Middle East & Africa Pharmaceuticals Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD11182

December 2024

82

About the Report

Middle East & Africa Pharmaceuticals Market Overview

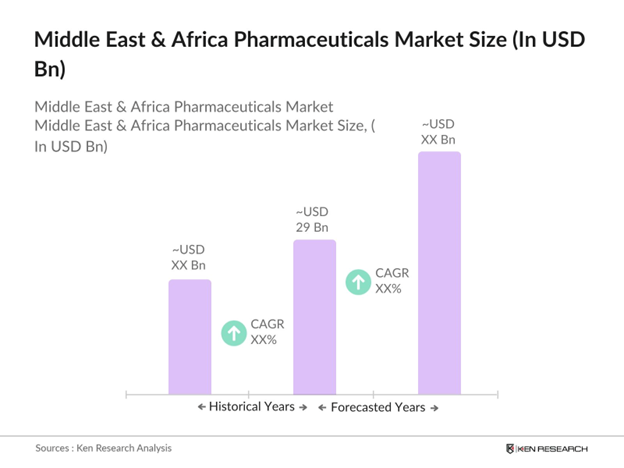

- The Middle East & Africa (MEA) pharmaceuticals market is valued at USD 29 billion, driven by a growing population, increasing prevalence of chronic diseases, and rising healthcare expenditures. The region's expanding healthcare infrastructure and government initiatives to improve medical access further contribute to market growth.

- Saudi Arabia and South Africa are dominant players in the MEA pharmaceuticals market. Saudi Arabia's dominance is attributed to its substantial healthcare investments and a robust pharmaceutical manufacturing sector. South Africa leads due to its well-established healthcare system and status as a hub for pharmaceutical research and development.

- The drug approval processes in the Middle East and Africa (MEA) region are diverse, reflecting the varying regulatory frameworks of individual countries. In Africa, the African Medicines Agency (AMA) was established in 2019 to enhance regulatory harmonization across the continent. However, as of 2022, only 15 countries had ratified the treaty establishing the AMA, indicating ongoing efforts toward regulatory cohesion. These varying approval processes can impact the time-to-market for new drugs, necessitating strategic navigation by pharmaceutical companies.

Middle East & Africa Pharmaceuticals Market Segmentation

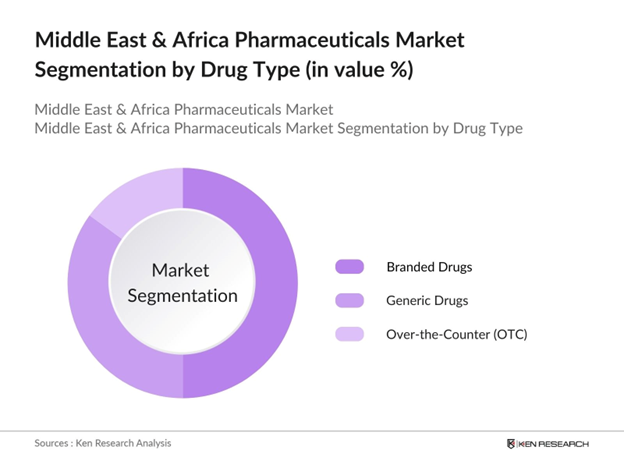

By Drug Type: The MEA pharmaceuticals market is segmented by drug type into branded drugs, generic drugs, and over-the-counter (OTC) drugs. Branded drugs hold a dominant market share due to strong brand recognition and physician preference for established medications. However, the generic drugs segment is experiencing significant growth, driven by cost-effectiveness and government policies promoting generic drug use.

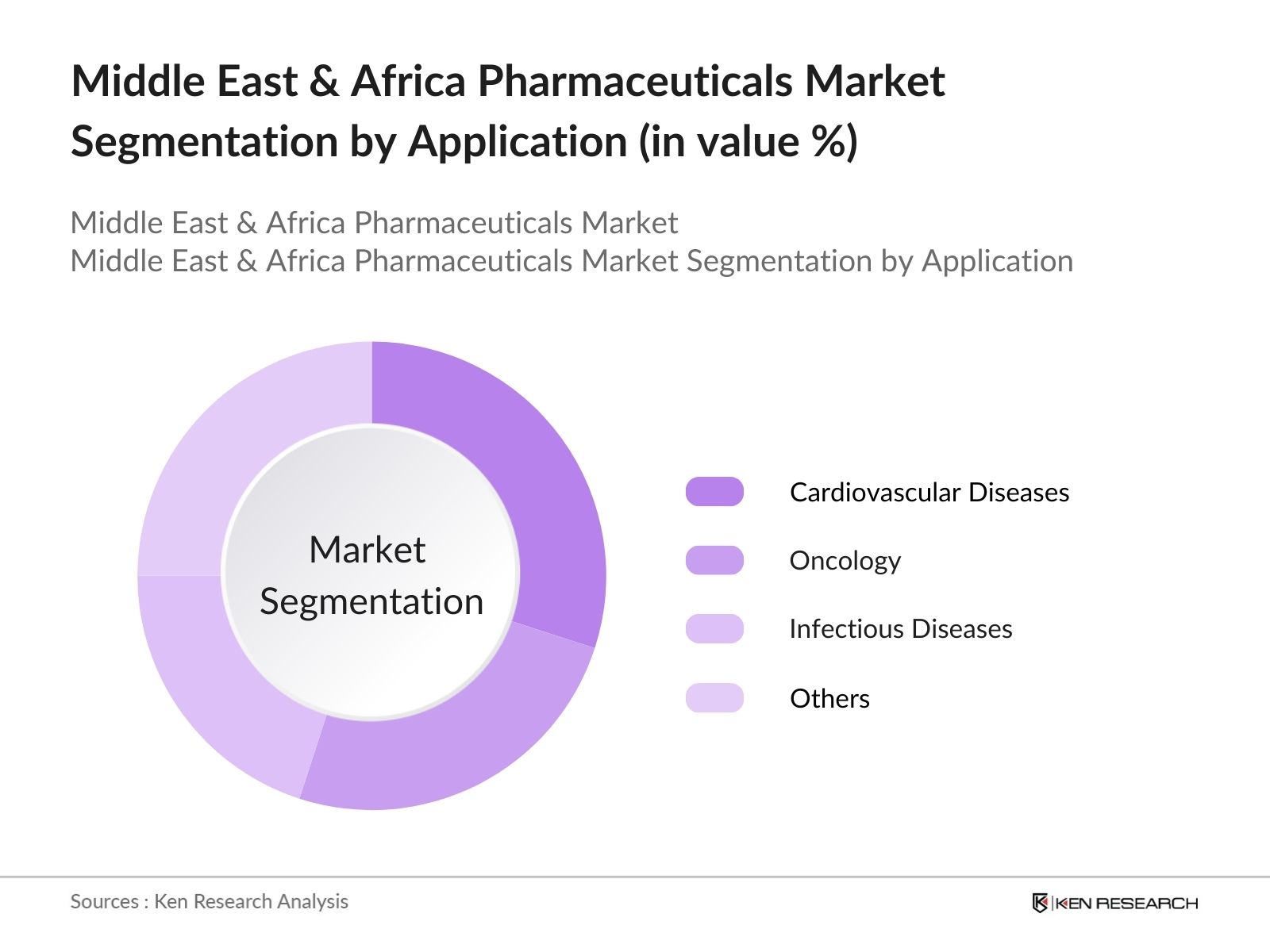

By Application: The market is also segmented by application into cardiovascular diseases, oncology, infectious diseases, and others. Cardiovascular diseases dominate the market share, reflecting the high prevalence of heart-related conditions in the region. Oncology is a rapidly growing segment, driven by increasing cancer incidence and advancements in cancer treatment therapies.

Middle East & Africa Pharmaceuticals Market Competitive Landscape

The MEA pharmaceuticals market is characterized by the presence of both multinational corporations and local companies. Key players include Pfizer Inc., Novartis AG, Sanofi S.A., GlaxoSmithKline plc, and AstraZeneca plc. These companies maintain a strong market presence through extensive product portfolios, strategic partnerships, and continuous investment in research and development.

Middle East & Africa Pharmaceuticals Market Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases: The Middle East and Africa (MEA) region is experiencing a significant rise in chronic diseases. For instance, the International Diabetes Federation reported that in 2021, approximately 73 million adults aged 20-79 in the Middle East and North Africa (MENA) region were living with diabetes, a number projected to increase substantially in the coming years. This escalating burden underscores the growing demand for pharmaceutical interventions to manage and treat chronic conditions.

- Rising Healthcare Expenditure: Healthcare spending in the MEA region has been on an upward trajectory. According to the World Bank, Saudi Arabia's health expenditure per capita increased from $1,147 in 2018 to $1,274 in 2020. Similarly, South Africa's health expenditure per capita rose from $526 in 2018 to $570 in 2020. This increase in healthcare spending reflects a commitment to improving healthcare infrastructure and access, thereby boosting the pharmaceutical market.

- Government Initiatives and Healthcare Reforms: Governments across the MEA region are implementing reforms to enhance healthcare delivery. For example, Saudi Arabia's Vision 2030 aims to privatize healthcare services and increase private sector participation from 25% to 35% by 2025. In Egypt, the Universal Health Insurance Law, enacted in 2018, seeks to provide comprehensive health coverage to all citizens by 2032. These initiatives are expected to increase the demand for pharmaceuticals as access to healthcare services expands.

Challenges

- Counterfeit Medicines and Drug Quality Concerns: The proliferation of counterfeit medicines poses a significant challenge in the MEA region. The issue of counterfeit medicines significantly affects public health in Africa, with estimates suggesting that nearly 500,000 deaths occur annually due to trafficked medical products in sub-Saharan Africa alone. This includes deaths linked to substandard antimalarial and antibiotic treatments. This issue undermines patient trust and poses serious health risks, necessitating stringent regulatory measures to ensure drug quality and safety.

- Intellectual Property Rights and Patent Protection Issues: Intellectual property rights (IPR) enforcement varies across the MEA region, affecting pharmaceutical innovation. The Global Innovation Index 2021 ranked South Africa 61st and Egypt 94th out of 132 economies in terms of IPR protection. Weak IPR enforcement can deter investment in pharmaceutical research and development, impacting the availability of new and innovative drugs.

Middle East & Africa Pharmaceuticals Market Future Outlook

Over the next five years, the MEA pharmaceuticals market is expected to experience significant growth, driven by continuous government support, advancements in pharmaceutical technologies, and increasing consumer demand for effective healthcare solutions. The expansion of healthcare infrastructure and rising awareness of chronic diseases will further propel market growth.

Market Opportunities

- Expanding Access to Healthcare Services: Efforts to expand healthcare access are creating opportunities in the pharmaceutical market. A study reported that healthcare access in Sub-Saharan Africa (SSA) stands at approximately42.56%, indicating limited access despite global targets for universal health coverage (SDG 3.8) aimed at ensuring everyone can obtain necessary health services. This expansion increases the demand for pharmaceuticals to meet the healthcare needs of a growing population.

- Growth in Generic Pharmaceuticals: The demand for affordable medications is boosting the generic pharmaceuticals market in the MEA region. In South Africa, generics accounted for 65% of the pharmaceutical market volume in 2020, according to the South African Health Products Regulatory Authority. The MEA region's population growth, coupled with increasing life expectancy, is driving demand for healthcare services, including pharmaceuticals. As a result, generic drugs are becoming essential for providing affordable healthcare solutions to a broader population segment.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Drug Type |

- Branded Drugs |

|

By Product Type |

- Prescription Medicines |

|

By Application |

- Cardiovascular Diseases |

|

By Distribution Channel |

- Hospital Pharmacies |

|

By Country |

- Saudi Arabia |

Products

Key Target Audience

Pharmaceutical Manufacturers

Healthcare Providers

Research and Development Organizations

Healthcare Insurance Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority, South African Health Products Regulatory Authority)

Companies

Players Mentioned in the Report

Pfizer Inc.

Novartis AG

Sanofi S.A.

GlaxoSmithKline plc

AstraZeneca plc

Johnson & Johnson

Merck & Co., Inc.

Roche Holding AG

AbbVie Inc.

Cipla Limited

Table of Contents

1. Middle East & Africa Pharmaceuticals Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Middle East & Africa Pharmaceuticals Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Middle East & Africa Pharmaceuticals Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Prevalence of Chronic Diseases

3.1.2 Rising Healthcare Expenditure

3.1.3 Government Initiatives and Healthcare Reforms

3.1.4 Technological Advancements and Innovation

3.2 Market Challenges

3.2.1 Counterfeit Medicines and Drug Quality Concerns

3.2.2 Intellectual Property Rights and Patent Protection Issues

3.2.3 Regulatory Hurdles and Compliance

3.3 Opportunities

3.3.1 Expanding Access to Healthcare Services

3.3.2 Medical Tourism and Healthcare Investments

3.3.3 Growth in Generic Pharmaceuticals

3.4 Trends

3.4.1 Adoption of Biopharmaceuticals

3.4.2 Integration of Digital Health Technologies

3.4.3 Personalized Medicine Approaches

3.5 Government Regulations

3.5.1 Drug Approval Processes

3.5.2 Pricing and Reimbursement Policies

3.5.3 Import and Export Regulations

3.5.4 Intellectual Property Laws

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Middle East & Africa Pharmaceuticals Market Segmentation

4.1 By Drug Type (In Value %)

4.1.1 Branded Drugs

4.1.2 Generic Drugs

4.1.3 Over-the-Counter (OTC) Drugs

4.2 By Product Type (In Value %)

4.2.1 Prescription Medicines

4.2.2 OTC Medicines

4.2.3 Biopharmaceuticals

4.2.4 Active Pharmaceutical Ingredients (APIs)

4.3 By Application (In Value %)

4.3.1 Cardiovascular Diseases

4.3.2 Oncology

4.3.3 Infectious Diseases

4.3.4 Neurological Disorders

4.3.5 Respiratory Diseases

4.3.6 Gastrointestinal Disorders

4.3.7 Diabetes

4.3.8 Others

4.4 By Distribution Channel (In Value %)

4.4.1 Hospital Pharmacies

4.4.2 Retail Pharmacies

4.4.3 Online Pharmacies

4.4.4 Others

4.5 By Country (In Value %)

4.5.1 Saudi Arabia

4.5.2 South Africa

4.5.3 United Arab Emirates

4.5.4 Egypt

4.5.5 Nigeria

4.5.6 Kenya

4.5.7 Rest of Middle East & Africa

5. Middle East & Africa Pharmaceuticals Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Pfizer Inc.

5.1.2 Novartis AG

5.1.3 Sanofi S.A.

5.1.4 GlaxoSmithKline plc

5.1.5 AstraZeneca plc

5.1.6 Johnson & Johnson

5.1.7 Merck & Co., Inc.

5.1.8 Roche Holding AG

5.1.9 AbbVie Inc.

5.1.10 Cipla Limited

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Regional Presence, R&D Investment, Strategic Initiatives, Number of Employees, Headquarters)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Middle East & Africa Pharmaceuticals Regulatory Framework

6.1 Drug Approval Processes

6.2 Compliance Requirements

6.3 Certification Processes

7. Middle East & Africa Pharmaceuticals Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Middle East & Africa Pharmaceuticals Future Market Segmentation

8.1 By Drug Type (In Value %)

8.2 By Product Type (In Value %)

8.3 By Application (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Country (In Value %)

9. Middle East & Africa Pharmaceuticals Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the MEA pharmaceuticals market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the MEA pharmaceuticals market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple pharmaceutical manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the MEA pharmaceuticals market.

Frequently Asked Questions

01. How big is the Middle East & Africa Pharmaceuticals Market?

The Middle East & Africa pharmaceuticals market is valued at USD 29 billion, driven by a growing population, increasing prevalence of chronic diseases, and rising healthcare expenditures.

02. What are the challenges in the Middle East & Africa Pharmaceuticals Market?

Challenges in Middle East & Africa pharmaceuticals market include counterfeit medicines, regulatory hurdles, and intellectual property rights issues. Ensuring drug quality and compliance with varying regional regulations also pose significant challenges.

03. Who are the major players in the Middle East & Africa Pharmaceuticals Market?

Key players in Middle East & Africa pharmaceuticals market include Pfizer Inc., Novartis AG, Sanofi S.A., GlaxoSmithKline plc, and AstraZeneca plc. These companies dominate the market due to their extensive product portfolios, strong R&D capabilities, and strategic partnerships across the region.

04. What are the growth drivers of the Middle East & Africa Pharmaceuticals Market?

Growth in the MEA pharmaceuticals market is driven by factors such as an increasing prevalence of chronic diseases, government healthcare reforms, and rising healthcare expenditure. Moreover, advancements in biopharmaceuticals and expanding healthcare infrastructure in emerging economies are bolstering market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.