Middle East & Africa Energy Drink Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD10107

December 2024

98

About the Report

Middle East & Africa Energy Drinks Market Overview

- The Middle East & Africa energy drinks market is valued at USD 4.5 billion, based on a five-year historical analysis. The market's growth is largely driven by the rising consumer demand for energy-boosting beverages in urban areas and a substantial youth demographic. With an increasing number of working professionals and athletes prioritizing quick energy sources, the demand has continued to expand.

- Within the region, countries such as Saudi Arabia, UAE, and South Africa stand out as dominant players in the energy drinks market. The high disposable income in Saudi Arabia and UAE, coupled with a growing health and fitness consciousness, drives demand. In South Africa, where urbanization rates are high, the youth population favors affordable and convenient energy solutions. The strong retail infrastructure and accessibility of products further support the dominance of these regions.

- Several MEA countries, including the UAE, have implemented advertising restrictions to limit youth exposure to energy drink advertisements. In 2023, the UAE enacted policies restricting advertising of high-caffeine drinks during peak youth viewership hours. This regulation aims to mitigate potential adverse health impacts associated with excessive consumption, aligning with broader efforts to promote health-conscious advertising practices.

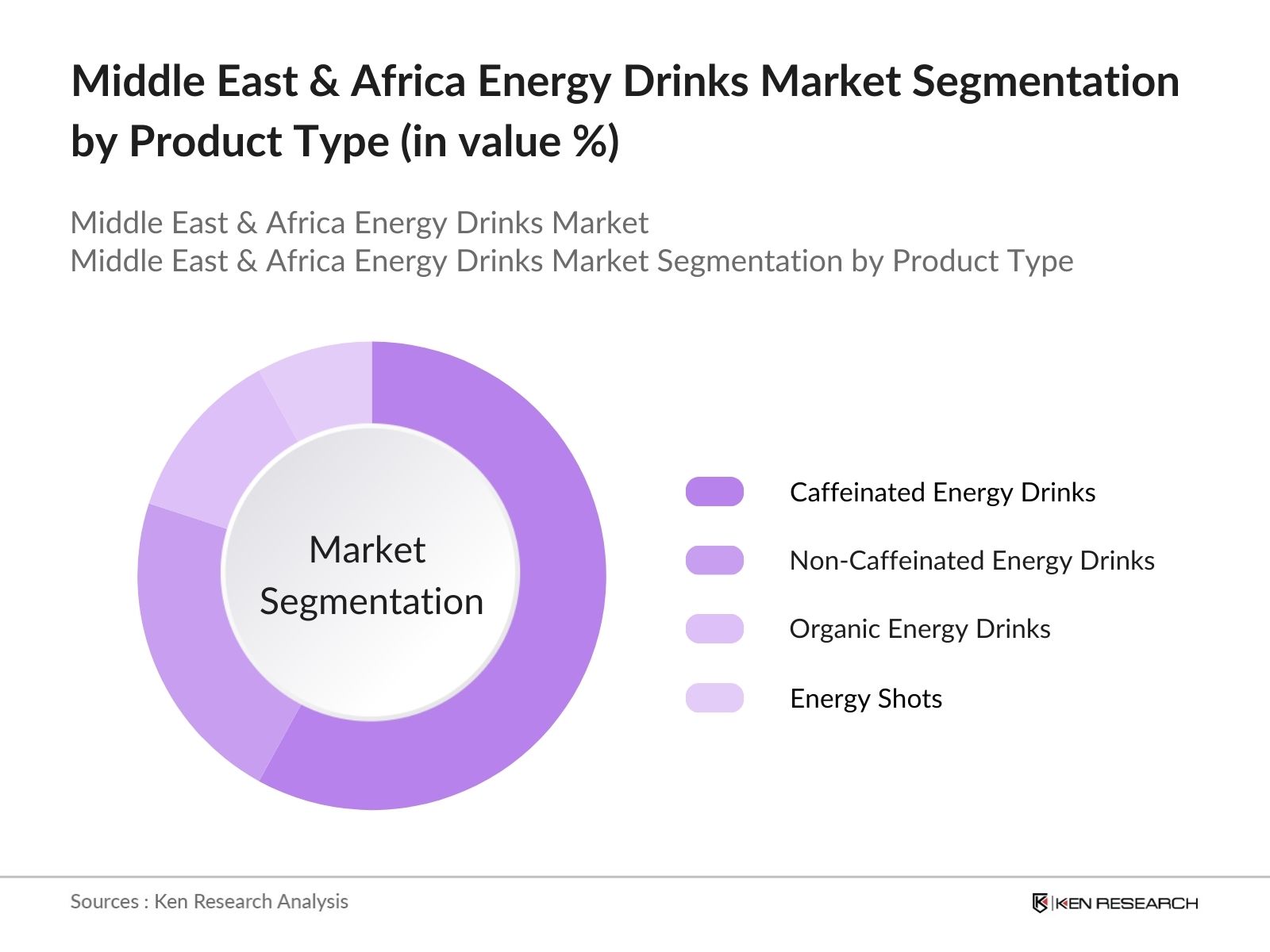

Middle East & Africa Energy Drinks Market Segmentation

By Product Type: The Middle East & Africa energy drinks market is segmented by product type into caffeinated energy drinks, non-caffeinated energy drinks, organic energy drinks, and energy shots. Recently, caffeinated energy drinks hold a dominant market share. This dominance is due to the high preference among consumers for products that deliver an instant energy boost. Leading brands with established consumer trust and extensive distribution networks support this segments stronghold in the market.

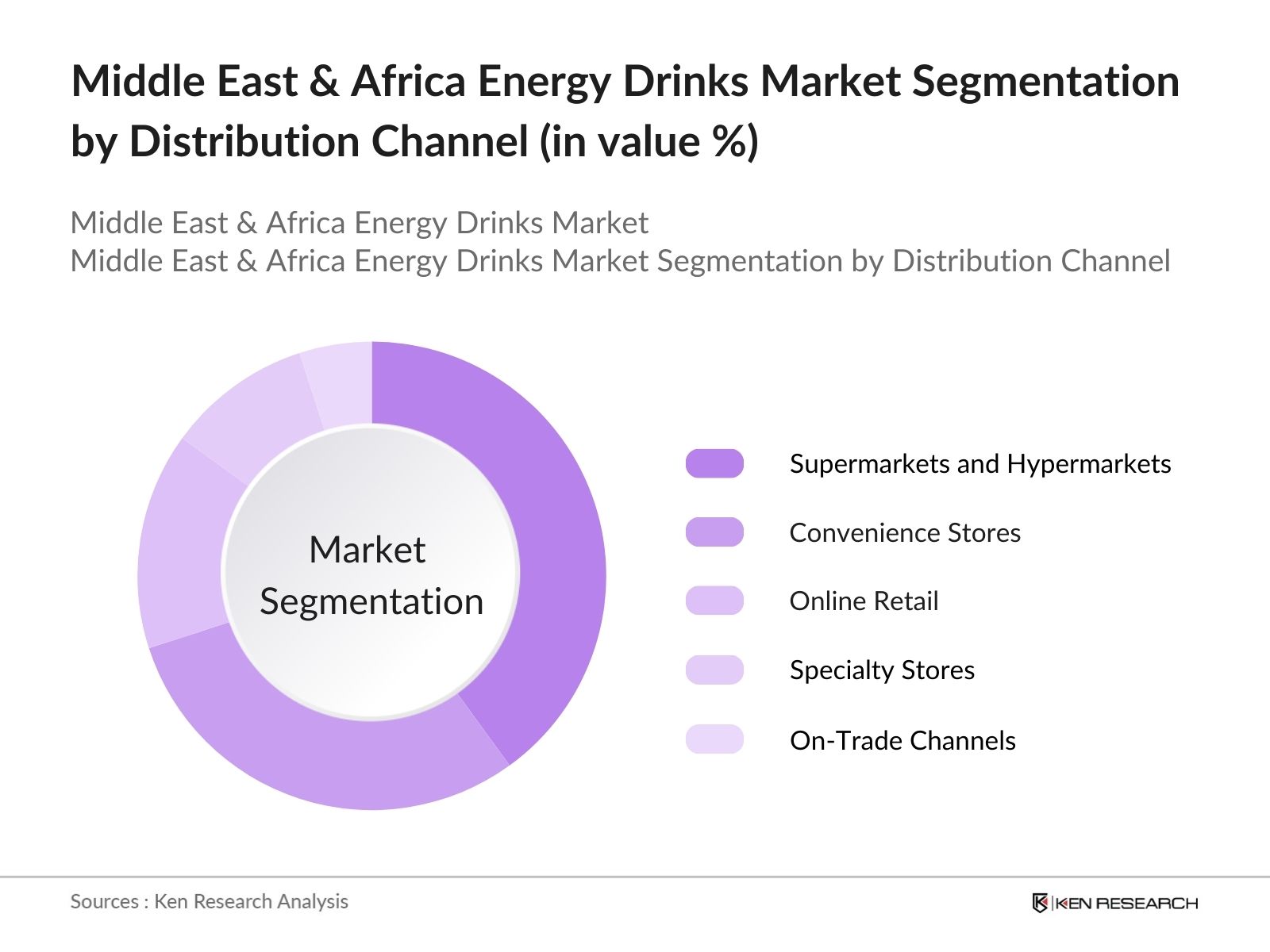

By Distribution Channel: In terms of distribution, the market is segmented into supermarkets and hypermarkets, convenience stores, online retail, specialty stores, and on-trade channels. Supermarkets and hypermarkets lead the market share, providing easy access and variety. The in-store promotions by top brands in this segment have solidified the prominence of this channel in driving sales.

Middle East & Africa Energy Drinks Market Competitive Landscape

The Middle East & Africa energy drinks market is dominated by key players, including both regional and international brands. Leading companies like Red Bull GmbH and Monster Beverage Corporation continue to have a strong presence due to their well-established distribution networks and extensive product portfolios that appeal to varied consumer segments.

Middle East & Africa Energy Drinks Market Analysis

Growth Drivers

- Health and Wellness Trends: In the Middle East and Africa, rising health consciousness has fueled demand for energy drinks marketed as wellness products. The Gulf Health Council noted an increase in health-focused consumer spending, with energy drinks containing vitamins, electrolytes, and nootropic additives seeing growth due to a 15% surge in fitness center memberships in urban areas across Saudi Arabia, UAE, and South Africa in 2023. The push towards health-centric consumption aligns with government goals, such as Saudi Vision 2030, which emphasizes lifestyle improvements.

- Urban Lifestyle Adoption: The energy drinks market in MEA is expanding as urbanization accelerates. Urban residency has grown by over 3 million individuals in 2023 across Saudi Arabia, UAE, and Nigeria, fostering an environment where convenient, on-the-go beverages are in demand. As the urban population is projected to account for nearly 62% of MEA by 2025, increased exposure to Western dietary preferences fuels energy drink consumption among active and time-conscious urban dwellers, enhancing market growth.

- Product Diversification: Diversified offerings, such as caffeine-free, low-sugar, and vitamin-infused energy drinks, appeal to health-conscious consumers and non-traditional energy drink users. The introduction of new flavors and formulations, such as the vitamin B12-enriched energy drink line in the UAE, reflects the shift. Additionally, in South Africa, non-caffeinated energy drinks gained popularity with nearly 40% of launches catering to caffeine-sensitive consumers in 2023. Such variety caters to a broader demographic and fuels market penetration across different consumer segments.

Challenges

- Stringent Health Regulations: Stringent government regulations on ingredients and labeling are prominent challenges. For instance, UAE mandates energy drinks with warning labels for caffeine content over 150 mg per 500 ml, impacting distribution and sales. Additionally, Saudi Arabia imposes ingredient restrictions to limit artificial additives, posing formulation challenges for manufacturers. Regulatory costs and compliance barriers are burdensome for companies and impact market growth, as reported by the Gulf Standardization Organization in 2023.

- High Competition from Alternatives: Alternatives like fruit-infused water, herbal teas, and sports drinks challenge energy drinks market share. In South Africa, sports drinks grew by 8 million liters in sales volume compared to energy drinks in 2023, reflecting shifting consumer interest. These substitutes, perceived as healthier or better suited for hydration, limit energy drinks growth potential, especially among health-conscious demographics that prioritize lower-calorie options.

Middle East & Africa Energy Drinks Market Future Outlook

Middle East & Africa energy drinks market is poised for substantial growth, driven by evolving consumer preferences toward health-focused energy drinks and the expansion of distribution networks. The increasing interest in organic and natural formulations is expected to accelerate demand, while companies invest in local manufacturing and marketing to strengthen their regional foothold. Growing online retail adoption is also anticipated to expand consumer access, making energy drinks more accessible across diverse geographic areas in the MEA region.

Market Opportunities

- Functional and Organic Ingredients: Demand for organic and functional ingredients presents growth opportunities for energy drink manufacturers. Over 25% of UAE consumers actively seek products with functional health benefits like antioxidants, according to recent data. With expanding health and organic trends, MEA consumers show strong interest in drinks containing adaptogens, vitamins, and natural caffeine sources like guarana, offering brands an avenue to align with consumer preferences.

- Expansion into Untapped Rural Markets: The rural segment in regions such as Sub-Saharan Africa, where 60% of the population resides, represents an untapped market for energy drinks. With improving infrastructure and rising income levels in these areas, brands have an opportunity to expand their reach beyond urban centers. In Nigeria, rural incomes increased by 200 USD on average in 2023, allowing for discretionary spending on beverages like energy drinks as distribution networks grow.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Caffeinated Energy Drinks |

|

By Distribution Channel |

Supermarkets and Hypermarkets |

|

By Target Consumer Group |

Teenagers |

|

By Flavor |

Fruit-Flavored |

|

By Region |

GCC Countries |

Products

Key Target Audience

Energy Drink Manufacturers

Health and Wellness Companies

Sports and Fitness Centers

Sports and Fitness Companies

Packaging and Labeling Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health, Saudi Food & Drug Authority)

Companies

Players Mentioned in the Report

Red Bull GmbH

Monster Beverage Corporation

PepsiCo, Inc.

The Coca-Cola Company

Rockstar, Inc.

Lucozade (Suntory Holdings Ltd.)

XS Energy (Amway)

Power Horse Energy Drinks GmbH

Hansen Natural Corp.

Eastroc Super Drink

Table of Contents

1. Middle East & Africa Energy Drinks Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Market Segmentation Overview

2. Middle East & Africa Energy Drinks Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Middle East & Africa Energy Drinks Market Analysis

3.1 Growth Drivers (Health Awareness, Urbanization, Lifestyle Shifts, Youth Population Growth)

3.1.1 Health and Wellness Trends

3.1.2 Increased Disposable Income

3.1.3 Urban Lifestyle Adoption

3.1.4 Product Diversification

3.2 Market Challenges (Price Sensitivity, Regulatory Restrictions, Health Concerns)

3.2.1 Stringent Health Regulations

3.2.2 High Competition from Alternatives

3.2.3 Price Sensitivity in Emerging Markets

3.3 Opportunities (Product Innovation, Market Expansion, E-Commerce Growth)

3.3.1 Functional and Organic Ingredients

3.3.2 Expansion into Untapped Rural Markets

3.3.3 Digital Marketing and E-Commerce Channels

3.4 Trends (Clean Label, Low-Sugar Formulations, Natural Ingredients, Premiumization)

3.4.1 Demand for Low-Sugar Variants

3.4.2 Use of Natural and Functional Ingredients

3.4.3 Product Premiumization

3.5 Government Regulations (Ingredient Regulations, Health and Safety Standards, Advertising Restrictions)

3.5.1 Product Labeling Standards

3.5.2 Marketing Restrictions Targeting Youth

3.5.3 Import and Export Regulations

3.6 SWOT Analysis

3.7 Porters Five Forces Analysis

3.8 Stakeholder Ecosystem

3.9 Competitive Landscape Overview

4. Middle East & Africa Energy Drinks Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Caffeinated Energy Drinks

4.1.2 Non-Caffeinated Energy Drinks

4.1.3 Organic Energy Drinks

4.1.4 Energy Shots

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets and Hypermarkets

4.2.2 Convenience Stores

4.2.3 Online Retail

4.2.4 Specialty Stores

4.2.5 On-Trade Channels

4.3 By Target Consumer Group (In Value %)

4.3.1 Teenagers

4.3.2 Adults

4.3.3 Athletes

4.3.4 Working Professionals

4.4 By Flavor (In Value %)

4.4.1 Fruit-Flavored

4.4.2 Unflavored

4.4.3 Custom Flavors

4.5 By Region (In Value %)

4.5.1 GCC Countries

4.5.2 South Africa

4.5.3 Egypt

4.5.4 Rest of MEA

5. Middle East & Africa Energy Drinks Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Red Bull GmbH

5.1.2 Monster Beverage Corporation

5.1.3 PepsiCo, Inc.

5.1.4 The Coca-Cola Company

5.1.5 Rockstar, Inc.

5.1.6 Lucozade (Suntory Holdings Ltd.)

5.1.7 XS Energy (Amway)

5.1.8 Power Horse Energy Drinks GmbH

5.1.9 Hansen Natural Corp.

5.1.10 Eastroc Super Drink

5.2 Cross-Comparison Parameters (Revenue, Product Range, Distribution Reach, Market Share, R&D Investment, Regional Presence, Key Marketing Strategies, Strategic Alliances)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Middle East & Africa Energy Drinks Market Regulatory Framework

6.1 Food Safety and Standards Regulations

6.2 Health and Nutrition Labeling Requirements

6.3 Import and Trade Policies

6.4 Advertising and Promotion Regulations

7. Middle East & Africa Energy Drinks Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Drivers Influencing Future Market Growth

8. Middle East & Africa Energy Drinks Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Target Consumer Group (In Value %)

8.4 By Flavor (In Value %)

8.5 By Region (In Value %)

9. Middle East & Africa Energy Drinks Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Customer Cohort Analysis

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved creating an ecosystem map of stakeholders in the Middle East & Africa energy drinks market. Extensive desk research and secondary data sources were used to identify crucial market variables that impact the markets growth trajectory and segment trends.

Step 2: Market Analysis and Construction

This step involved collecting and analyzing historical data on the market's growth, with a focus on distribution channels and consumer preferences. Secondary sources and proprietary databases helped confirm trends and identify the penetration rates of various product types and distribution channels.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with industry experts, such as regional distributors and retail analysts, providing insights into market shifts. These consultations were key to refining data accuracy, ensuring relevance to industry realities.

Step 4: Research Synthesis and Final Output

This final phase synthesized primary and secondary research findings to deliver a comprehensive analysis. The data-driven approach ensured a detailed and reliable report, offering strategic insights to business professionals in the MEA energy drinks market.

Frequently Asked Questions

01. How big is the Middle East & Africa Energy Drinks Market?

The Middle East & Africa energy drinks market is valued at USD 4.5 billion, driven by a young population, urbanization, and increasing demand for quick energy solutions.

02. What are the challenges in the Middle East & Africa Energy Drinks Market?

Key challenges in Middle East & Africa energy drinks market include regulatory restrictions on caffeine levels, price sensitivity in emerging markets, and competition from alternative functional beverages, impacting overall market profitability.

03. Who are the major players in the Middle East & Africa Energy Drinks Market?

Leading players in Middle East & Africa energy drinks market include Red Bull GmbH, Monster Beverage Corporation, PepsiCo, Inc., The Coca-Cola Company, and Rockstar, Inc., which dominate due to strong brand equity and extensive distribution networks.

04. What are the growth drivers of the Middle East & Africa Energy Drinks Market?

Middle East & Africa energy drinks market is driven by health and wellness trends, a large youth demographic, and increased disposable income, encouraging the shift toward energy drinks for convenience and lifestyle needs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.