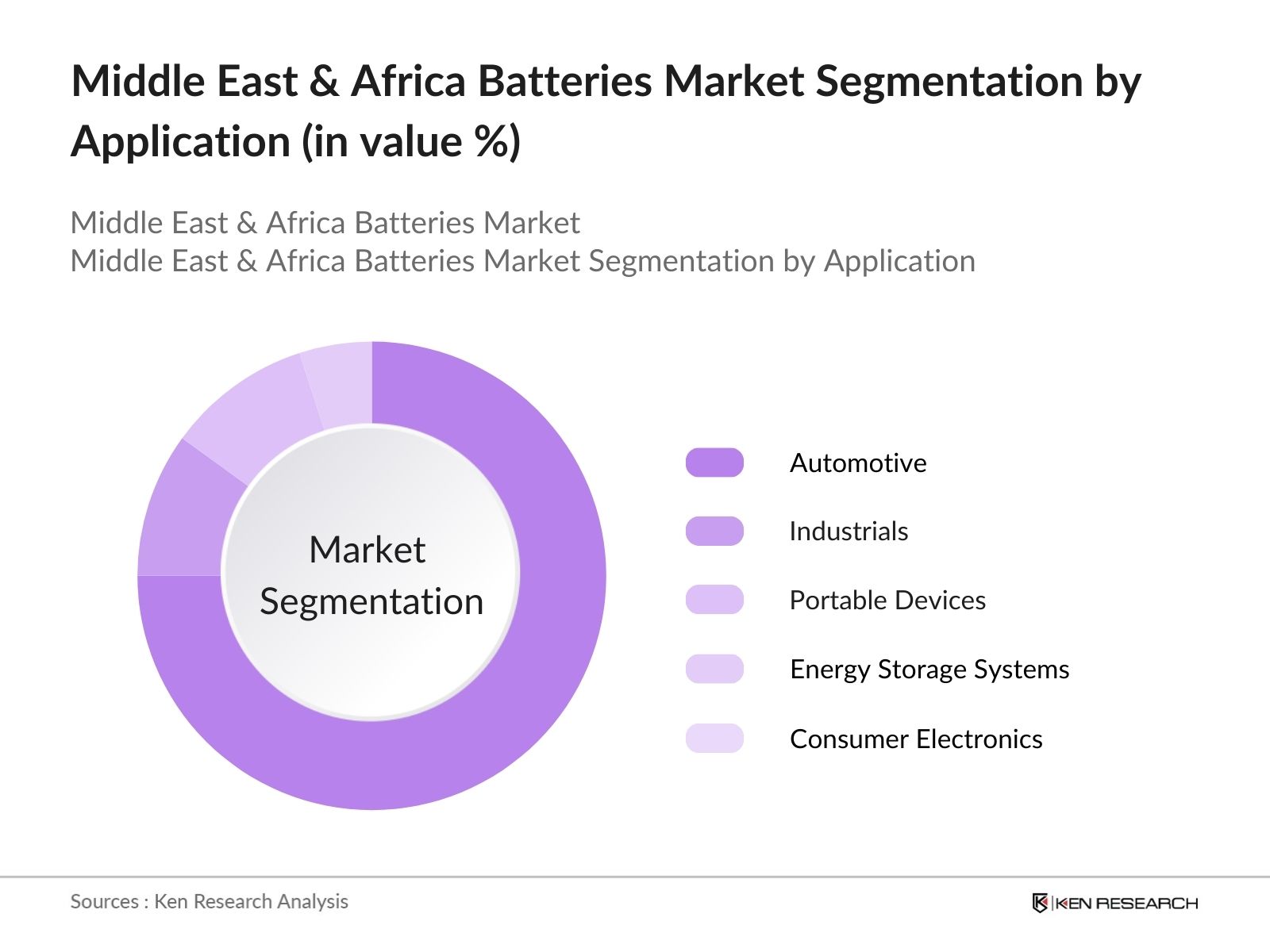

Middle East & Africa Batteries Market Segmentation

By Battery Type: The MEA batteries market is segmented by battery type into lead-acid, lithium-ion, nickel-metal hydride, nickel-cadmium, and others. Lithium-ion batteries hold a dominant market share due to their high energy density, longer lifespan, and efficiency, making them ideal for applications in EVs and renewable energy storage systems. The declining cost of lithium-ion batteries further enhances their adoption across various sectors.

By Application: The market is also segmented by application into automotive, industrial, portable devices, energy storage systems, and consumer electronics. The automotive segment leads the market, driven by the increasing adoption of EVs in the region. Government incentives and policies promoting electric mobility, along with advancements in battery technology, contribute to the dominance of this segment.

Middle East & Africa Batteries Market Competitive Landscape

The MEA batteries market is characterized by the presence of key players focusing on technological advancements and strategic partnerships to strengthen their market position. Companies such as EnerSys, LG Electronics, Samsung SDI Co., Ltd., Panasonic Corporation, and Exide Industries Ltd. play significant roles in shaping the market dynamics.

Middle East & Africa Batteries Market Analysis

Growth Drivers

-

Increasing Adoption of Electric Vehicles: The Middle East and Africa (MEA) region is witnessing a notable rise in electric vehicle (EV) adoption. In Ethiopia, the government has banned the importation of non-electric private vehicles, aiming to import 500,000 electric cars monthly by 2030. However, challenges such as unreliable electricity supply and scarce spare parts persist. In Tunisia, Nissan Motor plans to introduce its e-Power hybrid technology to test the African market for EVs, addressing the continent's low vehicle ownership and infrastructural challenges.

- Expansion of Renewable Energy Projects: The MEA region is actively expanding its renewable energy capacity, necessitating efficient energy storage solutions. In Morocco, the government has announced that China's Gotion High-Tech will spearhead the construction of the country's inaugural EV battery gigafactory, with an initial capacity of 20 gigawatt-hours (GWh). This development underscores the region's commitment to integrating renewable energy sources, thereby increasing the demand for battery storage systems to manage energy intermittency and enhance grid stability.

- Declining Lithium-Ion Battery Prices: Advancements in battery technology and economies of scale have led to a significant reduction in lithium-ion battery prices. This cost decline has made electric vehicles and energy storage systems more accessible in the MEA region. For instance, new sodium-ion batteries, which are about 30% cheaper than lithium-ion batteries, are starting to enter the electric vehicle market, potentially reducing EV prices by hundreds of pounds. This trend is expected to further drive the adoption of battery-powered applications across various sectors.

Challenges

-

Supply Chain Disruptions: The MEA battery market faces supply chain challenges, particularly in sourcing critical minerals like lithium. The International Energy Agency (IEA) warns that the green transition could see a critical minerals shortfall unless significant investments are made in new mining projects and recycling. Lithium supply is projected to meet only 50% of global demand by 2035, highlighting the need for sustainable access to these minerals. These supply constraints can lead to production delays and increased costs, impacting the battery market's growth.

- Safety Concerns Related to Battery Usage: Incidents of battery fires and explosions have raised concerns, prompting the need for stringent safety standards and advanced battery management systems to mitigate risks. Lithium-ion batteries are known for their high energy density, but this characteristic also makes them susceptible to hazards such as fire and explosion. When LiBs fail, they can undergo a phenomenon known asthermal runaway, which is a rapid increase in temperature that leads to violent reactions within the battery cells.

3.3.3 Development of Energy Storage Systems

The integration of renewable energy sources in the MEA region is driving the need for advanced energy storage systems (ESS). The Middle East and Africa battery market is experiencing significant growth due to various strategic initiatives, product developments, and a shift towards renewable energy and electric vehicles.

Developing and deploying ESS can enhance grid stability, manage energy intermittency, and support the region's transition to sustainable energy solutions.

3.4 Trends

3.4.1 Integration with Smart Grid Infrastructure

The MEA region is increasingly integrating batteries with smart grid infrastructure to enhance energy efficiency and reliability. The Middle East and Africa battery market is experiencing significant growth due to various strategic initiatives, product developments, and a shift towards renewable energy and electric vehicles. This trend facilitates real-time energy management, demand response, and the seamless integration of renewable energy sources, contributing to a more resilient and efficient power grid.

3.4.2 Rise of Battery Recycling Initiatives

The rise of battery recycling initiatives in the MEA region is addressing concerns around environmental sustainability and resource scarcity. In South Africa, the government has implemented regulations for recycling battery materials to reduce landfill waste and promote sustainable practices. This aligns with the broader trend of circular economies, where resources are reused and recycled to minimize environmental impact. According to the International Energy Agency (IEA), recycling could potentially meet up to 12% of global lithium demand and 25% of cobalt demand by 2040, offering a sustainable solution to meet the growing demand for these critical minerals. These recycling initiatives can significantly reduce the region's reliance on imported raw materials and promote the establishment of a local battery materials supply chain. (iea.org)

3.4.3 Emergence of Solid-State Batteries

Solid-state battery technology is emerging as a transformative trend in the MEA region's battery market. Unlike traditional lithium-ion batteries, solid-state batteries use a solid electrolyte, which reduces safety risks associated with thermal runaway and enhances energy density. Leading companies in the region are investing in research and development to explore the viability of solid-state batteries, which are more stable and have a longer lifespan. According to the World Economic Forum, advancements in solid-state battery technology are expected to increase energy density by 50%, making them ideal for electric vehicles and energy storage applications in the MEA market. This shift towards solid-state batteries is anticipated to drive innovation and offer safer, more efficient energy storage solutions. (weforum.org)

3.5 Government Regulations

3.5.1 Emission Reduction Targets

Several MEA countries have set ambitious emission reduction targets as part of their commitments to the Paris Agreement, leading to increased adoption of battery-powered systems. For instance, the UAE has pledged to achieve net-zero emissions by 2050, which requires significant investments in renewable energy and electric mobility solutions. he UAE aims to increase its renewable energy capacity significantly, with plans to generate over70 GW of powerfrom renewable sources by 2050, supported by an investment of approximatelyUSD 700 billionin renewable energy projects uae-embassy.org)

3.5.2 Renewable Energy Adoption Policies

Policies promoting renewable energy adoption are accelerating the growth of the battery market in the MEA region. In Morocco, for example, the government has set a target to derive over 52% of its energy from renewable sources by 2030. This ambitious target necessitates a strong energy storage infrastructure to manage the intermittency of solar and wind energy. Consequently, the demand for high-capacity batteries is rising, as they play a crucial role in ensuring a stable and reliable power supply. Such policies are driving investments in energy storage technologies and fostering a conducive environment for battery market expansion. (moroccoworldnews.com)

3.5.3 Incentives for Electric Vehicle Adoption

Governments across the MEA region are introducing incentives to promote electric vehicle (EV) adoption, thereby driving the demand for batteries. For instance, in South Africa, the government has proposed tax reductions and subsidies for EV purchases as part of its green transport strategy. These incentives aim to make EVs more affordable and accessible, thereby encouraging a shift towards cleaner transportation options. In addition, the Saudi Arabian government announced a partnership with Lucid Motors to produce up to 150,000 EVs per year locally. Such initiatives reflect a strong governmental push towards electric mobility, supporting the growth of the battery market. (lucidmotors.com)

Middle East & Africa Batteries Market Future Outlook

Over the next five years, the MEA batteries market is expected to experience significant growth, driven by continuous government support, advancements in battery technology, and increasing consumer demand for sustainable energy solutions. The expansion of renewable energy projects and the rising adoption of EVs are anticipated to further propel market growth.

Market Opportunities

- Technological Advancements in Battery Technologies: Innovations in battery technology present significant opportunities for the MEA market. For example, 3D printing technology, particularly Sakuu's Kavian platform, is revolutionizing the manufacturing of solid-state batteries by eliminating the use of liquid electrolytes. This innovation addresses environmental and safety concerns associated with lithium-ion batteries and is being adopted by major players like SK On, the fifth-largest electric vehicle battery supplier. Such advancements can lead to more efficient, safer, and cost-effective battery solutions, driving market growth.

- Growth in Consumer Electronics Market: The consumer electronics market in the MEA region is expanding, increasing the demand for batteries. In the United Arab Emirates, total shipments of mobile phones in the first quarter of 2022 were around 1.5 million units, worth about USD 494.6 million. This surge in electronic device usage necessitates efficient battery solutions, providing growth opportunities for battery manufacturers and suppliers.

Scope of the Report

|

Segment |

Sub-Segments |

|

Battery Type |

Lead-Acid Batteries |

|

Application |

Automotive Batteries |

|

End-User Industry |

Automotive |

|

Country |

Saudi Arabia |

Products

Key Target Audience

Battery Manufacturers

Electric Vehicle Manufacturers

Renewable Energy Companies

Industrial Equipment Manufacturers

Consumer Electronics Companies

Automotive OEMs

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Arabian Standards Organization, UAE Ministry of Energy and Infrastructure)

Companies

Players Mentioned in the Report

EnerSys

LG Electronics

Samsung SDI Co., Ltd.

Panasonic Corporation

Exide Industries Ltd.

Middle East Battery Company (MEBCO)

C&D Technologies Inc.

Tesla Inc.

East Penn Manufacturing Co.

Leclanch

Table of Contents

1. Middle East & Africa Batteries Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Middle East & Africa Batteries Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Middle East & Africa Batteries Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Adoption of Electric Vehicles

3.1.2 Expansion of Renewable Energy Projects

3.1.3 Declining Lithium-Ion Battery Prices

3.1.4 Government Initiatives and Policies

3.2 Market Challenges

3.2.1 Supply Chain Disruptions

3.2.2 Safety Concerns Related to Battery Usage

3.2.3 High Initial Investment Costs

3.3 Opportunities

3.3.1 Technological Advancements in Battery Technologies

3.3.2 Growth in Consumer Electronics Market

3.3.3 Development of Energy Storage Systems

3.4 Trends

3.4.1 Integration with Smart Grid Infrastructure

3.4.2 Rise of Battery Recycling Initiatives

3.4.3 Emergence of Solid-State Batteries

3.5 Government Regulations

3.5.1 Emission Reduction Targets

3.5.2 Renewable Energy Adoption Policies

3.5.3 Incentives for Electric Vehicle Adoption

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Middle East & Africa Batteries Market Segmentation

4.1 By Battery Type (In Value %)

4.1.1 Lead-Acid Batteries

4.1.2 Lithium-Ion Batteries

4.1.3 Nickel-Metal Hydride Batteries

4.1.4 Nickel-Cadmium Batteries

4.1.5 Others

4.2 By Application (In Value %)

4.2.1 Automotive Batteries

4.2.2 Industrial Batteries

4.2.3 Portable Batteries

4.2.4 Energy Storage Systems

4.2.5 Consumer Electronics

4.3 By End-User Industry (In Value %)

4.3.1 Automotive

4.3.2 Electronics

4.3.3 Energy & Power

4.3.4 Telecommunications

4.3.5 Military & Defense

4.4 By Country (In Value %)

4.4.1 Saudi Arabia

4.4.2 United Arab Emirates

4.4.3 South Africa

4.4.4 Nigeria

4.4.5 Rest of Middle East & Africa

5. Middle East & Africa Batteries Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 EnerSys

5.1.2 LG Electronics

5.1.3 Samsung SDI Co., Ltd.

5.1.4 Panasonic Corporation

5.1.5 Exide Industries Ltd.

5.1.6 Middle East Battery Company (MEBCO)

5.1.7 C&D Technologies Inc.

5.1.8 Tesla Inc.

5.1.9 East Penn Manufacturing Co.

5.1.10 Leclanch

5.2 Cross Comparison Parameters

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Middle East & Africa Batteries Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Middle East & Africa Batteries Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Middle East & Africa Batteries Future Market Segmentation

8.1 By Battery Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Country (In Value %)

9. Middle East & Africa Batteries Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the MEA batteries market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the MEA batteries market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple battery manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the MEA batteries market.

Frequently Asked Questions

01. How big is the Middle East & Africa Batteries Market?

The Middle East & Africa batteries market is valued at USD 9 billion, driven by the increasing adoption of electric vehicles, expansion of renewable energy projects, and declining lithium-ion battery prices.

02. What are the challenges in the Middle East & Africa Batteries Market?

Challenges in Middle East & Africa batteries market include supply chain disruptions, safety concerns related to battery usage, and high initial investment costs. Addressing these issues is crucial for sustained market growth.

03. Who are the major players in the Middle East & Africa Batteries Market?

Key players in Middle East & Africa batteries market include EnerSys, LG Electronics, Samsung SDI Co., Ltd., Panasonic Corporation, and Exide Industries Ltd. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04. What are the growth drivers of the Middle East & Africa Batteries Market?

The growth of the Middle East & Africa batteries market is driven by the increasing adoption of electric vehicles, expansion of renewable energy infrastructure, and favorable government policies promoting clean energy solutions. Advancements in battery technology and decreasing costs of lithium-ion batteries further enhance the demand across various applications in the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.