Middle East & Africa Commercial Vehicles Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD8487

November 2024

93

About the Report

Middle East & Africa Commercial Vehicles Market Overview

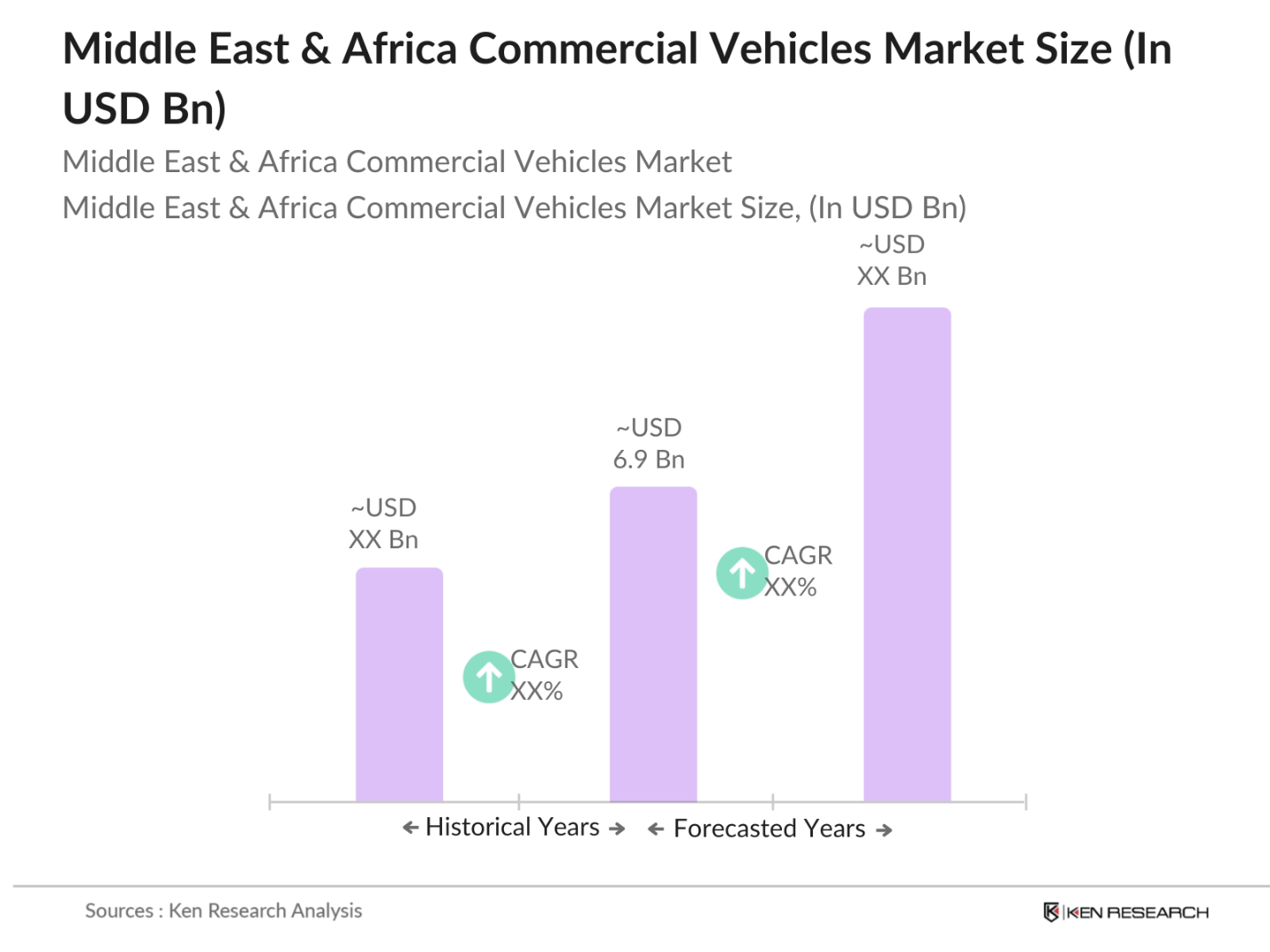

- The Middle East & Africa commercial vehicles market is valued at approximately USD 6.9 billion. This valuation is based on a historical five-year analysis, with significant contributions from sectors such as construction, logistics, and public transportation. The growth is driven by expanding infrastructure development projects across key regions, especially the Gulf Cooperation Council (GCC) countries, along with rising demand for efficient transportation in densely populated urban centers. The increasing need for fuel-efficient, technologically advanced vehicles is also contributing to market expansion.

- Key countries and cities dominate this market due to their strategic economic position and substantial investments in logistics and transportation infrastructure. Countries like Saudi Arabia, the UAE, and South Africa hold significant influence. The dominance of the GCC region stems from ongoing large-scale infrastructure projects such as the Saudi Vision 2030 and UAE's Expo 2020 initiatives, which have increased demand for commercial vehicles. South Africa, as a major economic hub in Sub-Saharan Africa, plays a pivotal role due to its well-developed transportation networks and regional logistics operations.

- Telematics, a key trend in fleet management, is becoming increasingly popular in the MEA region. As of 2023, 40% of commercial fleets in South Africa utilize GPS and telematics for tracking and managing their vehicles. This adoption allows for real-time monitoring of vehicles, optimizing routes, reducing fuel consumption, and improving safety standards. Countries like the UAE are also seeing a rapid rise in telematics adoption, making fleet operations more efficient and cost-effective.

Middle East & Africa Commercial Vehicles Market Segmentation

By Vehicle Type: The Middle East & Africa commercial vehicle market is segmented by vehicle type into Light Commercial Vehicles (LCVs), Medium Commercial Vehicles (MCVs), Heavy Commercial Vehicles (HCVs), and Buses & Coaches. Among these, Light Commercial Vehicles (LCVs) hold the dominant share in the market. This is attributed to their widespread application in urban logistics, last-mile deliveries, and small-scale transportation. The rise of e-commerce and growing urbanization have increased the demand for agile and efficient LCVs to navigate congested city roads and meet the rising demand for quick deliveries. Moreover, the affordability and fuel efficiency of LCVs make them a popular choice among SMEs in the logistics sector.

By Application: The Middle East & Africa commercial vehicle market is further segmented by application into Transportation & Logistics, Construction, Mining & Agriculture, Public Transport, and Oil & Gas. The Transportation & Logistics segment dominates the market due to the region's critical role as a global logistics hub. Key cities like Dubai and Jeddah have developed world-class logistics infrastructure that supports the distribution of goods across the region and beyond. The surge in e-commerce activities, driven by digitalization and growing consumer demand for fast and reliable deliveries, has further cemented the importance of commercial vehicles in this segment.

Middle East & Africa Commercial Vehicles Market Competitive Landscape

The Middle East & Africa commercial vehicles market is characterized by intense competition, with several global and regional players vying for market share. Global giants such as Daimler AG and Volvo Trucks have a significant presence due to their robust product offerings and technological advancements. Local manufacturers, especially in South Africa and Egypt, also play an important role, catering to regional demands and specific market requirements. The market is primarily dominated by global players like Daimler AG, Volvo Trucks, and MAN SE, who offer advanced technologies such as telematics and connected vehicle solutions. These firms have a robust international footprint and continue to expand their influence in the Middle East & Africa by focusing on fuel-efficient and environmentally friendly commercial vehicle options. Regional players such as Tata Motors also hold significant sway in parts of the market due to their competitive pricing strategies and localized manufacturing operations.

Middle East & Africa Commercial Vehicles Industry Analysis

Growth Drivers

- Infrastructure Development: The Middle East & Africa (MEA) region is witnessing a surge in infrastructure investments, which directly impacts the commercial vehicle market. In 2023, Saudi Arabias Vision 2030 initiative led to the allocation of over $150 billion toward transport infrastructure projects, including roads and public transportation systems. Similarly, Nigeria has invested $3.1 billion into its road network projects as part of the Presidential Infrastructure Development Fund. This growing focus on infrastructure translates into increased demand for commercial vehicles to transport materials, equipment, and labor across regions.

- Urbanization and Population Growth: The urban population in Africa is expected to increase by 24 million people between 2022 and 2024. With cities like Lagos growing rapidly, the need for urban transport solutions becomes essential. In 2023, 56% of the population in the Middle East was urban, and by 2024, countries like Saudi Arabia and the UAE are expected to invest heavily in urban mobility, contributing to the demand for commercial vehicles. The transportation infrastructure in cities will require efficient logistical networks to meet the needs of growing urban centers, thus fueling market growth.

- Demand for Efficient Logistics Solutions: Logistics is a critical component in the MEA region, especially for countries with a rising export-import sector. The World Bank's Logistics Performance Index ranks the UAE 11th globally, highlighting the robust logistics infrastructure. In 2022, e-commerce in the region boomed, further driving the demand for efficient supply chains and last-mile delivery solutions, requiring an increase in the fleet of commercial vehicles. Nations like Egypt and South Africa are also advancing their logistics industries with new ports and trade corridors, boosting demand for high-efficiency vehicles in logistics.

Market Challenges

- High Operational Costs: Commercial vehicle operators in the Middle East & Africa face elevated operational costs due to rising fuel prices and maintenance expenses. As of 2024, crude oil prices hover around $85 per barrel, significantly impacting fuel-dependent transport operations. Furthermore, maintenance costs for heavy-duty vehicles have seen a sharp rise, particularly in countries like Nigeria, where import tariffs on spare parts have increased. These challenges reduce profit margins for fleet operators, restraining market growth despite increasing demand for logistics.

- Shortage of Skilled Drivers: The commercial vehicle market in the MEA region faces a significant challenge with the shortage of skilled drivers. According to a report from the South African Department of Transport, the region faces a shortfall of over 150,000 truck drivers in 2023. Furthermore, driver training programs are limited, with only 20% of applicants in countries like Kenya receiving adequate certification. This lack of skilled labor directly impacts the efficiency of logistics operations, causing delays and increased operational costs.

Middle East & Africa Commercial Vehicles Market Future Outlook

Over the next five years, the Middle East & Africa commercial vehicle market is expected to witness steady growth driven by government investments in infrastructure, a rising demand for fuel-efficient vehicles, and the continued expansion of e-commerce and logistics networks. Additionally, the growing shift towards electric and hybrid commercial vehicles, particularly in the GCC, due to environmental regulations and sustainability initiatives, will significantly influence the market landscape. The construction of new roadways, ports, and airports as part of major development projects in Saudi Arabia, the UAE, and South Africa will stimulate demand for medium and heavy commercial vehicles, while the expansion of smart cities and modernized public transport systems will drive the adoption of buses and coaches with advanced technological features.

Opportunities

- Adoption of Electric and Hybrid Commercial Vehicles: The adoption of electric and hybrid commercial vehicles is gaining traction in the Middle East & Africa, spurred by environmental regulations and sustainability targets. As of 2023, the UAE has over 6,000 electric vehicles on the road, while countries like Morocco are investing in electric bus fleets for public transportation. The availability of government incentives for purchasing hybrid vehicles further accelerates this shift, presenting a significant growth opportunity for the commercial vehicle market as businesses opt for cleaner, cost-efficient transportation solutions.

- Expansion of E-commerce Sector: The rapid expansion of the e-commerce sector in MEA has created a robust demand for commercial vehicles, especially for last-mile delivery services. In 2022, online retail sales in Saudi Arabia reached $7.5 billion, driving the need for a well-established fleet to manage the delivery of goods across urban and rural areas. This trend is mirrored in other countries, such as South Africa, where e-commerce is growing rapidly, and companies are investing heavily in logistics and delivery vehicles.

Scope of the Report

|

By Vehicle Type |

Light Commercial Vehicles (LCVs) Medium Commercial Vehicles (MCVs) Heavy Commercial Vehicles (HCVs) Buses & Coaches |

|

By Application |

Transportation & Logistics Construction Mining & Agriculture Public Transport Oil & Gas |

|

By Fuel Type |

Diesel Electric Hybrid Hydrogen |

|

By Region |

GCC (Saudi Arabia, UAE, Qatar) North Africa (Egypt, Algeria, Morocco) Sub-Saharan Africa (South Africa, Kenya, Nigeria) East Africa (Ethiopia, Tanzania) |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Transportation & Logistics Companies

Construction Firms

Government and Regulatory Bodies (Ministry of Transportation, Environmental Protection Agencies)

Vehicle Manufacturing Industries

Oil & Gas Companies

Mining & Agricultural Companies

Investor and Venture Capitalist Firms

Fleet Management and Leasing Companies

Companies

Players Mentioned in the Report

Daimler AG

Volvo Trucks

MAN SE

Isuzu Motors

Tata Motors

Hino Motors

Ford Motor Company

Ashok Leyland

Hyundai Motors

Foton Motor Group

Table of Contents

1. Middle East & Africa Commercial Vehicles Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East & Africa Commercial Vehicles Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East & Africa Commercial Vehicles Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development (Number of new projects, investment in transport)

3.1.2. Urbanization and Population Growth (Urbanization rate, rising population)

3.1.3. Demand for Efficient Logistics Solutions (Logistics index, supply chain advancements)

3.1.4. Government Policies and Regulations (Emissions standards, trade tariffs, incentives)

3.2. Market Challenges

3.2.1. High Operational Costs (Fuel prices, maintenance costs)

3.2.2. Shortage of Skilled Drivers (Training programs, workforce shortage metrics)

3.2.3. Fluctuating Oil Prices (Crude oil price trends, impact on vehicle ownership)

3.2.4. Technological Disruption (Electrification, autonomous vehicle technology)

3.3. Opportunities

3.3.1. Adoption of Electric and Hybrid Commercial Vehicles (Electrification rate, sustainability metrics)

3.3.2. Expansion of E-commerce Sector (Growth in online sales, last-mile delivery vehicles)

3.3.3. Infrastructure Investments (Government expenditure on road transport, smart cities projects)

3.4. Trends

3.4.1. Increasing Adoption of Telematics (Fleet management penetration, GPS adoption rates)

3.4.2. Rise of Autonomous Driving Technologies (Autonomous vehicle testing, AI adoption in transport)

3.4.3. Shift towards Hydrogen and Hybrid Fuel Technologies (Fuel cell vehicles, alternative energy adoption)

3.4.4. Integration of Connected Commercial Vehicles (IOT in transport, smart fleet integration)

3.5. Government Regulation

3.5.1. Import and Export Regulations (Tariff rules, trade agreements impact on vehicle imports)

3.5.2. Emission Standards and Targets (Euro emission standards, national CO2 targets)

3.5.3. Fleet Modernization Programs (Incentives for new vehicle purchases, scrappage schemes)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.8.1. Supplier Power

3.8.2. Buyer Power

3.8.3. Threat of Substitutes

3.8.4. Threat of New Entrants

3.8.5. Competitive Rivalry

3.9. Competitive Ecosystem Analysis

4. Middle East & Africa Commercial Vehicles Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Light Commercial Vehicles (LCVs)

4.1.2. Medium Commercial Vehicles (MCVs)

4.1.3. Heavy Commercial Vehicles (HCVs)

4.1.4. Buses & Coaches

4.2. By Application (In Value %)

4.2.1. Transportation & Logistics

4.2.2. Construction

4.2.3. Mining & Agriculture

4.2.4. Public Transport

4.2.5. Oil & Gas

4.3. By Fuel Type (In Value %)

4.3.1. Diesel

4.3.2. Electric

4.3.3. Hybrid

4.3.4. Hydrogen

4.4. By Region (In Value %)

4.4.1. GCC (Saudi Arabia, UAE, Qatar)

4.4.2. North Africa (Egypt, Algeria, Morocco)

4.4.3. Sub-Saharan Africa (South Africa, Kenya, Nigeria)

4.4.4. East Africa (Ethiopia, Tanzania)

5. Middle East & Africa Commercial Vehicles Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Daimler AG

5.1.2. Volvo Trucks

5.1.3. MAN SE

5.1.4. Scania AB

5.1.5. Isuzu Motors

5.1.6. Tata Motors

5.1.7. Hino Motors

5.1.8. Ashok Leyland

5.1.9. Ford Motor Company

5.1.10. Hyundai Motors

5.1.11. Foton Motor Group

5.1.12. Iveco

5.1.13. Nissan Motors

5.1.14. Toyota

5.1.15. General Motors (GMC)

5.2. Cross Comparison Parameters (Revenue, Market Share, Manufacturing Capacity, Geographical Presence, Technological Innovation, Product Portfolio,

Customer Base, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Government & Private Investments

5.8. New Product Launches

6. Middle East & Africa Commercial Vehicles Market Regulatory Framework

6.1. Import Tariffs and Trade Agreements

6.2. Environmental and Emission Standards

6.3. Safety and Compliance Regulations

6.4. Certification and Homologation Procedures

7. Middle East & Africa Commercial Vehicles Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Middle East & Africa Commercial Vehicles Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Application (In Value %)

8.3. By Fuel Type (In Value %)

8.4. By Region (In Value %)

9. Middle East & Africa Commercial Vehicles Market Analyst’s Recommendations

9.1 TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Strategies

9.4. Market Entry and Expansion Recommendations

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research begins by mapping the commercial vehicle ecosystem in the Middle East & Africa, focusing on stakeholders such as manufacturers, distributors, and end-users. Extensive desk research was conducted to gather information on market trends, regulations, and infrastructure projects affecting the commercial vehicle market.

Step 2: Market Analysis and Construction

In this stage, historical data was compiled to assess the growth and market penetration of commercial vehicles across key regions in the Middle East & Africa. This analysis includes evaluating the demand for vehicles in different sectors such as logistics, construction, and public transportation.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, in-depth interviews were conducted with industry experts including commercial vehicle manufacturers, fleet operators, and governmental bodies. These insights were instrumental in refining data accuracy and ensuring reliability.

Step 4: Research Synthesis and Final Output

The final stage involves cross-verifying data obtained from secondary sources through consultations with manufacturers and industry professionals. A combination of top-down and bottom-up approaches ensures a comprehensive understanding of market dynamics and trends, providing a reliable forecast for the market.

Frequently Asked Questions

01. How big is the Middle East & Africa Commercial Vehicles Market?

The Middle East & Africa commercial vehicles market is valued at USD 6.9 billion, driven by strong demand from construction, logistics, and public transportation sectors.

02. What are the challenges in the Middle East & Africa Commercial Vehicles Market?

Key challenges include fluctuating oil prices, rising operational costs, and the lack of skilled drivers. Additionally, regulatory hurdles and the slow adoption of electric vehicles present further obstacles.

03. Who are the major players in the Middle East & Africa Commercial Vehicles Market?

Major players in the market include Daimler AG, Volvo Trucks, MAN SE, Tata Motors, and Isuzu Motors. These companies dominate due to their extensive product portfolios and strong geographical presence.

04. What are the growth drivers of the Middle East & Africa Commercial Vehicles Market?

The market is propelled by increased investments in infrastructure, the expansion of logistics and e-commerce, and the rising need for efficient public transport systems in growing urban centers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.