Middle East & Africa Satellite Communications Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD4750

December 2024

94

About the Report

Middle East & Africa Satellite Communications Market Overview

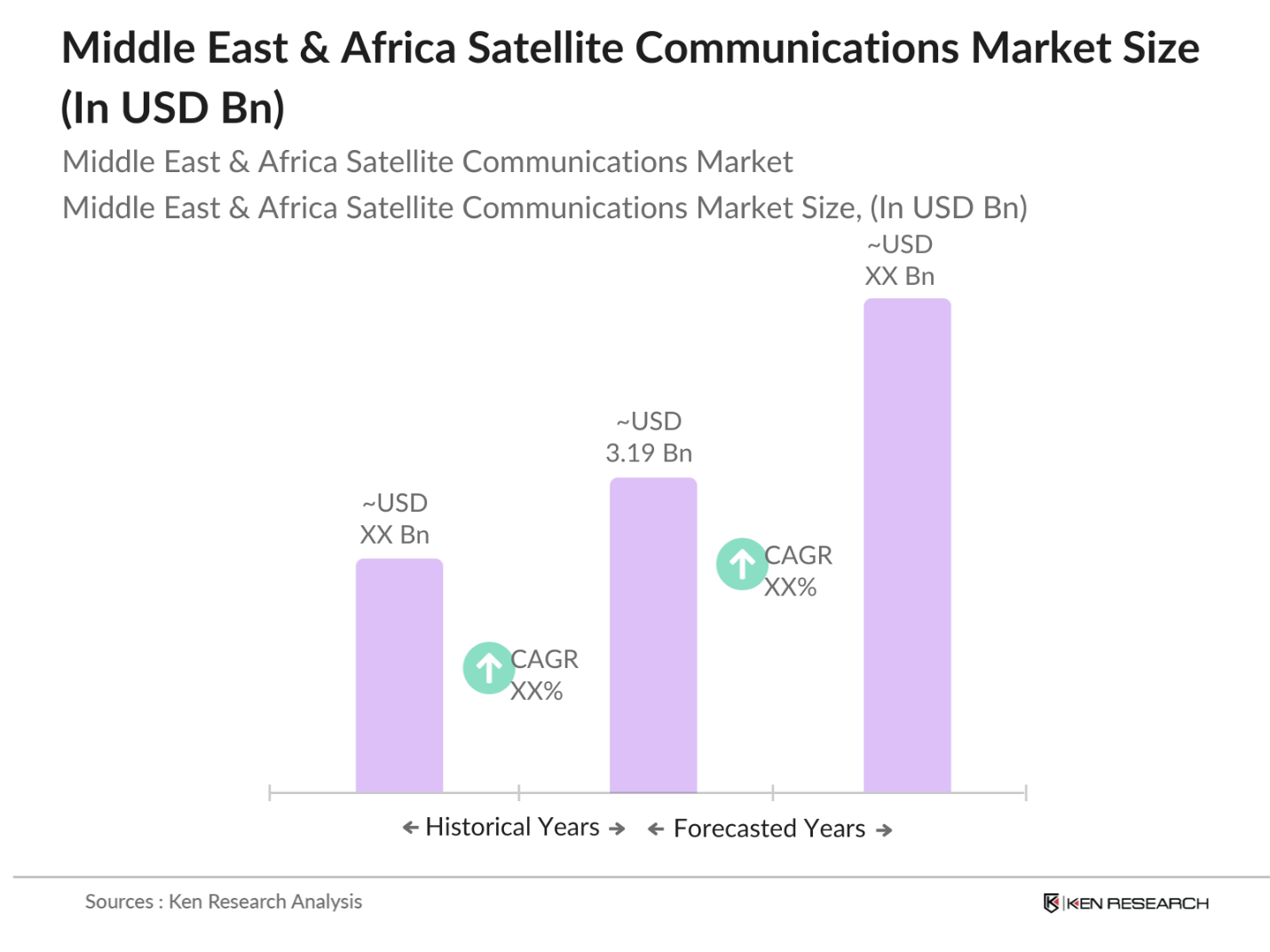

- The Middle East & Africa satellite communications market is valued at USD 3.19 Billion, based on a five-year historical analysis. The market is primarily driven by the rapid expansion of communication infrastructure in remote and underserved areas, coupled with the growing demand for high-speed broadband services in sectors like defense, media, and telecommunications. Satellite services are essential in areas with limited terrestrial network access, and the increased need for reliable, uninterrupted connectivity is a significant driver of market growth.

- The Middle East & Africa region is dominated by countries like Saudi Arabia, South Africa, and the UAE. These countries have robust satellite infrastructure due to high demand for advanced communication technologies in military, commercial, and government sectors. Their dominance is attributed to strong government investments in satellite technology, strategic geographic positioning for global communication, and the rising adoption of low Earth orbit (LEO) satellites to serve the growing demand for broadband and mobile communications.

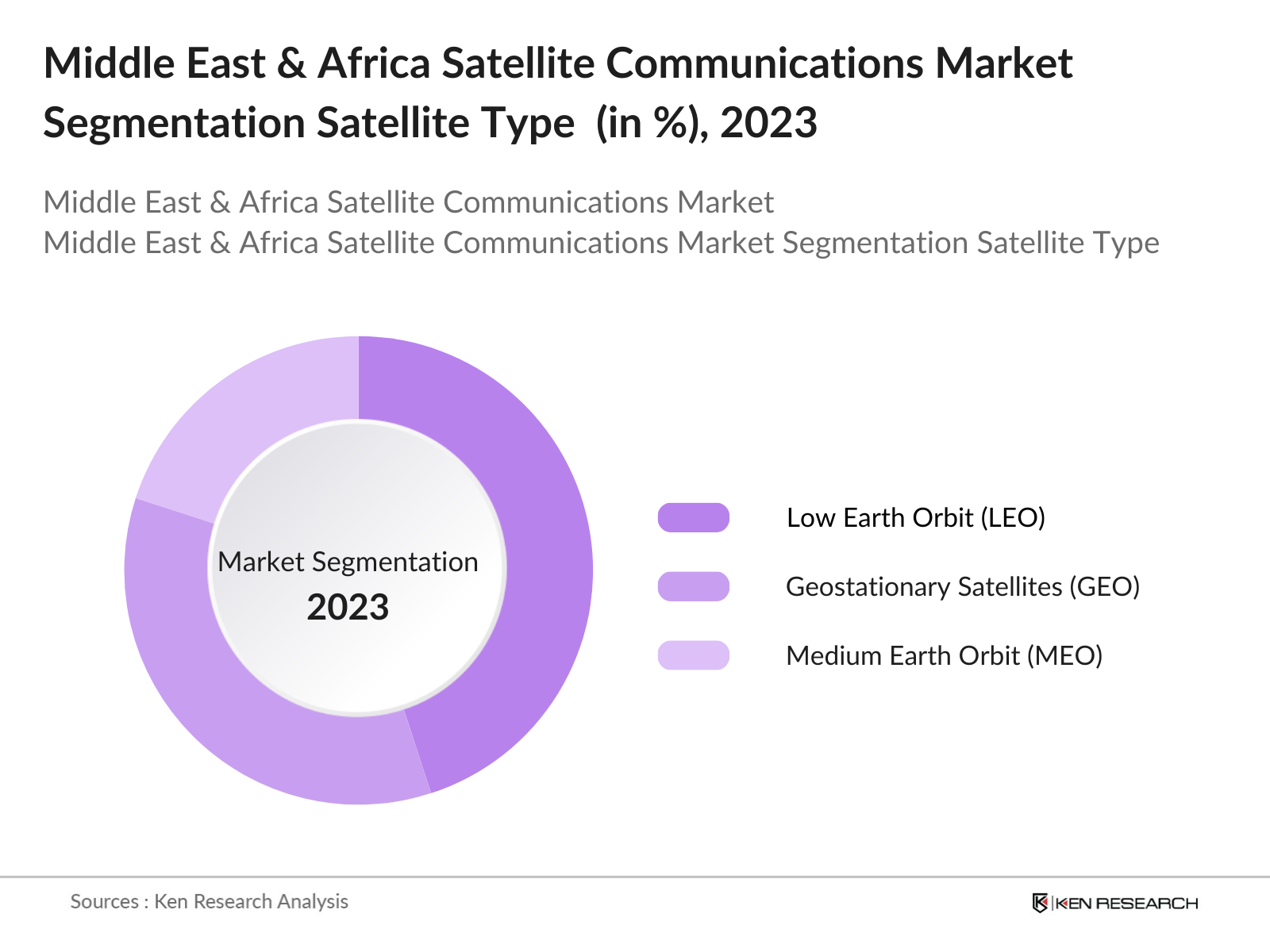

- The trend toward Low Earth Orbit (LEO) satellites is reshaping the satellite communications landscape in the Middle East and Africa. By 2023, the number of LEO satellites launched globally exceeded 1,200, with many targeting the African market to provide high-speed internet. Countries such as Nigeria and South Africa are increasingly investing in LEO technology, aiming to enhance connectivity in remote areas. This trend is projected to accelerate further, with an anticipated increase in LEO satellite launches to support various applications, including broadband and IoT services, by 2025.

Middle East & Africa Satellite Communications Market Segmentation

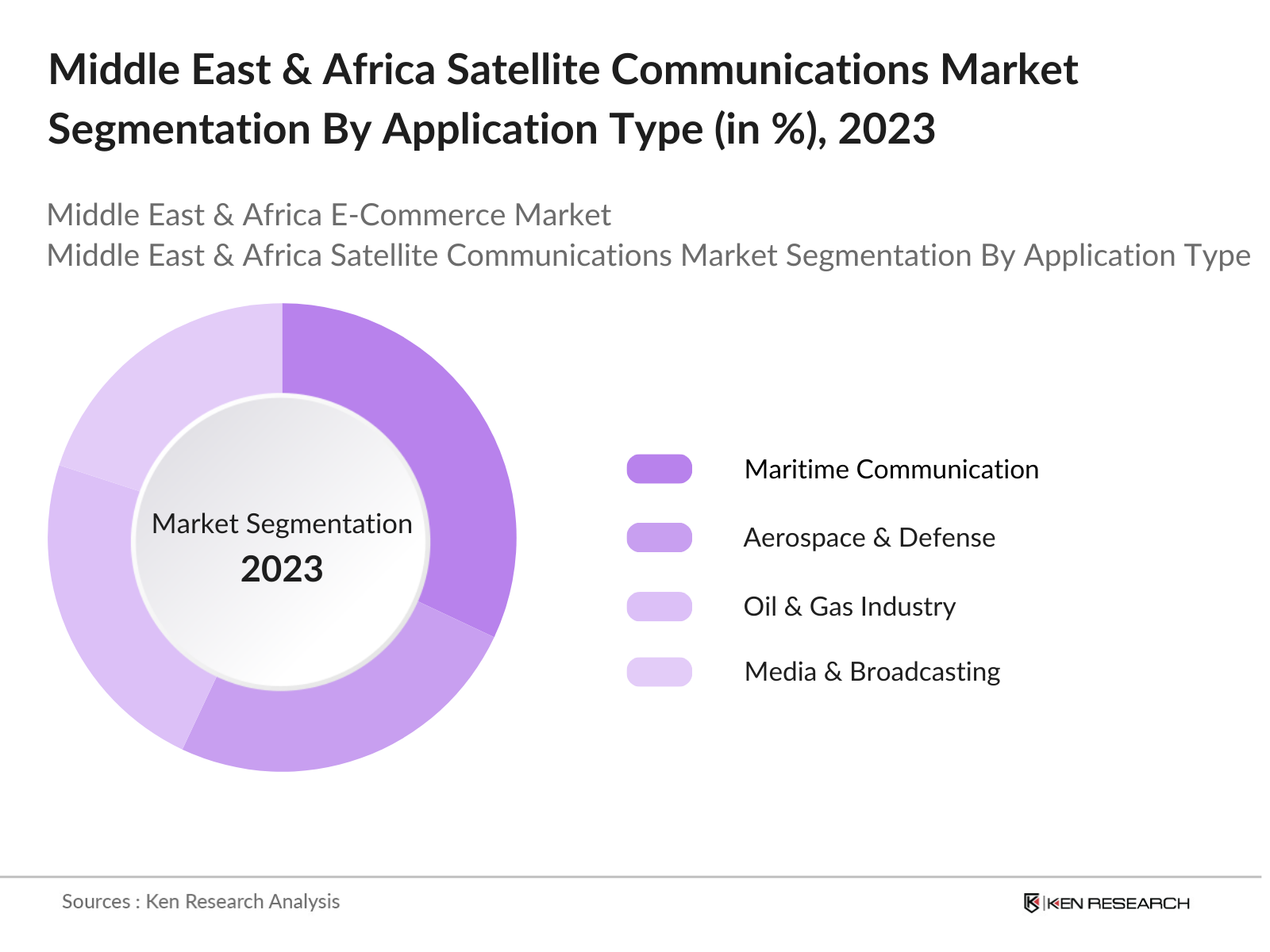

By Application: The satellite communications market in the Middle East & Africa is segmented by application into maritime communication, aerospace and defense, oil & gas industry, media & broadcasting, and telemedicine. Among these, maritime communication holds a dominant market share. This is primarily due to the region's strategic maritime trade routes, including the Gulf of Aden, Red Sea, and the Suez Canal. Reliable satellite communications are critical for vessel monitoring, safety, and operational efficiency, making this segment a key contributor to market growth.

By Satellite Type: The market is segmented by satellite type into geostationary satellites (GEO), medium Earth orbit satellites (MEO), and low Earth orbit satellites (LEO). Low Earth orbit satellites dominate the market in terms of satellite type. LEO satellites are favored due to their low latency and high-speed connectivity, which is essential for data-intensive applications. Companies like SpaceX and OneWeb have deployed a significant number of LEO satellites, contributing to the widespread adoption of this technology.

Middle East & Africa Satellite Communications Market Competitive Landscape

The Middle East & Africa satellite communications market is led by a mix of regional and global players, with companies such as Yahsat and Arabsat dominating the region, alongside global leaders like SES and Eutelsat. This competitive landscape is shaped by the regional demand for improved satellite services, especially for defense, government, and corporate sectors. The focus is on expanding satellite fleets, offering new communication services, and increasing coverage.

Middle East & Africa Satellite Communications Industry Analysis

Growth Drivers

- Expansion of 5G Technology: The rollout of 5G technology is transforming communication landscapes in the Middle East and Africa. With 5G networks promising speeds of up to 10 Gbps, the demand for satellite services is increasing significantly to enhance connectivity in remote regions. As of 2023, the region's investment in 5G infrastructure has surpassed $20 billion, highlighting a robust commitment to improving broadband access. Satellite communication systems are expected to complement 5G networks, particularly in areas where terrestrial options are limited. The integration of 5G and satellite services could provide seamless connectivity for an estimated 400 million people in underserved regions.

- Rising Demand for Broadband Connectivity: Broadband connectivity remains a priority in the Middle East and Africa, with penetration rates reaching 80% in urban areas. The African continent alone saw a surge in internet users from 340 million in 2021 to 500 million in 2023, underscoring a growing demand for robust connectivity solutions. The regions governments are actively investing in broadband initiatives, with over $5 billion allocated to expanding internet infrastructure by 2025. This increased connectivity directly boosts the need for satellite communication services, especially in rural and remote locations lacking reliable internet access.

Source: International Telecommunication Union - Government Initiatives and Investments: Governments in the Middle East and Africa are increasingly recognizing the strategic importance of satellite communications. For instance, the UAEs Space Agency has earmarked $1.5 billion for space-related projects over the next five years, enhancing the countrys satellite capabilities. Additionally, in South Africa, the government has introduced tax incentives for companies investing in satellite technologies, driving further growth in the sector. By 2025, government funding in the space sector across the region is projected to increase by 25%, reflecting a strong commitment to expanding satellite infrastructure and services.

Market Challenges

- High Operational Costs: One of the major challenges in the satellite communications sector is the high operational costs associated with satellite launches and maintenance. In 2023, the average cost of launching a satellite from the region was approximately $100 million. Additionally, ongoing maintenance and operational expenses for satellites can exceed $20 million annually. These high costs deter smaller companies from entering the market and limit the expansion of satellite services, particularly in countries with constrained budgets. To address this, collaborative initiatives among countries are being encouraged to share resources and reduce overall costs.

- Regulatory Hurdles: Regulatory challenges significantly impact the growth of the satellite communications market in the region. Spectrum licensing issues are prevalent, with many countries lacking comprehensive regulatory frameworks to govern satellite communications. In 2023, over 50% of satellite operators in Africa reported difficulties in securing necessary licenses, delaying project timelines. Additionally, varying national regulations complicate international satellite operations, leading to increased operational risks and uncertainties. To facilitate growth, a more harmonized regulatory approach among nations is critical, as emphasized by recent discussions at the African Telecommunications Union.

Middle East & Africa Satellite Communications Market Future Outlook

Over the next five years, the Middle East & Africa satellite communications market is expected to experience steady growth, driven by increased investment in satellite infrastructure and the adoption of advanced communication technologies like 5G. The rising demand for broadband services, particularly in remote areas, is also expected to propel market growth. Furthermore, the continued deployment of low Earth orbit satellites will play a crucial role in improving internet connectivity and supporting digital transformation efforts in the region.

Opportunities

- Satellite-as-a-Service: The emergence of Satellite-as-a-Service (SaaS) is creating significant growth opportunities within the satellite communications sector. With current estimates showing the global demand for cloud-based services exceeding $500 billion, there is a clear market need for flexible satellite solutions that cater to diverse industries. By 2025, it is projected that at least 30% of businesses in the region will integrate SaaS into their operational frameworks, further driving the need for efficient satellite communications. This trend presents an opportunity for satellite operators to diversify their service offerings and attract a broader clientele.

- Growth in IoT Connectivity: The growth of the Internet of Things (IoT) is set to revolutionize satellite communications, particularly in Machine-to-Machine (M2M) communications. Current estimates suggest that the number of connected IoT devices in the region will reach 2 billion by 2025. This presents a substantial opportunity for satellite providers to offer connectivity solutions for remote monitoring and data transmission in sectors such as agriculture, energy, and transportation. The current trend of integrating satellite technology with IoT platforms is expected to enhance data collection and analysis capabilities, fostering innovation and efficiency in various industries.

Scope of the Report

|

By Application |

Maritime Communication Aerospace and Defense Oil & Gas Industry Media & Broadcasting Telemedicine |

|

By Satellite Type |

Geostationary Satellites (GEO) Medium Earth Orbit Satellites (MEO) Low Earth Orbit Satellites (LEO) |

|

By Frequency Band |

C Band Ku Band Ka Band |

|

By Component |

Satellite Ground Equipment Transponders Antennas Modems |

|

By End User |

Government and Military Commercial Enterprises Individual Consumers |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Satellite Communications Companies

Telecommunications Companies

Government and Regulatory Bodies (International Telecommunication Union, National Space Agencies)

Defense and Military Industies

Internet Service Companies

Maritime and Aviation Companies

Oil & Gas Industries

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Yahsat

SES S.A.

Arabsat

Eutelsat

Intelsat

Thuraya

Avanti Communications

Hughes Network Systems

Globalstar

Telesat

Table of Contents

1. Middle East & Africa Satellite Communications Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Middle East & Africa Satellite Communications Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Middle East & Africa Satellite Communications Market Analysis

3.1 Growth Drivers

3.1.1. Expansion of 5G Technology

3.1.2. Rising Demand for Broadband Connectivity

3.1.3. Government Initiatives and Investments

3.1.4. Increased Use of Small Satellites

3.2 Market Challenges

3.2.1. High Operational Costs

3.2.2. Regulatory Hurdles

3.2.3. Competition from Terrestrial Networks

3.3 Opportunities

3.3.1. Satellite-as-a-Service

3.3.2. Growth in IoT Connectivity

3.3.3. Expansion in Rural and Remote Areas

3.4 Trends

3.4.1. Rise of Low Earth Orbit (LEO) Satellites

3.4.2. Increasing Demand for High-Throughput Satellites

3.4.3. Satellite Integration with UAVs

3.5 Government Regulation

3.5.1. National Space Policy

3.5.2. Data Security and Privacy Laws

3.5.3. Compliance with ITU Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Middle East & Africa Satellite Communications Market Segmentation

4.1 By Application (In Value %)

4.1.1. Maritime Communication

4.1.2. Aerospace and Defense

4.1.3. Oil & Gas Industry

4.1.4. Media & Broadcasting

4.1.5. Telemedicine

4.2 By Satellite Type (In Value %)

4.2.1. Geostationary Satellites (GEO)

4.2.2. Medium Earth Orbit Satellites (MEO)

4.2.3. Low Earth Orbit Satellites (LEO)

4.3 By Frequency Band (In Value %)

4.3.1. C Band

4.3.2. Ku Band

4.3.3. Ka Band

4.4 By Component (In Value %)

4.4.1. Satellite Ground Equipment

4.4.2. Transponders

4.4.3. Antennas

4.4.4. Modems

4.5 By End User (In Value %)

4.5.1. Government and Military

4.5.2. Commercial Enterprises

4.5.3. Individual Consumers

5. Middle East & Africa Satellite Communications Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Intelsat

5.1.2. SES S.A.

5.1.3. Eutelsat Communications

5.1.4. Arabsat

5.1.5. Yahsat

5.1.6. Inmarsat

5.1.7. Thuraya

5.1.8. Avanti Communications

5.1.9. Globalstar

5.1.10. Hughes Network Systems

5.1.11. Gilat Satellite Networks

5.1.12. Spacecom

5.1.13. Telesat

5.1.14. OneWeb

5.1.15. Starlink (SpaceX)

5.2 Cross Comparison Parameters (Headquarters, Satellite Fleet Size, Revenue, No. of Employees, Market Share, Network Coverage, Partnership Deals, Key Technology Platforms)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Middle East & Africa Satellite Communications Market Regulatory Framework

6.1 Frequency Spectrum Allocation (Regulatory Bodies and Compliance)

6.2 Licensing and Permitting Requirements

6.3 Certification and Standardization

7. Middle East & Africa Satellite Communications Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Middle East & Africa Satellite Communications Future Market Segmentation

8.1 By Application (In Value %)

8.2 By Satellite Type (In Value %)

8.3 By Frequency Band (In Value %)

8.4 By Component (In Value %)

8.5 By End User (In Value %)

9. Middle East & Africa Satellite Communications Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Market Entry Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Middle East & Africa Satellite Communications Market. This step is underpinned by extensive desk research, utilizing secondary databases to gather comprehensive industry-level information. The primary objective is to identify the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the satellite communications market is compiled and analyzed. This includes assessing market penetration, satellite deployment rates, and revenue generation. Additionally, an evaluation of technological advancements is conducted to ensure the accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts from leading satellite communication companies. These consultations provide valuable operational and financial insights, which are instrumental in refining the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with satellite operators and service providers to acquire insights into product segments, satellite fleet performance, and consumer demand. This interaction ensures a comprehensive, accurate, and validated analysis of the Middle East & Africa satellite communications market.

Frequently Asked Questions

01. How big is the Middle East & Africa Satellite Communications Market?

The Middle East & Africa satellite communications market is valued at USD 7.5 billion, driven by increased demand for high-speed internet and communication services, especially in remote and underserved areas.

02. What are the challenges in the Middle East & Africa Satellite Communications Market?

Challenges include high operational costs, spectrum licensing hurdles, and competition from terrestrial networks like fiber optics, which offer faster and more cost-effective solutions in certain regions.

03. Who are the major players in the Middle East & Africa Satellite Communications Market?

Key players include Yahsat, Arabsat, SES S.A., Eutelsat, and Intelsat. These companies dominate due to their extensive satellite fleets and regional market presence.

04. What are the growth drivers of the Middle East & Africa Satellite Communications Market?

The market is driven by the increasing demand for broadband services, the expansion of 5G technology, and the deployment of low Earth orbit (LEO) satellites for high-speed, low-latency communication.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.