Middle East & Africa Video Game Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD10915

November 2024

87

About the Report

Middle East & Africa Video Game Market Overview

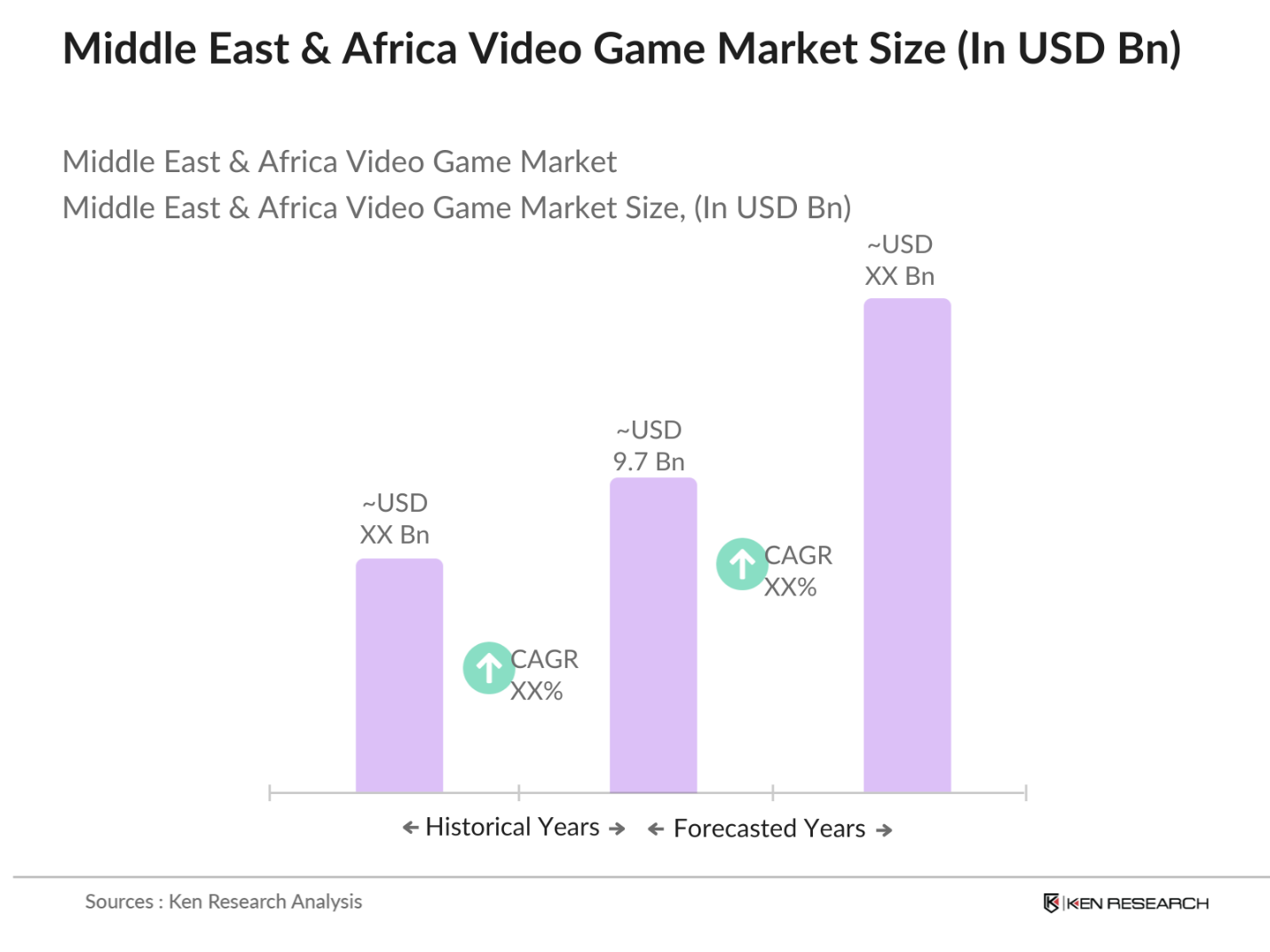

- The Middle East & Africa (MEA) video game market is valued at USD 9.7 billion, supported by an expansive growth trajectory driven by digital transformation and a rising gaming community. High internet penetration, mobile adoption, and increased investments in technology are accelerating the gaming ecosystem. Furthermore, the market is increasingly influenced by younger demographics seeking interactive and immersive experiences, boosting demand for mobile and console gaming platforms. The prevalence of smartphones and high-speed internet networks also play a key role in sustaining market demand.

- In MEA, the United Arab Emirates (UAE), Saudi Arabia, and South Africa emerge as dominant countries due to technological advancements, high disposable incomes, and active gaming communities. These countries are at the forefront, with robust esports infrastructure, active digital payment systems, and a population keen on adopting the latest gaming technology. The support from both government initiatives and private sector investments further strengthens their leadership in the gaming industry.

- Content regulation remains a priority, as countries like Saudi Arabia enforce strict gaming content guidelines in line with cultural values. In 2024, around 30% of games submitted for distribution in the Middle East faced modifications or restrictions. This regulatory environment, while restrictive for some publishers, has encouraged the development of culturally appropriate games that cater to regional tastes.

Middle East & Africa Video Game Market Segmentation

By Platform Type: The MEA video game market is segmented by platform type into console, mobile, and PC gaming. Mobile gaming holds a dominant market share within the platform type due to the high penetration of smartphones and the affordability of mobile gaming apps. This segments growth is fueled by the popularity of casual games and the accessibility of games on both iOS and Android platforms, catering to a broad audience with varied gaming preferences.

By Game Genre: MEAs video game market is segmented by game genre into action, adventure, sports, simulation, and role-playing games (RPG). Action games dominate the market share in this genre segmentation. Their popularity can be attributed to the adrenaline-inducing experiences they provide, coupled with advancements in gaming graphics and the engagement from multiplayer modes. Many action games also benefit from a strong esports following, which amplifies user engagement through online tournaments and collaborations.

Middle East & Africa Video Game Market Competitive Landscape

The MEA video game market is dominated by a few major players, which include both local and international companies. This consolidation underscores the significant influence of key companies that offer diversified gaming content, exclusive partnerships, and technological innovations. Their presence in the region enables widespread access to a variety of genres and platforms, contributing to the industrys steady expansion.

Middle East & Africa Video Game Industry Analysis

Growth Drivers

- Rising Gamer Population: The gamer population in the Middle East and Africa has been expanding substantially. In 2024, there were approximately 50 million active gamers across the region, according to reports from the World Bank. This rise in gamers is attributed to an increasing youth population, with nearly 60% of people in the region under the age of 30, creating a broad base of potential new gamers. The high rate of urbanization, at over 58% in 2024, is also contributing to the rise in gaming as urban areas have better access to internet and devices essential for gaming.

- Expanding Mobile and Console Gaming: The penetration of smartphones in the Middle East and Africa has reached over 200 million devices as of 2024, with mobile gaming representing a significant portion of gaming activity due to accessibility and affordability. The console market also saw growth, with approximately 15 million consoles actively used across the region, boosted by high-profile game releases and investments by international console manufacturers. The rapid expansion in both mobile and console gaming aligns with regional goals to increase digital adoption.

- High-speed Internet Expansion: High-speed internet access has grown significantly, with over 68% of the Middle East population now having access to broadband or 4G/5G connectivity. In Africa, connectivity continues to improve with government-backed infrastructure projects expanding internet reach, achieving an internet penetration rate of approximately 40% in 2024. This increase in internet accessibility has directly supported online gaming and multiplayer gaming experiences, broadening the gamer base.

Market Challenges

- Cybersecurity Risks: Cybersecurity is a rising concern, as around 30% of gamers in the Middle East and Africa report being victims of online fraud or data theft in 2024. With the increase in online gaming platforms, data privacy issues are exacerbated by limited regional cybersecurity infrastructure and legislation. Governments are working to improve digital security, but currently, less than 40% of countries in the region have comprehensive data protection laws, highlighting the need for greater regulatory oversight.

- Limited Payment Options: The lack of accessible digital payment methods in Africa remains a hurdle, with only 25% of the population having access to digital financial services in 2024. This limitation restricts the ability of many gamers to participate in online transactions for game purchases or in-game purchases, especially in underserved regions. In contrast, the Middle East is seeing rapid growth in digital payment adoption, with nearly 80% of the UAE population using mobile wallets. However, broader financial inclusivity is needed for market-wide accessibility.

Middle East & Africa Video Game Market Future Outlook

Over the next five years, the MEA video game market is expected to continue its robust growth, driven by expanding digital infrastructure, the proliferation of mobile devices, and rising interest in immersive technologies such as AR and VR. The introduction of 5G networks is anticipated to further accelerate the adoption of cloud gaming and facilitate smoother online gameplay. As consumer preferences shift towards mobile gaming and esports, the market is poised for substantial advancements, fostering a vibrant and competitive ecosystem.

Opportunities

- Increasing Adoption of AR/VR in Gaming: AR/VR technology is gaining traction, particularly in high-income regions within the Middle East, where nearly 8% of gamers have used AR/VR in gaming experiences as of 2024. Countries like the UAE are encouraging tech adoption, supported by government grants for AR/VR innovation in gaming and entertainment sectors. This shift is anticipated to drive new gaming experiences, positioning AR/VR as a promising frontier within the market.

- Collaboration with Global Publishers: With local publishers increasingly collaborating with international gaming giants, the Middle East has witnessed a 25% rise in the localization of globally popular games for the region. For instance, Saudi Arabias Public Investment Fund invested in gaming companies, paving the way for partnerships that bring region-specific content to gamers. This trend is predicted to deepen in upcoming years as global publishers seek to capture the market potential in the region.

Scope of the Report

|

Game Genre |

Action |

|

Platform |

Console |

|

Revenue Model |

Free-to-Play |

|

Player Age Group |

Children |

|

Country |

UAE |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Video Game Companies

Mobile Gaming Development Companies

Digital Payment Solution Provider Companies

Telecommunication Service Provider Companies

Retail Chains and Digital Distributor Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Telecommunications Regulatory Authority UAE, KSA General Authority for Audiovisual Media)

Esports Event Organizer and Promoter Companies

Companies

Players Mentioned in the Report

Tencent Games

Activision Blizzard

Electronic Arts

Sony Interactive Entertainment

Microsoft Xbox Game Studios

Ubisoft Entertainment

Take-Two Interactive

Epic Games

NetEase Games

Nintendo Co., Ltd.

Table of Contents

1. Middle East & Africa Video Game Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Middle East & Africa Video Game Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Middle East & Africa Video Game Market Analysis

3.1 Growth Drivers

3.1.1 Rising Gamer Population (Gamers)

3.1.2 Expanding Mobile and Console Gaming (Device Penetration)

3.1.3 High-speed Internet Expansion (Internet Speed and Accessibility)

3.1.4 Growing Popularity of Esports (Esports Events and Viewership)

3.2 Market Challenges

3.2.1 Cybersecurity Risks (Data Privacy & Security)

3.2.2 Limited Payment Options (Digital Payment Penetration)

3.2.3 Regulatory Hurdles (Regulatory Compliance)

3.3 Opportunities

3.3.1 Increasing Adoption of AR/VR in Gaming (AR/VR Integration)

3.3.2 Collaboration with Global Publishers (Global Partnerships)

3.3.3 Potential in Cloud Gaming Services (Cloud Gaming Readiness)

3.4 Trends

3.4.1 Rise of Free-to-Play and Subscription Models (Monetization Models)

3.4.2 Cross-Platform Gaming Expansion (Cross-Platform Compatibility)

3.4.3 Increased Localization Efforts (Localized Content)

3.5 Government Regulation

3.5.1 Gaming Censorship Laws (Content Regulation)

3.5.2 Age Rating Standards (Age-based Restrictions)

3.5.3 Data Protection Compliance (User Data Compliance)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Middle East & Africa Video Game Market Segmentation

4.1 By Game Genre (In Value %)

4.1.1 Action

4.1.2 Adventure

4.1.3 Role-playing

4.1.4 Simulation

4.1.5 Sports

4.2 By Platform (In Value %)

4.2.1 Console

4.2.2 PC

4.2.3 Mobile

4.2.4 Cloud Gaming

4.3 By Revenue Model (In Value %)

4.3.1 Free-to-Play

4.3.2 Subscription

4.3.3 Pay-to-Play

4.3.4 In-game Purchases

4.4 By Player Age Group (In Value %)

4.4.1 Children

4.4.2 Teenagers

4.4.3 Adults

4.4.4 Seniors

4.5 By Country (In Value %)

4.5.1 UAE

4.5.2 Saudi Arabia

4.5.3 South Africa

4.5.4 Egypt

4.5.5 Other Middle Eastern and African Countries

5. Middle East & Africa Video Game Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Tencent Games

5.1.2 Activision Blizzard

5.1.3 Electronic Arts

5.1.4 Epic Games

5.1.5 Sony Interactive Entertainment

5.1.6 Microsoft Xbox Game Studios

5.1.7 Take-Two Interactive

5.1.8 Ubisoft Entertainment

5.1.9 Nintendo Co., Ltd.

5.1.10 Bandai Namco Entertainment

5.1.11 NetEase Games

5.1.12 Sega Corporation

5.1.13 Square Enix

5.1.14 Pearl Abyss

5.1.15 CD Projekt

5.2 Cross Comparison Parameters (Headquarters, Game Genres, Revenue, Local Partnerships, Player Base Size, Esports Investment, Mobile Gaming Penetration, Cloud Infrastructure)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Middle East & Africa Video Game Market Regulatory Framework

6.1 Content Classification Standards

6.2 Licensing Requirements

6.3 In-app Purchase Regulations

7. Middle East & Africa Video Game Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Middle East & Africa Video Game Market Future Segmentation

8.1 By Game Genre (In Value %)

8.2 By Platform (In Value %)

8.3 By Revenue Model (In Value %)

8.4 By Player Age Group (In Value %)

8.5 By Country (In Value %)

9. Middle East & Africa Video Game Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves identifying key stakeholders in the MEA video game market, including gaming companies, publishers, and distribution networks. Extensive secondary research is conducted to pinpoint variables such as platform adoption rates, consumer demographics, and internet infrastructure.

Step 2: Market Analysis and Construction

This phase entails compiling historical data on market penetration by platform type and user preference. By analyzing data across sub-segments and regional dynamics, a comprehensive understanding of the revenue flow and market composition is established.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are then validated through interviews with industry professionals from gaming companies, esports organizations, and technology providers. These insights contribute to refining revenue models, identifying high-growth segments, and corroborating projected trends.

Step 4: Research Synthesis and Final Output

In the final phase, detailed interactions with major players are conducted to verify statistics through a bottom-up approach. This synthesis of quantitative data ensures the accuracy and reliability of the final report, providing an insightful analysis of the MEA video game market.

Frequently Asked Questions

01. How big is the Middle East & Africa Video Game Market?

The Middle East & Africa video game market is valued at USD 9.7 billion, driven by increased mobile adoption, expanding gaming communities, and strong investments in the digital sector.

02. What are the main challenges in the Middle East & Africa Video Game Market?

Key challenges include data privacy concerns, regulatory restrictions on content, and limited digital payment options in certain regions. These factors can hinder the gaming experience and restrict market growth.

03. Who are the major players in the Middle East & Africa Video Game Market?

Prominent players in the market include Tencent Games, Activision Blizzard, Sony Interactive Entertainment, Microsoft Xbox Game Studios, and Electronic Arts, known for their innovative content and robust distribution networks.

04. What are the growth drivers of the Middle East & Africa Video Game Market?

The market is bolstered by high smartphone penetration, growing interest in esports, and improvements in internet infrastructure, particularly with the advent of 5G technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.