Middle East & Africa Beauty and Personal Care Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD9320

December 2024

97

About the Report

Middle East & Africa Beauty and Personal Care Market Overview

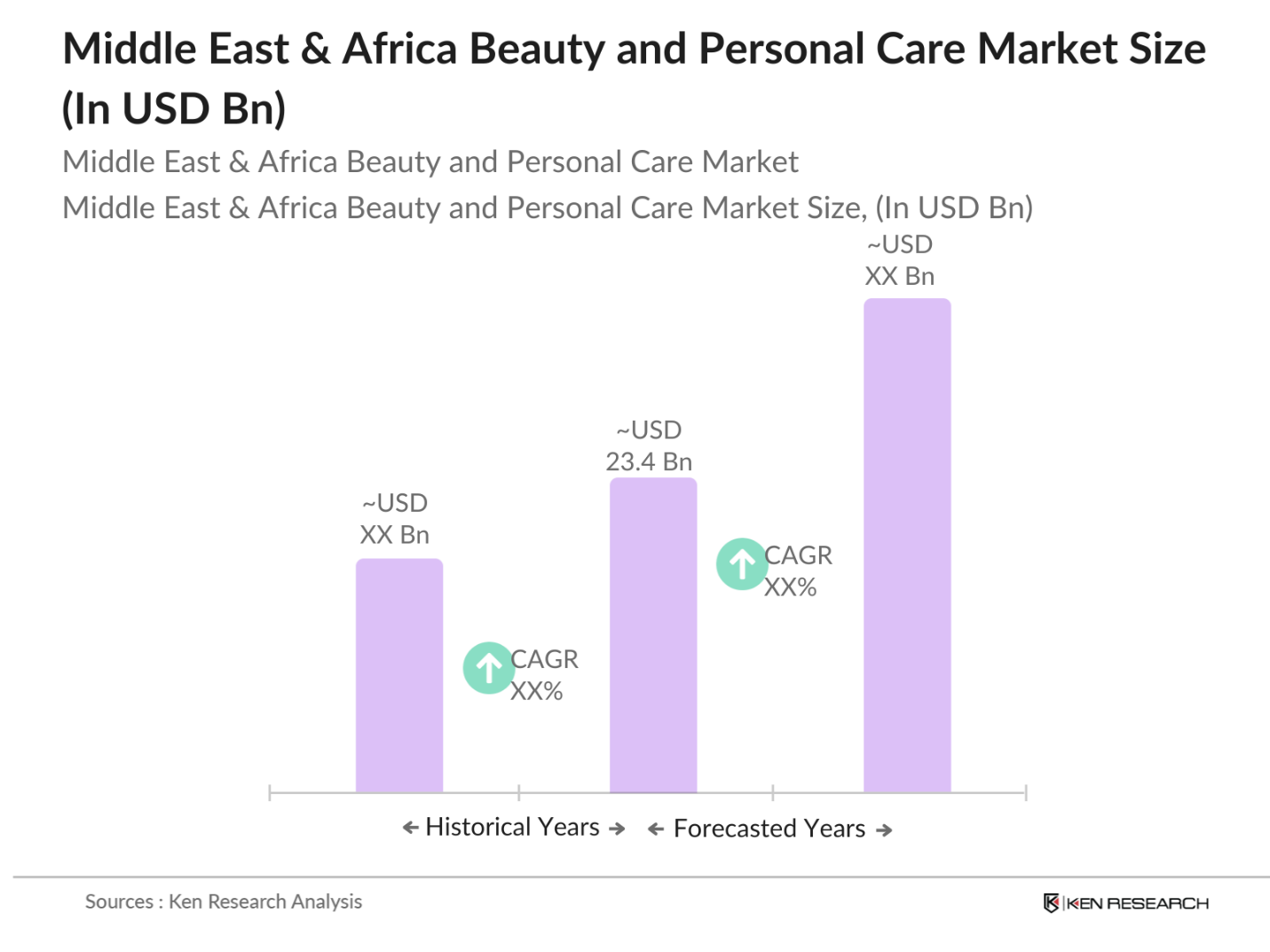

- The Middle East & Africa beauty and personal care market is valued at USD 23.4 billion, with growth driven primarily by rising disposable incomes, urbanization, and a shifting consumer focus toward premium and organic products. Increased social media influence, product personalization, and growing demand for mens grooming products further support market expansion. This growth trajectory has been consistent over the past five years, showcasing a robust demand across the region, largely concentrated in urban centers where consumer awareness is higher.

- In this market, dominant regions include the Gulf Cooperation Council (GCC) countries, Egypt, and South Africa. These areas lead due to a combination of high-income populations, strong retail networks, and consumer affinity for luxury and high-quality products. The demand in GCC countries is particularly notable due to the regions young, fashion-conscious population, which actively engages with both local and international beauty brands. Egypt and South Africa also show high market potential owing to their large, diverse consumer bases and well-established beauty and retail sectors.

- Consumers in the Middle East and Africa are increasingly prioritizing sustainability and ethical considerations in their beauty product choices. This trend is driving brands to adopt eco-friendly packaging, cruelty-free testing methods, and sustainable sourcing of ingredients to meet consumer expectations.

Middle East & Africa Beauty and Personal Care Market Segmentation

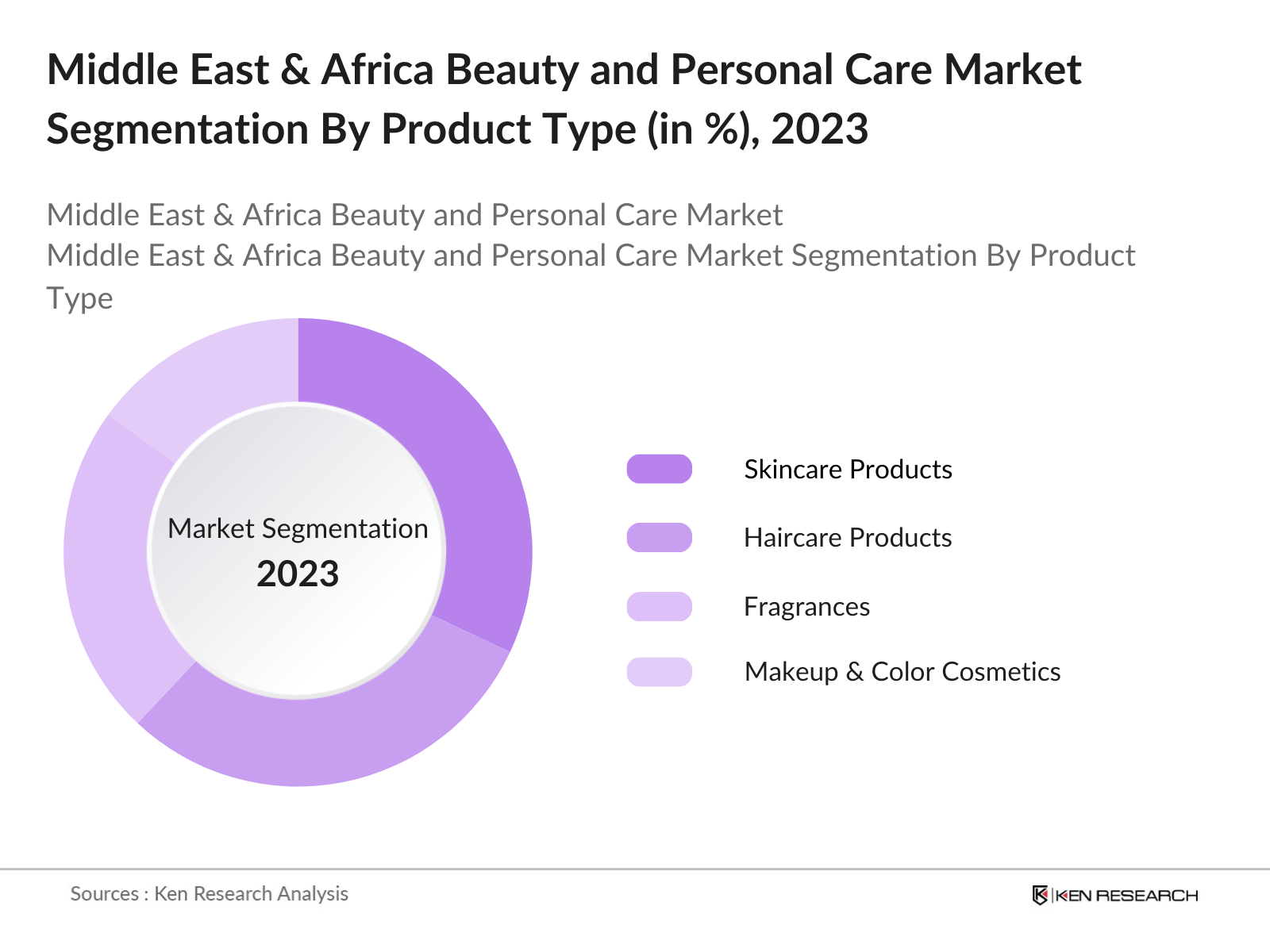

By Product Type: The Middle East & Africa beauty and personal care market is segmented by product type into skincare products, haircare products, fragrances, makeup & color cosmetics, and mens grooming products. Skincare products dominate this segment due to increasing awareness of skin health, the influence of social media trends promoting skincare routines, and consumer interest in anti-aging products. Brands such as LOral and Este Lauder have capitalized on this by launching products specifically tailored to the needs and preferences of consumers in the region.

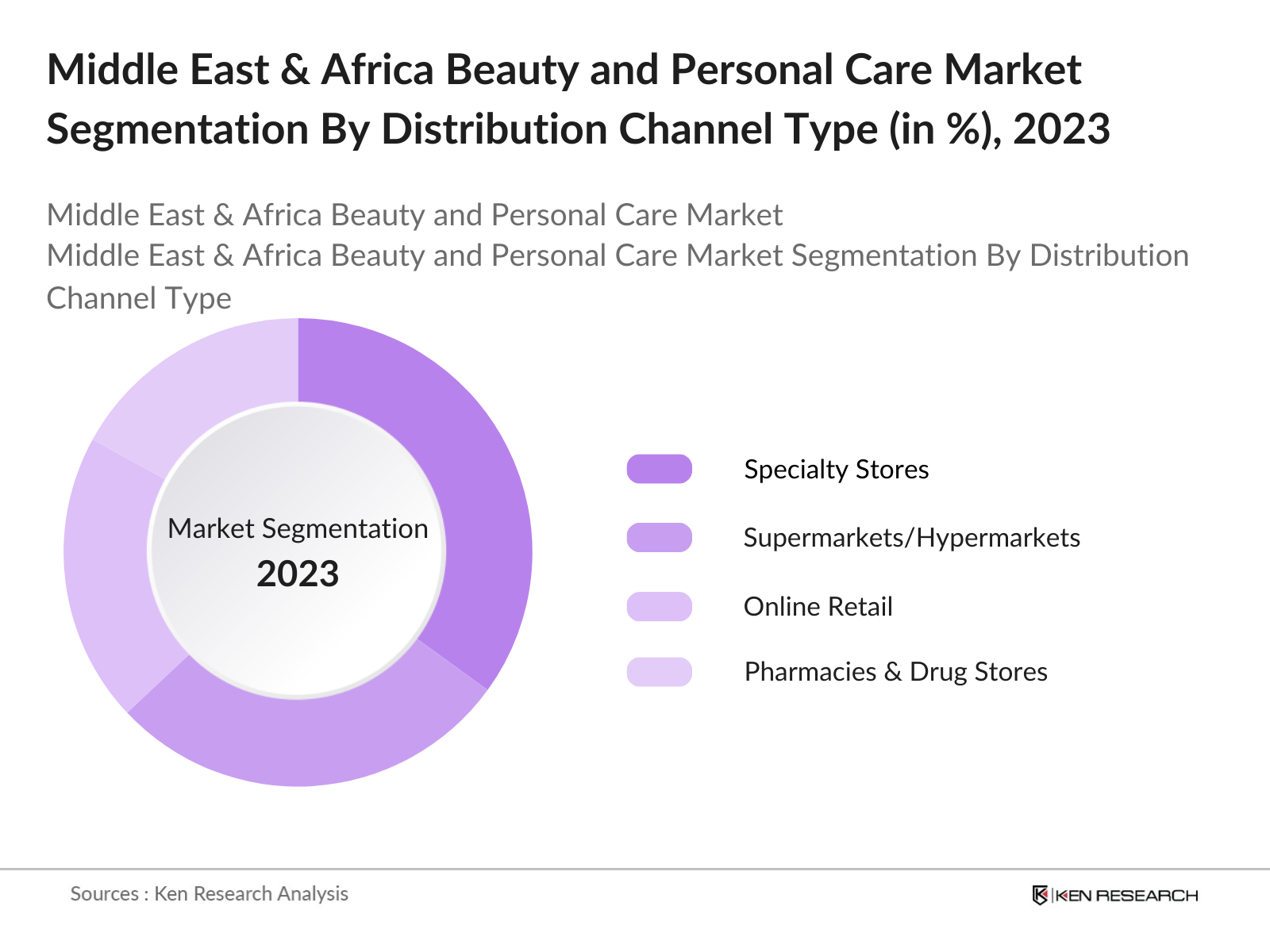

By Distribution Channel: In terms of distribution channels, the market is segmented into online retail, supermarkets/hypermarkets, specialty stores, pharmacies & drug stores, and direct sales. Specialty stores lead the segment as they offer consumers a wide range of brands, samples, and expert advice, creating a tailored shopping experience that caters to the regions preference for high-quality service and product knowledge. This is particularly appealing in the Gulf region, where consumers seek out premium products and personalized assistance.

Middle East & Africa Beauty and Personal Care Market Competitive Landscape

The Middle East & Africa beauty and personal care market is characterized by competition among international and regional players. Major companies such as LOral, Unilever, and Procter & Gamble dominate the market, leveraging their extensive product lines and strong brand presence. Regional brands also have a growing footprint, as consumers show interest in products tailored to their cultural preferences and skin types.

Middle East & Africa Beauty and Personal Care Industry Analysis

Growth Drivers

- Rising Disposable Income: The Middle East and North Africa (MENA) region has experienced a notable increase in disposable income, contributing to higher consumer spending on beauty and personal care products. In 2022, the region's GDP per capita reached $8,973.9, reflecting enhanced purchasing power among consumers. This economic growth has enabled individuals to allocate more funds toward personal grooming and beauty products, driving market expansion.

- Growing Urbanization: Urbanization rates in the Middle East and Africa have been on the rise, leading to increased demand for beauty and personal care products. In 2022, the urban population in the Middle East & North Africa was approximately 64% of the total population, indicating a significant urban demographic. Urban residents often have greater access to retail outlets and are more exposed to global beauty trends, fueling market growth.

- Increased Demand for Organic Products: Consumers in the Middle East and Africa are increasingly seeking organic and natural beauty products. This shift is driven by a growing awareness of health and environmental concerns. The clean beauty industry in the Gulf Cooperation Council (GCC) is projected to reach $2.6 billion by 2025, highlighting a significant opportunity for brands offering organic products.

Market Challenges

- Economic Instability: Certain countries in the Middle East and Africa face economic instability, which can impact consumer spending on non-essential items like beauty products. For example, Lebanon has experienced significant economic challenges, affecting the purchasing power of its citizens and, consequently, the beauty market.

- Regulatory Barriers: The beauty and personal care market in the Middle East and Africa is subject to diverse regulatory standards across different countries. These varying regulations can pose challenges for companies attempting to enter multiple markets within the region, necessitating compliance with a range of health and safety standards, labeling requirements, and import regulations.

Middle East & Africa Beauty and Personal Care Market Future Outlook

Over the next five years, the Middle East & Africa beauty and personal care market is projected to experience continued growth due to technological advancements, the rise of personalized beauty solutions, and increased investment in sustainable and natural products. The expansion of e-commerce platforms, combined with a higher demand for wellness and personal care products, is expected to drive market demand further. This trend also aligns with the growing health-conscious approach of consumers and the interest in clean and green beauty alternatives.

Opportunities

- E-commerce Growth: The Middle East and Africa have witnessed a surge in e-commerce activities, providing a lucrative platform for beauty and personal care products. The region's e-commerce market is expanding rapidly, with consumers increasingly preferring online shopping for convenience and a wider product selection. This trend offers brands an opportunity to reach a broader audience and boost sales through digital channels.

- Expansion of Mens Grooming Segment: There is a growing trend among men in the Middle East and Africa to invest in grooming products. This shift is driven by changing societal norms and increased awareness of personal care among men. The men's grooming segment presents a significant opportunity for brands to introduce specialized products catering to male consumers.

Scope of the Report

|

Product Type |

Skincare Products Haircare Products Fragrances Makeup & Color Cosmetics Mens Grooming Products |

|

Distribution Channel |

Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies & Drug Stores Direct Sales |

|

End-User |

Individual Consumers Salons & Spas Specialty Clinics |

|

Ingredient Type |

Natural Ingredients Synthetic Ingredients Vegan/Plant-Based Ingredients |

|

Region |

Gulf Cooperation Council (GCC) South Africa, Egypt Morocco Rest of Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health, Saudi Food & Drug Authority)

Beauty and Personal Care Product Manufacturing Industries

Retail Chains and Specialty Companies

E-commerce Platform Companies

Cosmetics and Skin Care Companies

Wellness and Lifestyle Companies

Companies

Players Mentioned in the Report

L'Oral Group

Unilever PLC

Procter & Gamble Co.

Este Lauder Companies Inc.

Shiseido Company, Limited

Beiersdorf AG

Johnson & Johnson Services, Inc.

Avon Products Inc.

Coty Inc.

Natura & Co

Table of Contents

1. Middle East & Africa Beauty and Personal Care Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Middle East & Africa Beauty and Personal Care Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Middle East & Africa Beauty and Personal Care Market Analysis

3.1 Growth Drivers

3.1.1 Rising Disposable Income

3.1.2 Growing Urbanization

3.1.3 Increased Demand for Organic Products

3.1.4 Youth-Centric Product Innovations

3.2 Market Challenges

3.2.1 Economic Instability

3.2.2 Regulatory Barriers

3.2.3 Counterfeit Products

3.2.4 Limited Availability of Natural Ingredients

3.3 Opportunities

3.3.1 E-commerce Growth

3.3.2 Expansion of Mens Grooming Segment

3.3.3 Increased Adoption of Beauty Devices

3.3.4 Niche Products for Sensitive Skin

3.4 Trends

3.4.1 Sustainable and Ethical Beauty Practices

3.4.2 Increased Focus on Clean Beauty Products

3.4.3 Rising Demand for Multi-functional Products

3.4.4 Advanced Personalization through AI

3.5 Government Regulations

3.5.1 Health and Safety Standards

3.5.2 Labeling and Packaging Requirements

3.5.3 Import and Export Regulations

3.5.4 Consumer Protection Laws

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Middle East & Africa Beauty and Personal Care Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Skincare Products

4.1.2 Haircare Products

4.1.3 Fragrances

4.1.4 Makeup & Color Cosmetics

4.1.5 Mens Grooming Products

4.2 By Distribution Channel (In Value %)

4.2.1 Online Retail

4.2.2 Supermarkets/Hypermarkets

4.2.3 Specialty Stores

4.2.4 Pharmacies & Drug Stores

4.2.5 Direct Sales

4.3 By End-User (In Value %)

4.3.1 Individual Consumers

4.3.2 Salons & Spas

4.3.3 Specialty Clinics

4.4 By Ingredient Type (In Value %)

4.4.1 Natural Ingredients

4.4.2 Synthetic Ingredients

4.4.3 Vegan/Plant-Based Ingredients

4.5 By Region (In Value %)

4.5.1 Gulf Cooperation Council (GCC)

4.5.2 South Africa

4.5.3 Egypt

4.5.4 Morocco

4.5.5 Rest of Middle East & Africa

5. Middle East & Africa Beauty and Personal Care Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 L'Oral Group

5.1.2 Procter & Gamble Co.

5.1.3 Unilever PLC

5.1.4 Este Lauder Companies Inc.

5.1.5 Shiseido Company, Limited

5.1.6 Beiersdorf AG

5.1.7 Avon Products Inc.

5.1.8 Henkel AG & Co. KGaA

5.1.9 Coty Inc.

5.1.10 Kao Corporation

5.1.11 Revlon Inc.

5.1.12 Johnson & Johnson Services, Inc.

5.1.13 Natura & Co

5.1.14 Amorepacific Corporation

5.1.15 The Body Shop International Limited

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Sustainability Practices, Research & Development Expenditure, Regional Presence, Marketing Strategy, Customer Engagement Techniques)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Investments

5.8 Government Grants

6. Middle East & Africa Beauty and Personal Care Market Regulatory Framework

6.1 Product Approval Process

6.2 Compliance Standards

6.3 Certification and Licensing Requirements

6.4 Import Tariffs and Tax Regulations

7. Middle East & Africa Beauty and Personal Care Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Middle East & Africa Beauty and Personal Care Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By End-User (In Value %)

8.4 By Ingredient Type (In Value %)

8.5 By Region (In Value %)

9. Middle East & Africa Beauty and Personal Care Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Targeted Marketing Strategies

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first stage involved developing a comprehensive ecosystem map of all major stakeholders in the Middle East & Africa beauty and personal care market. Detailed desk research was performed using secondary and proprietary databases to pinpoint significant market influencers and trends, helping define critical variables impacting the market.

Step 2: Market Analysis and Construction

This step incorporated historical data analysis and trends within the Middle East & Africa market. We evaluated market penetration, demand fluctuations, and sales channels to ensure reliable revenue estimations. This analysis formed the base for constructing robust market projections.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed from initial data findings were then validated through consultations with industry experts, utilizing computer-assisted telephone interviews (CATIs). This feedback enriched our analysis with operational and market insights directly from practitioners in the beauty and personal care sector.

Step 4: Research Synthesis and Final Output

The last phase included direct engagement with beauty product manufacturers and distributors to gain insights into market segments, sales performance, and consumer preferences. These interactions helped refine and validate our data, ensuring a comprehensive analysis of the Middle East & Africa beauty and personal care market.

Frequently Asked Questions

01. How big is the Middle East & Africa beauty and personal care market?

The Middle East & Africa beauty and personal care market is valued at USD 23.4 billion, driven by increasing disposable incomes, demand for premium products, and strong regional consumer engagement with beauty and personal care products.

02. What are the challenges in the Middle East & Africa beauty and personal care market?

Challenges include economic instability in certain areas, regulatory complexities, and competition from counterfeit products, which affects consumer trust and brand reliability in the market.

03. Who are the major players in the Middle East & Africa beauty and personal care market?

Key players include L'Oral Group, Unilever PLC, Procter & Gamble Co., Este Lauder Companies Inc., and Shiseido Company, Limited. These companies maintain dominance due to their diverse product portfolios, strong distribution networks, and sustained investment in marketing and innovation.

04. What are the growth drivers of the Middle East & Africa beauty and personal care market?

Market growth is supported by rising disposable incomes, growing demand for personalized and premium beauty products, and the influence of social media trends that drive consumer awareness and engagement.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.