Middle East & Africa Fast Food Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD10795

January 2025

86

About the Report

Middle East & Africa Fast Food Market Overview

- The Middle East & Africa Fast Food Market is valued at approximately USD 33.7 billion, driven by a surge in consumer demand for convenient and affordable dining options. The expansion of fast food outlets across urban centers, coupled with rising disposable incomes, is fueling growth. Increasing investments by local and global brands in response to shifting dietary preferences and expanding online food delivery services are further propelling this market.

- Dominant markets within the region, including the United Arab Emirates and Saudi Arabia, lead due to urbanization, high disposable incomes, and tourism. In these countries, the demand for fast food is strong, with customers seeking quick, international, and culturally diverse menu options. Additionally, both nations have established infrastructure to support quick-service restaurants (QSRs) and online food delivery platforms, reinforcing their market dominance.

- MEA governments are emphasizing stringent food safety protocols, with the UAE enforcing HACCP (Hazard Analysis and Critical Control Points) standards across all food establishments in 2024. These requirements enhance food safety but also increase operational demands on fast food chains to maintain compliance. Such measures ensure higher quality standards but require constant monitoring and adjustments by businesses.

Middle East & Africa Fast Food Market Segmentation

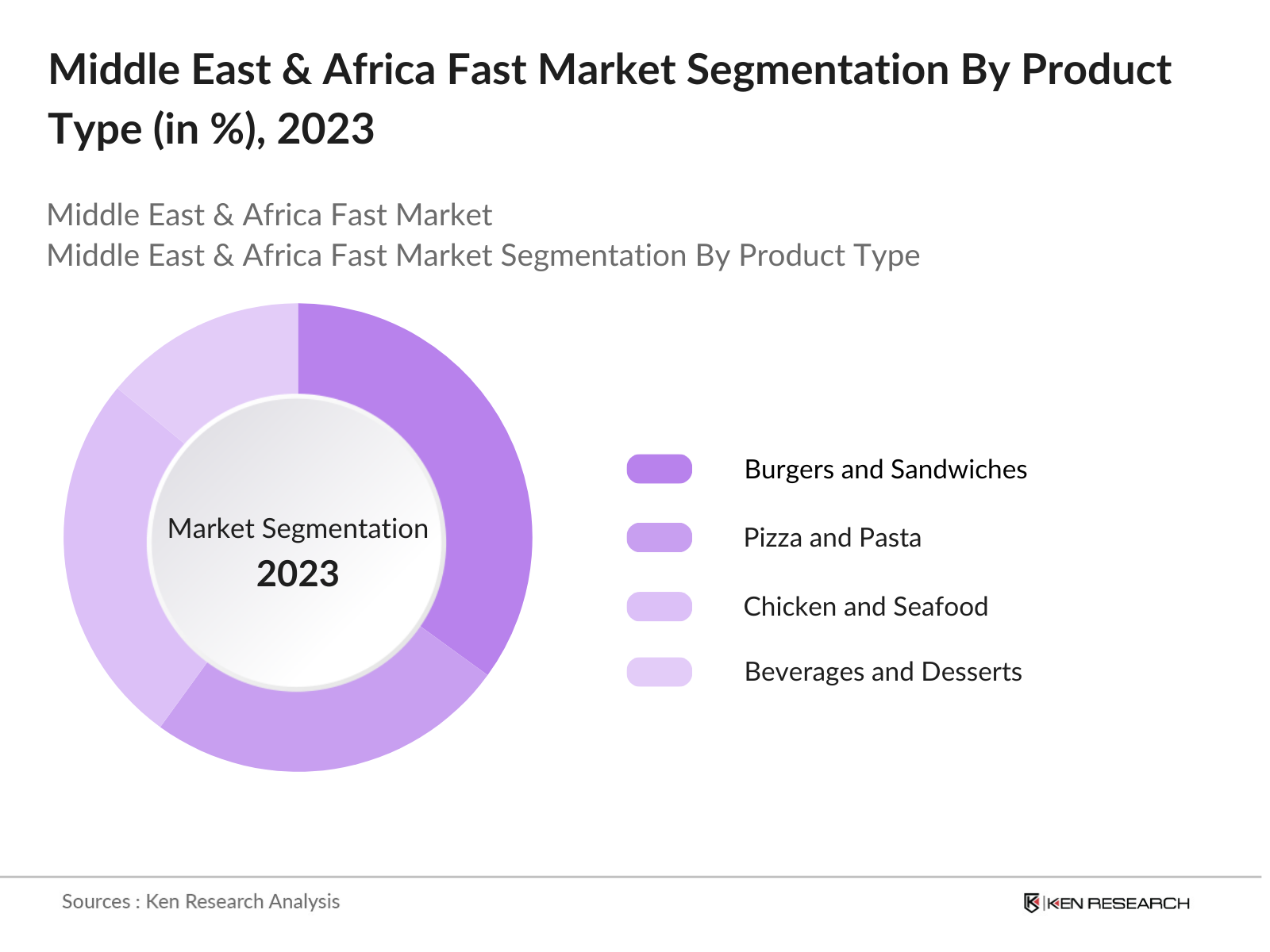

By Product Type: The Middle East & Africa Fast Food Market is segmented by product type into burgers and sandwiches, pizza and pasta, chicken and seafood, beverages and desserts, and others (ethnic and specialty foods). The burgers and sandwiches segment has a dominant market share due to its broad appeal across age groups and the variety of options within this category, which cater to local tastes and international preferences. Global brands like McDonalds and Burger King have established strong brand loyalty in the region, which further strengthens this segment's hold on the market.

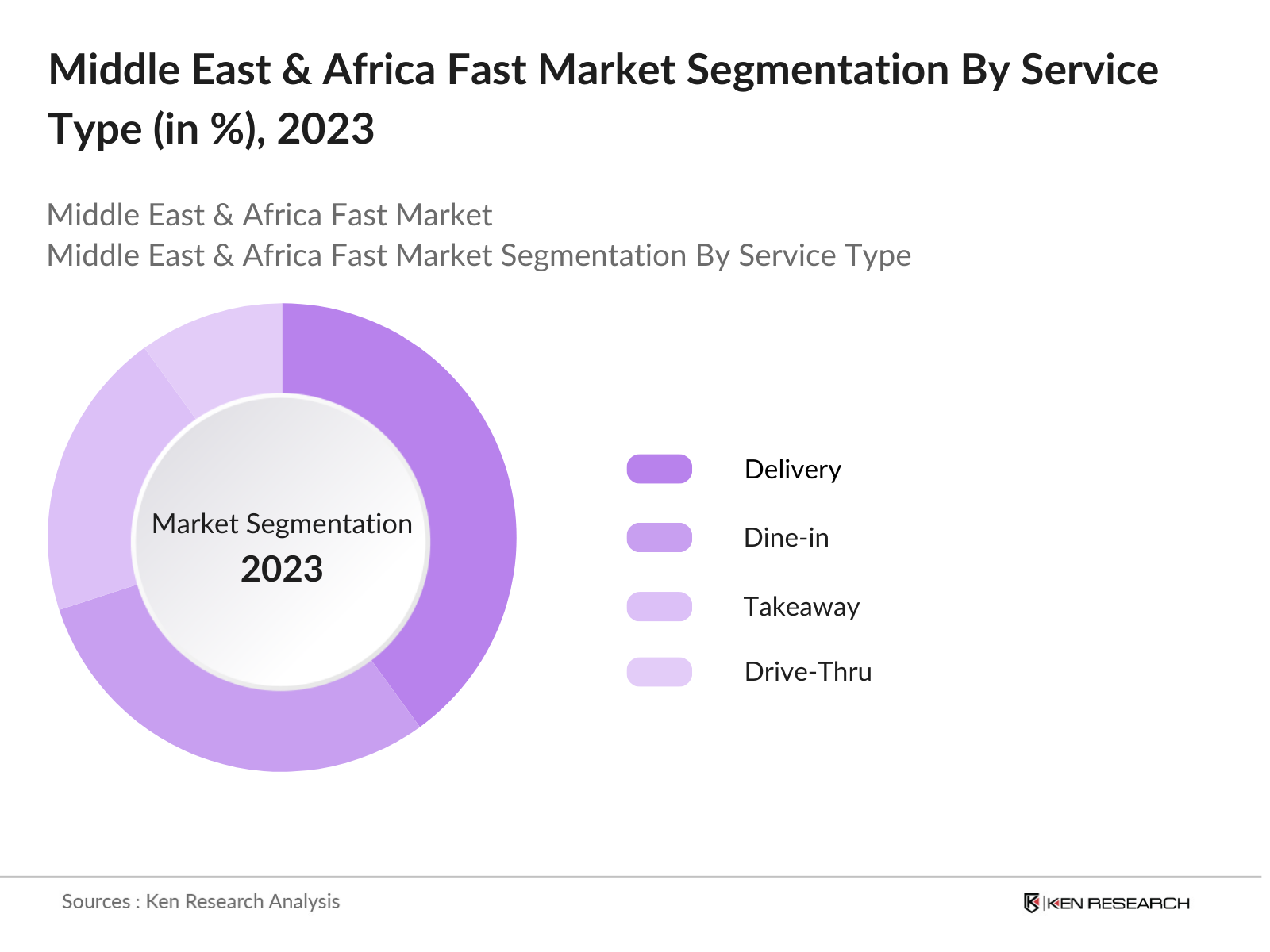

By Service Type: The market is also segmented by service type, including dine-in, takeaway, drive-thru, and delivery. Delivery services are increasingly dominating this segment due to the growing popularity of online ordering and convenience. Partnerships with food delivery platforms like UberEats, Talabat, and Deliveroo have expanded accessibility, especially among younger, urban consumers who favor the convenience of having fast food delivered to their doorstep.

Middle East & Africa Fast Food Market Competitive Landscape

The Middle East & Africa fast food market is dominated by key players who have established extensive networks across major cities in the region. These brands leverage strong brand recognition, consistent quality, and innovative menu adaptations to local tastes to remain competitive. Regional players are also investing in digital marketing and partnerships with delivery platforms to reach a wider consumer base.

Middle East & Africa Fast Food Industry Analysis

Growth Drivers

- Rising Urbanization and Shift Towards Convenient Food Options: Urbanization in the MEA region has been accelerating, with 73 million people now residing in urban areas, creating a significant demand for convenient food options as urban dwellers increasingly seek time-saving solutions in their daily routines. Countries such as Saudi Arabia, UAE, and South Africa are witnessing rapid urban migration, contributing to fast food's popularity. According to the World Bank, 60% of the MEA population resides in urban areas as of 2024, a substantial increase from previous years, aligning with the growth in the fast food sector.

- Expansion of Delivery and Online Ordering Services: In 2024, MEA countries saw a notable rise in online food orders, supported by expanding internet infrastructure, with over 160 million internet users in the region. The UAE reported that 48% of its urban population orders food online, boosted by improvements in online payment systems and last-mile delivery services. The increased adoption of online food services contributes directly to fast food market growth as users demand quicker and more convenient access to their favorite brands.

- Increasing Demand for International Cuisines: The MEA market has seen a sharp increase in the preference for international cuisines, influenced by tourism and expatriate populations, especially in cities like Dubai, Riyadh, and Cairo. Approximately 70% of the fast food options in Dubai offer international flavors as of 2024, demonstrating a clear market shift. The tourism sector's strong influence, with 40 million visitors to the region in 2023, bolsters demand for a diverse range of cuisines, accelerating fast food chains' entry and expansion.

Market Challenges

- Health Concerns Associated with Fast Food Consumption: Rising health concerns are creating challenges for the fast food industry in the MEA. Obesity rates have spiked, with Saudi Arabia reporting that 36% of its adult population is obese as of 2024, leading to a heightened awareness about the potential health risks of frequent fast food consumption. The healthcare sector is now spending an estimated USD 10 billion on obesity-related diseases, adding pressure on fast food providers to offer healthier options.

- Regulatory Restrictions on Ingredients and Food Safety: MEA governments are implementing stricter regulations on ingredients and food safety, particularly around trans fats and artificial additives. The UAE, for example, has introduced mandatory nutritional labeling and reduced trans fats limits in all packaged foods by 2024. These policies increase compliance costs for fast food providers, impacting product formulation and sourcing. As these regulations expand, fast food providers must adapt to ensure they meet compliance standards, especially in the Gulf region.

Middle East & Africa Fast Food Market Future Outlook

Over the next five years, the Middle East & Africa fast food market is expected to experience sustained growth driven by a combination of rising consumer demand for quick and convenient food options, rapid urbanization, and the increased penetration of online food delivery services. The expanding range of healthier menu options and plant-based alternatives is anticipated to attract health-conscious consumers, while continued investment in digital infrastructure will enhance consumer experience and drive sales growth.

Opportunities

- Rising Demand for Healthy and Organic Fast Food Options: The demand for healthier fast food options is growing in MEA, with a significant rise in organic food consumption. Saudi Arabia alone has witnessed a 30% increase in organic fast food sales in 2023, reflecting consumers' shift toward healthier alternatives. This demand opens a lucrative avenue for fast food chains to introduce organic, low-calorie, and nutrient-rich items. Government incentives in promoting organic agriculture also support this opportunity.

- Increasing Partnerships with Delivery Platforms: The collaboration between fast food outlets and delivery platforms has surged, with popular apps witnessing a 40% rise in registered restaurants in 2024. As 40 million MEA consumers rely on these platforms for food orders, partnerships provide fast food chains with expanded reach and visibility. In Egypt, for example, 60% of consumers order fast food through digital platforms, highlighting the potential for growth in online order integrations.

Scope of the Report

|

Product Type |

Burgers and Sandwiches |

|

Service Type |

Dine-in |

|

Age Group |

Youth (15-24) |

|

Distribution Channel |

Quick-Service Restaurants (QSR) |

|

Region |

GCC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Quick Service Restaurant (QSR) Chain Companies

Food Delivery Platform Companies

Hospitality and Tourism Industries

Real Estate Development Companies

Franchise Investor Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Dubai Municipality, Saudi Food & Drug Authority)

Health and Nutrition Advocacy Companies

Companies

Players Mentioned in the Report

McDonald's

KFC

Burger King

Pizza Hut

Domino's

Hardee's

Popeyes

Subway

Dunkin' Donuts

Krispy Kreme

Table of Contents

1. Middle East & Africa Fast Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East & Africa Fast Food Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East & Africa Fast Food Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Urbanization and Shift Towards Convenient Food Options

3.1.2. Expansion of Delivery and Online Ordering Services

3.1.3. Increasing Demand for International Cuisines

3.1.4. Influence of Young Population and Changing Lifestyles

3.2. Market Challenges

3.2.1. Health Concerns Associated with Fast Food Consumption

3.2.2. Regulatory Restrictions on Ingredients and Food Safety

3.2.3. High Operating Costs and Intense Competition

3.3. Opportunities

3.3.1. Rising Demand for Healthy and Organic Fast Food Options

3.3.2. Increasing Partnerships with Delivery Platforms

3.3.3. Growth in Emerging Markets within MEA

3.4. Trends

3.4.1. Introduction of Plant-Based and Vegan Options

3.4.2. Technology Integration in Ordering and Payment Systems

3.4.3. Rise in Pop-up and Ghost Kitchen Models

3.5. Regulatory Landscape

3.5.1. Food Safety Regulations

3.5.2. Nutritional Information and Transparency Policies

3.5.3. Import Regulations on Food Ingredients

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

4. Middle East & Africa Fast Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Burgers and Sandwiches

4.1.2. Pizza and Pasta

4.1.3. Chicken and Seafood

4.1.4. Beverages and Desserts

4.1.5. Others (Ethnic and Specialty Foods)

4.2. By Service Type (In Value %)

4.2.1. Dine-in

4.2.2. Takeaway

4.2.3. Drive-Thru

4.2.4. Delivery

4.3. By Age Group (In Value %)

4.3.1. Youth (15-24)

4.3.2. Adults (25-44)

4.3.3. Middle Age (45-60)

4.3.4. Senior Adults (60+)

4.4. By Distribution Channel (In Value %)

4.4.1. Quick-Service Restaurants (QSR)

4.4.2. Full-Service Restaurants

4.4.3. Cafs and Specialty Stores

4.4.4. Online Delivery Platforms

4.5. By Region (In Value %)

4.5.1. GCC

4.5.2. North Africa

4.5.3. South Africa

4.5.4. Rest of Middle East

5. Middle East & Africa Fast Food Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. McDonalds

5.1.2. KFC

5.1.3. Dominos

5.1.4. Pizza Hut

5.1.5. Subway

5.1.6. Burger King

5.1.7. Baskin Robbins

5.1.8. Hardees

5.1.9. Dunkin' Donuts

5.1.10. Popeyes

5.1.11. Krispy Kreme

5.1.12. TGI Fridays

5.1.13. Nandos

5.1.14. Jollibee

5.1.15. Papa Johns

5.2. Cross-Comparison Parameters (Revenue, Market Position, Franchise Expansion, Regional Presence, Product Portfolio, Innovations, Employee Count, Customer Demographic Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Landscape

6. Middle East & Africa Fast Food Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Packaging and Labeling Requirements

6.3. Compliance with Advertising Regulations

6.4. Labor Regulations for Fast Food Industry

7. Middle East & Africa Fast Food Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Influencing Future Growth

8. Middle East & Africa Fast Food Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Service Type (In Value %)

8.3. By Age Group (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Middle East & Africa Fast Food Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. Market Positioning Strategy

9.4. Innovation and Differentiation Opportunities

9.5. Digital Transformation Initiatives

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping out the ecosystem of the Middle East & Africa Fast Food Market, identifying key stakeholders and variables that affect the market. This involves in-depth secondary research and consulting proprietary databases to capture accurate industry-level data.

Step 2: Market Analysis and Data Collection

Historical data related to the Middle East & Africa Fast Food Market is compiled and analyzed to understand market penetration and revenue generation. This step also involves evaluating service quality and distribution networks to ensure reliability in revenue forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including QSR operators and supply chain professionals, to gain financial and operational insights. This feedback is used to refine and confirm the accuracy of the market data.

Step 4: Research Synthesis and Final Output

In the final step, insights from direct industry interactions are integrated with quantitative analysis to develop a comprehensive, validated report on the Middle East & Africa Fast Food Market. This includes projections, competitive positioning, and recommendations for market entry and growth strategies.

Frequently Asked Questions

01. How big is the Middle East & Africa Fast Food Market?

The Middle East & Africa Fast Food Market is valued at approximately USD 33.7 billion, supported by a growing consumer base and rising demand for quick dining options.

02. What are the challenges in the Middle East & Africa Fast Food Market?

The market faces challenges such as health concerns related to fast food consumption, high operational costs, and strict regulatory requirements on food safety and quality.

03. Who are the major players in the Middle East & Africa Fast Food Market?

Leading players include McDonald's, KFC, Burger King, Pizza Hut, and Domino's, which hold significant influence due to brand recognition and extensive outlet networks.

04. What are the growth drivers of the Middle East & Africa Fast Food Market?

Key drivers include increasing urbanization, a shift toward convenient food options, and the rising popularity of online food delivery services, which continue to boost market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.