Middle East & Africa Ice Cream Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6640

December 2024

85

About the Report

Middle East & Africa Ice Cream Market Overview

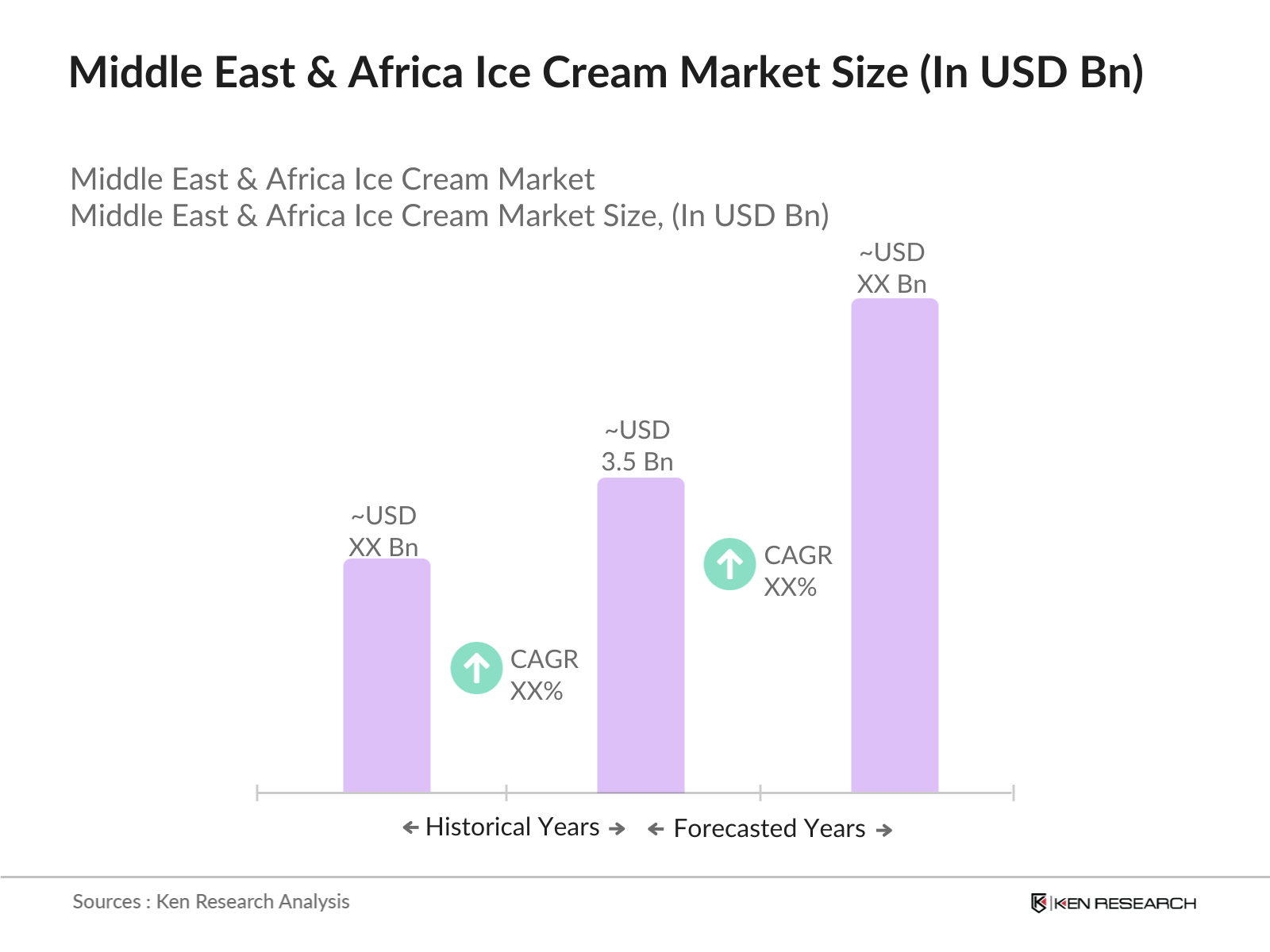

- The Middle East & Africa ice cream market is valued at USD 3.5 billion, based on a five-year historical analysis. The market is driven by increasing disposable incomes and the region's expanding tourism sector, which has led to a surge in demand for premium and artisanal ice cream products. The growth of modern retail formats, such as supermarkets and hypermarkets, has also contributed significantly to the rise in ice cream sales, providing better accessibility for consumers. Furthermore, favorable climatic conditions in many parts of the region further fuel the demand for cold desserts.

- The market is primarily dominated by the Gulf Cooperation Council (GCC) countries, with the United Arab Emirates and Saudi Arabia being the largest contributors. These countries dominate due to their high per capita incomes, the prevalence of international tourists, and the increasing westernization of food consumption patterns. Additionally, countries like South Africa and Egypt are emerging markets due to growing urbanization and the expansion of middle-class consumers with higher disposable income, which enables greater spending on non-essential items such as premium ice cream.

- The growing trend towards non-dairy alternatives is reshaping the ice cream landscape in the Middle East and Africa. As of 2024, vegan ice cream represents approximately 12% of the total ice cream market share, reflecting a substantial increase from 8% in 2022. This trend is driven by the rising number of health-conscious consumers and those with dietary restrictions, seeking plant-based options. Manufacturers are increasingly developing innovative flavors using almond, coconut, and oat bases to cater to this demand. The shift towards non-dairy alternatives is expected to drive product diversification and growth within the market.

Middle East & Africa Ice Cream Market Segmentation

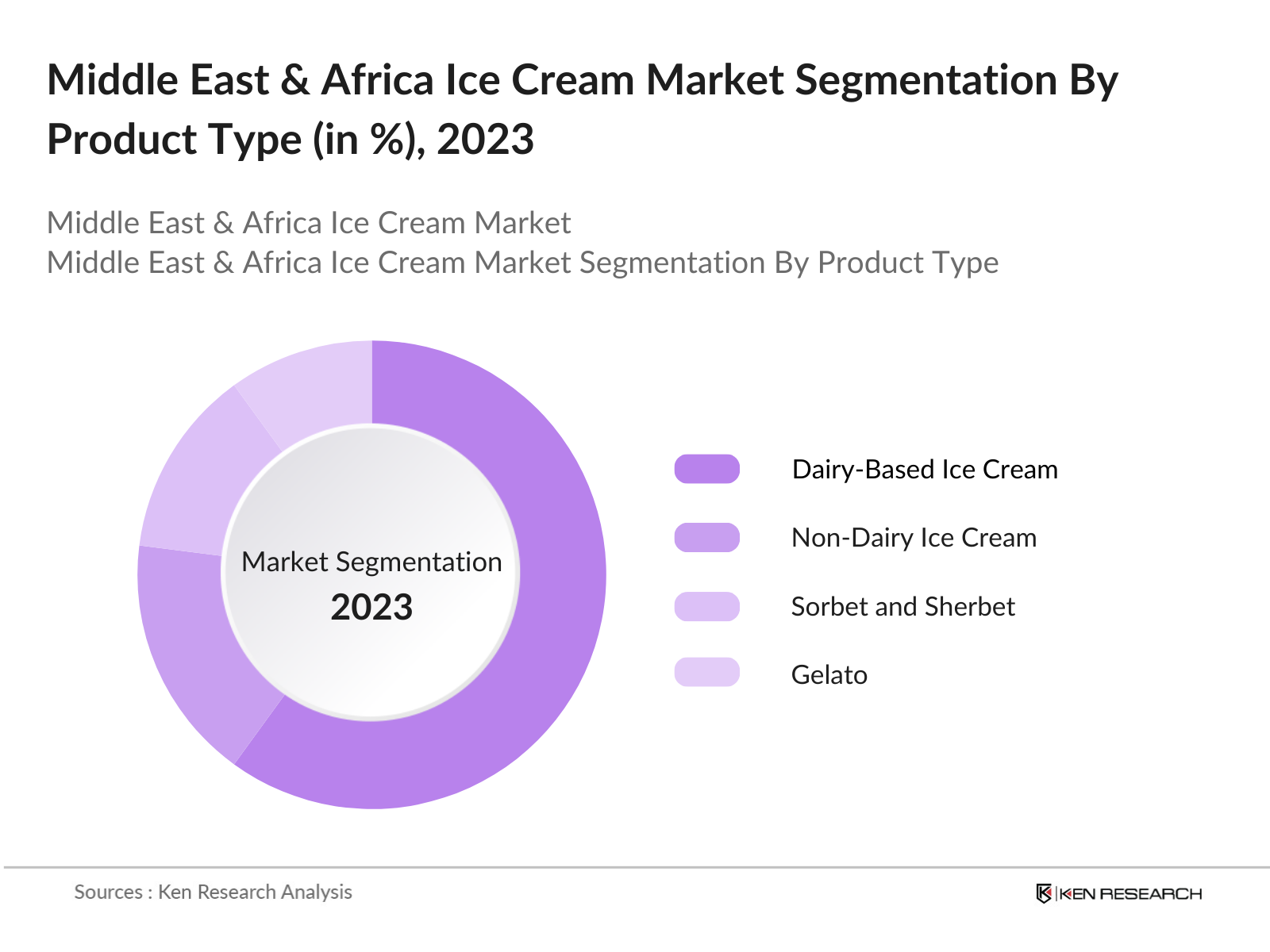

By Product Type: The Middle East & Africa ice cream market is segmented by product type into dairy-based ice cream, non-dairy ice cream, sorbet and sherbet, gelato, and frozen yogurt. Dairy-based ice cream holds the dominant market share in the region due to its traditional consumption and the vast array of flavors available. Leading brands have established a strong presence in this segment, leveraging local dairy production and consumer preferences. The introduction of healthier options within the dairy-based segment has further strengthened its dominance.

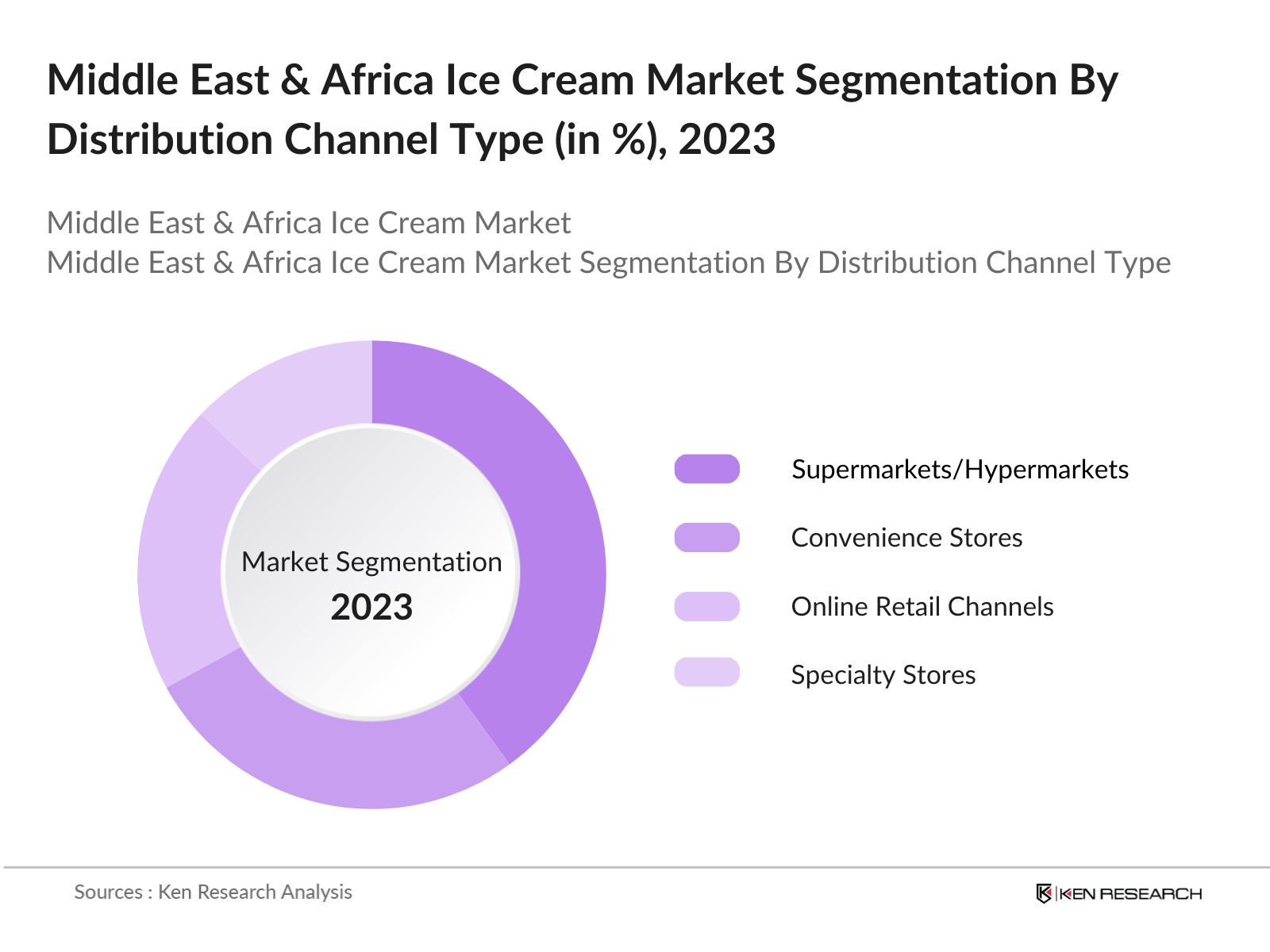

By Distribution Channel: The market is also segmented by distribution channels into supermarkets/hypermarkets, convenience stores, online retail channels, specialty stores, and ice cream parlors. Supermarkets and hypermarkets dominate the market share due to their wide reach and the ability to offer a diverse range of products. Their dominance is also attributed to the increasing trend of consumers seeking convenience, leading to higher foot traffic in these retail outlets. In addition, their focus on consumer experience and product variety gives them a competitive edge over other distribution channels.

Middle East & Africa Ice Cream Market Competitive Landscape

The Middle East & Africa ice cream market is dominated by a mix of international conglomerates and regional players, making it highly competitive. Companies such as Unilever and Nestl are well-established in the region, offering a wide variety of ice cream products across multiple segments. These companies have successfully localized their products by catering to regional tastes and preferences, making them the leading players in the market.

|

Company Name |

Established Year |

Headquarters |

Number of Employees |

Distribution Reach |

Product Range |

Manufacturing Facilities |

Regional Market Share |

Revenue |

Key Partnerships |

|

Unilever Group |

1929 |

London |

150,000+ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Nestl S.A. |

1867 |

Switzerland |

275,000+ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Mars, Inc. |

1911 |

USA |

130,000+ |

_ |

_ |

_ |

_ |

_ |

_ |

|

General Mills |

1928 |

USA |

40,000+ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Lotte Confectionery |

1967 |

South Korea |

25,000+ |

_ |

_ |

_ |

_ |

_ |

_ |

Middle East & Africa Ice Cream Industry Analysis

Growth Drivers

- Rise in Disposable Income: The rise in disposable income in the Middle East and Africa has significantly influenced ice cream consumption patterns. As of 2024, the average per capita income in the region is approximately $10,400, reflecting a steady increase from around $9,800 in 2022, as reported by the World Bank. This increase in disposable income enables consumers to spend more on leisure products, including ice cream, thus driving market growth. Higher incomes lead to a shift in consumer preferences towards premium and indulgent ice cream products, enhancing overall demand. As disposable incomes continue to rise, the potential for growth in the ice cream sector remains substantial.

- Expanding Urbanization: Urbanization in the Middle East and Africa is a critical driver for the ice cream market, with urban populations expected to grow from 60% in 2022 to about 62% in 2024. The urban population's increase translates to an estimated 8 million additional urban residents in the region, fostering a growing demand for convenient and premium ice cream products. Urban areas typically offer a higher concentration of retail outlets and food service establishments, making ice cream more accessible. This shift towards urban living is expected to lead to more frequent indulgences in ice cream consumption as lifestyles change.

- Increasing Demand for Premium Products: The trend toward premium ice cream products is growing, driven by consumer preferences for high-quality, artisanal offerings. In 2024, the premium ice cream segment accounts for about $1.2 billion in revenue in the region, with a 10% increase from 2022 figures. This demand is propelled by rising consumer awareness about quality ingredients, unique flavors, and innovative product offerings. As consumers become more discerning, they are willing to pay higher prices for artisanal ice cream, fueling growth in the premium segment. This trend is expected to continue as brands focus on product differentiation and quality enhancements.

Market Challenges

- High Import Taxes on Ingredients: High import taxes on dairy ingredients and other components pose significant challenges to the ice cream market in the Middle East and Africa. For instance, countries like South Africa impose tariffs as high as 25% on imported dairy products. This taxation increases production costs for ice cream manufacturers, leading to higher retail prices for consumers. The burden of import taxes can deter potential market entrants and restrict the growth of local manufacturers aiming to produce a variety of ice cream flavors and products. Regulatory changes or trade agreements could potentially mitigate these challenges, but the current landscape remains difficult for producers.

- Fluctuations in Raw Material Prices: Fluctuations in global dairy prices significantly impact the ice cream market in the region. As of 2024, the average price of whole milk powder hovers around $4,300 per ton, reflecting a rise from $3,700 in 2022 due to supply chain disruptions and climate-related challenges affecting dairy production. These price increases can squeeze profit margins for ice cream manufacturers, leading to potential price hikes for consumers. Such volatility in raw material prices poses a consistent challenge for manufacturers, requiring them to navigate cost management strategies effectively to remain competitive in the market.

Middle East & Africa Ice Cream Market Future Outlook

Over the next few years, the Middle East & Africa ice cream market is expected to show moderate growth driven by increasing urbanization, a growing middle-class population, and higher consumer spending on premium products. Rising health consciousness among consumers is likely to boost demand for non-dairy and organic ice creams, while innovations in flavor and packaging will further stimulate market expansion. Key regional players are also expected to capitalize on opportunities in untapped markets, particularly in sub-Saharan Africa and East Africa, where ice cream consumption is gradually increasing. The growing presence of e-commerce platforms will also contribute to the expansion of the market, providing consumers with a more convenient shopping experience.

Opportunities

- Rise in Health-Conscious Consumers: The shift towards health-conscious consumerism is creating new opportunities within the ice cream market. In 2024, organic ice cream sales are projected to account for approximately $200 million in revenue, up from $150 million in 2022. As consumers increasingly prioritize health and wellness, there is a growing demand for low-fat, low-sugar, and organic ice cream options. Brands that focus on these healthier alternatives are likely to attract a broader customer base. The rise in health awareness presents a significant opportunity for market players to innovate and meet the evolving preferences of consumers.

- Penetration into Untapped Markets: Expanding into untapped rural markets presents a notable growth opportunity for the ice cream industry in the Middle East and Africa. Currently, rural areas account for approximately 35% of total ice cream consumption, which is expected to increase as distribution networks improve. By focusing on rural outreach and tailored marketing strategies, ice cream manufacturers can cater to emerging consumer segments. The increase in disposable income in these regions, coupled with a growing preference for indulgent treats, signifies an opportunity for manufacturers to penetrate these markets effectively

Scope of the Report

|

By Product Type |

Dairy-Based Ice Cream Non-Dairy Ice Cream Sorbet and Sherbet Gelato Frozen Yogurt |

|

By Ingredient |

Milk & Cream Sweeteners Stabilizers & Emulsifiers Flavors & Additives Fruits & Nuts |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Channels Specialty Stores Ice Cream Parlors |

|

By Consumer Demographic |

Children (Aged 1-12) Teenagers (Aged 13-19) Adults (Aged 20-59) Seniors (Aged 60+) |

|

By Region |

GCC Countries North Africa Sub-Saharan Africa East Africa Southern Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Dubai Municipality, Saudi Food and Drug Authority)

Food and Beverage Companies

Tourism and Hospitality Industries

Import and Distribution Industries

E-commerce Companies

Dairy Produce Companies

Companies

Players Mentioned in the Report:

Unilever Group

Nestl S.A.

Mars, Inc.

General Mills

Lotte Confectionery

Almarai

R&R Ice Cream

Cold Stone Creamery

Carvel Corporation

Blue Bell Creameries

Dairy Queen

Baskin-Robbins

Hagen-Dazs

Kwality Ice Cream

IFFCO Group

Table of Contents

1. Middle East & Africa Ice Cream Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (By Product Type, By Distribution Channel, By Ingredient, By Region, By Consumer Demographic)

1.3. Market Growth Rate (Annual Market Growth Rate in %)

1.4. Market Segmentation Overview

2. Middle East & Africa Ice Cream Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (In Value %)

2.3. Key Market Developments and Milestones

3. Middle East & Africa Ice Cream Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Disposable Income (Per Capita Income Growth in USD)

3.1.2. Expanding Urbanization (Urban Population % Growth)

3.1.3. Increasing Demand for Premium Products

3.1.4. Growth in Tourism Sector (Tourist Arrivals and Impact on Ice Cream Consumption)

3.2. Market Challenges

3.2.1. High Import Taxes on Ingredients

3.2.2. Fluctuations in Raw Material Prices (Global Dairy Prices)

3.2.3. Regulatory Hurdles for New Product Introductions (Food Safety Standards)

3.3. Opportunities

3.3.1. Rise in Health-Conscious Consumers (Demand for Low-Fat and Organic Ice Cream)

3.3.2. Penetration into Untapped Markets (Rural Market Consumption Trends)

3.3.3. Increased Brand Collaborations with Cafs and Restaurants

3.4. Trends

3.4.1. Shift Towards Non-Dairy Alternatives (Market Share of Vegan Ice Cream)

3.4.2. Growth of Artisanal Ice Cream Brands (Number of Small-Scale Manufacturers)

3.4.3. Expansion of E-Commerce Channels (Online Sales Contribution in %)

3.5. Government Regulation

3.5.1. Local Food Safety Guidelines

3.5.2. Tariffs on Imported Dairy Ingredients

3.5.3. Regional Free Trade Agreements Impact on Ice Cream Sector

3.6. SWOT Analysis (Specific to Middle East & Africa Ice Cream Market)

3.7. Stake Ecosystem (Key Stakeholders in the Market)

3.8. Porters Five Forces (Bargaining Power of Suppliers, Buyers, Threat of New Entrants, Threat of Substitutes, Competitive Rivalry)

3.9. Competition Ecosystem (Overview of Competitive Landscape)

4. Middle East & Africa Ice Cream Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Dairy-Based Ice Cream

4.1.2. Non-Dairy Ice Cream (Vegan Alternatives)

4.1.3. Sorbet and Sherbet

4.1.4. Gelato

4.1.5. Frozen Yogurt

4.2. By Ingredient (In Value %)

4.2.1. Milk & Cream

4.2.2. Sweeteners

4.2.3. Stabilizers & Emulsifiers

4.2.4. Flavors & Additives

4.2.5. Fruits & Nuts

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail Channels

4.3.4. Specialty Stores

4.3.5. Ice Cream Parlors

4.4. By Consumer Demographic (In Value %)

4.4.1. Children (Aged 1-12)

4.4.2. Teenagers (Aged 13-19)

4.4.3. Adults (Aged 20-59)

4.4.4. Seniors (Aged 60+)

4.5. By Region (In Value %)

4.5.1. GCC Countries

4.5.2. North Africa

4.5.3. Sub-Saharan Africa

4.5.4. East Africa

4.5.5. Southern Africa

5. Middle East & Africa Ice Cream Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Unilever Group

5.1.2. Nestl S.A.

5.1.3. Mars, Inc.

5.1.4. General Mills

5.1.5. Lotte Confectionery

5.1.6. Almarai

5.1.7. R&R Ice Cream

5.1.8. Cold Stone Creamery

5.1.9. Carvel Corporation

5.1.10. Blue Bell Creameries

5.1.11. Dairy Queen

5.1.12. Baskin-Robbins

5.1.13. Hagen-Dazs

5.1.14. Kwality Ice Cream

5.1.15. IFFCO Group

5.2. Cross Comparison Parameters (Revenue, Manufacturing Facilities, Regional Presence, Distribution Channels, Product Portfolio, Employee Count, Marketing Spend, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Collaborations, Partnerships)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Middle East & Africa Ice Cream Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Import and Export Regulations

6.3. Licensing and Certification Requirements

7. Middle East & Africa Ice Cream Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Middle East & Africa Ice Cream Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredient (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Consumer Demographic (In Value %)

8.5. By Region (In Value %)

9. Middle East & Africa Ice Cream Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Preferences and Demand Shifts

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the entire ice cream ecosystem across the Middle East & Africa. This includes extensive desk research to identify key industry players, consumption patterns, and product demand drivers. Proprietary databases and credible secondary sources such as government and trade association reports are used to define the market structure.

Step 2: Market Analysis and Construction

Historical data on ice cream consumption, production, and import/export statistics is compiled and analyzed to build a comprehensive market model. Key variables such as market penetration rates, distribution networks, and revenue generation trends are thoroughly assessed. The accuracy of data is ensured through triangulation with multiple sources.

Step 3: Hypothesis Validation and Expert Consultation

To validate our findings, we consult industry experts from leading companies and regulatory bodies. These consultations provide deep insights into market dynamics, competitive positioning, and regional opportunities. Feedback from stakeholders is incorporated into the final data set to refine our analysis.

Step 4: Research Synthesis and Final Output

In the final stage, data is synthesized into actionable insights, supported by primary and secondary sources. A bottom-up approach is employed to estimate market sizes across segments, and the final report is generated with detailed competitive analysis and future growth recommendations.

Frequently Asked Questions

01. How big is the Middle East & Africa Ice Cream Market?

The Middle East & Africa ice cream market was valued at USD 3.5 billion. Its growth is driven by higher disposable incomes, an expanding tourism sector, and favorable climatic conditions in the region.

02. What are the challenges in the Middle East & Africa Ice Cream Market?

Challenges include fluctuating raw material prices, particularly dairy, and regulatory hurdles, such as strict food safety standards and high import duties on ingredients.

03. Who are the major players in the Middle East & Africa Ice Cream Market?

Key players in the market include Unilever Group, Nestl S.A., Mars, Inc., General Mills, and Lotte Confectionery. These companies lead the market due to their extensive product portfolios and robust distribution networks.

04. What are the growth drivers of the Middle East & Africa Ice Cream Market?

Growth drivers include increasing disposable income, expanding urbanization, rising demand for premium ice cream products, and growth in the tourism sector.

05. What are the latest trends in the Middle East & Africa Ice Cream Market?

Trends include the growing popularity of non-dairy and organic ice cream, increased consumer interest in artisanal and premium products, and the rise of e-commerce as a distribution channel.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.