Middle East & Africa Marine Vessel Market Outlook to 2030

Region:Global

Author(s):Abhinav Kumar

Product Code:KROD5075

December 2024

93

About the Report

Middle East & Africa Marine Vessel Market Overview

- The Middle East & Africa Marine Vessel market is valued at USD 9 billion, based on a five-year historical analysis. This growth is primarily driven by increased maritime trade and the rise of offshore energy projects, including oil and gas exploration activities. The surge in demand for oil and natural gas exports, coupled with the regions strategic importance as a global trade route, has catalyzed the development of both commercial and defense vessels. These factors are crucial in driving the overall market size.

- Major cities and countries such as Dubai, Abu Dhabi, and Nigeria dominate the Middle East & Africa Marine Vessel market due to their expansive port infrastructure, strategic geographic positioning, and significant investments in maritime logistics. Countries like the UAE and Nigeria are key players because of their pivotal roles in the global energy market and their continual advancements in port technology, making them central hubs for maritime traffic and vessel demand.

- The IMO 2020 regulation mandates that sulphur emissions from marine vessels must be reduced to 0.5%, significantly lower than the previous limit. Compliance has been particularly challenging for older vessels in the MEA region. However, governments, such as Saudi Arabia and Egypt, have begun implementing national compliance programs to support ship operators. These programs offer incentives for adopting cleaner technologies, such as scrubbers and LNG propulsion systems, to ensure adherence to the new standards.

Middle East & Africa Marine Vessel Market Segmentation

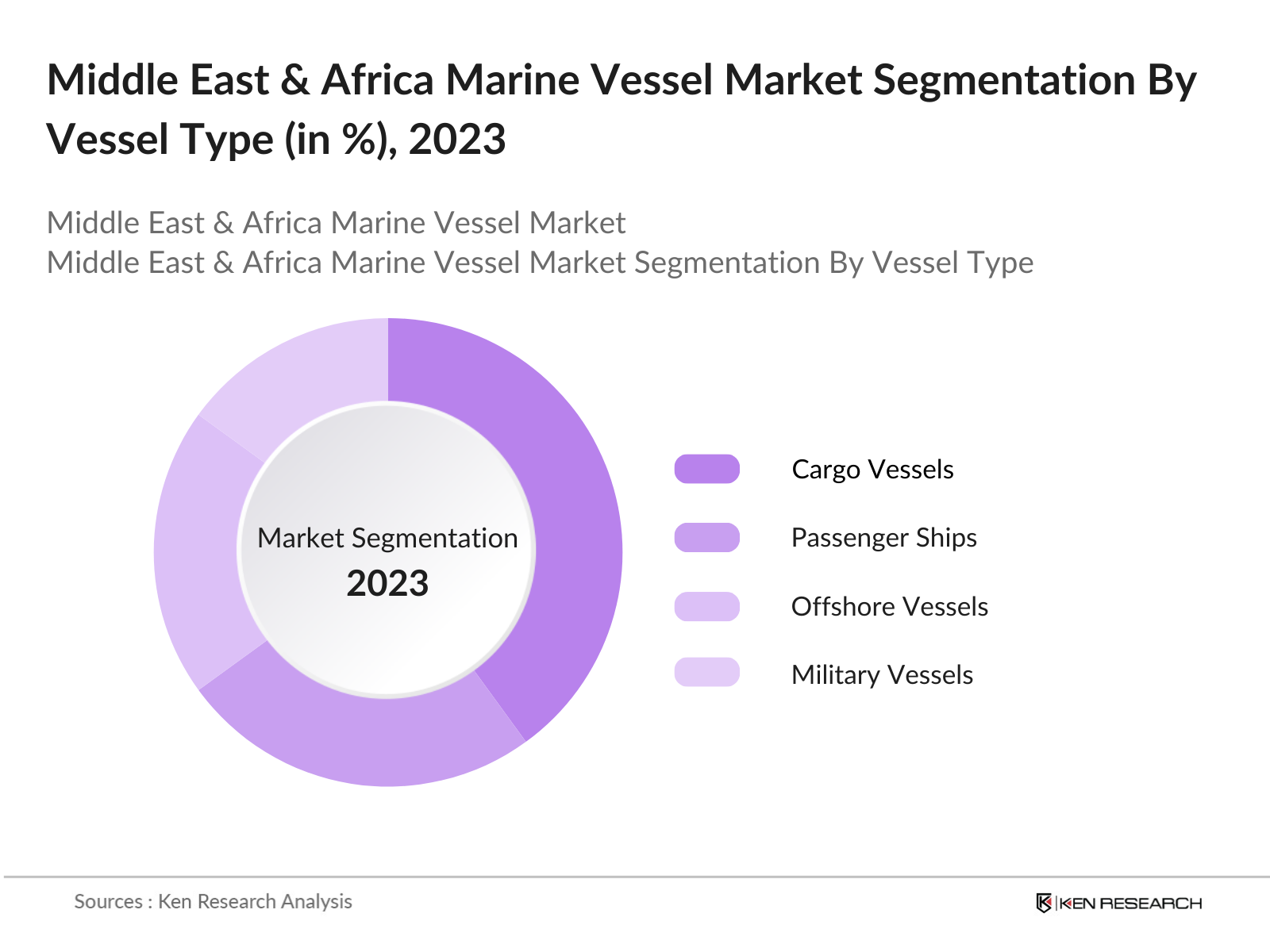

By Vessel Type: The Middle East & Africa Marine Vessel market is segmented by vessel type into cargo vessels, passenger ships, offshore vessels, and military vessels. Recently, cargo vessels have gained a dominant market share due to the increasing international seaborne trade and the heavy reliance of Middle Eastern and African economies on exports of oil, gas, and other natural resources. The expansion of major shipping routes like the Suez Canal and extensive investment in cargo infrastructure across key ports have also contributed to this growth.

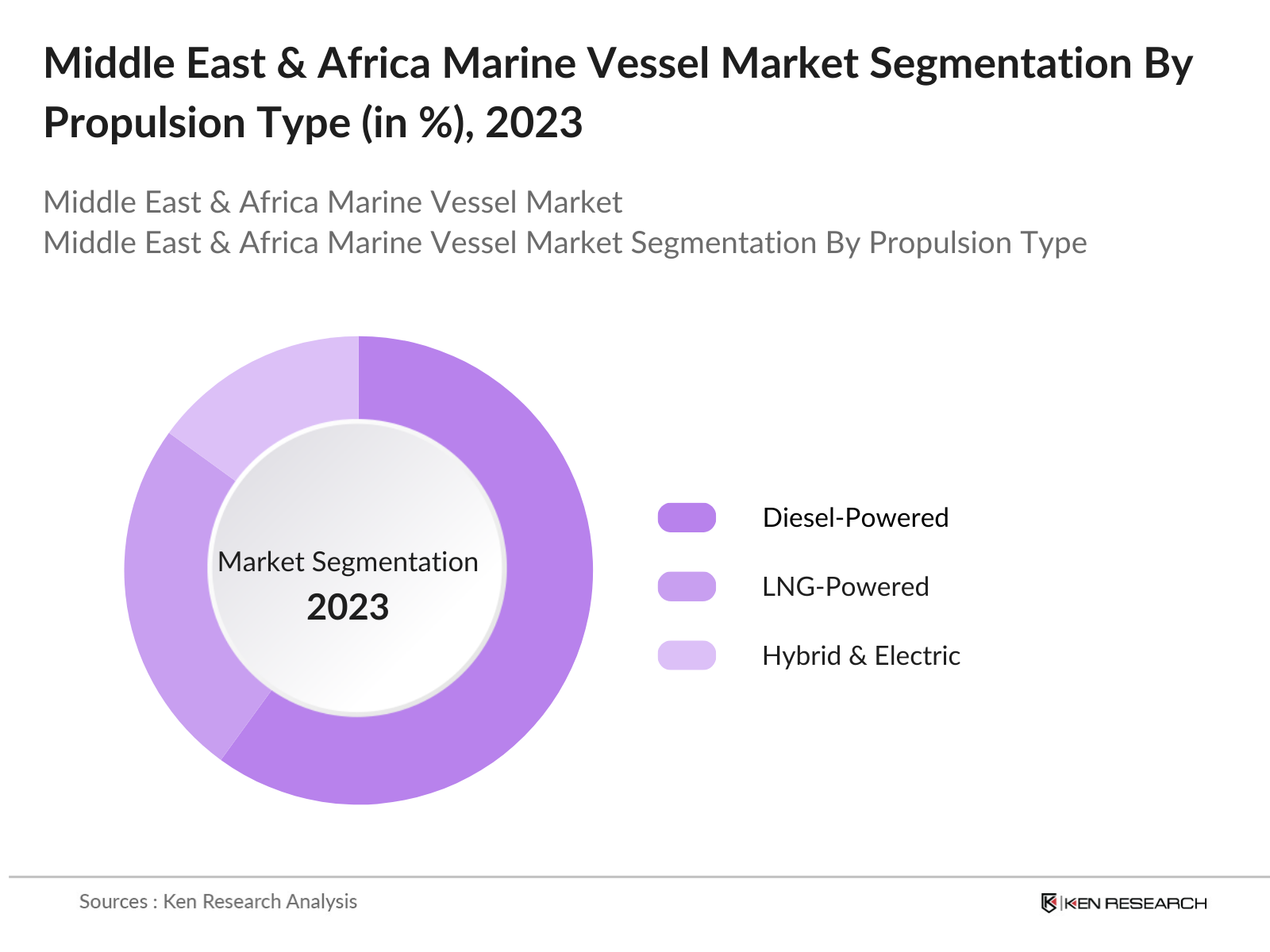

By Propulsion Type: The market is also segmented by propulsion type into diesel-powered vessels, LNG-powered vessels, and hybrid & electric vessels. Diesel-powered vessels dominate the market, holding the largest share, as they remain the preferred choice due to their established technology and widespread availability. However, with growing environmental concerns and stringent emissions regulations, LNG-powered and hybrid vessels are gaining traction, especially in the GCC countries where investments in cleaner marine fuels are increasing.

Middle East & Africa Marine Vessel Market Competitive Landscape

The Middle East & Africa Marine Vessel market is characterized by the presence of both local and international players. Companies like Hyundai Heavy Industries and Damen Shipyards Group dominate the market, along with local players like Abu Dhabi Ship Building. These firms have a substantial influence due to their innovative vessel designs, shipbuilding capacity, and strong connections with governments and military sectors. The competitive landscape is highly consolidated, with the top five players contributing significantly to the markets total revenue. The market's competitiveness is further heightened by companies investing in green technologies and expanding into autonomous shipping, a growing trend in the region.

|

Company Name |

Establishment Year |

Headquarters |

Shipbuilding Capacity |

Order Backlog |

R&D Spending |

No. of Employees |

Global Presence |

|

Hyundai Heavy Industries |

1972 |

Ulsan, South Korea |

_ |

_ |

_ |

_ |

_ |

|

Damen Shipyards Group |

1927 |

Gorinchem, Netherlands |

_ |

_ |

_ |

_ |

_ |

|

Abu Dhabi Ship Building |

1996 |

Abu Dhabi, UAE |

_ |

_ |

_ |

_ |

_ |

|

Mitsubishi Heavy Industries |

1884 |

Tokyo, Japan |

_ |

_ |

_ |

_ |

_ |

|

Fincantieri S.p.A. |

1959 |

Trieste, Italy |

_ |

_ |

_ |

_ |

_ |

Middle East & Africa Marine Vessel Industry Analysis

Growth Drivers

- Increase in Seaborne Trade: Seaborne trade has significantly contributed to the growth of the Middle East & Africa (MEA) marine vessel market. Global trade volumes in 2023 exceeded 11 billion metric tons, with a considerable portion handled via sea routes. The MEA region's strategic location between Asia, Europe, and North America makes it a pivotal point for global maritime transport. The expansion of maritime transport infrastructure, particularly in ports like Jeddah and Durban, facilitates increased cargo throughput, boosting vessel demand. The World Bank reported a steady increase in trade facilitation efforts across the region to support this growth.

- Offshore Oil & Gas Exploration: Offshore oil and gas exploration remains a vital driver of the marine vessel market in MEA, with energy operations off the coasts of countries like Nigeria, Angola, and Saudi Arabia. In 2023, offshore oil production contributed over 25% to the region's total output. Demand for exploration vessels has increased due to expanding deep-sea drilling activities. Notably, Saudi Aramco's offshore projects contributed to a significant rise in vessel use. Energy sector investments from Gulf countries further reinforce this trend.

- Naval Modernization Programs: Naval defense spending has surged across the MEA region, driving demand for advanced marine vessels. In 2023, Saudi Arabia and the UAE committed over USD 20 billion toward modernizing their naval fleets, while African nations like Egypt invested in both coastal defense and international maritime security initiatives. These investments reflect the growing need to secure shipping lanes and counter piracy. The increased budget allocation for defense bolsters demand for technologically advanced naval vessels across the region.

Market Challenges

- High Operating and Fuel Costs: Fuel prices have been volatile in recent years, with crude oil prices surpassing USD 80 per barrel in 2023. High fuel costs have directly impacted the operating expenses of marine vessels in the MEA region, especially given the reliance on oil-based fuels. Shipping companies face difficulties maintaining profitability amid these rising operational costs. The need for energy-efficient solutions, such as LNG-fueled ships, is growing as operators struggle to mitigate fuel price fluctuations.

- Stringent Environmental Regulations: Environmental regulations, particularly those enforced by the International Maritime Organization, present significant challenges for the marine vessel market. The IMO 2020 sulphur cap mandates that marine vessels reduce sulphur emissions to 0.5% globally, with even stricter limits in emission control areas. Compliance with these regulations requires significant retrofitting or adopting expensive green technologies, which can increase operational costs for ship operators across the MEA region.

Middle East & Africa Marine Vessel Market Future Outlook

Over the next five years, the Middle East & Africa Marine Vessel market is expected to witness significant growth. This growth will be fueled by increased investments in port infrastructure, advancements in vessel technology, and the shift towards greener, more energy-efficient vessels. The region's strategic importance in global trade routes, coupled with government initiatives promoting maritime development, will further enhance market prospects. Additionally, as environmental regulations tighten, demand for LNG and hybrid-powered vessels is likely to see exponential growth.

Opportunities

- Growth in Maritime Tourism: Maritime tourism, particularly the cruise industry, has seen growth in the MEA region. In 2023, over 1.7 million tourists embarked on cruises in the region, particularly in the Red Sea and Gulf regions. Countries like Saudi Arabia and the UAE have heavily invested in cruise terminals, attracting global cruise operators. The rising middle-class population and increased interest in leisure tourism support this trend, creating opportunities for marine vessels in the hospitality sector.

- Technological Innovation in Green Vessels: The adoption of electric propulsion systems in marine vessels presents a growing opportunity in the MEA market. Several governments, particularly in the Gulf, are offering incentives to companies that adopt clean technologies. In 2023, the UAE launched a sustainable shipping initiative, promoting the use of electric and hybrid vessels in coastal and short-sea shipping. This trend aligns with the global shift towards decarbonizing the maritime sector and presents a promising growth opportunity.

Scope of the Report

|

Vessel Type |

Cargo Vessels Passenger Ships Offshore Vessels Military Vessels |

|

Propulsion Type |

Diesel-Powered LNG-Powered Hybrid & Electric |

|

Application |

Commercial Defense Offshore |

|

Region |

GCC Countries South Africa Nigeria Egypt |

|

End-User |

Shipping Companies Government Authorities |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (International Maritime Organization, Suez Canal Authority)

Shipping Companies

Offshore Operation Companies

Port Industries

Naval Defense Industries

Energy Sector Corporations (Oil and Gas)

Investors and Venture Capitalist Firms

Maritime Logistics Companies

Companies

Players Mentioned in the Report

Hyundai Heavy Industries

Daewoo Shipbuilding & Marine Engineering

Samsung Heavy Industries

China State Shipbuilding Corporation

Fincantieri S.p.A.

Damen Shipyards Group

Mitsubishi Heavy Industries

Abu Dhabi Ship Building

Oman Drydock Company

Naval Group

Table of Contents

1. Middle East & Africa Marine Vessel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Commercial, Defense, Offshore, Cargo)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East & Africa Marine Vessel Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East & Africa Marine Vessel Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Seaborne Trade

3.1.2. Offshore Oil & Gas Exploration

3.1.3. Naval Modernization Programs

3.1.4. Technological Advancements in Vessel Design

3.2. Market Challenges

3.2.1. High Operating and Fuel Costs

3.2.2. Stringent Environmental Regulations

3.2.3. Volatility in Global Trade

3.3. Opportunities

3.3.1. Growth in Maritime Tourism

3.3.2. Technological Innovation in Green Vessels

3.3.3. Investments in Port Infrastructure

3.4. Trends

3.4.1. Shift Toward LNG-Powered Vessels

3.4.2. Adoption of Digitalization & AI in Marine Operations

3.4.3. Rising Demand for Autonomous Vessels

3.5. Government Regulation

3.5.1. IMO 2020 Emission Standards

3.5.2. National Maritime Safety Regulations

3.5.3. Environmental Incentives for Green Ships

3.5.4. Subsidies for Shipbuilding

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem (Shipbuilders, Owners, Operators)

3.8. Porters Five Forces Analysis

3.8.1. Threat of New Entrants

3.8.2. Bargaining Power of Buyers

3.8.3. Bargaining Power of Suppliers

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competition Ecosystem (Marine Transport, Offshore Shipping)

4. Middle East & Africa Marine Vessel Market Segmentation

4.1. By Vessel Type (In Value %)

4.1.1. Cargo Vessels

4.1.2. Passenger Ships

4.1.3. Offshore Vessels

4.1.4. Military Vessels

4.2. By Propulsion Type (In Value %)

4.2.1. Diesel-Powered

4.2.2. LNG-Powered

4.2.3. Hybrid & Electric

4.3. By Application (In Value %)

4.3.1. Commercial

4.3.2. Defense

4.3.3. Offshore

4.4. By Region (In Value %)

4.4.1. GCC Countries

4.4.2. South Africa

4.4.3. Nigeria

4.4.4. Egypt

4.5. By End-User (In Value %)

4.5.1. Shipping Companies

4.5.2. Government Authorities

4.5.3. Offshore Operators

4.5.4. Private Owners

5. Middle East & Africa Marine Vessel Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Hyundai Heavy Industries

5.1.2. Daewoo Shipbuilding & Marine Engineering

5.1.3. Samsung Heavy Industries

5.1.4. China State Shipbuilding Corporation

5.1.5. Fincantieri S.p.A.

5.1.6. Damen Shipyards Group

5.1.7. Mitsubishi Heavy Industries

5.1.8. Abu Dhabi Ship Building

5.1.9. Oman Drydock Company

5.1.10. Naval Group

5.1.11. Huntington Ingalls Industries

5.1.12. Austal Limited

5.1.13. China Shipbuilding Industry Corporation

5.1.14. Keppel Offshore & Marine

5.1.15. STX Offshore & Shipbuilding

5.2. Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Headquarters Location

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Order Backlog

5.2.6. Shipbuilding Capacity

5.2.7. R&D Spending

5.2.8. Geographic Presence

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures & Partnerships

5.8. Government Grants

6. Middle East & Africa Marine Vessel Market Regulatory Framework

6.1. Environmental Standards (IMO, MARPOL)

6.2. Compliance Requirements

6.3. Certification Processes (Classification Societies)

7. Middle East & Africa Marine Vessel Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Middle East & Africa Marine Vessel Future Market Segmentation

8.1. By Vessel Type (In Value %)

8.2. By Propulsion Type (In Value %)

8.3. By Application (In Value %)

8.4. By Region (In Value %)

8.5. By End-User (In Value %)

9. Middle East & Africa Marine Vessel Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by mapping out the entire ecosystem of the Middle East & Africa Marine Vessel Market. Through extensive desk research and proprietary databases, we identified critical variables influencing market growth, such as trade volume, energy exports, and defense budgets.

Step 2: Market Analysis and Construction

We then compiled historical data to assess market penetration and shipbuilding activity. This involved evaluating trends in commercial and defense vessels, port infrastructure investments, and demand for fuel-efficient vessels.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses were validated through direct consultation with industry experts, including shipbuilding companies, port authorities, and energy sector stakeholders, using computer-assisted telephone interviews (CATIs).

Step 4: Research Synthesis and Final Output

The final research phase involved integrating insights from various manufacturers to verify key statistics on market segments, vessel design, and propulsion trends, ensuring an accurate, validated analysis.

Frequently Asked Questions

01. How big is the Middle East & Africa Marine Vessel Market?

The Middle East & Africa Marine Vessel Market is valued at USD 9 billion. It is driven by increased maritime trade, energy exploration projects, and strategic government investments in shipbuilding.

02. What are the challenges in the Middle East & Africa Marine Vessel Market?

Key challenges include high operational costs, stringent environmental regulations, and geopolitical uncertainties that can affect trade routes and demand for maritime logistics services.

03. Who are the major players in the Middle East & Africa Marine Vessel Market?

The market is dominated by Hyundai Heavy Industries, Damen Shipyards Group, Abu Dhabi Ship Building, and Fincantieri, known for their shipbuilding capacities and technological advancements.

04. What are the growth drivers of the Middle East & Africa Marine Vessel Market?

Growth is propelled by increasing global trade, demand for oil and gas exports, and investments in green vessel technologies such as LNG-powered ships.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.